Market Overview

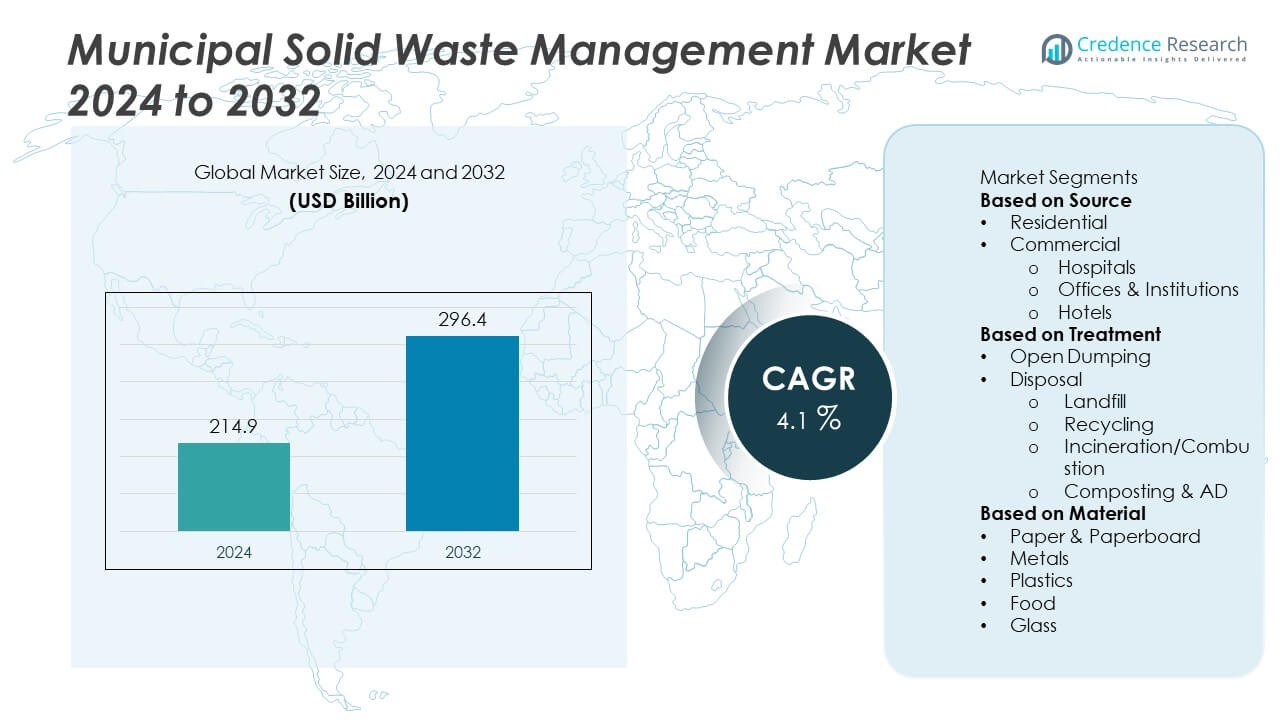

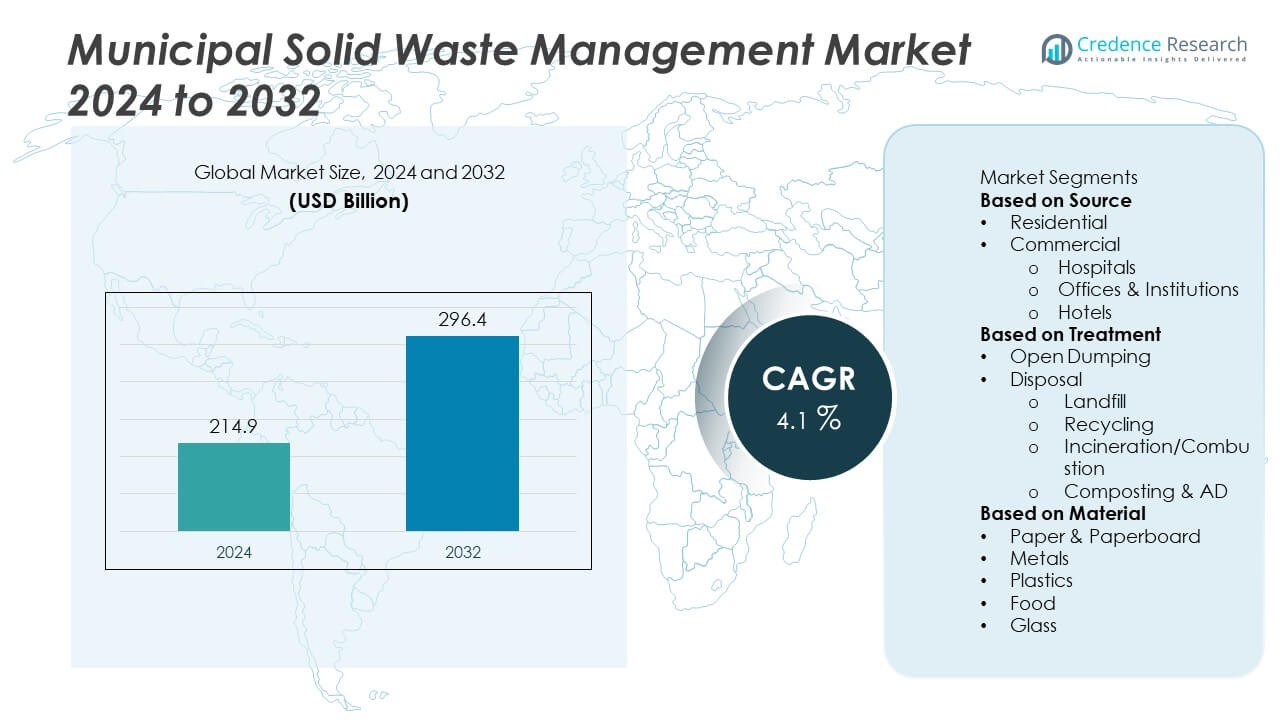

The Municipal Solid Waste Management Market size was valued at USD 214.9 billion in 2024 and is projected to reach USD 296.4 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Municipal Solid Waste Management Market Size 2024 |

USD 214.9 Billion |

| Municipal Solid Waste Management Market, CAGR |

4.1% |

| Municipal Solid Waste Management Market Size 2032 |

USD 296.4 Billion |

The Municipal Solid Waste Management Market advances through strong drivers such as rapid urbanization, rising waste volumes, and stricter environmental regulations that push municipalities toward sustainable practices. It gains support from government initiatives promoting recycling, composting, and waste-to-energy adoption, while public-private partnerships enhance infrastructure efficiency.

The Municipal Solid Waste Management Market demonstrates a broad geographical footprint, shaped by varying regulatory frameworks, infrastructure maturity, and urbanization levels across regions. North America leads with advanced recycling systems, strong policy support, and widespread adoption of waste-to-energy technologies. Europe emphasizes circular economy practices, strict landfill restrictions, and high recycling efficiency, supported by progressive environmental directives. Asia-Pacific emerges as the fastest-evolving region, driven by rapid urban growth, government-backed initiatives, and rising investments in smart waste management solutions. Latin America and the Middle East & Africa show steady progress with modernization programs and increasing private sector participation. Key players shaping the market include China Everbright Environment Group, a leader in waste-to-energy projects, Clean Harbors, known for comprehensive environmental and waste services, Recology, recognized for community-focused recycling programs, and GFL Environmental, which strengthens its presence with integrated collection, treatment, and disposal solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Municipal Solid Waste Management Market was valued at USD 214.9 billion in 2024 and is projected to reach USD 296.4 billion by 2032, expanding at a CAGR of 4.1%.

- The market grows through rising urbanization, increasing waste volumes, and government initiatives that enforce stricter environmental compliance and promote sustainable management systems.

- Key trends highlight the adoption of digital solutions such as IoT-enabled bins, AI-powered sorting, and route optimization platforms, alongside growing emphasis on circular economy practices.

- Competition remains strong, with leading players such as China Everbright Environment Group, Recology, GFL Environmental, and Clean Harbors investing in recycling infrastructure, waste-to-energy plants, and smart monitoring technologies.

- The market faces restraints in the form of high operational costs, inadequate infrastructure in emerging economies, and low public participation in source segregation, which limit large-scale adoption.

- North America and Europe dominate with advanced recycling systems and stringent regulatory frameworks, while Asia-Pacific experiences rapid growth through urban expansion and government-backed initiatives.

- Latin America and the Middle East & Africa gradually modernize through international funding, public-private partnerships, and investments in waste-to-energy and composting solutions, creating long-term growth opportunities.

Market Drivers

Rising Urbanization and Population Growth Driving Demand for Efficient Waste Handling

The Municipal Solid Waste Management Market grows steadily with rapid urbanization and population expansion across developed and developing regions. Higher population density generates greater household, commercial, and industrial waste volumes. Urban centers require modern collection, segregation, and disposal systems to prevent public health risks and environmental degradation. Governments and municipalities prioritize investment in infrastructure and integrated systems to keep pace with the mounting pressure. Public-private partnerships strengthen service delivery through advanced logistics and sustainable disposal practices. The growing urban middle class reinforces expectations for hygienic waste management solutions.

- For instance, Recology processes more than 1.5 million tons of recyclable and compostable material annually across its operations in the United States, demonstrating the scale required to manage rising urban waste volumes.

Increasing Focus on Environmental Regulations and Sustainability Standards

Governments across the globe enforce stringent environmental standards to minimize landfill use and control greenhouse gas emissions. The Municipal Solid Waste Management Market benefits from regulatory frameworks that mandate recycling, waste-to-energy adoption, and extended producer responsibility. It supports sustainable development by promoting circular economy practices and resource recovery. Strict compliance requirements push municipalities to implement advanced sorting, composting, and treatment technologies. International agreements on climate action and carbon neutrality encourage faster adoption of eco-friendly processes. Companies in the sector align with these goals to ensure long-term operational viability.

- For instance, China Everbright Environment Group operates more than 200 waste-to-energy projects with a combined daily processing capacity exceeding 160,000 tonnes, significantly reducing landfill reliance while complying with strict emission standards.

Technological Advancements in Recycling, Treatment, and Waste-to-Energy Solutions

The Municipal Solid Waste Management Market experiences transformation through innovations in smart bins, automated collection systems, and AI-driven sorting. It strengthens efficiency by reducing manual intervention and optimizing operational costs. Waste-to-energy facilities expand capacity to convert non-recyclable waste into electricity and heat, supporting renewable energy goals. Advanced recycling technologies improve recovery of plastics, metals, and electronic waste with higher precision. Data analytics and IoT solutions help monitor collection routes, reduce inefficiencies, and improve compliance reporting. Continuous innovation attracts investments from both governments and private operators.

Rising Public Awareness and Shifting Consumer Preferences Toward Sustainable Practices

The Municipal Solid Waste Management Market expands with rising public awareness of sustainability and ecological responsibility. It gains momentum as consumers demand recycling services, reduced plastic usage, and environmentally responsible practices. Educational initiatives and awareness campaigns influence behavioral change in urban households. Businesses adopt sustainable packaging, while communities participate in source segregation of biodegradable and recyclable materials. Municipalities respond to public pressure by enhancing transparency and accountability in waste management systems. Growing citizen participation ensures stronger adoption of efficient waste management models.

Market Trends

Growing Adoption of Waste-to-Energy Facilities to Support Renewable Energy Goals

The Municipal Solid Waste Management Market advances with the expansion of waste-to-energy plants that convert non-recyclable waste into electricity and heat. It enables municipalities to reduce landfill dependence while addressing rising energy demands. Governments support the deployment of these facilities through policy incentives and funding programs. The trend aligns with global commitments to expand renewable energy capacity and reduce greenhouse gas emissions. Companies in the sector invest in modern incineration, gasification, and anaerobic digestion technologies to maximize energy recovery. This approach integrates environmental sustainability with economic efficiency.

- For instance, Keppel Seghers is part of Hong Kong’s Integrated Waste Management Facility, which will process 3,000 tonnes of municipal solid waste per day and generate 480 million kWh of electricity annually once operational.

Integration of Digital Technologies and Smart Waste Solutions for Operational Efficiency

The Municipal Solid Waste Management Market embraces IoT-enabled bins, automated route optimization, and AI-powered sorting technologies. It enhances collection efficiency, reduces operational costs, and improves service reliability. Data-driven platforms allow municipalities to track waste volumes, predict collection schedules, and maintain real-time monitoring. Smart technologies provide transparency to citizens and strengthen accountability for waste services. Advanced analytics support better decision-making in recycling, treatment, and disposal. This trend accelerates adoption of digital infrastructure across urban waste management systems.

- For instance, GFL Environmental deployed over 3,000 smart bins equipped with IoT sensors across Canadian municipalities in 2023, enabling real-time monitoring and reducing unnecessary collection trips by more than 15 million kilometers annually.

Expanding Circular Economy Practices and Resource Recovery Initiatives

The Municipal Solid Waste Management Market gains momentum through practices that extend the lifecycle of materials and reduce raw material dependence. It emphasizes recycling, composting, and recovery of valuable resources from electronic and plastic waste. Companies adopt sustainable packaging, while governments introduce extended producer responsibility regulations. Municipalities strengthen segregation practices to improve recycling rates and minimize landfill use. Circular economy initiatives contribute to reduced environmental impact and support global sustainability goals. Investment in material recovery facilities highlights the growing importance of resource efficiency.

Rising Collaboration Between Public and Private Stakeholders to Improve Infrastructure

The Municipal Solid Waste Management Market evolves through partnerships that address infrastructure gaps in waste collection, transportation, and treatment. It benefits from joint ventures, concession models, and investment in modern facilities. Municipalities rely on private operators to deliver advanced technologies and operational expertise. Public participation in funding and awareness programs ensures community involvement in sustainable waste management. International organizations promote collaboration to improve waste systems in emerging economies. This trend drives consistent improvements in service delivery and accelerates modernization across regions.

Market Challenges Analysis

High Operational Costs and Limited Infrastructure in Developing Regions

The Municipal Solid Waste Management Market faces significant challenges from high collection, transportation, and treatment costs. It struggles with limited infrastructure in emerging economies where waste volumes rise faster than system capacity. Many municipalities depend on outdated equipment and underfunded facilities that cannot meet modern efficiency or environmental standards. Budget constraints restrict adoption of advanced recycling and waste-to-energy technologies. Rural and semi-urban areas often lack organized collection networks, creating inefficiencies and uncontrolled dumping. This gap in resources and infrastructure slows the pace of sustainable waste management practices.

Regulatory Complexity and Low Public Participation in Waste Segregation

The Municipal Solid Waste Management Market also encounters difficulties in managing diverse regulatory frameworks and compliance requirements across regions. It must adapt to varying policies on landfill use, recycling quotas, and emissions control, which creates operational hurdles. Public participation in source segregation remains low, limiting the effectiveness of recycling and composting initiatives. Inconsistent awareness campaigns fail to drive lasting behavioral change in many communities. Informal waste handling practices persist, undermining formal systems and reducing efficiency. These challenges emphasize the need for stronger collaboration between regulators, municipalities, and citizens to achieve long-term sustainability goals.

Market Opportunities

Expansion of Waste-to-Energy Projects and Advanced Recycling Technologies

The Municipal Solid Waste Management Market creates strong opportunities through investments in waste-to-energy and high-efficiency recycling technologies. It supports governments and private operators seeking to reduce landfill dependency while generating renewable energy. Growing interest in advanced incineration, pyrolysis, and anaerobic digestion expands the potential for energy recovery from non-recyclable waste. Recycling innovations in plastics, e-waste, and metals enable higher material recovery rates and cost efficiency. These opportunities align with global sustainability goals and climate commitments. Increased funding from both international organizations and local authorities reinforces the momentum for modern infrastructure deployment.

Rising Potential in Emerging Economies and Smart Waste Management Solutions

The Municipal Solid Waste Management Market holds significant opportunities in rapidly urbanizing economies where infrastructure modernization remains a priority. It addresses the growing demand for organized collection, segregation, and treatment systems across Asia-Pacific, Africa, and Latin America. Adoption of IoT-enabled bins, route optimization platforms, and AI-driven sorting enhances service efficiency and transparency. Municipalities explore digital platforms that allow real-time monitoring and citizen participation. Stronger public-private partnerships in these regions create avenues for long-term investment and technological integration. The push for smart and sustainable cities amplifies demand for scalable waste management solutions.

Market Segmentation Analysis:

By Source

The Municipal Solid Waste Management Market classifies waste sources into residential, commercial, and industrial sectors. Residential areas generate a large share of waste through food scraps, packaging materials, plastics, and paper products. It requires regular collection services and community-level segregation practices to maintain efficiency. Commercial establishments such as retail outlets, offices, and restaurants contribute through paper, plastics, and food waste that need systematic disposal. Industrial sources add to the complexity with bulk quantities of non-hazardous materials, often requiring specialized handling. Growth in urbanization and rising consumption patterns reinforce demand for effective waste management across all sources.

- For instance, Biffa in the UK manages waste from over 76,000 business customers and collects more than 4 million tonnes of municipal and commercial waste annually, ensuring coverage across residential and industrial sectors.

By Treatment

The Municipal Solid Waste Management Market segments treatment processes into collection, recycling, incineration, composting, and landfilling. Collection remains the first critical step, supported by advanced logistics and digital monitoring systems. Recycling strengthens its share as governments and businesses prioritize material recovery and circular economy practices. Incineration and waste-to-energy methods expand rapidly, addressing energy needs while reducing landfill dependency. Composting gains attention with rising demand for sustainable agricultural practices and organic waste utilization. Landfills continue to serve as a last resort, though stricter regulations push municipalities toward more sustainable alternatives. It reflects a global shift toward environmentally responsible treatment solutions.

- For instance, Cleanaway in Australia operates more than 100 recycling and resource recovery facilities, including organics processing sites capable of treating over 300,000 tonnes of food and garden waste annually, converting it into compost and renewable energy feedstock.

By Material

The Municipal Solid Waste Management Market categorizes materials into paper, plastics, metals, glass, food, and others. Paper and cardboard maintain a strong position with high recycling rates supported by established collection channels. Plastics pose significant challenges due to their environmental impact, yet advanced recycling technologies create new opportunities for recovery. Metals and glass contribute consistently, with high potential for reuse in industrial applications. Food waste accounts for a substantial portion, encouraging expansion of composting and anaerobic digestion facilities. Other materials, including textiles and e-waste, add diversity and require specialized recycling systems. It highlights the need for integrated approaches to address the varied material composition of urban waste.

Segments:

Based on Source

- Hospitals

- Offices & Institutions

- Hotels

Based on Treatment

- Landfill

- Recycling

- Incineration/Combustion

- Composting & AD

Based on Material

- Paper & Paperboard

- Metals

- Plastics

- Food

- Glass

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Municipal Solid Waste Management Market, accounting for 34% of the global market in 2024. Strong regulatory frameworks, advanced infrastructure, and high public awareness contribute to the region’s leadership. The United States generates more than 292 million tons of municipal solid waste annually, with nearly 32% directed to recycling and composting programs. Canada complements the market with nationwide recycling policies and landfill diversion targets. It benefits from robust investment in waste-to-energy plants, digital monitoring solutions, and public-private partnerships that improve operational efficiency. Growing emphasis on sustainability and stricter emission control regulations further encourage adoption of advanced recycling and treatment technologies. Continuous technological innovation positions North America as a mature and reliable market for sustainable waste management practices.

Europe

Europe represents 28% of the Municipal Solid Waste Management Market in 2024, supported by strict environmental directives and well-developed recycling infrastructure. Countries such as Germany, Sweden, and the Netherlands demonstrate world-leading recycling rates exceeding 50%. The European Union enforces stringent regulations on landfill use, promoting circular economy initiatives and extended producer responsibility programs. It drives demand for composting, anaerobic digestion, and advanced sorting technologies. Public awareness of ecological responsibility supports efficient source segregation across households and commercial establishments. Investment in modern incineration plants with energy recovery enhances the region’s waste-to-energy capacity. Europe’s consistent focus on regulatory compliance and innovation sustains its strong market presence.

Asia-Pacific

Asia-Pacific commands 24% of the Municipal Solid Waste Management Market in 2024, with rapid urbanization and industrialization driving demand for organized systems. China generates over 235 million tons of municipal waste annually, supported by national policies promoting recycling and waste-to-energy adoption. India follows with strong government-backed initiatives such as Swachh Bharat Mission, which encourages segregation and infrastructure expansion in urban centers. Japan and South Korea maintain advanced recycling frameworks with high recovery rates of plastics, metals, and food waste. It benefits from rising investments in smart waste collection, IoT-enabled monitoring, and large-scale composting facilities. Growing environmental awareness and urban population growth further reinforce Asia-Pacific’s position as the fastest-growing regional market.

Latin America

Latin America accounts for 8% of the Municipal Solid Waste Management Market in 2024, with demand driven by urbanization and government initiatives to modernize infrastructure. Brazil leads the region, producing more than 79 million tons of municipal waste annually, followed by Mexico and Argentina. It faces challenges from limited recycling infrastructure and heavy reliance on landfills, yet opportunities arise from public-private partnerships and international funding. Governments implement stricter landfill management policies and promote selective collection programs to boost recycling rates. Community-driven initiatives play a growing role in improving waste segregation and reducing informal waste handling. Rising investments in composting and waste-to-energy projects support gradual modernization of the region’s waste management systems.

Middle East and Africa

The Middle East and Africa hold 6% of the Municipal Solid Waste Management Market in 2024, with rising urbanization and infrastructure expansion creating demand for efficient solutions. The United Arab Emirates and Saudi Arabia invest heavily in waste-to-energy projects to reduce landfill dependency and meet sustainability goals. South Africa and Nigeria represent emerging markets where inadequate collection infrastructure and limited recycling capacity remain challenges. It benefits from international collaboration and government-led initiatives that encourage modernization and private sector participation. The region witnesses growing adoption of digital platforms for monitoring and smart city waste management programs. Long-term opportunities emerge from expanding population bases and the urgent need for sustainable solutions to address rising waste volumes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Keppel Seghers

- Recology

- China Everbright Environment Group

- OMNI Conversion Technologies

- Cleanaway

- GFL Environmental

- Hitachi Zosen

- L. Harvey

- Biffa

- Clean Harbors

Competitive Analysis

The competitive landscape of the Municipal Solid Waste Management Market is shaped by leading players such as China Everbright Environment Group, Biffa, Recology, Cleanaway, Clean Harbors, GFL Environmental, Hitachi Zosen, Keppel Seghers, OMNI Conversion Technologies, and E.L. Harvey, which drive industry growth through technological innovation, service diversification, and sustainable operations. Strategic investments in waste-to-energy facilities, advanced recycling technologies, and digital waste monitoring solutions strengthen efficiency and regulatory compliance. Market reach is further expanded through partnerships and acquisitions, enabling enhanced service capabilities across urban and industrial waste streams. A strong focus on sustainable practices such as resource recovery, composting, and reduced landfill dependency aligns with circular economy principles. Continuous innovation combined with regional expansion underpins competitive intensity and supports long-term growth in the sector.

Recent Developments

- In August 2025, China Everbright Environment Group announced (interim 1H results) that it secured three new projects totaling RMB 2.336 billion investments, adding a daily household waste processing capacity of 3,000 tonnes.

- In June 2025, Biffa reached the halfway point of a hazardous waste removal project at the former Ratcliffe-on-Soar power station deploying specialists to support decommissioning efforts.

- In June 2025, Biffa secured a contract for waste, recycling, and street cleaning services in Wokingham Borough Council.

- In June 2025, Recology released its 2025 Sustainability Update reporting the processing of 1.5 million tons of recyclable and compostable material and the avoidance of 1.7 million metric tons.

Report Coverage

The research report offers an in-depth analysis based on Source,Treatment,Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Urban regions drive continued demand for scalable, efficient waste management systems.

- Governments expand incentives for recycling and waste-to-energy projects.

- Investment growth targets smart waste technologies like IoT monitoring and AI sorting.

- Waste-to-energy facilities play a larger role in integrating energy recovery with disposal strategies.

- Circular economy principles shape packaging, recycling, and material reuse frameworks.

- Public-private partnerships deliver modern infrastructure and build resilience.

- Consumer awareness prompts stronger source segregation and sustainable behavior.

- Emerging economies accelerate modernization of collection and treatment networks.

- Regulatory frameworks evolve toward stricter landfill restrictions and resource recovery targets.

- Mergers, acquisitions, and strategic alliances fuel expansion and drive innovation.