Market Overview

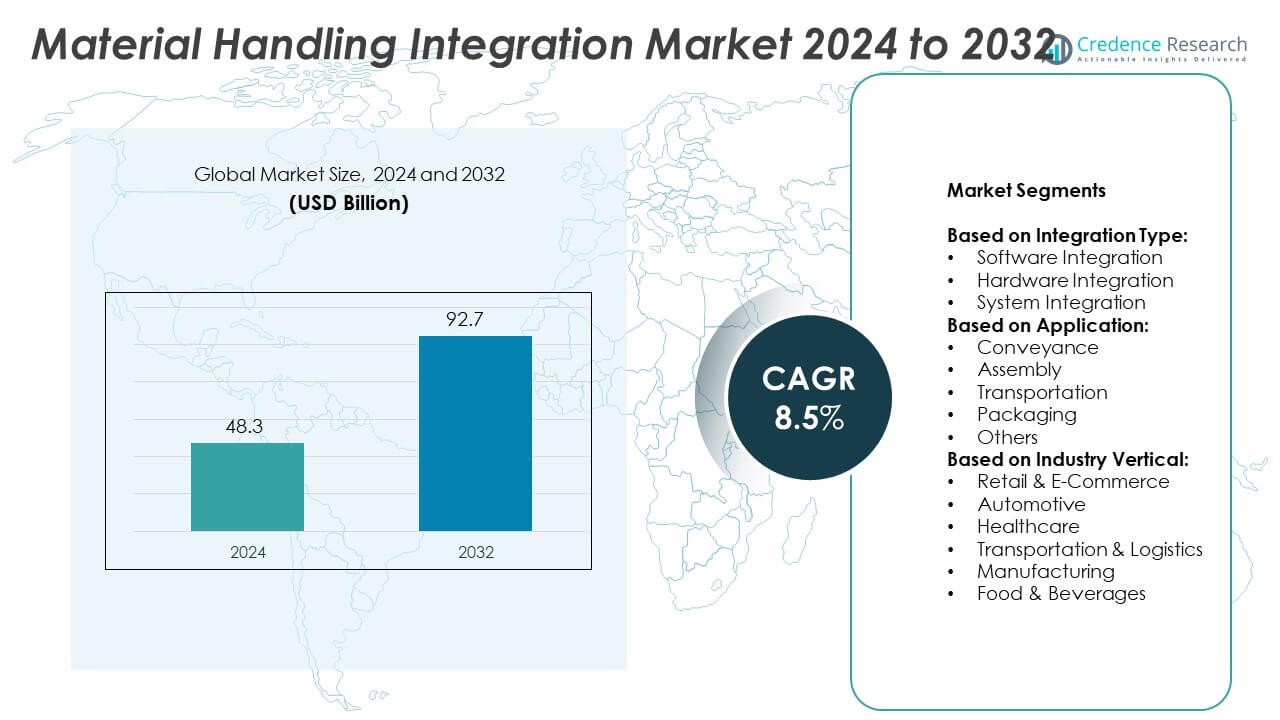

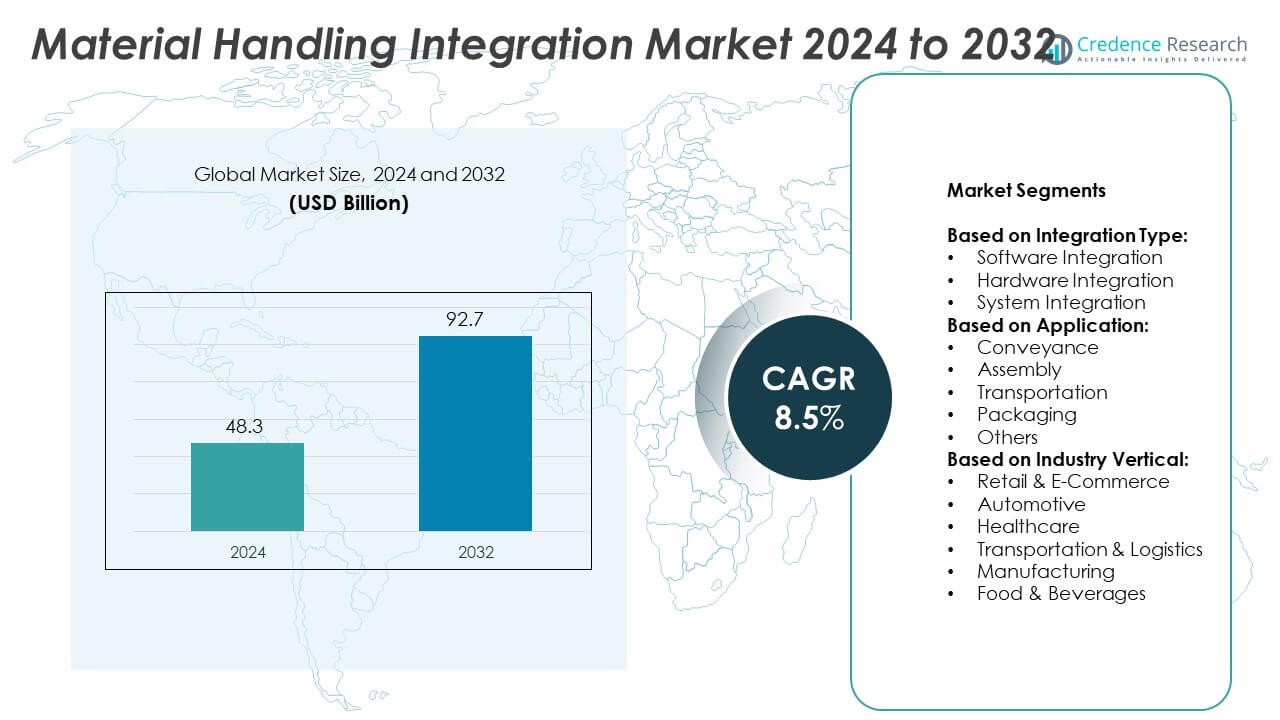

Material Handling Integration Market size was valued at USD 48.3 billion in 2024 and is anticipated to reach USD 92.7 billion by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Material Handling Integration Market Size 2024 |

USD 48.3 Billion |

| Material Handling Integration Market, CAGR |

8.5% |

| Material Handling Integration Market Size 2032 |

USD 92.7 Billion |

The Material Handling Integration market grows rapidly due to rising automation adoption, increasing e-commerce expansion, and the demand for efficient warehouse operations. Companies invest in AI-powered platforms, robotics, and IoT-enabled solutions to improve productivity and streamline supply chain processes. It benefits from the growing need for real-time inventory visibility, predictive analytics, and seamless data integration. Trends highlight the shift toward smart warehousing, cloud-based platforms, and sustainable automation practices that reduce energy consumption. Businesses focus on developing scalable, integrated systems to meet evolving operational demands, enhance workforce efficiency, and strengthen overall supply chain performance across diverse industry sectors.

The Material Handling Integration market shows strong regional variation, with North America and Europe leading adoption due to advanced logistics infrastructure and technological innovation, while Asia-Pacific rises rapidly amid industrialization and e-commerce acceleration. It benefits from growth in emerging markets across Latin America and the Middle East, where investments in automation and modernization increase. Leading players driving the market include Daifuku Co., Ltd., Jungheinrich AG, SSI SCHAEFER, and TGW Logistics Group, all of whom develop scalable, intelligent systems tailored to diverse operational demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Material Handling Integration market was valued at USD 48.3 billion in 2024 and is projected to reach USD 92.7 billion by 2032, growing at a CAGR of 8.5% between 2025 and 2032.

- Rising automation adoption, increasing e-commerce expansion, and growing demand for efficient warehouse operations drive the market’s growth.

- Trends indicate a strong shift toward robotics, AI-powered platforms, IoT-enabled solutions, and cloud-based systems that enhance operational efficiency and real-time visibility.

- The market is competitive, with key players such as Daifuku Co., Ltd., Jungheinrich AG, SSI SCHAEFER, KION GROUP AG, Honeywell International Inc., TGW Logistics Group, and Swisslog Holding AG focusing on innovation and strategic partnerships.

- High implementation costs, integration complexities, and workforce skill gaps act as restraints, limiting adoption for small and medium-sized enterprises.

- North America leads the market due to advanced automation infrastructure and strong technology adoption, while Europe focuses on sustainable automation and smart warehousing solutions.

- Asia-Pacific shows the fastest growth, driven by rising industrialization, booming e-commerce, and increasing investment in robotics and digital transformation, with Latin America and the Middle East also witnessing steady adoption of integrated solutions.

Market Drivers

Rising Automation and Industry 4.0 Adoption

The Material Handling Integration market experiences significant growth due to increasing automation and the adoption of Industry 4.0 solutions. Companies invest in integrated systems to enhance operational efficiency, reduce downtime, and optimize material flow. Automated guided vehicles, robotic systems, and AI-powered solutions enable faster and more accurate operations. It supports industries in meeting high production demands while minimizing labor dependency. Smart warehouses equipped with IoT-based systems provide real-time visibility and predictive maintenance capabilities. These advancements create opportunities for scalable integration across manufacturing, logistics, and distribution facilities.

- For instance, DENSO implemented Automated Guided Vehicles (AGVs) in their Maryville, Tennessee facility, achieving a 48 reduction in process defects and enabling 33 of labor to be reallocated to better positions without eliminating any roles

Growing Demand for E-commerce and Efficient Warehousing

The Material Handling Integration market gains momentum from the rapid expansion of e-commerce and the rising need for streamlined warehouse operations. Businesses face increasing order volumes, shorter delivery cycles, and higher customer expectations. It drives the adoption of automated storage and retrieval systems, conveyor solutions, and real-time tracking technologies. Integrated platforms improve inventory management and enable seamless coordination between suppliers and distribution centers. Retailers and logistics providers invest in advanced material handling technologies to manage growing SKU complexity. This trend pushes companies to modernize their warehouse infrastructure for better speed and accuracy.

- For instance, Amazon Robotics has deployed more than 750,000 robots across its fulfillment network since 2012.

Focus on Cost Optimization and Operational Efficiency

The Material Handling Integration market benefits from strong demand for solutions that optimize costs and enhance operational efficiency. Companies leverage integrated systems to reduce energy consumption, minimize material waste, and lower handling errors. It enables centralized control and advanced analytics that improve workflow planning. Predictive data insights support better decision-making and resource allocation. Businesses prioritize technologies that reduce manual intervention and improve asset utilization. These solutions create a competitive advantage by streamlining processes and enhancing overall productivity.

Expanding Applications Across Diverse Industries

The Material Handling Integration market continues to grow due to its wide adoption across multiple sectors, including automotive, food and beverage, healthcare, and retail. Industries require customized solutions to meet specific operational challenges and regulatory standards. It facilitates smooth coordination between production lines, packaging systems, and distribution channels. Technological advancements in robotics, AI, and IoT enhance the adaptability of integrated solutions. Companies adopt scalable platforms that support dynamic business requirements and supply chain agility. This increasing cross-industry reliance strengthens the overall market demand for advanced material handling integration systems.

Market Trends

Adoption of Robotics and AI-driven Systems

The Material Handling Integration market witnesses a strong shift toward robotics and AI-enabled solutions to improve automation levels and operational efficiency. Companies deploy robotic arms, automated guided vehicles, and machine learning algorithms to handle complex workflows. It enables faster processing, reduces human errors, and enhances accuracy in material movement. AI-powered analytics also support predictive maintenance and optimize equipment performance. Businesses invest in advanced robotics to meet increasing throughput requirements and maintain operational agility. This trend drives innovation and accelerates the integration of intelligent systems across industries.

- For instance, Starship Technologies, a delivery robot company, had completed over 5 million autonomous deliveries using 2,000 delivery robots by June 2023.

Growing Popularity of Smart Warehousing Solutions

The Material Handling Integration market benefits from the rising adoption of smart warehouse technologies designed to improve supply chain visibility and control. IoT-enabled devices, digital twins, and real-time tracking platforms enhance data-driven decision-making. It enables organizations to monitor inventory levels, track assets, and improve response times for order fulfillment. Integrated warehouse management systems reduce delays and enhance space utilization efficiency. Retailers, logistics providers, and manufacturers rely on smart solutions to manage dynamic customer demands. This advancement positions smart warehousing as a critical trend shaping material handling innovation.

- For instance, Toyota Motor Manufacturing (Burnaston plant, UK) introduced a MasterMover TOW300 AGV, which runs for 16 hours per day and covers around 5,000 miles per year delivering resin back doors throughout production—completing two years with no safety incidents reported.

Integration of Cloud-based Platforms and Analytics

The Material Handling Integration market experiences growth from increased demand for cloud-driven platforms and advanced analytics capabilities. Businesses adopt centralized solutions to streamline operations and synchronize workflows across facilities. It facilitates seamless data sharing, real-time monitoring, and better operational transparency. Cloud-based technologies allow scalable deployments and support remote management of material handling equipment. Predictive analytics tools empower companies to forecast demand and optimize resource utilization. This trend enhances business agility and strengthens digital transformation strategies.

Sustainability-driven Automation and Green Logistics

The Material Handling Integration market evolves with a growing focus on sustainability and energy-efficient solutions. Companies invest in eco-friendly automation systems designed to lower emissions and minimize resource consumption. It drives the development of energy-efficient conveyors, electric vehicles, and recyclable packaging systems. Businesses adopt integrated solutions that comply with environmental regulations and corporate sustainability goals. The push toward green logistics enhances long-term cost savings and strengthens brand reputation. This trend accelerates the adoption of sustainable material handling practices across global supply chains.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Material Handling Integration market faces challenges due to significant initial investments and system integration complexities. Businesses require substantial capital to deploy automated solutions, robotics, and IoT-enabled platforms. It becomes difficult for small and medium enterprises to justify these costs without immediate returns. Integrating advanced technologies with legacy infrastructure often leads to operational disruptions and higher implementation timelines. Companies need skilled professionals to manage system configurations and ensure seamless compatibility between equipment and software. These financial and technical barriers limit adoption among cost-sensitive industries.

Workforce Skill Gaps and Cybersecurity Concerns

The Material Handling Integration market encounters challenges linked to workforce readiness and growing cybersecurity risks. Automation and AI-powered systems require skilled operators, technicians, and data specialists to manage sophisticated equipment. It becomes challenging for organizations to upskill employees quickly to keep pace with technological advancements. Increased connectivity through IoT and cloud platforms also exposes material handling systems to potential cyber threats. Companies must invest in secure networks, real-time monitoring, and data protection frameworks to safeguard sensitive information. These challenges slow down adoption rates and create operational vulnerabilities in highly digitized environments.

Market Opportunities

Expansion of Automated and Intelligent Systems

The Material Handling Integration market creates significant opportunities through the rapid advancement of automation, robotics, and AI-powered solutions. Businesses across manufacturing, retail, logistics, and e-commerce increasingly adopt integrated systems to handle rising operational demands. It enables faster processing, improves efficiency, and enhances accuracy in material movement. The growing shift toward autonomous mobile robots, predictive analytics, and AI-driven warehouse management systems accelerates adoption. Companies investing in smart automation gain improved scalability and flexibility to meet evolving supply chain requirements. This transformation opens new revenue streams and drives competitive advantages for technology providers.

Rising Demand from E-commerce and Emerging Economies

The Material Handling Integration market benefits from increasing e-commerce expansion and industrial growth in emerging economies. Rapid online retail penetration creates higher demand for optimized warehousing and faster order fulfillment solutions. It drives investments in advanced conveyor systems, automated storage and retrieval technologies, and real-time tracking platforms. Emerging regions witness significant infrastructure development, boosting opportunities for large-scale system integration. Businesses in Asia-Pacific, Latin America, and the Middle East accelerate automation adoption to improve operational efficiency. These factors create long-term growth prospects and strengthen the global footprint of material handling integration solutions.

Market Segmentation Analysis:

By Integration Type:

The Material Handling Integration market demonstrates strong growth across integration types, with software integration holding a vital role in driving digital transformation. Businesses deploy advanced software solutions for warehouse management, predictive analytics, and automated control systems to streamline workflows. It enables seamless connectivity between various equipment and enhances real-time decision-making capabilities. Hardware integration also contributes significantly, focusing on sensors, robotics, and IoT-enabled devices to optimize handling processes. System integration combines hardware and software components into unified platforms, ensuring smooth operations and improved productivity.

- For instance, Manhattan’s cloud‑native Active WMS unifies distribution planning and execution; it updates every 90 days and serves around 1,200 customers globally as of early 2025.

By Application:

The Material Handling Integration market expands through diverse operational needs, including conveyance, assembly, transportation, and packaging. Conveyance solutions dominate due to increasing adoption of automated conveyor belts and robotic systems for efficient material movement. It plays a crucial role in enabling smooth production flows and minimizing operational downtime. Assembly and packaging segments benefit from high demand in manufacturing and e-commerce, where speed and precision are essential. Transportation solutions focus on integrating automated guided vehicles and intelligent routing systems to improve distribution efficiency. Other applications include custom automation systems designed for specialized industry requirements.

By Industry Vertical:

The market shows significant diversification across industry verticals, with retail and e-commerce driving substantial demand due to rising online orders and complex inventory needs. The automotive sector invests heavily in automation to enhance assembly line efficiency and reduce manual intervention. It also records strong adoption in healthcare for advanced inventory tracking and accurate supply management. Transportation and logistics benefit from improved route optimization, faster fulfillment, and enhanced real-time visibility. Manufacturing, food, and beverage industries adopt integration solutions to achieve better resource utilization and process optimization. This cross-industry penetration highlights the growing reliance on intelligent, automated handling systems to achieve operational excellence.

Segments:

Based on Integration Type:

- Software Integration

- Hardware Integration

- System Integration

Based on Application:

- Conveyance

- Assembly

- Transportation

- Packaging

- Others

Based on Industry Vertical:

- Retail & E-Commerce

- Automotive

- Healthcare

- Transportation & Logistics

- Manufacturing

- Food & Beverages

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Material Handling Integration market in North America accounts for a dominant 34% share, driven by rapid automation adoption, digital transformation, and the presence of leading technology providers. The region benefits from extensive investments in warehouse automation, advanced robotics, and AI-powered systems, particularly within the retail, e-commerce, and automotive sectors. It also witnesses strong growth due to the increasing demand for efficient material flow and real-time operational visibility. Companies prioritize integrated platforms that enhance workforce productivity, optimize supply chain operations, and reduce operational downtime. The expansion of smart warehouses and cloud-based solutions further strengthens the regional market, making North America a hub for innovation and large-scale implementation.

Europe

Europe holds a significant 27% share in the Material Handling Integration market, supported by rising demand for sustainable automation and regulatory compliance. The region invests heavily in energy-efficient technologies and IoT-enabled systems to achieve operational excellence. It benefits from the presence of established automotive, manufacturing, and logistics sectors that require high-performance integrated solutions. Companies focus on adopting smart warehouse management systems, automated guided vehicles, and predictive analytics to improve productivity. E-commerce growth and cross-border trade also accelerate the adoption of advanced material handling technologies. The region’s strong emphasis on digitalization and environmental sustainability enhances the integration of next-generation automation systems.

Asia-Pacific

The Material Handling Integration market in Asia-Pacific secures a growing 28% share, making it the fastest-expanding regional market. Increasing industrialization, booming e-commerce activity, and rising manufacturing capacities fuel strong demand for automated solutions. It benefits from government initiatives supporting smart factories and digital infrastructure development. Countries such as China, Japan, and India witness significant investments in robotics, AI-driven platforms, and automated storage systems to improve efficiency and reduce labor dependency. The region experiences rapid adoption of integrated technologies in sectors like automotive, retail, food and beverages, and logistics. Emerging economies drive high-volume deployments, positioning Asia-Pacific as a critical growth engine for the global market.

Latin America

Latin America captures 6% of the Material Handling Integration market, with growth supported by rising industrial expansion and increasing e-commerce penetration. The region sees growing adoption of automation in manufacturing, warehousing, and logistics to improve productivity and cost efficiency. It benefits from infrastructure development projects and rising foreign investments in digital transformation. Companies adopt integrated solutions to streamline supply chain operations, manage inventory effectively, and enhance service delivery. Brazil and Mexico lead regional growth due to their expanding retail and manufacturing industries. Rising awareness of operational efficiency creates opportunities for advanced automation deployment.

Middle East & Africa

The Material Handling Integration market in the Middle East & Africa holds 5% of the global share, driven by infrastructure modernization and technological advancement. The region invests in digital logistics solutions, automated warehouses, and smart transportation networks to support its growing retail and logistics sectors. It benefits from economic diversification initiatives that promote industrial automation and integration technologies. Countries like the UAE and Saudi Arabia witness increasing adoption of AI-powered platforms, robotic handling systems, and connected warehouse management solutions. Rising demand for real-time visibility and optimized material flow strengthens the adoption of advanced integration systems. Growing regional investments position the Middle East & Africa as an emerging opportunity for global players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KNAPP AG

- FORTNA Inc.

- SSI SCHAEFER

- Jungheinrich AG

- Swisslog Holding AG

- TGW Logistics Group

- Cargotec

- Daifuku Co., Ltd.

- Honeywell International Inc

- KION GROUP AG

- Murata Machinery Ltd.

- Fives

Competitive Analysis

The Material Handling Integration market is highly competitive, with leading players including Daifuku Co., Ltd., Jungheinrich AG, Cargotec, KION GROUP AG, Honeywell International Inc, SSI SCHAEFER, KNAPP AG, TGW Logistics Group, Fives, FORTNA Inc., Murata Machinery Ltd., and Swisslog Holding AG driving innovation and technological advancements. These companies focus on developing advanced automation systems, AI-powered solutions, and IoT-enabled platforms to enhance operational efficiency and streamline material flow. The competitive landscape is shaped by continuous investments in robotics, predictive analytics, and integrated warehouse management systems to meet rising customer demands. Companies adopt strategies like mergers, acquisitions, and strategic collaborations to expand global footprints and strengthen market positioning. Rising demand from e-commerce, logistics, and manufacturing sectors accelerates the development of customized solutions tailored to specific operational needs. The competition further intensifies as players enhance product portfolios, introduce energy-efficient technologies, and invest in research to improve scalability and flexibility. With increasing emphasis on digital transformation and end-to-end automation, leading manufacturers aim to deliver faster, cost-effective, and sustainable integration solutions while addressing diverse industry requirements worldwide.

Recent Developments

- In 2025, Daifuku announced plans to showcase its latest automated systems—such as the Sorting Transfer Robot L (SOTR‑L), SOTR‑S, robotic depalletization, and advanced sortation systems—at ProMat 2025

- In May 2025, Jungheinrich and EP Equipment entered a strategic partnership under the theme “Shaping the future of material handling together”

- In February 2024, Cargotec published its Annual Report for 2023, detailing strategy, operations, and performance

Report Coverage

The research report offers an in-depth analysis based on Integration Type, Application, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will accelerate through continued adoption of integrated automation in response to rising e‑commerce and logistics demands.

- Industry players will expand offerings of AI‑driven analytics to support predictive maintenance and real‑time optimization.

- Companies will increasingly deploy autonomous mobile robots and robotic arms to achieve greater throughput and flexibility.

- Cloud‑based platforms will gain prominence, enabling scalable control and seamless integration across distributed facilities.

- Sustainability will influence solution design, driving adoption of energy‑efficient conveyors, electric vehicles, and green logistics practices.

- Vendors will offer modular systems that integrate with legacy infrastructure and support phased digital transformation.

- Demand from emerging markets will rise significantly as industrialization and digital investments grow in Asia, Latin America, and the Middle East.

- Cybersecurity will become a central concern, prompting providers to embed robust protections into connected material handling platforms.

- Collaboration among technology, robotics, and software firms will intensify to develop comprehensive, end‑to‑end integrated solutions.

- The push toward universal standards and interoperability will facilitate smoother integration of diverse systems and equipment.