| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Plastic Welding Equipment Market Size 2024 |

USD 285.97 Million |

| Mexico Plastic Welding Equipment Market, CAGR |

5.81% |

| Mexico Plastic Welding Equipment Market Size 2032 |

USD 449.37 Million |

Market Overview

Mexico Plastic Welding Equipment Market size was valued at USD 285.97 million in 2024 and is anticipated to reach USD 449.37 million by 2032, at a CAGR of 5.81% during the forecast period (2024-2032).

The Mexico plastic welding equipment market is experiencing steady growth, driven by increasing demand from the automotive, construction, and packaging industries, which rely heavily on durable and precision-joined plastic components. The rise in infrastructure development projects and a growing preference for lightweight and high-strength materials in manufacturing further fuel market expansion. Additionally, advancements in welding technologies, such as ultrasonic and laser welding, are enhancing operational efficiency and product quality, prompting greater adoption across various sectors. The shift toward automation and Industry 4.0 integration is also encouraging manufacturers to invest in advanced plastic welding systems. Environmental regulations promoting recyclable materials and sustainable production practices are influencing the development of energy-efficient and eco-friendly welding equipment. Moreover, Mexico’s strategic location and trade agreements support its role as a manufacturing hub, attracting international players and boosting equipment demand. These factors collectively create a positive outlook for the plastic welding equipment market in Mexico.

The geographical landscape of the Mexico plastic welding equipment market is shaped by the industrial strength and specialization of key cities such as Mexico City, Monterrey, Guadalajara, and Tijuana. These regions serve as major hubs for sectors like automotive, electronics, medical devices, and packaging, driving consistent demand for advanced plastic welding solutions. The market benefits from Mexico’s strategic location, strong manufacturing base, and growing infrastructure investments. In terms of key players, the market features a mix of global and regional manufacturers, including Branson Ultrasonics Corporation, Dukane Corporation, Emerson Electric Co., Leister Technologies AG, and Herrmann Ultraschalltechnik GmbH & Co. KG. These companies compete by offering a range of manual, semi-automatic, and fully automatic welding systems, tailored to meet the evolving needs of different industries. Their focus on technological innovation, energy efficiency, and automation continues to shape market dynamics and support the broader industrial growth in Mexico.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico plastic welding equipment market was valued at USD 285.97 million in 2024 and is projected to reach USD 449.37 million by 2032, growing at a CAGR of 5.81% during the forecast period.

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- Growing demand from industries like automotive, electronics, and medical devices is driving the need for advanced plastic welding solutions.

- Technological advancements, including automation and Industry 4.0, are creating new opportunities for market growth.

- Rising demand for lightweight and durable materials in automotive and packaging sectors is further propelling market expansion.

- The market faces challenges such as high initial investment costs and the need for skilled labor.

- Key players in the market include Branson Ultrasonics, Dukane Corporation, and Leister Technologies, which focus on innovation and high-quality solutions.

- Mexico’s strategic location and infrastructure development contribute to its dominant position in North America’s manufacturing landscape.

Report Scope

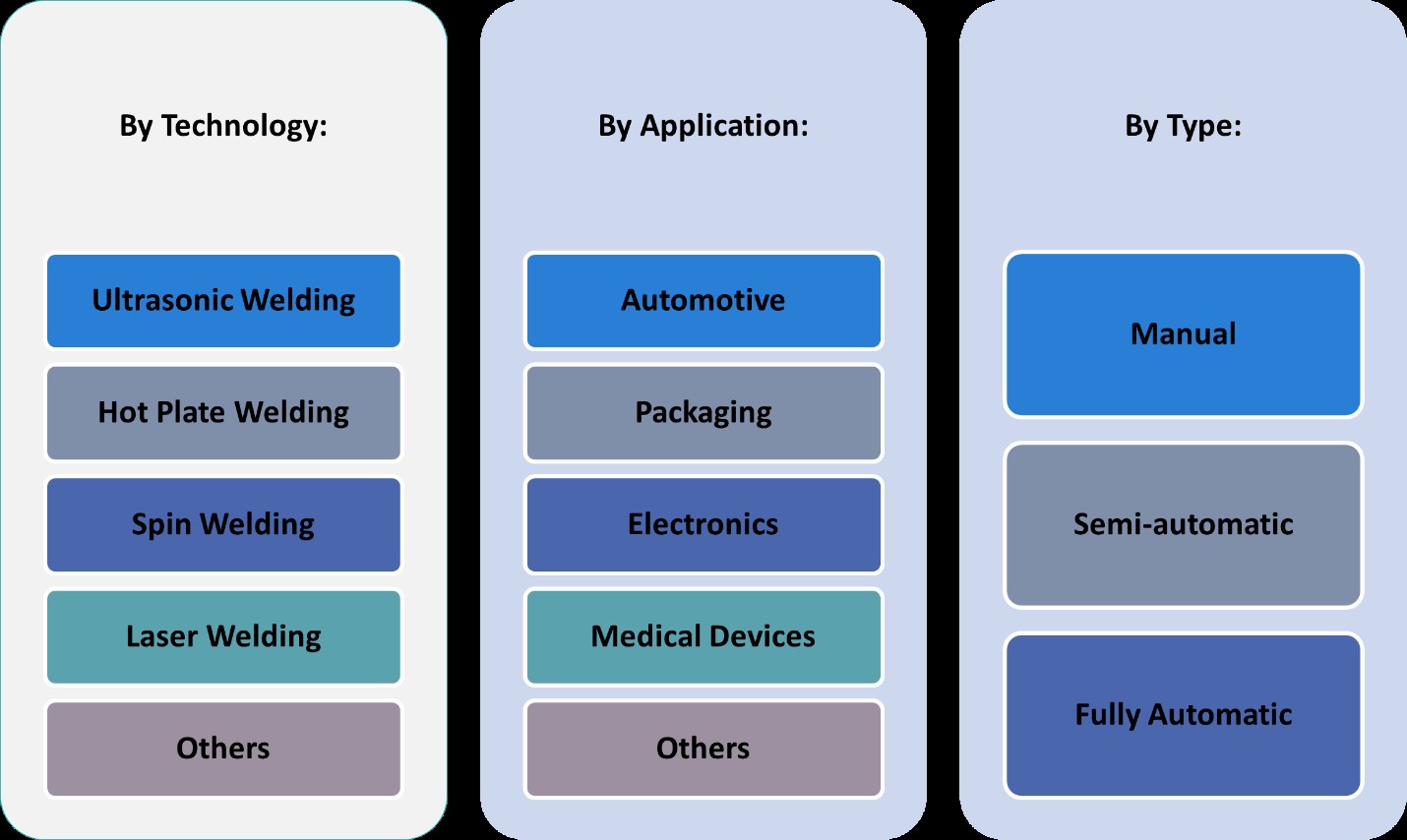

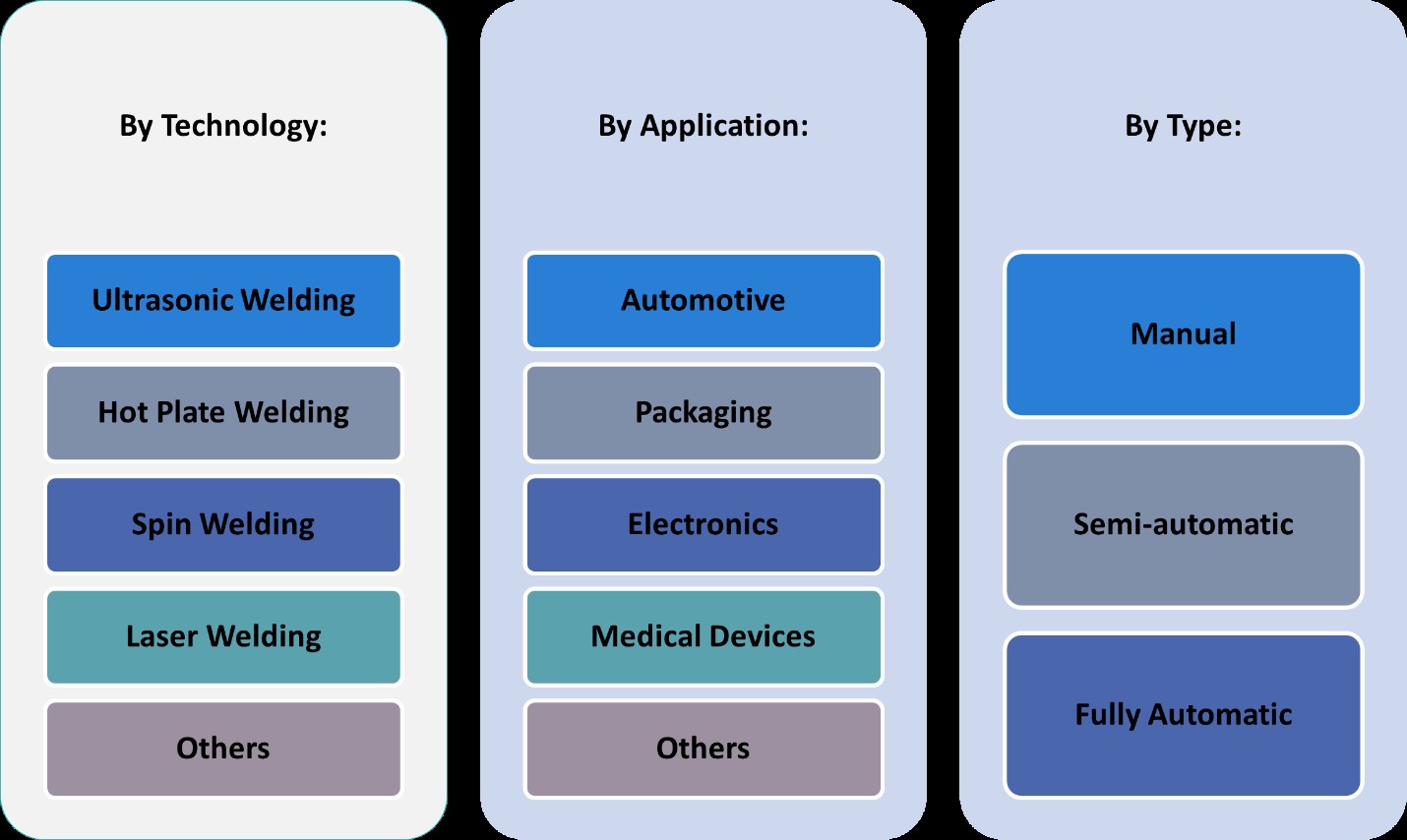

This report segments the Mexico Plastic Welding Equipment Market as follows:

Market Drivers

Infrastructure Development and Construction Growth

Mexico’s expanding construction and infrastructure sectors also serve as key growth drivers for the plastic welding equipment market. As the government invests in large-scale infrastructure projects ranging from water supply systems and urban development to telecommunications and energy there is a growing need for thermoplastic pipes, panels, and components. For instance, surveys conducted by construction authorities in Mexico indicate a rising demand for butt fusion welding equipment in water distribution projects, particularly for joining high-density polyethylene (HDPE) pipes. Plastic welding equipment plays an essential role in fabricating and installing these materials efficiently and securely. In particular, technologies like butt fusion and extrusion welding are in high demand for joining HDPE and other thermoplastics used in water and gas distribution systems. As infrastructure modernization accelerates, so does the requirement for reliable plastic welding solutions across diverse applications.

Favorable Trade Environment and Foreign Investments

Mexico’s strategic geographic location and participation in trade agreements like the United States-Mexico-Canada Agreement (USMCA) create a favorable environment for industrial growth, including the plastic welding equipment market. The country serves as a manufacturing and export base for global companies seeking to access North American and Latin American markets. For instance, government reports indicate that foreign direct investment (FDI) in Mexico’s automotive sector has led to the adoption of advanced plastic welding technologies to meet export quality standards. This position attracts significant FDI into Mexico’s manufacturing sector, especially in automotive, electronics, and consumer goods. The influx of capital and technology fosters innovation and boosts demand for high-performance plastic welding solutions. Furthermore, the supportive policy landscape and government incentives for industrial development encourage both local and international players to expand their operations, reinforcing the market’s upward trajectory.

Growing Demand from Automotive and Transportation Sectors

Mexico’s strong position as a leading automotive manufacturing hub in North America significantly drives the demand for plastic welding equipment. The automotive industry increasingly relies on plastic components due to their lightweight, durability, and cost-effectiveness, especially for fuel systems, interiors, and under-the-hood applications. As global and domestic automakers expand production capacities in Mexico, the need for efficient, high-quality plastic joining solutions rises. Advanced welding technologies, such as hot plate, ultrasonic, and vibration welding, are particularly critical in achieving precise and durable bonds. With ongoing investments from global automotive giants and Tier 1 suppliers, the demand for plastic welding equipment is expected to remain robust throughout the forecast period.

Technological Advancements and Automation Integration

Rapid advancements in welding technology and the integration of automation are transforming the plastic welding landscape in Mexico. Manufacturers are increasingly adopting automated systems and Industry 4.0 solutions to improve precision, reduce labor costs, and increase throughput. Innovations such as laser welding, infrared welding, and digital monitoring systems are being integrated into production lines to ensure consistent weld quality and traceability. These advancements enable companies to meet stringent quality standards while optimizing productivity. Additionally, the shift toward energy-efficient equipment and smart controls aligns with both environmental goals and operational efficiency, further accelerating the adoption of advanced plastic welding technologies across industries.

Market Trends

Integration of Automation and Industry 4.0 Technologies

The Mexican plastic welding equipment market is increasingly embracing automation and Industry 4.0 technologies to enhance precision, efficiency, and scalability. Manufacturers are adopting robotic welding systems and smart machinery equipped with sensors and real-time monitoring capabilities. For instance, surveys conducted by industry associations in Mexico reveal that over 50% of automotive manufacturers have integrated robotic welding systems to improve production efficiency and meet stringent quality standards. This shift towards automation not only improves product quality but also reduces operational costs and minimizes human error. The trend is particularly prominent in sectors like automotive and electronics, where high-volume production and stringent quality standards necessitate advanced welding solutions. The integration of these technologies positions Mexican manufacturers to compete more effectively in the global market.

Rising Demand for Lightweight and Durable Materials

There is a growing trend towards the use of lightweight and durable plastic materials in various industries, including automotive, aerospace, and construction. This shift is driven by the need for fuel efficiency, cost reduction, and compliance with environmental regulations. Consequently, the demand for advanced plastic welding equipment capable of handling new materials and complex assemblies is on the rise. Manufacturers are investing in technologies such as ultrasonic and laser welding to meet these evolving requirements, thereby propelling market growth.

Expansion of Infrastructure and Construction Projects

Mexico’s ongoing infrastructure development and urbanization efforts are contributing to increased demand for plastic welding equipment. The construction of pipelines, water treatment facilities, and residential buildings necessitates reliable and efficient plastic welding solutions. Technologies like butt fusion and extrusion welding are gaining traction for their effectiveness in joining thermoplastic pipes and components. This trend is expected to continue as the government and private sector invest in infrastructure projects to support economic growth.

Emphasis on Sustainability and Environmental Compliance

Environmental concerns and regulatory pressures are driving the adoption of sustainable practices in the manufacturing sector. Companies are seeking energy-efficient and eco-friendly plastic welding equipment to reduce their carbon footprint and comply with environmental standards. For instance, data from environmental agencies in Mexico shows that manufacturers in the consumer goods sector are adopting ultrasonic welding technologies to minimize waste and energy consumption during production. Innovations in welding technology that minimize waste and energy consumption are becoming increasingly important. This focus on sustainability is not only a response to regulatory requirements but also a strategic move to appeal to environmentally conscious consumers and stakeholders.

Market Challenges Analysis

High Initial Investment and Technical Expertise Requirements

One of the primary challenges facing the Mexico plastic welding equipment market is the high upfront cost associated with acquiring advanced welding technologies. Equipment such as laser and ultrasonic welding machines, while offering high precision and efficiency, require significant capital investment. This can be a major barrier for small and medium-sized enterprises (SMEs) with limited financial resources. For instance, surveys conducted by manufacturing associations in Mexico indicate that over 60% of SMEs in the automotive sector face difficulties in adopting advanced welding technologies due to high initial costs and the need for specialized training programs. In addition to cost, operating these sophisticated machines demands skilled labor and technical expertise, which are not always readily available in the local workforce. The lack of adequately trained technicians can lead to improper handling, reduced operational efficiency, and increased maintenance costs. As a result, many companies may hesitate to adopt newer technologies, slowing down overall market growth and innovation in the sector.

Supply Chain Disruptions and Dependence on Imports

The Mexico plastic welding equipment market is also challenged by supply chain disruptions and a high dependence on imported machinery and components. Many critical parts and high-end equipment are sourced from international manufacturers, primarily from Europe, the United States, and Asia. Any disruptions such as global semiconductor shortages, trade restrictions, or logistic bottlenecks can lead to delays, increased procurement costs, and reduced availability of essential equipment. Moreover, currency fluctuations and international trade policies further complicate procurement and pricing strategies. This reliance on imports also limits domestic manufacturing capabilities and innovation, making the market vulnerable to external shocks. To overcome these challenges, there is a growing need for investment in local production capabilities, supplier diversification, and policy support to strengthen Mexico’s industrial base and reduce external dependency.

Market Opportunities

The Mexico plastic welding equipment market presents considerable opportunities driven by the country’s evolving industrial landscape and strategic economic positioning. As Mexico continues to establish itself as a manufacturing hub for North America, the demand for efficient, reliable, and advanced plastic welding technologies is poised to grow. Sectors such as automotive, electronics, and medical device manufacturing increasingly rely on high-performance plastic components, necessitating precision joining methods. This trend creates a fertile ground for both local and international suppliers of welding equipment to expand their presence, especially by offering customized, industry-specific solutions. Moreover, the growing push for lightweight materials and sustainability in product design opens avenues for innovation in welding processes, particularly those compatible with advanced thermoplastics and bio-based polymers.

Additionally, Mexico’s trade agreements and proximity to the United States provide a competitive advantage for export-oriented production, attracting foreign direct investment into manufacturing infrastructure. This investment, in turn, fuels demand for automated and digitally integrated welding systems that align with Industry 4.0 standards. Local companies that adopt these modern technologies can enhance their operational efficiency and quality standards, increasing their competitiveness in the global market. There is also potential for domestic innovation and manufacturing of plastic welding machinery, which could reduce dependency on imports and foster a more resilient local supply chain. As environmental regulations become more stringent, the market also offers space for eco-friendly and energy-efficient equipment, paving the way for suppliers that emphasize sustainability and regulatory compliance. These opportunities collectively signal a promising outlook for stakeholders willing to invest in advanced capabilities, workforce development, and localized production strategies.

Market Segmentation Analysis:

By Type:

The Mexico plastic welding equipment market is segmented into manual, semi-automatic, and fully automatic systems, each serving distinct industrial requirements. Manual plastic welding equipment holds a notable share, especially in small-scale operations and maintenance applications, where cost-effectiveness and flexibility are prioritized. However, the demand for semi-automatic systems is growing steadily due to their balance between operational control and increased productivity. These systems are favored in mid-sized production environments where consistency and moderate automation are required. Fully automatic plastic welding equipment, though representing a smaller share currently, is projected to experience the fastest growth. This trend is driven by increasing adoption in high-volume manufacturing sectors such as automotive and electronics, where speed, precision, and integration with digital systems are critical. As more manufacturers pursue smart manufacturing strategies, the uptake of fully automated welding solutions is expected to accelerate. The shift toward automation also reflects broader industrial goals of reducing labor dependency, improving product consistency, and complying with stringent quality standards.

By Application:

Application-wise, the Mexico plastic welding equipment market is diverse, with significant demand originating from automotive, electronics, packaging, and medical devices industries. The automotive sector leads in terms of market share, driven by Mexico’s strong position as a manufacturing hub for global automakers. Plastic welding is essential in assembling fuel systems, interior components, and under-the-hood applications. The electronics sector also demonstrates robust demand, particularly for precision welding techniques used in delicate assemblies. Packaging is another key application, with the need for secure and efficient plastic sealing solutions in food and consumer goods packaging. The medical devices segment is witnessing rising interest due to the growing production of disposable and compact plastic components, which require hygienic and accurate welding processes. Additionally, other applications, including consumer products and infrastructure, contribute to market growth. The increasing industrial diversification in Mexico supports broader adoption of plastic welding equipment across these segments, presenting ample opportunities for specialized equipment suppliers and service providers.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Regional Analysis

Mexico City

Mexico City holds the largest share of the plastic welding equipment market in the country, accounting for approximately 35% of total market revenue. As the nation’s capital and a key industrial and commercial center, Mexico City is home to a dense concentration of manufacturing facilities and corporate headquarters. The region benefits from well-established infrastructure, access to a skilled labor force, and proximity to decision-makers in the government and private sectors. Plastic welding equipment is in high demand here, particularly in the electronics, packaging, and medical device industries, where precise and high-throughput welding solutions are essential. The growth in medical manufacturing, driven by both domestic demand and exports, is further fueling the adoption of advanced welding technologies in the region.

Monterrey

Monterrey represents about 28% of the plastic welding equipment market in Mexico, standing out as a major industrial and manufacturing hub in the northern region. Known for its strong presence in the automotive, construction, and heavy machinery industries, Monterrey has a high demand for plastic welding systems used in automotive components, pipes, and industrial products. The city’s emphasis on technological advancement and investment in industrial automation has accelerated the uptake of semi-automatic and fully automatic welding solutions. Monterrey’s close proximity to the United States and its role as a key export region also make it attractive for multinational companies establishing production bases, further bolstering equipment demand.

Guadalajara

With a 22% market share, Guadalajara is recognized as Mexico’s technology and electronics manufacturing capital. The city’s robust electronics sector drives the need for high-precision plastic welding equipment, particularly ultrasonic and laser welding machines used in circuit assemblies, connectors, and small enclosures. Additionally, Guadalajara’s emerging medical device manufacturing industry is rapidly adopting plastic welding technology for the production of disposable and implantable devices. The region benefits from a well-developed supply chain, innovation ecosystems, and collaboration between academia and industry, making it a favorable environment for high-tech manufacturing and specialized welding solutions.

Tijuana

Tijuana contributes around 15% to the national plastic welding equipment market, with a strong focus on export-oriented manufacturing. The city’s strategic location along the U.S. border positions it as a key player in maquiladora operations, particularly for the medical device and consumer electronics industries. Tijuana’s plastic welding demand is primarily driven by high-volume production environments that require reliable and efficient joining technologies. While its market share is smaller compared to larger metropolitan regions, Tijuana’s rapid industrial expansion and infrastructure improvements continue to create growth opportunities, especially for automated and energy-efficient welding solutions.

Key Player Analysis

- Branson Ultrasonics Corporation

- Dukane Corporation

- Emerson Electric Co.

- DRADER Manufacturing Industries Ltd.

- Wegener Welding LLC

- Leister Technologies AG

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Bielomatik Leuze GmbH & Co. KG

- Frimo Group GmbH

- Sonics & Materials, Inc.

Competitive Analysis

The competitive landscape of the Mexico plastic welding equipment market is characterized by a mix of established global players and specialized regional manufacturers. Leading companies include Branson Ultrasonics Corporation, Dukane Corporation, Emerson Electric Co., DRADER Manufacturing Industries Ltd., Wegener Welding LLC, Leister Technologies AG, Herrmann Ultraschalltechnik GmbH & Co. KG, Bielomatik Leuze GmbH & Co. KG, Frimo Group GmbH, and Sonics & Materials, Inc. These players dominate the market by offering a diverse range of manual, semi-automatic, and fully automatic welding solutions tailored to different industrial needs. Leading manufacturers emphasize developing high-efficiency solutions, including automated and energy-saving systems, to meet the increasing demand for production scalability and environmental sustainability. Additionally, the integration of smart technologies, such as automation and real-time monitoring systems, has become a major focus among competitors looking to enhance their offerings. This trend aligns with the broader Industry 4.0 movement, where manufacturers strive to improve operational efficiency and precision in high-volume production environments. The competition is also influenced by factors such as pricing strategies, customer support services, and the ability to provide customized solutions for industries like automotive, electronics, packaging, and medical devices.

The growing need for lightweight materials and durable, precision components is driving demand for innovative plastic welding equipment. Companies that successfully combine technological advancements with cost-effective solutions will be better positioned to capture market share as the industry continues to evolve.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The Mexico plastic welding equipment market is moderately concentrated, with a few dominant players holding significant market share. However, there is also a notable presence of smaller and regional manufacturers catering to specific industry needs, creating a competitive environment. The market characteristics are defined by a strong demand for technological innovation, with companies focusing on advanced welding techniques such as ultrasonic, laser, and infrared welding. These technologies are essential for applications requiring high precision and durability, such as in automotive, electronics, and medical device manufacturing. Additionally, automation is a key characteristic of the market, with manufacturers increasingly adopting automated welding systems to enhance production efficiency and reduce operational costs. As demand for sustainable and energy-efficient solutions grows, companies are also focusing on eco-friendly welding technologies. The market’s competitive dynamics are further influenced by factors such as cost efficiency, customer support, and the ability to customize solutions based on industry-specific requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for plastic welding equipment in Mexico is expected to grow as industries seek efficient manufacturing processes.

- The automotive sector will continue to drive advancements in plastic welding technology due to increased vehicle production.

- Strong government regulations regarding sustainability will likely encourage the use of eco-friendly welding methods.

- The packaging industry in Mexico is projected to expand, increasing the need for high-quality plastic welding equipment.

- The construction sector will benefit from advancements in welding equipment for plastic pipes and fittings.

- Growing investment in infrastructure development will drive the demand for durable plastic welding solutions.

- Automation and robotic integration in plastic welding equipment will increase productivity and reduce labor costs.

- Companies will prioritize energy-efficient plastic welding equipment to meet environmental standards and reduce operational costs.

- The rising trend of customization in plastic products will lead to more demand for precise and flexible welding technologies.

- Collaboration between local and international manufacturers is expected to boost innovation and improve equipment quality in Mexico.