Market Overview

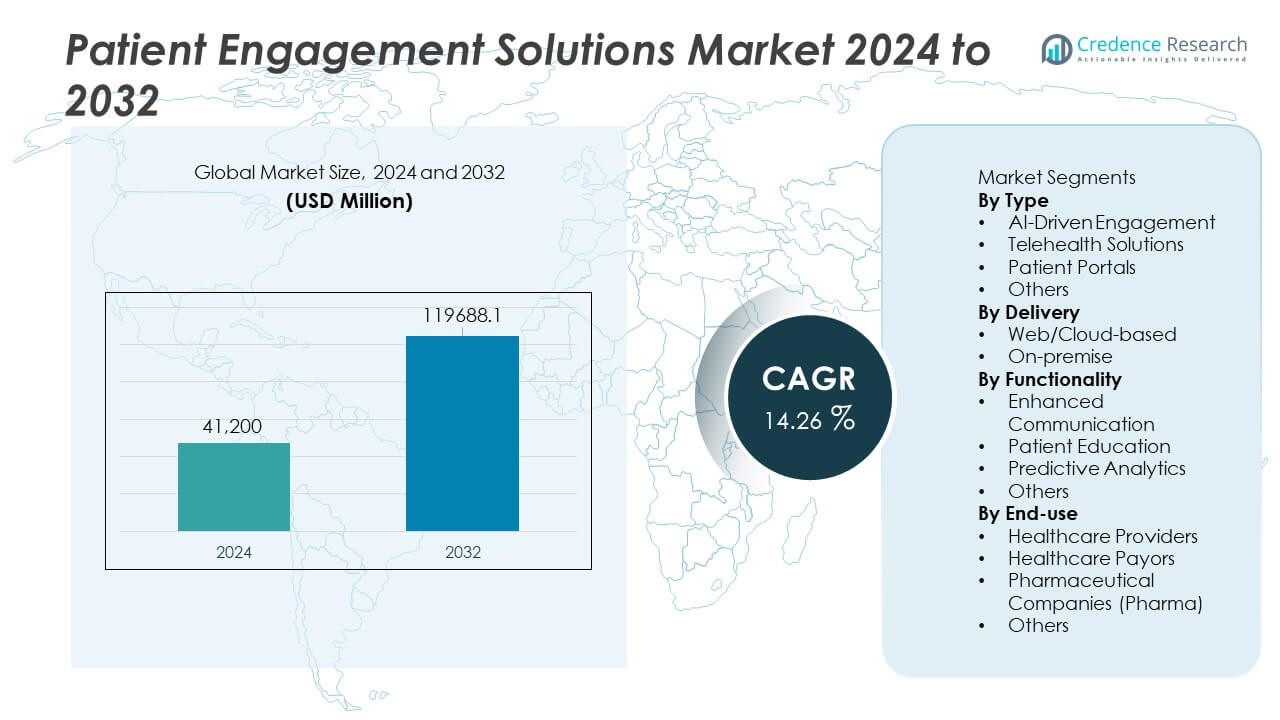

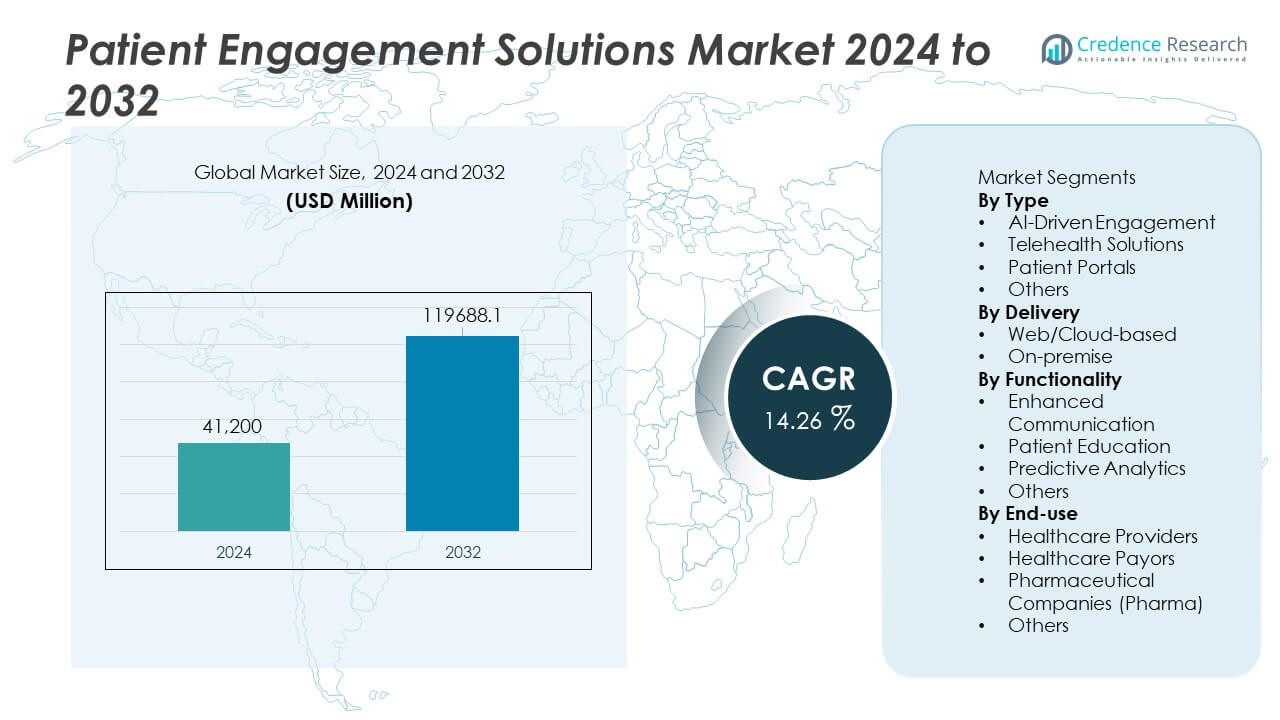

The Patient Engagement Solutions Market was valued at USD 41,200 million in 2024 and is projected to reach USD 119,688.1 million by 2032, expanding at a CAGR of 14.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Patient Engagement Solutions Market Size 2024 |

USD 41,200 Million |

| Patient Engagement Solutions Market, CAGR |

14.26% |

| Patient Engagement Solutions Market Size 2032 |

USD 119,688.1 Million |

The Patient Engagement Solutions market is driven by major players including Experian Information Solutions, Cerner Corporation (Oracle), CPSI, ResMed, Epic Systems Corporation, Klara Technologies, McKesson Corporation, Allscripts Healthcare, NextGen Healthcare, and Koninklijke Philips N.V. These companies advance AI-enabled communication tools, integrated patient portals, telehealth platforms, and predictive analytics systems that enhance care continuity and patient satisfaction. North America leads the market with 43% share, supported by strong digital infrastructure and high adoption of remote-care technologies. Europe follows with 28% share, driven by patient-centered healthcare initiatives, while Asia Pacific holds 22% share due to rising digitalization and expanding cloud-based health platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Patient Engagement Solutions market reached USD 41,200 million in 2024 and will grow at a CAGR of 14.26% through 2032.

- Demand rises as healthcare systems adopt AI-driven engagement tools and telehealth platforms, with AI-led solutions holding 38% share due to strong personalization and automation capabilities.

- Mobile-first platforms, predictive analytics, and integrated communication systems shape major trends as providers enhance workflow efficiency and patient experience.

- Competition strengthens as leading companies invest in interoperability, cloud-based deployment, and digital innovation while navigating challenges tied to data security, integration barriers, and compliance requirements.

- North America leads with 43% share, Europe follows with 28%, and Asia Pacific holds 22%, supported by expanding digital health adoption, strong telehealth growth, and rising demand for remote-care engagement tools across diverse patient populations.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

AI-driven engagement leads the type segment with 38% share, driven by rising demand for personalized care, automated support, and real-time decision assistance. Healthcare providers adopt AI tools to improve patient communication, enhance triage efficiency, and predict care needs based on behavioral and clinical patterns. Telehealth solutions follow as virtual consultations gain traction, especially for chronic disease monitoring and remote follow-up care. Patient portals continue to expand as hospitals strengthen digital access to records and appointments. AI’s dominance reflects its strong ability to automate workflows, improve satisfaction, and support continuous engagement across diverse care settings.

- For instance, Epic Systems expanded its AI-driven clinical decision support by integrating its “Sepsis Model,” which evaluates numerous clinical variables and delivers risk scores within moments of data input. The model’s intended purpose is to improve early detection outcomes within health systems using Epic EHR.

By Delivery

Web and cloud-based platforms dominate the delivery segment with 72% share, supported by rapid digital transformation across healthcare systems and rising demand for scalable, cost-efficient deployment models. Cloud-based patient engagement tools enable easy integration with electronic health records, mobile applications, and remote monitoring devices. They offer strong flexibility, real-time data access, and lower IT maintenance requirements, making them preferred for both large health networks and clinics. On-premise solutions maintain relevance in facilities requiring strict data localization or enhanced customization. Cloud leadership strengthens as healthcare organizations prioritize interoperability, remote accessibility, and fast implementation.

- For instance, Philips HealthSuite Platform expanded its cloud capacity to support over 100 million connected medical devices and manage more than 15 petabytes of clinical data through secure cloud hosting. The platform enables remote monitoring workflows used in over 30 countries, supporting real-time patient engagement and clinician dashboards.

By Functionality

Enhanced communication holds the leading 44% share, driven by growing adoption of digital messaging, automated reminders, and virtual care interactions that strengthen patient-provider coordination. Hospitals and clinics rely on communication platforms to reduce missed appointments, improve care continuity, and increase patient satisfaction. Patient education tools grow steadily as personalized learning modules support chronic condition management and treatment adherence. Predictive analytics expands as providers use AI insights to identify risk patterns, forecast admissions, and support preventive-care strategies. The dominance of enhanced communication reflects its foundational role in improving engagement outcomes and streamlining health-system workflows.

Key Growth Drivers

Rising Demand for Personalized and Accessible Care

Healthcare systems increasingly adopt patient engagement solutions to deliver personalized experiences, improve accessibility, and support continuous care. Digital platforms enable tailored communication, behavior tracking, and treatment reminders that enhance adherence and clinical outcomes. Rising chronic disease prevalence accelerates adoption as patients seek tools that simplify long-term condition management. Providers rely on engagement solutions to reduce readmissions, improve satisfaction scores, and streamline care workflows. As consumers expect seamless digital interactions, demand grows for platforms that deliver personalized support across web, mobile, and AI-driven interfaces.

- For instance, Kaiser Permanente deployed AI-enabled technology that assists physicians with clinical decision-making and streamlines workflows for a large number of members through its integrated system.

Expansion of Telehealth and Remote Care Models

Telehealth adoption accelerates the need for advanced engagement tools that support virtual consultations, remote monitoring, and digital follow-up care. These solutions help providers extend reach, reduce clinical burdens, and improve patient convenience. Growth in home-based care, especially for chronic and aging populations, fuels demand for integrated communication, education, and monitoring systems. Engagement platforms enhance care continuity by enabling real-time data sharing and timely intervention. As hybrid care models become standard, digital engagement remains essential for improving outcomes and reducing healthcare costs.

- For instance, Teladoc Health expanded its remote monitoring program to support a variety of connected devices, tracking conditions such as diabetes and hypertension.

Increasing Integration of AI and Predictive Analytics

AI-powered engagement tools transform care delivery through intelligent automation, risk prediction, and personalized recommendations. Predictive analytics helps providers identify high-risk patients, forecast disease progression, and tailor interventions. Automated chat, voice assistants, and symptom-checking tools improve operational efficiency and reduce provider workload. AI-driven insights enhance care coordination and support proactive decision-making. As healthcare systems shift toward data-driven approaches, demand for advanced analytics solutions grows, strengthening their role in improving engagement quality and clinical effectiveness.

Key Trends & Opportunities

Growth of Mobile-First Engagement and Consumer-Centric Platforms

Healthcare providers increasingly adopt mobile-first platforms that offer convenient access to appointments, medication reminders, and educational content. Consumers seek intuitive, app-based solutions that support self-management and improve communication with care teams. Integration of wearable data expands opportunities for continuous monitoring and personalized guidance. User-friendly digital tools also improve adherence and empower patients to participate actively in their care. As digital literacy rises globally, mobile engagement becomes a major opportunity for firms delivering flexible, patient-centric solutions.

- For instance, MyChart by Epic expanded its mobile functionality to support active patient accounts, offering secure messaging, telehealth, and medication reminders. The app integrates data from a wide variety of wearable device platforms, enabling continuous tracking of steps, heart rate, and sleep patterns.

Adoption of Connected Ecosystems and Integrated Health Platforms

Healthcare organizations invest in integrated systems that connect EHRs, telehealth services, remote monitoring, and patient-facing applications. These ecosystems support seamless data exchange, enhance workflow automation, and simplify communication between providers and patients. Opportunities grow for vendors offering interoperability, intelligent dashboards, and customizable engagement frameworks. Integrated platforms help reduce fragmentation, improve transparency, and support value-based care initiatives. As health systems prioritize unified digital infrastructure, integrated engagement platforms gain strong market momentum.

- For instance, Oracle Health (Cerner) expanded its integrated ecosystem by enabling the exchange of clinical records through its interoperability network. The platform now connects many healthcare facilities across global markets.

Key Challenges

Data Privacy, Security, and Regulatory Compliance

Patient engagement solutions handle sensitive personal and medical data, creating major concerns around privacy, cybersecurity, and compliance. Healthcare providers must follow strict regulations governing data storage, access, and transmission. Breaches or misuse of patient information undermine trust and limit adoption. Vendors must invest heavily in encryption, authentication, and secure cloud architectures to meet regulatory standards. Ensuring consistent compliance across global regions adds further operational complexity.

Integration Barriers and Technology Adoption Gaps

Many healthcare organizations face challenges integrating new engagement platforms with existing EHRs, telehealth systems, and legacy workflows. Limited technical expertise and resource constraints slow implementation, especially in small and mid-sized facilities. Adoption gaps arise when systems lack interoperability or require extensive customization. These challenges hinder seamless workflow adoption and reduce the effectiveness of digital engagement strategies. Vendors must address integration simplicity and user training to improve adoption rates across diverse healthcare environments.

Regional Analysis

North America

North America leads the Patient Engagement Solutions market with 43% share, driven by strong digital health adoption, advanced healthcare infrastructure, and high investment in AI-driven platforms. Providers prioritize telehealth, mobile apps, and predictive analytics to improve patient outcomes and reduce operational burdens. The region benefits from favorable reimbursement frameworks, rising chronic disease prevalence, and widespread use of electronic health records. Large health systems integrate engagement tools to support value-based care and enhance patient experience. Strong innovation from technology vendors and continuous regulatory support reinforce North America’s dominant position.

Europe

Europe holds 28% share, supported by growing emphasis on patient-centered care, digital transformation initiatives, and cross-border health data integration. Governments encourage adoption of telehealth and patient communication tools to improve care continuity and reduce system strain. Rising aging populations and chronic illness rates further strengthen demand for digital education and remote-monitoring solutions. Hospitals integrate patient portals and automated communication platforms to enhance engagement and reduce avoidable readmissions. The region’s strict data protection regulations promote secure, compliant systems, while ongoing healthcare modernization supports expansion of digital engagement tools.

Asia Pacific

Asia Pacific accounts for 22% share, emerging as a fast-growing market driven by rapid digitalization, expanding telehealth usage, and rising healthcare investment across China, India, Japan, and Southeast Asia. Growing smartphone penetration and increasing awareness of digital health tools strengthen adoption of mobile-based engagement platforms. Healthcare providers implement cloud-based systems to manage large patient populations and streamline service delivery. Government initiatives promoting digital health and chronic disease management accelerate growth. As healthcare infrastructure modernizes, Asia Pacific becomes a strong hub for scalable patient-engagement technologies.

Latin America

Latin America holds 5% share, supported by rising demand for telehealth, mobile health apps, and patient education tools, especially in Brazil and Mexico. Healthcare providers adopt digital platforms to improve access in underserved regions and reduce clinical workflow burdens. Economic constraints slow rapid adoption, yet increasing private investment and digital health reforms enhance market potential. Providers rely on web-based engagement tools to support chronic disease management and remote consultations. Growing digital literacy and expansion of cloud infrastructure contribute to gradual market expansion.

Middle East & Africa

Middle East & Africa account for 2% share, driven by expanding digital health initiatives in Gulf countries and rising interest in AI-enabled patient communication tools. Wealthier nations such as the UAE and Saudi Arabia lead adoption due to strong investments in smart healthcare infrastructure. Emerging African markets adopt engagement platforms at a slower pace due to resource limitations but benefit from growing telemedicine programs. Increasing focus on preventive care, remote monitoring, and patient education supports steady demand. Ongoing healthcare modernization and digital transformation programs create long-term growth opportunities.

Market Segmentations:

By Type

- AI-Driven Engagement

- Telehealth Solutions

- Patient Portals

- Others

By Delivery

- Web/Cloud-based

- On-premise

By Functionality

- Enhanced Communication

- Patient Education

- Predictive Analytics

- Others

By End-use

- Healthcare Providers

- Healthcare Payors

- Pharmaceutical Companies (Pharma)

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Patient Engagement Solutions market is driven by key players such as Experian Information Solutions, Inc., Cerner Corporation (Oracle), CPSI, Ltd., ResMed, Epic Systems Corporation, Klara Technologies, Inc., McKesson Corporation, Allscripts Healthcare, LLC, NextGen Healthcare, Inc., and Koninklijke Philips N.V. These companies focus on delivering advanced digital platforms that support communication, remote monitoring, AI-driven engagement, and integrated care management. Competition intensifies as vendors enhance interoperability with EHRs, expand mobile capabilities, and invest in predictive analytics to improve patient outcomes. Strategic partnerships with hospitals, payers, and telehealth providers strengthen market presence and accelerate innovation. Companies also prioritize data security, user experience, and scalable cloud-based architectures to meet rising demand for flexible digital health ecosystems. As healthcare systems shift toward value-based care, firms that offer comprehensive, integrated engagement solutions with strong analytics capabilities gain a significant competitive advantage.

Key Player Analysis

- Experian Information Solutions, Inc.

- Cerner Corporation (Oracle)

- CPSI, Ltd.

- ResMed

- Epic Systems Corporation

- Klara Technologies, Inc.

- McKesson Corporation

- Allscripts Healthcare, LLC

- NextGen Healthcare, Inc.

- Koninklijke Philips N.V.

Recent Developments

- In August 2025, Oracle Health enhanced its electronic data-capture solution to streamline clinical trials, adding AI-enabled EHR interoperability, improved data collection and safety integration — capabilities that support eventual expansion of patient-centric tools and engagement across care and research settings.

- In April 2025, Experian Information Solutions, Inc. (Experian Health) released its annual “State of Patient Access 2025” report — showing improved patient access metrics and reinforcing its focus on scheduling, intake and payment solutions to boost patient engagement.

- In October 2024, Cerner Corporation (Oracle) announced that its parent Oracle Health plans to roll out a next-generation EHR in 2025 with embedded cloud, AI and analytics — a step expected to bolster patient engagement capabilities via smarter and more integrated health record tools.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Delivery, Functionality, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-driven engagement tools will expand as personalization becomes central to patient care.

- Telehealth-based interaction will increase as hybrid care models become standard.

- Mobile-first platforms will dominate due to rising patient demand for convenient digital access.

- Predictive analytics will strengthen early risk detection and targeted intervention.

- Integration with wearable devices will enhance continuous monitoring and engagement.

- Cloud-based deployment will grow as providers seek scalability and lower infrastructure costs.

- Providers will adopt more multilingual and culturally adaptive engagement tools.

- Data security enhancements will become essential to maintain trust and regulatory compliance.

- Partnerships between technology firms and healthcare systems will accelerate innovation.

- Emerging markets will adopt digital engagement solutions as infrastructure and digital literacy improve.

Market Segmentation Analysis:

Market Segmentation Analysis: