Market Overview

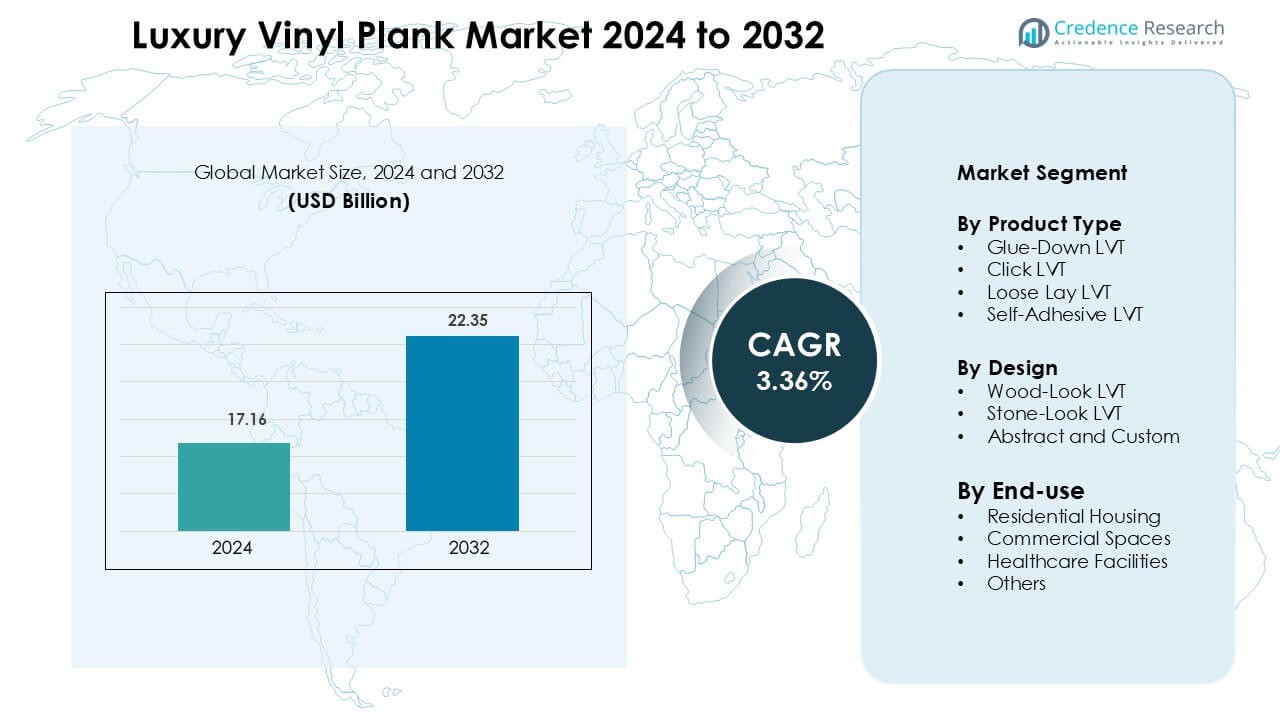

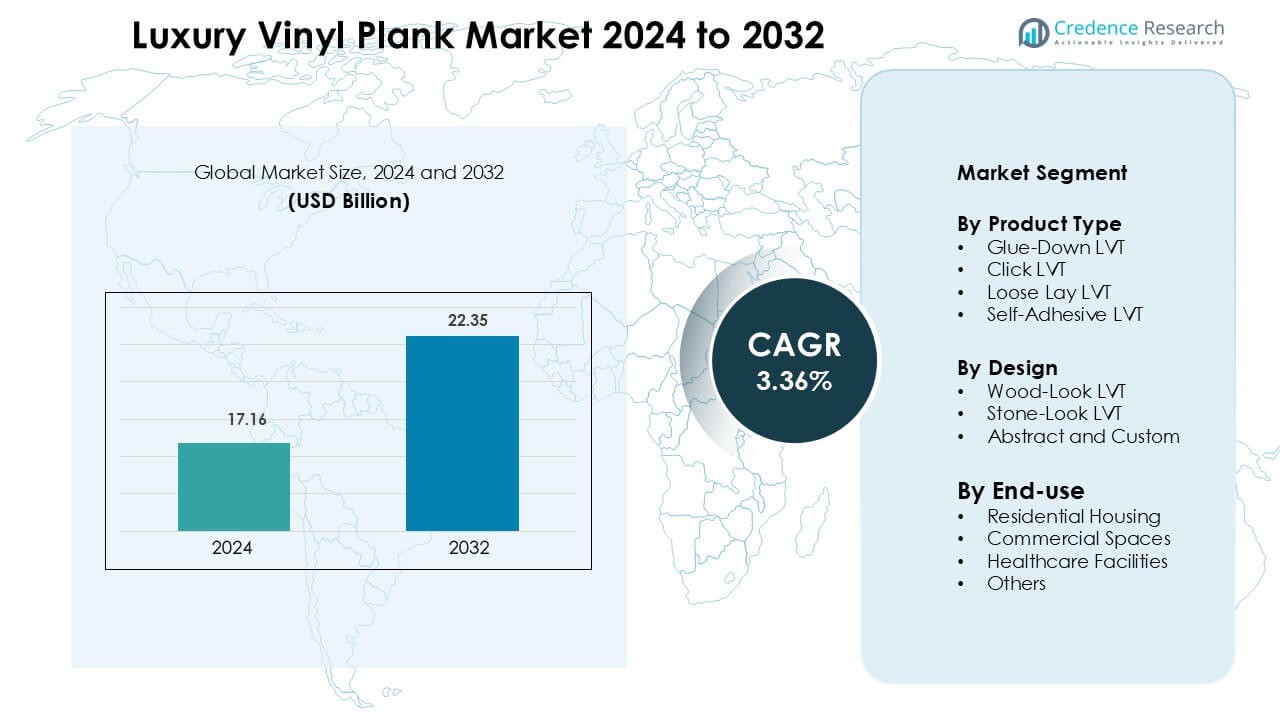

Luxury Vinyl Plank Market was valued at USD 17.16 billion in 2024 and is anticipated to reach USD 22.35 billion by 2032, growing at a CAGR of 3.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Vinyl Plank Market Size 2024 |

USD 17.16 Billion |

| Luxury Vinyl Plank Market, CAGR |

3.36% |

| Luxury Vinyl Plank Market Size 2032 |

USD 22.35 Billion |

The Luxury Vinyl Plank market includes major players such as Forbo Flooring Systems, Shaw Industries Group, Congoleum Corporation, Gerflor Group, Interface, Tarkett, Mohawk Industries, Mannington Mills, Beaulieu International Group, and Armstrong Flooring. These companies compete through realistic wood- and stone-look designs, rigid-core technologies, antimicrobial coatings, and low-VOC formulations. Product launches, distributor partnerships, and regional manufacturing expansion help strengthen market reach in both residential and commercial segments. North America remains the leading region with 38% market share, supported by strong renovation spending, wide product availability, and high demand for waterproof and pet-friendly flooring.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Luxury Vinyl Plank market reached USD 17.16 billion in 2024 and is projected to grow at a CAGR of 3.36 % through 2032, driven by rising demand for waterproof and durable flooring solutions.

- Strong residential renovation activity and DIY installations fuel adoption, with residential housing holding the largest segment share at 49% due to low maintenance, stain resistance, and wood-like aesthetics.

- Key trends include rapid growth of rigid-core and designer LVP, along with antimicrobial coatings and sustainability-focused, low-VOC materials that support healthy indoor environments.

- Major players such as Mohawk Industries, Shaw Industries, Tarkett, Mannington Mills, and Gerflor compete through digital printing, embossed textures, recycling programs, and expanded dealer networks to increase visibility.

- North America leads the market with 38% share, supported by commercial upgrades, premium remodeling projects, and strong retail availability, while Asia Pacific shows the fastest growth through urban housing development and expanding local production.

Market Segmentation Analysis:

By Product Type

Glue-down LVT holds the largest share in this segment with 42% of total sales. Builders and large commercial projects prefer glue-down formats due to strong adhesion, long service life, and low replacement cost. The format performs well in high-traffic areas where heavy furniture and equipment are common. Click LVT continues to grow as DIY adoption rises in residential upgrades. Loose lay and self-adhesive formats attract users seeking fast installation and minimal subfloor preparation, especially in rental and temporary spaces. Product innovation with waterproof cores and anti-scratch layers also drives demand.

- For instance, Shaw Industries has a large resilient flooring manufacturing facility (Plant RP) in Ringgold, Georgia. The company has made significant investments in this facility to expand its resilient product lines.

By Design

Wood-look LVT dominates this segment with 58% share, supported by strong demand for natural aesthetics at affordable prices. Homeowners and commercial buyers prefer realistic grain patterns, wide-plank looks, and matte finishes. The segment benefits from digital printing and embossed textures that closely mimic hardwood. Stone-look LVT appeals to luxury retail and hospitality interiors seeking marble or slate effects without structural reinforcement. Abstract and custom patterns serve boutique projects, corporate branding, and interior designers who require unique visual identity. Growth continues as manufacturers expand premium textures and stain-resistant coatings.

- For instance, Armstrong Flooring website mentions a Lutea Paradise rigid core product designed for light commercial spaces that features a 20mil wear layer for protection against scratches, scuffs, and stains.

By End-use

Residential housing accounts for 49% of market share, making it the dominant sub-segment. Home renovation, urban apartment flooring, and single-family homes prefer LVT due to durability, stain resistance, and low maintenance. Waterproof variants support kitchens, bathrooms, and basements, expanding adoption. Commercial spaces such as office centers, hospitality, and retail outlets choose LVT for design flexibility and quick replacement during renovations. Healthcare facilities benefit from slip resistance, hygiene properties, and sound control. Growing construction activities and shifting preference toward eco-friendly, phthalate-free flooring continue to strengthen market penetration across all end users.

Key Growth Drivers

Rising Residential Renovation and Remodeling Activities

Home improvement and renovation projects are a major catalyst for Luxury Vinyl Plank demand. Consumers prefer LVP for its waterproof structure, easy installation, and hardwood-like visuals. The product offers scratch resistance, thermal comfort, and compatibility with radiant heating systems, making it ideal for kitchens, bedrooms, and basements. DIY-friendly click installations allow homeowners to reduce labor costs and shorten renovation timelines. Urban apartments, rental properties, and modular homes also use LVP as a cost-effective alternative to natural wood. Quiet underfoot performance and low maintenance needs further encourage adoption. As housing upgrades continue, renovation spending and real estate refurbishments strengthen market growth across developed and emerging regions.

- For instance, Mannington Mills has expanded its ADURA® Max production line in Calhoun, Georgia, to support the surge in residential remodeling and DIY flooring installations. The flooring line incorporates Mannington’s innovative HydroLoc™ waterproof core and exclusive ScratchResist® technology, the latter of which features an aluminum oxide performance coating designed to provide exceptional resistance to everyday household scratches and keep floors looking newer longer.

Expansion in Commercial and Institutional Construction

Commercial construction in offices, hospitality, retail, and education sectors increasingly adopts LVP flooring to replace ceramic tiles and laminates. Facility owners prefer LVP due to stain resistance, slip protection, and fast replacement during maintenance cycles. Healthcare and assisted-living centers value its durability, sound absorption, and seamless installation that supports hygiene compliance. The product’s long wear layers, anti-bacterial coatings, and high load-bearing capacity enhance suitability for high-traffic environments. New construction in malls, restaurants, and coworking spaces drives procurement of premium wood-look and stone-look finishes. As commercial interiors demand design flexibility and performance at balanced cost, LVP remains a preferred flooring category.

- For instance, Gerflor supplied over 500,000 m² of its Creation 70 LVT series for commercial and healthcare projects across Europe, featuring a 0.70 mm wear layer and Sanitized® antibacterial treatment proven to reduce bacterial growth by 99.9% in clinical testing, ensuring compliance with hygiene standards in medical and educational facilities.

Advancements in Manufacturing and Surface Technologies

Technological improvements enhance aesthetics, performance, and sustainability in the LVP market. Digital printing and registered embossing create realistic textures that replicate natural stone and hardwood. Rigid core and SPC constructions increase dimensional stability, making planks less vulnerable to temperature or moisture changes. Manufacturers invest in anti-scratch, UV-resistant, and stain-guard layers to extend product lifespan in demanding environments. Eco-friendly backing materials and low-VOC formulations support green building certifications and healthy indoor air standards. Easy recyclability and phthalate-free production appeal to environmentally conscious buyers. As production efficiency reduces cost per unit, advanced LVP solutions gain higher acceptance among both residential and commercial users.

Key Trends & Opportunities

Shift Toward Waterproof and Pet-Friendly Flooring

A growing share of consumers prefer waterproof and pet-proof flooring for long-term reliability. Luxury Vinyl Plank offers 100% moisture resistance, preventing warping and swelling in kitchens, bathrooms, and basements. Scratch protection and stain-block coatings make LVP suitable for homes with pets and children. This trend supports rapid consumption in rental properties, vacation homes, and multi-family buildings. Manufacturers develop odor-resistant and antimicrobial surfaces to enhance hygiene. Retailers also market acoustic underlayment systems to reduce noise levels in multi-story structures. With a rise in active pet ownership and indoor lifestyle habits, waterproof LVP remains a strong opportunity segment.

- For instance, Mohawk Industries is a real company and widely known for innovative flooring products, including various proprietary and patented technologies related to durability and installation (e.g., Uniclic, WetProtect).

Rapid Growth of Custom-Printed and Designer LVP

Interior designers and commercial brands increasingly demand custom flooring visuals to match store themes, hospitality décor, and corporate identity. Digital printing supports high-resolution graphics, abstract designs, and unique color palettes. Boutique hotels, cafés, and luxury retail stores adopt premium LVP lines that replicate marble, exotic hardwood, or bespoke patterns without high installation cost. Custom offerings attract architects seeking distinct aesthetics in lobbies and public spaces. Manufacturers invest in modular plank formats that support fast layout changes and seasonal renovation cycles. As personalization grows across residential and commercial interiors, designer-grade LVP presents a major opportunity for premium product lines.

- For instance, The Gerflor Creation collection does include products with a 0.7 mm wear layer, specifically the Creation 70 range, which is designed for heavy commercial use (European class 34/43). A 0.7 mm wear layer is indeed an industry standard for heavy commercial and even light industrial applications.

Key Challenges

Environmental Concerns and Disposal Issues

Despite improvements in greener materials, PVC-based flooring still faces scrutiny related to recyclability and end-of-life disposal. Some LVP formats contain plasticizers or additives that make recycling difficult without specialized processing. Waste from renovation projects and commercial upgrades increases landfill burden when old planks are discarded. Growing regulatory pressure for circular materials forces manufacturers to invest in take-back programs and closed-loop production. While demand remains strong, brands must balance performance features with sustainable chemistry and responsibly sourced inputs. Failure to meet tightening environmental standards may restrict adoption in green-certified buildings or government projects.

Competition from Alternative Flooring Materials

Luxury Vinyl Plank competes with laminate, hardwood, ceramic, and engineered wood flooring. Improvements in laminate water resistance and hybrid flooring offer similar benefits at competitive prices. Natural wood continues to attract premium buyers seeking long-term value and resale benefits. Ceramic tiles remain preferred in high-moisture spaces due to proven longevity. Price-sensitive commercial buyers may choose sheet vinyl or SPC tiles to reduce installation costs. To maintain market share, LVP suppliers must enhance durability, improve sustainable content, and expand customization options. Intense price competition and new entrants challenge established brands to innovate and protect margins.

Regional Analysis

North America

North America holds the largest regional share at 38%, driven by strong residential renovation and commercial construction spending. Homeowners prefer LVP for its waterproof structure, quick installation, and hardwood-like finish. Retail chains, hospitality spaces, and healthcare centers adopt durable LVP for high-traffic flooring. The U.S. leads the region through extensive product availability across home improvement stores and distribution networks. Growth continues as builders shift from laminate and ceramic toward rigid-core formats with improved acoustic and thermal performance. Rising demand for pet-friendly and stain-resistant flooring further strengthens market penetration in single-family homes and rental apartments.

Europe

Europe accounts for 27% market share, supported by eco-friendly construction rules and rapid commercial refurbishment. Countries such as Germany, France, and the U.K. adopt LVP in offices, retail spaces, and hospitality environments due to low maintenance and slip resistance. Demand rises for phthalate-free and low-VOC flooring that meets indoor air quality and green building certifications. Renovation of aging residential complexes also drives adoption of click-lock formats. The region shows growing preference for stone-look and abstract designs in luxury real estate, corporate interiors, and boutique hotels. Sustainable sourcing and recycling programs further boost market credibility.

Asia Pacific

Asia Pacific holds 22% of the market and remains the fastest-growing region. Rapid urbanization, rising disposable incomes, and expanding commercial real estate drive LVP installation across apartments, malls, hotels, and corporate buildings. China and India lead growth through large-scale housing projects and cost-efficient flooring demand. Waterproof and termite-resistant features make LVP suitable for humid climates. Developers favor quick installation and low replacement cost in high-density cities. Local manufacturing expansions reduce product cost and improve availability. Premium wood-look designs gain traction in luxury homes, smart cities, and hospitality projects, strengthening long-term adoption.

Latin America

Latin America holds 8% market share, supported by rising modular construction and refurbishment of hospitality and retail spaces. Brazil and Mexico show increasing demand for affordable, durable flooring as consumers prefer materials that withstand moisture and heavy foot traffic. Import penetration and growing distributor networks broaden access to product varieties. Residential builders adopt LVP for kitchens and living areas to replace traditional tiles. Commercial buyers value acoustic comfort and quick maintenance in offices and educational facilities. Expansion of urban housing and retail chains supports gradual market improvement across major economies.

Middle East & Africa

The Middle East & Africa region represents 5% of the market, with growth led by tourism projects, luxury residential spaces, and new commercial infrastructure. The UAE and Saudi Arabia invest in premium interior materials for hotels, malls, and high-rise apartments. Wood-look and stone-look LVP offer aesthetic appeal without the moisture-related issues of hardwood. Heat-resistant rigid-core products gain popularity in warm climates. Partnerships with international flooring suppliers increase product diversity. Although adoption remains lower than other regions, rising construction investments and expanding retail presence create steady long-term opportunities.

Market Segmentations:

By Product Type

- Glue-Down LVT

- Click LVT

- Loose Lay LVT

- Self-Adhesive LVT

By Design

- Wood-Look LVT

- Stone-Look LVT

- Abstract and Custom

By End-use

- Residential Housing

- Commercial Spaces

- Healthcare Facilities

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Luxury Vinyl Plank market features strong competition among global flooring manufacturers, regional specialists, and brands focused on customization and waterproof products. Companies such as Mohawk Industries, Shaw Industries, Tarkett, Mannington Mills, Interface, and Gerflor invest in advanced printing technologies, embossed textures, and rigid-core constructions to enhance durability and design realism. Many players expand product lines with phthalate-free materials, antimicrobial coatings, and acoustic underlayment to serve residential and commercial buyers. Strategic actions include acquisitions, partnerships with distributors, and capacity expansions in Asia and North America to reduce lead times and improve pricing. Retail networks, e-commerce channels, and dealer programs strengthen brand visibility. As innovation shifts toward sustainable chemistry, recyclability, and take-back systems, manufacturers focus on circular production models to meet green building standards. The competitive environment remains dynamic, with premium designs, performance features, and installation convenience shaping buyer preferences and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Beaulieu International Group New Congol LLC acquires Congoleum assets, bolstering its U.S. resilient/LVP footprint. Deal announcement confirmed by B.I.G. and trade press.

- In February 2025, Shaw rolled out 2025 resilient updates. New Floorté Classic (WPC) and Floorté Pro (SPC) designs, plus flex and loose-lay options.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Design, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for waterproof and pet-friendly flooring will continue to rise in homes and rental properties.

- Commercial projects will adopt premium LVP for faster installation and low maintenance.

- Rigid-core and SPC formats will gain wider acceptance due to improved dimensional stability.

- Digital printing and embossed surfaces will enhance natural wood and stone realism.

- Manufacturers will expand phthalate-free and low-VOC product lines to meet green building needs.

- Custom patterns and designer visuals will grow in hospitality, retail, and luxury interiors.

- Recycling programs and circular manufacturing will become key brand differentiators.

- E-commerce channels and dealer networks will strengthen product reach and consumer access.

- Asia Pacific will show strong long-term growth supported by urban construction and rising income levels.

- Product durability, acoustic comfort, and easy installation will remain core purchasing factors.