Market Overview

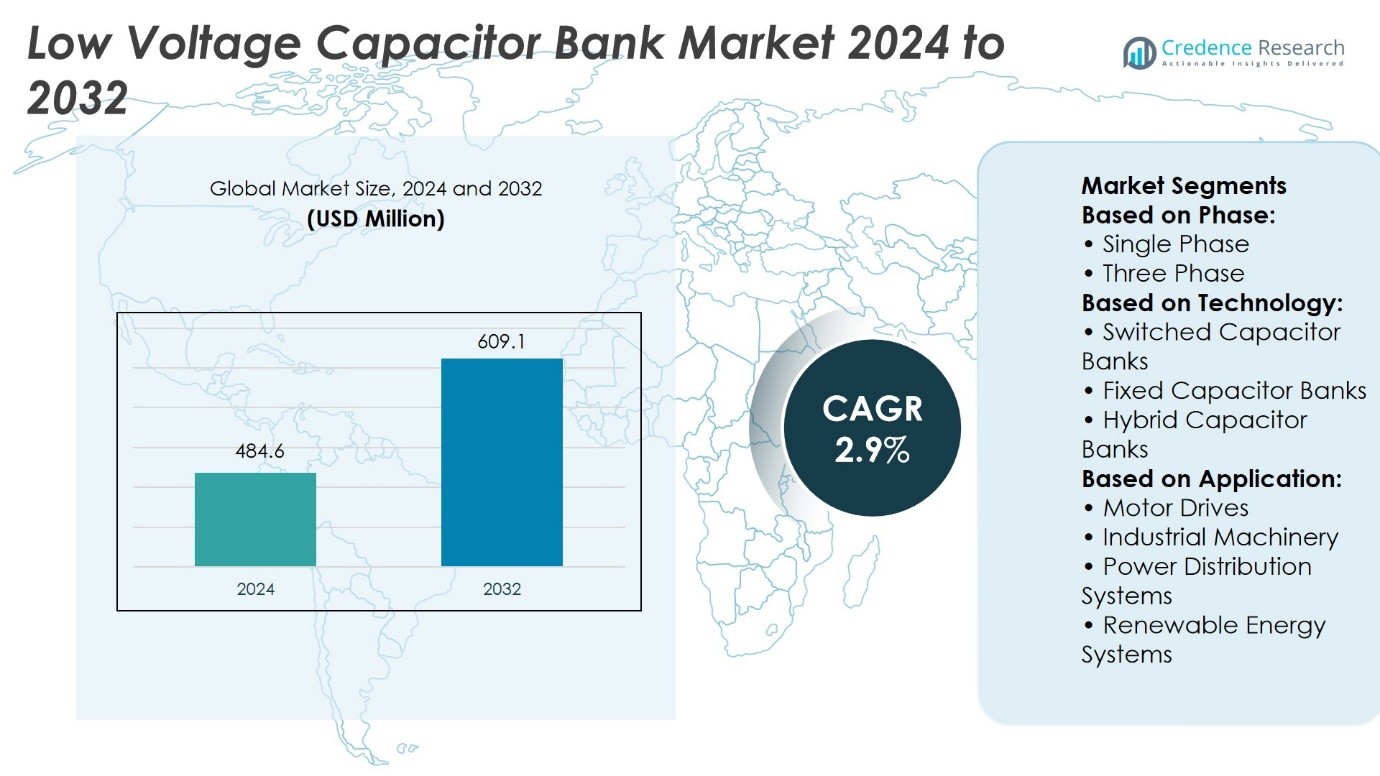

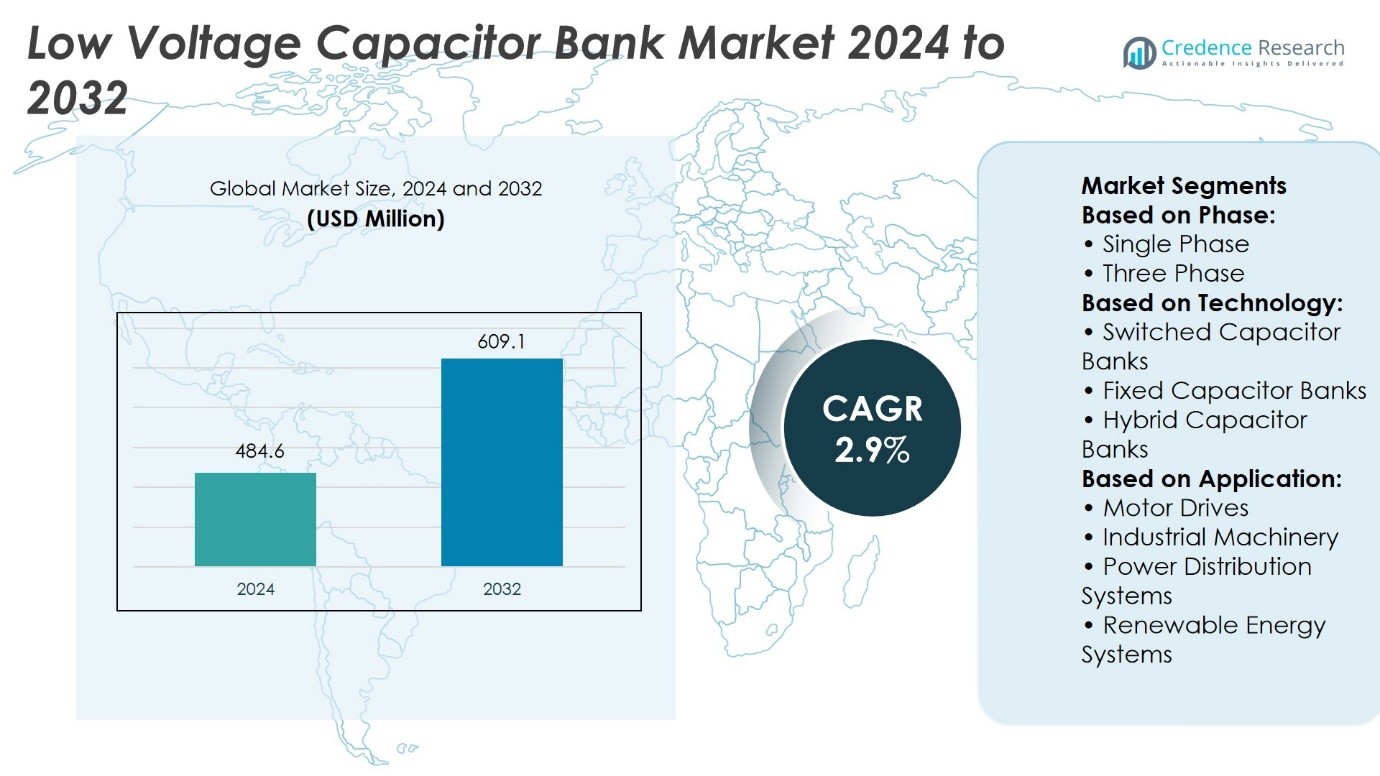

Low Voltage Capacitor Bank Market size was valued at USD 484.6 million in 2024 and is anticipated to reach USD 609.1 million by 2032, at a CAGR of 2.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Capacitor Bank Market Size 2024 |

USD 484.6 Million |

| Low Voltage Capacitor Bank Market, CAGR |

2.9% |

| Low Voltage Capacitor Bank Market Size 2032 |

USD 609.1 Million |

The Low Voltage Capacitor Bank Market grows through strong drivers such as rising demand for energy efficiency, grid stability, and reliable power factor correction across industrial and commercial sectors. It gains momentum from government initiatives promoting smart grids and renewable integration, where capacitor banks support voltage regulation and reduce energy losses. Trends highlight increasing adoption of digital monitoring, automation, and eco-friendly designs that enhance operational efficiency and sustainability. It also benefits from rapid industrialization in emerging economies and expansion of distributed energy systems, positioning capacitor banks as essential components for modern, resilient, and efficient power infrastructure worldwide.

The Low Voltage Capacitor Bank Market shows strong geographical presence across Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, with Asia Pacific holding the largest share due to rapid industrialization and electrification programs. North America and Europe maintain steady growth through grid modernization and renewable integration, while Latin America and MEA create emerging opportunities. Key players include ARTECHE, Bharat Heavy Electricals, CIRCUTOR, Eaton, Enerlux Power, GE Vernova, Hitachi Energy, Larsen & Toubro, Legrand, and Powerside.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low Voltage Capacitor Bank Market was valued at USD 484.6 million in 2024 and is projected to reach USD 609.1 million by 2032, growing at a CAGR of 2.9%.

- Rising demand for energy efficiency, power quality, and reliable power factor correction drives consistent adoption across industries.

- Expanding industrialization, urbanization, and smart city projects strengthen demand for grid modernization and efficient power distribution.

- Integration with renewable energy and distributed generation creates new opportunities by supporting voltage stability and grid resilience.

- Market competition is shaped by global leaders and regional suppliers focusing on innovation, eco-friendly designs, and automation.

- High initial investment costs and maintenance complexities act as restraints, particularly in cost-sensitive regions.

- Asia Pacific holds the largest share, while North America and Europe grow steadily, and Latin America and MEA provide emerging opportunities.

Market Drivers

Rising Demand for Energy Efficiency and Power Quality

The Low Voltage Capacitor Bank Market advances due to growing emphasis on energy efficiency and improved power quality across industries. It reduces reactive power consumption and minimizes energy losses, allowing businesses to achieve operational cost savings. Many utilities encourage adoption to stabilize distribution networks and optimize grid performance. It supports compliance with regulatory frameworks that mandate efficient energy utilization. Power quality issues such as voltage fluctuations and harmonic distortions further accelerate demand. The ability of capacitor banks to deliver reliable compensation strengthens their role in modern electrical infrastructure.

- For instance, The Federal Highway Administration of the US Department of Transportation funded 635 million for zero-emission refueling programs and intended to broaden infrastructure for charging electric vehicles and other alternative fuels.

Expanding Industrialization and Urbanization Driving Grid Modernization

Rapid industrial expansion and urban growth create sustained demand for reliable power distribution, boosting the Low Voltage Capacitor Bank Market. It supports continuous operations in manufacturing, commercial complexes, and infrastructure projects where stable electricity is critical. Growing electrification in emerging economies accelerates the need for grid modernization and efficient reactive power management. It helps reduce transmission losses and ensures uninterrupted supply to urban and industrial hubs. Rising investments in smart city projects integrate capacitor banks to enhance network reliability. The deployment of advanced automation and monitoring solutions makes adoption more attractive for utilities and industries.

- For instance, The U.S. possesses utility scale battery capacity of using operational and planned systems. Developers are expecting to add 26 GW in 2024 and around 19.6 GW in 2025. Furthermore, it is anticipated that over 300 projects will become operational before the end of 2025, half of which will be based in Texas.

Integration with Renewable Energy and Distributed Generation

The shift toward renewable energy integration strengthens opportunities for the Low Voltage Capacitor Bank Market. It helps balance fluctuations in solar and wind generation by stabilizing voltage and improving grid resilience. With distributed energy systems expanding, capacitor banks provide critical support to maintain consistent power supply. Utilities adopt them to mitigate intermittency issues associated with renewable sources. It aligns with sustainability objectives by reducing dependency on fossil-based grid balancing systems. The growing use of microgrids and localized power networks further increases the requirement for efficient compensation equipment.

Supportive Government Policies and Investments in Smart Grids

Government initiatives promoting energy conservation and grid reliability drive strong adoption in the Low Voltage Capacitor Bank Market. It benefits from financial incentives, subsidies, and policies supporting advanced power management technologies. Many countries prioritize investments in smart grid infrastructure, where capacitor banks are integral to enhancing system stability. It supports demand-side management programs that encourage industries and commercial users to optimize energy consumption. Rising focus on reducing carbon emissions reinforces the adoption of reactive power compensation systems. Strategic investments by utilities and private players ensure long-term market growth through modernization and efficiency improvements.

Market Trends

Growing Preference for Smart and Automated Capacitor Banks

The Low Voltage Capacitor Bank Market observes a strong trend toward smart and automated systems designed for real-time monitoring and control. It integrates advanced sensors, communication modules, and control algorithms to optimize reactive power management. Smart capacitor banks help utilities and industries reduce downtime and improve grid stability with predictive maintenance. It aligns with digital transformation goals in energy infrastructure by enabling remote monitoring and diagnostics. The adoption of IoT-enabled solutions ensures faster response to voltage fluctuations and load variations. The growing use of intelligent systems marks a significant shift from conventional capacitor banks to advanced digital models.

- For instance, NEOM secured a contract with investors for its first expansion of residential communities by June 2023. This serves as part of a social infrastructure development project to accommodate the increasing population of workers in the region. The value of the agreement is more than 5.6 billion, making it one of the largest international public & private partnerships to date in developing housing.

Rising Integration with Renewable Energy and Distributed Systems

Increasing deployment of renewable energy projects strengthens the role of capacitor banks in stabilizing power supply. The Low Voltage Capacitor Bank Market benefits from their ability to manage intermittency in solar and wind energy generation. It improves voltage profiles and mitigates power factor issues caused by distributed generation. Many utilities adopt capacitor banks to enhance grid reliability and ensure smooth integration of renewables. It contributes to energy transition goals by reducing dependency on fossil-based balancing mechanisms. The expansion of microgrids and localized networks further elevates the demand for flexible and efficient capacitor solutions.

- For instance, the European Investment Bank (EIB) sanctioned a green loan summing to 700 million in March 2024 to aid Iberdrola with the extension of their power grid in Spain. To promote the integration of renewable energy sources and electrification via electric vehicle.

Adoption of Eco-Friendly and Energy-Efficient Designs

Sustainability trends reshape the design and development of capacitor banks across global markets. The Low Voltage Capacitor Bank Market advances with growing preference for eco-friendly materials and low-loss components. It reduces energy wastage while improving efficiency of power distribution networks. Manufacturers focus on developing designs that minimize environmental impact and align with global energy conservation targets. It drives innovation in compact, lightweight, and recyclable capacitor systems. The emphasis on green technologies reinforces market competitiveness and long-term adoption.

Increasing Role of Digital Platforms and Predictive Analytics

The rising use of digital platforms for asset monitoring defines a clear trend in capacitor bank deployment. The Low Voltage Capacitor Bank Market evolves with integration of predictive analytics for condition-based maintenance and performance optimization. It reduces unplanned failures by detecting anomalies before system breakdowns. Utilities and industries leverage advanced software tools for better load forecasting and power factor correction planning. It strengthens operational efficiency and lowers maintenance costs across critical facilities. The combination of digital intelligence and hardware optimization marks a pivotal trend for the sector’s advancement.

Market Challenges Analysis

High Initial Costs and Complex Installation Requirements

The Low Voltage Capacitor Bank Market faces challenges from high upfront costs and complex installation processes. It demands significant investment in equipment, skilled labor, and supporting infrastructure, which limits adoption in small and medium-scale enterprises. Many end-users hesitate to invest due to extended payback periods despite long-term operational savings. It also requires careful design and system integration to avoid technical inefficiencies. Complex installation often involves coordination with existing grid systems, which adds to time and cost burdens. The financial and technical barriers reduce accessibility for cost-sensitive markets and slow overall adoption.

Operational Risks and Maintenance Constraints

Operational risks and maintenance complexities create another challenge for the Low Voltage Capacitor Bank Market. It remains vulnerable to failures caused by voltage fluctuations, harmonics, and overloading conditions. Unexpected breakdowns can lead to costly downtimes in industrial and utility operations. It also requires periodic inspection, monitoring, and replacement of components to ensure reliability. Limited availability of skilled technicians in emerging economies restricts effective maintenance and servicing. These factors make reliability assurance difficult, impacting user confidence and slowing the pace of widespread deployment.

Market Opportunities

Expansion of Smart Grid Infrastructure and Renewable Integration

The Low Voltage Capacitor Bank Market presents strong opportunities through growing investments in smart grid infrastructure and renewable energy integration. It supports utilities in improving grid efficiency, enhancing voltage stability, and managing reactive power in complex networks. The rising deployment of distributed generation systems and microgrids increases demand for capacitor banks to balance fluctuations. It aligns with government initiatives and funding programs aimed at energy transition and grid modernization. The integration of advanced monitoring and automation technologies further expands potential for smarter, more resilient power systems. These factors position capacitor banks as essential components in the next generation of energy infrastructure.

Demand Growth in Emerging Economies and Industrial Expansion

Rapid industrialization and urban growth across emerging economies create substantial opportunities for the Low Voltage Capacitor Bank Market. It addresses the growing need for efficient power factor correction in manufacturing facilities, commercial complexes, and large infrastructure projects. Expanding electrification programs in developing regions increase adoption potential, particularly where grid reliability remains a concern. It enables industries to optimize energy consumption and reduce operational costs, improving competitiveness in global markets. The rise of sustainable industrial practices and emphasis on energy conservation strengthen its role in supporting long-term growth. These conditions highlight significant prospects for expanding market presence across diverse regions.

Market Segmentation Analysis:

By Phase

The Low Voltage Capacitor Bank Market divides by phase into single phase and three phase systems, each addressing distinct operational needs. Single phase banks are widely adopted in residential and small commercial applications where power demand is relatively low. It ensures cost-effective power factor correction and helps reduce electricity bills for smaller consumers. Three phase banks dominate in industrial and utility sectors, where higher loads and continuous operations require stronger reactive power management. It improves grid stability, reduces losses, and supports large-scale machinery. Growing urbanization and industrial growth continue to drive adoption of three phase systems as power demand scales.

- For instance, The Grid Deployment Office under the U.S. Department of Energy has allocated 10 million through the Transmission Acceleration Grants (TAG) Program for transmission deployment assistance at the state, tribal, and regional nonprofit levels. This is expected to facilitate local and regional planning.

By Technology

Technology segmentation highlights switched, fixed, and hybrid capacitor banks with distinct performance advantages. Fixed capacitor banks remain suitable for stable load conditions, offering low-cost solutions with simple design. It finds application in systems with predictable demand, where voltage fluctuations are limited. Switched capacitor banks gain popularity in industrial and utility operations, where loads vary significantly, requiring automated adjustment. Hybrid banks combine flexibility with efficiency, making them valuable in complex systems with variable and unpredictable loads. It supports optimized energy management, reducing stress on grids while improving power quality. The rising demand for automation and adaptive solutions strengthens growth of switched and hybrid segments.

- For instance, as reported by the Association of American Clean Power, the clean energy sector in the U.S. has attracted nearly 500 billion in new investments in the past 24 months alone, and this surge is boosting a manufacturing renaissance as companies plan to build or expand upwards of 160 factories in the US and hire over 100,000 workers in the manufacturing sector.

By Application

Applications extend across motor drives, industrial machinery, power distribution, and renewable energy systems. Motor drives benefit from capacitor banks by improving power factor and reducing operational costs in heavy-duty equipment. Industrial machinery requires reliable power compensation to maintain efficiency and prevent downtime in production processes. The Low Voltage Capacitor Bank Market plays a critical role in power distribution systems, where it stabilizes voltage and reduces losses across networks. Renewable energy systems increasingly integrate capacitor banks to balance intermittent generation and maintain grid reliability. It supports solar, wind, and hybrid projects by ensuring consistent performance and reducing energy imbalances. Expanding applications across industries and energy infrastructure reflect strong and diverse growth potential.

Segments:

Based on Phase:

Based on Technology:

- Switched Capacitor Banks

- Fixed Capacitor Banks

- Hybrid Capacitor Banks

Based on Application:

- Motor Drives

- Industrial Machinery

- Power Distribution Systems

- Renewable Energy Systems

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 25% of the Low Voltage Capacitor Bank Market in 2023. The region benefits from strong investments in grid modernization, energy efficiency, and renewable integration. It uses capacitor banks to stabilize voltage, reduce energy losses, and manage increasing demand from electric vehicles, manufacturing facilities, and data centers. The United States and Canada drive the majority of installations, supported by regulatory incentives and technological innovation. It strengthens reliability across industrial and utility sectors where uninterrupted power is essential. Growing renewable projects and advanced automation further enhance adoption, ensuring steady growth across the region.

Europe

Europe holds about 20% of the Low Voltage Capacitor Bank Market in 2023. The region emphasizes carbon reduction goals, smart grid upgrades, and renewable integration, making capacitor banks essential in power networks. Germany, the UK, and France lead investments in reactive power solutions to support industrial loads and renewable energy penetration. It provides critical support for stabilizing voltage and improving grid resilience in diverse applications. Strict regulations on energy efficiency encourage adoption across commercial and industrial sectors. Manufacturers in the region focus on eco-friendly and compact designs, aligning with sustainability agendas. Continued modernization of distribution networks sustains steady demand across European markets.

Asia Pacific

Asia Pacific dominates the Low Voltage Capacitor Bank Market with a share of 32.66% in 2023, the largest globally. The region grows rapidly due to industrial expansion, urbanization, and large-scale renewable energy deployment. China, India, and Southeast Asian countries prioritize power factor correction to support manufacturing hubs, urban infrastructure, and smart cities. It plays a critical role in reducing transmission losses and stabilizing fast-expanding grids. Government-backed electrification programs and renewable initiatives accelerate adoption across utilities and industries. Manufacturers in Asia Pacific benefit from cost advantages and growing domestic demand, positioning the region as the global leader in market growth.

Latin America

Latin America contributes around 8% of the Low Voltage Capacitor Bank Market in 2023. The region faces rising electricity demand alongside growing reliance on renewable energy. Brazil, Mexico, and Chile lead adoption with strong investments in grid expansion and modernization. It addresses challenges of unstable distribution networks by improving voltage control and efficiency. Increasing urbanization and industrial development also expand opportunities for deployment. Governments in the region support electrification projects, which enhances market penetration. While smaller than other regions, Latin America shows steady growth potential through sustainable energy priorities and infrastructure upgrades.

Middle East & Africa

Middle East & Africa represents nearly 7% of the Low Voltage Capacitor Bank Market in 2023. The region invests in strengthening grid infrastructure, especially in Gulf nations and South Africa, to meet rising power demand. It plays a significant role in stabilizing renewable integration and supporting new electrification projects. Countries in the Middle East focus on advanced capacitor bank installations to enhance large industrial operations and utility networks. Africa benefits from ongoing rural electrification and urban development, though adoption remains moderate due to cost constraints. Government-backed projects and foreign investments drive gradual but steady expansion. The region’s market continues to grow with infrastructure modernization and renewable energy adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Low Voltage Capacitor Bank Market players include ARTECHE, Bharat Heavy Electricals, CIRCUTOR, Eaton, Enerlux Power, GE Vernova, Hitachi Energy, Larsen & Toubro, Legrand, and Powerside. The Low Voltage Capacitor Bank Market reflects a competitive environment where companies focus on delivering reliable, efficient, and technologically advanced solutions for diverse applications. Competition revolves around product innovation, cost optimization, and integration of smart monitoring systems that enhance grid stability and energy efficiency. Firms differentiate through eco-friendly designs, compact configurations, and solutions tailored to renewable energy integration. Growing emphasis on automation, predictive maintenance, and digital platforms further reshapes competition, making adaptability to evolving grid standards a crucial success factor. Strategic expansion into emerging economies, investment in R&D, and alignment with sustainability initiatives strengthen the market presence of leading participants while ensuring long-term relevance in global power infrastructure.

Recent Developments

- In April 2025, BHEL in coordination with Hitachi Energy India has received a high-profile contract to construct an HVDC 6000 MW transmission corridor of roughly 950 km distance starting from Bhadla, Rajasthan and terminating in Fatehpur, UP. Within the confines of the project, BHEL is responsible for the crucial component’s production which includes shunt reactors, converter transformers, medium voltage switchgear, filter bank capacitors.

- In February 2025, Schneider Electric has confirmed that it will build three new plants in India located in Kolkata, Hyderabad, and Ahmednagar, which will aid in the expansion of their existing manufacturing operations. This change in the investment strategy deepens India’s role as Schneider’s third largest market and key manufacturing hub.

- In September 2024, Arteche Lantegi Elkartea SA declared the strategic commencement of energy storage activities by acquiring equity in Finnish firm Teraloop Oy which is famous for its advanced technologies in flywheel-based energy storage and power management systems. In addition, Arteche is given exclusive distribution rights for some international markets for flywheel technology.

- In February 2024, Powerside’s Pole-MVar, launched a new pole-mounted tuned-filter capacitor bank intended for harmonic distortio and harmonic resonance mitigation that does it in a more economical manner. Considering the needs of utility and industrial engineers, this compact device powerfully counteracts grid instability from the convergence of emerging technologies and aging infrastructure.

Market Concentration & Characteristics

The Low Voltage Capacitor Bank Market demonstrates a moderately concentrated structure with a mix of global manufacturers and regional suppliers competing across industrial, commercial, and utility sectors. It features established multinational firms that dominate with advanced technologies, strong distribution networks, and integrated service portfolios, while regional companies strengthen their presence through cost-effective solutions and localized support. It is characterized by continuous innovation in smart monitoring, automation, and eco-friendly designs, driven by rising demand for energy efficiency and renewable integration. Competition emphasizes reliability, product customization, and compliance with evolving grid standards, making differentiation vital for sustained growth. It maintains a dynamic balance between global scale and regional adaptability, reflecting strong opportunities for both established leaders and emerging participants in the energy infrastructure landscape.

Report Coverage

The research report offers an in-depth analysis based on Phase, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Low Voltage Capacitor Bank Market will expand with rising demand for energy-efficient power distribution systems.

- It will benefit from increasing adoption of smart grids and digital monitoring technologies.

- Renewable energy integration will create strong opportunities for advanced capacitor bank solutions.

- It will witness higher demand from industrial and commercial sectors seeking cost optimization.

- Eco-friendly and low-loss designs will gain prominence to align with global sustainability targets.

- It will experience growth in emerging economies driven by electrification and infrastructure projects.

- Automation and predictive maintenance will shape product development and deployment strategies.

- It will see stronger competition with global players focusing on innovation and regional companies emphasizing affordability.

- Government policies promoting energy conservation and grid modernization will support steady adoption.

- It will maintain long-term relevance by enabling voltage stability and efficiency in evolving power networks.