Frequently Asked Questions:

Market Overview:

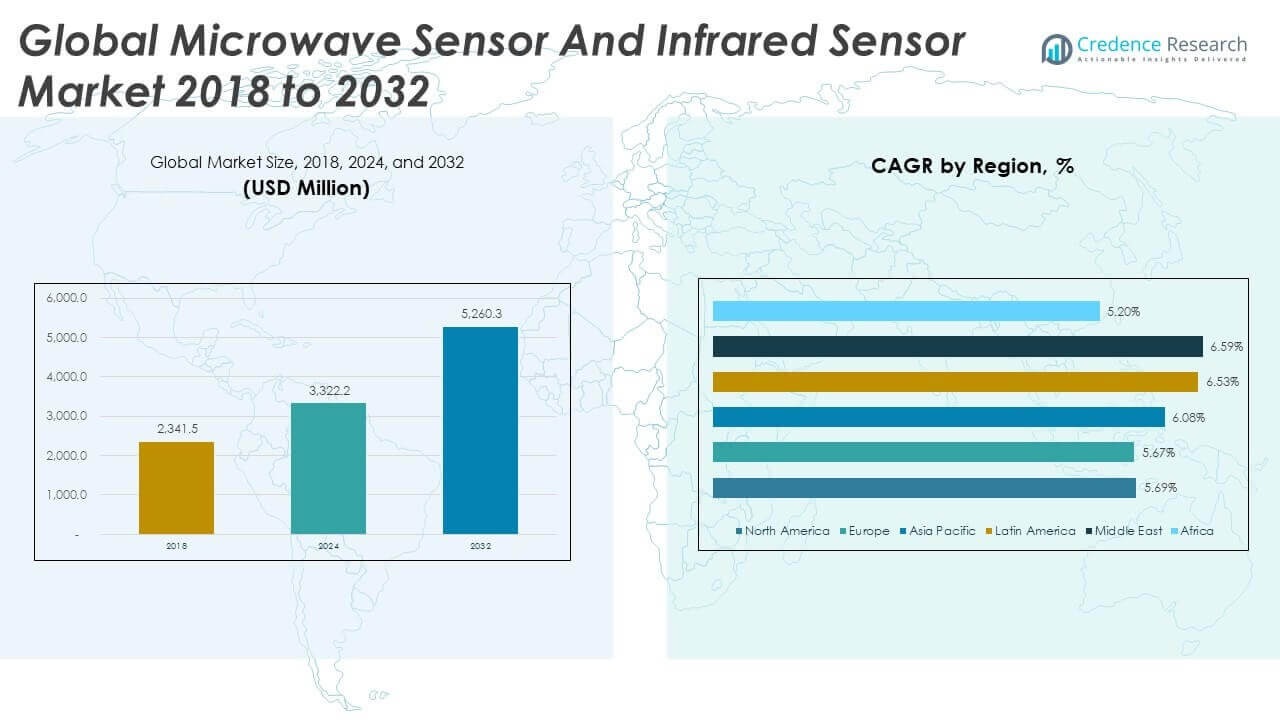

The Global Microwave Sensor and Infrared Sensor Market size was valued at USD 2,341.50 million in 2018 to USD 3,322.20 million in 2024 and is anticipated to reach USD 5,260.30 million by 2032, at a CAGR of 5.92% during the forecast period.

| REPORT ATTRIBUTE | DETAILS |

|---|---|

| Historical Period | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Microwave Sensor and Infrared Sensor Market Size 2024 | USD 3,322.20 million |

| Microwave Sensor and Infrared Sensor Market, CAGR | 5.92% |

| Microwave Sensor and Infrared Sensor Market Size 2032 | USD 5,260.30 million |

The market is growing due to increasing demand for automation, security, and energy-efficient systems across sectors. Microwave sensors offer strong detection performance in harsh environments, while infrared sensors support contactless and precise thermal sensing. Industrial automation, smart homes, automotive safety, and public safety systems drive sensor deployments. Vendors are expanding portfolios with AI-integrated sensing and multi-sensor modules. Demand is further fueled by investments in robotics, defense surveillance, and intelligent infrastructure. The market benefits from rising emphasis on non-contact monitoring and predictive maintenance in smart factories. Innovation and miniaturization also support adoption in wearables and consumer devices.

Asia Pacific leads the global market due to strong electronics manufacturing, urbanization, and smart city initiatives in countries like China, Japan, and South Korea. North America follows, supported by defense, industrial automation, and ADAS adoption. Europe maintains solid growth with regulatory support for energy efficiency and smart infrastructure. Latin America, Middle East, and Africa represent emerging opportunities driven by modernization and security upgrades. Each region shows unique drivers, but all contribute to expanding sensor use in public, private, and industrial domains.

Market Insights:

- The Global Microwave Sensor and Infrared Sensor Market was valued at USD 2,341.5 million in 2018, grew to USD 3,322.2 million in 2024, and is projected to reach USD 5,260.3 million by 2032, expanding at a CAGR of 5.92%.

- Asia Pacific held the largest regional share at 33%, driven by electronics manufacturing, urbanization, and smart infrastructure. Europe followed with 26.6% share due to industrial automation and energy mandates, while North America captured 23.8% through ADAS, defense, and smart home applications.

- The Middle East is the fastest-growing region at 6.59% CAGR, fueled by smart city initiatives, border surveillance systems, and energy automation across GCC nations.

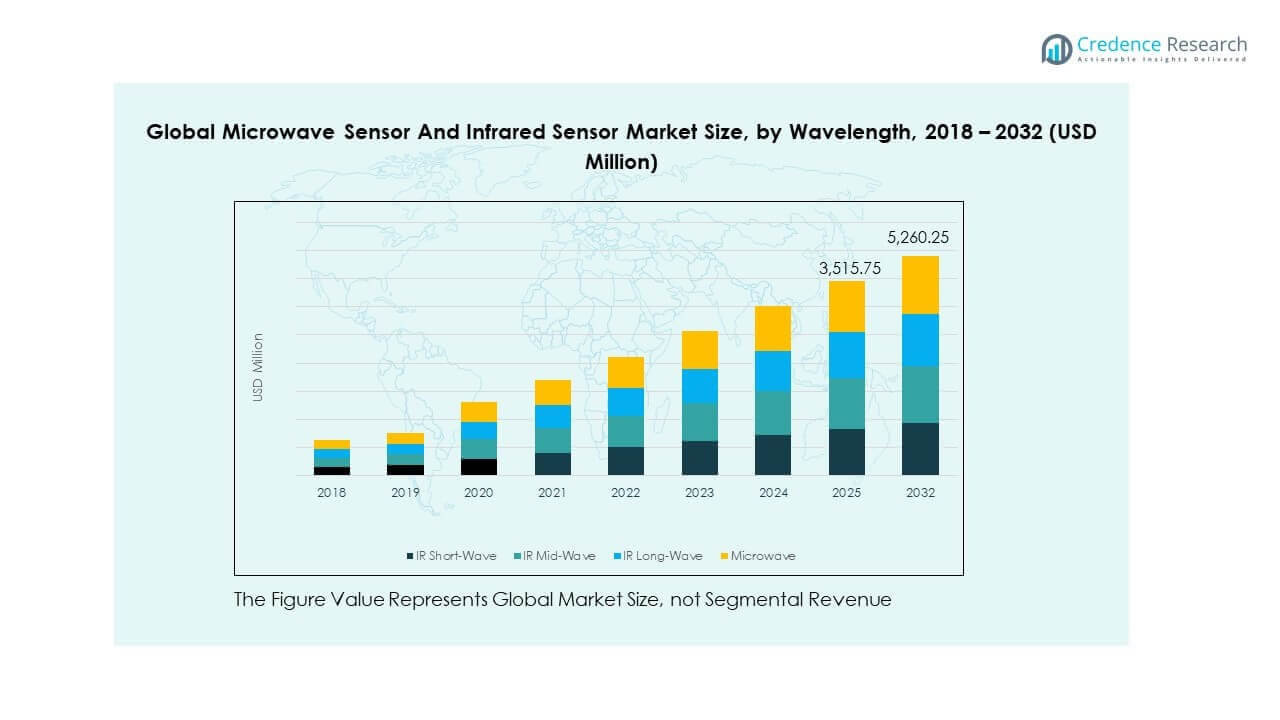

- In 2024, IR Mid-Wave held the largest wavelength segment share at approximately 28%, supporting thermal detection in defense and industrial applications.

- Microwave wavelength sensors accounted for roughly 25% of the 2024 market, favored in automotive, factory safety, and long-range surveillance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download SampleMarket Drivers

Rising Demand for Advanced Motion Detection Across Security and Automation Applications

The Global Microwave Sensor and Infrared Sensor Market is driven by demand for high-precision motion sensing. Security systems increasingly require sensors with better range, sensitivity, and environmental resistance. Microwave sensors offer superior accuracy in detecting motion through walls, smoke, or dust. Infrared sensors remain vital in passive detection for indoor surveillance and consumer electronics. Industrial automation relies on both technologies to enhance safety and operational efficiency. Smart home integration has also surged, pushing sensor adoption in lighting, intrusion alarms, and occupancy monitoring. It benefits from the growing need for intelligent infrastructure. The rise in theft, trespassing, and smart surveillance continues to push deployments.

- For instance, Optex’s REDWALL SIP series includes outdoor dual-technology PIR/microwave detectors designed for wide-area perimeter protection with high stability in harsh conditions.

Integration in Automotive Safety Systems and Advanced Driver Assistance Platforms

Automotive manufacturers integrate microwave and infrared sensors for blind-spot detection, adaptive cruise control, and pedestrian detection. These technologies ensure real-time monitoring of surroundings, improving road safety. The Global Microwave Sensor and Infrared Sensor Market benefits from vehicle electrification and ADAS expansion. Microwave sensors detect motion and object distance, crucial for autonomous features. Infrared sensors support night vision and obstacle tracking. Vehicle safety regulations in North America, Europe, and Asia further support adoption. Automakers deploy sensor fusion to combine outputs for more reliable decisions. It ensures efficient data capture under diverse driving conditions.

- For instance, Continental’s ARS540 is a 77 GHz long‑range 4D imaging radar that measures object range, relative speed, and direction to support advanced driver‑assistance and automated driving systems. The sensor offers high‑resolution detection up to several hundred meters and enhances vehicle environment perception for functions like adaptive cruise control and collision avoidance.

Growing Adoption in Energy-Efficient Smart Building Technologies

Commercial and residential buildings adopt infrared and microwave sensors for lighting control, HVAC automation, and access management. These systems improve energy savings and occupant comfort. Governments promote smart infrastructure through green building standards, supporting sensor demand. The Global Microwave Sensor and Infrared Sensor Market gains from integration into intelligent lighting, fire alarms, and space utilization systems. Microwave sensors detect motion in large or partitioned spaces, while infrared models optimize temperature sensing. Office complexes, malls, and institutions rely on sensors to automate low-use zones. It enhances sustainability metrics for facility operators. Retrofit upgrades in older buildings also fuel uptake.

Industrial Automation and Robotics Driving Sensor Integration in Manufacturing

Factories use sensors for machine monitoring, process control, and asset tracking. Microwave sensors excel in harsh industrial environments due to their resilience to dust, vibration, and temperature. Infrared sensors assist in material identification, fault detection, and thermal profiling. The Global Microwave Sensor and Infrared Sensor Market sees increasing demand from robotics and warehouse automation. Sensors enable autonomous guided vehicles and cobots to navigate and interact safely. Manufacturing plants adopt predictive maintenance strategies supported by sensor data. It helps reduce downtime and improve throughput. Growth of smart factories under Industry 4.0 supports deeper sensor penetration.

Market Trends

Miniaturization of Sensor Modules to Enable Integration in Compact and Portable Devices

Manufacturers develop smaller sensors with equal or improved performance to meet space-constrained applications. This trend supports wearables, drones, and IoT nodes requiring lightweight and compact sensing solutions. The Global Microwave Sensor and Infrared Sensor Market benefits from advances in MEMS and packaging technologies. Portable consumer devices embed motion and proximity detection to enable gesture control and screen optimization. Healthcare monitors, fitness devices, and smart accessories use integrated sensors for real-time tracking. It allows multi-sensor combinations in compact devices. Demand for miniaturized components in AR/VR headsets and compact robotics continues to expand use cases.

- For instance, Sony’s IMX500 intelligent vision sensor integrates a stacked CMOS image sensor with on‑chip AI processing, enabling real‑time inference directly at the sensor level without external processors.

Dual-Technology Sensor Development to Improve Reliability in Diverse Environments

Vendors are combining microwave and infrared sensors into hybrid units to leverage strengths of both technologies. Dual sensors deliver better accuracy by mitigating false alarms due to temperature shifts or obstructions. The Global Microwave Sensor and Infrared Sensor Market gains traction through such innovations. These modules enable smarter decisions for lighting control, intrusion detection, and occupancy monitoring. Commercial buildings and public spaces favor hybrid sensors for consistent performance. It reduces maintenance calls by ensuring accuracy across lighting, weather, or airflow conditions. Demand for fail-safe sensing grows across utilities, metros, and high-traffic buildings.

- For instance, Bosch Security Systems’ TriTech motion detectors combine passive infrared with microwave Doppler sensing and are specified to detect movement across coverage areas up to 12 m by 12 m while reducing nuisance alarms by more than 35% compared with single‑technology PIR units in internal validation tests.

Use of Wireless and Battery-Powered Sensors to Support Flexible Deployments

The shift to wireless sensor networks reduces installation complexity and extends monitoring to remote or hard-to-wire areas. The Global Microwave Sensor and Infrared Sensor Market sees rising preference for battery-operated modules with long-life and low-power design. Smart city initiatives deploy these sensors across parking lots, parks, and transit systems. Wireless sensors support easier retrofitting and scalable installation. It enables cost-effective expansion without large infrastructure changes. Applications in perimeter security, energy monitoring, and public facilities benefit from fast and flexible deployments. Demand for sustainable sensors aligns with green design principles.

Integration with Edge Computing and AI for Real-Time Sensing and Analytics

Edge-enabled sensors process data locally to reduce latency and improve responsiveness. The Global Microwave Sensor and Infrared Sensor Market shifts toward intelligent modules that pair with AI algorithms. Real-time decision-making improves efficiency in traffic control, retail analytics, and smart agriculture. Infrared sensors paired with thermal imaging support predictive maintenance and process optimization. Microwave sensors improve anomaly detection and behavioral tracking in sensitive environments. It supports privacy-focused monitoring without capturing identity details. Localized processing also reduces cloud dependency and bandwidth use.

Market Challenges Analysis

Sensor Accuracy Affected by Environmental Interference and External Operating Conditions

Microwave and infrared sensors face challenges in maintaining precision across varied conditions. Infrared sensors may underperform in environments with high heat or reflective surfaces. Microwave sensors can trigger false positives due to interference from metal surfaces or high-frequency noise. The Global Microwave Sensor and Infrared Sensor Market must overcome design limitations to ensure reliability in critical applications. Dust, fog, smoke, and temperature shifts reduce sensing accuracy. Manufacturers need better shielding, calibration, and filtering to meet end-user expectations. It affects deployments in industrial, outdoor, or high-traffic areas. Poor signal discrimination in complex settings impacts system trust.

Cost Pressures, IP Licensing, and Compatibility with Legacy Infrastructure

Market adoption is limited by pricing concerns in low-margin verticals. Integration into legacy systems increases the need for backward compatibility and custom interfaces. The Global Microwave Sensor and Infrared Sensor Market must address challenges in interoperability across platforms. Product development incurs high R&D and compliance costs, especially for automotive and defense-grade models. Licensing fees for patented sensing technologies also raise total costs. It affects uptake in budget-constrained municipal or public-sector projects. Vendors must balance performance, cost, and ecosystem compatibility. Long sales cycles in institutional procurement slow deployment pace.

Market Opportunities

Expansion of Smart City Projects and Public Infrastructure Modernization Globally

Smart cities incorporate intelligent sensors for lighting, traffic, waste, and crowd management. These applications rely on real-time detection, automation, and low maintenance. The Global Microwave Sensor and Infrared Sensor Market can scale across parking zones, transit hubs, and surveillance posts. Governments prioritize digitized infrastructure to improve urban living standards. It offers volume opportunities for sensor makers with durable and energy-efficient solutions. Growth in Asia, Middle East, and Latin America creates new deployment zones.

Rise of AI-Powered Surveillance, Retail Analytics, and Building Intelligence

Advanced analytics enhances value of sensor data for security and facility management. AI integration supports behavior tracking, people counting, and anomaly detection. The Global Microwave Sensor and Infrared Sensor Market can grow by serving next-gen smart retail, airports, and commercial campuses. It meets demand for automated insights without compromising privacy. These trends open new revenue streams for OEMs and platform providers.

Market Segmentation Analysis:

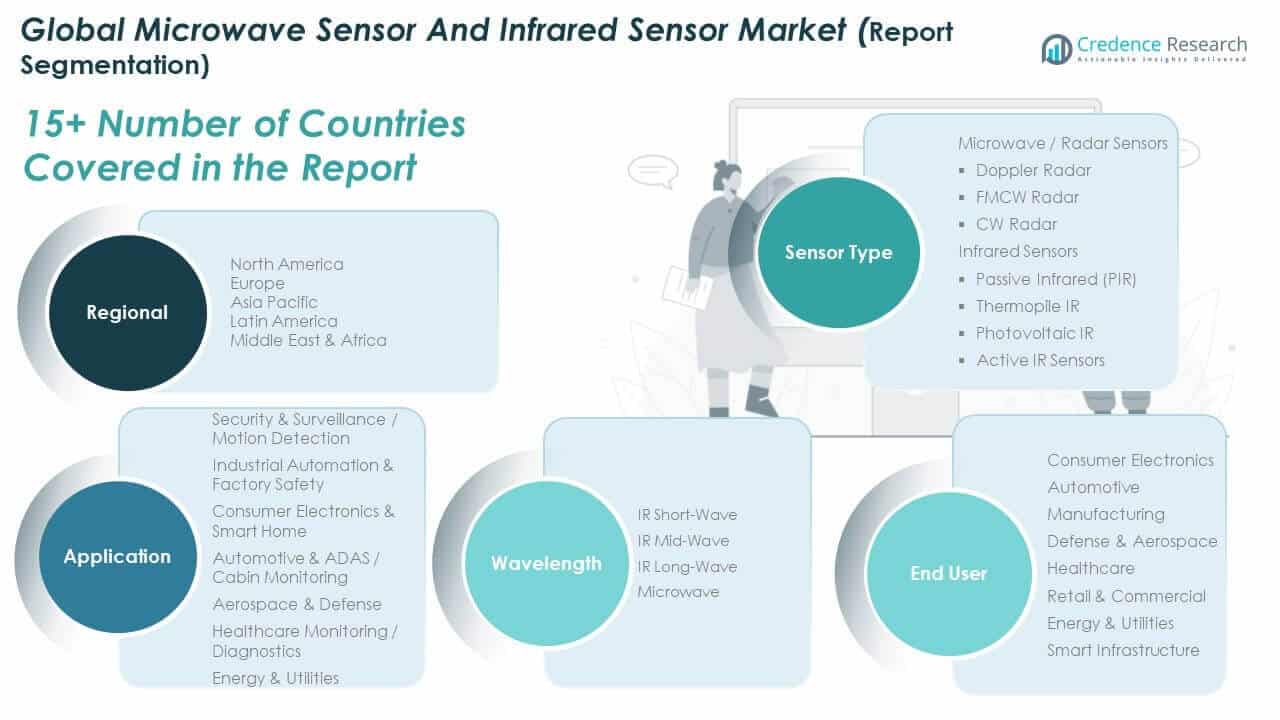

By Sensor Type

Microwave/Radar sensors dominate due to their reliability in challenging conditions like fog, dust, or glass obstructions. Doppler radar remains popular for motion detection and speed measurement in security and automotive systems. FMCW radar supports short- and long-range detection, enabling safer ADAS functionality. CW radar suits low-cost motion-sensing applications. Infrared sensors also hold strong share. PIR sensors lead in occupancy detection for smart homes. Thermopile IR supports temperature measurement and industrial safety. Photovoltaic and active IR sensors offer niche uses in flame detection and gesture control. The Global Microwave Sensor and Infrared Sensor Market benefits from varied sensor types across cost and performance needs.

- For instance, Texas Instruments’ IWR6843 mmWave sensor operates at 60-64 GHz with 4 receive and 3 transmit channels for industrial motion detection.

By Application

Security and surveillance represent the largest application due to the demand for reliable motion detection and intrusion control. Industrial automation leverages sensors for safety, process optimization, and robot navigation. Consumer electronics continue to integrate IR sensors in wearables, smartphones, and home automation. Automotive applications grow with ADAS, in-cabin sensing, and driver monitoring. Aerospace and defense use sensors for perimeter security and missile guidance. Healthcare uses them for contactless patient monitoring. Energy and utilities benefit from sensors in predictive maintenance and fault detection. It supports diverse applications across personal, industrial, and mission-critical domains.

By Wavelength

Microwave band dominates in industrial, automotive, and security use due to high penetration and long-range detection. IR long-wave sensors see adoption in surveillance and temperature-sensing systems due to their thermal imaging capability. Mid-wave IR is used in high-end defense and scientific instrumentation. Short-wave IR sensors are favored in spectroscopy, semiconductor inspection, and chemical analysis. The Global Microwave Sensor and Infrared Sensor Market leverages different wavelengths based on application complexity, response time, and range requirements. It creates a layered adoption pattern across price-performance tiers.

By End User

Consumer electronics remains a key end-user segment, driven by the integration of sensors in phones, appliances, and wearables. Automotive firms adopt both microwave and infrared sensors to meet evolving safety and automation goals. Manufacturing facilities use sensors for robotics, equipment health monitoring, and safety compliance. Defense and aerospace demand highly precise and rugged sensors for security and tactical systems. Healthcare providers adopt contactless sensors for real-time diagnostics. Retail and commercial segments adopt them for space optimization and customer tracking. Smart infrastructure and utilities adopt sensors for intelligent lighting, grid monitoring, and energy efficiency. It supports a wide end-user base with both volume and high-value opportunities.

- For instance, Texas Instruments’ IWR6843 mmWave sensor, based on FMCW radar technology, supports industrial safety applications such as presence detection and machine guard systems that stop equipment when operators enter hazardous zones.

Segmentation:

By Sensor Type

- Microwave / Radar Sensors

- Doppler Radar

- FMCW Radar

- CW Radar

- Infrared Sensors

- Passive Infrared (PIR)

- Thermopile IR

- Photovoltaic IR

- Active IR Sensors

By Application

- Security & Surveillance / Motion Detection

- Industrial Automation & Factory Safety

- Consumer Electronics & Smart Home

- Automotive & ADAS / Cabin Monitoring

- Aerospace & Defense

- Healthcare Monitoring / Diagnostics

- Energy & Utilities

By Wavelength

- IR Short-Wave

- IR Mid-Wave

- IR Long-Wave

- Microwave

By End User

- Consumer Electronics

- Automotive

- Manufacturing

- Defense & Aerospace

- Healthcare

- Retail & Commercial

- Energy & Utilities

- Smart Infrastructure

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Microwave Sensor and Infrared Sensor Market size was valued at USD 564.55 million in 2018 to USD 790.74 million in 2024 and is anticipated to reach USD 1,230.37 million by 2032, at a CAGR of 5.69% during the forecast period. North America accounted for 23.8% of the global market in 2024. The region benefits from strong adoption across industrial automation, homeland security, and connected vehicles. U.S.-based manufacturers integrate radar and IR sensors into advanced driver-assistance systems (ADAS) and smart infrastructure. High deployment in smart homes, perimeter control, and commercial monitoring supports demand. The defense sector contributes significantly through drone vision, missile systems, and border surveillance. The Global Microwave Sensor and Infrared Sensor Market in North America is shaped by advanced R&D, supportive government funding, and mature supply chains. It continues to see steady integration into both consumer and enterprise applications. Urban modernization and data-driven building systems enhance the long-term outlook.

Europe

The Europe Global Microwave Sensor and Infrared Sensor Market size was valued at USD 632.22 million in 2018 to USD 884.19 million in 2024 and is anticipated to reach USD 1,372.93 million by 2032, at a CAGR of 5.67% during the forecast period. Europe represented 26.6% of the global market in 2024. The region shows high demand in automotive, industrial robotics, and energy management. Leading OEMs adopt sensors to comply with emissions, safety, and sustainability mandates. Germany, France, and the UK lead adoption across electric vehicles and smart factories. Building automation also drives uptake of PIR and thermopile IR sensors. The Global Microwave Sensor and Infrared Sensor Market in Europe benefits from EU’s focus on energy efficiency and circular economy. Defense modernization and airport upgrades contribute to stable sensor deployments. Growth remains anchored by precision manufacturing, strong regulatory frameworks, and digital transformation.

Asia Pacific

The Asia Pacific Global Microwave Sensor and Infrared Sensor Market size was valued at USD 764.98 million in 2018 to USD 1,094.91 million in 2024 and is anticipated to reach USD 1,753.77 million by 2032, at a CAGR of 6.08% during the forecast period. Asia Pacific held the 33% share of the global market in 2024, making it the largest regional contributor. China, Japan, South Korea, and India fuel demand through expanding electronics manufacturing and urbanization. Smart city initiatives, 5G rollouts, and automotive electrification contribute to large-scale sensor deployment. PIR and radar modules are embedded in home appliances, lighting systems, and public surveillance. The Global Microwave Sensor and Infrared Sensor Market in Asia Pacific grows with OEM innovation and economies of scale. Government programs drive localization of production and next-gen semiconductor investment. Competitive pricing and rising disposable income further support volume growth.

Latin America

The Latin America Global Microwave Sensor and Infrared Sensor Market size was valued at USD 205.12 million in 2018 to USD 301.56 million in 2024 and is anticipated to reach USD 499.72 million by 2032, at a CAGR of 6.53% during the forecast period. Latin America contributed 9.1% to the global revenue in 2024. Brazil and Mexico lead adoption across automotive and industrial zones. Energy utilities and transport infrastructure use sensors to improve safety and monitoring. PIR sensors are gaining ground in commercial security systems and consumer devices. The Global Microwave Sensor and Infrared Sensor Market in Latin America benefits from import substitution and infrastructure digitization. Government contracts in urban lighting and traffic management present near-term opportunities. Cost-effective sensor integration remains key for broader regional uptake. Investments in automation and smart building retrofits will gradually expand adoption.

Middle East

The Middle East Global Microwave Sensor and Infrared Sensor Market size was valued at USD 111.93 million in 2018 to USD 165.21 million in 2024 and is anticipated to reach USD 275.11 million by 2032, at a CAGR of 6.59% during the forecast period. Middle East held a 5% share of the global market in 2024. Gulf countries deploy sensors across smart city projects, border surveillance, and oilfield automation. Infrared sensors are widely used for fire detection, temperature tracking, and energy monitoring. The Global Microwave Sensor and Infrared Sensor Market in this region gains traction through security upgrades and AI-led infrastructure. Demand is growing in commercial buildings, airports, and utilities. Public safety projects and renewable energy grids create steady demand. Sensor manufacturers benefit from high-spec project requirements and technology-neutral procurement.

Africa

The Africa Global Microwave Sensor and Infrared Sensor Market size was valued at USD 62.75 million in 2018 to USD 85.62 million in 2024 and is anticipated to reach USD 128.35 million by 2032, at a CAGR of 5.20% during the forecast period. Africa accounted for 2.6% of the global market in 2024. Sensor deployment is expanding in urban safety, renewable energy, and healthcare applications. South Africa and Egypt lead in adoption due to infrastructure modernization and growing electronics imports. The Global Microwave Sensor and Infrared Sensor Market in Africa remains nascent but shows potential in energy, mining, and telecom sectors. Off-grid solar installations use motion and thermal sensors for automation and theft prevention. Public health and diagnostics create demand for infrared-based non-contact solutions. Strategic partnerships and government-backed digitization programs will help expand regional access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- STMicroelectronics

- Omron Corporation

- Panasonic Corporation

- Hamamatsu Photonics K.K.

- Texas Instruments Incorporated

- Raytheon Technologies Corporation

- Other Key Players

Competitive Analysis:

The Global Microwave Sensor and Infrared Sensor Market features a mix of global electronics giants and niche sensor specialists. Key players include Honeywell, STMicroelectronics, Murata, Omron, Panasonic, and Texas Instruments. These firms compete on accuracy, power efficiency, range, and integration capability. It remains highly competitive due to rapid innovation and falling sensor costs. Companies invest in AI-enabled modules, hybrid technologies, and application-specific customization. Mergers, partnerships, and regional expansions strengthen market reach and production flexibility. Leading vendors secure contracts in automotive, industrial, and defense sectors, where performance and reliability are critical. Competitive advantage depends on product miniaturization, interoperability, and supply chain agility.

Recent Developments:

- In October 2025, LightPath Technologies received a $4.8 million purchase order from a returning customer for advanced infrared camera systems tailored for public safety applications.

Report Coverage:

The research report offers an in-depth analysis based on Sensor Type, Application, Wavelength, and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will benefit from deeper penetration of sensors in smart homes and connected buildings worldwide.

- Automotive adoption will expand with stronger focus on cabin monitoring and driver safety systems.

- Industrial automation will rely more on robust sensors for safety compliance and machine intelligence.

- Defense and aerospace demand will remain steady due to surveillance and threat detection needs.

- Healthcare adoption will rise through contactless diagnostics and patient monitoring solutions.

- Smart infrastructure projects will create long-term demand for motion and thermal sensing.

- Sensor fusion will gain importance to improve accuracy and reduce false detection events.

- Miniaturized and low-power designs will support integration in compact electronics.

- Regional manufacturing hubs will strengthen supply chains and reduce dependency risks.

- Ongoing innovation will push wider adoption across emerging and cost-sensitive markets.

Table of Content

CHAPTER NO. 1 : GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

2.1 Pulse of the Industry – Market Snapshot

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Sensor Type Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Sensor Type, Application, Wavelength, & End User Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis By Region

6.1.1. Global Microwave Sensor And Infrared Sensor Market Import Revenue By Region

6.2. Export Analysis By Region

6.2.1. Global Microwave Sensor And Infrared Sensor Market Export Revenue By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. Global Microwave Sensor And Infrared Sensor Market: Company Market Share

7.2. Global Microwave Sensor And Infrared Sensor Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Services Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

CHAPTER NO. 8 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET – BY SENSOR TYPE SEGMENT ANALYSIS

8.1. Microwave Sensor And Infrared Sensor Market Overview By Sensor Type Segment

8.1.1. Microwave Sensor And Infrared Sensor Market Revenue Share By Sensor Type

8.2. Microwave / Radar Sensors

8.2.1. Doppler Radar

8.2.2. FMCW Radar

8.2.3. CW Radar

8.3. Infrared Sensors

8.3.1. Passive Infrared (PIR)

8.3.2. Thermopile IR

8.3.3. Photovoltaic IR

8.3.4. Active IR Sensors

CHAPTER NO. 9 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET – BY APPLICATION SEGMENT ANALYSIS

9.1. Microwave Sensor And Infrared Sensor Market Overview By Application Segment

9.1.1. Microwave Sensor And Infrared Sensor Market Revenue Share By Application

9.2. Security & Surveillance / Motion Detection

9.3. Industrial Automation & Factory Safety

9.4. Consumer Electronics & Smart Home

9.5. Automotive & ADAS / Cabin Monitoring

9.6. Aerospace & Defense

9.7. Healthcare Monitoring / Diagnostics

9.8. Energy & Utilities

CHAPTER NO. 10 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET – BY WAVELENGTH SEGMENT ANALYSIS

10.1. Microwave Sensor And Infrared Sensor Market Overview By Wavelength Segment

10.1.1. Microwave Sensor And Infrared Sensor Market Revenue Share By Wavelength

10.2. IR Short-Wave

10.3. IR Mid-Wave

10.4. IR Long-Wave

10.5. Microwave

CHAPTER NO. 11 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET – BY END USER SEGMENT ANALYSIS

11.1. Microwave Sensor And Infrared Sensor Market Overview By End User Segment

11.1.1. Microwave Sensor And Infrared Sensor Market Revenue Share By End User

11.2. Consumer Electronics

11.3. Automotive

11.4. Manufacturing

11.5. Defense & Aerospace

11.6. Healthcare

11.7. Retail & Commercial

11.8. Energy & Utilities

11.9. Smart Infrastructure

CHAPTER NO. 12 : MICROWAVE SENSOR AND INFRARED SENSOR MARKET – REGIONAL ANALYSIS

12.1. Microwave Sensor And Infrared Sensor Market Overview By Region Segment

12.1.1. Global Microwave Sensor And Infrared Sensor Market Revenue Share By Region

12.1.2. Regions

12.1.3. Global Microwave Sensor And Infrared Sensor Market Revenue By Region

12.1.4. Sensor Type

12.1.5. Global Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

12.1.6. Application

12.1.7. Global Microwave Sensor And Infrared Sensor Market Revenue By Application

12.1.8. Wavelength

12.1.9. Global Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

12.1.10. End User

12.1.11. Global Microwave Sensor And Infrared Sensor Market Revenue By End User

CHAPTER NO. 13 : NORTH AMERICA MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

13.1. North America Microwave Sensor And Infrared Sensor Market Overview By Country Segment

13.1.1. North America Microwave Sensor And Infrared Sensor Market Revenue Share By Region

13.2. North America

13.2.1. North America Microwave Sensor And Infrared Sensor Market Revenue By Country

13.2.2. Sensor Type

13.2.3. North America Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

13.2.4. Application

13.2.5. North America Microwave Sensor And Infrared Sensor Market Revenue By Application

13.2.6. Wavelength

13.2.7. North America Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

13.2.8. End User

13.2.9. North America Microwave Sensor And Infrared Sensor Market Revenue By End User

13.3. U.S.

13.4. Canada

13.5. Mexico

CHAPTER NO. 14 : EUROPE MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

14.1. Europe Microwave Sensor And Infrared Sensor Market Overview By Country Segment

14.1.1. Europe Microwave Sensor And Infrared Sensor Market Revenue Share By Region

14.2. Europe

14.2.1. Europe Microwave Sensor And Infrared Sensor Market Revenue By Country

14.2.2. Sensor Type

14.2.3. Europe Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

14.2.4. Application

14.2.5. Europe Microwave Sensor And Infrared Sensor Market Revenue By Application

14.2.6. Wavelength

14.2.7. Europe Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

14.2.8. End User

14.2.9. Europe Microwave Sensor And Infrared Sensor Market Revenue By End User

14.3. UK

14.4. France

14.5. Germany

14.6. Italy

14.7. Spain

14.8. Russia

14.9. Rest of Europe

CHAPTER NO. 15 : ASIA PACIFIC MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

15.1. Asia Pacific Microwave Sensor And Infrared Sensor Market Overview By Country Segment

15.1.1. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue Share By Region

15.2. Asia Pacific

15.2.1. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue By Country

15.2.2. Sensor Type

15.2.3. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

15.2.4. Application

15.2.5. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue By Application

15.2.6. Wavelength

15.2.7. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

15.2.8. End User

15.2.9. Asia Pacific Microwave Sensor And Infrared Sensor Market Revenue By End User

15.3. China

15.4. Japan

15.5. South Korea

15.6. India

15.7. Australia

15.8. Southeast Asia

15.9. Rest of Asia Pacific

CHAPTER NO. 16 : LATIN AMERICA MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

16.1. Latin America Microwave Sensor And Infrared Sensor Market Overview By Country Segment

16.1.1. Latin America Microwave Sensor And Infrared Sensor Market Revenue Share By Region

16.2. Latin America

16.2.1. Latin America Microwave Sensor And Infrared Sensor Market Revenue By Country

16.2.2. Sensor Type

16.2.3. Latin America Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

16.2.4. Application

16.2.5. Latin America Microwave Sensor And Infrared Sensor Market Revenue By Application

16.2.6. Wavelength

16.2.7. Latin America Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

16.2.8. Form

16.2.9. Latin America Microwave Sensor And Infrared Sensor Market Revenue By End User

16.3. Brazil

16.4. Argentina

16.5. Rest of Latin America

CHAPTER NO. 17 : MIDDLE EAST MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

17.1. Middle East Microwave Sensor And Infrared Sensor Market Overview By Country Segment

17.1.1. Middle East Microwave Sensor And Infrared Sensor Market Revenue Share By Region

17.2. Middle East

17.2.1. Middle East Microwave Sensor And Infrared Sensor Market Revenue By Country

17.2.2. Sensor Type

17.2.3. Middle East Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

17.2.4. Application

17.2.5. Middle East Microwave Sensor And Infrared Sensor Market Revenue By Application

17.2.6. Wavelength

17.2.7. Middle East Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

17.2.8. End User

17.2.9. Middle East Microwave Sensor And Infrared Sensor Market Revenue By End User

17.3. GCC Countries

17.4. Israel

17.5. Turkey

17.6. Rest of Middle East

CHAPTER NO. 18 : AFRICA MICROWAVE SENSOR AND INFRARED SENSOR MARKET – COUNTRY ANALYSIS

18.1. Africa Microwave Sensor And Infrared Sensor Market Overview By Country Segment

18.1.1. Africa Microwave Sensor And Infrared Sensor Market Revenue Share By Region

18.2. Africa

18.2.1. Africa Microwave Sensor And Infrared Sensor Market Revenue By Country

18.2.2. Sensor Type

18.2.3. Africa Microwave Sensor And Infrared Sensor Market Revenue By Sensor Type

18.2.4. Application

18.2.5. Africa Microwave Sensor And Infrared Sensor Market Revenue By Application

18.2.6. Wavelength

18.2.7. Africa Microwave Sensor And Infrared Sensor Market Revenue By Wavelength

18.2.8. En User

18.2.9. Africa Microwave Sensor And Infrared Sensor Market Revenue By End User

18.3. South Africa

18.4. Egypt

18.5. Rest of Africa

CHAPTER NO. 19 : COMPANY PROFILES

19.1. Honeywell International Inc.

19.1.1. Company Overview

19.1.2. Product Portfolio

19.1.3. Financial Overview

19.1.4. Recent Developments

19.1.5. Growth Strategy

19.1.6. SWOT Analysis

19.2. Murata Manufacturing Co., Ltd.

19.3. STMicroelectronics

19.4. Omron Corporation

19.5. Panasonic Corporation

19.6. Hamamatsu Photonics K.K.

19.7. Murata Manufacturing Co., Ltd.

19.8. Texas Instruments Incorporated

19.9. Raytheon Technologies Corporation

19.10. Other Key Players

Request A Free Sample

We prioritize the confidentiality and security of your data. Our promise: your information remains private.

Ready to Transform Data into Decisions?

Request Your Sample Report and Start Your Journey of Informed Choices

Providing the strategic compass for industry titans.

About Author

Sushant Phapale

ICT & Automation Expert

Sushant is an expert in ICT, automation, and electronics with a passion for innovation and market trends.

Related Reports

Africa RFID Market

The Africa RFID Market size was valued at USD 184.5 million in 2018 to USD 259.6 million in 2024 and is anticipated to reach USD 416.4 million by 2032, at a CAGR of 6.11% during the forecast period.

System on Module Market

The System on Module Market size was valued at USD 850.00 million in 2018 to USD 1,386.07 million in 2024 and is anticipated to reach USD 4,076.28 million by 2032, at a CAGR of 14.54% during the forecast period.

India Switches Market

The India Switches Market size was valued at USD 1,197.81 million in 2018 to USD 2,249.81 million in 2024 and is anticipated to reach USD 5,797.32 million by 2032, at a CAGR of 11.70% during the forecast period.

Rigid Flex PCB Market

The Rigid-flex Printed Circuit Boards (PCBs) Market size was valued at USD 18,200.00 million in 2018 to USD 25,401.18 million in 2024 and is anticipated to reach USD 55,187.31 million by 2032, at a CAGR of 10.27% during the forecast period.

Semiconductor Bonder Machine Market

The Semiconductor Bonder Machine Market size was valued at USD 890.00 million in 2018 to USD 1,153.03 million in 2024 and is anticipated to reach USD 1,995.61 million by 2032, at a CAGR of 7.14% during the forecast period.

U.S. Electric Toothbrush Market

The U.S. Electric Toothbrush Market size was valued at USD 887.41 million in 2018 to USD 1,177.15 million in 2024 and is anticipated to reach USD 1,687.28 million by 2032, at a CAGR of 4.28% during the forecast period.

Emergency Restoration Systems Market

The Emergency Restoration Systems Market size was valued at USD 1,900.00 million in 2018 to USD 2,509.72 million in 2024 and is anticipated to reach USD 4,647.54 million by 2032, at a CAGR of 8.12% during the forecast period.

On-Board Magnetic Sensors Market

The On board magnetic sensors market is projected to grow from USD 1,509 million in 2024 to USD 3,789.3 million by 2032. The market is expected to expand at a compound annual growth rate of 12.2% from 2024 to 2032.

Electronic Document Management System Market

The Global Electronic Document Management System Market size was valued at USD 3,965.50 million in 2018 to USD 8,149.30 million in 2024 and is anticipated to reach USD 20,449.71 million by 2032, at a CAGR of 11.36% during the forecast period.

Trace Chemical Detector Market

The Global Trace Chemical Detector Market size was valued at USD 1,800.00 million in 2018 to USD 2,335.02 million in 2024 and is anticipated to reach USD 4,064.87 million by 2032, at a CAGR of 7.22% during the forecast period.

Retail Sourcing and Procurement Market

Retail Sourcing and Procurement Market size was valued at USD 5,820 million in 2024 and is anticipated to reach USD 19,080.37 million by 2032, at a CAGR of 16% during the forecast period.

Retail Logistics Market

Retail Logistics Market size was valued at USD 283,520 million in 2024 and is anticipated to reach USD 743,115.8 million by 2032, at a CAGR of 12.8% during the forecast period.

Licence Option

Report delivery within 24 to 48 hours

Quick Connect

Europe

North America

Request A Free Sample

What people say?

Thank you for the data! The numbers are exactly what we asked for and what we need to build our business case.

Materials Scientist

(privacy requested)

The report was an excellent overview of the Industrial Burners market. This report does a great job of breaking everything down into manageable chunks.

Imre Hof

Management Assistant, Bekaert

Trusted By