| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Water Pump Market Size 2023 |

USD 1,416.37 Million |

| Mexico Water Pump Market, CAGR |

2.81% |

| Mexico Water Pump Market Size 2032 |

USD 1,818.66 Million |

Market Overview:

Mexico Water Pump Market size was valued at USD 1,416.37 million in 2023 and is anticipated to reach USD 1,818.66 million by 2032, at a CAGR of 2.81% during the forecast period (2023-2032).

The Mexico water pump market is driven by several factors that contribute to its growth. One of the main drivers is the expansion of industrial sectors such as oil and gas, chemical processing, and power generation. These industries require reliable and efficient pumping systems to handle various operations, such as fluid transfer, cooling, and processing of hazardous materials. Additionally, the rapid infrastructure development in the country, particularly in water and wastewater treatment facilities, has significantly boosted the demand for advanced pumping solutions. As Mexico faces increasing water scarcity concerns, there is a growing emphasis on water conservation and efficient management, further driving the adoption of water pumps. Technological advancements in pump design, materials, and control systems have also played a key role, enhancing the efficiency and performance of pumps, making them more attractive to various industries.

Regionally, the northern part of Mexico, particularly in states like Nuevo León and Tamaulipas, is a major industrial hub that heavily influences the water pump market. This region is home to a high concentration of manufacturing activities in industries such as oil, gas, and chemicals, all of which require pumping solutions for various processes. In addition to the northern region, the central and southern areas of Mexico also present substantial opportunities for water pumps, driven by the ongoing development of water and wastewater management infrastructure. Local governments and municipalities in these areas are investing in projects to improve water access and sanitation services, which further fuels the demand for pumping systems. Overall, regional variations in demand are shaped by local industrial activities, infrastructure projects, and efforts to address environmental challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico water pump market was valued at USD 1,416.37 million in 2023 and is projected to reach USD 1,818.66 million by 2032, at a CAGR of 2.81% during the forecast period.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Industrial expansion, particularly in sectors like oil and gas, chemicals, and power generation, is a major driver, increasing the demand for efficient pumping solutions in fluid transfer, cooling, and hazardous material handling.

- Rapid infrastructure development in water and wastewater treatment facilities, along with the expansion of urban water supply networks, has spurred the need for advanced pumping systems to manage large water volumes.

- Water scarcity concerns are driving efforts towards more efficient water usage, leading to growing adoption of water pumps for desalination, wastewater treatment, and rainwater harvesting.

- Technological advancements in pump design, materials, and automation have significantly improved efficiency, performance, and sustainability, making pumps more reliable and energy-efficient.

- Despite their long-term benefits, high initial costs for advanced pumps pose a barrier for smaller businesses and municipalities with limited budgets, hindering widespread adoption.

- Regional demand varies, with northern Mexico (Nuevo León, Tamaulipas) being a major industrial hub, while central and southern regions see growth due to infrastructure projects focused on water access and wastewater management.

Market Drivers:

Industrial Expansion

The industrial expansion in Mexico plays a pivotal role in driving the demand for water pumps. As industries such as oil and gas, chemicals, and power generation continue to grow, there is an increasing need for efficient and reliable pumping solutions. Water pumps are integral to these industries for a range of applications, including fluid transfer, cooling systems, and handling hazardous materials. The oil and gas sector, in particular, requires pumps for operations in both upstream and downstream processes, including extraction, transportation, and refining. Similarly, the chemical industry demands high-performance pumps for the safe and efficient movement of liquids and chemicals. As industrial activities expand, the need for advanced water pump systems to support operations intensifies, contributing significantly to market growth.

Infrastructure Development

Infrastructure development is another key driver in the Mexico water pump market. The government and private sector are increasingly investing in the construction and modernization of infrastructure, particularly in water and wastewater management systems. This focus on improving water treatment facilities, urban water supply networks, and irrigation systems has heightened the demand for water pumps that can efficiently manage large volumes of water. For instance, Xylem has partnered with the municipal government of Monterrey to upgrade their wastewater treatment infrastructure, including the installation of Flygt submersible pumps and advanced monitoring systems. As urbanization accelerates and populations grow, particularly in major cities like Mexico City, Guadalajara, and Monterrey, the need for advanced water management solutions becomes more critical. The expansion of municipal and industrial water supply systems further accelerates the demand for water pumps, reinforcing the overall market growth.

Water Scarcity and Conservation Efforts

Mexico’s water scarcity issues are a significant driver of the water pump market. With increasing pressure on the country’s water resources due to population growth, agriculture, and industrialization, there is a growing focus on efficient water management and conservation. The need to optimize water usage, reduce waste, and improve water quality is leading to increased demand for water pumps in both urban and rural settings. Technologies such as pumps for desalination, wastewater treatment, and rainwater harvesting are gaining traction as the country seeks to address its water shortage concerns. Governments, municipalities, and private companies are investing in infrastructure and solutions that improve water use efficiency, driving the demand for advanced pump technologies designed to conserve and optimize water resources.

Technological Advancements

Advancements in pump technology are another important factor propelling the growth of the Mexico water pump market. Over the years, innovations in pump design, materials, and automation have made pumps more efficient, reliable, and cost-effective. For instance, the VEICHI solar pump system installed in Mexico operates automatically, requires no manual monitoring, and eliminates the need for batteries, offering a green, non-polluting, and low-noise solution for agricultural irrigation. Modern pumps are designed to offer higher performance, durability, and energy efficiency, making them a preferred choice for industries and municipalities alike. Additionally, the integration of digital technologies, such as sensors and automated control systems, has improved the monitoring and management of pump systems. These innovations allow users to optimize pump performance, reduce energy consumption, and extend the lifespan of equipment. As technology continues to advance, the water pump market in Mexico is expected to benefit from enhanced product offerings that cater to the growing need for efficiency and sustainability in water management solutions.

Market Trends:

Technological Integration and Smart Pumping Solutions

The Mexico water pump market is experiencing a significant shift towards the integration of advanced technologies, notably the adoption of smart pumping solutions. Manufacturers are increasingly incorporating sensors, artificial intelligence (AI), and data analytics into their pump systems. For example, smart pumps are being deployed in industrial sectors to enable real-time monitoring and predictive maintenance, which helps to detect potential issues before they occur, thus reducing downtime. These innovations enable real-time monitoring, predictive maintenance, and optimization of energy consumption. Such technological advancements not only enhance operational efficiency but also contribute to cost reductions and prolonged equipment lifespan, making them highly attractive to industrial and municipal users seeking sustainable and reliable water management solutions.

Shift Towards Energy-Efficient and Sustainable Pumps

There is a growing emphasis on energy-efficient and environmentally sustainable water pumps in Mexico. This trend is driven by both regulatory pressures and a heightened awareness of environmental impacts. Manufacturers are responding by developing pumps that consume less energy and are made from eco-friendly materials. Additionally, the incorporation of renewable energy sources, such as solar power, into pump systems is gaining traction, particularly in agricultural and rural applications. These sustainable solutions align with Mexico’s broader goals of reducing carbon emissions and promoting green technologies.

Growth in Residential and Irrigation Pump Segments

The residential and agricultural sectors in Mexico are witnessing increased demand for water pumps, reflecting broader trends in urbanization and agricultural modernization. For example, in urban areas like Mexico City, the adoption of residential water pumps has increased by 18% as the demand for efficient water distribution systems grows. Simultaneously, in rural regions, there is a growing adoption of irrigation pumps to support agricultural activities, driven by the need for efficient water usage and enhanced crop yields. This dual demand from both residential and agricultural sectors is contributing to the overall expansion of the water pump market in Mexico.

Regional Disparities in Water Pump Demand

Regional variations in water pump demand are becoming more pronounced across Mexico. Northern states, such as Nuevo León and Tamaulipas, are experiencing robust growth in industrial applications, including oil and gas and chemical processing, which require specialized pumping solutions. In contrast, central and southern regions are focusing more on infrastructure development, particularly in water and wastewater management, leading to increased demand for municipal pumping systems. These regional disparities are influencing market strategies, with companies tailoring their offerings to meet the specific needs of each area.

Market Challenges Analysis:

High Initial Cost of Advanced Pumping Systems

One of the key restraints in the Mexico water pump market is the high initial cost associated with advanced pumping systems. While these pumps offer improved efficiency, sustainability, and reliability, their upfront capital expenditure can be a significant barrier for smaller businesses and municipalities with limited budgets. For instance, the cost of a solar water pump system in Mexico typically ranges between USD 2,000 and USD 6,000, which is often unaffordable for many small farmers and businesses. This financial challenge is particularly evident in sectors like agriculture and smaller urban areas, where investments in cutting-edge pump technology may not always be feasible. Despite the long-term cost savings provided by these pumps, the initial financial commitment remains a constraint for widespread adoption.

Limited Access to Skilled Workforce

Another challenge in the Mexico water pump market is the limited availability of skilled labor required for the installation, operation, and maintenance of advanced pumping systems. As technologies in the water pump sector become more sophisticated, the demand for highly skilled professionals capable of managing these systems increases. However, Mexico faces a shortage of trained workers in this field, which can lead to delays in project implementation and increased operational risks. Without a sufficiently skilled workforce, companies may struggle to fully capitalize on the benefits offered by modern pump technologies.

Regulatory and Compliance Challenges

Navigating the regulatory landscape poses a challenge for companies operating in the Mexico water pump market. Strict environmental and operational regulations can create additional hurdles, particularly for manufacturers and end-users who are required to comply with national and local standards. The process of obtaining permits, meeting environmental requirements, and adhering to safety regulations can be time-consuming and costly. Moreover, any changes to regulations or delays in compliance enforcement can disrupt business operations and increase uncertainty within the market.

Economic Volatility

Economic fluctuations in Mexico, such as inflation or changes in government spending priorities, can pose a challenge to the stability and growth of the water pump market. During periods of economic uncertainty, companies may delay investments in new infrastructure or technologies, leading to slower market growth. Economic instability can also lead to reduced consumer and business spending, further limiting the market’s potential for expansion.

Market Opportunities:

The Mexico water pump market presents significant opportunities driven by the country’s increasing focus on infrastructure development and water management. As urbanization accelerates, particularly in major cities, the demand for efficient water distribution and wastewater management systems is rising. This growth creates an opportunity for water pump manufacturers to supply both residential and industrial applications. The government’s ongoing investments in expanding and modernizing water infrastructure, including treatment plants and irrigation systems, further fuel this demand. Additionally, projects aimed at addressing water scarcity through advanced water treatment solutions, such as desalination and wastewater recycling, present ample opportunities for the adoption of specialized pumping systems.

Furthermore, the growing trend of sustainability and environmental conservation in Mexico offers opportunities for innovation in energy-efficient and eco-friendly pumping solutions. With rising awareness about the need to reduce energy consumption and minimize environmental impact, manufacturers can capitalize on the demand for pumps that incorporate renewable energy sources, such as solar power, and advanced energy-saving technologies. The agricultural sector, particularly in rural areas, also presents growth potential as there is a need for modern irrigation systems to optimize water use and increase crop yields. This creates a substantial opportunity for water pump providers to offer affordable, efficient, and sustainable solutions that meet the needs of both residential and agricultural markets, contributing to the overall market growth in Mexico.

Market Segmentation Analysis:

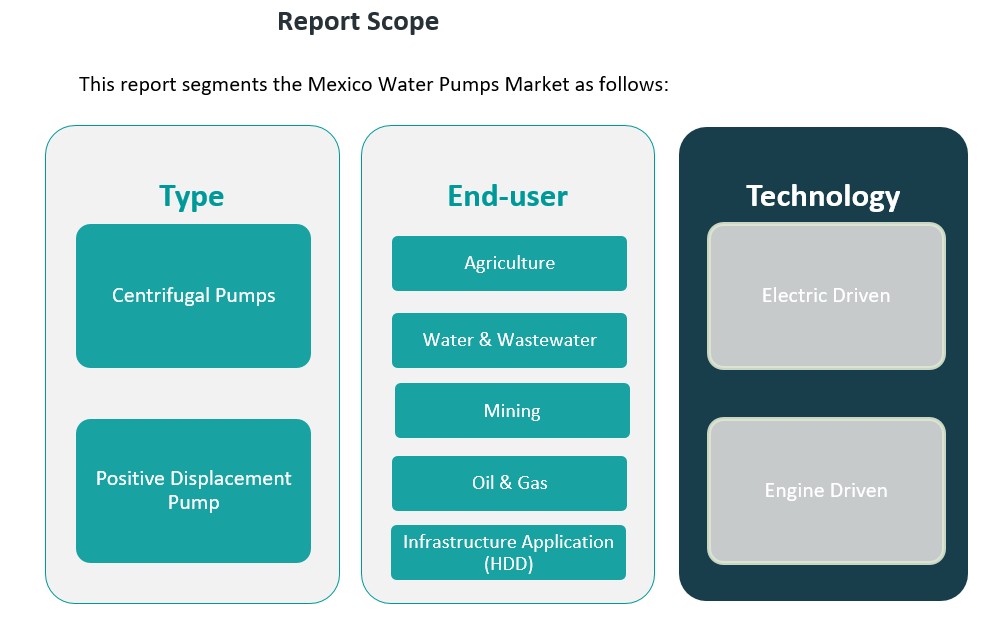

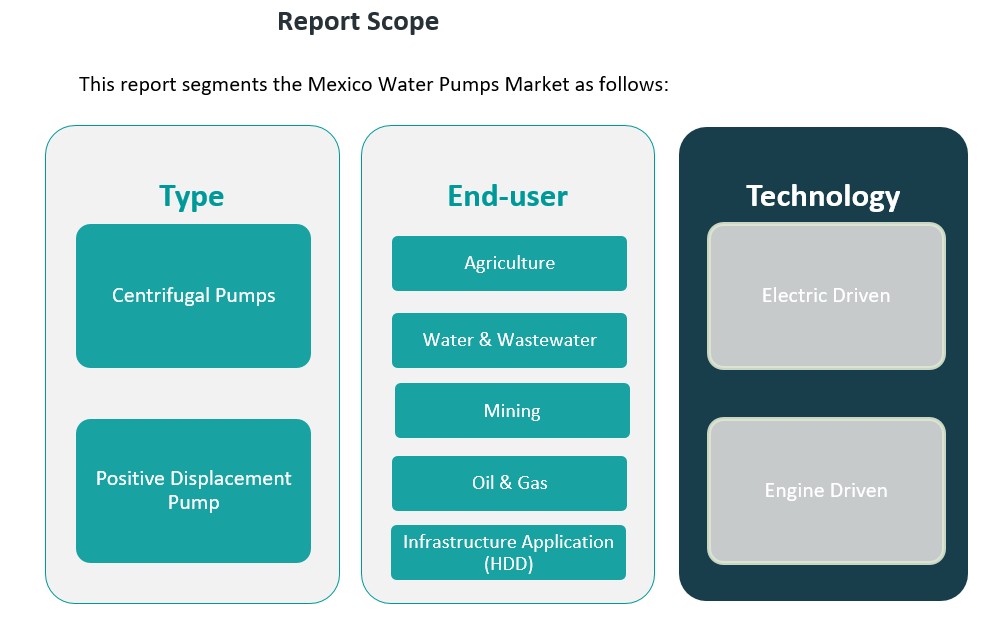

The Mexico water pump market is segmented across various categories, each contributing to the market’s diverse applications and growth.

By Type Segment: The market is primarily divided into centrifugal pumps and positive displacement pumps. Centrifugal pumps dominate the market due to their widespread use in applications requiring high flow rates and continuous water transfer. These pumps are commonly used in water and wastewater management, irrigation systems, and industrial processes. On the other hand, positive displacement pumps, though less common, are preferred for applications requiring precise, consistent flow rates, such as in the oil and gas sector. These pumps are also increasingly used in industries like mining and chemicals, where high-pressure applications are needed.

By End-User Segment: The key end-users of water pumps in Mexico include agriculture, water and wastewater management, mining, oil and gas, and infrastructure applications. The agriculture sector is a significant driver, particularly for irrigation pumps as Mexico looks to modernize farming practices. The water and wastewater sector also represents a major segment due to ongoing urbanization and increased demand for water treatment facilities. The mining sector uses water pumps for slurry and dewatering applications, while the oil and gas industry requires pumps for fluid handling and transportation. Infrastructure applications, particularly horizontal directional drilling (HDD) for pipe installation, also require specialized water pumps to manage water flow during construction.

By Technology Segment: Water pumps are also categorized by their power source, which includes electric-driven and engine-driven pumps. Electric-driven pumps are more commonly used due to their efficiency and lower operational costs, making them ideal for urban and residential applications. Engine-driven pumps, while less energy-efficient, are preferred in remote locations and industries like agriculture and mining, where mobility and durability are critical.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Mexico water pump market is witnessing varying levels of demand across different regions, driven by industrial growth, infrastructure development, and agricultural needs. Each region of the country plays a unique role in shaping the overall market landscape.

In the northern region of Mexico, particularly in states like Nuevo León, Tamaulipas, and Coahuila, industrial growth is a significant driver of the water pump market. The northern region is home to a substantial portion of the country’s manufacturing, oil and gas, and mining industries, all of which require specialized pumping solutions. The oil and gas sector, in particular, contributes to the high demand for pumps used in fluid transfer, cooling, and chemical processing applications. Additionally, the mining industry in northern Mexico relies heavily on water pumps for slurry handling and dewatering. This region’s industrial focus has led to a higher market share in terms of water pump usage in sectors like oil, gas, and mining.

The central region, including states like Jalisco, Guanajuato, and Querétaro, has seen substantial growth in water and wastewater management, with a focus on improving urban infrastructure. The rising urbanization in cities such as Guadalajara has driven demand for water pumps in municipal water distribution systems, wastewater treatment plants, and stormwater management. The need for reliable and efficient water management systems has fueled the demand for water pumps in this region. The central area also supports agriculture, though to a lesser extent compared to the northern and southern parts of the country.

In the southern region, states like Chiapas and Oaxaca, agriculture plays a more dominant role. These areas rely heavily on irrigation systems to support agricultural activities, particularly in rural areas. The adoption of efficient irrigation pumps is growing as farmers modernize their practices to ensure better water conservation and increased crop yields. Furthermore, rural development projects aimed at improving water access have also contributed to the increasing demand for water pumps in the southern part of Mexico.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT INC.

- EBARA CORPORATION

- Ruhrpumpen

Competitive Analysis:

The Mexico water pump market is highly competitive, with numerous players vying for market share across various sectors, including industrial, municipal, and agricultural applications. Key global manufacturers such as Grundfos, Flowserve, and Xylem dominate the market, leveraging their extensive product portfolios and advanced technologies to cater to diverse customer needs. These companies are known for their reliable and energy-efficient pumps, which are essential for industries like oil and gas, water treatment, and agriculture. In addition to global players, regional manufacturers also contribute to the competition, offering cost-effective solutions tailored to the local market. These regional companies often focus on specific niches, such as irrigation pumps for agriculture or pumps for wastewater management, providing specialized products that cater to Mexico’s unique regional demands. To maintain competitiveness, companies in the market are focusing on technological advancements, such as the integration of smart pumping systems and energy-efficient solutions, to meet growing sustainability demands and increase operational efficiency.

Recent Developments:

- In March 2025, SLB was awarded a major drilling contract by Woodside Energy for the ultra-deepwater Trion development project offshore Mexico. The contract covers the delivery of 18 ultra-deepwater wells over three years, leveraging AI-enabled drilling technologies. Operations are set to begin in early 2026, reinforcing SLB’s strategic presence in Mexico’s offshore energy sector.

- In February 2025, Ingersoll Rand acquired SSI Aeration, Inc., a global leader in wastewater treatment plant equipment, to expand its capabilities in the wastewater treatment market. This acquisition allows Ingersoll Rand to offer comprehensive, energy-efficient solutions for municipal and industrial water treatment, supporting its growth strategy in high-potential sustainable markets.

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

Market Concentration & Characteristics:

The Mexico water pump market exhibits a moderately concentrated structure, characterized by the presence of both global and regional players. Prominent international manufacturers such as Grundfos, Xylem, KSB, and Sulzer dominate the market, offering a diverse range of high-quality pumping solutions across various sectors, including water treatment, agriculture, and industrial applications. These companies leverage advanced technologies and extensive distribution networks to maintain a competitive edge. In addition to global players, the market also features a growing number of regional and local manufacturers. These companies often focus on niche segments, providing tailored solutions that cater to specific regional needs and regulatory requirements. Their localized presence allows for more responsive customer service and competitive pricing strategies, which are particularly appealing to small and medium-sized enterprises. The market is witnessing a shift towards energy-efficient and sustainable pumping solutions, driven by increasing environmental awareness and regulatory pressures. Manufacturers are investing in research and development to produce pumps that consume less energy and have a longer operational lifespan. Additionally, the integration of smart technologies, such as IoT-enabled monitoring systems, is becoming more prevalent, enhancing operational efficiency and predictive maintenance capabilities. Despite the competitive landscape, the market faces challenges such as high initial investment costs and the need for skilled labor to operate and maintain advanced pumping systems. However, the ongoing infrastructure development and industrial growth in Mexico present significant opportunities for market expansion and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Mexico water pump market is expected to see steady growth due to increasing industrial activities, particularly in oil and gas, mining, and manufacturing sectors.

- Urbanization and infrastructure development will drive demand for water pumps in municipal water supply and wastewater treatment systems.

- Technological advancements, such as energy-efficient and smart pumps, will become more prevalent as industries seek to optimize operational efficiency.

- The agriculture sector will continue to expand its use of irrigation pumps as farmers modernize practices and focus on water conservation.

- Increasing environmental regulations will push for more sustainable, eco-friendly pumping solutions to reduce energy consumption and minimize carbon footprints.

- Rising awareness of water scarcity will lead to greater investments in water management technologies, including pumps for desalination and wastewater recycling.

- Regional disparities in market demand will encourage tailored solutions for specific sectors like mining in the north and irrigation in the south.

- The integration of IoT and automation into pump systems will improve real-time monitoring and predictive maintenance, enhancing overall system efficiency.

- Competitive pressure will encourage both global and regional manufacturers to innovate and offer cost-effective, high-performance solutions.

- Government initiatives to improve water access and infrastructure will continue to create opportunities for market expansion, particularly in underserved areas.