Market Overview

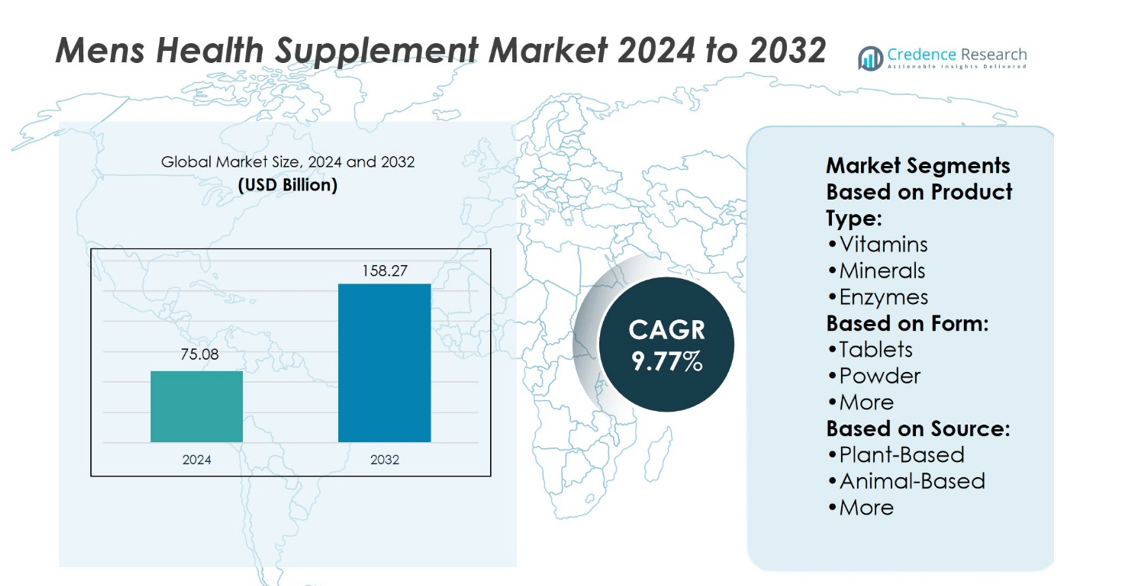

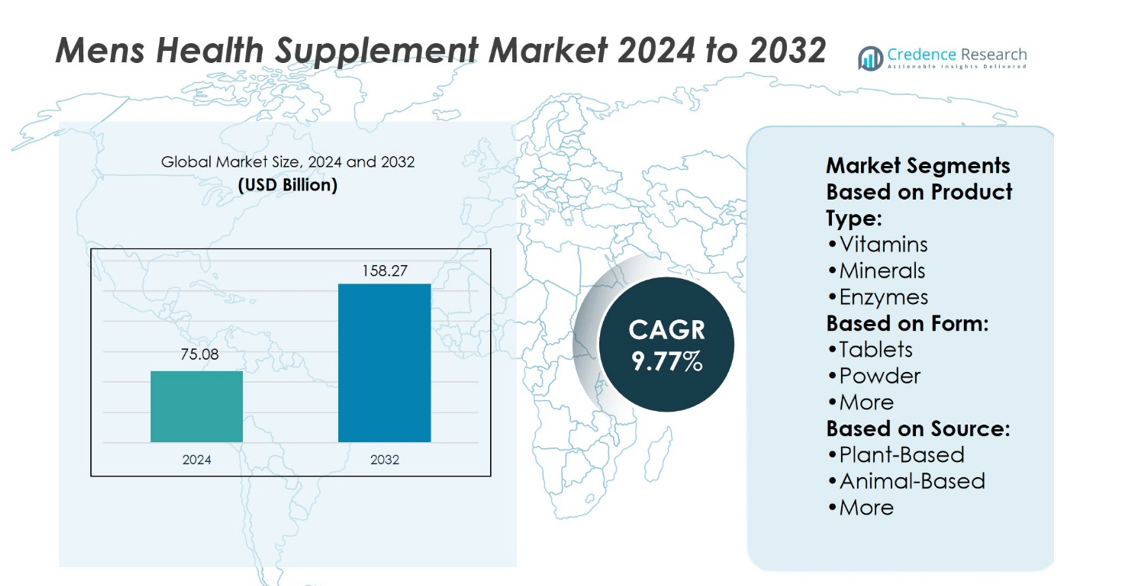

Men’s Health Supplement Market size was valued at USD 75.08 billion in 2024 and is anticipated to reach USD 158.27 billion by 2032, at a CAGR of 9.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Men’s Health Supplement Market Size 2024 |

USD 75.08 billion |

| Men’s Health Supplement Market, CAGR |

9.77% |

| Men’s Health Supplement Market Size 2032 |

USD 158.27 billion |

The mens health supplement market grows through strong drivers and evolving trends shaping global demand. Rising focus on fitness, immunity, and preventive healthcare fuels adoption across all age groups. Increasing lifestyle-related concerns, such as stress and fatigue, push demand for targeted formulations. Plant-based and clean-label supplements gain traction as consumers seek natural solutions. Companies integrate personalized nutrition and digital tools to enhance engagement and loyalty. Expanding e-commerce channels strengthen availability and consumer reach worldwide. Continuous investment in clinical validation and product innovation supports credibility and differentiation. Together, these factors drive steady expansion and reinforce long-term market opportunities.

North America holds the largest share of the mens health supplement market, supported by strong consumer awareness and advanced retail networks. Europe follows with high demand for clean-label and scientifically validated products, while Asia-Pacific shows rapid growth driven by rising middle-class adoption and e-commerce expansion. Latin America and the Middle East & Africa record steady uptake through growing distribution channels. Key players shaping this landscape include GNC, Amway, Life Extension, NOW Foods, and Metagenics.

Market Insights

- Mens Health Supplement Market size was USD 75.08 billion in 2024 and will reach USD 158.27 billion by 2032 at a CAGR of 9.77%.

- Rising focus on fitness, immunity, and preventive health drives steady market adoption.

- Plant-based and clean-label products emerge as key trends influencing consumer choices.

- Strong competition centers on innovation, branding, clinical validation, and distribution strength.

- High costs of premium formulations and strict regulations act as market restraints.

- North America leads with advanced retail networks and strong consumer awareness.

- Asia-Pacific records fastest growth supported by e-commerce expansion and middle-class adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Preventive Healthcare and Wellness

The Mens Health Supplement Market benefits from the rising emphasis on preventive healthcare. Men increasingly adopt supplements to support long-term vitality and reduce disease risks. It helps individuals maintain energy, improve immunity, and strengthen overall well-being. Growing health awareness encourages consistent demand for vitamins, minerals, and specialty products. Physicians and nutritionists recommend supplements to complement balanced diets. This steady adoption reflects a shift from treatment toward prevention in modern healthcare practices.

- For instance, Irwin Naturals, which was recently acquired by FitLife Brands, offers a variety of liquid soft-gel supplement SKUs. The brand’s products are distributed through its existing network of retailers across North America, which, according to older company descriptions, has been reported to be over 100,000 “doors”.

Growing Fitness and Sports Nutrition Trends

The expansion of fitness culture drives higher supplement consumption among men. Protein powders, performance boosters, and recovery aids remain key products in gyms and sports communities. It supports muscle building, stamina, and faster recovery cycles for active individuals. Professional athletes and fitness influencers promote supplements, increasing trust and market visibility. Sports nutrition brands create targeted solutions for endurance and strength. The demand for effective formulations continues to rise across both recreational and professional users.

- For instance, Life Extension developed Hybrid-FENUMAT™ technology to enhance fisetin bioavailability—making fisetin up to 23 times more absorbable via a galactomannan hydrogel scaffold, as shown in a clinical study published in the Journal of Nutritional Science.

Rising Incidence of Lifestyle-Related Disorders

The Mens Health Supplement Market gains traction from rising cases of obesity, diabetes, and cardiovascular issues. Supplements focusing on heart health, weight management, and metabolic balance gain popularity. It addresses concerns related to sedentary lifestyles and poor dietary habits. Nutraceutical companies develop specialized blends targeting male-specific conditions. Growing middle-aged populations create consistent demand for clinically supported supplements. This trend highlights the role of dietary support in modern disease management.

Influence of E-Commerce and Digital Platforms

Online platforms expand access to health supplements worldwide. E-commerce enables men to compare, review, and purchase products with ease. It strengthens transparency by showcasing certifications, customer ratings, and ingredient details. Direct-to-consumer brands use digital channels to promote tailored supplement solutions. Subscription models and personalized health apps increase long-term customer retention. The combination of digital outreach and convenience accelerates global market penetration for supplement providers.

Market Trends

Rising Demand for Natural and Clean-Label Products

The Mens Health Supplement Market reflects a growing preference for natural and clean-label options. Men increasingly select products free from artificial additives and synthetic ingredients. It aligns with global consumer demand for transparency and health-conscious choices. Plant-based proteins, herbal extracts, and organic formulations gain traction across multiple segments. Regulatory approvals for natural supplements further support credibility and adoption. The trend reinforces trust between brands and consumers, strengthening long-term loyalty.

- For instance, Nordic Naturals tests every product from raw ingredients to final goods through certified laboratories. That includes verifying no detectable PCBs at levels down to one part per trillion, and confirming that soft gels containing 1,000 mg of oil match labelled omega-3 content exactly, even when concentration ranges from about 28 % to 84 % of the fill volume.

Growing Focus on Personalized Nutrition

Personalization shapes a key trend in men’s health supplements. Companies adopt DNA testing, lifestyle assessments, and digital tools to design tailored solutions. It enables consumers to receive nutrient blends matching their individual health needs. Personalized subscription models expand access to customized products for specific age groups or conditions. Brands leverage advanced data analytics to deliver precise recommendations. This targeted approach improves product efficacy and customer satisfaction, making personalization a growth catalyst.

- For instance, NOW Foods uses the DuPont RiboPrinter® system to DNA-fingerprint up to 32 probiotic samples every 8 hours, allowing verification of more than 1,000 strains annually to confirm species identity and purity.

Expansion of Functional and Multibenefit Supplements

The Mens Health Supplement Market evolves with demand for functional and multifunctional products. Men seek supplements addressing immunity, cognitive performance, heart health, and energy simultaneously. It drives innovation in product formulations with blended vitamins, minerals, and bioactive compounds. Functional beverages, gummies, and powders add convenience to traditional capsules. Companies highlight evidence-backed claims to strengthen consumer trust in multifunctional offerings. The trend reflects a shift toward comprehensive wellness support in everyday consumption.

Influence of Digital Marketing and Online Retail Growth

Digital engagement accelerates supplement awareness and accessibility for men. E-commerce platforms provide a wide range of products with competitive pricing. It simplifies the purchase process and builds confidence through detailed product reviews. Social media campaigns and influencer partnerships increase visibility across diverse age groups. Direct-to-consumer brands maximize online presence to capture larger audiences. The synergy between digital marketing and retail innovation continues to reshape industry dynamics.

Market Challenges Analysis

Regulatory Complexity and Quality Concerns

The Mens Health Supplement Market faces challenges linked to strict and varying global regulations. Companies must comply with ingredient approvals, labeling rules, and safety standards across multiple regions. It creates delays in product launches and raises compliance costs for manufacturers. Quality concerns also persist due to counterfeit and unverified supplements entering the supply chain. Negative publicity from unsafe products damages consumer confidence and brand reputation. Firms must invest in testing, certification, and transparency to maintain credibility and trust.

Intense Competition and Consumer Skepticism

Strong competition in the supplement sector creates pressure on pricing and product differentiation. The Mens Health Supplement Market includes global leaders, regional brands, and new entrants competing for visibility. It forces companies to increase spending on innovation and marketing to retain market share. Consumer skepticism about supplement effectiveness further complicates adoption. Men often question claims without clear scientific backing or clinical validation. Building trust requires brands to demonstrate proven outcomes supported by credible research and real-world evidence.

Market Opportunities

Expansion into Emerging Economies and Untapped Demographics

The Mens Health Supplement Market holds strong potential in emerging regions with rising disposable incomes. Growing middle-class populations in Asia-Pacific, Latin America, and Africa increasingly invest in health products. It creates opportunities for brands to introduce affordable, locally adapted formulations. Untapped demographics such as younger men and older adults expand the consumer base. Marketing strategies tailored to regional health concerns strengthen adoption. Companies leveraging distribution networks in pharmacies, supermarkets, and online platforms can secure long-term growth.

Innovation in Product Formats and Scientific Backing

Product innovation offers significant room for opportunity in men’s health supplements. Consumers show rising interest in convenient forms such as gummies, functional drinks, and powders. It enables companies to meet lifestyle demands while boosting daily adherence. Expanding research into clinically validated ingredients improves product credibility and market acceptance. Brands investing in scientific studies can differentiate themselves through evidence-backed claims. This approach strengthens consumer trust and enhances competitive positioning across diverse product categories.

Market Segmentation Analysis:

By Product Type

The Mens Health Supplement Market divides into vitamins, minerals, enzymes, and other specialized products. Vitamins remain the leading segment with strong demand for vitamin D, B-complex, and multivitamins. Minerals such as zinc, magnesium, and calcium hold relevance for immunity and bone health. Enzyme-based supplements attract attention for digestion and metabolic support. It demonstrates how product type segmentation addresses varied nutritional needs across age groups. Specialty blends focusing on heart health, energy, or prostate function further expand the product range.

- For instance, Nutrilite ingredients come from nearly 6,000 acres of Amway‑owned certified organic farms. This vertical control—from seed to supplement—helps Amway deliver traceable, pure botanical powders.

By Form

Supplements are available in tablets, capsules, powders, and other convenient formats. Tablets and capsules continue to dominate due to ease of dosage and wide availability. Powders gain traction among fitness enthusiasts who prefer flexible mixing with food or beverages. Gummies and functional drinks emerge as attractive alternatives for younger consumers. It reflects a shift toward user-friendly delivery formats that improve adherence. Brands experiment with innovative packaging to enhance portability and long-term shelf stability.

- For instance, Caltrate Bone & Joint Calcium + Vitamin D Supplement includes calcium carb onate, a concentrated form of calcium. Each tablet provides 600 mg of calcium, with the total dosage determined by the number of tablets taken per day, as specified on the product label.

By Source

The Mens Health Supplement Market also segments by source, including plant-based, animal-based, and synthetic options. Plant-based supplements witness rising popularity with increasing demand for vegan and natural products. Animal-based sources such as fish oil and collagen remain vital for targeted health benefits. Synthetic formulations offer standardized dosing and broad scalability in manufacturing. It shows how source segmentation aligns with evolving consumer preferences and ethical considerations. Growing awareness of sustainability also supports the adoption of plant-based solutions across markets.

Segments:

Based on Product Type:

- Vitamins

- Minerals

- Enzymes

Based on Form:

Based on Source:

- Plant-Based

- Animal-Based

- More

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the men’s health supplement market with an estimated 35% share. The region benefits from high disposable incomes, strong consumer awareness, and a well-established healthcare system. The United States leads adoption, supported by extensive retail pharmacy chains and advanced e-commerce networks. Supplements focusing on vitamins, omega-3 fatty acids, and sports nutrition perform strongly. Canada adds steady demand, driven by lifestyle-focused consumers. Regulations from the FDA ensure product quality and safety, fostering trust among buyers. Premium product lines and subscription models further expand growth.

Europe

Europe accounts for approximately 25% of the global market, making it the second-largest region. Germany, the United Kingdom, and France represent leading country markets. Consumers display a strong preference for natural, organic, and plant-based supplements. Strict EU guidelines create confidence in product safety and efficacy. Distribution primarily occurs through pharmacies and specialty health stores, with online sales growing rapidly. Aging male populations and increasing focus on preventive healthcare fuel demand. Innovation in herbal and mineral blends positions the region for continued expansion.

Asia Pacific

Asia Pacific contributes about 20% of the men’s health supplement market. China, India, Japan, and South Korea form the core of regional growth. Rising middle-class income levels and increasing awareness of health management drive demand. Herbal supplements remain popular, often blended with modern vitamin and mineral products. E-commerce platforms like Alibaba and Flipkart boost accessibility, especially in rural areas. Government wellness campaigns in India and China encourage supplementation. Local manufacturers adapt products to traditional practices, making the region a hub for fast growth.

Latin America

Latin America holds nearly 8% of the global market share. Brazil and Mexico dominate regional consumption, supported by an expanding urban middle class. Multivitamins, proteins, and energy-focused supplements attract strong demand. Economic volatility, however, limits premium product penetration. Distribution channels rely heavily on supermarkets and local pharmacies. Global brands often partner with local firms to strengthen market reach. Rising health awareness and fitness culture contribute to steady growth across metropolitan areas. Regulatory improvements continue to enhance consumer confidence.

Middle East & Africa

The Middle East & Africa together represent close to 7% of the market. Gulf Cooperation Council (GCC) countries drive higher spending due to strong per capita incomes. Saudi Arabia and the UAE see rising demand for energy boosters, vitamins, and performance supplements. In Africa, South Africa and Nigeria show growing adoption, led by urban populations. Market growth faces challenges from limited local production and heavy reliance on imports. Regulatory systems differ across nations, impacting market standardization. Expanding retail networks and health campaigns are improving accessibility and demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Mens Health Supplement Market players such as Nature’s Lab, Nordic Naturals, NOW Foods, Irwin Naturals, GNC, The Vitamin Shopee, Amway, Life Extension, New Chapter, Metagenics LLC. The Mens Health Supplement Market is highly competitive, driven by innovation and consumer trust. Companies focus on clinically validated formulations, transparent labeling, and high-quality ingredients to differentiate. Distribution strategies play a crucial role, with strong presence in retail stores, e-commerce platforms, and subscription models. Branding emphasizes performance, vitality, and long-term wellness, appealing to varied age groups. Digital engagement, influencer marketing, and direct-to-consumer channels strengthen customer loyalty. The market also benefits from rising demand for plant-based, clean-label, and personalized solutions. Overall, competition centers on credibility, scientific backing, and effective outreach across global markets.

Recent Developments

- In June 2025, Amway India launched Nutrilite Triple Protect a scientifically formulated, plant-based supplement powered by Acerola Cherry, Turmeric, and Licorice—targeting overall immunity, gut, and skin health. This initiative supports Amway’s push for holistic wellness, leveraging clean label, organic, and evidence-based ingredients to match growing consumer demand for proactive men’s health solutions.

- In May 2025, Metagenics introduced the HerWellness™ product line, focusing on women’s hormonal health. This line includes formulations combining botanicals like saffron and green tea extract with activated Vitamin B6, aiming to support hormone balance and alleviate symptoms associated with perimenopause and menopause.

- In February 2025, Fenix Health Science expanded its brain health product portfolio with enhanced formulations in its Omega, Neuro, and Mineral product lines. The Omega product line incorporates Lysoveta LPC, an ingredient that enhances Omega-3 absorption to support cognitive function.

- In October 2024, Nature’s Bounty expanded its women’s wellness portfolio by introducing the Intimacy Booster, a supplement designed to enhance sexual pleasure and support overall intimate well-being. This product combines clinically studied ingredients such as KSM-66® Ashwagandha and Panax Ginseng, which have been associated with improved arousal, lubrication, and stress reduction.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising awareness of preventive healthcare among men.

- Demand for plant-based and clean-label supplements will continue to increase.

- Personalized nutrition solutions will gain popularity through AI and DNA-based insights.

- E-commerce and subscription models will strengthen consumer access and loyalty.

- Sports nutrition and performance enhancement supplements will see strong growth.

- Companies will invest more in clinical studies to validate product effectiveness.

- Functional blends combining vitamins, minerals, and botanicals will drive innovation.

- Emerging markets will adopt supplements faster with improving distribution networks.

- Regulatory focus on safety and quality will shape product development.

- Digital marketing and influencer engagement will remain key growth strategies.