Market Overview:

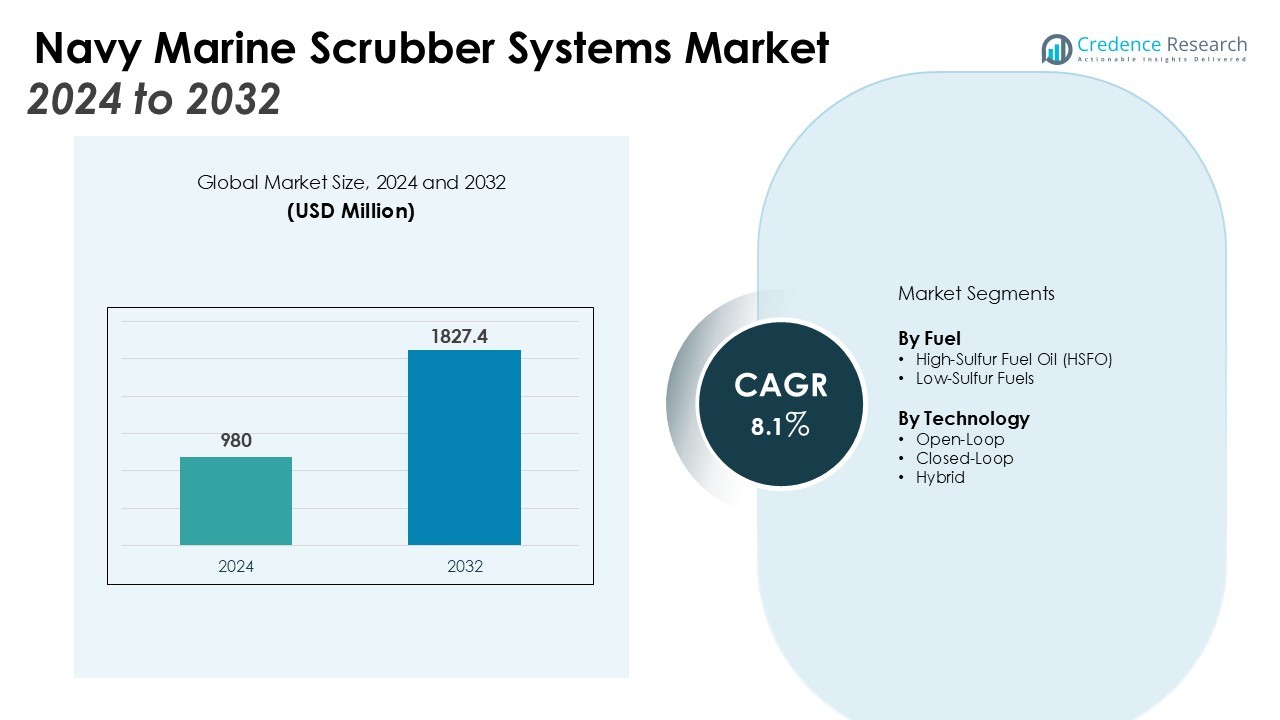

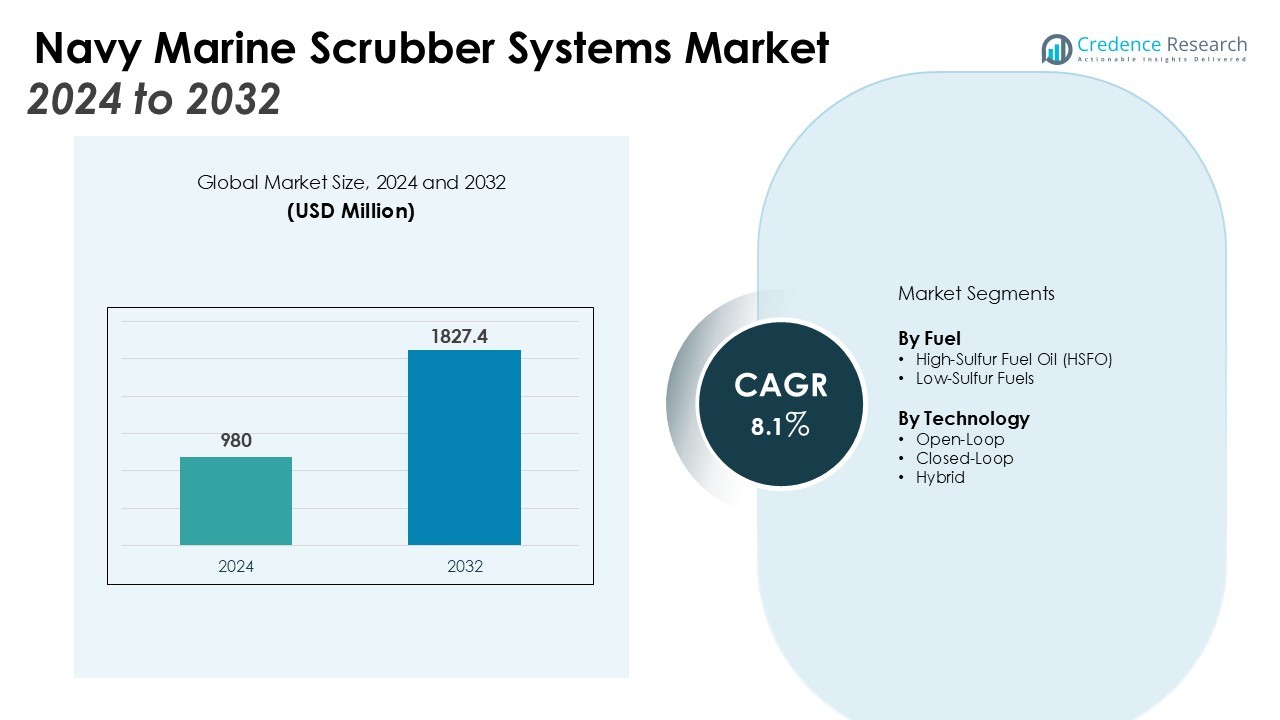

The Navy Marine Scrubber Systems Market size was valued at USD 980 million in 2024 and is anticipated to reach USD 1827.4 million by 2032, at a CAGR of 8.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Navy Marine Scrubber Systems Market Size 2024 |

USD 980 Million |

| Navy Marine Scrubber Systems Market, CAGR |

8.1% |

| Navy Marine Scrubber Systems Market Size 2032 |

USD 1827.4 Million |

Market growth is strongly supported by stricter emission norms, rising fuel costs, and growing sustainability commitments across naval fleets. Technological advancements, including hybrid scrubber systems and closed-loop designs, are improving operational efficiency and reliability. The integration of automation and digital monitoring further enhances real-time performance, reduces downtime, and helps naval operators achieve compliance without compromising on long-term cost savings. These factors are collectively fueling stronger demand for advanced scrubber systems in navy applications.

Regionally, Asia Pacific dominates the Navy Marine Scrubber Systems Market due to strong shipbuilding activity in China, South Korea, and Japan, coupled with strict emission compliance in regional waters. Europe holds a significant share, driven by Emission Control Areas (ECAs) and early adoption of sustainable technologies. North America is witnessing steady growth supported by regulatory frameworks and modernization programs within naval fleets. The Middle East is also emerging as a key market, driven by expanding naval capabilities and increasing investments in maritime defense infrastructure.

Market Insights:

- The Navy Marine Scrubber Systems Market was valued at USD 980 million and is projected to reach USD 1827.4 million by 2032, growing at a CAGR of 8.1%.

- Stricter IMO emission regulations and enforcement of Emission Control Areas are creating sustained demand for scrubber installations across naval fleets.

- Rising fuel cost pressures make scrubber systems a cost-effective solution, allowing navies to operate on high-sulfur fuel while meeting compliance standards.

- Hybrid and closed-loop scrubber technologies are improving reliability, reducing discharge risks, and strengthening operator confidence in advanced systems.

- High installation and retrofitting costs remain a challenge, especially for fleets operating under constrained defense budgets.

- Asia Pacific holds 42% share, followed by Europe at 31% and North America at 19%, reflecting regional leadership in adoption.

- The Middle East is emerging as a growth hub, supported by naval modernization and expanding defense investments across Gulf nations.

Market Drivers:

Stringent International Maritime Organization (IMO) Regulations Driving Adoption

The International Maritime Organization (IMO) sulfur emission regulations remain a central driver for the Navy Marine Scrubber Systems Market. Naval operators face strict compliance requirements to reduce sulfur oxides (SOx) and particulate matter emissions. Scrubber systems provide a cost-effective solution compared to switching entirely to low-sulfur fuels. The increasing enforcement of Emission Control Areas (ECAs) ensures continuous demand for advanced scrubber installations across naval fleets.

- For instance, Alfa Laval’s PureSOx scrubber system is trusted worldwide, with at least 25 vessels equipped with PureSOx scrubbers by Safe Bulkers alone for strict IMO compliance as of 2022.

Rising Fuel Costs and Need for Cost-Effective Alternatives

Fuel cost volatility continues to pressure naval operations. High-sulfur fuel oil is still cheaper than low-sulfur alternatives, making scrubbers an economically viable option. The Navy Marine Scrubber Systems Market benefits from this trend by offering a long-term cost-saving mechanism. It enables fleets to operate with high-sulfur fuels while meeting emissions standards, providing financial efficiency without regulatory risk.

- For instance, Wärtsilä received its first order for CCS-Ready scrubber systems for four 8,200 TEU container vessels, marking a major step in future-proofing fleets with technology designed for both current IMO regulations and future carbon capture integration.

Advancements in Hybrid and Closed-Loop Scrubber Technologies

Technological improvements are enhancing operational efficiency and reliability across the market. Hybrid scrubber systems, capable of switching between open-loop and closed-loop modes, provide flexibility for different maritime conditions. Closed-loop systems reduce water discharge issues, supporting compliance in sensitive environments. It is strengthening operator confidence and encouraging wider adoption of innovative scrubber solutions across navy fleets.

Growing Sustainability Commitments and Fleet Modernization Programs

Sustainability objectives and modernization programs are accelerating adoption across naval forces. Governments are prioritizing eco-friendly defense technologies that align with global climate goals. The Navy Marine Scrubber Systems Market gains momentum from naval investments in emission reduction and energy efficiency. It aligns with modernization programs aimed at equipping fleets with advanced, sustainable technologies, reinforcing long-term market growth.

Market Trends:

Integration of Digital Monitoring and Automation in Scrubber Systems

Digitalization is shaping the Navy Marine Scrubber Systems Market through the adoption of advanced monitoring and automation technologies. Real-time emission tracking and automated control systems are becoming standard features in new installations. These solutions enable naval operators to maintain compliance efficiently while reducing manual oversight and operational errors. Automation also lowers maintenance costs and extends system life cycles, making scrubbers more reliable. It supports predictive maintenance, which minimizes downtime and improves fleet readiness. The shift toward data-driven operations highlights the increasing role of smart technologies in naval emission management.

- For instance, the USS Fitzgerald uses Fathom5’s Enterprise Remote Monitoring Version 4 (ERM v4) AI system, which processes 10,000 sensor readings per second from critical ship systems to predict maintenance needs and enhance operational readiness.

Shift Toward Hybrid and Environmentally Adaptive Scrubber Solutions

Hybrid scrubber systems are gaining preference due to their flexibility in both open-loop and closed-loop modes. This trend is driven by the need to operate efficiently across varying maritime zones, including regions with stricter water discharge regulations. Closed-loop systems are also seeing greater adoption for their ability to reduce environmental risks. The Navy Marine Scrubber Systems Market benefits from this movement toward environmentally adaptive designs that align with sustainability goals. It is influencing procurement strategies, with navies prioritizing systems that offer compliance and environmental protection. This shift underscores the broader industry trend of aligning naval technologies with global climate and regulatory frameworks.

- For instance, Wärtsilä’s hybrid scrubber system installed on three new container vessels manages a total engine power output of 28 MW, providing operational flexibility with both open and closed-loop modes for emission control.

Market Challenges Analysis:

High Installation and Maintenance Costs Limiting Widespread Adoption

The Navy Marine Scrubber Systems Market faces challenges from the significant upfront investment required for installation. Many naval fleets operate on constrained defense budgets, making large-scale adoption difficult. The high cost of retrofitting older vessels with scrubbers often exceeds planned modernization budgets. It also requires specialized labor and technical expertise, which increases overall expenses. Regular maintenance and operational oversight further add to lifecycle costs, reducing the appeal for cost-sensitive naval programs. These financial barriers slow the pace of adoption, especially in developing defense markets.

Operational Complexity and Environmental Concerns Restricting Deployment

Scrubber systems introduce operational complexity that naval operators must carefully manage. Hybrid and closed-loop systems require advanced technical training and strict operational protocols. It often leads to higher reliance on skilled personnel, which not all fleets can support. Environmental concerns about water discharge from open-loop systems are leading to restrictions in many regions. This regulatory uncertainty creates hesitation for navies investing in long-term solutions. Limited infrastructure for waste handling also hampers full-scale deployment across global naval bases. These operational and environmental issues continue to challenge the steady growth of the market.

Market Opportunities:

Expansion of Naval Modernization Programs Creating Demand for Advanced Scrubber Systems

The Navy Marine Scrubber Systems Market is positioned to benefit from large-scale naval modernization programs. Governments worldwide are investing in next-generation fleets equipped with eco-friendly technologies. Scrubber systems provide a direct pathway to achieving compliance with international emission regulations while reducing long-term operational costs. It offers navies the ability to continue using cost-efficient fuels while maintaining sustainability targets. The alignment of scrubber systems with defense procurement priorities creates new growth opportunities. Expanding defense budgets in Asia Pacific and the Middle East further strengthen this demand outlook.

Growing Role of Hybrid and Closed-Loop Solutions in Strategic Naval Operations

Hybrid and closed-loop scrubber systems present significant opportunities for wider adoption in naval fleets. These systems offer operational flexibility across emission control zones while addressing stricter discharge restrictions. The Navy Marine Scrubber Systems Market benefits from rising interest in technologies that combine compliance with environmental responsibility. It opens avenues for manufacturers to develop scalable, adaptable, and digitally integrated solutions tailored for naval applications. Partnerships between technology providers and defense agencies can accelerate deployment across advanced and developing markets. The rising demand for sustainable naval operations supports long-term growth in this sector.

Market Segmentation Analysis:

By Fuel

The Navy Marine Scrubber Systems Market is segmented by fuel into high-sulfur fuel oil (HSFO) and low-sulfur alternatives. HSFO remains the dominant segment due to its cost advantage over compliant low-sulfur fuels. Scrubber systems enable fleets to continue using HSFO while meeting IMO emission regulations, making them a preferred choice for navies focused on balancing compliance and operational costs. It supports cost efficiency while ensuring environmental performance, strengthening demand for scrubber installations across naval vessels. The shift toward sustainable operations may gradually increase the role of cleaner fuels, but HSFO-driven adoption continues to lead current installations.

- For instance, the CR Ocean Engineering scrubber installed on the Stena Ro-Ro vessel with a 6 MW engine effectively complies with 0.1% sulfur equivalency requirements while enabling continued use of HSFO.

By Technology

Technology segmentation includes open-loop, closed-loop, and hybrid systems. Open-loop systems are widely used due to their simpler design and lower initial investment, but their adoption is facing restrictions in regulated waters. Closed-loop scrubbers are gaining traction because they minimize discharge risks and align with environmental protection standards. Hybrid systems are emerging as a strong growth segment, offering flexibility to operate in both open and closed modes depending on maritime zones. The Navy Marine Scrubber Systems Market benefits from this shift toward advanced technologies that combine operational efficiency with environmental compliance. It is driving greater investment in hybrid and digitally integrated scrubber solutions tailored for modern naval applications.

- For instance, Wärtsilä supplied hybrid scrubber systems to two Norwegian Cruise Line ships, enabling compliance with IMO sulfur restrictions and customized for space constraints on 325-meter vessels.

Segmentations:

By Fuel

- High-Sulfur Fuel Oil (HSFO)

- Low-Sulfur Fuels

By Technology

- Open-Loop

- Closed-Loop

- Hybrid

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific Leading with Strong Shipbuilding Activity and Naval Investments

Asia Pacific accounted for 42% share of the Navy Marine Scrubber Systems Market. The region dominates due to its robust shipbuilding industry and rapid naval expansion. China, South Korea, and Japan remain central to this growth, supported by government-backed maritime strategies and strict compliance with emission standards. Growing defense budgets in India and Southeast Asia further strengthen adoption, as these nations invest in modern naval fleets. It benefits from regional emphasis on sustainable shipping and military modernization. The presence of large-scale manufacturing hubs also enables cost-effective deployment of advanced scrubber technologies.

Europe Strengthened by Emission Control Areas and Early Technology Adoption

Europe held 31% share of the Navy Marine Scrubber Systems Market. The region’s strong position is driven by strict emission control measures and established environmental policies. The presence of Emission Control Areas (ECAs) in the North Sea, Baltic Sea, and Mediterranean accelerates demand for scrubber installations across naval fleets. Early adoption of closed-loop and hybrid systems highlights Europe’s commitment to sustainability and operational efficiency. It benefits from strong collaboration between naval forces and technology developers to ensure compliance and performance. Regional shipyards and retrofitting expertise further support the widespread use of scrubber systems in defense applications.

North America and Middle East Emerging as High-Growth Regions

North America accounted for 19% share of the Navy Marine Scrubber Systems Market. The region continues to expand its presence through modernization programs led by the United States Navy. Strong regulatory frameworks and rising investments in defense sustainability initiatives fuel steady market growth. It is supported by advanced R&D capabilities and high adoption of automation-driven solutions. The Middle East is emerging as another key region, backed by growing naval capabilities and strategic investments in maritime defense. Rising procurement of technologically advanced fleets across Gulf nations further boosts the demand for scrubber systems. Together, these regions present significant growth potential for global market expansion.

Key Player Analysis:

- NICRO

- KwangSung

- PureteQ

- ANDRITZ

- Aries Marine

- Damen Shipyards Group

- Schneider Electric

- SAACKE

- Fuji Electric

- MITSUBISHI HEAVY INDUSTRIES

- VDL AEC Maritime

- Hitachi Energy

Competitive Analysis:

The Navy Marine Scrubber Systems Market is highly competitive, with players focusing on technological innovation, regulatory compliance, and cost efficiency. Leading companies emphasize hybrid and closed-loop systems to address stricter environmental regulations and meet the operational needs of naval fleets. It is driving strong investment in digital monitoring, automation, and predictive maintenance features to enhance system performance and reliability. Strategic partnerships with defense organizations are common, enabling firms to align product development with modernization programs. Competition is also shaped by retrofitting capabilities, as naval forces seek to upgrade existing vessels with advanced scrubber solutions. Regional players in Asia Pacific leverage shipbuilding strength, while European companies capitalize on early adoption and sustainability expertise. Global leaders are positioning themselves by expanding product portfolios and offering integrated solutions, reinforcing their presence in a market where compliance and operational efficiency define long-term success.

Recent Developments:

- In June 2025, ANDRITZ announced an agreement to acquire the Salico Group, a company specializing in equipment for the metal processing industry.

- In August 2025, Damen Shipyards, in partnership with Windcat, launched the ‘Windcat Rotterdam,’ a new Commissioning Service Operation Vessel (CSOV) featuring a hybrid battery-electric propulsion system.

- In May 2025, Damen launched a new Island Class diesel-hybrid, battery-equipped ferry for BC Ferries, which is designed to be converted to full electric operation in the future.

Report Coverage:

The research report offers an in-depth analysis based on Fuel, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Navy Marine Scrubber Systems Market will expand with rising enforcement of IMO sulfur emission regulations across global waters.

- Naval forces will prioritize scrubber adoption to balance cost efficiency while maintaining compliance with strict emission standards.

- Hybrid and closed-loop scrubber systems will gain preference due to operational flexibility and environmental advantages.

- Digital integration with automation and real-time monitoring will strengthen system reliability and reduce maintenance downtime.

- Demand for retrofitting existing naval fleets will rise as governments focus on extending vessel life cycles.

- Asia Pacific will continue to lead adoption, supported by large-scale shipbuilding and expanding naval budgets.

- Europe will sustain growth through strict Emission Control Areas and established environmental policies.

- North America will advance steadily with modernization programs and strong defense sustainability initiatives.

- The Middle East will emerge as a growth hub due to rising naval capabilities and maritime defense investments.

- Global manufacturers will focus on innovation, partnerships, and scalable solutions to address evolving naval requirements.