Market Overview

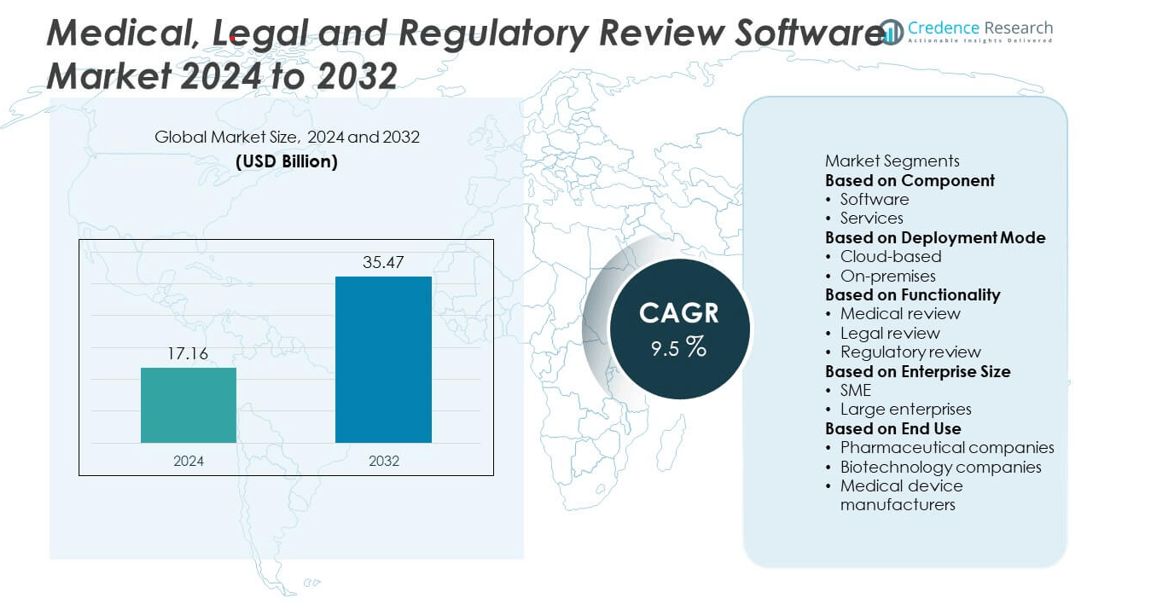

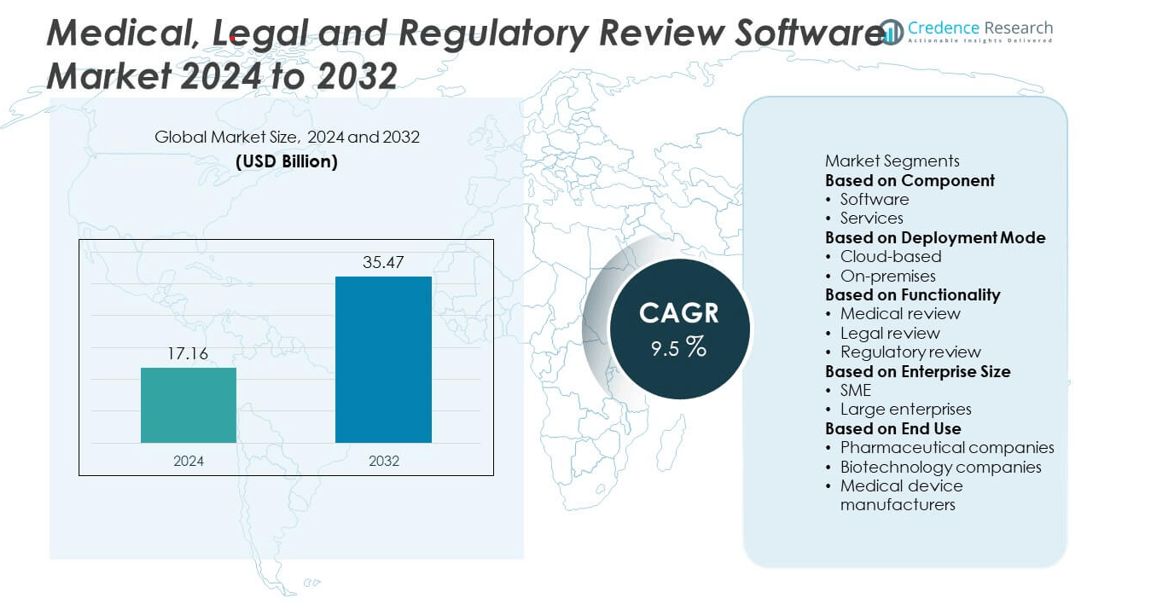

Medical, Legal and Regulatory Review Software Market was valued at USD 17.16 billion in 2024 and is expected to reach USD 35.47 billion by 2032, growing at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical, Legal and Regulatory Review Software Market Size 2024 |

USD 17.16 billion |

| Medical, Legal and Regulatory Review Software Market, CAGR |

9.5% |

| Medical, Legal and Regulatory Review Software Market Size 2032 |

USD 35.47 billion |

The Medical, Legal and Regulatory Review Software Market grows through rising regulatory complexity, demand for accurate content validation, and the need for faster product approvals. Organizations adopt these platforms to streamline compliance workflows, reduce manual errors, and enhance transparency across departments.

The Medical, Legal and Regulatory Review Software Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads adoption due to strict compliance frameworks and advanced healthcare IT infrastructure, while Europe emphasizes transparency and data protection under evolving regulations. Asia-Pacific records the fastest growth, driven by expanding healthcare systems and increasing regulatory oversight in emerging economies. Latin America and the Middle East & Africa show gradual adoption supported by digital health initiatives and growing pharmaceutical activity. Key players driving this market include Philips Healthcare, known for its integrated healthcare IT solutions, LexisNexis Risk Solutions, which focuses on legal and regulatory intelligence, Siemens Healthineers, offering advanced compliance and diagnostic platforms, and Wolters Kluwer, recognized for its regulatory content management and audit-ready tools. These companies expand global presence through AI integration, cloud-based platforms, and partnerships across healthcare and life sciences.

Market Insights

- The Medical, Legal and Regulatory Review Software Market was valued at USD 17.16 billion in 2024 and is expected to reach USD 35.47 billion by 2032, growing at a CAGR of 9.5%.

- Rising regulatory complexity in healthcare, pharmaceuticals, and legal services drives adoption of digital review platforms that reduce errors and ensure compliance accuracy.

- AI, automation, and natural language processing enhance efficiency, enabling faster content validation, risk detection, and streamlined approval cycles across global organizations.

- The market features strong competition among leading players such as Philips Healthcare, Siemens Healthineers, LexisNexis Risk Solutions, Oracle Health, and Wolters Kluwer, with firms focusing on cloud-based offerings and advanced analytics.

- High implementation costs, integration challenges with legacy infrastructure, and data security concerns act as restraints, particularly for small and mid-sized enterprises.

- North America leads adoption supported by advanced IT infrastructure and strict compliance frameworks, while Europe emphasizes regulatory transparency and Asia-Pacific grows rapidly with expanding healthcare systems.

- The market outlook remains positive as enterprises worldwide seek scalable, cloud-based compliance platforms that ensure audit readiness, improve transparency, and support multinational product launches.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Regulatory Complexity Across Healthcare and Life Sciences

The Medical, Legal and Regulatory Review Software Market expands with rising compliance needs in healthcare and life sciences. Companies face stringent rules from the FDA, EMA, and regional authorities. The software ensures adherence to documentation standards, labeling requirements, and approval timelines. It reduces manual errors and accelerates compliance workflows. Organizations adopt these platforms to manage dynamic policies across global markets. Rising regulatory complexity drives consistent demand for structured and automated review systems.

Increasing Demand for Speed and Accuracy in Content Review

Faster product approvals and accurate legal reviews remain critical for pharmaceutical and medical device companies. The Medical, Legal and Regulatory Review Software Market enables real-time collaboration across regulatory, legal, and marketing teams. It ensures accuracy in claims, patient information, and promotional content. By automating approvals, it lowers review cycle times and reduces risks of delayed launches. Companies prioritize speed while maintaining strict compliance. This need for precision and efficiency strengthens adoption across industries.

- For instance, Oracle Health’s Clinical AI Agent is now active across more than 40 medical specialties, and has generated nearly one million clinical notes to date. That adoption reflects wide use in specialties like cardiology, gastroenterology, nephrology, and urgent care. Physicians using the agent see around 30% reduction in daily documentation time.

Rising Adoption of Digital Platforms for Compliance Automation

Enterprises shift from manual processes toward AI-enabled platforms that automate repetitive compliance tasks. The Medical, Legal and Regulatory Review Software Market benefits from the integration of natural language processing and machine learning. These tools flag inconsistencies, highlight risks, and track document versions. It supports audit readiness by offering transparent records and traceability. Organizations reduce regulatory fines by ensuring accurate, timely submissions. This shift toward digital compliance solutions drives market growth at a steady pace.

- For instance, LexisNexis Legal & Professional launched its CaseMap+ AI platform in March 2025, with AI-driven document and transcript summarization, automated timeline creation, and automated issue tracking for litigation and regulatory review teams.

Globalization of Product Launches and Market Expansion

Expanding pharmaceutical and medical device launches across multiple geographies intensify compliance requirements. The Medical, Legal and Regulatory Review Software Market helps firms align with varied local regulations. It simplifies multi-country submissions and reduces bottlenecks in cross-border product rollouts. Global players use centralized review systems to standardize processes. It enhances operational efficiency by unifying compliance functions across business units. Growing international competition makes these software platforms a vital part of corporate strategies.

Market Trends

Integration of Artificial Intelligence and Automation in Compliance

The Medical, Legal and Regulatory Review Software Market is witnessing a steady move toward AI-powered solutions. Automated tools streamline content validation, detect inconsistencies, and ensure compliance accuracy. It reduces manual workload and accelerates review cycles across regulatory and legal teams. Machine learning algorithms enhance predictive capabilities for potential risks. Natural language processing supports better analysis of regulatory documents and submissions. This trend reflects a growing reliance on digital intelligence for complex compliance functions.

- For instance, Thomson Reuters’ CoCounsel Legal platform features Deep Research, capable of generating multi‑step research plans, tracing its logic, and delivering structured reports using Westlaw and Practical Law content.

Growing Use of Cloud-Based Platforms for Collaboration

Cloud deployment emerges as a key trend due to demand for seamless collaboration across global teams. The Medical, Legal and Regulatory Review Software Market benefits from secure and scalable cloud environments. It allows multiple stakeholders to access, edit, and approve documents in real time. Remote access supports decentralized regulatory and legal departments. Companies prefer cloud systems for faster updates and integration with existing enterprise tools. Growing preference for SaaS models ensures cost efficiency and operational flexibility.

- For instance, Wolters Kluwer’s cloud-based Sentri7 platform enables real-time compliance tracking, document version control, and multi-user approval workflows in pharmacy and regulatory settings. In 2025, Wolters Kluwer announced updates to the Sentri7 platform to enhance pharmacy and nursing workflows, as well as being recognized by KLAS Research for its infection control and monitoring capabilities.

Focus on End-to-End Transparency and Audit Readiness

Regulators demand transparency in compliance processes and documentation audits. The Medical, Legal and Regulatory Review Software Market is moving toward solutions with complete traceability and version control. It creates structured audit trails to meet strict oversight requirements. Automated tracking features enhance accountability within approval workflows. Organizations reduce risks of non-compliance penalties by adopting systems with built-in monitoring tools. This trend strengthens confidence in regulatory approvals and market readiness.

Adoption of Advanced Analytics for Strategic Decision-Making

Analytics-driven compliance platforms gain traction across large enterprises and mid-sized firms. The Medical, Legal and Regulatory Review Software Market leverages data insights to optimize approval timelines. It provides dashboards that highlight review delays, error rates, and compliance gaps. Predictive analytics help organizations anticipate risks before submissions. Companies use real-time reporting to streamline decision-making across regulatory and legal units. Growing reliance on analytics ensures smarter compliance management and faster product launches.

Market Challenges Analysis

High Implementation Costs and Complex Integration Requirements

The Medical, Legal and Regulatory Review Software Market faces challenges linked to high deployment costs and integration complexities. Organizations often struggle to align new systems with legacy infrastructure. It requires significant investments in customization, training, and maintenance. Smaller firms face barriers in adopting advanced compliance platforms due to limited budgets. Complex integration with enterprise resource planning and document management tools increases implementation timelines. These factors slow adoption across cost-sensitive businesses and regulated industries.

Evolving Regulatory Landscape and Data Security Concerns

Constantly changing global regulations create uncertainty for software vendors and users. The Medical, Legal and Regulatory Review Software Market must adapt quickly to updated standards across regions. It increases the burden on developers to provide continuous updates and compliance support. Data security concerns further complicate adoption, as companies manage sensitive legal and medical records. Risks of breaches or unauthorized access raise compliance liabilities. Ensuring robust security frameworks while maintaining system performance remains a persistent challenge.

Market Opportunities

Rising Demand for Digital Transformation in Regulatory Workflows

The Medical, Legal and Regulatory Review Software Market holds strong opportunities through the rising demand for digital compliance systems. Companies in pharmaceuticals, biotechnology, and medical devices seek platforms that replace manual documentation and accelerate approvals. It enables organizations to shorten review timelines, reduce compliance risks, and improve accuracy. Growing investment in cloud adoption creates scope for scalable, subscription-based models. Demand from mid-sized firms expands as affordable solutions become available. This digital shift creates a broad opportunity for vendors to capture emerging markets.

Expansion Potential in Emerging Economies and Cross-Industry Adoption

Rapid growth in healthcare infrastructure across Asia-Pacific, Latin America, and the Middle East generates new adoption potential. The Medical, Legal and Regulatory Review Software Market benefits from rising government initiatives that promote compliance and patient safety. It provides companies with tools to manage diverse regulations across multiple jurisdictions. Non-healthcare industries, including food, chemicals, and consumer goods, present growing opportunities for compliance automation. Vendors offering customizable, multilingual platforms can strengthen their global footprint. Expanding into these high-growth regions opens new revenue streams for technology providers.

Market Segmentation Analysis:

By Component

The Medical, Legal and Regulatory Review Software Market is segmented into software and services. Software solutions dominate due to rising adoption of AI-enabled platforms for content validation, audit trails, and compliance automation. It helps enterprises streamline multi-department collaboration and ensure transparency in approvals. Services, including consulting, training, and support, gain momentum as companies seek guidance for implementation and integration. Outsourced support assists organizations in adapting to complex regulations across multiple geographies. Both segments play a key role in strengthening compliance management across regulated industries.

- For instance, Allscripts (now Veradigm) serves over 180,000 physician users, and its platforms are active in more than 2,700 hospitals and 13,000 extended care organizations, illustrating broad deployment of both software tools and support services in compliance‑critical clinical settings.

By Deployment Mode

Deployment is categorized into cloud-based and on-premise models. Cloud-based platforms record strong growth as enterprises prioritize scalability, remote accessibility, and real-time collaboration. The Medical, Legal and Regulatory Review Software Market benefits from SaaS-based adoption among large and mid-sized firms. It supports faster upgrades, lower upfront costs, and integration with enterprise tools. On-premise deployment retains relevance in highly regulated industries with strict data security requirements. Organizations handling highly confidential data prefer in-house infrastructure to maintain control and security. Both deployment modes reflect varying enterprise priorities in managing compliance.

- For instance, Epic Systems’ EHR is deployed in over 3,600 hospitals across the U.S.—a mix of cloud‑connected and on‑premise installations—highlighting how enterprises balance control and connectivity based on their compliance and security needs.

By Functionality

Functionality segmentation covers document management, compliance monitoring, audit trails, workflow automation, and analytics. Document management leads with rising need for centralized storage, version control, and structured review processes. The Medical, Legal and Regulatory Review Software Market grows with increasing demand for audit-ready systems. It enables companies to monitor compliance in real time and reduce regulatory risks. Workflow automation improves approval timelines, while analytics provides insights into review performance and risk assessment. Organizations deploy multi-functional platforms to address the rising complexity of regulatory, legal, and medical review needs.

Segments:

Based on Component

Based on Deployment Mode

Based on Functionality

- Medical review

- Legal review

- Regulatory review

Based on Enterprise Size

Based on End Use

- Pharmaceutical companies

- Biotechnology companies

- Medical device manufacturers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Medical, Legal and Regulatory Review Software Market with 38% in 2024. The region benefits from a highly regulated healthcare and pharmaceutical sector led by the U.S. Food and Drug Administration (FDA) and Health Canada. Strict compliance requirements for clinical trials, drug approvals, and promotional content drive strong adoption of advanced review platforms. It enables companies to automate regulatory submissions and reduce risks of legal non-compliance. Cloud-based deployments are widely preferred, supported by strong IT infrastructure and integration with enterprise systems. Presence of major technology providers and high investment in digital compliance solutions further strengthen North America’s leadership in the global market.

Europe

Europe accounts for 27% of the Medical, Legal and Regulatory Review Software Market in 2024, driven by stringent compliance regulations such as the EU Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR). The regional market emphasizes transparency and data protection, which makes advanced compliance platforms essential for healthcare, life sciences, and legal sectors. It supports multi-country product submissions, ensuring faster alignment with European Medicines Agency (EMA) standards. Organizations across Germany, the UK, and France invest in platforms that offer multilingual support and traceability features. Vendors focus on delivering customizable solutions to meet regional variations in compliance requirements. This growing regulatory intensity consolidates Europe’s position as the second-largest market globally.

Asia-Pacific

Asia-Pacific represents 22% of the Medical, Legal and Regulatory Review Software Market in 2024 and records the fastest growth. Rising healthcare infrastructure investments and regulatory reforms in China, India, and Japan drive demand for advanced compliance solutions. It enables multinational pharmaceutical and medical device companies to meet diverse local regulations while expanding into emerging markets. Governments in the region strengthen oversight to ensure patient safety and product transparency, which fuels higher adoption of digital review systems. Cloud-based platforms see significant demand as organizations seek cost-effective, scalable solutions. Growing awareness of compliance automation among regional enterprises supports Asia-Pacific’s strong expansion trajectory.

Latin America

Latin America holds 7% of the Medical, Legal and Regulatory Review Software Market in 2024, with Brazil and Mexico leading adoption. The region faces challenges from fragmented regulations and limited IT infrastructure, but rising focus on pharmaceutical compliance and patient safety drives gradual adoption. It supports growing needs in healthcare and life sciences industries, particularly for documentation and audit-ready systems. International vendors collaborate with local players to deliver affordable, scalable platforms. Expansion of clinical trials in Latin America further increases demand for efficient compliance tools. Market opportunities strengthen as digital transformation initiatives gain momentum across the region.

Middle East & Africa

The Middle East & Africa region captures 6% of the Medical, Legal and Regulatory Review Software Market in 2024. Growth is supported by rising investments in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. It helps organizations align with evolving regulatory frameworks aimed at improving healthcare standards and ensuring product safety. Adoption remains gradual due to cost barriers, but governments encourage digital health initiatives and compliance modernization. Vendors offering localized solutions gain advantage by addressing regional variations in regulations and language requirements. Expansion in pharmaceutical and medical device manufacturing enhances future prospects for this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Philips Healthcare

- LexisNexis Risk Solutions

- Siemens Healthineers

- Epic Systems

- Wolters Kluwer

- Oracle Health

- GE Healthcare

- Thomson Reuters

- Optum

- Allscripts

Competitive Analysis

The competitive landscape of the Medical, Legal and Regulatory Review Software Market is defined by leading players such as Philips Healthcare, Siemens Healthineers, LexisNexis Risk Solutions, Oracle Health, Wolters Kluwer, Epic Systems, Allscripts, GE Healthcare, Optum, and Thomson Reuters. These companies focus on delivering advanced compliance platforms that integrate AI, automation, and cloud-based solutions to meet the growing complexity of global regulations. Vendors strengthen portfolios by expanding digital review capabilities, enabling real-time collaboration, and offering multilingual support for international markets. Strategic investments in research and development enhance functionalities like predictive analytics, workflow automation, and audit trail management, ensuring faster and more accurate regulatory submissions. Partnerships with healthcare providers, pharmaceutical firms, and legal organizations expand their reach across geographies. Competitive intensity is driven by a shift toward SaaS-based delivery models, which reduce costs and improve scalability. Continuous innovation, combined with regulatory expertise and global service networks, positions these players at the forefront of shaping compliance transformation worldwide.

Recent Developments

- In March 2025, Philips expanded its partnership with Ibex Medical Analytics, enhancing the Philips IntelliSite Pathology Solution (PIPS 6.0). The upgraded platform integrates AI-powered pathology tools for cancer diagnostics and drove productivity gains of up to 37% in reporting efficiency.

- In February 2025, Siemens AG Showcased mobile stroke‑care solution including Stroke Connect platform and CT scanning at ECR2025.

- In February 2025, LexisNexis finalized its acquisition of IDVerse, an AI-driven identity verification expert, to strengthen fraud detection capabilities within its health and legal compliance offerings.

- In February 2025, At ECR 2025, Philips introduced new AI-enabled software and cloud services designed to streamline radiology workflows, enhance clinical insight, and accelerate image review processes via intelligent imaging platforms

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Functionality, Enterprise Size, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global demand for digital compliance solutions.

- AI and machine learning will strengthen automation in legal and regulatory workflows.

- Cloud-based platforms will dominate adoption due to scalability and remote accessibility.

- Analytics-driven tools will support predictive risk assessment and faster decision-making.

- Integration with enterprise systems will improve transparency and operational efficiency.

- Emerging economies will drive growth with expanding healthcare and regulatory reforms.

- Data security and privacy will remain critical priorities for software providers.

- Multilingual and customizable platforms will gain importance in cross-border product launches.

- Strategic partnerships between technology vendors and healthcare organizations will accelerate innovation.

- Continuous regulatory updates will fuel demand for adaptive and audit-ready systems.