Market Overview

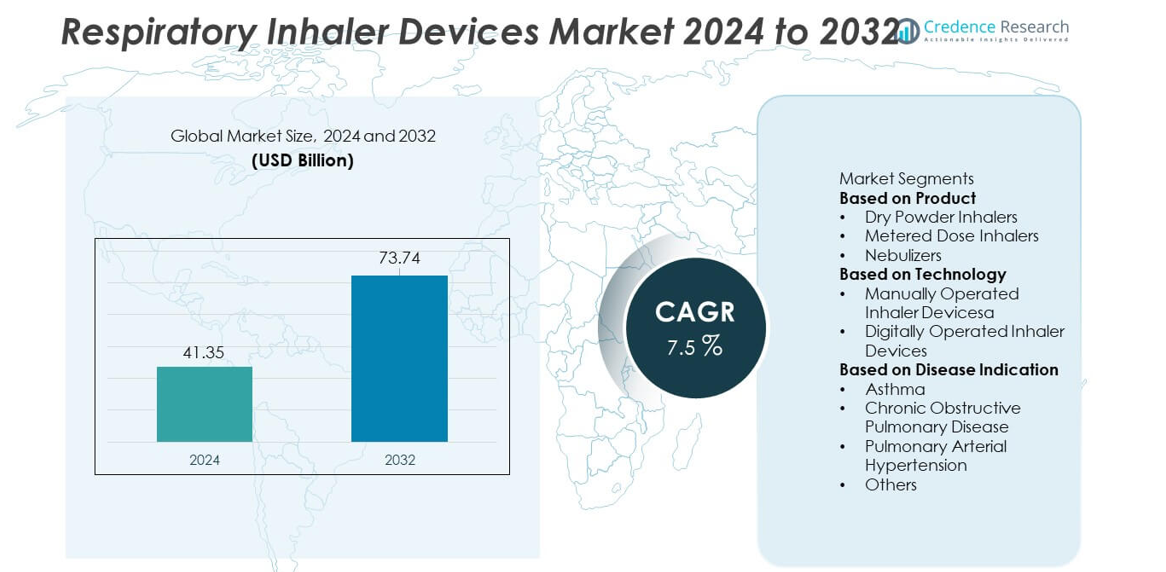

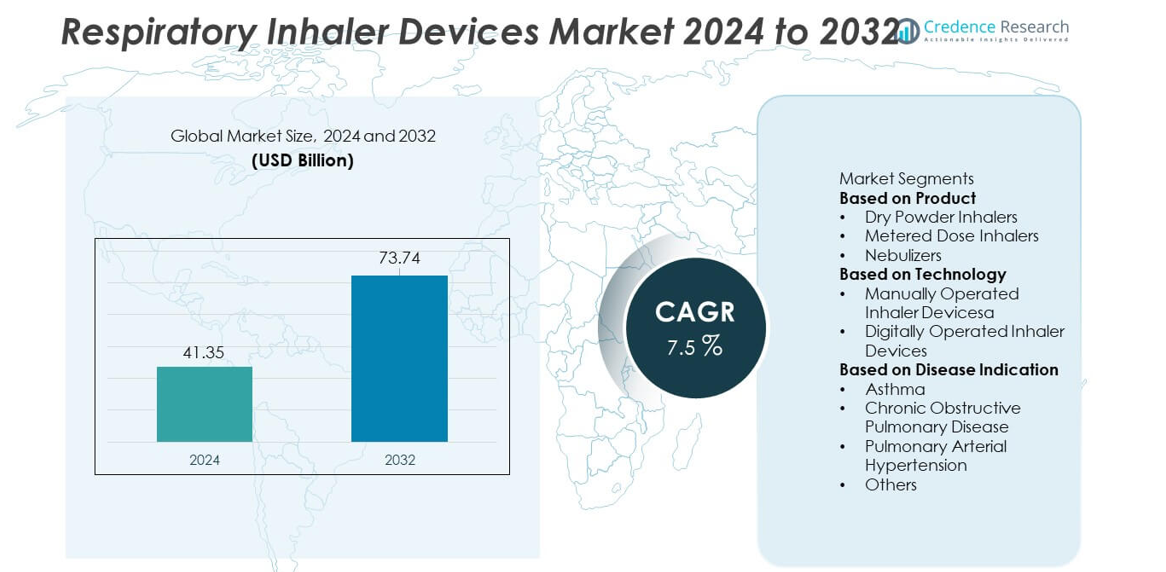

The Respiratory Inhaler Devices market reached USD 41.35 billion in 2024 and is projected to grow to USD 73.74 billion by 2032, supported by a 7.5% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Respiratory Inhaler Devices Market Size 2024 |

USD 41.35 billion |

| Respiratory Inhaler Devices Market, CAGR |

7.5% |

| Respiratory Inhaler Devices Market Size 2032 |

USD 73.74 billion |

The leading companies in the Respiratory Inhaler Devices market include GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim, Teva Pharmaceutical Industries Ltd., Novartis AG, Koninklijke Philips N.V., PARI Medical, Cipla Ltd., Omron Healthcare, and 3M Health Care. These companies strengthen their position through device innovation, digital inhaler platforms, and strong respiratory drug–device combinations. North America leads the market with 38% share, supported by advanced healthcare access and high adoption of smart inhalers. Europe holds 29% share, driven by strong regulatory support and rising COPD cases. Asia Pacific records 24% share, fueled by expanding patient pools and improved distribution channels. The competitive landscape continues to shift as firms invest in connected inhalers, patient monitoring technologies, and strategic collaborations that enhance long-term market growth.

Market Insights

- The market reached USD 41.35 billion in 2024 and will expand at a 7.5% CAGR, driven by rising respiratory disease prevalence and higher inhaler adoption across major regions.

- Strong demand for metered dose inhalers, holding 46% share, fuels growth as patients seek portable and easy-to-use devices supported by favorable reimbursement and wider retail availability.

- Digital inhaler advances boost adoption, with North America leading the market at 39% share, supported by connected device integration and strong healthcare spending.

- Competitive analysis shows leading companies expanding smart inhaler portfolios and focusing on sensor-enabled platforms for better dose tracking and therapy outcomes.

- Market restraints include high device costs, misuse-related inefficiency, and limited access in developing regions, while Asia Pacific with 28% share grows rapidly due to rising COPD and asthma cases and improved healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Dry powder inhalers lead this segment with a 42% share, supported by strong adoption in asthma and COPD management. Their breath-activated mechanism reduces coordination errors and improves dose delivery, which boosts preference among adults and adolescents. Metered dose inhalers follow due to wide availability and low cost, while nebulizers remain vital for severe respiratory cases and pediatric use. Growth across all product types is driven by rising respiratory disease prevalence, expanding home-care usage, and improved formulation technologies. Manufacturers focus on portable, user-friendly devices that support consistent dosing and better adherence.

- For instance, AstraZeneca leverages digital solutions and artificial intelligence to streamline various processes, from clinical trial design to data collection from remote devices.

By Technology

Manually operated inhaler devices dominate this category with a 68% share, driven by their affordability, simple design, and widespread use in both developing and developed regions. These devices remain the primary choice for asthma and COPD patients who rely on standardized inhalation techniques. Digitally operated inhalers grow steadily as connected features support dose tracking, error reduction, and remote monitoring. Rising demand for smart respiratory care, supported by telehealth adoption, accelerates digital inhaler penetration. Increased focus on treatment adherence and personalized therapy strengthens the shift toward sensor-enabled inhalation platforms.

- For instance, Teva Pharmaceutical validated its Digihaler sensor module through clinical testing that logged patient inhaler use data, including information on inhalation quality and patterns over time.

By Disease Indication

Asthma holds the dominant position with a 51% share, supported by high global incidence and strong reliance on maintenance inhalers. COPD follows closely as aging populations and smoking-related conditions push the need for frequent and long-term inhalation therapy. Pulmonary arterial hypertension and other respiratory disorders add to segment growth through increased adoption of targeted inhalation treatments. Rising pollution levels, higher diagnostic rates, and patient preference for portable devices drive widespread inhaler use across indications. Continuous improvement in drug formulations and inhaler delivery efficiency further enhances demand.

Key Growth Drivers

Rising Global Burden of Respiratory Diseases

Growing cases of asthma, COPD, and other chronic respiratory disorders drive strong demand for inhaler devices worldwide. Rising pollution levels, smoking rates, and urbanization increase respiratory disease prevalence, especially in emerging markets. Healthcare providers adopt advanced inhalers to improve long-term symptom control and prevent hospital admissions. Patients seek portable and easy-to-use devices, boosting adoption across homecare settings. Increasing disease diagnosis and awareness campaigns further accelerate inhaler uptake. Pharmaceutical companies enhance drug formulations to improve patient compliance and therapeutic outcomes. This expanding respiratory patient base continues to support steady market growth across both developed and developing regions.

- For instance, GSK scaled its Ellipta platform after completing clinical trials across multiple respiratory indications, confirming consistent dose delivery across varied inhalation profiles.

Shift Toward Smart and Digitally Enabled Inhalers

Adoption of connected inhalers rises as providers prioritize remote monitoring and personalized respiratory care. Digitally operated devices help track dosage accuracy, improve medication adherence, and support early detection of symptom changes. Integration with mobile apps enables real-time data transfer, helping clinicians adjust treatment plans faster. Smart inhalers gain strong acceptance in asthma and COPD management due to clinical need for continuous monitoring. Manufacturers invest in sensors, wireless technologies, and data-driven platforms to enhance device functionality. As home-based care expands, digitally enabled inhalers become a key growth driver for improved therapy outcomes.

- For instance, Novartis advanced its digital adherence programs by integrating platforms with sensors to track inhaler usage data through cloud-connected modules.

Expansion of Homecare and Self-Management Solutions

Homecare use increases as patients prefer convenient treatment options that reduce hospital visits and improve daily symptom control. Portable inhalers and compact nebulizers support self-management, especially among elderly patients and those with chronic respiratory issues. Healthcare systems encourage home-based treatment to reduce cost burden and improve patient comfort. Growth in telehealth services enhances remote support for inhaler use and dosage adherence. Companies develop lightweight, user-friendly devices with simplified operation for home use. This shift toward home therapy continues to expand market demand and strengthens long-term adoption trends.

Key Trends & Opportunities

Rise of Personalized and Precision Respiratory Therapy

Advances in sensor technology, digital monitoring, and AI-driven analytics support personalized treatment plans for respiratory patients. Device manufacturers design inhalers that adjust dosage patterns based on patient behavior and lung function. Precision therapy helps reduce medication wastage and improves long-term clinical outcomes. Integration with digital platforms creates opportunities for data-driven product development and customized care pathways. Growing focus on individualized treatment enhances patient satisfaction and drives premium device adoption. This trend positions smart inhalers as a major opportunity across specialty care and homecare environments.

- For instance, Propeller Health enhanced precision-therapy tools after validating sensor performance through datasets covering many inhaler events linked to clinical outcomes.

Growing Adoption of Environment-Friendly Inhaler Designs

Manufacturers explore eco-friendly inhaler components and low-emission propellants to comply with sustainability regulations. Metered dose inhalers shift toward greener propellant technologies to reduce environmental impact. Dry powder inhalers gain traction because they require no propellant and generate lower emissions across their lifecycle. Companies invest in recyclable materials, biodegradable packaging, and sustainable device designs. Increasing patient and regulatory pressure to reduce carbon footprint creates new opportunities for innovation. This trend strengthens the market shift toward sustainable respiratory care solutions globally.

- For instance, Chiesi Group invested in sustainable MDI designs supported by laboratory studies that measured propellant performance across aerosol dispersion cycles. These studies have shown comparable performance and tolerability of the new formulation, with a significantly reduced carbon footprint.

Key Challenges

High Cost of Advanced and Digitally Integrated Devices

Smart inhalers and sensor-based devices often carry higher prices, limiting adoption in cost-sensitive markets. Upfront investment in digital platforms, monitoring systems, and technology integration raises total therapy costs. Limited reimbursement coverage for advanced inhalers further restricts uptake among low-income patient groups. Healthcare providers in developing regions face budget constraints that slow digital inhaler adoption. This cost challenge remains a major barrier to widespread use of next-generation respiratory inhaler devices.

Complexity in Device Usage and Patient Non-Adherence

Many patients struggle with correct inhaler techniques due to device complexity, leading to poor symptom control. Incorrect inhalation timing, coordination issues, and dosage errors reduce treatment effectiveness. Elderly patients and children face added difficulty in managing certain device types. Non-adherence results in higher hospitalization risk and reduced long-term therapy outcomes. Despite training efforts, improving user technique remains a key challenge that affects inhaler performance and overall market efficiency.

Regional Analysis

North America

North America holds a 38% share of the Respiratory Inhaler Devices market, driven by high asthma and COPD prevalence and strong adoption of advanced inhalation technologies. The region benefits from established reimbursement systems, widespread access to healthcare, and early uptake of digitally connected inhalers. Major companies expand product availability through smart inhaler launches and strategic collaborations with digital health platforms. Rising demand for portable nebulizers and user-friendly inhaler formats further strengthens regional growth. Public health initiatives focused on reducing respiratory disease complications also support a steady rise in inhaler usage across clinical and homecare settings.

Europe

Europe accounts for a 29% share of the Respiratory Inhaler Devices market, supported by strong regulatory emphasis on treatment adherence and patient safety. The region adopts dry powder inhalers and eco-friendly propellant-free inhalers at a rapid pace due to sustainability policies. High diagnosis rates of asthma and COPD fuel consistent demand for maintenance therapy devices. Healthcare providers encourage the shift toward digitally monitored inhalers to improve long-term disease control. Growing investment in homecare respiratory management and increased use of compact nebulizers in elderly populations further expand the market across major countries such as Germany, the U.K., France, and Italy.

Asia Pacific

Asia Pacific holds a 25% share of the Respiratory Inhaler Devices market and represents the fastest-growing region due to rising pollution levels, urbanization, and increasing respiratory disease burden. Large patient populations in China and India drive significant demand for affordable inhalation therapies. Expanding healthcare infrastructure and growing awareness of early diagnosis encourage wider adoption of metered dose inhalers and nebulizers. Regional manufacturers strengthen cost-effective production and expand distribution across emerging markets. Government-led initiatives to manage chronic respiratory conditions support steady device penetration, while interest in digitally enabled inhalers grows as telehealth services expand.

Latin America

Latin America captures an 5% share of the Respiratory Inhaler Devices market, driven by increasing diagnosis and treatment of asthma and COPD across Brazil, Mexico, and Argentina. Limited access to specialist care boosts the demand for user-friendly inhalers suited for self-management. Growth in public healthcare spending supports wider distribution of essential inhalation therapies. Rising pollution in urban centers and a growing elderly population contribute to higher inhaler consumption. Market expansion remains moderate due to pricing pressures, yet investments in local manufacturing and improved supply chains help increase the availability of dry powder inhalers and portable nebulizers.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Respiratory Inhaler Devices market, supported by growing awareness of chronic respiratory diseases and expanding access to primary care services. Countries such as Saudi Arabia, the UAE, and South Africa show rising adoption of advanced inhalers due to higher pollution exposure and lifestyle-related respiratory challenges. Government programs promote early detection and long-term management, boosting demand for metered dose inhalers and compact nebulizers. However, limited affordability in several African nations slows broader uptake. Despite constraints, ongoing investment in healthcare modernization supports a gradual rise in inhaler device usage.

Market Segmentations:

By Product

- Dry Powder Inhalers

- Metered Dose Inhalers

- Nebulizers

By Technology

- Manually Operated Inhaler Devicesa

- Digitally Operated Inhaler Devices

By Disease Indication

- Asthma

- Chronic Obstructive Pulmonary Disease

- Pulmonary Arterial Hypertension

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Respiratory Inhaler Devices market features leading companies such as GSK plc, AstraZeneca, Boehringer Ingelheim, Novartis AG, Teva Pharmaceutical Industries, Koninklijke Philips, PARI Medical, Cipla Ltd., Chiesi Farmaceutici, and Omron Healthcare. These companies focus on device innovation, digital integration, and expanded therapeutic coverage. Firms strengthen portfolios through sensor-enabled inhalers, advanced DPI formulations, and next-generation nebulizer platforms. Digital adherence solutions, data-tracking features, and connected inhalers support stronger retention among patients with chronic conditions. Key players invest in partnerships with healthcare providers to improve respiratory disease management and patient training programs. Manufacturers also increase output capacities across Europe, Asia Pacific, and North America to meet rising demand for COPD and asthma treatments. Continuous R&D in drug–device combinations, environmentally safer propellants, and compact home-use systems reinforces competition and shapes long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AstraZeneca

- GlaxoSmithKline (GSK)

- Boehringer Ingelheim

- Novartis AG

- Teva Pharmaceutical Industries

- Cipla Ltd.

- Koninklijke Philips N.V.

- PARI GmbH

- Omron Healthcare

- Merck & Co., Inc.

Recent Developments

- In July 2025, AstraZeneca’s eco-friendly reformulation of Trixeo Aerosphere (using a next-generation low-GWP propellant) gained backing from the EU’s medicines regulator panel, the CHMP.

- In May 2025, AstraZeneca announced that its triple-combination inhaler Breztri Aerosphere met all primary endpoints in two late-stage clinical trials for uncontrolled asthma.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Disease Indication and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand rises as patients shift toward smart inhalers with real-time monitoring support.

- Digital platforms integrate with inhalers to improve adherence tracking and clinical decisions.

- Eco-friendly inhaler designs gain traction as regulators push for lower emissions.

- AI-enabled inhalers enhance dose accuracy and reduce misuse across key patient groups.

- Home-based respiratory care expands, driving higher sales of portable inhaler systems.

- Drug–device combination products gain market share due to better therapeutic outcomes.

- Connected inhalers support remote patient management for chronic lung disorders.

- Growth accelerates in Asia Pacific with rising asthma and COPD cases.

- Manufacturers invest in advanced sensors and micro-actuators to improve performance.

- Partnerships grow between pharma companies and digital health firms to strengthen adoption.