Market Overview

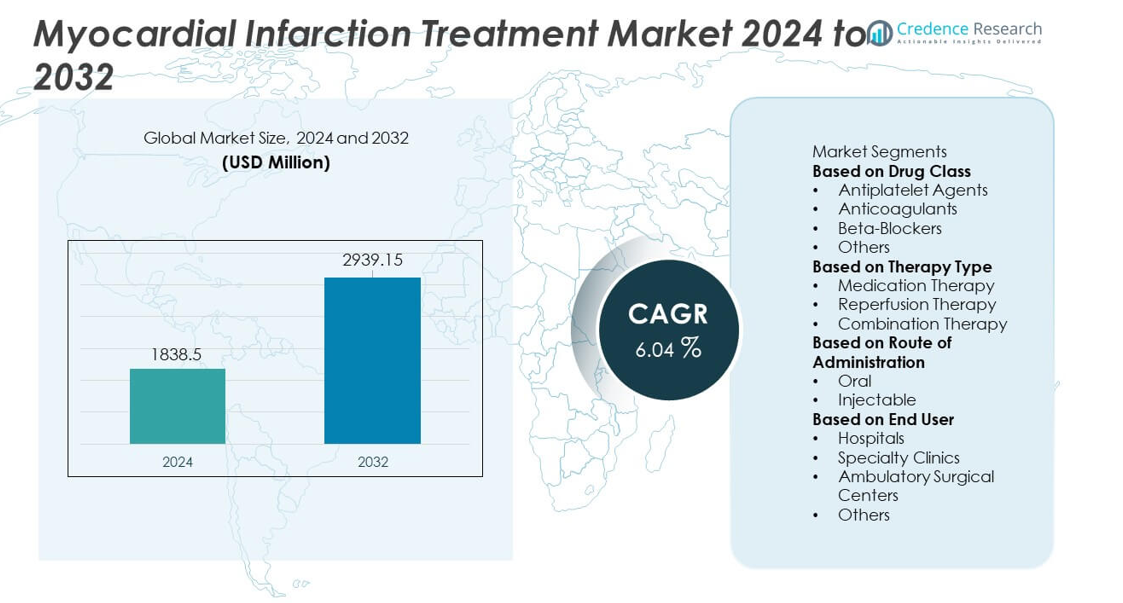

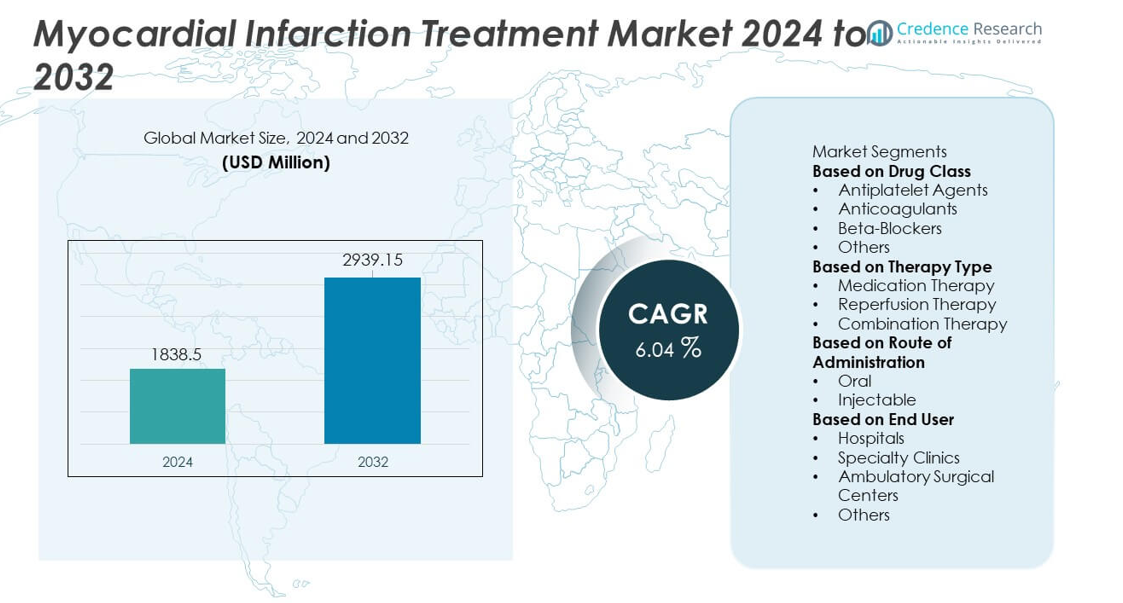

The Myocardial Infarction Treatment market was valued at USD 1,838.5 million in 2024 and is projected to reach USD 2,939.15 million by 2032, expanding at a CAGR of 6.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Myocardial Infarction Treatment Market Size 2024 |

USD 1,838.5 million |

| Myocardial Infarction Treatment Market, CAGR |

6.04% |

| Myocardial Infarction Treatment Market Size 2032 |

USD 2,939.15 million |

The top players in the Myocardial Infarction Treatment market include AstraZeneca, Novartis AG, Bayer AG, Bristol-Myers Squibb, Johnson & Johnson, Pfizer Inc., Amgen Inc., Eli Lilly and Company, Sanofi, and Merck & Co., Inc. These companies strengthen their presence through advanced antiplatelets, anticoagulants, statins, and innovative combination therapies supported by strong clinical research and global distribution networks. North America leads the market with a 38% share, driven by high cardiovascular disease prevalence and well-established cardiac care infrastructure. Europe follows with a 29% share, supported by strong preventive care programs, while Asia Pacific holds a 24% share fueled by rising cardiac risk factors and expanding access to advanced MI treatments.

Market Insights

- The Myocardial Infarction Treatment market reached USD 1,838.5 million in 2024 and is projected to reach USD 2,939.15 million by 2032, growing at a CAGR of 6.04% during the forecast period.

- Market growth is driven by rising cardiovascular disease incidence, improved access to emergency care, and increased adoption of evidence-based therapies, with antiplatelet agents leading the drug class segment at a 38% share.

- Key trends include growing use of personalized treatment plans, increased adoption of digital health tools for remote cardiac monitoring, and continued development of safer, more effective antiplatelet and anticoagulant drugs.

- Competitive intensity rises as major pharmaceutical companies invest in R&D pipelines, pursue regulatory approvals for advanced formulations, and expand preventive cardiology portfolios to strengthen global positioning.

- North America leads with a 38% share, followed by Europe at 29% and Asia Pacific at 24%, supported by improving cardiac care infrastructure, rising patient awareness, and growing demand for long-term MI management therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Class

Antiplatelet agents dominate the drug class segment with a 38% market share, driven by their central role in preventing further clot formation and reducing the risk of recurrent myocardial infarction. These drugs remain the first-line choice due to proven clinical efficacy, strong guideline recommendations, and widespread use in both acute and long-term management. Anticoagulants also contribute significantly, especially during early intervention phases, while beta-blockers support long-term cardiac recovery. Rising cardiovascular disease prevalence, increasing emergency admissions, and expanding adoption of evidence-based treatment protocols continue to reinforce the dominance of antiplatelet therapies.

- For instance, AstraZeneca reported clinical data from the ONSET/OFFSET study showing ticagrelor (180 mg loading dose) achieving a rapid onset of antiplatelet effect, with 41% inhibition of platelet aggregation (IPA) at 30 minutes, which supports faster stabilization during acute myocardial infarction compared to clopidogrel.

By Therapy Type

Medication therapy leads the therapy type segment with a 52% market share, supported by its essential role in stabilizing patients, managing symptoms, and preventing complications before and after hospital intervention. Medications such as antiplatelets, beta-blockers, and statins form the backbone of myocardial infarction management and are prescribed in nearly all cases. Reperfusion therapy, including thrombolysis and angioplasty support, accounts for additional demand but depends on facility availability and patient eligibility. Combination therapy gains traction in advanced cases requiring integrated approaches. Increased clinical adoption of guideline-based medical management drives the leadership of medication therapy.

- For instance, Forest Laboratories (and later AbbVie, following an acquisition) reported strong clinical adoption of its beta-blocker formulation Bystolic following results from a pivotal clinical trial program involving over 2,000 patients, showing effective blood pressure and heart rate control.

By Route of Administration

Oral administration dominates the segment with a 59% market share, driven by the long-term use of maintenance medications such as statins, ACE inhibitors, antiplatelets, and beta-blockers. Oral formulations support better patient compliance, cost effectiveness, and ease of chronic disease management following acute myocardial infarction. Injectable treatments hold a smaller share but remain critical during emergency care and early intervention stages, particularly for anticoagulants and thrombolytic agents. The strong global burden of cardiovascular disease and the need for lifelong therapy reinforce the continued dominance of oral administration in the market.

Key Growth Drivers

Rising Global Burden of Cardiovascular Diseases

The growing incidence of cardiovascular diseases remains a major driver of the myocardial infarction treatment market. Sedentary lifestyles, rising obesity rates, hypertension, and diabetes contribute significantly to increased cardiac events worldwide. Healthcare systems are witnessing higher emergency admissions, creating a strong need for efficient acute and post-acute care therapies. Advancements in diagnostic accuracy and greater awareness of early symptoms improve treatment initiation rates. Governments and health organizations continue to emphasize preventive cardiology, increasing the demand for long-term therapeutic management and accelerating market growth across both developed and emerging regions.

- For instance, Medtronic expanded its global cardiac care footprint by deploying its Reveal LINQ cardiac monitor to support early detection of cardiac arrhythmias, such as atrial fibrillation (AF), in patients with symptoms like unexplained fainting or stroke.

Advancements in Drug Therapies and Treatment Protocols

Continuous improvements in drug formulations and evidence-based treatment guidelines strengthen the adoption of modern myocardial infarction therapies. Newer antiplatelet agents, safer anticoagulants, and more effective beta-blockers enhance patient outcomes and reduce adverse events. Clinical research supports optimized combination therapies that deliver improved results during both acute intervention and secondary prevention. Hospitals and clinics increasingly adopt standardized MI treatment pathways, ensuring consistent and high-quality care. Growing investments in cardiovascular R&D and the introduction of novel therapeutics fuel greater market penetration and long-term adoption of advanced treatment options.

- For instance, Bayer strengthened its anticoagulant portfolio by completing the pivotal ATLAS ACS 2-TIMI 51 clinical study of over 15,500 patients, which demonstrated a significant reduction in cardiovascular death, myocardial infarction (MI), or stroke when low-dose rivaroxaban was used in combination therapy.

Expansion of Healthcare Infrastructure and Access to Emergency Care

Improved availability of cardiac care units, better-equipped hospitals, and the rise of specialized cardiology centers support faster and more effective MI treatment. Expanding emergency medical services and quicker response systems increase survival rates, driving demand for reperfusion therapies and life-saving drugs. Developing regions are investing heavily in healthcare modernization, making advanced cardiac treatments more accessible. Government-led health insurance programs further improve affordability for patients. The broader availability of skilled cardiologists and advanced interventional technologies continues to reinforce demand for comprehensive MI treatment solutions.

Key Trends & Opportunities

Growing Adoption of Personalized and Evidence-Based Treatment Approaches

Healthcare providers increasingly adopt personalized treatment plans tailored to patient-specific risk profiles, genetic markers, and comorbidities. Precision dosing of antiplatelets, beta-blockers, and anticoagulants enhances safety and reduces complications. Hospitals are integrating predictive analytics, AI-based diagnostic tools, and biomarker-driven decision-making to improve outcomes. The expansion of clinical data and real-world evidence supports better treatment optimization. This trend opens strong opportunities for pharmaceutical companies developing targeted therapies and advanced monitoring solutions for post-MI management.

- For instance, Roche advanced biomarker-guided treatment by introducing highly sensitive troponin T tests that allow for more rapid and accurate diagnosis of acute MI, with clinical studies involving thousands of patients worldwide.

Increasing Role of Digital Health and Remote Cardiac Monitoring

Digital health technologies create new opportunities in MI management by enabling continuous monitoring, timely intervention, and better adherence to medication. Wearable cardiac devices, remote ECG systems, and telemedicine platforms help clinicians track patient health after discharge, reducing the risk of recurrent events. Mobile health apps improve compliance with therapy and lifestyle changes. Hospitals increasingly adopt digital tools to support early diagnosis and faster triage. Growing acceptance of tele-cardiology strengthens the market for integrated digital and pharmaceutical care solutions.

- For instance, Apple expanded its cardiac monitoring ecosystem by enabling the ECG app on Apple Watch Series 4 and later models, which has been clinically validated as highly accurate for detecting signs of atrial fibrillation (AFib) in classifiable recordings, thus improving early arrhythmia detection.

Key Challenges

High Treatment Costs and Limited Access in Low-Income Regions

Despite advancements in MI therapies, high medication and hospitalization costs limit access in developing regions. Reperfusion procedures, branded antiplatelet drugs, and advanced diagnostics remain unaffordable for many patients. Unequal healthcare infrastructure and limited insurance coverage widen the treatment gap. This challenge restricts adoption of guideline-based therapies and delays critical intervention, affecting clinical outcomes. Pharmaceutical companies face obstacles in expanding penetration in cost-sensitive markets where affordability remains a primary concern.

Side Effects, Safety Concerns, and Treatment Compliance Issues

Many MI medications, including anticoagulants and antiplatelets, carry risks of bleeding and other adverse effects, requiring careful monitoring. Patient non-adherence to long-term therapy reduces treatment effectiveness and increases the likelihood of recurrent events. Complex medication regimens and lifestyle requirements further contribute to compliance challenges. Managing drug interactions in patients with multiple comorbidities remains difficult. These clinical and behavioral challenges make it harder for providers to maintain consistent therapeutic outcomes, affecting long-term market growth.

Regional Analysis

North America

North America holds a 38% market share, driven by a high prevalence of cardiovascular diseases, strong adoption of advanced treatment protocols, and widespread access to emergency care facilities. The United States leads regional demand due to well-established cardiac care centers, strong healthcare spending, and rapid adoption of evidence-based therapies. Favorable reimbursement policies and strong availability of skilled cardiologists further support treatment expansion. High awareness of early MI symptoms and increased use of preventive medications sustain long-term therapy demand. Continuous technological advancements and broad access to diagnostic tools reinforce North America’s dominant position in the market.

Europe

Europe accounts for a 29% market share, supported by strong healthcare infrastructure, national cardiac care programs, and rising emphasis on early diagnosis and preventive cardiology. Countries such as Germany, the United Kingdom, Italy, and France drive demand through well-developed emergency response systems and high utilization of standardized MI treatment pathways. The region benefits from growing adoption of statins, antiplatelet agents, and advanced reperfusion therapies. Aging populations and increasing lifestyle-related risk factors further accelerate market growth. Continuous investments in cardiac research and improved access to specialist care strengthen Europe’s position in the global market.

Asia Pacific

Asia Pacific holds a 24% market share, driven by rising incidence of cardiovascular diseases, rapid urbanization, and expanding access to hospital-based cardiac care. China, India, Japan, and South Korea represent major demand hubs due to large patient pools and increasing adoption of guideline-based treatments. Governments across the region invest heavily in healthcare modernization and public awareness campaigns related to heart diseases. Growing availability of emergency services and rising use of oral and injectable MI medications support market expansion. Asia Pacific remains the fastest-growing region due to improving healthcare access and increasing burden of cardiac risk factors.

Latin America

Latin America holds a 6% market share, driven by increasing awareness of cardiovascular diseases and expanding access to cardiac treatment services across Brazil, Mexico, Argentina, and Chile. Growth is supported by rising adoption of antiplatelet and anticoagulant therapies, though disparities in healthcare quality limit uniform access. Urban centers experience strong demand due to improved hospital infrastructure and expanding private healthcare networks. Public health initiatives focused on reducing hypertension and obesity also support early diagnosis and long-term therapy use. Despite economic fluctuations, the region shows steady growth driven by an increasing cardiac patient population.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, influenced by rising cardiac risk factors, including diabetes, hypertension, and smoking. Countries such as Saudi Arabia, the UAE, and South Africa lead adoption due to expanding hospital infrastructure and greater availability of cardiology specialists. Investments in emergency medical services and improved diagnosis capabilities support early MI management. However, limited access to advanced therapies and affordability challenges constrain broader adoption. Growing government focus on healthcare modernization and preventive programs is expected to strengthen long-term demand for myocardial infarction treatment across the region.

Market Segmentations:

By Drug Class

- Antiplatelet Agents

- Anticoagulants

- Beta-Blockers

- Others

By Therapy Type

- Medication Therapy

- Reperfusion Therapy

- Combination Therapy

By Route of Administration

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as AstraZeneca, Novartis AG, Bayer AG, Bristol-Myers Squibb, Johnson & Johnson, Pfizer Inc., Amgen Inc., Eli Lilly and Company, Sanofi, and Merck & Co., Inc. These companies strengthen their presence through extensive cardiovascular drug portfolios, strong distribution networks, and continuous investment in R&D for next-generation antiplatelets, anticoagulants, statins, and biologics. Many players focus on developing safer and more effective therapies with improved dosing profiles to reduce adverse events and enhance long-term patient outcomes. Strategic partnerships with research institutes, expansion into emerging markets, and regulatory approvals for advanced formulations support market growth. Companies also invest in real-world evidence studies and personalized medicine approaches to differentiate their products. With rising cardiovascular disease prevalence and growing demand for evidence-based therapies, leading players continue to compete on innovation, clinical trial success, and global market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AstraZeneca

- Novartis AG

- Bayer AG

- Bristol-Myers Squibb

- Johnson & Johnson (Janssen Pharmaceuticals)

- Pfizer Inc.

- Amgen Inc.

- Eli Lilly and Company

- Sanofi

- Merck & Co., Inc.

Recent Developments

- In November 2025, Bristol‑Myers Squibb and Johnson & Johnson halted a late-stage trial of their experimental anticoagulant Milvexian in patients after acute coronary syndrome — including MI — because the drug was unlikely to meet its main efficacy goal (despite no new safety concerns).

- In August 2025, Merck & Co., Inc. presented new real-world and trial data at the European Society of Cardiology Congress 2025 (ESC 2025) on atherosclerotic cardiovascular disease, including myocardial infarction outcomes and lipid-lowering therapy use trends in large patient cohorts.

- In March 2025, Eli Lilly and Company reported that its experimental drug lepodisiran cut levels of lipoprotein(a) — a known risk factor for heart attack — by 94% in a Phase-2 trial compared with placebo

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Therapy Type, Route of Administration, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for myocardial infarction treatments will rise as cardiovascular cases continue increasing worldwide.

- Advancements in antiplatelet and anticoagulant therapies will improve long-term patient outcomes.

- Personalized treatment approaches will gain traction through genetic profiling and risk-based therapy selection.

- Digital cardiac monitoring and telemedicine will strengthen post-MI care and reduce readmission rates.

- Reperfusion therapies will expand with better access to advanced cardiac centers in developing regions.

- Pharmaceutical companies will invest more in safer drugs with fewer bleeding risks.

- Combination therapy adoption will grow as clinical guidelines favor integrated treatment strategies.

- Emerging markets will experience faster growth due to improving healthcare infrastructure and growing awareness.

- AI-driven diagnostic tools will enhance early MI detection and quicker treatment decisions.

- Preventive cardiology programs will strengthen demand for long-term maintenance therapies across global markets.