Market Overview

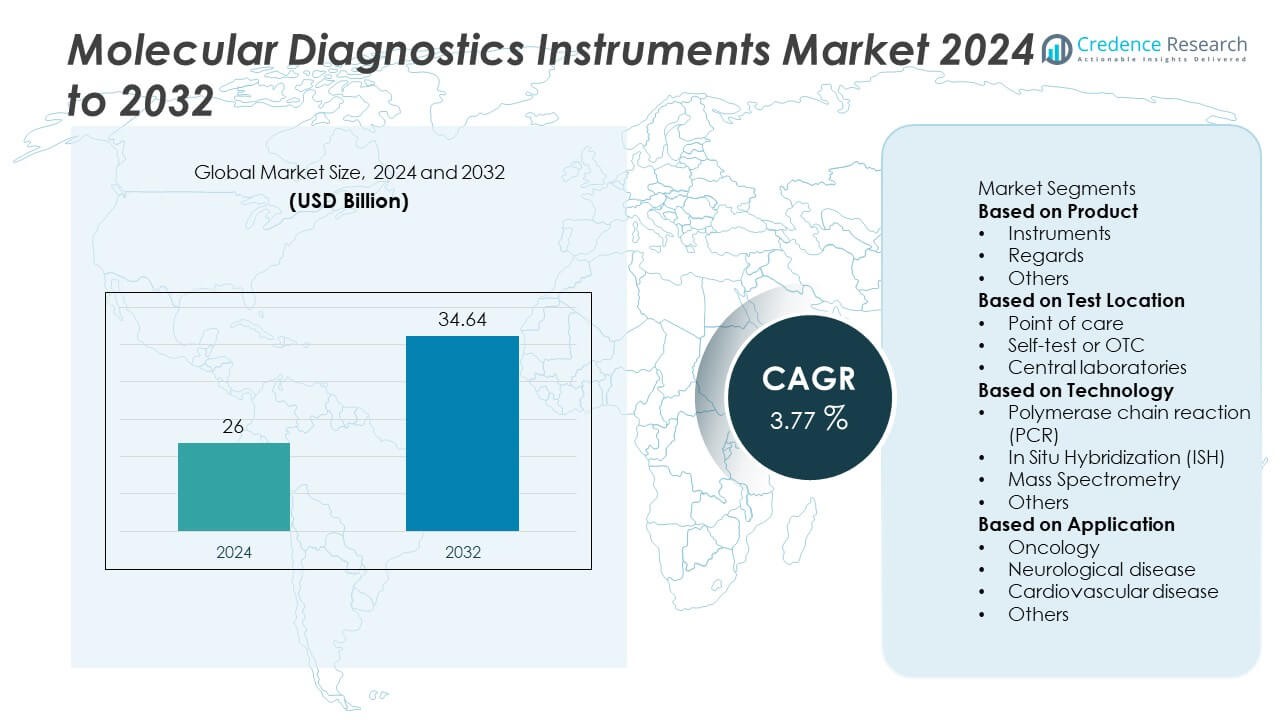

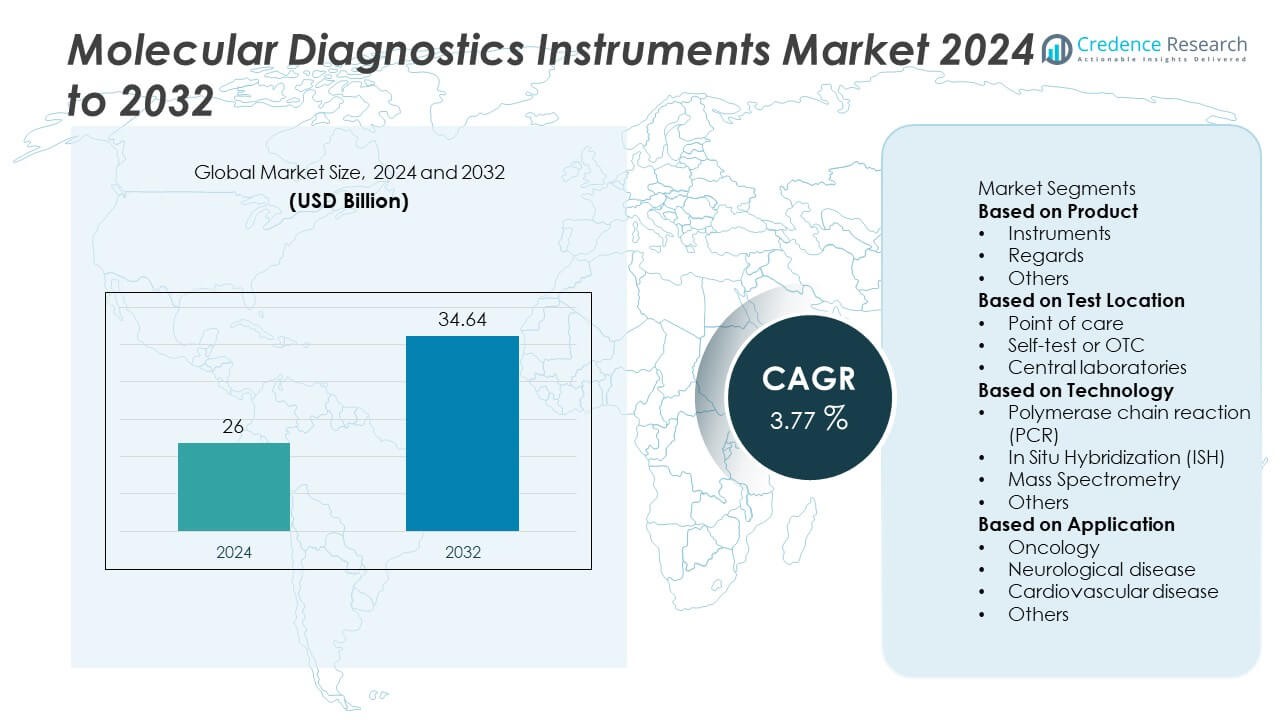

The Molecular Diagnostics Instruments Market was valued at USD 26 billion in 2024 and is projected to reach USD 34.64 billion by 2032, growing at a CAGR of 3.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molecular Diagnostics Instruments Market Size 2024 |

USD 26 Billion |

| Molecular Diagnostics Instruments Market, CAGR |

3.77% |

| Molecular Diagnostics Instruments Market Size 2032 |

USD 34.64 Billion |

The molecular diagnostics instruments market is led by prominent players including Agilent Technologies, Inc., QIAGEN, Illumina, Inc., Grifols, Hologic Inc. (Gen Probe), BD, Danaher, Bio-Rad Laboratories, Inc., BIOMÉRIEUX, and Abbott. These companies dominate through robust product portfolios, continuous innovation, and global distribution networks. North America holds the leading regional position with a 38.4% market share in 2024, driven by advanced healthcare infrastructure and high adoption of molecular testing technologies. Europe follows with 29.6% share, supported by strong regulatory frameworks and precision medicine initiatives. Asia-Pacific, accounting for 23.7%, is emerging rapidly due to growing healthcare investments and expanding laboratory networks across China, Japan, and India.

Market Insights

Market Insights

- The molecular diagnostics instruments market was valued at USD 26 billion in 2024 and is projected to reach USD 34.64 billion by 2032, growing at a CAGR of 3.77%.

- Rising demand for accurate and rapid disease detection, driven by increasing prevalence of infectious and chronic disorders, continues to accelerate market expansion globally.

- Technological advancements in PCR, next-generation sequencing, and automation are shaping industry trends, enabling faster diagnostics and enhanced data integration.

- Key players including Agilent Technologies, QIAGEN, Illumina, BD, and Danaher are focusing on innovation, digital solutions, and strategic collaborations to expand their market presence.

- North America leads with a 38.4% share, followed by Europe at 29.6% and Asia-Pacific at 23.7%, while the instruments segment dominates product categories with 58.3% share, supported by strong adoption across laboratories and clinical facilities.

Market Segmentation Analysis:

By Product

The instruments segment dominates the molecular diagnostics instruments market, accounting for around 58.3% share in 2024. This dominance is driven by the extensive use of automated analyzers, real-time PCR systems, and next-generation sequencing platforms in clinical laboratories. Rising demand for rapid, accurate, and high-throughput diagnostic tools supports the segment’s growth. Continuous technological upgrades, such as compact and integrated molecular analyzers, further enhance workflow efficiency and testing precision, making instruments the preferred choice across hospitals and research centers compared to reagents and other consumables.

- For instance, Hologic, Inc. launched its Panther Trax high-throughput molecular diagnostic platform capable of running 19 FDA-cleared assays on one automated system.

By Test Location

Central laboratories lead the market with nearly 62.5% share in 2024. Their dominance is attributed to the availability of advanced diagnostic infrastructure, trained personnel, and high test volumes supporting accurate molecular analysis. Growing demand for large-scale genomic testing, companion diagnostics, and infectious disease detection strengthens their position. However, point-of-care testing is gaining momentum due to its ability to deliver faster results in decentralized settings, reducing turnaround time for critical diagnostics and improving patient outcomes, especially in emergency and remote healthcare environments.

- For instance, Becton, Dickinson and Company (BD) introduced the COR MX/PX system which allows loading of up to 1,700 specimens and delivers up to 1,000 sample results in a single 24-hour period in high-volume labs.

By Technology

Polymerase chain reaction (PCR) remains the dominant technology, holding approximately 49.7% share in 2024. PCR’s leadership stems from its versatility, high sensitivity, and wide application in detecting infectious diseases, cancer biomarkers, and genetic disorders. The continuous innovation in quantitative and digital PCR enhances precision and reduces contamination risks. Additionally, the growing integration of automated PCR systems with cloud-based data analysis tools supports faster diagnostics. Although next-generation sequencing and mass spectrometry are expanding rapidly, PCR remains the gold standard for routine molecular testing due to cost-effectiveness and reliability.

Key Growth Drivers

Rising Prevalence of Infectious and Chronic Diseases

Increasing incidences of infectious diseases such as HIV, hepatitis, and COVID-19, along with chronic conditions like cancer and genetic disorders, are driving molecular diagnostics demand. Hospitals and laboratories are adopting molecular instruments for precise pathogen identification and early disease detection. The expanding use of multiplex assays and high-sensitivity PCR platforms enhances diagnostic accuracy and supports personalized treatment strategies, boosting overall market adoption.

- For instance, Roche launched the cobas® Respiratory flex test capable of detecting up to 12 respiratory viruses in a single reaction using their proprietary TAGS technology, which is designed to enable the detection of up to 15 diagnostic targets in a single well.

Technological Advancements in Diagnostic Platforms

Continuous innovation in PCR, next-generation sequencing (NGS), and microarray systems fuels market growth. Modern instruments offer automation, faster processing, and improved throughput, enabling simultaneous multi-gene analysis. Integration of AI and cloud-based analytics in diagnostic workflows reduces manual errors and accelerates result interpretation. These advancements enhance operational efficiency and drive laboratory modernization across healthcare systems.

- For instance, QIAGEN N.V. upgraded its QIAcuity digital PCR system to support up to 12 targets in a single reaction, enhancing multiplexing capabilities on existing hardware, thereby reducing sample and reagent use.

Expansion of Point-of-Care Testing Solutions

The growing need for rapid testing in decentralized settings is accelerating the adoption of compact molecular diagnostic instruments. Portable PCR devices and integrated cartridge-based systems are enabling faster turnaround times, particularly in infectious disease screening. Rising demand for near-patient testing in rural and emergency care settings supports industry growth, fostering accessibility and early disease management worldwide.

Key Trends & Opportunities

Growing Adoption of Automation and Digital Integration

Automation is transforming molecular diagnostics by improving consistency and reducing hands-on time. Laboratories are integrating digital workflow solutions and AI-powered analytics to enhance accuracy and traceability. Automated sample preparation and result interpretation systems minimize human error, increasing efficiency in high-throughput testing environments.

- For instance, bioMérieux’s automated processing line supports more than 2,500 samples per day on routine workflows with less than 10 minutes daily hands-on time for standard operations.

Rising Focus on Personalized and Precision Medicine

The increasing emphasis on individualized therapies drives demand for molecular instruments capable of detecting genetic mutations and biomarkers. Pharmaceutical companies are collaborating with diagnostics firms to co-develop companion diagnostic tools. This trend supports targeted treatment approaches and strengthens the role of molecular testing in oncology and rare disease management.

- For instance, Illumina, Inc. announced a companion diagnostic initiative targeting KRAS alterations across tumor types, enabling detection of over 40 distinct KRAS mutation variants in one assay for therapeutic alignment.

Key Challenges

High Cost of Advanced Molecular Instruments

The significant investment required for molecular diagnostic systems limits adoption, especially in developing economies. High equipment, maintenance, and reagent costs constrain smaller laboratories and clinics. The lack of reimbursement support for molecular testing further restricts accessibility, impacting market expansion in cost-sensitive regions.

Skilled Workforce Shortage and Operational Complexity

Operating molecular diagnostic instruments requires specialized technical expertise. Many healthcare facilities face challenges in training and retaining skilled personnel capable of managing high-end systems. The complexity of molecular workflows and data interpretation also delays widespread implementation, particularly in low-resource laboratory environments.

Regional Analysis

North America

North America leads the molecular diagnostics instruments market with a 38.4% share in 2024. The region benefits from strong healthcare infrastructure, early adoption of advanced diagnostic technologies, and a high prevalence of infectious and chronic diseases. The United States drives much of this growth due to robust R&D funding, favorable reimbursement frameworks, and the presence of major companies like Abbott Laboratories, Thermo Fisher Scientific, and Danaher Corporation. Growing demand for precision medicine and increased investment in molecular oncology testing continue to strengthen market expansion across the region.

Europe

Europe holds a 29.6% share of the molecular diagnostics instruments market in 2024. Countries such as Germany, the U.K., and France contribute significantly due to their strong focus on healthcare innovation and early disease detection. Supportive regulatory frameworks and national genomic programs are promoting molecular test adoption. The increasing use of PCR and NGS-based platforms in infectious disease and oncology diagnostics, coupled with the presence of leading manufacturers like Qiagen and bioMérieux, further supports Europe’s market position and ongoing technology integration.

Asia-Pacific

Asia-Pacific captures 23.7% of the molecular diagnostics instruments market in 2024, driven by rapid healthcare infrastructure development and rising disease awareness. China, Japan, and India are major contributors due to expanding diagnostic networks and government initiatives promoting advanced healthcare technologies. The growing demand for rapid and affordable molecular tests, particularly in infectious disease management, supports strong market growth. Investments in domestic production and increasing collaborations between international and regional diagnostic companies are further enhancing market accessibility and affordability across the region.

Latin America

Latin America accounts for 5.2% share of the molecular diagnostics instruments market in 2024. Growth in this region is supported by rising government efforts to improve diagnostic capabilities and control infectious diseases. Brazil and Mexico lead the market, focusing on expanding laboratory infrastructure and incorporating molecular testing into public healthcare systems. The increasing partnerships with global diagnostic firms and rising adoption of point-of-care molecular platforms are enhancing accessibility, though limited reimbursement coverage and high equipment costs continue to pose barriers to faster adoption.

Middle East & Africa

The Middle East & Africa region holds a 3.1% share in 2024, with gradual growth driven by rising healthcare investments and improved laboratory networks. Countries such as Saudi Arabia, the UAE, and South Africa are investing in modern diagnostic technologies to combat infectious disease burdens. Growing awareness of early diagnosis, expanding private healthcare facilities, and regional partnerships with international diagnostic companies support steady adoption. However, limited technical expertise and high setup costs continue to restrict wider implementation of advanced molecular diagnostic instruments in several African economies.

Market Segmentations:

By Product

- Instruments

- Regards

- Others

By Test Location

- Point of care

- Self-test or OTC

- Central laboratories

By Technology

- Polymerase chain reaction (PCR)

- In Situ Hybridization (ISH)

- Mass Spectrometry

- Others

By Application

- Oncology

- Neurological disease

- Cardiovascular disease

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the molecular diagnostics instruments market is characterized by the presence of leading players such as Agilent Technologies, Inc., QIAGEN, Illumina, Inc., Grifols, Hologic Inc. (Gen Probe), BD, Danaher, Bio-Rad Laboratories, Inc., BIOMÉRIEUX, and Abbott. These companies compete through product innovation, technological advancement, and strategic collaborations to strengthen their market positions. Continuous developments in PCR, next-generation sequencing, and automated molecular systems are driving innovation. Major players are investing in digital integration, AI-based diagnostic platforms, and decentralized testing solutions to improve accuracy and turnaround time. Mergers and acquisitions remain a key strategy for expanding product portfolios and global reach. For instance, companies are enhancing their molecular assay capabilities and automation technologies to cater to rising clinical and research demands. The competitive focus is shifting toward delivering compact, user-friendly, and high-throughput diagnostic systems that align with the growing trend of personalized and precision medicine.

Key Player Analysis

- Agilent Technologies, Inc.

- QIAGEN

- Illumina, Inc.

- Grifols

- Hologic Inc. (Gen Probe)

- BD

- Danaher

- Bio-Rad Laboratories, Inc.

- BIOMÉRIEUX

- Abbott

Recent Developments

- In October 2025, Hologic, Inc. received FDA 510(k) clearance and CE marking for its Panther Fusion® Gastrointestinal and Expanded Bacterial assays on its molecular diagnostic platform.

- In September 2025, QIAGEN N.V. gained U.S. clearance for its QIAstat-Dx Rise system, noting over 4,600 instruments placed globally to date.

- In September 2025, Agilent Technologies, Inc. entered into a non-exclusive collaboration with Lunit, Inc. to develop AI-powered companion diagnostic solutions that integrate Agilent’s instrumentation with Lunit’s tissue-based AI.

- In July 2025, Bio‑Rad Laboratories, Inc. launched four new droplet digital PCR (ddPCR) platforms including the QX Continuum™ and QX700™ series, extending its assay portfolio to over 400,000 assays.

Report Coverage

The research report offers an in-depth analysis based on Product, Test Location, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated molecular diagnostic systems will continue to expand across laboratories.

- Integration of AI and machine learning will enhance accuracy and speed of molecular testing.

- Demand for point-of-care molecular devices will grow in decentralized healthcare settings.

- Advancements in PCR and NGS technologies will strengthen precision and personalized medicine.

- Increasing collaborations between diagnostic firms and pharmaceutical companies will support companion diagnostics.

- Cloud-based data management and remote diagnostics will become more common in clinical workflows.

- Miniaturized and portable instruments will gain traction for field and home-based testing.

- Emerging markets in Asia-Pacific and Latin America will drive new growth opportunities.

- Sustainability initiatives will encourage development of energy-efficient and low-waste diagnostic devices.

- Regulatory support and increased R&D funding will foster innovation and accelerate market expansion.

Market Insights

Market Insights