Market Overview

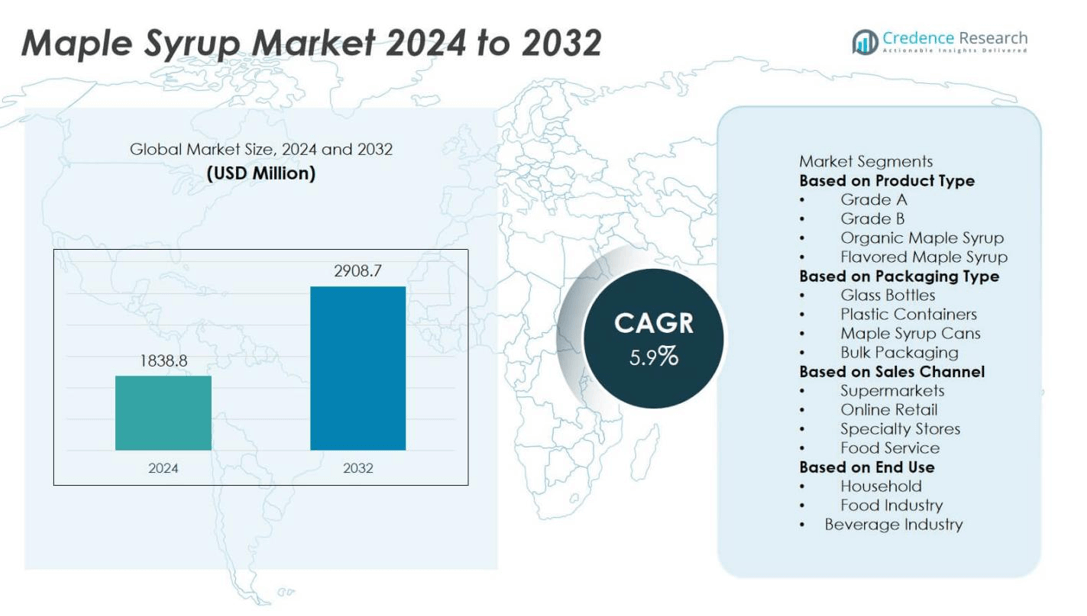

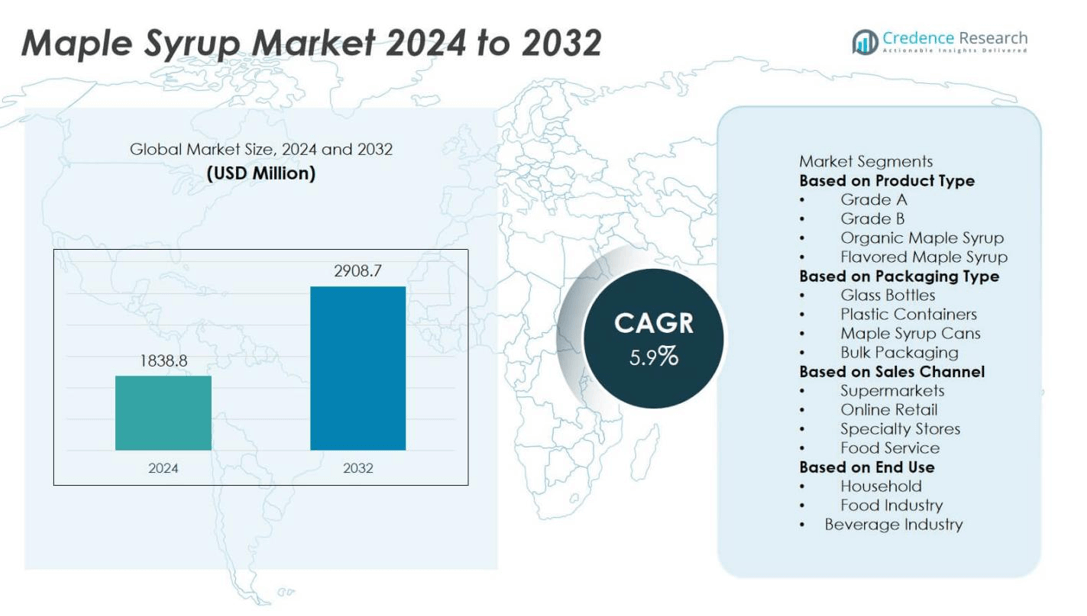

The Maple Syrup Market was valued at USD 1,838.8 million in 2024 and is projected to reach USD 2,908.7 million by 2032, registering a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maple Syrup Market Size 2024 |

USD 1,838.8 million |

| Maple Syrup Market, CAGR |

5.9% |

| Maple Syrup Market Size 2032 |

USD 2,908.7 million |

The Maple Syrup Market grows with rising consumer demand for natural and minimally processed sweeteners, supported by increasing awareness of its nutritional benefits and clean-label appeal. Expansion in premium and organic product lines, coupled with innovative flavor infusions, enhances market differentiation. Sustainability-focused harvesting practices and eco-friendly packaging strengthen brand positioning among environmentally conscious buyers.

The Maple Syrup Market has a strong presence across North America, Europe, and parts of Asia-Pacific, with North America dominating production due to favorable climatic conditions and established tapping traditions in Canada and the northeastern United States. Europe shows steady growth driven by rising demand for natural sweeteners in gourmet and specialty food segments. Leading companies such as Crown Maple, Butternut Mountain Farm, and Escuminac focus on premium-grade offerings, sustainable sourcing, and diversified flavor profiles to cater to evolving consumer preferences. Maple Grove Farms and Quebec Maple Syrup Producers leverage large-scale production capabilities and global distribution networks to strengthen their market reach, while artisanal producers like Stowe Maple Products and Maple Valley Cooperative emphasize small-batch authenticity and traceability to capture niche, high-value segments in both domestic and international markets.

Market Insights

- The Maple Syrup Market was valued at USD 1838.8 million in 2024 and is expected to reach USD 2908.7 million by 2032, at a CAGR of 5.9% during the forecast period.

- Growth is driven by rising consumer preference for natural sweeteners, clean-label products, and minimally processed alternatives, boosting demand in both retail and foodservice sectors.

- Key trends include the introduction of premium organic maple syrup, flavored infusions, and sustainable packaging solutions, which enhance brand appeal and expand customer reach.

- The competitive landscape features major players such as Crown Maple, Quebec Maple Syrup Producers, Butternut Mountain Farm, and Maple Grove Farms, focusing on quality differentiation, traceability, and global market penetration.

- Market restraints include seasonal dependency of maple sap harvesting, climatic fluctuations affecting yields, and higher production costs compared to synthetic sweeteners.

- North America leads production and consumption, while Europe sees growing demand in gourmet and bakery segments, and Asia-Pacific emerges as a rising market for premium imports.

- Expansion strategies include strengthening e-commerce distribution, building consumer awareness of nutritional benefits, and leveraging geographic origin marketing to enhance product authenticity and premium positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for Natural and Organic Sweeteners

The Maple Syrup Market benefits from the growing preference for natural, plant-based sweeteners over refined sugar and artificial alternatives. Consumers are increasingly aware of the health risks associated with high-fructose corn syrup and processed sugars, driving demand for maple syrup as a clean-label option. It appeals to health-conscious buyers seeking products with minimal processing and no artificial additives. The market gains momentum from its high mineral content and antioxidant properties, which position it as a functional sweetener. Food and beverage manufacturers incorporate maple syrup into bakery items, dairy products, and beverages to meet clean-label demands. The trend toward transparent ingredient sourcing strengthens its adoption across multiple product categories.

- For instance, Crown Maple processes sap from approximately 100,000 tapped trees and can scale up to 400,000 tapped trees, using reverse osmosis technology that removes up to 75% of water content from sap, thereby enhancing purity and production efficiency.

Expansion of Premium and Specialty Food Segments

The Maple Syrup Market experiences growth through the rising popularity of gourmet and specialty food products. Consumers are willing to pay premium prices for high-quality, sustainably sourced maple syrup, especially single-origin or organic varieties. It is increasingly featured in upscale restaurants, artisanal bakeries, and luxury gift assortments. Specialty food retailers highlight maple syrup’s unique flavor profile, enhancing its appeal among culinary enthusiasts. Seasonal and limited-edition product launches drive excitement in the premium segment. The growing association of maple syrup with authenticity and craftsmanship supports long-term value positioning.

- For instance, Butternut Mountain Farm operates a 150,000-square-foot certified organic and non-GMO production and warehouse facility—one of the largest in the U.S.—ensuring premium-grade processing and specialty syrup quality.

Increasing Applications in Processed and Packaged Foods

The Maple Syrup Market expands through its integration into diverse processed food categories. Manufacturers use it in cereals, granola bars, flavored dairy products, and sauces to enhance flavor while meeting consumer demand for natural ingredients. It offers a versatile sweetening option that aligns with reformulation strategies aimed at reducing artificial additives. The rising popularity of plant-based and gluten-free products further boosts usage in specialized food lines. Foodservice operators also integrate maple syrup into breakfast menus, desserts, and beverages to offer premium taste experiences. Continuous product innovation strengthens its role in the processed foods sector.

Growth in Export Opportunities and Global Awareness

The Maple Syrup Market gains from expanding international trade and rising global awareness of its quality and heritage. Export volumes are increasing to regions where maple syrup is considered a premium import, including Asia-Pacific and parts of Europe. It benefits from promotional efforts by trade associations highlighting its origin, production methods, and nutritional value. The rise in global culinary shows, online recipe sharing, and travel exposure introduces new consumers to maple syrup-based dishes. Governments in producing regions support branding initiatives to enhance its international presence. Strengthening global supply chains enables producers to meet rising overseas demand efficiently.

Market Trends

Rising Popularity of Organic and Single-Origin Varieties

The Maple Syrup Market is witnessing strong growth in demand for organic and single-origin products. Consumers are seeking assurance on quality, purity, and sustainable sourcing, driving producers to obtain organic certifications and highlight regional provenance. It benefits from growing awareness of environmental practices, with buyers favoring producers who use eco-friendly tapping and processing methods. Single-origin maple syrup appeals to connoisseurs who value unique flavor profiles linked to specific geographic areas. Retailers and online platforms are expanding premium organic product lines to meet this demand. The trend aligns with broader consumer shifts toward authenticity and traceability in food products.

- For instance, in 2023, Quebec had 1,472 maple companies certified organic, representing 21% of all operations within the province, according to provincial agricultural data, reflecting a substantial commitment to certified, transparent production.

Integration into Innovative Food and Beverage Products

The Maple Syrup Market is expanding through its incorporation into innovative food and beverage offerings. Manufacturers are infusing it into plant-based dairy alternatives, protein bars, craft beverages, and artisanal condiments to enhance flavor and meet clean-label expectations. It is also being featured in functional beverages, combining natural sweetness with added nutritional benefits. Chefs and foodservice operators are using maple syrup in fusion cuisines and gourmet recipes, boosting its culinary versatility. Seasonal product launches around holidays and limited-edition flavors drive consumer interest. This diversification strengthens its role beyond traditional breakfast uses.

- For instance, Butternut Mountain Farm operates a 150,000‑square‑foot certified organic, Non‑GMO, Kosher, and SQF‑verified production and warehouse facility, ensuring they deliver premium maple-based products with high processing standards.

Adoption of Sustainable Packaging and Ethical Sourcing Practices

The Maple Syrup Market is aligning with global sustainability trends by adopting eco-friendly packaging and promoting ethical sourcing. Producers are shifting to recyclable glass bottles, biodegradable labels, and lightweight transport-friendly containers to reduce environmental impact. It benefits from transparency initiatives that share details of forest stewardship, fair labor practices, and carbon footprint reduction. Brands are leveraging sustainability certifications to strengthen consumer trust and loyalty. Ethical sourcing resonates strongly with younger demographics who prioritize responsible consumption. This approach enhances brand value while supporting environmental conservation.

Growth of E-Commerce and Direct-to-Consumer Sales Channels

The Maple Syrup Market is gaining momentum from the expansion of e-commerce and direct-to-consumer models. Producers and specialty brands are establishing online storefronts to reach global customers without relying solely on retail intermediaries. It benefits from subscription services and curated gift boxes that promote recurring purchases. Social media and influencer marketing amplify brand visibility and educate consumers about product quality and uses. International shipping capabilities have expanded access to markets where maple syrup was previously limited. This shift toward digital sales channels increases brand reach while allowing producers to maintain stronger control over customer relationships.

Market Challenges Analysis

Impact of Climate Variability on Production Stability

The Maple Syrup Market faces significant challenges from climate variability that directly affects sap yield and quality. Fluctuating temperatures, shortened sap flow seasons, and unpredictable weather patterns disrupt tapping schedules and reduce production volumes. It depends heavily on specific climatic conditions, making it vulnerable to the effects of global warming. Producers experience increased operational costs when adapting harvesting techniques to mitigate weather-related risks. Variability in output also complicates supply chain planning and inventory management for both domestic and export markets. This instability can influence pricing, affecting competitiveness in global trade.

Rising Competition and Price Sensitivity in Global Markets

The Maple Syrup Market contends with growing competition from alternative sweeteners and flavored syrups that often have lower production costs. It must differentiate itself in markets where consumers are price-sensitive, particularly in regions unfamiliar with its unique taste and heritage. Production expenses, including labor, certification, and sustainable packaging, can elevate retail prices, limiting accessibility in cost-conscious segments. Fluctuations in currency exchange rates further impact export profitability for major producing countries. Counterfeit products and mislabeling also threaten brand trust and market reputation. Addressing these competitive pressures requires strategic marketing, quality assurance, and consumer education initiatives.

Market Opportunities

Expansion into Health-Conscious and Functional Food Segments

The Maple Syrup Market holds strong potential in health-conscious consumer segments seeking natural and minimally processed sweeteners. It offers a rich nutrient profile, including manganese, zinc, and antioxidants, which aligns with rising interest in functional foods. Manufacturers can capitalize on clean-label trends by highlighting maple syrup’s natural sourcing and absence of artificial additives. Opportunities exist to integrate it into fortified beverages, protein snacks, and wellness-focused bakery items. Collaborations with health food brands can extend its market presence beyond traditional breakfast applications. Educating consumers on its health benefits will strengthen its positioning in competitive sweetener categories.

Global Market Diversification through Innovative Applications

The Maple Syrup Market can expand by targeting emerging markets and developing non-traditional uses across the food and beverage industry. It can be incorporated into alcoholic beverages, gourmet sauces, and premium confectionery products to appeal to diverse consumer tastes. Growth prospects are supported by increasing demand for artisanal and specialty products in regions such as Asia-Pacific and the Middle East. Value-added product lines, including maple-infused condiments and ready-to-drink beverages, can enhance profitability. Strategic partnerships with international distributors and premium foodservice chains can accelerate penetration in high-growth markets. This diversification will reduce dependency on mature markets and enhance global competitiveness.

Market Segmentation Analysis:

By Product Type

The Maple Syrup Market segments by product type into Grade A, Processing Grade, and Substandard Grade. Grade A syrup, available in variations such as Golden, Amber, and Dark, dominates due to its premium quality, rich flavor, and suitability for direct consumption. Processing Grade syrup is primarily used in the food processing industry for manufacturing bakery goods, confectionery items, and flavored beverages. Substandard Grade finds limited application, often in industrial uses where flavor quality is less critical. Growing consumer preference for natural and high-grade sweeteners sustains demand for Grade A, while bulk buyers in the food industry contribute to the steady consumption of Processing Grade. The diversification of product types allows producers to target both retail and industrial markets effectively.

- For instance, the Québec Maple Syrup Producers (QMSP) manage a global strategic maple syrup reserve that holds 216,000 barrels—each barrel measuring 45 US gallons—ensuring consistent supply for quality-controlled product types across seasons.

By Packaging Type

The Maple Syrup Market divides by packaging type into glass bottles, plastic bottles, cans, and pouches. Glass bottles remain popular for premium-grade syrup due to their ability to preserve flavor and appeal to consumers seeking traditional, high-quality presentation. Plastic bottles offer convenience, lightweight handling, and cost-efficiency, making them suitable for mass-market retail. Cans are favored for bulk and foodservice applications, providing extended shelf life and durability during transportation. Pouches, though relatively new, are gaining traction in eco-conscious markets due to reduced material use and portability. Packaging innovations focused on sustainability and extended freshness are influencing buyer preferences across all categories.

By Sales Channel

The Maple Syrup Market categorizes sales channels into supermarkets and hypermarkets, specialty stores, online retail, and foodservice. Supermarkets and hypermarkets lead distribution by offering wide product variety and brand visibility to mainstream consumers. Specialty stores cater to niche buyers seeking artisanal, organic, and locally sourced maple syrup varieties. Online retail is experiencing rapid growth, driven by expanding e-commerce platforms and direct-to-consumer strategies that enable producers to reach global audiences. The foodservice sector remains a significant buyer, sourcing large quantities for use in restaurants, hotels, and catering services. Diversification across multiple sales channels enhances market resilience and provides producers with multiple pathways for expanding consumer reach.

Segments:

Based on Product Type

- Grade A

- Grade B

- Organic Maple Syrup

- Flavored Maple Syrup

Based on Packaging Type

- Glass Bottles

- Plastic Containers

- Maple Syrup Cans

- Bulk Packaging

Based on Sales Channel

- Supermarkets

- Online Retail

- Specialty Stores

- Food Service

Based on End Use

- Household

- Food Industry

- Beverage Industry

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Maple Syrup Market at 72%, driven by its strong production base, particularly in Canada and the northeastern United States. Canada accounts for over 70% of global maple syrup production, with Quebec alone producing more than 130 million pounds annually. The region benefits from established tapping infrastructure, favorable climatic conditions, and advanced processing facilities. Growing consumer preference for natural sweeteners and the integration of maple syrup in gourmet, bakery, and beverage products reinforce regional demand. The presence of major producers such as The Maple Guild, Coombs Family Farms, and Citadelle Maple Syrup Producers’ Cooperative strengthens its dominance. Strong domestic consumption, combined with high export volumes to Europe and Asia, ensures sustained growth in this region.

Europe

Europe captures 14% of the Maple Syrup Market, supported by a strong import network and rising consumer interest in premium natural sweeteners. The United Kingdom, Germany, and France are key markets, with maple syrup often positioned as a gourmet product. Demand is driven by the bakery, confectionery, and specialty beverage industries, where it is used for flavor enhancement and product differentiation. European consumers show increasing preference for organic and sustainably sourced maple syrup, aligning with strict EU food labeling and safety regulations. Specialty food retailers and high-end supermarkets are the primary distribution channels. Imports from Canada dominate supply, while local bottling and branding initiatives enhance value-added opportunities for distributors.

Asia-Pacific

Asia-Pacific accounts for 8% of the Maple Syrup Market, with demand expanding rapidly in Japan, China, and Australia. Japan has a well-established taste for maple syrup in bakery goods, breakfast foods, and confectionery, while China’s growing middle class is driving premium product adoption. Rising health awareness and the popularity of Western-style diets fuel demand for natural sweeteners in urban markets. E-commerce plays a significant role in market penetration, enabling international brands to reach consumers directly. Promotional campaigns highlighting the nutritional benefits and versatility of maple syrup are strengthening its market presence. The region’s growth potential is significant, supported by increasing culinary integration in both retail and foodservice sectors.

Latin America

Latin America holds 4% of the Maple Syrup Market, with consumption concentrated in Mexico, Brazil, and Chile. While production is minimal, the region imports syrup primarily from North America for use in bakery, confectionery, and specialty coffee sectors. Growing café culture and the rising influence of international cuisines are contributing to market expansion. Premium positioning and targeted marketing are necessary to overcome price sensitivity in certain segments. Online retail and specialty gourmet stores are the main drivers of consumer access to high-quality maple syrup.

Middle East & Africa

The Middle East & Africa region represents 2% of the Maple Syrup Market, with demand led by the UAE, Saudi Arabia, and South Africa. Consumption is centered around premium hospitality, gourmet retail, and expatriate communities familiar with maple syrup. High-end hotels and restaurants incorporate it into breakfast menus and dessert offerings. Limited local production means imports from Canada dominate supply. The rising trend of health-conscious diets and the expansion of premium food retail chains create opportunities for gradual market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crown Maple

- Maple Valley Cooperative

- American Maple Company

- Escuminac

- Vermont Maple Sugar Makers Association

- Stowe Maple Products

- Maple Grove Farms

- Quebec Maple Syrup Producers

- Butternut Mountain Farm

- Saunders Maple Inc

Competitive Analysis

Competitive dynamics in the Maple Syrup Market are shaped by leading players such as Crown Maple, Quebec Maple Syrup Producers, Butternut Mountain Farm, Maple Grove Farms, Escuminac, Maple Valley Cooperative, American Maple Company, Stowe Maple Products, Vermont Maple Sugar Makers Association, and Saunders Maple Inc. These companies compete through premium quality production, sustainable harvesting practices, and product innovation. Many emphasize single-source traceability, organic certification, and advanced syrup processing to meet the preferences of health-conscious and gourmet consumers. Large producers integrate modern sap collection and filtration technologies to maintain supply consistency, while smaller cooperatives focus on authenticity and community-driven branding. Eco-friendly packaging, expansion into emerging markets in Europe and Asia-Pacific, and targeted digital marketing are key growth strategies. Differentiation is further reinforced by seasonal quality control, unique flavor profiles, and positioning within the premium natural sweetener category, enabling market leaders to strengthen brand loyalty and expand their customer base.

Recent Developments

- In April 2025, Quebec Maple Syrup Producers (QMSP) announced a collective production of 225 million pounds of maple syrup, supported by the addition of 7 million new maple taps initiated in 2024.

- In March 2025, Vermont Maple Sugar Makers Association (VMSMA), Successfully hosted the 2025 Maple Open House Weekend, a key event promoting sugarhouse visits and local maple outreach.

- In May 2024, Butternut Mountain Farm unveiled a new generation of its popular squeeze bottle at the Specialty Food Association’s Summer Fancy Food Show.

Market Concentration & Characteristics

The Maple Syrup Market demonstrates a moderately concentrated structure, with production dominated by a limited number of players in North America, particularly in Canada and the northeastern United States. It benefits from a strong regional identity, where established brands maintain long-term supply agreements and deep relationships with distributors and retailers. The industry is characterized by seasonal production cycles tied to natural sap flow conditions, which influence supply stability and pricing. Producers focus on maintaining consistent quality standards through strict grading systems and advanced processing technologies to preserve flavor and purity. It also exhibits a growing emphasis on traceability, organic certification, and sustainable tapping practices to meet evolving consumer expectations. Competitive dynamics are shaped by product diversification, including flavored syrups, value-added maple-based products, and innovative packaging formats that cater to both retail and foodservice channels. This structure fosters brand loyalty while allowing niche artisanal producers to compete in premium market segments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Type, Sales Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and sustainably produced maple syrup will continue to grow globally.

- Producers will invest in advanced sap collection systems to improve efficiency and yield.

- Climate change will influence tapping seasons, prompting adoption of adaptive harvesting practices.

- Expansion into emerging markets will create new export opportunities for major producers.

- Value-added maple-based products will gain traction in confectionery, beverages, and bakery segments.

- Innovative packaging solutions will improve shelf life and consumer convenience.

- Branding focused on origin and authenticity will strengthen market differentiation.

- Digital marketing and e-commerce channels will become more prominent in driving sales.

- Collaboration between producers and foodservice operators will expand product applications.

- Sustainability certifications will increasingly shape consumer purchase decisions.