Market Overview

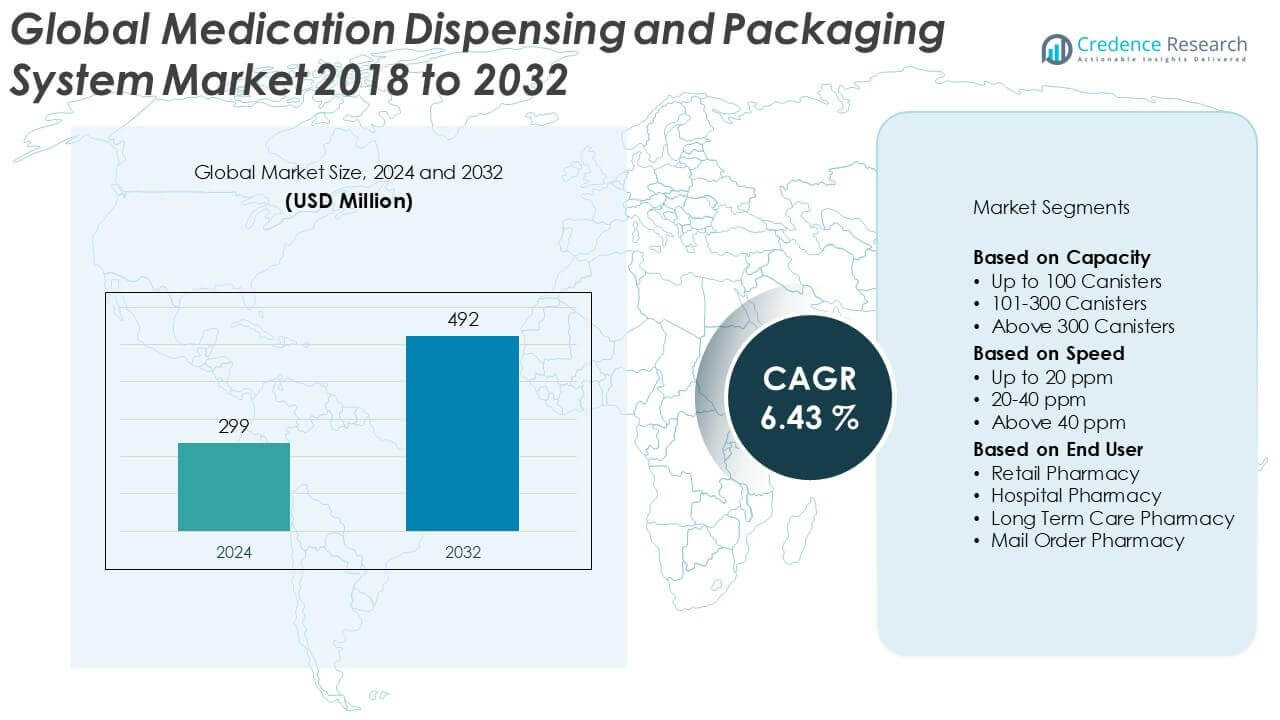

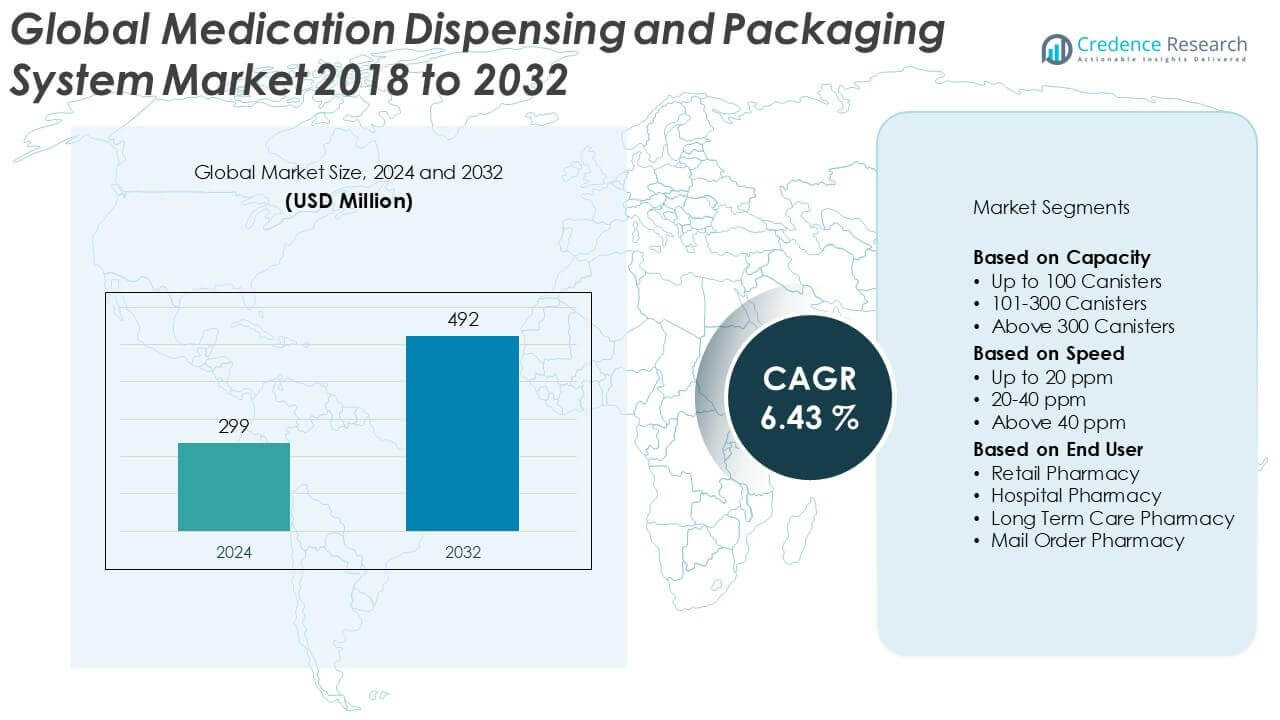

The Medication Dispensing and Packaging System market size was valued at USD 299 million in 2024 and is anticipated to reach USD 492 million by 2032, at a CAGR of 6.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medication Dispensing and Packaging System Market Size 2024 |

USD 299 Million |

| Medication Dispensing and Packaging System Market, CAGR |

6.43% |

| Medication Dispensing and Packaging System Market Size 2032 |

USD 492 Million |

The Medication Dispensing and Packaging System market is led by key players such as BD, Omnicell, Inc., Swisslog Holding AG, YUYAMA Co., Ltd., JVM Co. Ltd., ARXIUM Inc., and Global Factories B.V. These companies dominate the competitive landscape through advanced automation solutions, strong global presence, and continued innovation in medication safety and packaging efficiency. North America emerged as the leading region in 2024, capturing approximately 38% of the global market share. This leadership is driven by high adoption rates of pharmacy automation, robust healthcare infrastructure, and regulatory emphasis on medication accuracy. Major players continue to expand their footprint in this region while targeting growth in emerging markets through strategic partnerships and product customization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medication Dispensing and Packaging System market was valued at USD 299 million in 2024 and is projected to reach USD 492 million by 2032, growing at a CAGR of 6.43% during the forecast period.

- Increasing demand for pharmacy automation to reduce medication errors and improve operational efficiency is driving market growth, especially in hospital and long-term care settings.

- Key trends include the integration of cloud-based platforms and multi-dose packaging systems, supporting personalized medication management and enhancing adherence in chronic care.

- Leading companies such as BD, Omnicell, Inc., and Swisslog Holding AG dominate the competitive landscape with innovative, scalable solutions tailored for high-volume pharmacies; the 101–300 canisters segment accounted for over 45% market share in 2024.

- North America led the market with a 38% share, followed by Europe with 27% and Asia Pacific at 20%, with rapid growth expected in emerging economies due to expanding healthcare infrastructure and digital adoption.

Market Segmentation Analysis:

By Capacity

The Medication Dispensing and Packaging System market is segmented by capacity into up to 100 canisters, 101–300 canisters, and above 300 canisters. Among these, the 101–300 canisters segment dominated the market in 2024, accounting for over 45% of the global revenue share. This dominance is driven by its optimal balance between space efficiency and operational capacity, making it suitable for both medium-sized hospital and retail pharmacies. Growing demand for mid-range automation systems, especially in urban healthcare settings, further supports the growth of this segment, as they offer higher productivity without requiring extensive infrastructure investments.

- For instance, YUYAMA’s EV-180UC tablet packaging machine supports up to 240 canisters, allowing simultaneous dispensing and reducing manual refill frequency, with a packaging speed of up to 20 packets per minute.

By Speed

Based on speed, the market is categorized into up to 20 ppm, 20–40 ppm, and above 40 ppm. The 20–40 ppm segment held the largest market share in 2024, capturing more than 40% of the market. This segment’s leadership is attributed to its capability to handle moderate to high prescription volumes efficiently, which aligns with the operational needs of hospital and mail-order pharmacies. The increasing focus on reducing patient wait times and improving pharmacy throughput is encouraging the adoption of mid-speed systems that deliver a reliable balance between performance and cost-effectiveness.

- For instance, Omnicell’s XR2 Automated Central Pharmacy System dispenses up to 25 prescriptions per minute while integrating robotic arms, barcode verification, and real-time inventory tracking across 10,000+ medication types.

By End User

The end user segment includes retail pharmacy, hospital pharmacy, long-term care pharmacy, and mail order pharmacy. In 2024, the hospital pharmacy segment emerged as the dominant sub-segment with over 38% market share. Hospitals are rapidly adopting automated dispensing and packaging systems to improve medication accuracy, reduce manual handling errors, and enhance patient safety. The rising emphasis on workflow automation, coupled with the need for regulatory compliance and inventory optimization in hospital settings, continues to drive the uptake of these systems in this segment.

Key Growth Drivers

Rising Demand for Automation in Pharmacies

The increasing need for automation in pharmacies is a major growth driver in the medication dispensing and packaging system market. As pharmacies face growing prescription volumes and rising labor costs, automated systems offer enhanced operational efficiency, accuracy, and speed. These systems significantly reduce human error, ensure medication traceability, and free up pharmacists to focus on clinical tasks. The push for lean pharmacy workflows, especially in hospital and retail settings, continues to accelerate the adoption of these technologies across developed and emerging markets.

- For instance, Swisslog’s PillPick system automates the storage, packaging, and dispensing of unit doses and can process up to 600 doses per hour, significantly reducing manual workload and packaging errors.

Aging Population and Chronic Disease Prevalence

The growing global geriatric population and rising incidence of chronic illnesses are fueling the demand for efficient and error-free medication management solutions. Elderly patients often require multiple prescriptions, making accurate dispensing and adherence vital. Automated medication systems support multi-dose packaging and scheduled dispensing, improving patient compliance and healthcare outcomes. As healthcare providers increasingly prioritize patient safety and medication adherence, demand for dispensing and packaging solutions tailored for long-term care and home settings is also expected to rise steadily.

- For instance, BD’s Rowa Vmax system supports automated adherence packaging and is deployed in over 4,500 pharmacy sites globally, serving patients with complex medication regimens through integrated pill verification and error-reduction technologies.

Regulatory Focus on Medication Safety and Traceability

Stricter regulations regarding medication safety, traceability, and inventory control are pushing healthcare providers to adopt advanced dispensing and packaging systems. Regulatory bodies such as the FDA and EMA mandate precise tracking and error minimization, particularly in high-risk environments like hospitals and long-term care facilities. Automated systems offer features like barcoding, electronic verification, and audit trails, which help healthcare facilities comply with these standards. The need to meet evolving compliance requirements is a key factor propelling the integration of automation technologies in pharmacy workflows.

Key Trends & Opportunities

Integration with Cloud and Data Analytics

The growing integration of medication dispensing systems with cloud platforms and data analytics tools presents a major opportunity for enhancing real-time tracking, inventory control, and predictive maintenance. Cloud-based systems allow centralized data access across pharmacy networks, supporting better decision-making and remote monitoring. Analytics help forecast medication demand and identify inefficiencies, reducing waste and improving stock availability. As healthcare infrastructure becomes more digital, the synergy between automation and cloud technology is emerging as a critical enabler for operational intelligence.

- For instance, ARxIUM’s FastPak Elite integrates with the MedSelect platform, enabling real-time cloud-based analytics, inventory usage tracking across multiple sites, and automated compliance alerts across over 3,000 installations in North America.

Expansion of Telepharmacy Services

The rapid growth of telepharmacy and remote healthcare services is creating new avenues for medication dispensing and packaging solutions. With increasing reliance on virtual consultations, pharmacies are adapting to serve patients remotely by investing in automated systems that ensure timely and accurate prescription fulfillment. Mail-order and long-term care pharmacies, in particular, benefit from automation to meet growing remote demands. This trend is especially prominent in rural and underserved areas, where automation enables consistent delivery of pharmaceutical care without geographic constraints.

- For instance, JVM Co., Ltd.’s automatic dispensing system (NSP-1000) is widely deployed in remote pharmacy centers in South Korea and Japan, supporting mail-order dispensing of up to 1,000 prescriptions daily with automated labeling, pouch packaging, and system audit trails.

Customization and Multi-Dose Packaging Solutions

There is a rising demand for personalized and multi-dose packaging solutions to cater to patients on complex medication regimens. Medication adherence packaging—such as blister packs organized by dosing schedule—helps minimize confusion and enhances compliance, particularly among elderly and chronically ill patients. Customization features in modern dispensing systems allow pharmacies to tailor packaging based on patient needs, leading to better treatment outcomes and reduced hospital readmissions. This trend presents significant growth opportunities in home healthcare and long-term care settings.

Key Challenges

High Initial Investment and Maintenance Costs

One of the major challenges hindering market adoption is the high initial capital investment required for purchasing and installing automated medication dispensing and packaging systems. In addition to equipment costs, facilities must invest in training, IT integration, and regular system maintenance. These financial barriers are particularly restrictive for small and independent pharmacies, which often lack the resources to implement large-scale automation. While long-term operational benefits exist, the upfront expense continues to limit widespread adoption across price-sensitive markets.

System Integration and Workflow Disruption

Integrating new dispensing technologies with existing pharmacy information systems (PIS), electronic health records (EHR), and enterprise resource planning (ERP) platforms can be complex and time-consuming. Improper integration can lead to data silos, delayed prescriptions, or operational inefficiencies. Moreover, workflow disruptions during the transition period may impact productivity and service quality. Ensuring seamless interoperability and staff adaptability is crucial to realizing the full benefits of automation, yet these remain persistent challenges in many healthcare settings.

Regional Analysis

North America

North America held the largest share in the global Medication Dispensing and Packaging System market in 2024, accounting for approximately 38% of total revenue. The region benefits from advanced healthcare infrastructure, high adoption of pharmacy automation, and strict regulatory requirements regarding medication safety. The United States leads the regional market due to the presence of major players, widespread use of electronic health records, and strong investments in healthcare technology. Rising prescription volumes, aging demographics, and the demand for improved pharmacy workflows continue to support the region’s dominance in both hospital and retail pharmacy automation.

Europe

Europe captured around 27% of the global Medication Dispensing and Packaging System market in 2024, driven by increased focus on medication safety, error reduction, and stringent regulatory standards such as Falsified Medicines Directive (FMD). Countries like Germany, France, and the UK are witnessing rising adoption of automated systems across hospitals and community pharmacies. Government initiatives promoting e-health and digital transformation are further accelerating growth. Moreover, the growing elderly population and rising chronic disease burden across Western Europe are creating consistent demand for multi-dose and adherence packaging solutions in both urban and rural care settings.

Asia Pacific

The Asia Pacific region accounted for approximately 20% of the global market in 2024 and is expected to witness the fastest growth over the forecast period. Rapid urbanization, expanding healthcare access, and rising investment in pharmacy automation, particularly in China, Japan, South Korea, and India, are major contributing factors. The region’s growing middle class and increasing prescription volumes are driving demand for efficient dispensing systems in retail and hospital settings. Government initiatives to modernize healthcare infrastructure and digitize pharmacy operations further support market expansion, despite some cost sensitivity in low-income regions.

Latin America

Latin America contributed about 8% to the global Medication Dispensing and Packaging System market in 2024. The region is gradually adopting automation in healthcare due to rising demand for efficient medication management and improved patient safety. Countries like Brazil, Mexico, and Argentina are investing in modernizing pharmacy services, especially in urban hospitals and long-term care centers. However, high upfront costs and limited digital infrastructure pose challenges to broader adoption. As public and private healthcare systems expand and prioritize efficiency, the market is expected to grow steadily, particularly in metropolitan and higher-income segments.

Middle East & Africa

The Middle East & Africa region held a modest share of 7% in the global market in 2024. Growth is supported by increasing healthcare investments in the Gulf Cooperation Council (GCC) countries, especially the UAE and Saudi Arabia, which are focusing on digital transformation in healthcare. Hospital pharmacies are gradually adopting automated dispensing technologies to improve service delivery. However, many African nations face infrastructure and affordability challenges, limiting widespread adoption. Nevertheless, ongoing healthcare modernization programs and partnerships with global automation providers are likely to foster gradual market development across high-potential urban centers.

Market Segmentations:

By Capacity

- Up to 100 Canisters

- 101-300 Canisters

- Above 300 Canisters

By Speed

- Up to 20 ppm

- 20-40 ppm

- Above 40 ppm

By End User

- Retail Pharmacy

- Hospital Pharmacy

- Long Term Care Pharmacy

- Mail Order Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

Competitive Landscape

The competitive landscape of the Medication Dispensing and Packaging System market is characterized by the presence of several established global players and emerging regional providers competing on innovation, automation capabilities, and system integration. Companies such as BD, Omnicell, Inc., Swisslog Holding AG, and YUYAMA Co., Ltd. hold significant market shares due to their strong product portfolios, global distribution networks, and ongoing investments in R&D. These players focus on enhancing system speed, customization, and data integration to meet the evolving needs of retail, hospital, and long-term care pharmacies. Strategic collaborations, acquisitions, and technological advancements remain core strategies to expand market presence and address growing demand for accurate, high-volume dispensing solutions. As competition intensifies, differentiation through digital connectivity, compliance capabilities, and service support is becoming increasingly critical.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BD

- YUYAMA Co., Ltd

- ARXIUM Inc.

- Global Factories B.V.

- Omnicell, Inc.

- Swisslog Holding AG

- JVM Co. Ltd.

Recent Developments

- In Dec, 2024, a major market player Omnicell has introduced next generation cloud native, software workflow engine and data platform. Designed utilize full capacity of cloud native architecture which provides seamless integration of the robotics and smart devices to support a secure data driven medication management across continuum of care.

- In November 2023, Omnicell, Inc. announced that Kentucky-based Baptist Health has selected Omnicell’s Central Pharmacy Dispensing Service to address labor challenges and improve clinical and financial outcomes.

- In October 2023, JVM Co. Ltd is a key player in the pharmacy automation systems, particularly in dispensing, packaging and medication management solutions. Recent development in the next-generation automated drug dispensing systems, MENITH, which is successfully deployed in the Netherlands.

Market Concentration & Characteristics

The Medication Dispensing and Packaging System Market demonstrates a moderately concentrated structure, with a few dominant players controlling a significant share of the global revenue. Leading companies such as BD, Omnicell, Inc., Swisslog Holding AG, and YUYAMA Co., Ltd. drive competition through product innovation, strong distribution networks, and integration of digital technologies. It features high barriers to entry due to the capital-intensive nature of automation solutions and stringent regulatory requirements in the healthcare sector. The market favors companies offering scalable, customizable systems that meet the needs of diverse end users, including hospital, retail, and long-term care pharmacies. Demand for system accuracy, efficiency, and regulatory compliance shapes product development and competitive strategies. While global players lead in developed regions, smaller firms target niche markets with cost-effective solutions. It continues to evolve toward intelligent, connected systems that support data analytics, medication traceability, and patient safety. Price sensitivity in emerging regions impacts product adoption and competitive dynamics.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Speed, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing adoption of pharmacy automation across healthcare facilities.

- Rising chronic disease prevalence will elevate the need for accurate and efficient medication dispensing systems.

- Cloud-based and AI-integrated solutions will become more prominent, enabling real-time monitoring and predictive analytics.

- Multi-dose and adherence packaging systems will gain popularity to support patient compliance, especially among elderly populations.

- Retail and mail-order pharmacies will increase investments in high-speed dispensing units to manage growing prescription volumes.

- Developing regions will witness accelerated adoption due to expanding healthcare infrastructure and digital transformation initiatives.

- Strategic collaborations and acquisitions among key players will shape competitive dynamics and market expansion.

- Regulatory compliance and medication traceability requirements will continue to drive innovation in automated packaging solutions.

- Hospitals and long-term care settings will remain the primary end users, demanding scalable and integrated systems.

- Cost-effective and compact solutions will gain traction among small and mid-sized pharmacies globally.