| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Data Center Containment Market Size 2024 |

USD 165.72 Million |

| Middle East Data Center Containment Market, CAGR |

9.97% |

| Middle East Data Center Containment Market Size 2032 |

USD 354.40 Million |

Market Overview

The Middle East Data Center Containment Market is projected to grow from USD 165.72 million in 2024 to an estimated USD 354.40 million by 2032, with a compound annual growth rate (CAGR) of 9.97% from 2025 to 2032. This significant growth is driven by the rising demand for efficient cooling solutions and the expansion of data centers across the region.

Several factors are fueling the market’s growth, including the rapid expansion of the IT and telecom sectors, which require energy-efficient and scalable data center infrastructures. Data center operators are increasingly adopting containment solutions to optimize cooling efficiency and reduce operational costs. In addition, the increasing adoption of edge computing, the proliferation of IoT devices, and the ongoing investments in smart city projects are all major drivers. The growing emphasis on sustainability and energy efficiency also plays a crucial role in boosting demand for containment solutions.

Geographically, the Middle East market is experiencing rapid development, with the United Arab Emirates (UAE), Saudi Arabia, and Qatar emerging as key hubs for data center expansion. These countries are witnessing strong investments in digital infrastructure, further spurring the demand for containment solutions. Leading players in the market include companies like Vertiv, Schneider Electric, Rittal, and Stulz, who are playing a significant role in offering innovative containment solutions to meet the evolving needs of data centers in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East Data Center Containment Market is projected to grow from USD 165.72 million in 2024 to USD 354.40 million by 2032, with a CAGR of 9.97% from 2025 to 2032, driven by the rising demand for energy-efficient cooling solutions.

- Increasing reliance on cloud computing, edge computing, IoT devices, and digitalization initiatives is driving the demand for advanced data center containment solutions across the region.

- Rapid expansion of the IT and telecom sectors is fueling the need for scalable and energy-efficient data center infrastructures, propelling the demand for containment systems.

- High initial investment costs associated with advanced containment systems and ongoing operational costs may limit adoption for smaller data center operators in the region.

- The complexity of integrating new containment systems into existing legacy infrastructure may hinder the adoption rate, especially in older data centers.

- The UAE, Saudi Arabia, and Qatar are leading the data center containment market, with these countries driving major investments in digital infrastructure and smart city projects.

- Smaller GCC countries are gradually increasing their data center investments, which will contribute to the market’s growth in the coming years, though at a slower pace than the key players.

Market Drivers

Growing Demand for Energy Efficiency and Cost Optimization

The increasing need for energy efficiency is one of the primary drivers of the Middle East Data Center Containment Market. With the exponential rise in data traffic and the demand for cloud computing, data centers are under constant pressure to handle greater workloads while minimizing energy consumption. Data centers in the region face unique challenges due to harsh climatic conditions, which necessitate efficient cooling systems. Containment solutions, such as hot and cold aisle containment, optimize airflow within data centers, ensuring cool air is directed where needed while hot air is effectively contained and removed. For instance, Gulf Data Hub has implemented state-of-the-art containment systems in its facilities across the UAE and Saudi Arabia to address these challenges effectively. These measures result in significant energy savings by reducing cooling costs and enhancing operational efficiency. As global energy efficiency regulations tighten and businesses seek ways to lower operational expenses, data center operators in the Middle East increasingly adopt containment solutions as a cost-effective measure. These systems not only reduce energy consumption but also extend equipment lifespan, minimizing maintenance needs and replacement frequency. This dual benefit of cost savings and operational sustainability makes containment solutions a critical component of modern data center strategies in the region.

Expansion of Data Centers and Digital Transformation

The Middle East is undergoing a rapid digital transformation, with governments and businesses embracing cloud computing, big data analytics, IoT technologies, and AI. This shift has led to a surge in demand for data storage and processing capabilities, driving the expansion of data centers across the region. For instance, Saudi Arabia’s Vision 2030 initiative has spurred investments in hyperscale data centers to support smart cities like Neom. As more data centers emerge, challenges related to space optimization, cooling, and power efficiency become increasingly complex.To address these issues, operators are turning to advanced containment systems that enhance airflow management and reduce cooling energy consumption. These solutions also optimize physical space utilization within facilities. The adoption of cloud services by industries such as retail, banking, healthcare, and education further accelerates this trend. As an example, modular designs have gained popularity due to their scalability and energy efficiency. By ensuring operational efficiency while meeting growing digital demands, containment solutions play a pivotal role in supporting the region’s digital transformation initiatives.

Government Initiatives and Investments in Digital Infrastructure

Governments in the Middle East, particularly in countries like the United Arab Emirates (UAE), Saudi Arabia, and Qatar, are heavily investing in the development of digital infrastructure to position themselves as global technology hubs. These initiatives are part of broader national strategies aimed at diversifying economies, enhancing technological innovation, and supporting the digital economy. As part of these initiatives, significant investments are being made in the construction and expansion of data centers. The Middle East governments’ push for innovation through smart city projects, the Internet of Things (IoT), and the growing demand for data storage and processing have a direct impact on the need for data center containment solutions. To ensure the long-term sustainability and efficiency of these infrastructures, containment solutions are being implemented to enhance the cooling process and reduce energy consumption. Additionally, these efforts are often aligned with sustainability goals, which is another reason why containment systems are gaining popularity. Governments’ focus on supporting digital infrastructure development is, therefore, a major catalyst for the market growth.

Focus on Sustainability and Environmental Regulations

As environmental concerns become increasingly prominent, there is a strong push across the globe, including in the Middle East, to adopt sustainable practices in all sectors, including data centers. Data centers are among the largest consumers of electricity due to their need for 24/7 operation and high cooling requirements. Consequently, data center operators are increasingly under pressure to reduce their carbon footprint and comply with growing environmental regulations.Data center containment solutions play a crucial role in this regard by reducing the energy consumed in cooling processes. By improving airflow management and optimizing the cooling of equipment, containment solutions help reduce the need for excessive energy consumption. These solutions contribute to energy efficiency, which in turn helps data centers meet sustainability targets and comply with both local and international environmental regulations. Furthermore, the adoption of energy-efficient technologies can enhance the overall reputation of data center operators, as sustainability is becoming a key factor in the purchasing decisions of both businesses and consumers. As environmental standards continue to evolve, the demand for containment solutions will continue to rise in order to support data centers’ sustainability goals.

Market Trends

Focus on Sustainability and Green Data Centers

The Middle East is seeing a marked shift towards sustainability in the data center sector, with a growing emphasis on green data centers. The region’s governments and enterprises are increasingly aware of the need to adopt environmentally friendly practices and reduce the carbon footprint of their operations. As part of these efforts, energy-efficient and sustainable cooling solutions are becoming a focal point for data center operators.Data center containment systems are evolving to meet these sustainability demands. The trend is moving towards the use of renewable energy sources, such as solar and wind, to power data centers. In addition to renewable energy, advanced containment systems that reduce cooling requirements and optimize airflow management are being deployed to minimize energy consumption. The adoption of liquid cooling and free cooling techniques is also on the rise as they offer energy-efficient alternatives to traditional air cooling systems. These solutions help reduce energy consumption, lower operational costs, and contribute to sustainability goals. As the Middle East continues to prioritize environmental sustainability, green data centers will remain a critical trend in the region’s data center containment market.

Development of High-Density Data Centers

The trend toward high-density data centers is becoming more prominent in the Middle East as businesses require more computing power to support the ever-growing volumes of data being processed. High-density data centers are designed to accommodate a greater number of servers in a smaller physical footprint, which is essential for handling the increasing demands of cloud computing, IoT, and big data analytics.However, with increased density comes the challenge of managing heat. High-density environments generate significant amounts of heat, requiring advanced cooling solutions to prevent equipment failure and ensure optimal performance. Data center containment systems are evolving to meet these requirements by providing more efficient cooling strategies, such as aisle containment and in-row cooling. These systems are designed to effectively manage airflow, prevent hot spots, and ensure that cooling is directed precisely where it is needed. The ability to support high-density configurations without compromising on cooling efficiency is a key driver of growth in the Middle East Data Center Containment Market. As the demand for computing power continues to surge, high-density data centers, coupled with advanced containment solutions, will remain a key trend in the region.

Adoption of Hybrid and Multi-cloud Data Center Models

A prominent trend in the Middle East Data Center Containment Market is the growing adoption of hybrid and multi-cloud models by businesses. These models allow organizations to combine on-premises data center resources with public and private cloud services, enhancing scalability, flexibility, and resilience. As businesses in the region look to reduce capital expenditures and achieve greater operational efficiency, hybrid and multi-cloud environments are increasingly becoming the norm. For instance, government initiatives like Abu Dhabi’s ADGOV Cloud project illustrate this trend, aiming to consolidate digital infrastructure across government entities into a centralized hybrid multi-cloud setup. The expansion of hybrid and multi-cloud infrastructures necessitates advanced containment solutions to manage the complexities of cooling and energy consumption.

Increased Integration of Artificial Intelligence (AI) and Machine Learning (ML) for Cooling Optimization

Another significant trend in the Middle East Data Center Containment Market is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) for optimizing cooling systems within data centers. AI and ML algorithms are being employed to predict and optimize cooling requirements by analyzing real-time data, enabling data centers to adapt their cooling strategies dynamically based on fluctuating workloads and environmental conditions. For instance, AI-driven cooling management systems can optimize energy consumption across data centers by continuously adjusting cooling systems and server workloads based on current demand. This trend is particularly relevant in the Middle East, where high ambient temperatures pose a significant challenge to cooling efforts. The use of AI-driven containment solutions allows for predictive maintenance, ensuring that cooling systems operate at peak efficiency and minimizing downtime.

Market Challenges

High energy consumption and cooling costs

High energy consumption and cooling costs are significant challenges in the Middle East Data Center Containment Market due to the region’s extreme ambient temperatures. These conditions necessitate substantial energy use to maintain optimal operating environments, particularly as data centers expand to meet growing demands for cloud computing, IoT, and AI-driven services. Traditional cooling methods, such as air conditioning, are both energy-intensive and costly. For instance, the proliferation of high-density computing equipment in data centers has intensified the need for advanced cooling solutions like liquid cooling or free cooling. While these technologies improve efficiency, they often require significant investment and may not be universally viable across all facilities. This creates a balancing act for operators striving to meet energy efficiency regulations and sustainability goals while minimizing operational costs. Data center containment solutions aim to optimize airflow and enhance cooling efficiency, but the rising density of computing equipment exacerbates thermal management challenges. High-performance servers generate concentrated heat loads that traditional systems struggle to dissipate effectively. For instance, innovations like AI-driven cooling management and precision cooling systems are gaining traction in the region as they help address these issues by optimizing energy usage and maintaining equipment reliability. However, achieving sustainable cooling remains a critical hurdle in this rapidly evolving market.

Limited Availability of Skilled Workforce

Another significant challenge faced by the Middle East Data Center Containment Market is the shortage of a skilled workforce to design, implement, and maintain advanced containment systems. The growing demand for data center infrastructures and the increasing complexity of containment solutions require a high level of expertise in both IT and engineering. However, there is a lack of sufficient technical expertise in the region to meet these demands.Training and retaining skilled personnel in the Middle East’s rapidly evolving data center sector is an ongoing issue. The shortage of professionals with specialized knowledge in cooling systems, airflow management, and energy-efficient design means that data center operators may face difficulties in optimizing their containment solutions or troubleshooting when issues arise. This skills gap could potentially slow down the implementation of innovative containment technologies and hinder the market’s growth potential. Addressing this challenge will require strategic investments in workforce development and partnerships with educational institutions to foster a pool of skilled professionals.

Market Opportunities

Expansion of Smart Cities and Digital Transformation Initiatives

The rapid development of smart cities and the ongoing digital transformation in the Middle East present significant growth opportunities for the Data Center Containment Market. As governments in the region, particularly in countries like the UAE, Saudi Arabia, and Qatar, invest heavily in smart city projects and digital infrastructure, there is an increasing demand for advanced data storage and processing capabilities. Data centers are crucial for supporting these initiatives, and with the rising adoption of IoT, AI, and cloud technologies, the need for efficient containment solutions to manage energy consumption and ensure optimal cooling is expected to grow. The drive toward digitalization across sectors such as healthcare, finance, and government will also require the construction of new data centers, further fueling the demand for state-of-the-art containment solutions. With sustainability being a key focus in these initiatives, data centers will seek containment systems that not only optimize cooling but also contribute to their energy efficiency and carbon reduction targets.

Rising Adoption of High-Density and Edge Computing Data Centers

Another key opportunity in the Middle East Data Center Containment Market lies in the growing adoption of high-density and edge computing data centers. As businesses seek to process large volumes of data at lower latencies, edge data centers—located closer to end-users—are being deployed to provide faster and more efficient computing capabilities. These high-density environments require advanced containment solutions to manage increased heat generation and ensure efficient airflow. This shift toward edge computing and high-density data centers presents an opportunity for containment solution providers to offer tailored, scalable, and energy-efficient systems that meet the unique needs of these next-generation infrastructures.

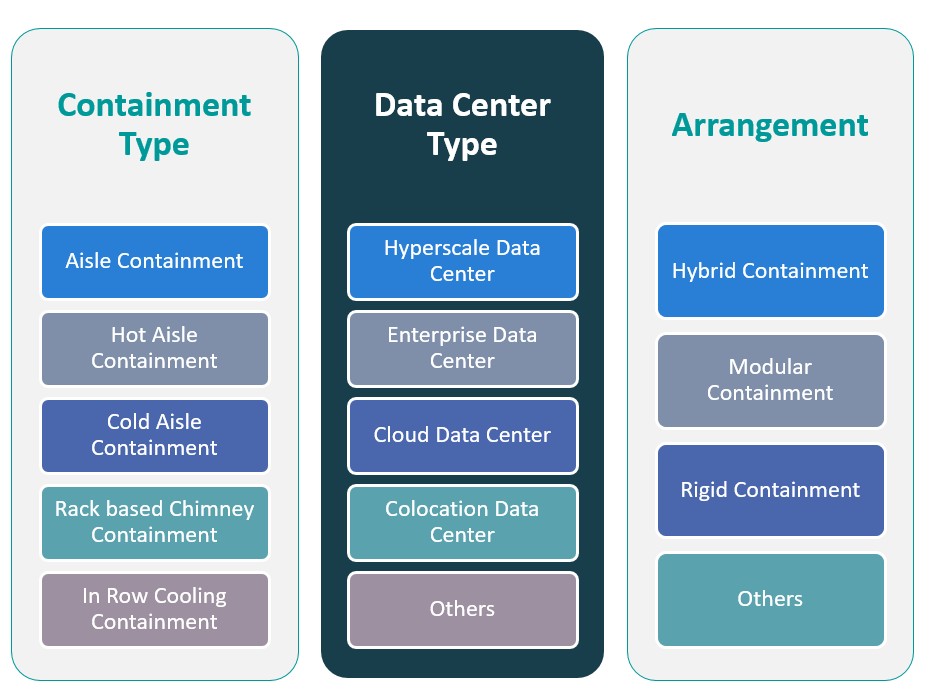

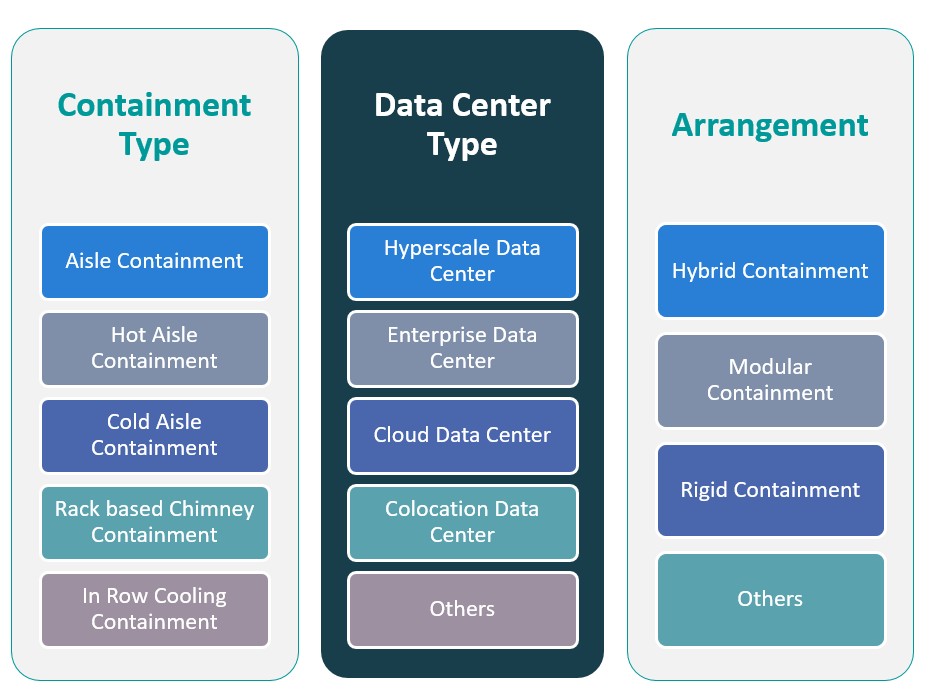

Market Segmentation Analysis

By Containment Type

Aisle containment systems are widely used in the Middle East to optimize cooling efficiency in data centers. Aisle containment is typically divided into hot and cold aisle containment. These systems help segregate hot and cold airflows, improving cooling efficiency and reducing energy consumption. With increasing energy costs and the growing demand for cooling solutions in high-temperature environments, aisle containment is expected to continue its dominance in the market. Hot aisle containment (HAC) systems focus on enclosing the hot aisle within the data center to prevent hot air from mixing with cool air, enhancing cooling efficiency. This containment type is ideal for data centers with high-density server setups, where the management of airflow becomes critical. The growing trend of high-density computing in the region boosts the demand for hot aisle containment. Cold aisle containment (CAC) works similarly to hot aisle containment, but it focuses on enclosing the cold aisle, ensuring that cold air is efficiently directed to server intakes, thus reducing cooling costs. As the demand for cooling solutions increases in the Middle East’s expanding data center sector, cold aisle containment is gaining traction, especially in medium-density data centers. Rack-based chimney containment provides cooling by isolating server racks within the data center, reducing the interaction between hot and cold air. This system is particularly effective in high-density setups where individual server cabinets require specific airflow management. This segment is witnessing growth as data centers with high-density equipment become more prevalent. In-row cooling containment solutions are designed to cool servers by placing cooling units directly in line with server rows. This localized cooling method is gaining popularity in the region’s high-performance data centers where efficient and targeted cooling is needed for specific server configurations.

By Data Center Type

Hyperscale data centers, characterized by large-scale operations and vast storage capabilities, are a major segment in the Middle East. These centers support cloud services, big data, and AI applications, leading to a growing need for efficient containment solutions to manage their massive power and cooling requirements. Enterprise data centers serve individual organizations and are typically smaller in scale than hyperscale data centers. However, they still require advanced containment systems to optimize cooling efficiency and meet business continuity needs. As enterprise organizations in the Middle East expand their IT infrastructures, they are increasingly adopting containment systems. Cloud data centers are on the rise as businesses migrate to cloud computing models. These data centers host cloud service providers and cater to multi-tenant environments. Containment systems in cloud data centers are critical for energy efficiency, especially as cloud service demand grows in the Middle East. Colocation data centers provide shared facilities for different businesses to house their IT infrastructure. These data centers are also expanding in the Middle East due to the rise in demand for shared computing and storage resources. Colocation centers rely on efficient containment solutions to ensure optimal cooling across diverse tenant systems. The “Others” category includes smaller, specialized data center types, including edge data centers and micro data centers, which are becoming increasingly popular in the region. These data centers are typically closer to end users and require customized containment solutions to manage localized cooling and power demands.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Kuwait

Regional Analysis

United Arab Emirates (38%)

The UAE is a key player in the Middle East Data Center Containment Market, contributing the largest share to the market. With Dubai positioned as a regional technology and business hub, the demand for data centers has surged in recent years. The country’s investments in smart city initiatives, data-driven government services, and the growth of the fintech and e-commerce sectors are major drivers of data center expansion. The UAE is expected to maintain its dominance, holding an estimated 38% market share. As digital transformation accelerates and cloud adoption increases, the need for advanced containment systems to optimize cooling and energy efficiency will continue to rise.

Saudi Arabia (30%)

Saudi Arabia is another key region in the Middle East, with rapid advancements in its digital infrastructure, spurred by the Vision 2030 initiative. The government’s focus on diversifying the economy and reducing dependence on oil has led to massive investments in IT and data center infrastructure. This growth has contributed to Saudi Arabia’s significant share in the data center containment market, projected to be around 30%. As demand for data centers in various sectors like healthcare, finance, and telecommunications grows, the need for efficient containment solutions to manage cooling and energy consumption will be essential in supporting these large-scale developments.

Key players

- Huawei

- Siemens AG

- Data Center Solutions (DCS)

- Vertiv

- FMS Tech

Competitive Analysis

The Middle East Data Center Containment Market is highly competitive, with several major players offering advanced containment solutions. Huawei stands out with its innovative technologies and global reach, providing a wide array of containment solutions with an emphasis on energy efficiency and scalability. Siemens AG, known for its expertise in digital industries, leverages its strong engineering background to offer integrated data center containment solutions that focus on sustainability and operational efficiency. Data Center Solutions (DCS) specializes in tailored containment systems and is recognized for its customer-centric approach, offering highly flexible solutions. Vertiv, a leader in data center infrastructure, delivers reliable containment solutions with an emphasis on power, cooling, and IT management. FMS Tech, although smaller, competes by offering cutting-edge containment solutions and focusing on providing cost-effective solutions for mid-sized data centers. These players continually innovate to stay competitive, meeting the rising demand for efficient and sustainable data center operations in the region.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The Middle East Data Center Containment Market is characterized by moderate to high concentration, with a few dominant players such as Huawei, Siemens AG, Vertiv, and Data Center Solutions (DCS) leading the market. These companies are heavily invested in innovation, offering advanced and customized containment solutions that focus on energy efficiency, scalability, and sustainability. While these major players hold significant market share, the market also sees the presence of smaller, specialized companies like FMS Tech, which cater to niche segments and offer cost-effective, flexible containment systems for medium-sized data centers. The market’s competitive dynamics are driven by technological advancements, the increasing demand for high-density data centers, and a growing emphasis on reducing energy consumption. As a result, companies are focused on continuous research and development to improve the performance of their containment solutions while expanding their geographic footprint within the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The increasing adoption of cloud computing, IoT, and AI technologies will drive demand for data centers in the Middle East, resulting in higher requirements for containment solutions to ensure cooling and energy efficiency.

- As governments and organizations prioritize sustainability, data centers will increasingly implement containment solutions that optimize energy usage, contributing to greener operations and compliance with environmental regulations.

- The region’s growth in hyperscale data centers will require highly efficient containment solutions to manage the massive heat generation, driving advancements in high-density cooling techniques.

- The integration of AI and machine learning for cooling optimization will become more prevalent, allowing data centers to dynamically adjust containment systems based on real-time operational data, improving efficiency.

- With the rise of edge computing, there will be an increasing demand for modular containment solutions that can scale quickly to meet localized data processing needs, reducing latency and improving data delivery speeds.

- The ongoing development of liquid cooling, free cooling, and in-row cooling technologies will provide new opportunities for containment solutions, reducing operational costs while meeting the growing heat management challenges.

- Regional initiatives like Saudi Arabia’s Vision 2030 and UAE’s smart city projects will continue to boost data center investments, creating opportunities for advanced containment systems to meet the specific needs of these infrastructures.

- As data centers increasingly move towards higher densities, containment solutions designed to manage power and cooling for dense server configurations will be crucial in ensuring operational efficiency.

- The growing demand for colocation services across the Middle East will further drive the need for effective containment systems, as these centers often house diverse and dense computing equipment from multiple tenants.

- The competitive landscape in the Middle East Data Center Containment Market will intensify, with mergers and acquisitions likely, as companies strive to enhance their technological capabilities and expand their market share across the region.