| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Cardiovascular Devices Market Size 2024 |

USD 3,677.90 Million |

| Latin America Cardiovascular Devices Market, CAGR |

6.0% |

| Latin America Cardiovascular Devices Market Size 2032 |

USD 6,217.09 Million |

Market Overview

The Latin America Cardiovascular Devices Market is projected to grow from USD 3,677.90 million in 2024 to an estimated USD 6,217.09 million by 2032, with a compound annual growth rate (CAGR) 6.0% from 2025 to 2032. This steady growth is driven by rising cardiovascular disease prevalence, increasing healthcare expenditure, and technological advancements in medical devices.

A significant market driver includes the rapid urbanization and resulting increase in sedentary lifestyles, which elevate the risk of heart diseases. Additionally, the adoption of advanced technologies like AI-enabled diagnostic systems and wearable cardiac monitoring devices is reshaping the region’s cardiovascular care landscape. Trends such as increased awareness of preventive healthcare and the expansion of private healthcare facilities further accelerate market development.

Geographically, Brazil dominates the Latin America cardiovascular devices market due to its well-developed healthcare infrastructure and rising patient pool. Mexico and Argentina are also showing robust growth, supported by improved access to cardiovascular treatments and government-led health reforms. Key players in the market include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, and Siemens Healthineers. These companies are investing in product innovation, regional collaborations, and expansion strategies to strengthen their footprint in the Latin American market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin American cardiovascular devices market is projected to grow from USD3,677.90 million in 2024 to USD6,217.09 million by 2032, at a CAGR of 6.0%. This growth is fueled by technological advancements and rising cardiovascular disease prevalence in the region.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- Increasing urbanization and sedentary lifestyles are leading to a higher incidence of cardiovascular diseases, driving demand for diagnostic and therapeutic cardiovascular devices.

- Rising healthcare expenditure and government initiatives focused on improving access to cardiovascular care are contributing to market expansion, particularly in underserved regions.

- The high cost of advanced cardiovascular devices and economic disparities within the region can limit access to healthcare technologies, particularly in rural and low-income areas.

- Limited healthcare infrastructure in certain Latin American countries poses challenges to widespread adoption of advanced cardiovascular technologies, hindering overall market growth.

- Brazil leads the market, accounting for the largest share due to its robust healthcare infrastructure, followed by Mexico and Argentina, which are experiencing steady growth.

- The growth of cardiovascular device adoption is also seen in emerging Latin American countries, where increased awareness and healthcare reforms are expanding access to advanced treatments.

Report Scope

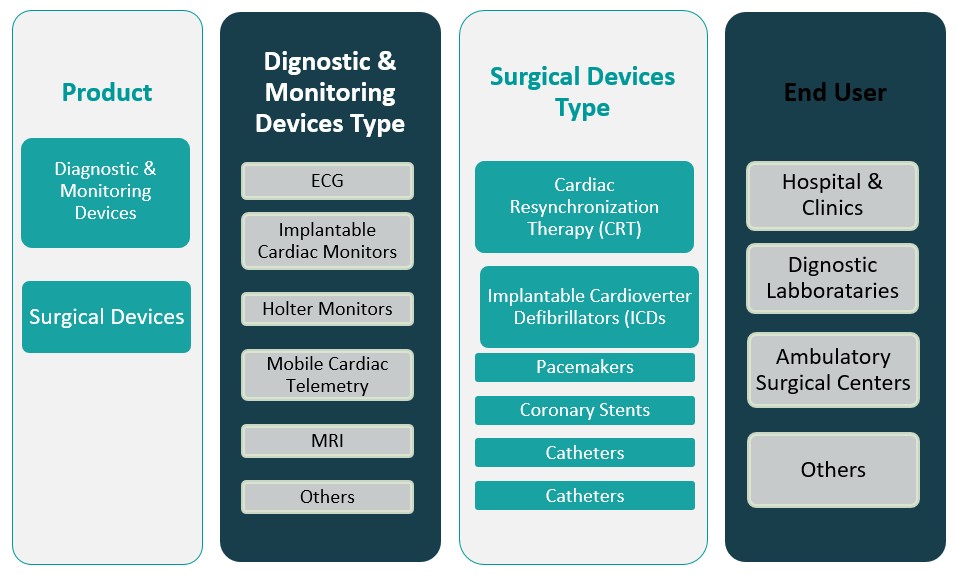

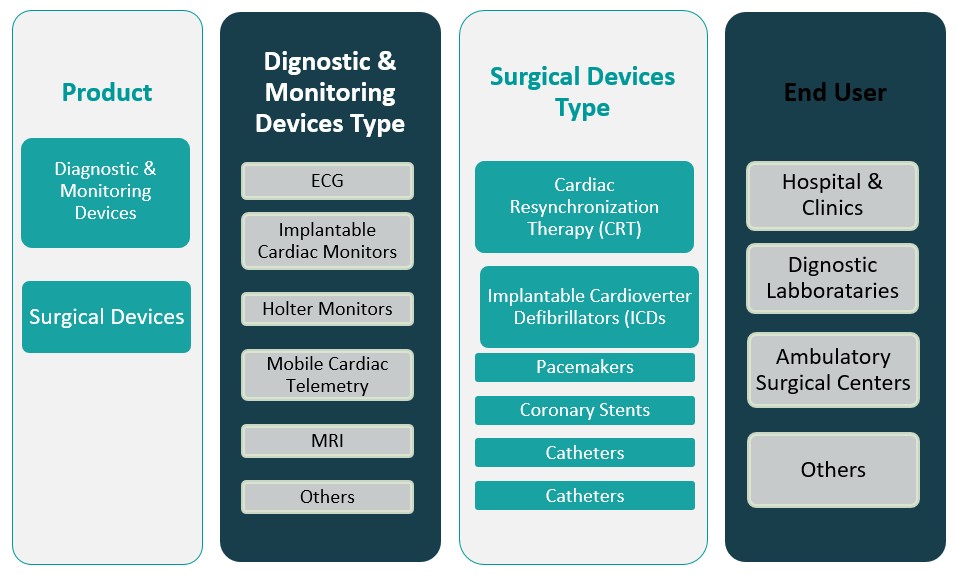

This report segments the Latin America Cardiovascular Devices Market as follows:

Market Drivers

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases (CVDs) in Latin America is a key driver of the cardiovascular devices market. According to the World Health Organization (WHO), CVDs are one of the leading causes of death in the region, with factors such as aging populations, unhealthy lifestyle choices, and high rates of hypertension, diabetes, and obesity contributing to the growing burden. For instance, major healthcare providers across Latin America have expanded their cardiovascular care services by establishing hundreds of specialized treatment centers in response to increasing patient needs. Leading medical device manufacturers have introduced innovative cardiovascular solutions, including enhanced pacemakers and stent technologies, which are being adopted by hospitals for improved patient care.As the demand for cardiovascular care increases, the need for advanced diagnostic, monitoring, and therapeutic devices escalates. Consequently, hospitals and clinics are integrating state-of-the-art cardiovascular technologies such as pacemakers, stents, defibrillators, and diagnostic imaging systems to improve patient outcomes. Governments and healthcare providers are implementing cardiovascular health initiatives, with increased investments supporting early diagnosis and treatment programs.

Technological Advancements and Product Innovation

Technological advancements in cardiovascular devices are reshaping the Latin American market. Innovations in minimally invasive procedures, remote monitoring technologies, and artificial intelligence (AI) are driving the evolution of cardiovascular care. Medical institutions are adopting robotic-assisted cardiovascular surgeries, significantly reducing recovery times and improving precision in procedures. For instance, leading manufacturers have launched AI-powered diagnostic tools, allowing healthcare professionals to detect and assess cardiovascular conditions more accurately. The introduction of wearable cardiac monitoring devices has revolutionized patient care, enabling continuous tracking of heart health outside hospital settings. Medical technology companies are also enhancing biomaterials used in stents and pacemakers, improving device longevity and reducing complications for patients. Hospitals are increasingly integrating these advanced technologies into routine care, ensuring patients receive effective and timely cardiovascular treatments. With ongoing developments in AI-driven diagnostics, minimally invasive interventions, and remote monitoring solutions, the availability of innovative cardiovascular devices in Latin America continues to expand.

Government Support and Healthcare Infrastructure Development:

Government initiatives in Latin America are playing a crucial role in expanding access to advanced cardiovascular treatments and driving the growth of the cardiovascular devices market. Governments are increasingly recognizing the importance of cardiovascular health and are allocating funds to enhance healthcare infrastructure, improve diagnostics, and implement national health programs targeting CVD prevention and management. In many countries, healthcare reforms are being implemented to increase access to high-quality care, including cardiovascular treatments, in both urban and rural areas. Additionally, Latin American countries such as Brazil, Mexico, and Argentina have made significant strides in improving their healthcare systems by investing in advanced medical technologies and expanding hospital networks. This has resulted in greater accessibility to state-of-the-art cardiovascular devices, particularly in underserved areas. Public-private partnerships and collaborations with global manufacturers are fostering market expansion by improving the availability of cardiovascular products and services. As a result, government policies are directly supporting the adoption of new devices, facilitating market growth, and making cardiovascular healthcare more accessible to the general population.

Rising Demand for Preventive Healthcare and Health Awareness:

The growing awareness of the importance of cardiovascular health and preventive care in Latin America is significantly driving the demand for cardiovascular devices. As people in the region become more health-conscious, there is a shift towards proactive health management, which includes regular heart screenings, lifestyle modifications, and the use of medical devices to monitor heart health. The increasing focus on preventive care and early detection is fostering demand for devices that help in the monitoring of vital signs, such as blood pressure monitors, cholesterol measurement devices, and home ECG devices. Additionally, social media, health campaigns, and education programs are raising awareness about the risks of heart disease and the benefits of early intervention. These initiatives are helping individuals understand the importance of maintaining good cardiovascular health and seeking medical help at an early stage. As preventive healthcare becomes more ingrained in the culture, the demand for cardiovascular diagnostic devices and home monitoring solutions is increasing. This trend is expected to continue, as healthcare professionals and patients alike become more focused on reducing the risk of heart diseases before they become life-threatening, thus driving further growth in the cardiovascular devices market in Latin America.

Market Trends

Adoption of Minimally Invasive Procedures

Minimally invasive procedures are rapidly gaining traction in the Latin America cardiovascular devices market. These procedures, which involve smaller incisions and shorter recovery times, are preferred by both healthcare providers and patients due to their lower risk of complications and quicker recovery periods compared to traditional surgeries. For instance, Colombia has seen significant advancements in minimally invasive cardiac surgery, with international training programs helping local surgeons adopt these techniques. Additionally, transcatheter mitral valve-in-valve implantation has been successfully performed in Latin America, with reports from a single center documenting 50 cases and a 98% device success rate. As technology advances, devices such as catheter-based stents, balloon angioplasty systems, and robotic surgery tools have become more efficient, allowing for precise and controlled procedures. This trend is largely driven by the growing demand for outpatient procedures, as well as the desire to reduce healthcare costs and improve patient outcomes. Minimally invasive interventions also align with the increasing adoption of personalized medicine, where treatment plans are tailored to individual patient needs. The shift towards these procedures is anticipated to continue, as hospitals and clinics invest in the latest technologies to enhance patient care and improve operational efficiency.

Rise of Wearable Cardiovascular Devices

The growing trend of wearable cardiovascular devices is significantly shaping the Latin American market. With increasing health-consciousness among consumers and the rise of chronic cardiovascular conditions, there is a growing demand for devices that allow individuals to track their heart health in real-time. For instance, Wearable devices, such as smartwatches that monitor ECGs, blood pressure monitors, and heart rate trackers, are gaining widespread acceptance for both preventive healthcare and chronic disease management. These devices provide patients and healthcare providers with continuous heart data, which aids in early diagnosis and timely intervention. The trend is supported by the expansion of digital health technologies, improving the overall accessibility and affordability of wearable devices. As telemedicine and remote monitoring become more prevalent, wearable cardiovascular devices are expected to continue to grow in popularity, offering patients a more proactive approach to managing their cardiovascular health.

Integration of Artificial Intelligence and Machine Learning:

Artificial Intelligence (AI) and Machine Learning (ML) technologies are revolutionizing cardiovascular care in Latin America. AI-powered diagnostic tools and machine learning algorithms are helping healthcare providers in the region to detect heart conditions more accurately and efficiently. From imaging systems that can analyze cardiac scans in real-time to AI algorithms that assist in predicting patient outcomes, the integration of these technologies is enhancing the precision of cardiovascular diagnoses. In addition, AI is being used to develop personalized treatment plans for patients based on their specific health data. The rapid growth of data analytics and healthcare IT infrastructure in Latin America is enabling more hospitals and clinics to incorporate AI-driven solutions into their cardiovascular practices. As healthcare providers seek to improve clinical outcomes and reduce human error, AI and ML are expected to play an increasingly important role in reshaping cardiovascular diagnostics, treatment, and patient monitoring across the region.

Government Initiatives and Health Insurance Reforms:

Government initiatives and health insurance reforms are significantly influencing the Latin America cardiovascular devices market. Many Latin American countries are actively investing in healthcare infrastructure to improve access to cardiovascular care and medical technologies. National health programs focused on reducing the burden of cardiovascular diseases are driving demand for advanced medical devices. In addition, several governments are implementing health insurance reforms that include coverage for cardiovascular treatments and diagnostic services. These reforms are making cardiovascular devices more affordable and accessible to a broader population, especially in countries like Brazil, Mexico, and Argentina. Public-private partnerships are also being fostered to ensure that more hospitals and clinics are equipped with the latest cardiovascular devices. With a greater emphasis on heart disease prevention, early diagnosis, and treatment accessibility, government support is expected to continue driving growth in the cardiovascular devices market across Latin America.

Market Challenges

Limited Access to Advanced Healthcare in Rural Areas:

One of the major challenges faced by the Latin American cardiovascular devices market is the unequal distribution of healthcare services, particularly in rural and remote regions. While urban areas benefit from well-equipped healthcare facilities and access to advanced cardiovascular devices, rural regions often struggle with limited infrastructure, insufficient healthcare professionals, and lower availability of cutting-edge technologies. This disparity results in delayed diagnoses, inadequate treatment options, and poorer health outcomes for individuals living in rural areas. Furthermore, the cost of acquiring and maintaining advanced cardiovascular devices can be prohibitively high for healthcare facilities in these regions, limiting the widespread adoption of such technologies. For instance, studies indicate that only 35% of hospitals in rural Latin America have adequate cardiovascular imaging equipment, compared to over 80% in major metropolitan areas. To address this challenge, governments and private organizations must work towards improving healthcare accessibility in underserved areas. Initiatives such as mobile health clinics, telemedicine, and increased public health funding could help bridge this gap. However, achieving equitable access to cardiovascular care and devices across the entire region remains a significant hurdle, impacting the overall growth potential of the market.

High Cost of Cardiovascular Devices and Economic Barriers:

The high cost of cardiovascular devices remains a significant challenge for the Latin American market. Many advanced devices, such as stents, pacemakers, and diagnostic imaging systems, are expensive to purchase, maintain, and operate. This financial burden is particularly challenging in countries where healthcare budgets are limited or underfunded. Although some countries have made strides in subsidizing healthcare and implementing public health programs, the cost of importing foreign-made devices often makes them inaccessible to a large portion of the population. Additionally, the economic disparities within the region result in a wide gap between the healthcare options available to higher-income individuals and those in lower-income groups. These economic barriers hinder the widespread adoption of advanced cardiovascular technologies and delay the implementation of early detection and treatment strategies. The market is expected to face continued pricing pressure, and overcoming this challenge will require a concerted effort from both government bodies and manufacturers to provide cost-effective solutions, local manufacturing opportunities, and insurance coverage that makes cardiovascular devices more affordable to a wider population.

Market Opportunities

Growth in Preventive Healthcare and Early Diagnosis:

One of the significant opportunities in the Latin American cardiovascular devices market lies in the increasing emphasis on preventive healthcare and early diagnosis. As cardiovascular diseases continue to rise, particularly due to lifestyle changes and aging populations, there is a growing focus on early intervention and risk management. The demand for diagnostic devices, such as ECG monitors, blood pressure cuffs, and cholesterol testing tools, is expanding as both healthcare providers and individuals seek ways to detect heart conditions before they become critical. Additionally, the rise of wearable devices that continuously monitor cardiovascular health presents a growing opportunity. With advancements in digital health technologies and telemedicine, healthcare systems across the region are better equipped to offer remote monitoring, consultations, and preventative care. Manufacturers can capitalize on this trend by developing affordable, easy-to-use, and reliable cardiovascular diagnostic and monitoring devices tailored to the needs of the Latin American market, enabling healthcare systems to adopt preventive strategies that improve patient outcomes and reduce overall healthcare costs.

Government Health Initiatives and Expanding Insurance Coverage:

The Latin American region presents substantial market opportunities for cardiovascular device manufacturers due to ongoing government health initiatives and the expansion of health insurance coverage. Several countries, such as Brazil, Mexico, and Argentina, are prioritizing cardiovascular health as part of national health programs, leading to greater investments in healthcare infrastructure and access to advanced medical devices. Additionally, the growing trend toward comprehensive health insurance coverage is making cardiovascular treatments and devices more accessible to a broader segment of the population. Public-private partnerships, along with increased funding from both government and international organizations, are enhancing access to cutting-edge technologies, particularly in underserved regions. Manufacturers can tap into this opportunity by aligning their product offerings with national healthcare initiatives, offering affordable and innovative cardiovascular devices, and supporting the accessibility of high-quality healthcare in emerging markets within Latin America.

Market Segmentation Analysis

By Product

The Latin American cardiovascular devices market is segmented into two main categories: diagnostic and monitoring devices, and surgical devices. The diagnostic and monitoring devices segment holds a significant share, driven by the rising demand for early detection and continuous monitoring of cardiovascular conditions. Devices such as electrocardiograms (ECG), echocardiograms, blood pressure monitors, and cholesterol testing tools are widely used in hospitals, clinics, and at-home settings. As cardiovascular diseases increase, healthcare providers and individuals seek advanced diagnostic tools for early intervention. On the other hand, the surgical devices segment, which includes pacemakers, stents, defibrillators, and heart valves, is growing steadily due to advancements in surgical techniques and the increasing number of heart surgeries performed in the region. With technological innovations leading to minimally invasive procedures, the demand for surgical devices is expected to rise in tandem with the overall growth of cardiovascular health interventions.

By End User

The Latin American cardiovascular devices market serves a diverse set of end users, including hospitals and clinics, diagnostic laboratories, ambulatory surgical centers, and others. Hospitals and clinics are the largest end users, as they provide comprehensive cardiovascular care, from diagnosis to treatment. These facilities are equipped with a wide range of diagnostic and therapeutic devices used in both inpatient and outpatient settings. Diagnostic laboratories also play a significant role, as they are essential for conducting tests and analyses, such as blood tests and imaging, to detect cardiovascular conditions. The increasing focus on preventive healthcare has led to a surge in demand for diagnostic services. Ambulatory surgical centers (ASCs) are emerging as important end users as well, driven by the growing trend of outpatient procedures and the preference for less invasive surgeries. ASCs offer patients the option of undergoing cardiovascular procedures, such as stent placements and pacemaker installations, without the need for extended hospital stays. The “others” category captures various other healthcare providers, including specialized cardiovascular centers and research institutions, contributing to market growth as well.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Based on Region

Regional Analysis

Brazil (40%)

Brazil is the dominant player in the Latin American cardiovascular devices market, holding a significant market share of approximately 40%. Brazil’s large population, well-established healthcare system, and increasing demand for cardiovascular treatments position it as the leading market in the region. The country benefits from a strong healthcare infrastructure, which includes a wide network of public and private hospitals and diagnostic centers equipped with advanced cardiovascular devices. Furthermore, Brazil’s government has prioritized healthcare reforms that focus on improving access to medical technologies, contributing to the increased adoption of cardiovascular devices. The rising prevalence of cardiovascular diseases, coupled with a growing middle-class population that demands better healthcare services, ensures the continued expansion of the market in Brazil.

Mexico (25%)

Mexico follows Brazil as the second-largest market in the region, capturing around 25% of the total market share. Mexico is experiencing rapid healthcare expansion, particularly with government initiatives aimed at reducing the burden of chronic diseases like cardiovascular conditions. The increasing urbanization and the growing number of health-conscious individuals in the country are driving the demand for diagnostic and therapeutic cardiovascular devices. Additionally, Mexico’s strategic location and its burgeoning healthcare market make it an attractive destination for global cardiovascular device manufacturers looking to tap into Latin American markets.

Key players

- Abbott

- GE Healthcare

- Medtronic

- Siemens Healthineers

- Philips Healthcare

- Boston Scientific

- Biotronik

- Flexicare

- DynaVox

- HeartTec

- Tecnología Médica Avanzada

- DGLAB

- Biorithm

- Cary

- Biocorp

Competitive Analysis

The Latin American cardiovascular devices market is highly competitive, with major global players such as Abbott, Medtronic, Siemens Healthineers, and Boston Scientific leading the charge. Abbott and Medtronic dominate the market due to their comprehensive product portfolios, strong brand recognition, and ability to cater to a wide range of cardiovascular diseases through advanced diagnostic, therapeutic, and monitoring devices. Siemens Healthineers and Philips Healthcare bring cutting-edge imaging technologies to the region, establishing their presence in diagnostic markets. Local companies like Tecnología Médica Avanzada and DGLAB, while smaller, offer specialized solutions tailored to the regional healthcare needs. The competitive landscape is further intensified by emerging players such as Biotronik and Biocorp, which are carving out niches with innovative products. As the market continues to grow, companies are focusing on strategic partnerships, product innovation, and regional expansion to strengthen their foothold and meet the evolving demand for cardiovascular care in Latin America.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The Latin American cardiovascular devices market exhibits a moderate level of concentration, with a mix of dominant global players and emerging regional companies. Leading multinational companies such as Abbott, Medtronic, Siemens Healthineers, and Boston Scientific hold a significant market share due to their extensive product portfolios, established brand presence, and technological innovations in diagnostic, therapeutic, and monitoring devices. These companies benefit from their vast distribution networks and strong relationships with healthcare providers across the region. However, the market also sees growing participation from local manufacturers, such as Tecnología Médica Avanzada and DGLAB, which offer specialized products tailored to the unique healthcare needs of Latin America. The market is characterized by continuous product innovation, increasing demand for minimally invasive procedures, and a rising focus on preventive healthcare. Companies are increasingly focusing on affordability, accessibility, and localized solutions to cater to diverse socioeconomic conditions across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing prevalence of cardiovascular diseases will drive higher demand for advanced diagnostic devices such as ECG monitors and imaging systems. Early detection tools will become critical as healthcare systems prioritize preventive measures.

- Continued innovation in minimally invasive procedures, such as catheter-based stents and robotic-assisted surgeries, will enhance patient outcomes and reduce healthcare costs. These advancements will fuel market expansion, particularly in surgical devices.

- Wearable cardiovascular devices, including smartwatches with ECG capabilities and continuous heart monitors, will see significant growth. This trend aligns with the increasing focus on personalized healthcare and real-time monitoring of heart health.

- Government initiatives and private sector investments aimed at improving healthcare infrastructure in underserved regions will drive the adoption of cardiovascular devices. Rural areas will experience better access to essential diagnostic and therapeutic tools.

- As healthcare spending increases across Latin America, there will be greater investment in state-of-the-art cardiovascular devices. This will facilitate the growth of both public and private healthcare sectors in the region.

- The integration of telemedicine and remote monitoring technologies will enhance the management of cardiovascular conditions. Patients will benefit from convenient, timely consultations, and continuous monitoring from the comfort of their homes.

- National health programs focused on cardiovascular disease prevention will continue to gain momentum. Governments will allocate more funds to improve access to healthcare and cardiovascular treatments across the region.

- A growing awareness of the importance of preventive healthcare will drive the adoption of early-stage diagnostic tools. Consumers and healthcare providers will increasingly focus on reducing the risk of heart disease before it becomes life-threatening.

- With the region’s diverse needs, manufacturers will increasingly localize their product offerings. This will help cater to the specific healthcare requirements of various Latin American countries, improving affordability and accessibility.

- The market will witness intensified competition, with multinational corporations and emerging local players vying for market share. Companies will focus on strategic collaborations, technological innovations, and expanding distribution networks to strengthen their position in the region.