Market Overview:

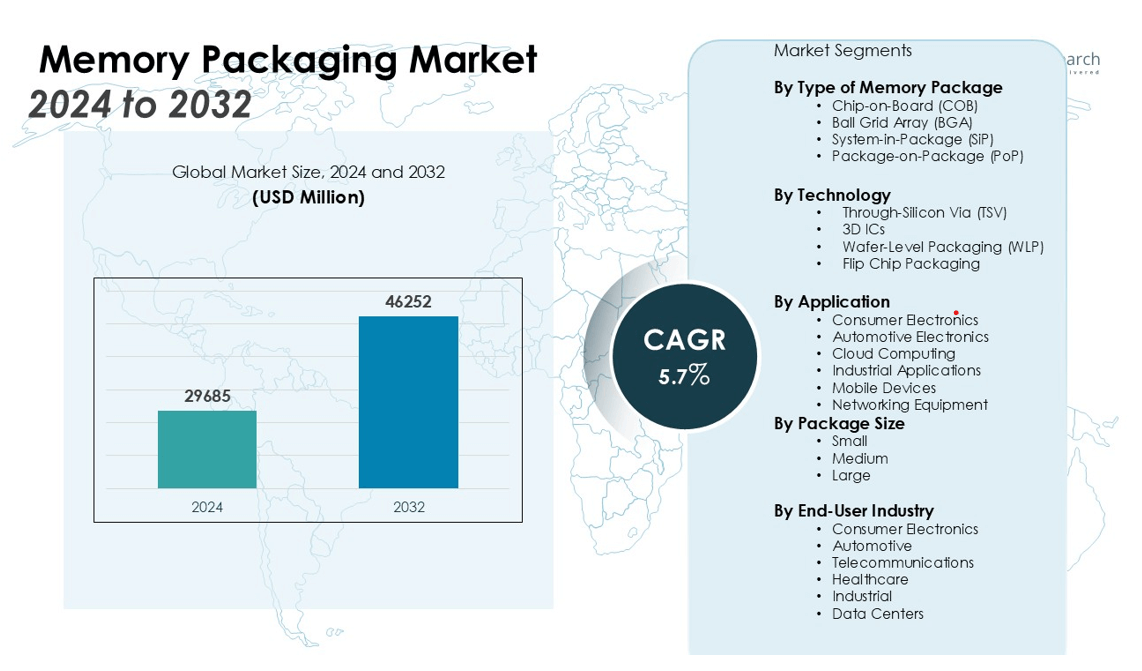

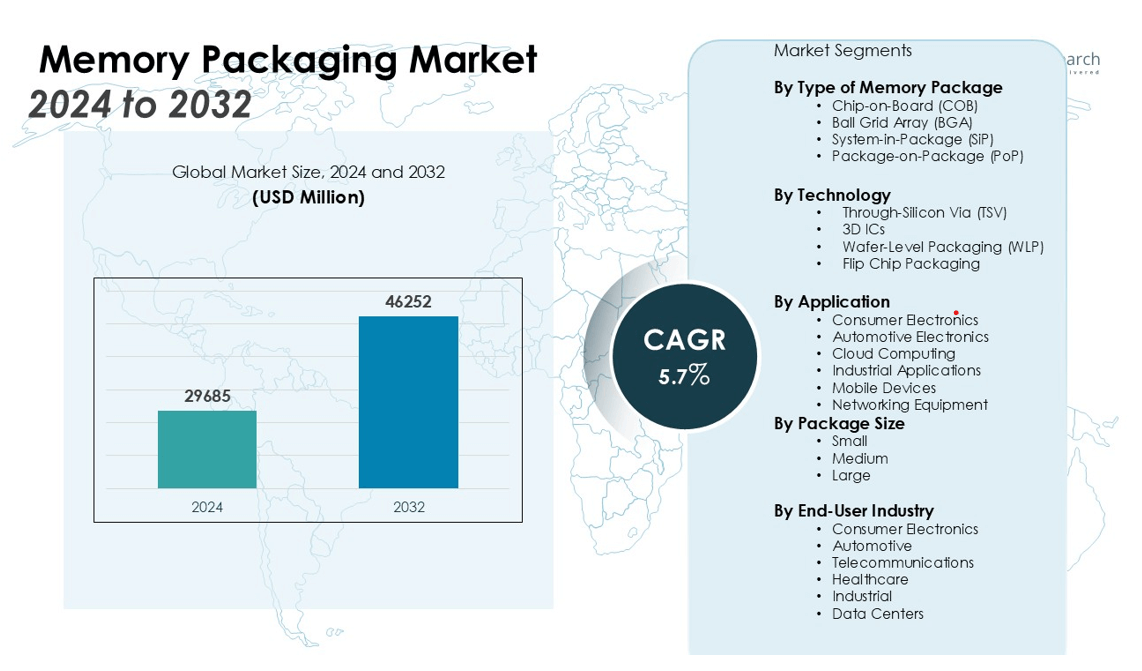

The Memory Packaging Market size was valued at USD 29685 million in 2024 and is anticipated to reach USD 46252 million by 2032, at a CAGR of 5.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Memory Packaging Market Size 2024 |

USD 29685 million |

| Memory Packaging Market, CAGR |

5.7% |

| Memory Packaging Market Size 2032 |

USD 46252 million |

Key drivers of the market include the rapid advancement of technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and 5G, which require high-performance memory solutions. The growing adoption of advanced packaging techniques, such as 3D ICs (Integrated Circuits) and TSV (Through-Silicon Via), enhances memory performance and energy efficiency, thereby fueling the market. Additionally, the surge in the use of memory chips in cloud computing, automotive electronics, and edge computing further supports market expansion. The growing emphasis on energy-efficient memory solutions is further accelerating the demand for innovative packaging technologies.

Regionally, Asia-Pacific dominates the memory packaging market, driven by its strong semiconductor manufacturing base, particularly in countries like China, South Korea, and Taiwan. The North American market follows closely, benefiting from high demand in the computing and storage sectors. Europe is expected to witness significant growth, with increasing applications in the automotive and industrial sectors, spurred by technological advancements and innovations in memory packaging. The expanding shift toward 5G infrastructure and data centers will also contribute to Europe’s market expansion.

Market Insights:

- The Memory Packaging Market was valued at USD 29685 million in 2024 and is projected to reach USD 46252 million by 2032, growing at a CAGR of 5.7% during the forecast period.

- Innovations such as 3D ICs and TSV technologies are enhancing memory performance and energy efficiency, enabling compact and efficient memory solutions for modern electronics.

- The expansion of data centers and cloud computing is propelling market growth, as these services require scalable and reliable memory solutions for large data storage and processing.

- Increased demand for memory solutions in automotive electronics and edge computing is driving market growth, with both sectors relying on advanced memory packaging technologies.

- Supply chain disruptions and material shortages are major challenges for the Memory Packaging Market, causing delays and increased production costs.

- Advanced packaging solutions, such as 3D ICs and TSV technology, require significant investment and increase production complexity, which can lead to higher costs and financial challenges for manufacturers.

- Asia-Pacific holds 45% of the market share, North America accounts for 30%, and Europe represents 18%, with each region experiencing growth driven by specific industry demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for High-Performance Memory Solutions

The Memory Packaging Market is witnessing significant growth due to the rising demand for high-performance memory solutions in various sectors. With the proliferation of AI, IoT, and 5G technologies, there is an increasing need for faster and more efficient memory chips. These technologies require robust memory solutions capable of supporting high-speed data processing and storage. As digital transformation accelerates, memory packaging plays a crucial role in meeting the performance needs of advanced applications, driving the market forward.

- For instance, Samsung’s HBM3E 12H memory delivers an industry-high bandwidth of up to 1,280GB/s and achieves a capacity of 36GB per stack, setting a benchmark for advanced AI and data center applications.

Advancements in Packaging Technologies

Innovations in packaging technologies, such as 3D ICs (Integrated Circuits) and TSV (Through-Silicon Via), are enhancing the performance and energy efficiency of memory chips. These advanced techniques allow for more compact and efficient memory solutions, supporting the growing demand for small, lightweight, and high-performance devices. The development of these packaging solutions is enabling improved memory capabilities, which is driving the expansion of the Memory Packaging Market by offering more efficient use of space and energy.

Expansion of Data Centers and Cloud Computing

The continued expansion of data centers and the growing reliance on cloud computing are crucial drivers of the Memory Packaging Market. With the increasing demand for cloud-based services, such as data storage and processing, the need for reliable and scalable memory solutions has intensified. Data centers require high-density, high-performance memory chips to manage vast amounts of data, further driving the adoption of advanced memory packaging technologies. This surge in demand for cloud computing solutions propels the market’s growth.

- For instance, Google Cloud’s new C4D virtual machine series offers configurations with up to 3TB of DDR5 memory in a single instance, supporting large-scale workloads for enterprise customers.

Growth in Automotive Electronics and Edge Computing

The rise in automotive electronics and edge computing is a significant contributor to the growth of the Memory Packaging Market. Automotive systems, such as autonomous driving and infotainment, rely heavily on memory chips for data processing. Similarly, edge computing requires efficient memory solutions for real-time data processing at the source. These sectors, driven by technological advancements and the need for real-time data management, further fuel the demand for high-performance memory solutions, supporting the market’s expansion.

Market Trends:

Shift Towards Advanced Packaging Solutions for Enhanced Performance

The Memory Packaging Market is witnessing a shift toward advanced packaging solutions to meet the growing demand for high-performance memory chips. Technologies like 3D ICs and TSV (Through-Silicon Via) are gaining traction as they enable higher memory density, reduced power consumption, and enhanced performance in a compact form factor. These advanced packaging techniques allow for better integration of memory chips, making them suitable for a wide range of applications, from consumer electronics to data centers. The ability to pack more memory into smaller spaces while maintaining high-speed processing is driving this trend forward. As device sizes continue to shrink and performance requirements rise, memory packaging innovations are becoming essential to meet these needs.

- For instance, the NVIDIA H200 GPU features 141GB of HBM3e memory and achieves a memory bandwidth of 4.8TB/s, which is a substantial advancement for AI and high-performance computing workloads.

Increasing Adoption of Memory Packaging in Emerging Technologies

The growing adoption of memory packaging in emerging technologies is another key trend shaping the market. Fields such as AI, 5G, and IoT require memory solutions that can handle vast amounts of data while maintaining high speed and low latency. As these technologies expand, there is a heightened demand for memory chips that can support faster data processing and improved energy efficiency. This trend is also influencing the packaging market, with more emphasis on scalable solutions that cater to high-performance needs in diverse industries. The integration of memory packaging in applications such as autonomous vehicles, edge computing, and wearable devices further accelerates the demand for cutting-edge memory packaging solutions. The Memory Packaging Market is positioned to benefit from these advancements, as it continues to play a pivotal role in supporting the next generation of technology.

- For instance, Micron DDR5 memory for edge computing devices achieves a 1.36x increase in effective bandwidth at DDR5-4800 compared to DDR4-3200, directly enabling higher throughput in industrial and AI-powered edge platforms.

Market Challenges Analysis:

Supply Chain Disruptions and Material Shortages

The Memory Packaging Market faces significant challenges due to ongoing supply chain disruptions and material shortages. The semiconductor industry’s reliance on specific raw materials, such as silicon and substrates, often leads to bottlenecks in production. These disruptions are further exacerbated by global trade tensions and geopolitical factors, causing delays and increased costs. With the growing demand for memory chips in various applications, including smartphones, servers, and AI-driven devices, the pressure on suppliers intensifies. This has led to fluctuations in material prices, creating financial strain on manufacturers. Additionally, any disruptions in the supply chain can hinder timely delivery and affect market growth.

Technological Complexity and Cost Implications

The rapid advancement of memory packaging technologies introduces complexity, making it difficult for manufacturers to keep pace with evolving demands. The adoption of advanced packaging solutions, such as 3D ICs and Through-Silicon Via (TSV) technology, requires substantial investments in R&D and high-precision manufacturing processes. These technologies, while offering performance enhancements, also bring increased production costs. Smaller players in the Memory Packaging Market face difficulties in achieving economies of scale, which limits their ability to compete effectively. The pressure to maintain profit margins while adopting cutting-edge technology can create financial challenges for industry participants.

Market Opportunities:

Growing Demand for Advanced Memory Solutions

The Memory Packaging Market presents significant opportunities driven by the growing demand for advanced memory solutions. The proliferation of smart devices, including smartphones, tablets, and gaming consoles, continues to fuel the need for high-performance memory chips. Emerging technologies, such as Artificial Intelligence (AI), Internet of Things (IoT), and 5G, further amplify the demand for memory solutions that offer enhanced speed and efficiency. As industries transition towards more sophisticated data processing and storage requirements, there is a rising need for packaging solutions that optimize memory performance while maintaining energy efficiency. The adoption of 3D ICs and TSV technologies presents a key opportunity for manufacturers to cater to this demand for cutting-edge memory devices.

Expansion in Automotive and Industrial Applications

The growing adoption of memory solutions in automotive and industrial applications is another promising opportunity for the Memory Packaging Market. The integration of memory chips in autonomous vehicles, electric vehicles, and industrial automation systems is rapidly increasing. These sectors require highly reliable and efficient memory packages to manage vast amounts of data generated by sensors, control systems, and IoT devices. As the automotive industry shifts towards advanced technologies, such as self-driving and connected vehicles, the demand for advanced memory packaging will continue to rise, opening up lucrative market prospects. This growing trend allows companies to diversify their product portfolios and explore new revenue streams.

Market Segmentation Analysis:

By Type of Memory Package

The market is segmented into several types of memory packages, including Chip-on-Board (COB), Ball Grid Array (BGA), and System-in-Package (SiP). The BGA segment holds a significant share due to its high reliability and compact design, making it ideal for consumer electronics and computing devices. SiP is gaining traction, particularly in mobile applications, due to its integration of multiple components in a single package, reducing the overall size and enhancing performance.

- For instance, Cadence Allegro design suite supports BGA packages with over 3,000 pins, enabling enterprise applications in automotive and telecommunications sectors.

By Technology

Key technologies in the market include Through-Silicon Via (TSV), 3D ICs, and Wafer-Level Packaging (WLP). TSV technology is widely used for high-density memory chips, providing better performance and energy efficiency. The 3D IC segment is growing due to its ability to stack memory chips, reducing the overall footprint while improving speed and power consumption. WLP technology is seeing increasing adoption for its advantages in reducing package size and enhancing integration.

- For instance, image sensors that incorporate TSV allow for signal path lengths to be reduced to less than 50μm, significantly decreasing latency and improving readout speed for high-resolution cameras.

By Application

The Memory Packaging Market is applied across various sectors, including consumer electronics, automotive, cloud computing, and industrial applications. Consumer electronics, especially smartphones and laptops, dominate the market due to the continuous demand for higher performance and miniaturization. The automotive sector is rapidly adopting memory packaging solutions for autonomous driving and infotainment systems, while cloud computing drives demand for scalable memory solutions in data centers.

Segmentations:

- By Type of Memory Package:

- Chip-on-Board (COB)

- Ball Grid Array (BGA)

- System-in-Package (SiP)

- Package-on-Package (PoP)

- By Technology:

- Through-Silicon Via (TSV)

- 3D ICs

- Wafer-Level Packaging (WLP)

- Flip Chip Packaging

- By Application:

- Consumer Electronics

- Automotive Electronics

- Cloud Computing

- Industrial Applications

- Mobile Devices

- Networking Equipment

- By Package Size:

- By End-User Industry:

- Consumer Electronics

- Automotive

- Telecommunications

- Healthcare

- Industrial

- Data Centers

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading the Memory Packaging Market

The Asia-Pacific region holds the largest share of the Memory Packaging Market, accounting for 45% of the global market. This dominance is driven by a strong semiconductor manufacturing base, especially in countries like China, South Korea, and Taiwan. The high demand for smartphones, laptops, and consumer electronics further fuels the need for memory packaging solutions. Rapid advancements in technologies such as 5G, IoT, and AI increase the demand for high-performance memory solutions. The region benefits from cost-effective manufacturing processes and significant investments in research and development, which strengthen its competitive position in the market.

North America: Strong Demand for High-Performance Solutions

North America commands a market share of 30% in the Memory Packaging Market, driven by robust demand for high-performance memory solutions. The United States plays a central role in memory technology development, with key players like Intel, Micron, and Qualcomm leading the industry. The increasing need for memory solutions in data centers, high-performance computing, and cloud services further supports market growth. Additionally, the expansion of industries such as automotive and healthcare, which require reliable memory solutions for data-intensive applications, adds to the region’s growth. North America’s focus on innovation and technological advancements makes it a key market for memory packaging solutions.

Europe: Growing Demand from Industrial and Automotive Sectors

Europe accounts for 18% of the global Memory Packaging Market share, with steady growth driven by the increasing adoption of memory solutions in industrial, automotive, and consumer electronics sectors. The region’s automotive industry is seeing a surge in demand for connected vehicles and autonomous driving technologies, which require advanced memory packaging. Key markets like Germany and France lead the charge in integrating memory technologies into industrial automation and smart factory systems. Europe’s commitment to sustainability and energy-efficient packaging also opens new avenues for market expansion. The growing demand for memory solutions in industrial applications supports a positive market outlook for Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Signetics

- Hana Micron

- KYEC

- FATC

- ASE Group

- JCET

- Tianshui Huatian Technology

- Amkor Technology

- Powertech Technology

- ChipMOS Technologies

Competitive Analysis:

The Memory Packaging Market is highly competitive, with several key players leading innovation and driving market growth. Companies such as Intel Corporation, Samsung Electronics, Micron Technology, and Texas Instruments dominate the market, offering a broad range of memory packaging solutions. These players focus on advanced technologies, including 3D ICs, TSV, and wafer-level packaging, to meet the growing demand for high-performance memory chips. Smaller players are focusing on niche segments, such as mobile and automotive applications, to strengthen their market position. To maintain a competitive edge, major companies are investing heavily in R&D to develop more compact, energy-efficient, and high-performance memory solutions. Strategic partnerships, mergers, and acquisitions are also key tactics used to expand product portfolios and market reach. The increasing demand for memory solutions in cloud computing, automotive electronics, and consumer devices further intensifies the competition among market leaders.

Recent Developments:

- In August 2024, Signetics and Vietnam’s CNCTech Group signed a cooperation agreement in Vinh Phuc province to develop a semiconductor manufacturing plant with an investment of over $100 million.

- In June 2025, Powertech Technology, in partnership with Nordson Electronics Solutions, completed the development of a new panel-level packaging technology that raised underfill yields above 99%, supporting the shift from wafer-based to panel-based production.

- In October 2024, Amkor announced a memorandum of understanding with TSMC to collaborate on advanced packaging and testing at a new facility in Peoria, Arizona, with a planned investment of $2 billion.

Market Concentration & Characteristics:

The Memory Packaging Market is moderately concentrated, with a few key players commanding a significant share. Companies such as Intel, Micron Technology, Samsung Electronics, and Texas Instruments dominate the market due to their technological capabilities and extensive product offerings. These players invest heavily in R&D to maintain a competitive edge in advanced memory packaging technologies like 3D ICs, TSV, and wafer-level packaging. The market is characterized by rapid technological advancements, high product differentiation, and a strong emphasis on miniaturization and energy efficiency. Smaller players focus on niche applications, such as automotive and mobile devices, to capture specific market segments. The competition is driven by innovation, cost efficiency, and the ability to scale production for various end-use industries, including consumer electronics, automotive, and data centers. Market entry barriers are relatively high due to the capital-intensive nature of advanced packaging technologies.

Report Coverage:

The research report offers an in-depth analysis based on Type of Memory Package, Technology, Application, Package Size, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Memory Packaging Market is experiencing significant growth, driven by the increasing demand for high-performance memory solutions in sectors like AI, IoT, and 5G technologies.

- Advanced packaging technologies, such as 3D ICs, TSV, and wafer-level packaging, are gaining traction for their ability to enhance memory performance and energy efficiency.

- The proliferation of data centers and the growing reliance on cloud computing are propelling the need for scalable and reliable memory solutions.

- Automotive electronics, particularly in autonomous driving and infotainment systems, are contributing to the rising demand for advanced memory packaging.

- Supply chain disruptions and material shortages pose challenges, affecting production timelines and costs.

- The rapid advancement of memory packaging technologies introduces complexity, requiring substantial investments in R&D and high-precision manufacturing processes.

- Asia-Pacific leads the market, accounting for a significant share, due to its strong semiconductor manufacturing base and high demand for consumer electronics.

- North America and Europe are also witnessing growth, driven by advancements in automotive electronics and industrial applications.

- The market is characterized by intense competition, with key players focusing on innovation and strategic partnerships to maintain a competitive edge.

- Future developments in memory packaging are expected to focus on miniaturization, energy efficiency, and integration of emerging technologies to meet the evolving demands of various industries.