Market Overview:

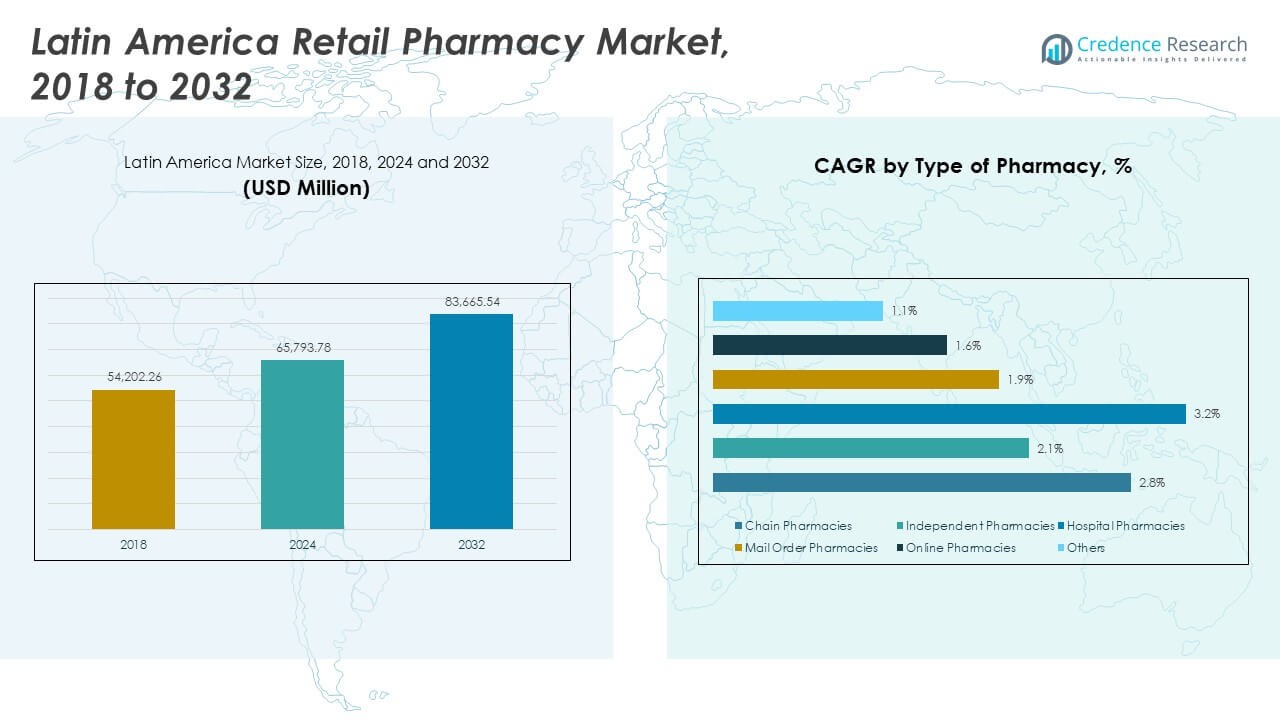

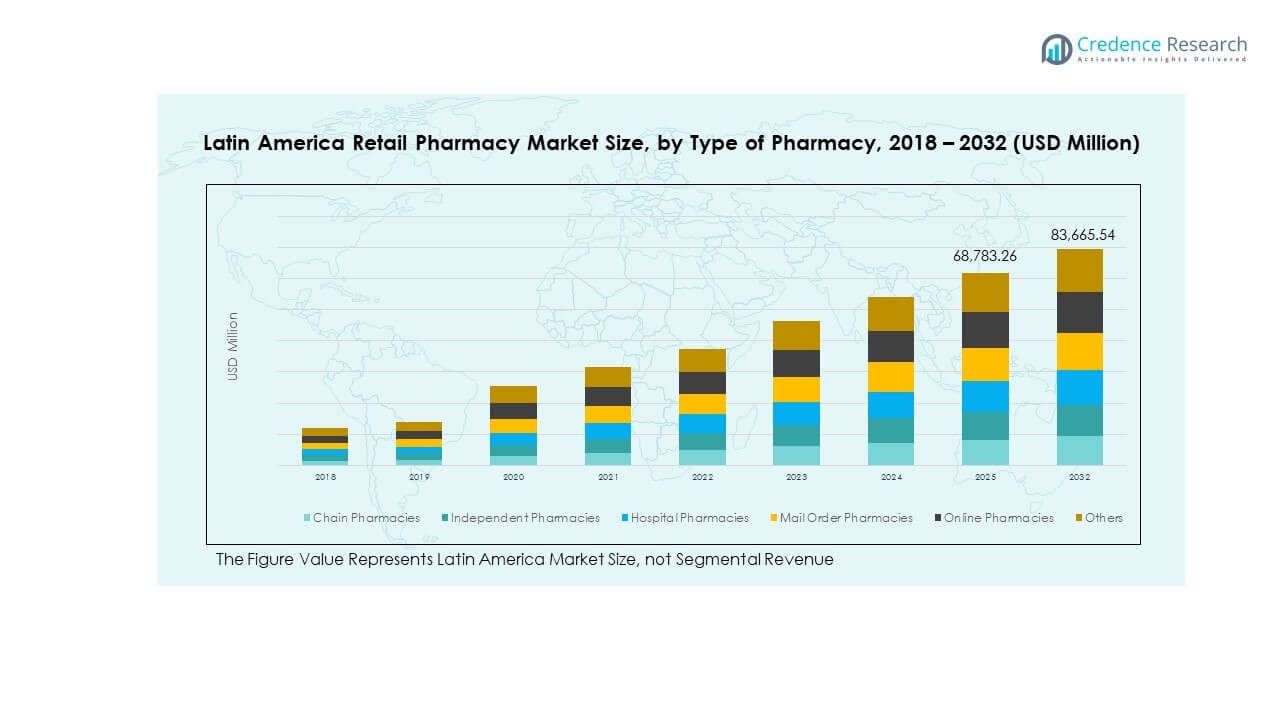

The Latin America Retail Pharmacy Market size was valued at USD 54,202.26 million in 2018 to USD 65,793.78 million in 2024 and is anticipated to reach USD 83,665.54 million by 2032, at a CAGR of 2.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Retail Pharmacy Market Size 2024 |

USD 65,793.78 Million |

| Latin America Retail Pharmacy Market, CAGR |

2.84% |

| Latin America Retail Pharmacy Market Size 2032 |

USD 83,665.54 Million |

The market is driven by rising healthcare awareness, improved access to medicines, and growing consumer demand for convenient healthcare solutions. Expanding urbanization and an increasing prevalence of chronic diseases are fueling the need for retail pharmacy services. E-pharmacy platforms and advanced digital solutions are improving operational efficiency and patient experience. Strategic investments, regulatory support, and innovative service offerings are shaping the market landscape and creating strong growth opportunities for both large chains and local operators.

Brazil leads the regional landscape, supported by its strong healthcare infrastructure and extensive pharmacy networks. Mexico is emerging as a fast-growing market driven by expanding retail chains and growing digital adoption. Argentina and Colombia are experiencing steady development through regulatory improvements and rising investment in healthcare access. Chile and other smaller markets are focusing on strengthening rural reach and modernizing distribution channels. This varied growth across subregions highlights the market’s expanding scope and rising strategic importance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America Retail Pharmacy Market was valued at USD 54,202.26 million in 2018, USD 65,793.78 million in 2024, and is projected to reach USD 83,665.54 million by 2032, growing at a CAGR of 2.84%.

- Brazil leads with a 38% share, followed by Mexico at 22% and Argentina at 14%, supported by strong healthcare infrastructure and dense retail networks.

- Mexico is the fastest-growing region with a 22% share, driven by expanding chain pharmacies and digital pharmacy adoption.

- Chain pharmacies hold 43% of the market share, supported by wide distribution and operational scale.

- Independent pharmacies account for 27% of the share, driven by localized service models and strong community trust.

Market Drivers

Rising Demand for Accessible and Affordable Healthcare Solutions

Growing healthcare awareness is increasing footfall at retail pharmacies across Latin America. Expanding access to essential medicines supports better treatment for chronic and acute conditions. It benefits from the rising middle-class population, which prioritizes convenient access to healthcare products. Urbanization creates demand for accessible drug distribution channels and patient-focused services. Government health programs support retail expansion through affordable medicine initiatives. Pharmacies offer broader product portfolios, including wellness and preventive care items. Consumers increasingly prefer pharmacy networks with transparent pricing and reliable product availability. This demand strengthens the market foundation for sustained growth.

- For instance, Farmacias Benavides, part of Walgreens Boots Alliance, offers over 11,000 products through its mobile app, which supports digital prescription uploads and home delivery across its nationwide network in Mexico. This expansion strengthens its digital health service accessibility.

Digital Transformation in Retail Pharmacy Operations

The rapid growth of e-pharmacy platforms is changing how customers access healthcare products. It enhances convenience, shortens waiting times, and ensures product availability across cities and towns. Pharmacies integrate digital payment systems, mobile applications, and automated order processing to meet customer expectations. Strong internet penetration supports digital prescription uploads and doorstep delivery models. Chain pharmacies invest in omnichannel retail strategies to build strong brand loyalty. Real-time inventory tracking helps reduce operational delays and stock shortages. Customers benefit from secure, transparent, and efficient ordering processes. These developments drive steady expansion of pharmacy networks.

Strengthening Pharmaceutical Distribution and Supply Chain Networks

Efficient supply chain systems enable timely medicine delivery to both urban and remote areas. Retailers build partnerships with wholesalers, logistics companies, and local distributors to optimize reach. It benefits from advanced warehouse management systems and cold chain logistics for sensitive drugs. Strong distribution networks help control costs and maintain product availability year-round. Government incentives encourage improved logistics infrastructure for the healthcare sector. Pharmacies use predictive analytics to prevent stockouts and manage high-demand products. Efficient last-mile delivery plays a key role in meeting consumer expectations. This solid logistics base supports scalable market growth.

- For instance, DHL Supply Chain announced in April 2025 the expansion of its Next‑Day Medical Expressservice connecting Brazil, Argentina, Chile, Colombia, and Peru to laboratories in the US, with 24/7 shipment monitoring and multi‑temperature control logistics for drugs and diagnostics.

Expanding Preventive Healthcare and Wellness Segment

Pharmacy chains are increasingly offering wellness, nutritional, and preventive health products alongside prescription medicines. Consumers prioritize self-care and regular monitoring of common health conditions. It gains strength from rising awareness of chronic diseases like diabetes and hypertension. Pharmacies expand service offerings such as vaccination, basic diagnostics, and health counseling. Product diversification builds brand loyalty and attracts wider consumer segments. Digital campaigns encourage people to adopt wellness routines supported by pharmacies. Preventive care products provide strong margins and stable demand cycles. These developments enhance revenue streams and build long-term customer engagement.

Market Trends

Integration of AI and Data Analytics in Retail Pharmacy Operations

Pharmacy chains are adopting AI-driven tools to improve operational efficiency. Advanced data analytics support demand forecasting, real-time stock monitoring, and automated replenishment systems. It strengthens decision-making on pricing, promotions, and targeted marketing strategies. Personalized recommendations improve consumer engagement and retention. Pharmacies leverage data insights to segment customers and optimize store performance. Predictive analytics support timely procurement of high-demand medicines. Digital dashboards enhance visibility across supply networks. This tech integration creates smarter, more responsive retail operations.

- For instance, Farmacias del Ahorro partnered with Google Cloud and Xertica to modernize its digital infrastructure, enabling over 11,000 videoconferences and generating nearly 3 million files on Google Drive within six months. This collaboration improved communication and operational efficiency across its nationwide pharmacy network in Mexico.

Expansion of Omnichannel Retailing Models Across Urban Markets

Pharmacies are embracing omnichannel models to create a unified shopping experience. Consumers can browse, order, and pick up products through multiple connected platforms. It enhances brand consistency and improves convenience for customers. Pharmacies integrate mobile apps, websites, and in-store systems to build stronger loyalty programs. Real-time synchronization ensures stock availability across channels. Companies use targeted promotions to engage online and offline shoppers. The model improves order accuracy, reduces delivery times, and enhances service quality. This shift positions pharmacy chains to meet evolving consumer expectations.

Growing Emphasis on Personalized Health and Consumer Experience

Consumers are seeking personalized product recommendations and tailored healthcare solutions. Pharmacies are implementing CRM systems to track preferences and purchase behavior. It allows targeted offers and better alignment of inventory with consumer needs. Wellness consultations and health monitoring programs attract new customers. Personalized experiences build trust and enhance repeat purchase rates. Loyalty programs reward frequent buyers and increase engagement. Pharmacies use advanced analytics to predict and meet future demand. This focus on personalization strengthens long-term relationships with consumers.

- For instance, Walgreens Boots Alliance deployed Zebra Technologies’ Workcloud Actionable Intelligence platform across roughly 8,000 U.S. stores in 2024. The technology enhanced inventory visibility and operational efficiency, supporting more accurate forecasting and streamlined pharmacy fulfillment processes nationwide.

Adoption of Sustainable Practices and Eco-Friendly Packaging

Pharmacy operators are integrating sustainable solutions to meet growing environmental expectations. Eco-friendly packaging and responsible sourcing practices are becoming standard. It reflects a growing shift in consumer values toward sustainability. Companies invest in recyclable materials and reduced plastic use. Green logistics strategies optimize transportation efficiency and lower emissions. Energy-efficient store designs reduce operational costs. Certifications and eco-labeling strengthen brand image in competitive markets. These practices support both environmental goals and customer trust.

Market Challenges Analysis

Regulatory Variability and Complex Compliance Environment

Diverse regulatory frameworks across Latin American countries create operational complexity. Pharmacies face different licensing, labeling, and pricing rules in each market. It increases compliance costs and limits expansion speed. Regulatory delays often affect the timely introduction of new drugs and health products. Smaller pharmacy operators struggle to keep pace with frequent policy updates. Differing pharmaceutical approval timelines disrupt consistent supply. Companies must invest in legal expertise and compliance technology to reduce risks. This fragmented landscape creates barriers for large-scale retail integration across multiple countries.

Economic Instability and Unequal Healthcare Access

Economic fluctuations affect both purchasing power and investment capacity in several countries. It impacts consumer spending on non-essential health and wellness products. Regional disparities in healthcare infrastructure limit pharmacy reach in rural zones. High inflation and currency volatility increase import costs for medicines. Smaller operators face pressure to maintain price stability while managing rising costs. Unreliable public healthcare access pushes demand toward private channels but increases inequality. Policy inconsistencies slow down coordinated development of nationwide pharmacy networks. This instability creates operational uncertainty for long-term strategic planning.

Market Opportunities

Expansion into Underserved and Rural Regions

Retail pharmacy chains have strong opportunities to grow in underserved rural and semi-urban areas. Strategic partnerships with logistics providers can address last-mile delivery gaps. It benefits from government programs promoting healthcare accessibility. Mobile health units and local distribution centers improve reach. Companies can tailor product portfolios to meet local health needs. Establishing presence in these regions builds strong market loyalty. These expansion initiatives enhance brand visibility and revenue streams. Rural growth creates a stable, long-term customer base.

Rising Adoption of Value-Added Healthcare Services

Pharmacies can increase profitability by offering diagnostic tests, wellness services, and vaccination programs. Consumers are willing to pay for convenient, reliable, and trusted healthcare solutions. It strengthens pharmacy positioning beyond product retailing. Value-added services create stronger differentiation from traditional outlets. Investment in trained staff and technology builds credibility. Pharmacies can partner with insurance providers to expand service access. These opportunities create sustainable revenue channels and higher consumer retention. Strategic execution ensures long-term competitive advantage in the region.

Market Segmentation Analysis

By Type of Pharmacy

Chain pharmacies dominate the Latin America Retail Pharmacy Market due to their extensive store networks and strong brand recognition. They benefit from economies of scale, advanced inventory management systems, and digital integration. Independent pharmacies maintain a steady presence by offering personalized service and community trust. Hospital pharmacies provide specialized care for inpatient and outpatient needs, while mail-order pharmacies gain traction for chronic disease prescriptions. Online pharmacies expand rapidly through e-commerce platforms. The “Others” category includes local cooperatives and regional outlets serving rural populations.

- For instance, Grupo DPSP (operating Drogaria São Paulo and Drogarias Pacheco) expanded to over 1,600 stores across nine Brazilian states in 2025 and announced the launch of more than 100 new stores alongside a new Health Hub service model for in-store vaccinations and diagnostic tests.

By Application

The oncology segment leads revenue generation due to rising cancer incidence and demand for continuous therapy. Diabetes follows, driven by growing awareness and medication adherence programs. Neurology medicines witness steady demand due to higher diagnosis rates of neurological disorders. Vitamins and supplements attract health-conscious consumers, reflecting preventive healthcare trends. OTC products show consistent growth due to easy availability and self-medication habits. The “Others” segment includes niche therapeutic areas supported by pharmacy consultations and digital prescriptions.

- For instance, Abbott Laboratories entered a 2023 agreement with mAbxience to launch oncology and women’s health biosimilars across Latin America by 2025, leveraging advanced GMP-certified manufacturing in Spain and Argentina. Diabetes medications show strong growth through digital monitoring.

By Type of Prescription

Prescription drugs hold the largest share owing to increased chronic disease prevalence and medical professional guidance. They require strong supply chain coordination and regulatory compliance. Over-the-counter (OTC) drugs, however, are expanding faster, fueled by consumer preference for affordable, easily accessible healthcare products. Pharmacies leverage promotional campaigns and digital platforms to boost OTC sales. This balance between prescription control and OTC convenience defines modern retail pharmacy evolution.

By Product Type

Generic drugs dominate sales due to affordability and growing acceptance among patients. Government efforts to promote cost-effective treatment support this segment. Branded drugs retain importance for specialized therapies requiring physician trust and strong brand assurance. The segment benefits from continuous product innovation, patent renewals, and awareness programs. It reinforces market diversity and drives competition among pharmacy distributors and manufacturers.

By Service Offered

Medication dispensing remains the foundation of pharmacy operations, ensuring compliance with treatment plans. Health screenings and vaccination services strengthen preventive healthcare roles. Consultation and counselling improve patient adherence and satisfaction. Chronic disease management programs support long-term patient engagement. It demonstrates the transition of pharmacies from simple drug dispensers to comprehensive health management centers.

By Customer Segment

Adult consumers account for a major share due to higher medication usage and self-care spending. The pediatric group depends on prescription-driven purchases, supported by awareness of child healthcare. Geriatric consumers represent a key segment with chronic disease needs and repeat prescriptions. It benefits from loyalty programs and home delivery services that enhance access and continuity of care. Pharmacies cater to each segment with tailored product portfolios and service models to sustain market growth.

Segmentation

By Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

- Others

By Application

- Oncology

- Diabetes

- Neurology

- Vitamins & Supplements

- OTC

- Others

By Type of Prescription

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Product Type

- Generic Drugs

- Branded Drugs

By Service Offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counselling

- Chronic Disease Management

By Customer Segment

- Pediatric

- Adults

- Geriatric

Regional Analysis

South America

South America holds a 54% share of the Latin America Retail Pharmacy Market, driven by Brazil, Argentina, and Chile. Brazil dominates the subregion due to its strong retail pharmacy chains, advanced healthcare infrastructure, and wide insurance coverage. Urbanization boosts demand for both prescription and OTC products. Pharmacy chains invest in digital integration, home delivery, and personalized care to strengthen their market position. Argentina and Chile benefit from growing health awareness and expanded pharmacy networks. Government support for generic drugs enhances accessibility across urban and semi-urban zones. It remains the most mature subregion with a balanced presence of chain and independent pharmacies.

Central America

Central America accounts for a 21% share of the Latin America Retail Pharmacy Market. Mexico plays a key role due to its large population, expanding pharmacy chains, and strong distribution infrastructure. Digital transformation supports e-pharmacy models and remote order fulfillment. Retail pharmacies offer chronic disease management programs, driving higher prescription volumes. Independent operators maintain significant market share in rural and semi-urban regions. Regulatory support for affordable drug access enhances consumer reach. It shows consistent growth with rising investment in logistics and service diversification.

Caribbean

The Caribbean holds a 25% share of the Latin America Retail Pharmacy Market, supported by markets such as Colombia and other island economies. Colombia leads the subregion through strategic expansion of pharmacy chains and strong digital adoption. Wellness products, preventive care, and OTC drugs drive consumer spending. Smaller islands focus on improving healthcare access through independent pharmacies and hospital-linked outlets. Online platforms are gaining popularity in urban centers. Tourism also supports demand for healthcare and wellness products. It is evolving into a dynamic growth region with strong opportunities for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Latin America Retail Pharmacy Market is characterized by strong competition among large regional chains, independent operators, and emerging digital platforms. It features both well-established pharmacy networks and growing online retailers competing for consumer trust and market coverage. Leading players such as RD Saúde, Pague Menos, Farmacias Guadalajara, Cruz Verde, and Farmatodo hold significant shares due to their extensive store networks and advanced service models. Smaller chains and independent pharmacies differentiate through localized services, community engagement, and flexible pricing strategies. Online platforms are expanding their footprint through e-pharmacy models and home delivery services. Strategic investments in digital infrastructure, logistics, and patient engagement tools strengthen competitive positioning. Mergers, acquisitions, and partnerships with health insurance providers drive further market consolidation. It fosters a dynamic environment where scale, operational efficiency, and technology adoption determine leadership. The competitive landscape is expected to intensify with increasing focus on value-added services and personalized healthcare delivery.

Recent Developments

- In October 2025, MercadoLibre made a major expansion into the Latin America retail pharmacy sector by launching a B2B marketplace and acquiring a prominent drugstore in Brazil. This strategic move marks MercadoLibre’s broader diversification beyond consumer retail and emphasizes the rapid digitalization in pharmacy distribution across Brazil, Argentina, Mexico, and Chile.

- In September 2025, Pague Menos completed a follow-on share offering, raising R$243.5 million (around $45.5 million) by issuing and selling common shares on the São Paulo Stock Exchange. This new capital strengthens their market position and supports ongoing expansion across the region. The transaction included both new shares from Pague Menos and shares sold by General Atlantic, a key investor.

Report Coverage

- The research report offers an in-depth analysis based on Type of Pharmacy, Application, Type of Prescription, Product Type, Service Offered and Customer Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Chain pharmacies will grow their network through mergers and strategic collaborations to improve coverage.

- E-pharmacy platforms will strengthen market growth by enhancing delivery speed and payment flexibility.

- Preventive healthcare and wellness offerings will gain priority in pharmacy product portfolios.

- Generic drug adoption will rise due to cost advantages and expanded chronic care services.

- Digital infrastructure will support automated inventory systems and personalized engagement.

- Screening and vaccination services will help pharmacies expand their healthcare role.

- Market consolidation will increase competition between leading chains and new online platforms.

- Policy harmonization will simplify regional operations and improve cross-border market activity.

- Omnichannel strategies will drive seamless integration between physical stores and digital platforms.

- Tailored patient care will boost customer retention and long-term growth momentum.