Market Overview

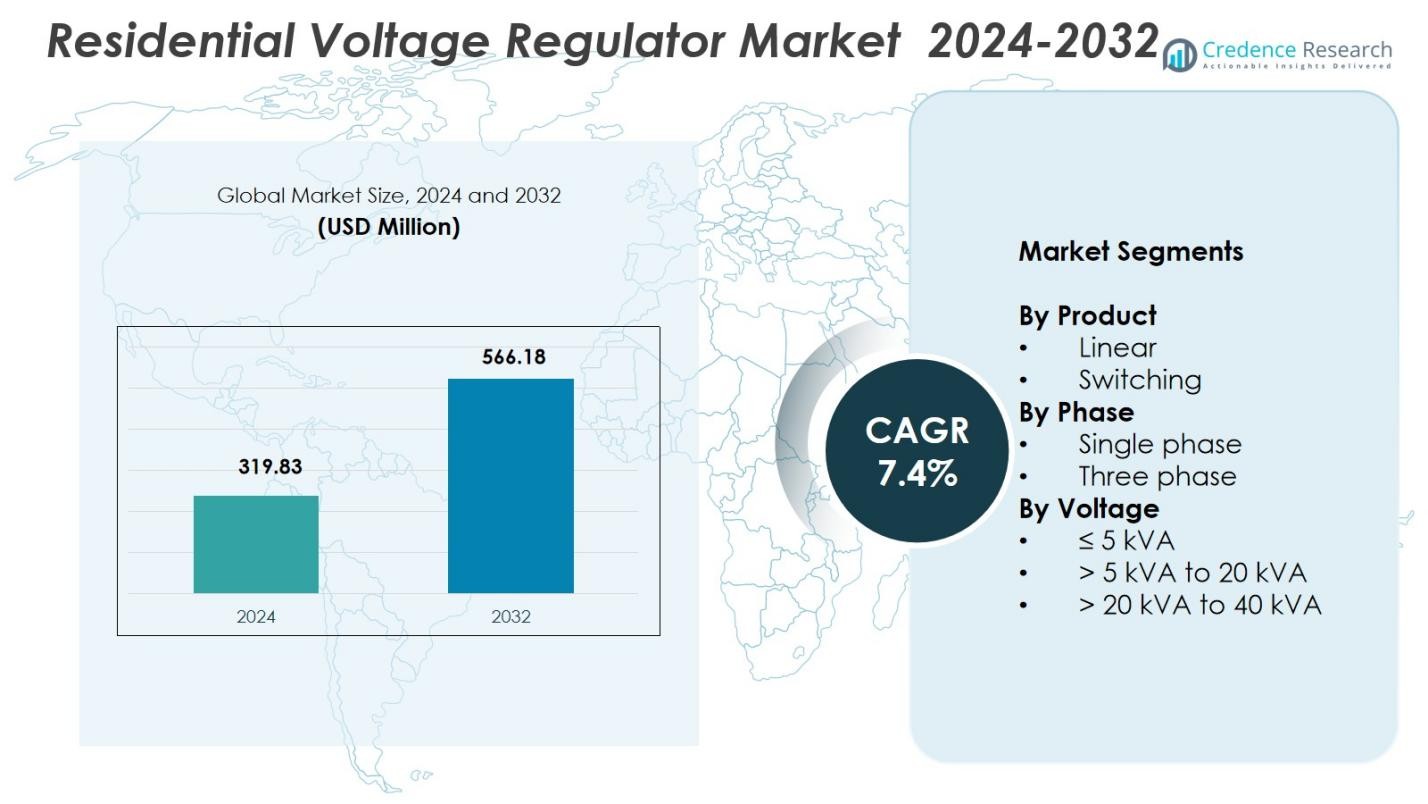

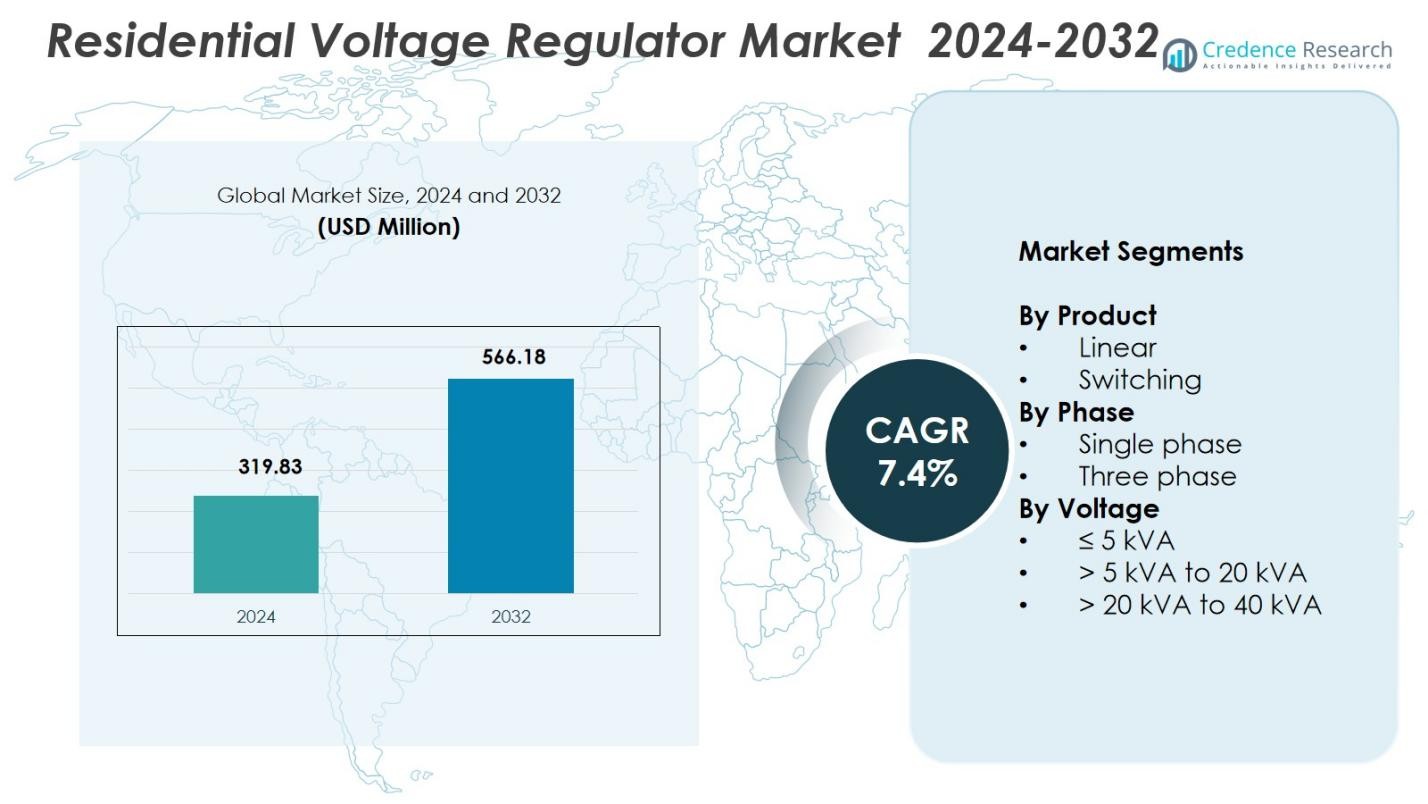

Residential Voltage Regulator Market size was valued at USD 319.83 Million in 2024 and is anticipated to reach USD 566.18 Million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Voltage Regulator Market Size 2024 |

USD 319.83 Million |

| Residential Voltage Regulator Market, CAGR |

7.4% |

| Residential Voltage Regulator Market Size 2032 |

USD 566.18 Million |

Residential Voltage Regulator Market is shaped by leading players such as ABB, Eaton, GE Vernova, Legrand, Basler Electric, Infineon Technologies, Microchip Technologies, Analog Devices, BTRAC, and Maschinenfabrik Reinhausen, all driving advancements in stable and efficient voltage control for modern households. These companies focus on enhancing digital monitoring, energy efficiency, and compatibility with smart-home systems. North America emerged as the leading region with 34.7% market share in 2024, supported by strong residential electrification and high adoption of sensitive home electronics. Europe and Asia-Pacific follow closely, driven by rapid urbanization, renewable integration, and growing emphasis on electrical safety in residential infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Residential Voltage Regulator Market was valued at USD 319.83 Million in 2024 and will reach USD 566.18 Million by 2032, growing at a CAGR of 7.4%.

- Market growth is driven by rising voltage fluctuations, increasing use of smart appliances, and expanding residential electrification that boosts demand for stable power regulation.

- Key trends include adoption of IoT-enabled regulators, digital monitoring features, and growing preference for solar-compatible solutions supporting distributed home energy systems.

- Leading players such as ABB, Eaton, GE Vernova, Legrand, Infineon Technologies, and Microchip Technologies strengthen market presence through advanced product enhancements and technology integration.

- North America led with 34.7% share in 2024, followed by Europe at 27.9% and Asia-Pacific at 24.6%, while the Linear segment dominated by product with 62.4% share, reflecting strong preference for reliable, low-noise residential voltage stabilization.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product:

In the Residential Voltage Regulator Market, the Linear segment dominated with 62.4% share in 2024, driven by its stable voltage correction, low noise generation, and suitability for sensitive household electronics such as smart appliances, lighting systems, and home entertainment devices. Linear regulators are widely preferred in residential settings due to their simple design, high reliability, and consistent output regulation without electromagnetic interference. Their ability to deliver precise voltage stabilization makes them ideal for modern homes with increasing penetration of IoT-enabled devices and sensitive power-dependent equipment, supporting continued adoption across global residential infrastructures.

- For instance, Infineon’s OPTIREG TLS115D0LD linear regulator, with up to 150 mA output current and features such as reverse-polarity protection and adjustable output around 2.0 V, is designed for robust power delivery in low-voltage control and sensing modules.

By Phase:

The Single-phase segment held the leading position with 71.6% share in 2024, supported by its extensive use in residential power distribution networks. Single-phase voltage regulators are integral to stabilizing household electrical loads, ensuring consistent power quality for appliances, HVAC systems, and lighting circuits. Their cost-effectiveness, ease of installation, and compatibility with standard residential wiring systems further accelerate adoption. Rising urbanization, expansion of smart-home ecosystems, and the need to protect domestic electronics from voltage fluctuations strengthen the demand for single-phase solutions across both new housing developments and retrofit applications.

- For instance, Howard Power Solutions’ SVR-1 single-phase regulators employ tap-changing autotransformers to maintain voltages within ±10% across 32 steps of 5/8%, with digital controls for residential pole-mounted or substation applications.

By Voltage:

Within the voltage category, the ≤ 5 kVA segment accounted for 54.2% share in 2024, reflecting strong demand for low-capacity voltage regulators suitable for typical household loads. These units are widely used to protect televisions, refrigerators, washing machines, and home networking equipment from voltage instability, particularly in regions with inconsistent grid performance. Their compact form factor, affordability, and energy efficiency make them the preferred choice for individual appliance protection and whole-home use. Increasing residential electrification, coupled with rising consumption of sensitive electronic devices, continues to sustain growth in this segment globally.

Key Growth Drivers

Rising Incidence of Residential Voltage Fluctuations

Growing instability in power grids, driven by rapid urbanization, rising electricity demand, and aging distribution infrastructure, significantly increases the need for residential voltage regulators. Consumers rely on these devices to protect household appliances, HVAC systems, and electronic equipment from voltage drops and surges that can lead to performance degradation or failure. The expansion of decentralized power networks and rooftop solar installations further amplifies fluctuation risks, reinforcing demand for reliable voltage-stabilizing solutions across both new and existing residential environments.

- For instance, Prabhakar Reddy paired a 10kW rooftop solar system with a 15kVA servo stabilizer to ensure consistent power output despite grid fluctuations.

Increasing Penetration of Home Electronics and Smart Appliances

Households are integrating more sensitive electronic devices, including smart televisions, connected appliances, home automation systems, and EV charging units, all of which require stable voltage for optimal performance. This shift amplifies the need for residential voltage regulators capable of maintaining precise power quality. As consumers adopt higher-value electronics with advanced circuitry, protection from electrical inconsistencies becomes essential. The rising popularity of premium appliances and IoT-enabled home ecosystems continues to accelerate adoption of voltage regulation technologies.

- For instance, Microtek’s EML-10090 mainline stabilizer handles input voltages from 100-290V with low and high cut-off protection plus MCB for spike currents, safeguarding entire household appliances including refrigerators and TVs without separate units.

Expansion of Smart Homes and Energy-Efficient Residential Infrastructure

The growing transition toward smart homes drives substantial demand for voltage regulators that ensure seamless operation of interconnected devices. These systems rely on stable power to support automation, energy management platforms, and digitally controlled appliances. In parallel, energy-efficient building initiatives encourage homeowners to integrate power-conditioning equipment to improve electrical safety and optimize energy consumption. Supportive government programs promoting energy efficiency, along with rising consumer awareness of electrical protection, further strengthen long-term demand.

Key Trends & Opportunities

Integration of Digital Monitoring and IoT-Based Control

A major trend shaping the Residential Voltage Regulator Market is the integration of digital monitoring, remote diagnostics, and IoT-enabled control features. Smart regulators equipped with sensors and real-time data analytics enhance power visibility and allow users to track load fluctuations, predict failures, and optimize energy usage. These capabilities create opportunities for manufacturers to introduce premium, connected solutions aligned with smart-home ecosystems. The shift toward intelligent power-management technologies positions digital voltage regulators as an evolving segment with strong future potential.

- For instance, Aulten’s 4 KVA digital voltage stabilizer for 1.5-ton ACs offers a multifunctional digital display for real-time input and output voltage monitoring, along with high/low voltage cut-off and a 5-10 second time delay system.

Growing Demand for Solar-Compatible Voltage Regulation Solutions

As residential solar installations accelerate globally, demand is rising for voltage regulators capable of managing bidirectional power flow and stabilizing voltage variations caused by distributed energy generation. Solar inverters and home energy storage systems require dependable regulation to protect circuits and maintain consistent output. This trend offers significant opportunities for manufacturers to develop solar-ready, hybrid, and adaptive voltage regulation solutions. The alignment with renewable energy adoption strengthens product relevance and supports long-term industry expansion.

- For instance, Voltronic Power Technology offers the Axpert VM 4 series inverters with integrated MPPT solar chargers for residential solar setups.

Key Challenges

High Installation and Maintenance Costs in Certain Regions

Despite growing adoption, high upfront installation costs and ongoing maintenance requirements can hinder market penetration in price-sensitive regions. Many households prioritize essential electrical upgrades over advanced voltage stabilization systems. Additionally, professional installation may be required for whole-home regulators, increasing total ownership cost. Limited consumer awareness regarding long-term benefits also restricts adoption. These cost-related barriers challenge market expansion, particularly in developing economies where infrastructure modernization progresses unevenly.

Presence of Low-Quality, Unregulated Products in the Market

The availability of low-cost, substandard voltage regulators poses a major challenge by undermining consumer trust and affecting product performance expectations. Unregulated imports and counterfeit units often fail to meet safety or reliability standards, resulting in inconsistent protection and higher failure rates. These alternatives disrupt pricing structures for established manufacturers, creating competitive pressure. The lack of stringent enforcement of electrical product standards in certain markets further exacerbates this issue, slowing the shift toward high-quality, certified residential voltage regulators.

Regional Analysis

North America

North America dominated the Residential Voltage Regulator Market with 34.7% share in 2024, driven by widespread adoption of smart-home technologies, strong residential electrification, and the need to safeguard sensitive electronics from grid disturbances. Aging transmission and distribution infrastructure across the U.S. and Canada increases voltage variability, reinforcing the uptake of stabilizing equipment in households. The region’s rapid integration of rooftop solar systems further amplifies demand for regulators capable of managing intermittent power flows. High consumer awareness, robust energy-efficiency regulations, and steady construction activities collectively support sustained market expansion.

Europe

Europe accounted for 27.9% share in 2024, supported by strong regulatory emphasis on electrical safety, energy efficiency, and home automation standards. Countries such as Germany, the UK, and France are adopting advanced residential electrical protection systems due to rising integration of smart appliances and increasing reliance on renewable energy sources. Grid modernization initiatives and rapid urban housing development further contribute to market growth. The expansion of distributed energy systems, including residential solar and heat pumps, heightens the need for voltage stability, driving demand for reliable and efficient residential voltage regulators across the region.

Asia-Pacific

Asia-Pacific held 24.6% share in 2024, driven by high urbanization rates, rising electricity consumption, and persistent grid fluctuations across emerging economies. Countries such as China, India, and Southeast Asian markets are witnessing substantial residential construction, boosting demand for voltage stabilization systems. Increasing penetration of household electronics and expanding middle-class income levels enhance the adoption of electrical protection devices. Government-led electrification programs and renewable energy integration further create demand for advanced regulators. The region’s large population base and rapid digital transformation position Asia-Pacific as a high-growth market throughout the forecast period.

Latin America

Latin America captured 7.8% share in 2024, fueled by widespread voltage instability and frequent power fluctuations across residential grids in countries such as Brazil, Mexico, and Argentina. Growing consumer awareness of appliance protection, coupled with rising adoption of modern home electronics, strengthens market demand. Expansion of residential infrastructure and increasing integration of distributed solar systems further accelerate uptake. Although price sensitivity remains a challenge, government programs aimed at improving electrical reliability and safety continue to support the adoption of residential voltage regulators across urban and semi-urban households in the region.

Middle East & Africa

The Middle East & Africa region accounted for 4.9% share in 2024, driven by ongoing residential development, increasing access to electricity, and growing investment in grid improvement projects. Frequent voltage fluctuations in several African nations elevate the need for stabilizing solutions, while rising adoption of air conditioners and home appliances in Gulf countries contributes to demand. Expanding urbanization, growth in smart-home deployment, and renewable energy projects including solar-driven residential clusters strengthen market adoption. Despite economic disparities across countries, infrastructure modernization initiatives continue to support steady demand for residential voltage regulators.

Market Segmentations:

By Product

By Phase

By Voltage

- ≤ 5 kVA

- > 5 kVA to 20 kVA

- > 20 kVA to 40 kVA

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Residential Voltage Regulator Market features leading participants such as ABB, Eaton, GE Vernova, Legrand, Basler Electric, Analog Devices, Infineon Technologies, Microchip Technologies, BTRAC, and Maschinenfabrik Reinhausen, all shaping product innovation and technological advancement. These companies focus on expanding their residential portfolios with digitally controlled, energy-efficient, and IoT-enabled voltage regulators that deliver improved accuracy and reliability. Many players are strengthening R&D capabilities to enhance voltage stabilization performance, integrate smart monitoring, and support renewable energy compatibility. Strategic initiatives, including product upgrades, regional expansions, and partnerships with utility providers or smart-home integrators, further reinforce market presence. Manufacturers are also responding to rising consumer expectations by offering compact, aesthetically compatible designs suited for modern homes. With increasing demand for high-performance electrical protection systems, the competitive environment continues to intensify, prompting companies to differentiate through innovation, quality, and advanced digital features.

Key Player Analysis

Recent Developments

- In October 2025, Legrand acquired Avtron Power Solutions, expanding its capabilities in power-quality and load-bank solutions relevant to residential voltage and power management.

- In June 2025, Hitachi Energy launched the Compact Line Voltage Regulator, a transformer-integrated solution presented at CIRED 2025 for efficient voltage control in distribution grids, supporting residential solar stability.

- In October 2024, ABB launched its new residential portfolio under the ReliaHome brand, debuting updated Load Center solutions for home energy distribution.

- In March 2023, Microchip Technologies released its new MPLAB SiC Power Simulator, enabling advanced design of SiC-based voltage control systems for residential and distributed energy applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Phase, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong demand as households increasingly prioritize protection for sensitive electronic devices.

- Adoption of smart-home technologies will accelerate the shift toward intelligent, connected voltage regulation solutions.

- Integration of IoT and remote monitoring features will become a standard offering across premium residential regulators.

- Growth in rooftop solar installations will drive demand for regulators compatible with distributed energy systems.

- Advancements in compact and energy-efficient designs will support higher adoption in modern residential infrastructure.

- Manufacturers will expand digital capabilities to enhance real-time voltage management and predictive maintenance.

- Increasing urbanization and electrification in emerging economies will strengthen market penetration.

- Regulatory emphasis on electrical safety and energy management will boost adoption of certified residential regulators.

- Rising replacement of outdated household stabilizers will create a steady retrofit demand cycle.

- Collaboration between smart-home ecosystem providers and voltage regulator manufacturers will shape future product innovation.

Market Segmentation Analysis:

Market Segmentation Analysis: