Market Overview

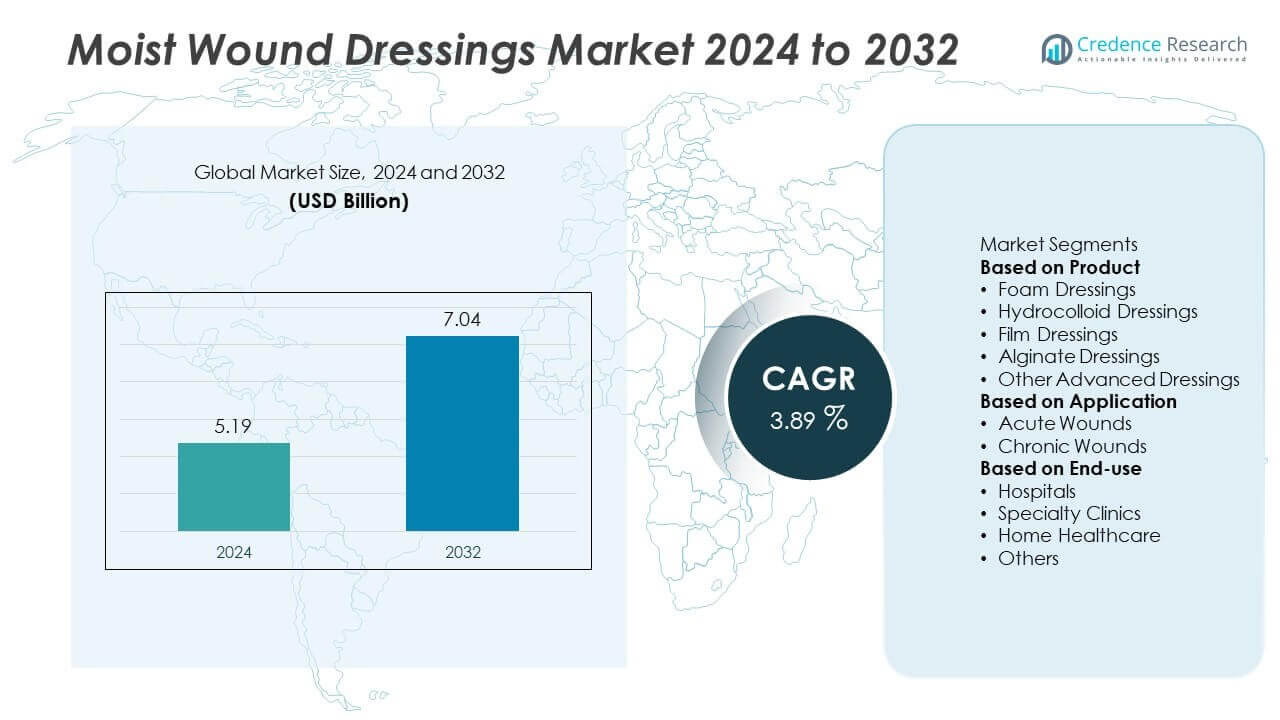

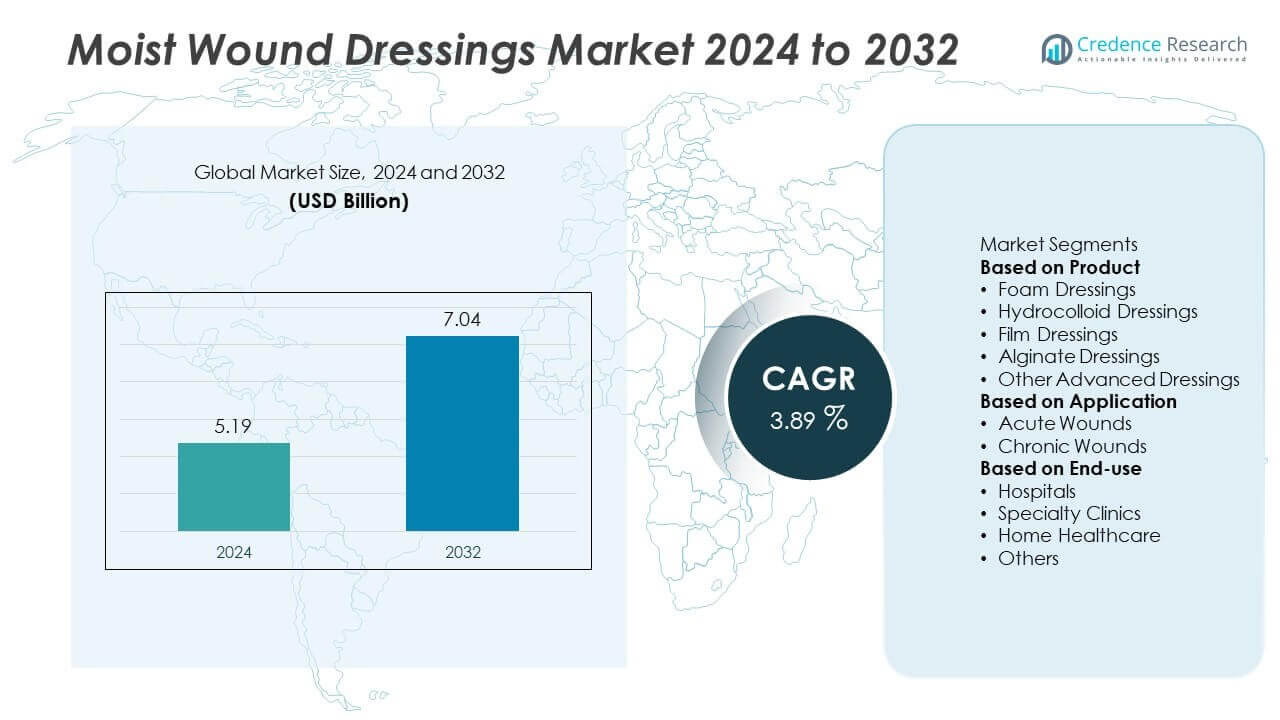

The Moist Wound Dressings market size was valued at USD 5.19 billion in 2024 and is projected to reach USD 7.04 billion by 2032, growing at a CAGR of 3.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Moist Wound Dressings Market Size 2024 |

USD 5.19 Billion |

| Moist Wound Dressings Market, CAGR |

3.89% |

| Moist Wound Dressings Market Size 2032 |

USD 7.04 Billion |

The Moist Wound Dressings Market grows through rising cases of chronic wounds, diabetes, and pressure ulcers that require advanced treatment. Hospitals adopt these products to reduce infection risks, accelerate recovery, and minimize hospital stays.

The Moist Wound Dressings Market demonstrates strong geographical diversity, with North America leading due to advanced healthcare systems, high chronic wound prevalence, and supportive reimbursement structures. Europe follows with widespread adoption of innovative wound care solutions supported by established clinical practices and R&D investments. Asia-Pacific emerges as the fastest-growing region, driven by rising diabetes cases, healthcare infrastructure expansion, and increasing awareness of advanced wound care. Latin America and the Middle East & Africa show gradual but steady growth through hospital expansions and private sector investments. Key players shaping the market include 3M, Smith & Nephew, Coloplast A/S, and Convatec, Inc., each focusing on technological advancements, product innovations, and strategic partnerships. Medline Industries, Cardinal Health, and B. Braun Medical Inc. contribute to supply chain strength and global distribution networks, while Acelity, Systagenix, and Derma Sciences, Inc. expand their portfolios to meet evolving patient needs across chronic and acute wound segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Moist Wound Dressings Market was valued at USD 5.19 billion in 2024 and is projected to reach USD 7.04 billion by 2032, growing at a CAGR of 3.89%.

- Rising prevalence of chronic wounds, diabetes, and pressure ulcers drives strong demand for advanced dressings.

- Technological innovations in foams, hydrocolloids, alginates, and hydrogels improve healing efficiency and patient comfort.

- Leading players such as 3M, Smith & Nephew, Coloplast, and Convatec expand portfolios through product innovation and global partnerships.

- High product cost and limited reimbursement in emerging economies act as restraints, slowing adoption in price-sensitive markets.

- North America dominates due to advanced healthcare infrastructure, while Asia-Pacific shows fastest growth supported by expanding healthcare access and awareness.

- Growing interest in home healthcare, antimicrobial solutions, and smart wound monitoring technologies represents a key trend shaping future opportunities.

Market Drivers

Rising Prevalence of Chronic and Acute Wounds

The growing incidence of chronic conditions such as diabetes, venous leg ulcers, and pressure ulcers drives demand for advanced wound care solutions. Patients with these conditions require long-term treatment that promotes moisture balance to speed recovery. Acute injuries from accidents, burns, and surgical procedures further expand the need for effective dressings. Hospitals and clinics adopt these products to reduce infection risks and improve healing outcomes. The Moist Wound Dressings Market benefits directly from the rising number of patients who need specialized care. It reinforces the role of dressings in improving patient recovery rates and lowering healthcare costs.

- For instance, clinical studies have shown Smith & Nephew’s ALLEVYN LIFE dressings can reduce hospital-acquired pressure injuries and generate significant cost savings, adding the dressings to a prevention protocol reduced sacral pressure injuries by up to 71% in one study.

Technological Advancements in Dressing Materials

Manufacturers introduce dressings with advanced features such as antimicrobial coatings, oxygen permeability, and bioactive compounds. These innovations enhance wound healing efficiency while reducing complications. Hydrocolloids, alginates, foams, and hydrogel-based products offer diverse solutions for different wound types. Companies also focus on materials that reduce pain during removal, improving patient compliance. Continuous R&D investment ensures the availability of dressings that combine comfort with clinical effectiveness. It strengthens the appeal of moist wound dressings among healthcare professionals worldwide.

- For instance, ConvaTec’s information, AQUACEL® Ag+ Extra is a silver-containing hydrofiber dressing for infected wounds. It contains 1.2% ionic silver, which is released in a controlled manner upon contact with wound fluid to combat infection.

Supportive Government and Healthcare Initiatives

Government programs and reimbursement policies encourage the use of advanced wound care technologies. Many healthcare systems promote early adoption of these products to minimize hospital stays and readmission rates. Policies that focus on reducing the burden of chronic wounds fuel the uptake of moisture-retentive solutions. Hospitals benefit from cost savings when wound healing accelerates under these technologies. The Moist Wound Dressings Market gains from favorable policies that align with improved patient outcomes. It ensures consistent demand across both developed and developing regions.

Growing Aging Population and Healthcare Infrastructure Expansion

An aging population increases susceptibility to chronic wounds and pressure ulcers, creating sustained demand. Elderly patients represent a large share of the consumer base for advanced wound dressings. Expanding healthcare infrastructure in emerging economies further supports adoption. Hospitals, long-term care facilities, and home healthcare providers integrate moist dressings into routine practices. Investments in advanced treatment centers accelerate product penetration across underserved regions. It broadens the global footprint of moist wound dressing solutions while improving access to quality care.

Market Trends

Shift Toward Advanced and Customized Wound Care Solutions

Healthcare providers increasingly adopt advanced dressings tailored to specific wound types and healing stages. Customized solutions such as foam dressings for exudating wounds and hydrocolloids for pressure ulcers gain traction. Patients prefer products that reduce dressing changes and minimize pain. The Moist Wound Dressings Market reflects this trend by offering diverse product lines for targeted applications. It helps healthcare facilities improve treatment efficiency and enhance patient satisfaction. Manufacturers focus on differentiation to meet growing demand for specialized solutions.

- For instance, Smith & Nephew reported that their Allevyn® Gentle Border foam dressings reduced dressing change frequency to every 5–7 days for exudating wounds, improving patient comfort.

Integration of Antimicrobial and Bioactive Technologies

Dressings with antimicrobial properties such as silver, iodine, or honey-based formulations gain strong acceptance. These technologies lower infection risks while supporting faster healing. Bioactive dressings that release growth factors or stimulate cell regeneration also expand their role in modern wound care. Hospitals and clinics recognize their value in reducing complications and shortening recovery times. The trend encourages consistent R&D investment in combining moisture retention with infection control. It reinforces the appeal of advanced dressings in high-risk patient groups.

- For instance, ConvaTec AQUACEL® Ag+ Extra dressings release ionic silver in a controlled manner as they absorb wound fluid. This technology effectively reduces infection risks in chronic wounds by targeting harmful bacteria and biofilm.

Rising Adoption of Home Healthcare and Self-Care Practices

Patients and caregivers increasingly choose home-based wound management due to convenience and cost benefits. Easy-to-apply moist dressings that require minimal supervision support this shift. Companies develop user-friendly packaging and instructions to aid non-professional use. The Moist Wound Dressings Market grows as self-care becomes an important trend in wound management. It reduces the burden on hospitals while ensuring continuity of care. Aging populations and patients with chronic conditions fuel consistent demand for home-use products.

Digitalization and Smart Wound Management Solutions

Integration of digital technologies into wound care introduces smart dressings capable of monitoring wound conditions. Sensors embedded in dressings track parameters such as moisture levels, pH, and temperature. These insights help clinicians adjust treatment strategies in real time. Research partnerships drive innovations that combine wearable health tech with traditional dressings. The trend highlights the future direction of the industry toward precision wound care. It enhances both treatment outcomes and long-term healthcare efficiency.

Market Challenges Analysis

High Cost of Advanced Dressing Products and Limited Reimbursement

The elevated cost of advanced moist wound dressings poses a barrier in many healthcare systems. Hospitals and clinics in low-income regions struggle to afford premium products. Limited reimbursement coverage in certain countries further restricts patient access. Price-sensitive markets often rely on traditional dressings despite slower healing outcomes. The Moist Wound Dressings Market faces pressure to balance innovation with affordability. It challenges manufacturers to create cost-effective solutions without compromising quality or clinical performance.

Awareness Gaps and Shortage of Skilled Professionals

Lack of awareness about advanced wound care among patients and healthcare workers limits adoption. Many caregivers continue to use outdated methods due to limited training. Shortages of skilled wound care specialists in emerging economies intensify the issue. Patients in rural areas often have poor access to advanced treatment options. The Moist Wound Dressings Market struggles to expand in these regions despite rising demand. It underscores the importance of education programs and workforce development to drive adoption globally.

Market Opportunities

Expansion in Emerging Healthcare Markets

Rapid improvements in healthcare infrastructure across Asia-Pacific, Latin America, and the Middle East create significant growth opportunities. Rising government investments and private sector involvement enhance access to advanced wound care. Hospitals and clinics in these regions adopt modern dressings to reduce infection rates and improve outcomes. The Moist Wound Dressings Market gains traction as awareness of specialized products increases. It allows manufacturers to expand product reach through partnerships with local distributors and healthcare providers. Growing medical tourism also accelerates adoption of advanced wound care technologies in developing economies.

Innovation in Smart and Sustainable Dressing Solutions

The integration of digital health features into wound dressings presents new avenues for growth. Smart dressings with sensors that monitor healing progress appeal to both clinicians and patients. Sustainability-focused innovations, such as biodegradable materials, align with global environmental goals. Companies that prioritize eco-friendly and technology-driven solutions can capture strong demand. The Moist Wound Dressings Market benefits from combining clinical effectiveness with sustainability and digital innovation. It encourages firms to invest in research pipelines that address evolving healthcare and regulatory needs.

Market Segmentation Analysis:

By Product

Moist wound dressings are categorized into hydrocolloids, hydrogels, alginates, foams, and films. Foam dressings hold a significant share due to their ability to absorb high exudate levels while maintaining moisture balance. Hydrocolloids remain popular for pressure ulcer treatment because of their strong adherence and long wear time. Hydrogels support healing in dry wounds by rehydrating tissue, which is vital in burn and necrotic cases. Alginates, derived from seaweed, are widely used for moderate to heavily exuding wounds. The Moist Wound Dressings Market grows as each product category addresses different clinical needs. It enables providers to select specialized options based on wound type and healing stage.

- For instance, The Mölnlycke Mepilex® Border foam dressing can be worn for up to seven days, depending on the wound, effectively reducing the frequency of dressing changes.

By Application

Applications cover chronic wounds, acute wounds, and surgical wounds. Chronic wounds such as diabetic ulcers and venous leg ulcers dominate usage due to the rising global burden of lifestyle-related diseases. Acute injuries from trauma and burns also drive consistent demand for advanced dressings. Surgical wounds represent a growing segment as hospitals prioritize faster recovery and reduced infection risk. The Moist Wound Dressings Market reflects strong adoption in chronic care, where patients require long-term management. It strengthens the role of these dressings in improving clinical outcomes across diverse medical conditions.

- For instance, studies have shown ConvaTec’s AQUACEL Ag dressings can reduce the incidence of superficial surgical site infections in certain procedures. A 2024 trial found that these dressings led to a 40% relative reduction of superficial infections after gastrointestinal surgery, especially in the lower GI tract.

By End-use

Hospitals account for the largest share due to high patient inflow and demand for advanced wound care. Specialty clinics and wound care centers also contribute strongly as they provide focused treatment programs. Home healthcare emerges as a high-potential segment supported by rising preference for self-care and outpatient treatment. Long-term care facilities use moist dressings to manage pressure ulcers and chronic conditions among elderly populations. The Moist Wound Dressings Market benefits from the growing diversity of end-use settings. It ensures product penetration across both institutional and home-based care environments, expanding overall market reach.

Segments:

Based on Product

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Alginate Dressings

- Other Advanced Dressings

Based on Application

- Acute Wounds

- Chronic Wounds

Based on End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 38% of the Moist Wound Dressings Market in 2024, leading global adoption. Strong prevalence of diabetes and obesity in the U.S. drives chronic wound cases that require continuous treatment. Hospitals and outpatient facilities across the region integrate advanced dressings to improve recovery outcomes and reduce infection risks. Government-backed reimbursement frameworks support the adoption of higher-cost, technologically advanced solutions. The presence of global players and active research initiatives further strengthen market penetration. It also benefits from the rising adoption of home healthcare practices, which encourages consistent demand for user-friendly products.

Europe

Europe held 27% of the global share, supported by advanced healthcare systems and strict regulatory guidelines. Countries such as Germany, France, and the UK prioritize the use of high-quality wound care products to reduce hospital stays. Growing elderly populations across Western Europe increase the incidence of pressure ulcers, fueling the need for moisture-retentive dressings. Reimbursement policies in several European nations encourage wider use of innovative solutions. The Moist Wound Dressings Market benefits from strong R&D investments and product approvals that align with EU healthcare standards. It also gains traction in Eastern Europe, where expanding healthcare budgets improve access.

Asia-Pacific

Asia-Pacific represented 22% of the global share and emerged as the fastest-growing regional market. Rising diabetes prevalence in China and India contributes to higher rates of chronic wounds. Healthcare infrastructure expansion across Southeast Asia improves access to advanced dressings in hospitals and specialty clinics. Local manufacturers and international players focus on partnerships to address growing demand. The Moist Wound Dressings Market expands as governments invest in wound care awareness and treatment programs. It benefits from a growing middle-class population with higher healthcare spending power. It also sees opportunities from medical tourism, particularly in countries like Thailand and India.

Latin America

Latin America captured 7% of the global share, with Brazil and Mexico leading regional adoption. Expanding healthcare services and rising investments in hospital infrastructure contribute to greater use of advanced dressings. Chronic conditions such as venous ulcers and diabetic wounds remain key drivers of demand. Limited reimbursement in some countries creates challenges, but rising awareness supports gradual adoption. The Moist Wound Dressings Market in Latin America benefits from collaborations between local distributors and multinational companies. It also grows through the increasing presence of private healthcare providers across urban areas.

Middle East & Africa

The Middle East & Africa accounted for 6% of the global share, showing gradual but steady adoption. High rates of lifestyle diseases such as diabetes in Gulf countries drive market growth. Hospitals in the UAE and Saudi Arabia adopt advanced dressings to reduce post-surgical complications and speed recovery. Africa faces challenges from limited awareness and affordability, but donor-backed healthcare projects improve access in select regions. The Moist Wound Dressings Market gains momentum through government-led investments in modern healthcare infrastructure. It ensures long-term growth opportunities, particularly in urban centers and specialized care facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Moist Wound Dressings Market features leading players including 3M, Smith & Nephew, Coloplast A/S, Convatec Inc., Medline Industries, Cardinal Health, B. Braun Medical Inc., Acelity, Systagenix, and Derma Sciences Inc. These companies hold strong positions through broad product portfolios, innovation in advanced materials, and established distribution networks. They focus on expanding product lines with technologies such as antimicrobial coatings, bioactive compounds, and smart monitoring features to address diverse clinical needs. Strategic mergers, acquisitions, and partnerships help strengthen their market reach and accelerate research capabilities. Leading firms invest heavily in R&D to deliver dressings that improve healing outcomes while reducing patient discomfort, aligning with the growing demand for efficient and patient-friendly solutions. Expansion in emerging markets remains a priority, supported by collaborations with local distributors and healthcare providers. Sustainability initiatives, such as developing eco-friendly and biodegradable dressing materials, also gain prominence. Competitive pressure encourages continuous innovation, pricing strategies, and regulatory compliance efforts. The Moist Wound Dressings Market therefore reflects a dynamic environment where innovation, product differentiation, and global presence remain central to sustaining leadership and capturing long-term growth opportunities.

Recent Developments

- In August 2025, Smith & Nephew initiated the U.S. launch of ALLEVYN Ag+ SURGICAL, a new antimicrobial silver foam dressing featuring ComfortSTAY™ silicone adhesion and HighFLEX™ flexibility for improved patient movement.

- In May 2025, Coloplast A/S reported that its Advanced Wound Dressings segment grew 3%, with Kerecis (fish-skin-based technology acquired in 2023) growing 30%.

- In January 2024, Medline Industries, Inc. launched OptiView® Transparent Dressing with HydroCore™ technology. This first-of-its-kind clear wound dressing redistributes pressure and cools the skin, while letting caregivers observe the wound without removal.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing global prevalence of chronic wounds will continue to boost demand.

- Innovations in antimicrobial and bioactive technologies will enhance treatment efficacy.

- Rise in smart dressings with sensor capabilities will support precision wound management.

- Sustainable and biodegradable materials will gain traction across markets.

- Expansion of home healthcare services will encourage adoption of user-friendly products.

- Emerging economies will drive strong growth through infrastructure development.

- Partnerships between global and local players will broaden distribution reach.

- Increased focus on patient comfort and reduced dressing changes will influence designs.

- Regulatory support and reimbursement reforms will enable wider access to advanced dressings.

- Digital health integration will improve monitoring and optimize healing outcomes.