Market Overview:

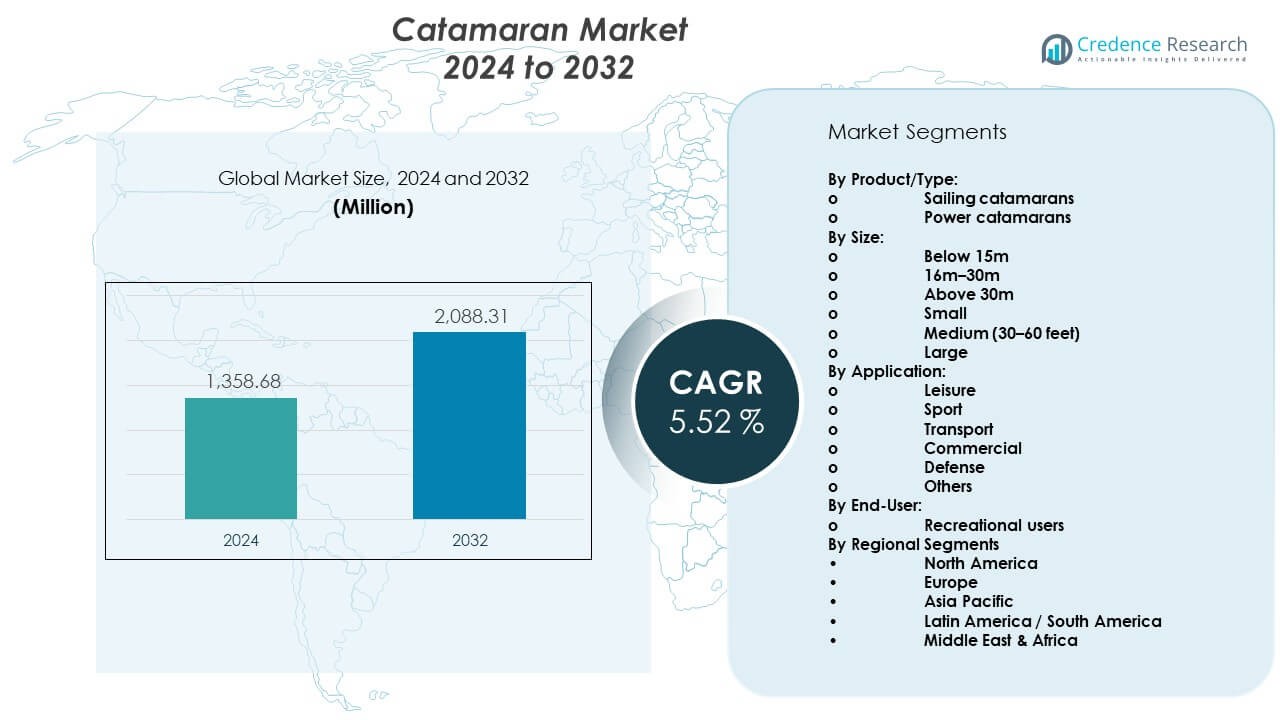

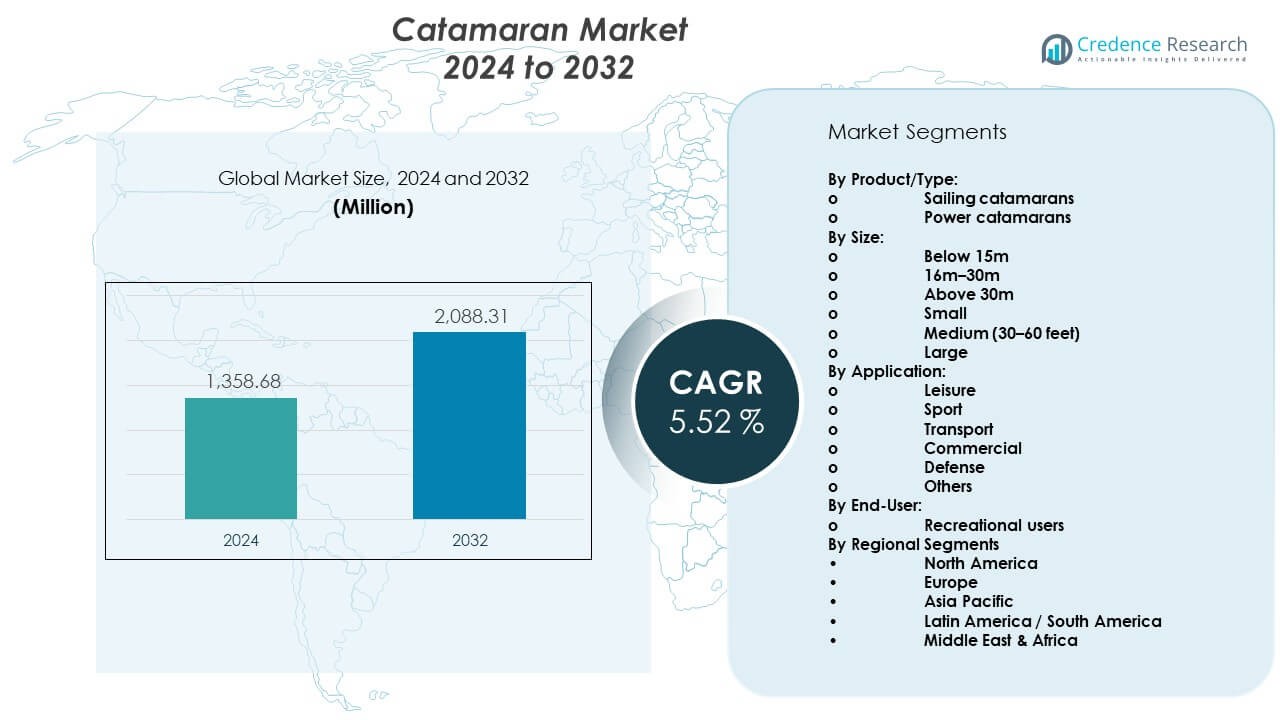

The Catamaran Market is projected to grow from USD 1358.68 million in 2024 to an estimated USD 2088.31 million by 2032, with a compound annual growth rate (CAGR) of 5.52% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Catamaran Market Size 2024 |

USD 1358.68 Million |

| Catamaran Market, CAGR |

5.52% |

| Catamaran Market Size 2032 |

USD 2088.31 Million |

Strong lifestyle shifts drive the Catamaran Market as more travelers choose premium sailing experiences and charter services expand. Buyers prefer multi-hull boats for better stability during long voyages. Tourism operators use catamarans to offer smoother rides for island tours and coastal trips. Designers add hybrid propulsion and advanced navigation features to improve performance. Rising focus on marine recreation encourages families and groups to select catamarans for private use. Builders respond with customizable layouts that support comfort and safety.

North America leads the Catamaran Market due to strong marine tourism, rising yacht ownership, and advanced boatbuilding capabilities. Europe follows with demand from charter operators and a mature sailing culture across coastal nations. Asia Pacific emerges as the fastest-growing region due to growing coastal tourism and rising interest in luxury boating. The Middle East shows potential with investments in waterfront recreation. Latin America grows at a steady pace supported by expanding tourism hubs and favorable coastal routes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Catamaran Market reached USD 1358.68 million in 2024 and is projected to hit USD 2088.31 million by 2032, growing at a CAGR of 5.52%.

- North America leads with 38% share due to strong yacht ownership, Europe follows with 32% driven by a mature sailing culture, and Asia Pacific holds 20% supported by expanding charter tourism.

- Asia Pacific is the fastest-growing region with 20% share, supported by rising coastal tourism, fleet expansion, and increasing interest in marine recreation.

- The leisure segment accounts for the largest share at 42%, driven by high adoption in personal boating and global tourism routes.

- Medium-size vessels (30–60 feet) hold 46% share due to balanced performance, comfort, and suitability for both private and charter use.

Market Drivers:

Growing Shift Toward Premium Leisure Boating Experiences

Rising demand for luxury marine travel drives interest in spacious multi-hull vessels. Buyers seek smoother rides during long coastal and island routes. Tourism operators use catamarans to deliver safe group travel and premium charter services. The Catamaran Market gains strength from travellers who prefer comfort over speed. Consumers choose boats that offer stable platforms for recreation and family activities. Builders introduce new layouts that support private ownership and charter operations. Hybrid propulsion attracts buyers who want cleaner sailing. Manufacturers respond with designs that enhance user comfort on open waters.

- For instance, Leopard Catamarans markets the 40 Powercat as offering 50% more living space and 50% lower fuel consumption compared with monohulls of similar size, with two engines of 250–370 HP for strong cruising power.

Advancements in Marine Engineering and Hybrid Propulsion Systems

Strong progress in hull design and lightweight materials improves vessel efficiency. Marine engineers focus on stability and reduced drag to support longer trips. New hybrid systems help owners cut fuel use during extended voyages. The market benefits from advanced navigation tools that guide safer routes. It gains support from design upgrades that improve noise control on board. Buyers show strong interest in electric-ready platforms for future upgrades. Operators prefer boats that require less maintenance during seasonal use. Builders integrate smart controls that improve handling for new owners.

- For instance, hulls built by Fountaine Pajot use resin-infused vinylester with balsa cores to reduce weight while preserving strength, improving performance and stability. Marine engineers focus on stability and reduced drag to support longer trips.

Rising Demand From Charter Tourism and Group Sailing Activities

Global tourism growth encourages charter companies to expand multi-hull fleets. Travelers choose catamarans for group sailing trips and custom tour packages. Operators promote wider cabins that support families and larger groups. The Catamaran Market gains traction from rising coastal tourism in key regions. Charter firms invest in vessels that offer better comfort for long itineraries. Manufacturers support this shift with scalable models for tour operators. New layouts help improve onboard safety during crowded trips. Strong demand from holiday destinations boosts vessel production.

Increasing Preference for Safer and More Stable Marine Platforms

Multi-hull stability attracts buyers who prioritize safety during open-sea travel. Catamarans offer balanced handling in rough conditions and reduce motion discomfort. Families choose these vessels to ensure smoother trips during long vacations. The market grows with rising awareness of safety among new boat owners. It benefits from improved materials that offer better structural strength. Operators prefer stable platforms for water sports and leisure packages. Marine builders focus on wider beams that improve passenger comfort. Enhanced safety features support adoption across recreational sectors.

Market Trends:

Market Trends:

Expansion of Eco-Friendly and Low-Emission Catamaran Designs

Manufacturers invest in propulsion systems that support cleaner marine travel. Shipyards use lightweight composites to reduce drag and fuel load. Hybrid and solar-assisted vessels gain more attention from eco-focused travellers. The Catamaran Market moves toward features that cut operating footprints. Owners prefer boats that meet new coastal emission rules. Operators use green designs to improve brand appeal among tourists. Electric drive systems emerge in smaller multi-hull ranges. Builders integrate energy-saving layouts across luxury and charter fleets.

- For instance, Fountaine Pajot’s new models (like FP55) integrate hybrid-electric drive with up to 6,300 W of solar power and twin 50 kW electric motors enough to power onboard electricity at anchor without generator use. Shipyards use lightweight composites to reduce drag and fuel load.

Growing Customization Demand Across Luxury and Adventure Segments

Buyers seek tailored interiors and flexible layouts for unique sailing experiences. Luxury owners request upgraded cabins with smart controls and premium finishes. Adventure users prefer rugged decks and gear support for long trips. The market grows with interest in personal comfort during extended voyages. It responds with modular designs that meet diverse travel styles. Charter firms ask for customizable seating for group travel. Designers offer upgrades that support different marine activities. Shipyards deliver models suited for wider recreational needs.

- For instance, Leopard Catamarans allows clients to choose between multiple deck configurations and cabin setups to suit charter or private needs. Luxury owners request upgraded cabins with smart controls and premium finishes.

Rise of Digitally Connected Vessels With Smart Monitoring Systems

Marine electronics advance to support real-time vessel tracking and safety tools. Smart dashboards guide owners during complex routes and busy marinas. The Catamaran Market benefits from connectivity that improves navigation confidence. Operators use digital systems to improve fleet monitoring. Owners prefer remote control features for lights, power, and system checks. Builders add sensors that support predictive maintenance. Smart tools help reduce downtime during seasonal storage. Digital upgrades strengthen demand for next-generation vessels.

Expansion of Catamaran Adoption in Commercial and Passenger Transport

Governments promote multi-hull vessels for short-route passenger services. Operators choose catamarans for fuel savings and smoother coastal travel. The market grows with rising investment in marine mobility solutions. It supports mass transit routes in island regions and tourism hubs. Builders design larger models that meet transport safety norms. Commercial buyers seek improved seating and boarding layouts. New materials help improve durability during continuous operation. Interest in fast coastal transit boosts commercial fleet upgrades.

Market Challenges Analysis:

High Production Costs and Complex Multi-Hull Manufacturing Processes

Multi-hull construction requires advanced composites and skilled labor, raising costs. Builders face challenges while shaping larger beams and dual hull structures. The Catamaran Market struggles with limited access to low-cost materials in some regions. It also faces long production cycles during peak demand seasons. Owners encounter higher repair expenses due to complex structural layouts. Shipyards must invest in precision tools that raise operational costs. Rising component prices add pressure for small manufacturers. Limited economies of scale hinder cost reductions for new market entrants.

Operational Limitations and Infrastructure Constraints Across Emerging Markets

Many marinas lack docking spaces designed for wider vessels. Operators face difficulty maneuvering multi-hull boats through narrow ports. It leads to delays in fleet deployment across developing coastal regions. Some buyers avoid catamarans due to limited service centers. Training gaps create handling challenges for first-time owners. Weather patterns in certain areas affect long-range sailing comfort. Commercial operators face downtime during seasonal storms. Limited awareness restricts adoption in regions with low marine tourism.

Market Opportunities:

Growing Potential in Eco-Tourism and Sustainable Marine Experiences

Travelers show strong interest in low-impact marine tours and silent cruising. Catamarans offer platforms suited for eco-friendly travel across scenic coastlines. The Catamaran Market gains support from operators who promote clean tourism. It benefits from hybrid and solar-assisted propulsion upgrades. Charter companies use green fleets to attract responsible travelers. New design innovations open space for quieter water experiences. Buyers choose these vessels to align with sustainability values. Coastal nations support eco-marine projects that encourage fleet expansion.

Expansion of High-End Luxury Catamarans and Custom Yacht Experiences

Luxury buyers seek spacious cabins and premium comfort for long voyages. Designers introduce high-end materials and custom layouts to elevate onboard appeal. The market benefits from rising interest in private yachting vacations. It supports growth in multi-hull superyachts with advanced features. Shipyards target wealthy buyers seeking exclusive sailing options. Charter firms promote luxury packages for group adventures. High customization potential opens new revenue streams for builders. Rising demand in premium travel regions strengthens long-term growth.

Market Segmentation Analysis:

By Product/Type

The Catamaran Market expands across sailing catamarans and power catamarans, with each category serving different performance needs. Sailing models attract buyers who value efficiency and quiet operation during long coastal trips. Power catamarans gain interest from users who prefer higher speeds and stronger maneuvering capability. Both segments benefit from design upgrades that improve comfort and handling. Charter operators continue to adopt both types to meet varied customer expectations. Builders invest in hull innovation to support better stability and durability. Demand strengthens across tourism and private ownership groups seeking multi-hull benefits.

- For instance, Sailing models attract buyers who value efficiency and quiet operation during long coastal trips Fountaine Pajot builds sail-cats from 40 to 80 feet for comfort and stability.

By Size

Market segmentation spans below 15m, 16m–30m, above 30m, and traditional classifications such as small, medium, and large. Small and medium sizes attract recreational buyers who value easy handling and lower operating costs. Large vessels support premium charter services and extended voyages. It gains support from owners seeking spacious cabins for family cruising. Shipyards deliver diverse models to cover sport, leisure, and commercial needs. Medium ranges gain traction due to better balance between performance and comfort. Larger builds grow in regions where luxury tourism expands. Demand across all sizes reflects rising interest in stable multi-hull platforms.

By Application

Applications include leisure, sport, transport, commercial, defense, and others. Leisure holds the widest use due to strong interest in marine recreation. Sport models attract buyers who prioritize speed and optimization during racing events. Transport and commercial uses grow in coastal regions that depend on stable passenger routes. Defense users adopt multi-hulls for patrol needs and extended marine missions. It benefits from ongoing upgrades in propulsion and onboard safety. Tourism growth drives higher adoption in charter fleets. Each segment maintains steady investment focus from manufacturers.

By End-User

Recreational users form the core end-user base due to rising interest in marine tourism and personal boating. Buyers prefer stable platforms that support family cruising and water sports. It gains traction through wider use in private ownership markets. Charter firms also influence product demand through seasonal fleet expansion. Manufacturers respond with modular layouts that support comfort and safety. Growing lifestyle shifts strengthen interest in long-range sailing trips. Recreational adoption continues to guide long-term product development and innovation.

Segmentation:

By Product/Type:

- Sailing catamarans

- Power catamarans

By Size:

- Below 15m

- 16m–30m

- Above 30m

- Small

- Medium (30–60 feet)

- Large

By Application:

- Leisure

- Sport

- Transport

- Commercial

- Defense

- Others

By End-User:

By Regional Segments

- North America:

- Europe:

- U.K.

- Germany

- France

- Italy

- Spain

- Asia Pacific:

- China

- Japan

- India

- Australia

- Latin America / South America:

- Middle East & Africa:

Regional Analysis:

North America

North America holds the largest share of the Catamaran Market at around 38% due to strong recreational boating activity and high yacht ownership. The region benefits from advanced boatbuilding capabilities and widespread adoption of premium multi-hull vessels. Charter operators in the U.S. and Caribbean support steady demand through year-round tourism. It gains support from buyers who prefer stable platforms for long-range cruising. Marinas across coastal states invest in infrastructure suited for wider vessels. Growing interest in hybrid marine systems strengthens new purchase trends. Innovation-led manufacturers continue to influence the region’s dominant position.

Europe

Europe follows with nearly 32% share driven by a mature sailing culture and strong presence of global catamaran builders. Countries such as France, Germany, and Italy support the segment through long-standing marine craftsmanship. The Catamaran Market benefits from high charter demand across Mediterranean destinations. Buyers choose multi-hull designs for comfort during extended voyages in diverse waters. It gains traction through growing adoption of eco-friendly propulsion across EU waters. Regional marinas support fleet expansion with better docking and service facilities. Strong tourism routes help reinforce Europe’s leading role in vessel demand.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific holds around 20% share and stands out as the fastest-growing region due to rising coastal tourism in China, Australia, and Southeast Asia. Buyers across the region prefer multi-hulls for their stability during island travel and charter operations. Latin America contributes nearly 6% share supported by expansion of marine tourism in Brazil and Mexico. It gains visibility through investments in luxury coastal routes and adventure sailing. Middle East & Africa hold close to 4% share backed by growing interest in leisure boating in the UAE and South Africa. Regional governments invest in waterfront development projects that support future fleet growth. Coastal tourism trends guide long-term expansion across emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Catamaran Market features strong competition among established global shipyards that focus on innovation, material upgrades, and custom configurations. Leading brands invest in advanced hull engineering and hybrid propulsion to strengthen product appeal across leisure and charter segments. It gains momentum through steady demand for luxury models that support long-range cruising. Companies differentiate through flexible layouts, lightweight composites, and smart navigation systems. Charter operators influence product strategy by requesting scalable models for tourism needs. Competitive pressure encourages builders to expand production capacity and adopt efficient manufacturing systems. Global players also widen dealer networks to capture emerging coastal markets.

Recent Developments:

- In October 2025, Groupe Beneteau completed the acquisition of BMS, a shipyard specializing in maintenance, customization, and refit of large catamarans, particularly Lagoon vessels located in Canet-en-Roussillon, France. The acquisition adds BMS’s 14 employees and €3.3 million in annual revenue to Groupe Beneteau’s operations. According to the official announcement, more than 50 Lagoon catamarans are serviced annually at BMS facilities, and the integration expands Lagoon’s global service network to eight service centers. The company’s founders, Pascal Cantiran and Denis Ranjard, will continue to manage operations.

- In August 2025, Leopard Catamarans announced the launch of its enhanced warranty offering designed to provide comprehensive coverage and support for catamaran owners. The dual warranty framework combines builder and OEM coverage with real-time digital tracking and global service network integration. The R&C builder warranty provides 14-month protection against construction defects, extended 24-month coverage for non-structural windows, and six-year structural assurance for hulls, decks, and structural components. Leopard Catamarans’ global service network spans six continents and more than 20 countries.

- In April 2025, The Multihull Company announced its appointment as an authorized dealer for Nautitech Catamarans. This partnership marks a significant expansion in The Multihull Company’s portfolio of world-class cruising catamarans. The Multihull Company will represent Nautitech’s full line of high-performance catamarans, including the Nautitech 44 Open and Nautitech 48 Open, recently named 2025 European Yacht of the Year. Seasoned brokers Conor Dugan and Caroline LaViolette were designated as lead brokers with The Multihull Company to represent the Nautitech line. Both models were showcased at the 2025 International Multihull Show in La Grande Motte, France, from April 23 to 27.

Report Coverage:

The research report offers an in-depth analysis based on By Product/Type, By Size, By Application, and By End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Demand for multi-hull vessels will rise due to growing recreational boating activity.

- Hybrid and electric propulsion will gain strong interest in new production cycles.

- Charter companies will expand fleets to match tourism growth across coastal areas.

- Luxury buyers will drive higher adoption of large and customizable models.

- Digital systems will increase usage of smart navigation and onboard monitoring.

- Emerging regions will create new opportunities through marine infrastructure growth.

- Builders will focus on lightweight composites to improve performance and durability.

- Eco-tourism projects will support expansion of low-emission catamaran fleets.

- Transport operators will adopt multi-hulls for stable short-route passenger services.

- Global players will strengthen partnerships to expand distribution networks.

Market Trends:

Market Trends: