| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Green Data Center Market Size 2024 |

USD 2,084.59 Million |

| Middle East Green Data Center Market, CAGR |

17.37% |

| Middle East Green Data Center Market Size 2032 |

USD 7,507.39 Million |

Market Overview

The Middle East Green Data Center Market is projected to grow from USD 2,084.59 million in 2024 to an estimated USD 7,507.39 million by 2032, with a compound annual growth rate (CAGR) of 17.37% from 2025 to 2032. This growth is driven by the increasing demand for sustainable and energy-efficient data storage solutions in the region.

Key drivers of the Middle East Green Data Center Market include the region’s commitment to sustainability and the need for energy-efficient infrastructure. Governments are implementing policies that encourage the development of green data centers, while businesses are increasingly prioritizing environmental responsibility. Technological advancements, such as the integration of renewable energy sources and the adoption of innovative cooling solutions, are also playing a significant role in reducing the carbon footprint of data centers.

Geographically, the United Arab Emirates (UAE), Saudi Arabia, and Qatar are leading the way in the development of green data centers. These countries are investing heavily in digital infrastructure and are home to several key players in the market, including Equinix, center3 (stc), Gulf Data Hub, Mobily, Khazna Data Centers, and Ooredoo. These developments are positioning the Middle East as a hub for sustainable data center operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East Green Data Center Market is projected to grow from USD 2,084.59 million in 2024 to USD 7,507.39 million by 2032, at a CAGR of 17.37% from 2025 to 2032.

- The global Green Data Center Market is expected to grow from USD 59,645.02 million in 2024 to USD 239,470.06 million by 2032, at a CAGR of 18.98% from 2025 to 2032.

- Key drivers include the increasing demand for sustainable data storage solutions, rapid digital transformation, and the adoption of renewable energy sources in data center operations.

- Technological advancements, such as energy-efficient cooling solutions and AI-powered energy management systems, are further driving the demand for green data centers.

- High initial capital investments required to build and implement green technologies in data centers can be a significant barrier, especially for smaller businesses.

- Extreme environmental conditions in the Middle East, such as high temperatures and dust storms, make it challenging to maintain energy-efficient and sustainable data center operations.

- The UAE, Saudi Arabia, and Qatar lead the Middle East in the development of green data centers, investing in renewable energy and digital infrastructure.

- Emerging markets in North Africa, including Egypt and Morocco, are showing growing interest in sustainable data center solutions as they expand their digital economies and renewable energy resources.

Report Scope

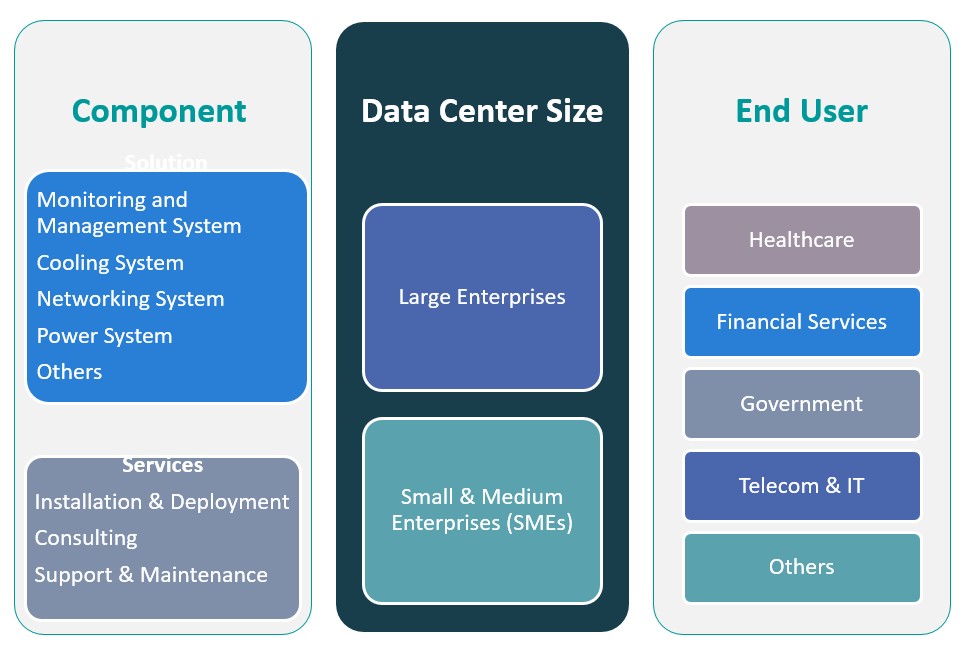

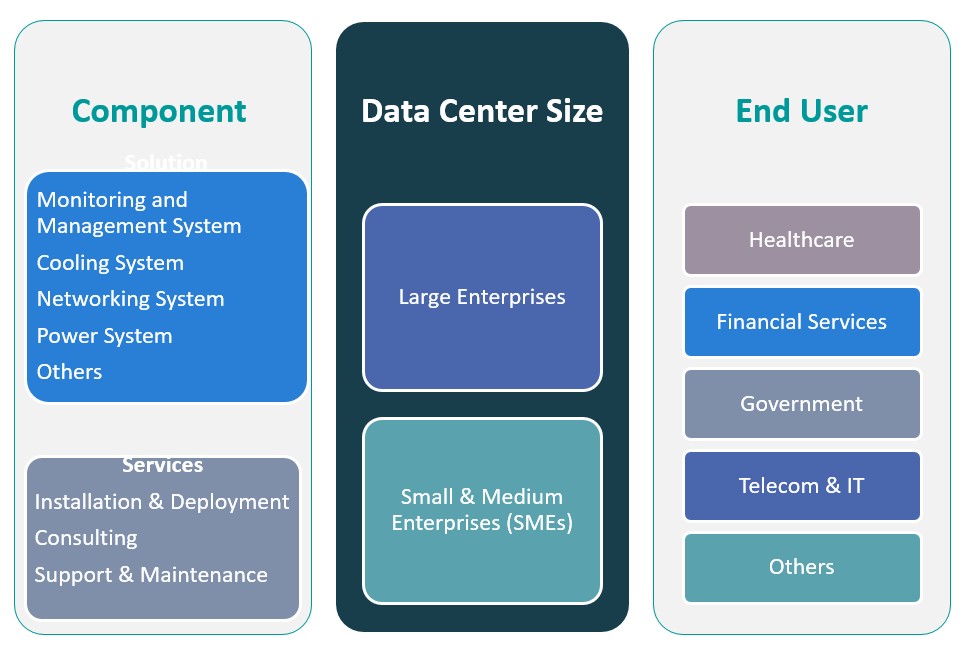

This report segments the Middle East Green Data Center Market as follows:

Market Drivers

Technological Advancements in Renewable Energy Integration

One of the major drivers of the Middle East green data center market is the rapid integration of renewable energy sources into the power supply of data centers. The region is increasingly turning to renewable energy sources such as solar and wind power to meet the growing demand for electricity in data centers while reducing their carbon footprints. The Middle East, with its abundance of sunlight, is particularly well-suited to leverage solar energy as a primary renewable source. Major investments in solar power infrastructure, such as large-scale solar farms, are being made to supply clean energy to power data centers. Renewable energy integration not only reduces operational costs in the long term but also contributes to the reduction of greenhouse gas emissions, which is a key objective for both governments and companies aiming to meet sustainability targets. Several data center operators in the Middle East have already committed to using 100% renewable energy in their operations. Additionally, energy storage technologies, such as battery storage systems, are being implemented to manage the intermittent nature of renewable power sources. This ensures a stable and continuous power supply for data centers while reducing reliance on fossil fuels. The growing availability and adoption of renewable energy solutions in the region have become a critical driver for the expansion of green data centers, particularly in countries with ambitious renewable energy goals like the UAE and Saudi Arabia.

Increasing Focus on Corporate Social Responsibility (CSR) and Environmental Awareness

Corporate Social Responsibility (CSR) has become an essential aspect of business strategy in the Middle East. As environmental awareness grows among consumers, businesses are under increasing pressure to demonstrate their commitment to sustainability. The public is becoming more conscious of the environmental impacts of the products and services they consume, and companies that fail to adopt sustainable practices risk reputational damage. Data centers, as high-energy-consuming entities, have come under scrutiny for their environmental impact. Consequently, organizations across the region are now prioritizing green data center solutions to enhance their CSR efforts and align with environmental values. In addition to consumer pressure, businesses are also responding to the expectations of investors and stakeholders who are increasingly factoring environmental, social, and governance (ESG) considerations into their decision-making processes. This trend has created an environment where companies are not only investing in green technologies to reduce costs but also to gain a competitive advantage in the market. Green data centers, by offering sustainable and energy-efficient solutions, help businesses improve their ESG profiles, attract environmentally-conscious consumers, and differentiate themselves in a competitive marketplace. As a result, there is a growing incentive for companies to embrace green data center solutions as part of their broader sustainability initiatives, contributing significantly to the growth of the market in the Middle East.

Rising Demand for Energy-Efficient Data Storage Solutions

The growing demand for digital services and data storage solutions has spurred the need for more energy-efficient data centers in the Middle East. For instance, traditional data centers consume approximately 2% of the world’s total electricity, and this figure is expected to rise with increasing digitalization. In response, organizations are investing in green technologies such as advanced cooling systems, which can reduce energy consumption by up to 40%, and energy-efficient servers that lower operational costs by 20-30%. Additionally, the integration of renewable energy sources like solar and wind power has been reported to cut carbon emissions by nearly 50% in some facilities. These advancements not only address environmental concerns but also align with financial goals by reducing operational expenses. Furthermore, the adoption of cloud computing and virtualization technologies has significantly increased data processing loads on regional data centers. To manage this demand sustainably, companies in the Middle East are implementing energy-efficient solutions such as free-air cooling, which can lower cooling energy usage by up to 70%, and AI-based power management systems that optimize energy distribution in real-time. These innovations are pivotal in improving the energy efficiency of data centers, driving the growth of the green data center market in the region.

Government Initiatives and Regulatory Support

Governments in the Middle East have recognized the importance of sustainability in driving the growth of green data centers and have been proactively supporting initiatives to promote energy-efficient infrastructure. For example, the UAE’s Green Agenda 2030 includes a target to increase the share of clean energy to 50% by 2050, while Saudi Arabia’s Vision 2030 aims to reduce carbon emissions by 278 million tons annually. These ambitious goals are supported by incentives such as tax breaks and subsidies for businesses investing in green technologies. In Saudi Arabia, the government has allocated over $50 billion for renewable energy projects, which include green data center initiatives. Regulatory frameworks also play a crucial role in advancing the adoption of green data centers. For instance, the UAE mandates compliance with its Estidama Pearl Rating System for sustainable construction, which includes data centers. This regulatory environment, coupled with increasing pressure from consumers and stakeholders for corporate sustainability, encourages enterprises to adopt energy-efficient solutions. As a result, the demand for green data centers continues to grow, aligning with both regional and global environmental goals.

Market Trends

Sustainability-Driven Data Center Design and Architecture

In the Middle East, there is a growing trend towards designing and constructing data centers with sustainability at the forefront. Modern green data centers are being built with energy-efficient infrastructure and eco-friendly designs that optimize resource use and minimize environmental impact. Data center designs are increasingly incorporating features like energy-efficient lighting, advanced insulation, and sustainable building materials to reduce energy consumption and enhance overall operational performance. Additionally, data centers are being equipped with systems that enable real-time energy consumption monitoring, helping operators track efficiency and optimize operations. The trend towards sustainable design extends to the use of modular and scalable data center layouts, which allow for greater flexibility and energy optimization. As a result, new data centers in the Middle East are not just focused on providing high-performance computing power but are also being constructed with environmental responsibility in mind. This trend aligns with regional sustainability goals and is expected to continue as more data centers adopt green building standards such as LEED and BREEAM certifications.

Adoption of AI and IoT for Energy Management

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) for energy management is gaining traction in the Middle East Green Data Center Market. These technologies are helping data center operators monitor and optimize energy consumption in real time, ensuring that energy efficiency is maximized. AI-based systems can predict energy demand, adjust cooling systems automatically, and optimize workload distribution to ensure that energy use is always aligned with operational needs. IoT sensors provide real-time data on various factors like temperature, humidity, and equipment performance, which helps operators make data-driven decisions on energy usage. By combining AI and IoT technologies, data centers in the Middle East are not only improving their energy efficiency but also enhancing overall operational reliability. This trend is transforming the way data centers are managed and operated, making energy consumption more predictable and reducing waste. As these technologies become more advanced, their adoption is expected to play a key role in the long-term sustainability of the green data center market in the region.

Integration of Renewable Energy Sources

A significant trend in the Middle East Green Data Center Market is the growing integration of renewable energy sources, particularly solar and wind power, into data center operations. With the region’s abundant sunlight and favorable environmental conditions for renewable energy generation, countries like the UAE and Saudi Arabia are taking advantage of solar energy to power their data centers. For instance, the Mohammed bin Rashid Al Maktoum Solar Park in Dubai generates over 1,000 megawatts of clean energy annually, supporting various facilities, including data centers. Additionally, many data center operators are exploring energy storage solutions, such as battery systems, to enhance grid stability and ensure uninterrupted service during periods of low renewable energy generation. As the region moves towards a more sustainable energy infrastructure, renewable energy integration is becoming a defining feature of the Middle East green data center market, driving further innovation and investments in clean energy technologies.

Advanced Cooling Technologies

Another prominent trend in the Middle East Green Data Center Market is the increasing adoption of advanced cooling technologies. Cooling is one of the most energy-intensive processes in data centers, and traditional air-conditioning systems are no longer efficient enough to meet the growing demand for sustainability. To address this, data center operators are turning to innovative cooling solutions such as liquid cooling, free-air cooling, and even immersion cooling systems. For instance, Etisalat has implemented liquid cooling systems in its Abu Dhabi data centers, reducing cooling energy consumption by approximately 40%. Free-air cooling, which leverages natural outdoor air to cool data center equipment, is particularly suited for the Middle East’s climate, where high temperatures are common. These technologies are not only more energy-efficient but also contribute to a reduction in overall operational costs. As the market continues to prioritize energy savings and environmental impact, these advanced cooling systems are becoming a cornerstone of green data center design and operation in the region.

Market Challenges

High Initial Capital Investment

One of the primary challenges facing the Middle East Green Data Center Market is the high initial capital investment required to build energy-efficient infrastructure. While green data centers offer significant long-term operational savings through energy efficiency, the upfront costs for incorporating renewable energy solutions, advanced cooling technologies, and sustainable building designs can be substantial. For instance, Etisalat deployed solar-powered data centers in the UAE, showcasing the integration of renewable energy to reduce carbon emissions. Many businesses in the region are hesitant to commit to such large investments, especially when they have traditionally relied on cost-effective, non-sustainable solutions. The integration of renewable energy sources like solar or wind, along with energy-efficient cooling systems, requires specialized infrastructure, advanced technologies, and significant financial resources, which can deter smaller players or those with tight budgets. Furthermore, the lack of government incentives or subsidies to offset these costs can make the transition to greener solutions even more challenging. As the demand for green data centers grows, companies will need to find ways to balance the high initial investment with the long-term benefits of energy savings and improved sustainability. This financial burden remains a key hurdle for many organizations in the region and slows down the pace of adoption for green data centers, despite the growing focus on environmental responsibility.

Climate and Environmental Conditions

The harsh climate and extreme environmental conditions of the Middle East present another significant challenge for the development of green data centers. The region is characterized by high ambient temperatures and dust storms, which place additional stress on data center operations, particularly regarding cooling requirements. Traditional cooling methods can be inefficient and costly in such extreme conditions, while more advanced cooling systems like free-air cooling or liquid cooling, which are effective in temperate climates, may struggle to meet performance expectations under the harsh Middle Eastern conditions. As a result, data centers in the region require specialized designs and solutions tailored to cope with extreme heat and environmental factors. Furthermore, the reliance on renewable energy, such as solar power, is heavily dependent on uninterrupted access to sunlight, which may be impacted by dust accumulation on solar panels. To mitigate this, regular maintenance and cleaning are required, adding to operational costs and logistical complexity. These climatic and environmental challenges create barriers to the seamless deployment of green data centers and pose ongoing operational risks, potentially hindering the widespread adoption of energy-efficient technologies in the region.

Market Opportunities

Expansion of Renewable Energy Infrastructure

A significant opportunity in the Middle East Green Data Center Market lies in the region’s growing commitment to renewable energy. The Middle East, particularly countries like the UAE, Saudi Arabia, and Qatar, is heavily investing in solar and wind power to diversify their energy sources and reduce reliance on fossil fuels. This shift towards renewable energy presents a considerable opportunity for green data center operators to integrate solar, wind, and other renewable sources into their energy supply. As governments and private sectors continue to invest in large-scale renewable energy projects, data centers in the region can tap into these resources to power their operations sustainably. The integration of renewable energy not only helps reduce the carbon footprint of data centers but also offers cost-saving potential in the long term. This growing emphasis on renewable energy infrastructure aligns with regional sustainability goals, creating a favorable environment for the development of green data centers. As a result, businesses that adopt green technologies and renewable energy sources can gain a competitive advantage in terms of both cost efficiency and corporate social responsibility.

Government Incentives and Sustainability Initiatives

Another key opportunity in the Middle East Green Data Center Market lies in government support and sustainability initiatives. Countries across the region are prioritizing sustainability as part of their long-term economic strategies, such as Saudi Arabia’s Vision 2030 and the UAE’s Green Agenda. These initiatives encourage the construction and operation of green data centers by offering regulatory incentives, tax benefits, and subsidies for businesses that adopt energy-efficient technologies. With increasing pressure to meet environmental goals, governments are also promoting policies that mandate the reduction of carbon emissions and energy consumption, further driving the demand for sustainable data storage solutions. Companies that align their operations with these policies stand to benefit from these government incentives while also enhancing their public image through their commitment to sustainability. The supportive regulatory environment provides a unique opportunity for both local and international players to invest in green data centers and expand their operations in the region.

Market Segmentation Analysis

By Component

The Middle East Green Data Center Market is segmented into various components, each playing a crucial role in ensuring energy efficiency and sustainability. Monitoring and Management Systems are integral for ensuring the continuous optimization of data center operations. These systems monitor energy consumption, environmental factors, and operational performance in real-time, allowing data center operators to identify areas for improvement and maintain energy efficiency. Cooling Systems are another vital component, as they are responsible for maintaining the optimal temperature within the data center. The increasing adoption of energy-efficient cooling methods, such as free-air cooling, liquid cooling, and advanced cooling systems, significantly reduces energy consumption. Networking Systems are essential for ensuring connectivity and efficient data transfer between various servers and systems in a green data center. These systems support low-latency communication while maintaining minimal energy consumption. Power Systems are also critical to ensure reliable and sustainable energy supply to the data center. The integration of renewable energy sources, such as solar power, into power systems helps reduce the reliance on conventional electricity grids, ensuring green operations. Other components, such as Backup Power Systems, also contribute to ensuring the uninterrupted operation of data centers in the event of power failures. Collectively, these components contribute to the energy efficiency, sustainability, and overall performance of green data centers in the region.

By Data Center Type

The Middle East Green Data Center Market is also segmented by data center type, primarily focusing on Large Enterprises and Small & Medium Enterprises (SMEs). Large enterprises dominate the market due to their substantial data storage and processing needs. These organizations are more likely to invest in advanced green technologies, such as renewable energy systems and energy-efficient cooling mechanisms, to meet sustainability goals and reduce operational costs. On the other hand, SMEs are increasingly adopting green data center solutions as part of their sustainability initiatives. Although SMEs may not require the extensive infrastructure that large enterprises do, the growing awareness of environmental responsibility and the availability of cost-effective solutions have encouraged smaller businesses to integrate green data center solutions.

Segments

Based on Component

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

Based on Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Based on Region

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

UAE (34%)

As of 2024, the UAE holds the largest market share, with approximately 34% of the region’s green data center market. This dominance is driven by the country’s ambitious sustainability initiatives, such as the UAE Green Agenda 2030, which aims to reduce carbon emissions and promote energy-efficient infrastructure. Dubai, as a hub for data centers, is seeing a surge in green data center projects, supported by strong government incentives for businesses adopting renewable energy solutions and energy-efficient technologies.

Saudi Arabia (28%)

Saudi Arabia, with 28% of the regional market share, follows closely behind. The country’s Vision 2030 initiative emphasizes diversifying the economy, improving sustainability, and investing in green technologies. Saudi Arabia is increasingly turning to renewable energy sources like solar and wind to power data centers, which significantly enhances their sustainability profile. Large-scale infrastructure projects and an expanding digital economy further contribute to the demand for green data centers in the region. With several mega data center developments in the pipeline, the Kingdom is poised to experience strong growth in this segment.

Key players

- Etisalat Digital

- Gulf Data Hub

- Ooredoo Group

- Microsoft Azure

- Khazna

Competitive Analysis

The Middle East Green Data Center Market is highly competitive, with key players like Etisalat Digital, Gulf Data Hub, Ooredoo Group, Microsoft Azure, and Khazna leading the charge in sustainability and technological innovation. Etisalat Digital stands out with its strong focus on digital transformation and sustainability solutions, leveraging renewable energy and advanced data center technologies. Gulf Data Hub is known for its extensive data center infrastructure and strategic partnerships with energy providers, allowing it to integrate green technologies into its operations efficiently. Ooredoo Group has committed to reducing its carbon footprint, offering energy-efficient data center solutions powered by renewable energy. Microsoft Azure, a global leader in cloud services, continues to expand its green data centers in the region, integrating renewable energy and advanced cooling technologies. Khazna, a regional player, is focusing on cutting-edge energy-efficient data centers while aligning with regional sustainability goals, ensuring robust growth in this rapidly evolving market. The competition is driven by the increasing demand for energy-efficient and environmentally responsible data storage solutions.

Recent Developments

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of liquid cooling infrastructure solutions. This acquisition strengthens Vertiv’s capabilities in high-density compute cooling, aligning with the industry’s shift towards energy-efficient data center technologies.

- In July 2024, Huawei unveiled three green data center facility solutions at the Global Smart Data Center Summit. These include the AeroTurbo fans, IceCube polymer heat exchangers, and iCooling AI energy efficiency cooling solutions, designed to optimize cooling efficiency and reduce energy consumption.

- In May 2024, Microsoft launched its first hyperscale cloud data center region in Mexico, located in Querétaro. This facility aims to provide scalable, highly available, and resilient cloud services, supporting digital transformation and sustainable innovation in the region.

- In June 2024, HPE partnered with Danfoss to introduce the HPE IT Sustainability Services – Data Center Heat Recovery. This turnkey heat recovery module helps organizations manage and repurpose excess heat, contributing to more sustainable IT infrastructures.

- In November 2024, Google announced a partnership with SB Energy Global to supply 942 MW of renewable energy to power its data center operations in Texas. This initiative supports Google’s commitment to operate on carbon-free energy and aligns with its sustainability goals.

- In January 2025, AWS announced plans to invest approximately $11 billion in Georgia to expand its infrastructure, supporting cloud computing and AI technologies. This investment is expected to create at least 550 new high-skilled jobs and enhance the state’s digital innovation capabilities.

- In May 2024, IBM announced a partnership with Schneider Electric to develop and deploy energy-efficient data center solutions, focusing on reducing carbon emissions and improving operational efficiency.

Market Concentration and Characteristics

The Middle East Green Data Center Market exhibits moderate market concentration, with a mix of dominant global players and emerging regional companies. Key players like Microsoft Azure, Etisalat Digital, Ooredoo Group, and Khazna hold significant market share due to their large-scale operations, strong technological capabilities, and commitment to sustainability. These companies lead in integrating renewable energy sources, advanced cooling systems, and energy-efficient designs into their data center infrastructure. However, the market also includes a growing number of smaller, specialized players such as Gulf Data Hub, which focus on providing tailored green data center solutions to meet local and regional demands. The competitive landscape is characterized by continuous technological innovation, particularly in energy efficiency and sustainability practices. With governments in the Middle East emphasizing sustainability goals and supporting the development of green infrastructure, the market is poised for further expansion, attracting both established players and new entrants aiming to capitalize on the growing demand for eco-friendly data storage solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As countries in the Middle East continue to invest in renewable energy, the demand for green data centers powered by solar and wind energy will increase, enhancing sustainability efforts across the region.

- Governments, particularly in Saudi Arabia and the UAE, will implement stricter environmental regulations, encouraging businesses to adopt energy-efficient and green technologies in data centers, spurring market expansion.

- The growing adoption of cloud computing, IoT, and AI will drive demand for data centers, further supporting the need for sustainable and energy-efficient facilities to handle increased data traffic.

- Innovations in cooling technologies, such as liquid and free-air cooling, will enhance the energy efficiency of green data centers, reducing operational costs and environmental impact.

- As digital infrastructures grow, there will be an upsurge in new green data center construction projects in key regional hubs, particularly in cities like Dubai and Riyadh, promoting market growth.

- Companies in the region will continue to align their operations with global sustainability trends, driving investment in green data center solutions as part of their CSR strategies.

- Countries like Egypt, Algeria, and Morocco will see increased adoption of green data centers due to growing demand for digital infrastructure, government incentives, and renewable energy investments.

- With the rise of cloud and edge computing technologies, there will be an increasing need for smaller, energy-efficient data centers that adhere to green standards while delivering faster services.

- As energy costs rise and environmental concerns grow, energy-efficient data centers will be a key differentiator, providing operators with a competitive edge in the region’s market.

- Partnerships between data center operators, renewable energy providers, and technology companies will increase, leading to innovations in sustainability and enabling more efficient green data center operations.