Market Overview

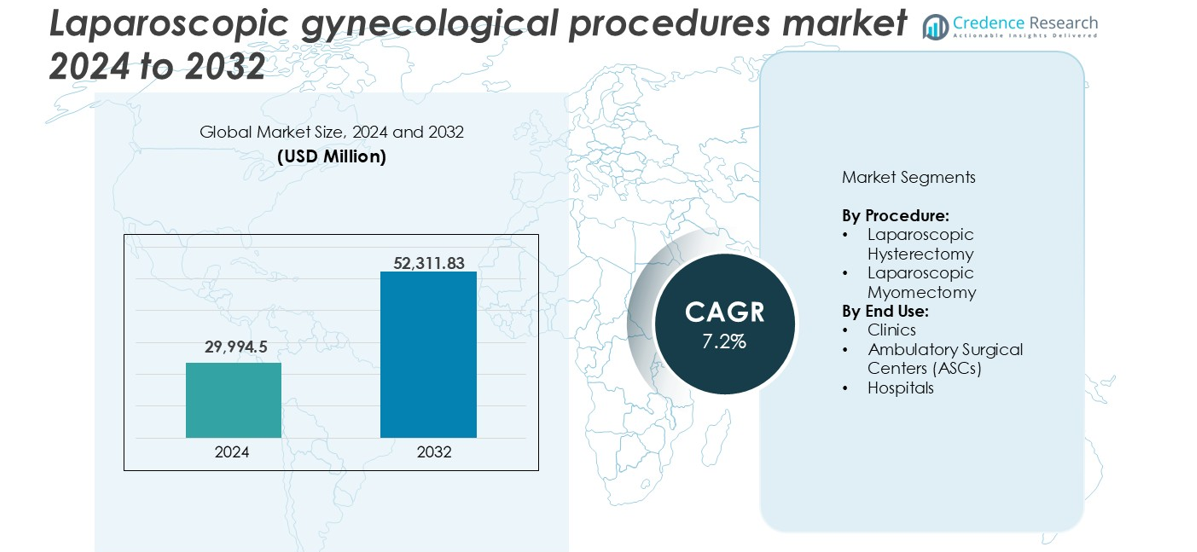

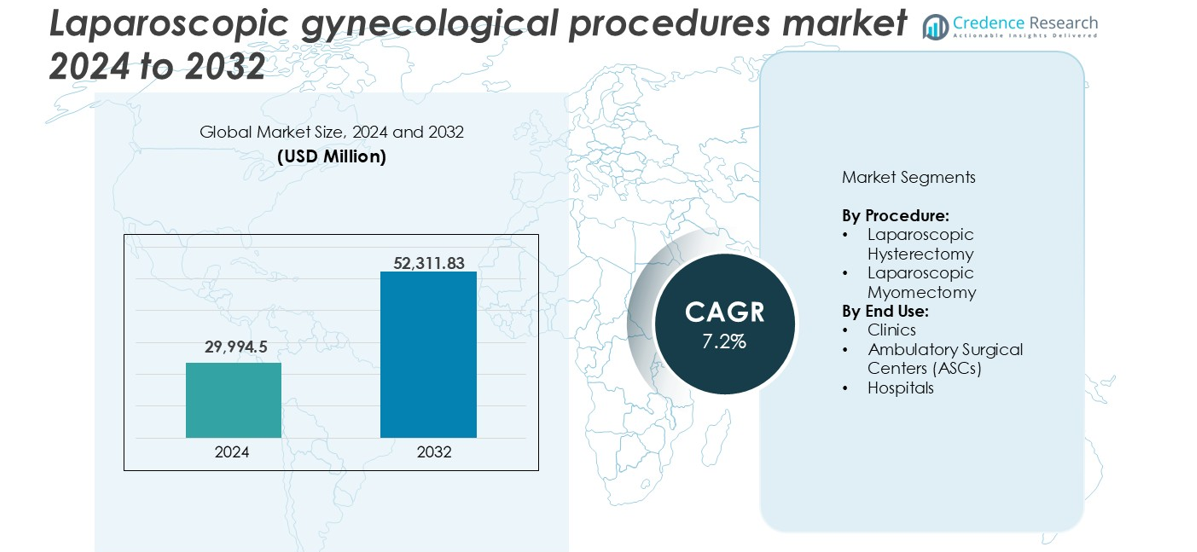

The Laparoscopic Gynecological Procedures Market size was valued at USD 29,994.5 million in 2024 and is anticipated to reach USD 52,311.83 million by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laparoscopic Gynecological Procedures Market Size 2024 |

USD 29,994.5 million |

| Laparoscopic Gynecological Procedures Market, CAGR |

7.2% |

| Laparoscopic Gynecological Procedures Market Size 2032 |

USD 52,311.83 million |

Top players in the laparoscopic gynecological procedures market include Medtronic, Johnson & Johnson, Stryker, Olympus Corporation, Karl Storz SE & CO. KG, and Intuitive Surgical. These companies lead through strong product portfolios, continuous innovation, and global reach. They offer advanced laparoscopic systems, energy devices, and imaging technologies that support high procedural efficiency. North America dominates the market with a 35% share in 2024, driven by high surgical volumes, skilled healthcare professionals, and favorable reimbursement structures. Europe follows with a 28% share, supported by well-established hospital networks and early adoption of minimally invasive techniques.

Market Insights

- The laparoscopic gynecological procedures market was valued at USD 29,994.5 million in 2024 and is projected to reach USD 52,311.83 million by 2032, growing at a CAGR of 7.2%.

- Rising demand for minimally invasive surgeries due to faster recovery, reduced pain, and lower risk drives market growth.

- Key trends include growing adoption of robotic-assisted laparoscopy and the expansion of ambulatory surgical centers for day-care procedures.

- Major players like Medtronic, Johnson & Johnson, and Olympus lead the market through advanced devices and global presence, while mid-sized firms focus on innovation in ergonomic and precision tools.

- North America holds the largest regional share at 35%, followed by Europe at 28% and Asia-Pacific at 22%. By procedure, laparoscopic hysterectomy leads with over 60% segment share, while hospitals account for more than 65% of procedures by end use, supported by better infrastructure and skilled personnel.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Procedure

Laparoscopic hysterectomy holds the largest share in the laparoscopic gynecological procedures market, accounting for over 60% of the segment in 2024. This dominance is driven by its widespread adoption for treating conditions such as fibroids, endometriosis, and abnormal bleeding. Surgeons prefer the technique due to reduced postoperative pain, quicker recovery, and lower risk of complications. Increasing awareness about minimally invasive surgeries further supports its use. Laparoscopic myomectomy also sees steady growth, especially among younger women seeking fertility-preserving options, but adoption remains limited compared to hysterectomy due to procedural complexity.

- For instance, in 2023, Intuitive Surgical’s da Vinci systems supported approximately 2.29 million procedures globally, a 22% increase over 2022. While gynecologic procedures like hysterectomies remain a core application, general surgery has become the largest and fastest-growing category for the platform.

By End Use

Hospitals dominate the end-use segment with more than 65% market share in 2024, supported by advanced infrastructure, availability of skilled surgical teams, and comprehensive post-surgical care. Hospitals perform a high volume of gynecological surgeries, especially for complex cases requiring advanced imaging and anesthesia. Clinics and ambulatory surgical centers (ASCs) show growing traction, particularly for elective and outpatient procedures. ASCs benefit from faster turnaround, reduced costs, and shorter waiting times, making them attractive for routine laparoscopic interventions, although hospitals remain the primary setting for most high-risk or complicated procedures.

- For instance, Cleveland Clinic performed over 6,000 gynecological surgeries in 2023, with more than 90% of minimally invasive cases performed in outpatient settings.

Key Growth Drivers

Rising Preference for Minimally Invasive Surgical Techniques

Minimally invasive procedures continue to gain traction due to their clinical advantages. Laparoscopic gynecological procedures offer reduced post-operative pain, shorter hospital stays, minimal scarring, and faster recovery times. These benefits align with patient preferences and healthcare provider goals to improve outcomes and reduce costs. Surgeons also favor laparoscopy for its enhanced visualization and precision. Increased awareness, growing gynecological disease burden, and the shift toward outpatient care have accelerated adoption globally. In developing regions, improving hospital infrastructure and rising access to skilled surgeons support growth. Elective procedures like laparoscopic hysterectomy and myomectomy now see higher volumes across both public and private care settings.

- For instance, India’s Apollo Hospitals Group has expanded its specialized gynecology units across more than 15 major cities, utilizing its Apollo Spectra and Mainstream Hospital networks to perform thousands of minimally invasive procedures annually.

Growing Incidence of Gynecological Disorders

The prevalence of conditions such as uterine fibroids, endometriosis, and abnormal uterine bleeding continues to rise. These disorders often require surgical intervention when medication proves ineffective. Laparoscopic procedures are increasingly the first-line surgical option for such conditions, especially among women of reproductive age. Lifestyle changes, late pregnancies, and hormonal imbalances have contributed to disease incidence across urban populations. Diagnostic advancements and better screening practices have improved detection rates, further increasing procedure volume. Hospitals and specialty clinics are now better equipped to offer timely laparoscopic care, boosting market demand. The need for fertility-preserving treatments also drives myomectomy cases, particularly in younger women.

- For instance, the Centers for Disease Control and Prevention (CDC) reports that uterine fibroids affect up to 70% of women by age 50 in the U.S., driving demand for surgical management.

Technological Advancements in Surgical Equipment

Continuous improvements in laparoscopic tools, imaging systems, and energy devices have enhanced surgical efficiency and safety. High-definition cameras, 3D visualization, and robotic assistance now enable greater precision during complex gynecological procedures. Advanced energy devices reduce tissue damage and bleeding, improving patient outcomes. These innovations have lowered the learning curve for surgeons and improved adoption across tier-2 and tier-3 hospitals. Companies invest in ergonomic instruments and AI-enabled platforms to support decision-making. For instance, integrated systems that combine visualization, suction, and dissection enhance operative control. As hospitals upgrade equipment, more institutions offer laparoscopic services, expanding access and procedure volumes.

Key Trends & Opportunities

Rise of Ambulatory Surgical Centers and Day-Care Procedures

The shift toward outpatient laparoscopic surgeries is accelerating. Ambulatory surgical centers (ASCs) offer lower costs, reduced infection risks, and faster turnover than traditional hospitals. Improvements in anesthesia and post-operative care now allow same-day discharge for procedures like laparoscopic hysterectomy and myomectomy. Payers and patients prefer ASCs due to affordability and convenience. Surgeons also benefit from focused workflows and scheduling flexibility. This trend supports greater case volumes, especially in urban centers. Private healthcare chains are expanding ASC networks to meet demand. The model aligns well with value-based care initiatives and supports long-term market growth.

- For instance, Surgery Partners performed over 605,000 surgical cases across its 180+ locations in 2023, with gynecologic surgery remaining a key component of its multi-specialty outpatient portfolio.

Expanding Access in Emerging Economies

Emerging markets present significant growth opportunities due to increasing investments in healthcare infrastructure. Countries across Asia-Pacific, Latin America, and the Middle East are expanding surgical capacity to meet women’s health needs. Government programs support minimally invasive surgery training and equipment upgrades in public hospitals. Rising disposable income and health awareness also drive demand in private sectors. Medical tourism in countries like India and Thailand further fuels adoption. Local distributors and multinational device makers are forming strategic partnerships to penetrate these markets. Expanding access to skilled care and diagnostics will continue to unlock volume potential in these underserved regions.

Key Challenges

High Equipment and Setup Costs

Laparoscopic gynecological procedures require advanced operating room infrastructure, high-end imaging systems, and trained personnel. The upfront investment for hospitals remains significant, especially in low-income regions. Consumable costs and device maintenance add to the financial burden. Smaller clinics often lack the capital or volume justification to invest in full laparoscopic setups. As a result, access is uneven across geographies. Limited reimbursement in some countries further restricts affordability for patients and providers. While prices are gradually declining, cost remains a barrier to large-scale adoption, especially in rural or resource-constrained environments.

Steep Learning Curve and Skilled Surgeon Shortage

Laparoscopic surgery requires advanced hand-eye coordination, specialized training, and consistent practice. Many gynecological surgeons in developing regions still rely on open techniques due to limited access to formal laparoscopy training programs. The learning curve delays adoption and impacts surgical outcomes in some cases. Lack of simulation-based training tools and standardized certification also hinders skill development. Experienced laparoscopic surgeons are concentrated in urban tertiary centers, creating geographic disparities in access. Expanding training infrastructure, mentorship programs, and curriculum integration in medical schools will be necessary to address this challenge and ensure consistent procedural quality.

Regional Analysis

North America

North America holds the largest share of the laparoscopic gynecological procedures market, accounting for over 35% in 2024. The region benefits from high awareness, advanced surgical infrastructure, and favorable reimbursement policies. The U.S. leads due to widespread adoption of minimally invasive techniques in both public and private hospitals. Gynecologists are well-trained in laparoscopy, and patients actively prefer quicker recovery options. Robust presence of medical device manufacturers also drives innovation and accessibility. Canada shows steady growth supported by government-backed healthcare and an aging population with increased demand for hysterectomy and myomectomy procedures.

Europe

Europe represents approximately 28% of the global market share, driven by strong healthcare systems and early adoption of laparoscopic techniques. Countries like Germany, France, and the UK lead in procedural volume due to skilled surgical teams and high diagnostic penetration. Public hospitals and academic centers are equipped with advanced imaging and minimally invasive tools. Growing awareness of women’s health and rising fibroid cases support consistent demand. Eastern Europe sees gradual uptake as healthcare funding improves. Cross-border healthcare policies and support for outpatient surgery further reinforce the region’s growth momentum.

Asia-Pacific

Asia-Pacific accounts for around 22% of the laparoscopic gynecological procedures market and shows the fastest growth rate. Rising population, increased access to healthcare, and government investment in hospital upgrades are key drivers. China, Japan, and India lead regional demand, supported by growing gynecological disorder prevalence and improved insurance coverage. Medical tourism in Thailand, Singapore, and South Korea boosts procedural volume. Surgeons are increasingly trained in laparoscopy through national programs. Urban hospitals rapidly adopt advanced technologies, while rural areas show slower uptake due to infrastructure gaps. Device manufacturers expand partnerships to meet rising demand.

Latin America

Latin America holds a smaller share of about 9% in the global market but demonstrates steady growth. Brazil and Mexico lead in adoption due to expanding private hospital networks and increasing urban population. Rising awareness about minimally invasive options and improving health insurance penetration support procedure volumes. Public sector investments in surgical capacity also contribute to access in mid-sized cities. However, limited training programs and uneven access to equipment remain challenges. Cross-country collaborations and professional education efforts are helping increase the regional capability to perform laparoscopic gynecological surgeries.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of the market. Gulf countries like Saudi Arabia and the UAE dominate due to strong investments in healthcare infrastructure and high demand for advanced surgical care. These nations attract medical professionals and technologies from global markets. In Africa, access remains concentrated in private hospitals and urban centers. The demand for minimally invasive gynecological procedures is rising as awareness and income levels grow. Government programs supporting maternal health and international aid initiatives help expand access, but affordability and skilled workforce shortages still limit broad adoption.

Market Segmentations:

By Procedure:

- Laparoscopic Hysterectomy

- Laparoscopic Myomectomy

By End Use:

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Hospitals

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the laparoscopic gynecological procedures market is marked by the presence of several global and regional players focused on innovation, product expansion, and strategic partnerships. Leading companies such as Medtronic, Johnson & Johnson, Stryker, and Olympus Corporation dominate with strong product portfolios and global distribution networks. These firms invest heavily in developing advanced imaging systems, robotic-assisted platforms, and ergonomic instruments to enhance surgical precision and efficiency. Mid-sized players like Karl Storz, Richard Wolf GmbH, and CONMED Corporation offer specialized tools and compete through technological differentiation. Intuitive Surgical and Microline Surgical strengthen competition by promoting robotic and minimally invasive solutions tailored for gynecological use. Firms also target emerging markets through localized manufacturing, training programs, and distributor collaborations to expand market access. The growing demand for outpatient procedures and surgeon-friendly tools continues to drive product innovation, while pricing pressure and hospital cost-containment strategies influence competition across both premium and value segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- B. Braun SE

- Welfare Medical Ltd.

- Medtronic

- Shenzhen Mindray Bio Medical Electronics Co., Ltd.

- Richard Wolf GmbH

- Stryker

- CONMED Corporation

- Johnson and Johnson

- Microline Surgical

- Karl Storz SE & CO. Kg

- Intuitive Surgical

- CooperCompanies

Recent Developments

- In May 2025, B. Braun Thailand partnered with the Thai-German Multidisciplinary Endoscopic Training (TG-MET) Center to advance laparoscopic gynecology training for resident physicians. The collaboration focuses on improving surgical proficiency and patient outcomes through education, global knowledge exchange, and hands-on experience, enhancing B. Braun’s commitment to enhancing minimally invasive gynecologic care in Thailand.

- In April 2024, Medtronic introduced 14 new AI algorithms to enhance its digital capabilities in post-operative analysis for laparoscopic and robotic-assisted surgery. These algorithms, integrated within the Touch Surgery ecosystem, provide surgical insights across various procedures, including cholecystectomy, sleeve gastrectomy, and hysterectomy

Report Coverage

The research report offers an in-depth analysis based on Procedure, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive gynecological surgeries will continue to grow across both developed and emerging markets.

- Robotic-assisted laparoscopic procedures will see wider adoption due to improved precision and surgeon control.

- Hospitals and specialty centers will expand investments in advanced laparoscopic equipment and training programs.

- Ambulatory surgical centers will gain traction for routine gynecological procedures due to cost and time efficiency.

- Rising awareness of uterine health will lead to earlier diagnosis and higher procedure volumes.

- Technological innovation in imaging, energy devices, and surgical tools will enhance procedural outcomes.

- Emerging economies will offer strong growth opportunities with improving healthcare infrastructure and access.

- Training programs and simulation-based education will reduce skill gaps among gynecological surgeons.

- Collaborations between medical device firms and hospitals will accelerate the deployment of integrated surgical systems.

- Regulatory support and favorable reimbursement frameworks will help drive market expansion globally.