Market Overview

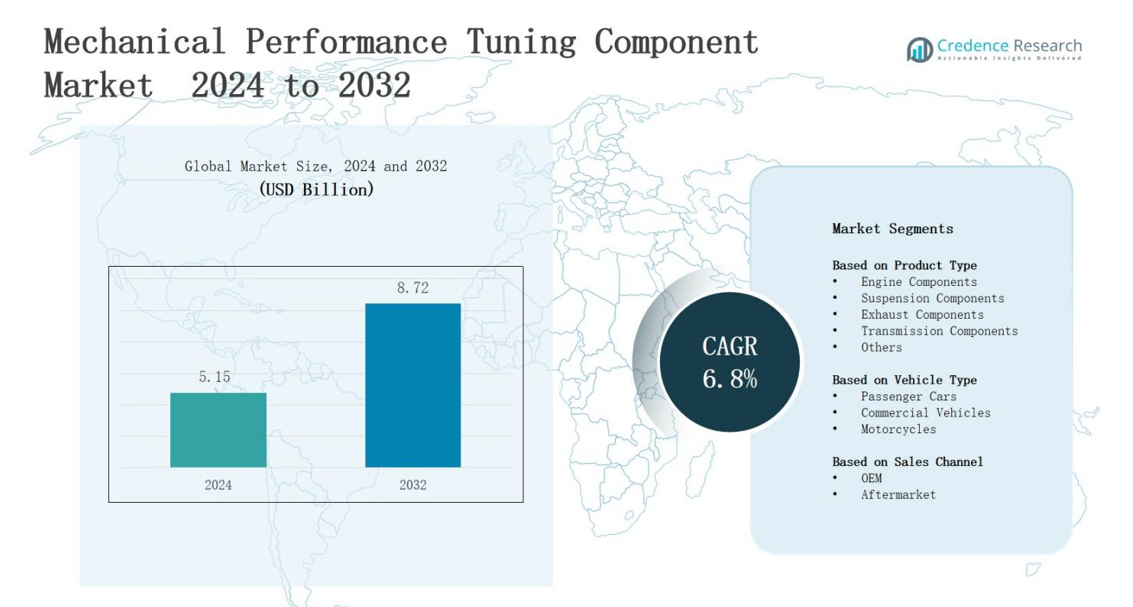

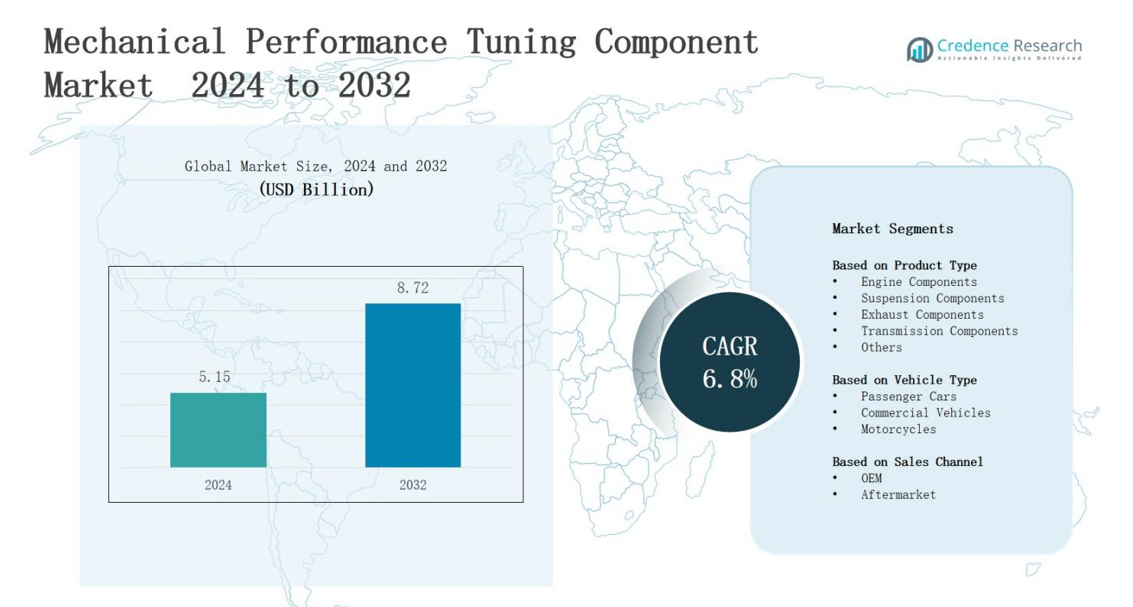

In the mechanical performance tuning component market, revenue is projected to grow from USD 5.15 billion in 2024 to USD 8.72 billion by 2032, registering a CAGR of 6.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mechanical Performance Tuning Component Market Size 2024 |

USD 5.15 billion |

| Mechanical Performance Tuning Component Market, CAGR |

6.8% |

| Mechanical Performance Tuning Component Market Size 2032 |

USD 8.71 billion |

The mechanical performance tuning component market is driven by the rising demand for enhanced vehicle efficiency, power, and customization among automotive enthusiasts and professional racers. Growing adoption of high-performance engines, turbochargers, and advanced drivetrain systems fuels market expansion, while stringent regulations on emissions and fuel efficiency encourage innovative tuning solutions. Technological advancements in lightweight materials, precision engineering, and digital diagnostic tools further propel market growth. Additionally, increasing consumer preference for personalized automotive performance and motorsport participation trends support steady demand. The market also benefits from the expansion of aftermarket services and global automotive production, reinforcing long-term growth prospects.

The mechanical performance tuning component market demonstrates strong regional diversity, with North America and Asia Pacific each holding 30% market share, Europe at 25%, and the Middle East & Africa at 10%. It benefits from high demand for passenger cars, motorcycles, and commercial vehicles across these regions. Key players such as HKS Co., Ltd., AEM Performance Electronics, MagnaFlow, Borla Performance Industries, K&N Engineering, Edelbrock, Holley Performance Products, Flowmaster, Injen Technology, Mishimoto Automotive, GReddy, and COBB Tuning Products actively expand their presence through regional distribution networks, aftermarket services, and technology-driven product offerings to capitalize on global growth opportunities.

Market Insights

- The mechanical performance tuning component market is projected to grow from USD 5.15 billion in 2024 to USD 8.72 billion by 2032, registering a CAGR of 6.8% due to rising demand for performance upgrades.

- Engine components dominate with a 35% share, driven by the need for increased power, torque, and fuel efficiency, while suspension, exhaust, and transmission components collectively hold significant market presence.

- Passenger cars lead vehicle types with a 50% share, supported by aftermarket customization and motorsport trends, followed by motorcycles at 30% and commercial vehicles at 20% for efficiency and durability improvements.

- Aftermarket sales channels account for 60% of the market, driven by consumer demand for personalized upgrades and installation services, while OEM channels represent 40% supported by integrated high-performance components.

- North America and Asia Pacific each hold 30% market share, Europe 25%, and Middle East & Africa 10%, with key players like HKS, AEM, MagnaFlow, Borla, K&N, Edelbrock, Holley, Flowmaster, Injen, Mishimoto, GReddy, and COBB expanding globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Vehicle Performance Enhancement

The mechanical performance tuning component market experiences strong growth due to increasing consumer interest in high-performance vehicles. Car enthusiasts and professional racers seek solutions that enhance engine power, torque, and overall drivability. It drives demand for components such as turbochargers, exhaust systems, and suspension upgrades. Manufacturers respond with innovative products that improve acceleration, handling, and fuel efficiency. Growing motorsport participation further strengthens this trend. The market also benefits from increased awareness of performance optimization techniques.

- For instance, Akrapovič introduced a new exhaust system that reduces weight by up to 50% while improving sound and performance, widely adopted by professional racers.

Advancements in Automotive Technology

Technological innovation fuels the market by offering precision-engineered components that improve efficiency and durability. It includes the integration of lightweight materials, advanced alloys, and digital diagnostic tools. These innovations allow tuners to achieve optimal performance while maintaining compliance with regulatory standards. The market expands as manufacturers focus on research and development to introduce high-quality components. It enables vehicles to deliver superior power output, handling, and reliability, attracting both hobbyists and professional users.

- For instance, Ford’s use of aluminum alloys in the F-150 reduces vehicle weight, improving fuel efficiency without compromising strength.

Regulatory Compliance and Environmental Considerations

Stricter emission standards and fuel efficiency regulations influence the mechanical performance tuning component market. It encourages the development of components that optimize engine performance without compromising environmental compliance. Manufacturers design solutions that reduce fuel consumption and emissions while enhancing power delivery. Regulatory pressure drives continuous innovation in aftermarket parts and tuning strategies. Consumers increasingly prioritize components that balance performance improvement with sustainability. This trend promotes long-term adoption of performance-oriented solutions across regions.

Expansion of Aftermarket Services and Global Reach

The market benefits from a growing network of aftermarket service providers offering tuning, installation, and maintenance support. It allows vehicle owners to access high-quality components and expert services easily. Expanding automotive production in emerging economies increases the potential customer base for performance upgrades. Rising disposable incomes and lifestyle trends encourage customization and personalization of vehicles. Manufacturers strengthen distribution channels and partnerships to capitalize on this growth. The trend supports consistent demand and global market expansion for performance components.

Market Trends

Growth of Aftermarket Customization Services

The mechanical performance tuning component market witnesses rapid expansion in aftermarket customization services. Consumers increasingly seek personalized solutions for engine upgrades, suspension tuning, and exhaust modifications. It enables automotive enthusiasts to enhance performance while reflecting individual preferences. Service providers offer tailored packages that combine technical expertise with high-quality components. Rising awareness of vehicle personalization and lifestyle-driven trends drives demand. Manufacturers support these services by supplying advanced tuning parts and installation guidance. The trend strengthens market adoption and brand loyalty.

- For instance, BMW’s M Performance Parts division provides factory-backed aftermarket upgrades such as sport exhaust systems, carbon fiber aerodynamics, and lightweight alloy wheels, designed to enhance engine response and handling.

Integration of Advanced Materials and Technologies

Technological innovation shapes market trends by introducing lightweight materials, high-strength alloys, and precision-engineered components. It enhances vehicle performance, efficiency, and durability while maintaining compliance with emission standards. Digital diagnostic systems and electronic control modules allow precise tuning of engine and drivetrain components. These technologies increase consumer confidence in performance modifications. Automotive manufacturers invest in research and development to integrate innovative solutions. The trend accelerates adoption of high-performance components and advanced tuning practices.

- For instance, Ford’s EcoBoost engines employ advanced turbocharging and direct fuel injection technologies managed by electronic control modules, delivering both higher output and lower emissions.

Focus on Eco-Friendly Performance Solutions

Environmental considerations influence trends within the mechanical performance tuning component market. It encourages the design of components that optimize engine output while minimizing fuel consumption and emissions. Manufacturers develop high-efficiency turbochargers, low-resistance exhaust systems, and hybrid-compatible tuning solutions. Consumers prioritize sustainable performance improvements without compromising power and reliability. Regulatory frameworks reinforce this trend, ensuring market players provide eco-conscious options. The market responds with innovative solutions that combine performance enhancement with environmental responsibility.

Expansion of Global Automotive Enthusiast Communities

Rising global interest in motorsports and automotive hobbies drives market trends. It strengthens the demand for performance components and tuning solutions across regions. Enthusiast communities share knowledge, recommend products, and influence purchasing decisions. Social media and online platforms facilitate the exchange of tuning strategies and showcase performance upgrades. Manufacturers leverage these networks to promote new components and gain market insights. Growing participation in racing events and automotive clubs supports consistent market growth and innovation.

Market Challenges Analysis

High Cost of Performance Components

The mechanical performance tuning component market faces challenges due to the high cost of advanced components. It limits adoption among price-sensitive consumers and hobbyists. Premium materials, precision engineering, and advanced technologies drive production expenses. Manufacturers must balance quality with affordability to maintain competitiveness. Limited availability of cost-effective solutions reduces market penetration in emerging regions. Consumers often prioritize basic maintenance over performance upgrades. The cost factor restrains widespread acceptance and slows overall market growth.

Stringent Regulatory and Safety Compliance

Regulatory and safety requirements create obstacles for the mechanical performance tuning component market. It must comply with emission standards, safety regulations, and warranty considerations. Non-compliant components face legal restrictions, recalls, or limited distribution. Manufacturers invest heavily in testing, certification, and quality assurance to meet global standards. Variations in regional regulations complicate product development and distribution. Consumers also demand reliable, safe performance solutions. Regulatory challenges impact innovation speed and increase operational costs across the market.

Market Opportunities

Expansion of Emerging Automotive Markets

The mechanical performance tuning component market benefits from growth in emerging automotive markets. It presents opportunities to reach new consumer segments in regions with rising vehicle ownership and disposable income. Manufacturers can introduce performance upgrades tailored to local preferences and road conditions. Increasing interest in motorsports and automotive hobbies stimulates demand for aftermarket components. Collaborations with regional distributors and service providers strengthen market presence. Targeted marketing campaigns and localized solutions enhance adoption rates. Emerging markets offer long-term potential for revenue growth and brand recognition.

Integration of Smart and Eco-Friendly Technologies

Opportunities arise from integrating smart and eco-friendly technologies into performance components. It allows manufacturers to develop solutions that optimize engine output while reducing emissions and fuel consumption. Advanced electronic control systems, lightweight materials, and hybrid-compatible parts attract environmentally conscious consumers. The market can capitalize on regulatory support for sustainable automotive solutions. Partnerships with tech companies enable innovation in digital diagnostics and performance monitoring. Demand for high-efficiency, eco-conscious components supports market expansion. These technological advancements create competitive differentiation and open new revenue streams.

Market Segmentation Analysis:

By Product Type

In the mechanical performance tuning component market, engine components dominate with a 35% share, driven by rising demand for enhanced power, torque, and fuel efficiency. Suspension components follow with 25%, supported by consumer focus on improved handling and ride comfort. Exhaust components hold 20%, fueled by emission compliance and performance optimization needs. Transmission components account for 15%, while other components represent 5%. Engine upgrades remain the primary growth driver, with turbochargers, high-performance pistons, and camshafts leading adoption.

- For instance, Garrett Motion launched its G-Series turbochargers in 2020, offering up to 1000 horsepower capability for performance vehicles, highlighting the growing adoption of advanced turbo systems.

By Vehicle Type

Passenger cars lead the mechanical performance tuning component market with a 50% share, reflecting high aftermarket customization and motorsport participation. Motorcycles hold 30%, supported by performance-oriented enthusiasts and racing applications. Commercial vehicles represent 20%, driven by fleet operators seeking efficiency and durability improvements. Passenger car growth is driven by rising disposable incomes and lifestyle trends favoring vehicle personalization. Motorcycle and commercial vehicle segments benefit from targeted performance upgrades that enhance safety, efficiency, and reliability.

By Sales Channel

Aftermarket sales channels dominate the mechanical performance tuning component market with a 60% share, fueled by demand for customized performance upgrades and installation services. OEM channels account for 40%, supported by vehicle manufacturers integrating high-performance components during production. Aftermarket growth is driven by accessibility of performance parts, expert installation services, and growing consumer interest in personalization. OEM adoption increases due to regulatory compliance, warranty assurance, and integration of advanced technologies. Both channels support overall market expansion through innovation and targeted solutions.

- For instance, BMW’s M Division equips models like the M3 and M4 with factory-installed performance exhaust systems and adaptive suspensions, delivering OEM-certified tuning solutions that align with warranty and emissions standards.

Segments:

Based on Product Type

- Engine Components

- Suspension Components

- Exhaust Components

- Transmission Components

- Others

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Motorcycles

Based on Sales Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 30% share of the mechanical performance tuning component market, driven by strong demand for performance vehicles and high aftermarket adoption. It benefits from a well-established automotive industry, advanced motorsport infrastructure, and high disposable incomes. Consumers prioritize vehicle personalization, including engine, suspension, and exhaust upgrades. Manufacturers introduce innovative, high-quality components to meet performance and regulatory standards. The presence of leading OEMs and aftermarket service providers strengthens distribution networks. Growth is further supported by racing events and automotive enthusiast communities. North America remains a key hub for technology adoption and premium component demand.

Europe

Europe accounts for 25% of the market, supported by strict emission regulations and growing demand for performance optimization. It emphasizes eco-friendly yet high-performance solutions, including lightweight materials and efficient exhaust systems. Consumers seek both passenger car and motorcycle tuning options. It benefits from strong aftermarket networks, motorsport participation, and advanced automotive technology adoption. Manufacturers focus on R&D to meet regulatory standards while enhancing power, handling, and fuel efficiency. European markets leverage collaborations between OEMs and aftermarket players. The region maintains steady growth due to innovation and consumer willingness to invest in performance upgrades.

Asia Pacific

Asia Pacific holds a 30% market share, reflecting increasing vehicle ownership and rising disposable income. It includes key automotive markets such as China, India, and Japan, with growing interest in aftermarket performance enhancements. Consumers seek engine, suspension, and transmission upgrades for both passenger cars and motorcycles. It benefits from expanding automotive production, motorsport participation, and urbanization trends. Manufacturers invest in localized solutions and distribution networks to capture regional demand. Market growth is fueled by lifestyle trends favoring vehicle personalization. Asia Pacific emerges as a high-potential region for long-term expansion in performance components.

Middle East & Africa

Middle East & Africa represents 10% of the market, driven by luxury vehicle ownership and motorsport interest. It targets high-performance upgrades for passenger cars and motorcycles, supported by affluent consumers. It benefits from emerging aftermarket networks and regional distribution partnerships. Manufacturers focus on performance solutions that enhance power, handling, and durability under extreme climatic conditions. The market also experiences growth from motorsport events and lifestyle-driven vehicle customization. It offers opportunities for premium component adoption and aftermarket services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mishimoto Automotive

- COBB Tuning Products, LLC

- Flowmaster, Inc.

- HKS Co., Ltd.

- Borla Performance Industries

- AEM Performance Electronics

- GReddy Performance Products, Inc.

- Injen Technology Co., Ltd.

- MagnaFlow Exhaust Products

- Holley Performance Products

- Edelbrock, LLC

- K&N Engineering, Inc.

Competitive Analysis

The mechanical performance tuning component market features a highly competitive landscape with both global and regional players striving for technological innovation and market share. It includes leading companies such as HKS Co., Ltd., AEM Performance Electronics, MagnaFlow Exhaust Products, Borla Performance Industries, K&N Engineering, Edelbrock, Holley Performance Products, Flowmaster, Injen Technology Co., Mishimoto Automotive, GReddy Performance Products, and COBB Tuning Products. These players focus on product differentiation through high-performance engine components, exhaust systems, suspension upgrades, and transmission solutions. It drives continuous investment in research and development to enhance efficiency, durability, and compliance with regulatory standards. Strategic collaborations, partnerships, and expansion of aftermarket service networks strengthen their market presence. Companies also leverage digital platforms and motorsport sponsorships to increase brand visibility and consumer engagement. The competitive intensity encourages the introduction of advanced materials, precision-engineered components, and smart technologies. It maintains steady growth while fostering innovation, ensuring performance enthusiasts have access to reliable, high-quality tuning solutions globally.

Recent Developments

- In February 2023, Martinrea International Inc. acquired Effenco Development Inc., strengthening its portfolio with ultracapacitor-based hybrid electric solutions aimed at improving vehicle efficiency and reducing emissions in heavy-duty trucks.

- In 2024, Spark Minda formed strategic partnerships, including a joint venture with Taiwan’s HSIN Chong Machinery Works Co. Ltd. for automotive sunroof and closure manufacturing, and an alliance with a global Japanese player to produce smart vehicle access systems, enhancing technological capabilities.

- In 2025, Siemens completed the acquisition of Altair Engineering on March 25. This move significantly enhanced Siemens’ AI-powered industrial software portfolio and is expected to influence mechanical performance tuning applications in both industrial and automotive sectors.

Market Concentration & Characteristics

The mechanical performance tuning component market exhibits a moderately concentrated structure with a mix of global leaders and regional specialists competing for market share. It is characterized by high innovation intensity, driven by consumer demand for engine, suspension, exhaust, and transmission upgrades that enhance power, efficiency, and vehicle customization. Key players such as HKS Co., Ltd., AEM Performance Electronics, MagnaFlow, Borla Performance Industries, K&N Engineering, Edelbrock, Holley Performance Products, Flowmaster, Injen Technology, Mishimoto Automotive, GReddy, and COBB Tuning Products focus on product differentiation through advanced materials, precision engineering, and smart diagnostic technologies. It relies heavily on aftermarket channels, which account for a majority of sales, while OEM integration supports growth in compliance-driven segments. Competitive dynamics emphasize R&D investment, strategic partnerships, and regional distribution expansion. It demonstrates steady growth potential fueled by lifestyle-driven vehicle personalization and rising global automotive production.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The mechanical performance tuning component market will experience steady growth driven by rising consumer demand for vehicle customization and high-performance upgrades.

- Engine components will continue to dominate due to their critical role in enhancing power and efficiency.

- Suspension and exhaust systems will see increased adoption for improved handling, ride comfort, and emission compliance.

- Passenger cars will remain the largest segment, supported by aftermarket personalization and motorsport trends.

- Motorcycles and commercial vehicles will grow steadily with targeted performance enhancements for efficiency and reliability.

- Aftermarket channels will maintain a leading role in sales due to accessibility and installation services.

- OEMs will expand their high-performance component integration to meet regulatory and consumer requirements.

- Technological advancements in lightweight materials and smart diagnostics will drive product innovation.

- Regional markets in North America, Europe, and Asia Pacific will offer significant growth opportunities.

- Strategic partnerships and collaborations among key players will strengthen market presence and distribution globally.