Market Overview

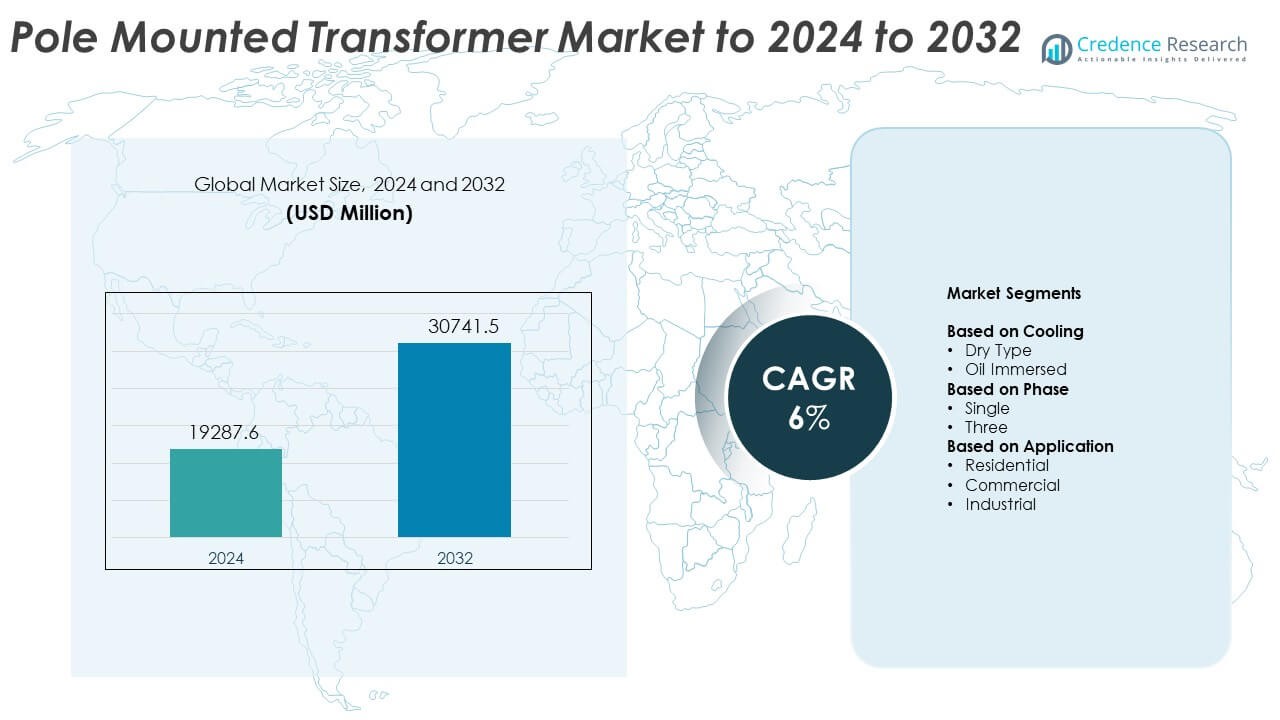

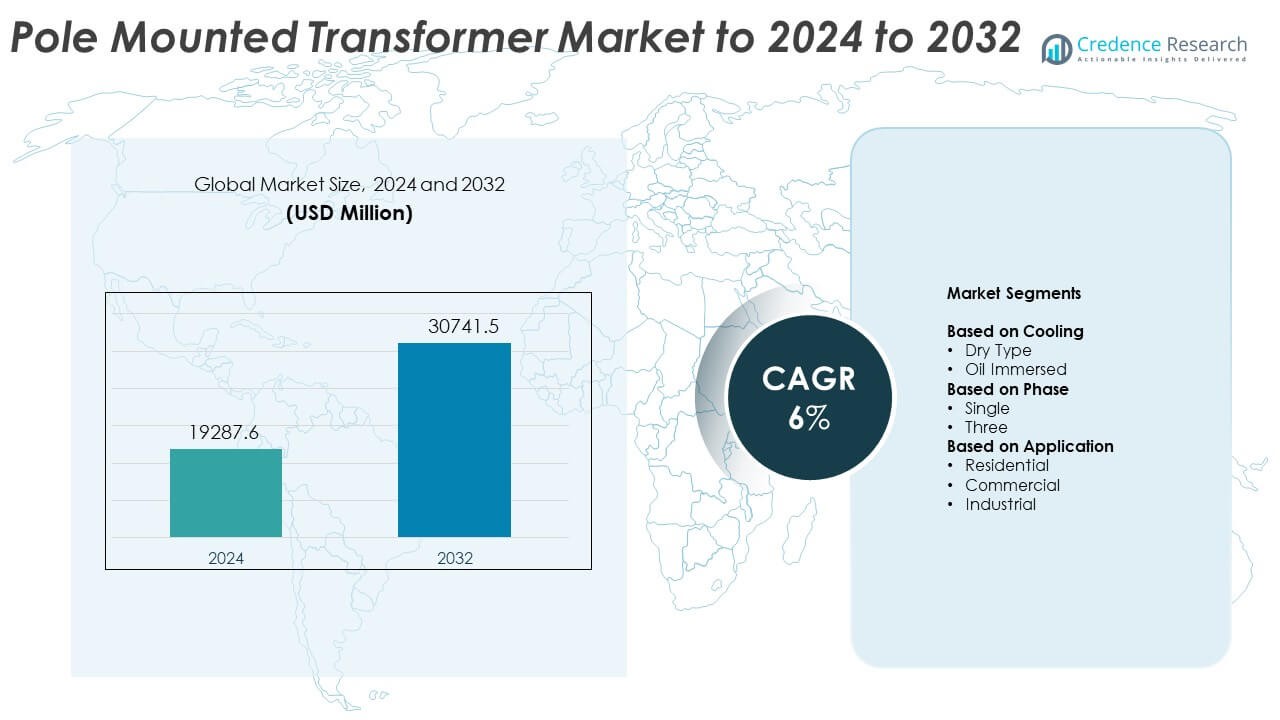

Pole Mounted Transformer Market size was valued USD 19287.6 million in 2024 and is anticipated to reach USD 30741.5 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pole Mounted Transformer Market Size 2024 |

USD 19287.6 Million |

| Pole Mounted Transformer Market, CAGR |

6% |

| Pole Mounted Transformer Market Size 2032 |

USD 30741.5 Million |

The Pole Mounted Transformer Market features major players such as Jiangshan Scotech, SGB Smit, GE, Eaton, Shihlin Electric, ABB, Siemens Energy, Schneider Electric, Hitachi Energy, and Ermco, each strengthening their portfolios through efficient designs, improved cooling systems, and advanced monitoring capabilities. Asia Pacific leads the global market with about 36% share due to rapid electrification and large-scale grid expansion across developing economies. North America follows with nearly 32% share, supported by strong modernization programs and replacement of aging assets. Europe holds around 27% share, driven by energy-efficiency regulations and continued investment in rural network upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Pole Mounted Transformer Market was valued at USD 19287.6 million in 2024 and is projected to reach USD 30741.5 million by 2032, growing at a CAGR of 6%.

- Growth is driven by rising rural electrification, increasing residential power demand, and large-scale grid modernization programs across developing and developed regions.

- Key trends include wider adoption of smart monitoring features, expanding renewable energy connections, and rising demand for oil-immersed units, which held about 63% share in 2024.

- Competition intensifies as global and regional manufacturers focus on high-efficiency designs, advanced cooling systems, and upgraded insulation to meet reliability and safety expectations.

- Asia Pacific led the market with around 36% share in 2024, followed by North America at 32% and Europe at nearly 27%, supported by strong electrification programs and increasing distribution network upgrades.

Market Segmentation Analysis:

By Cooling

Oil-immersed units held the dominant share in 2024 with about 63% of the Pole Mounted Transformer Market. Strong demand came from utilities that rely on stable performance in outdoor grids and rural networks. Oil-immersed designs support higher overload capacity and better heat dissipation, which helps operators handle peak loads. Dry-type transformers grew slowly due to safety benefits and low maintenance needs, yet adoption stayed limited in open environments. Expanding power distribution upgrades across developing regions continued to strengthen the lead of oil-immersed systems.

- For instance, SGB-SMIT’s oil distribution transformers are offered from 50 kVA up to 3,150 kVA, with large oil-filled distribution units reaching ratings of 20 MVA for utility networks.

By Phase

Single-phase transformers led this segment in 2024 with nearly 58% share of the Pole Mounted Transformer Market. Widespread use in rural and semi-urban grids drove strong demand as utilities expanded last-mile electrification. Single-phase devices offer lower installation cost and easy deployment, making them ideal for scattered load points. Three-phase units grew with rising commercial and small industrial loads, but higher cost slowed broader penetration. Grid modernization projects and ongoing residential connections supported the leadership of single-phase units.

- For instance, Eaton’s Cooper Power series single-phase overhead distribution transformers are manufactured in ratings from 5 kVA to 167 kVA specifically for utility overhead distribution use.

By Application

Residential use dominated the Pole Mounted Transformer Market in 2024 with around 51% share. Growth came from rising household grid connections and increasing electricity demand in developing economies. Governments continued expanding rural electrification programs, driving large installation volumes. Commercial use increased as small businesses and retail sites upgraded distribution lines. Industrial adoption remained smaller but steady, driven by utility-linked feeder upgrades. Strong residential demand and expanding distribution infrastructure kept this segment in the leading position.

Key Growth Drivers

Rising Rural Electrification and Grid Expansion

Governments continue to expand rural and semi-urban electrification, which increases demand for pole mounted transformers. Utilities prefer these units for low-cost deployment, fast installation, and strong performance in outdoor conditions. Growing population density in developing regions also pushes distribution upgrades. This expansion strengthens long-term demand as new households, farms, and small businesses connect to stable grid networks.

- For instance, Hitachi Energy India secured an order from Power Grid Corporation of India to supply 30 single-phase transformers rated at 765 kV and 500 MVA each to support national grid expansion in 2025.

Increase in Power Demand from Residential and Commercial Users

Higher electricity use across homes, retail sites, and community infrastructure supports rapid market growth. Rising demand for reliable distribution networks encourages utilities to install more pole-mounted transformers in suburbs and townships. Upgraded lighting loads, HVAC use, and appliance penetration further expand consumption. This trend drives recurring investment in modern, durable transformer systems that support stable voltage levels.

- For instance, ABB’s Type QL dry-type transformers are designed for building and commercial loads with standard ratings ranging from 15 kVA up to 1,000 kVA in single- and three-phase configurations

Utility Modernization and Replacement of Aging Assets

Many utilities face aging distribution equipment that requires replacement. Modern pole mounted transformers offer higher efficiency, safer operation, and longer service life, which pushes faster transition. Grid modernization policies also promote adoption of advanced monitoring and optimized cooling designs. Growing reliability needs and reduced outage requirements encourage operators to replace old hardware with improved units.

Key Trends and Opportunities

Shift Toward Smart and Monitoring-Enabled Transformers

Utilities increasingly adopt smart pole-mounted transformers that include real-time monitoring, load tracking, and alert systems. These features help operators manage peak loads, improve fault detection, and reduce downtime. Digital integration supports predictive maintenance, which cuts long-term costs. The shift creates strong opportunities for manufacturers offering IoT-enabled, high-performance designs for modern distribution networks.

- For instance, Schneider Electric’s EcoStruxure Transformer Expert uses integrated sensors that track temperature, moisture, partial discharge, vibration and hydrogen, and the associated sensor hardware operates on a low-voltage DC supply between 18 and 42 V.

Expansion of Renewable Energy Connections

Growing rooftop solar and small-scale wind installations create new opportunities for pole-mounted transformers. Distributed energy resources increase the need for stable voltage regulation and bi-directional load handling. Utilities install upgraded units along feeders to support fluctuating inputs. This trend strengthens demand for durable transformers capable of supporting mixed power flows in suburban and rural grids.

- For instance, WEG’s renewable pad-mounted transformer equipment includes interrupter controllers designed for primary currents up to 600 A at 35 kV, supporting integration of distributed generation on medium-voltage feeders.

Rising Use of Oil-Immersed High-Efficiency Designs

Utilities prefer advanced oil-immersed transformers because they support higher overload capacity and improved cooling. Manufacturers now offer low-loss materials and upgraded insulation to boost efficiency. These improvements reduce energy waste and enhance long-term reliability. Expanding adoption presents opportunities for suppliers focused on advanced materials and optimized thermal systems.

Key Challenges

High Installation Constraints in Urban and Dense Regions

Pole-mounted transformers face challenges in dense urban spaces where overhead lines are restricted. Limited pole height, safety clearances, and compact streets reduce installation feasibility. Many cities also shift toward underground distribution, which lowers demand. These constraints force utilities to rely more on pad-mounted or underground units in crowded zones.

Environmental and Safety Compliance Requirements

Strict regulations on oil handling, fire safety, and leakage control create hurdles for utilities and manufacturers. Compliance adds cost and slows installation timelines. Growing concerns over environmental risks push demand for safer materials and containment systems. Meeting evolving standards requires continuous design upgrades and higher operational spending.

Regional Analysis

North America

North America held about 32% share of the Pole Mounted Transformer Market in 2024, driven by steady grid modernization and replacement of aging distribution assets. Utilities increased investments in overhead line upgrades to improve reliability and reduce outage risks. Suburban expansion in the US and Canada supported rising deployment of single-phase units. The region also advanced adoption of monitoring-enabled transformers to support load management and storm resilience. Strong regulatory focus on efficient distribution networks and the need for stable residential supply kept demand consistent across major utility operators.

Europe

Europe accounted for nearly 27% share of the market in 2024, supported by ongoing grid reinforcement programs and rural network upgrades. Countries in Western Europe replaced older transformers with higher-efficiency units to reduce energy losses and comply with environmental norms. Growth in distributed energy projects, especially rooftop solar, also increased the need for improved voltage regulation. Eastern Europe expanded installations in smaller towns, aiding gradual market growth. Rising electrification of mobility infrastructure created additional demand for stable distribution lines, which further supported transformer deployment.

Asia Pacific

Asia Pacific dominated the market in 2024 with about 36% share, driven by rapid urbanization, rising electricity demand, and expanding rural electrification programs. Large populations in India, China, and Southeast Asia continued to push utilities to build new feeders and strengthen distribution links. Government-backed grid expansion plans supported high-volume installation of pole-mounted transformers. Industrial growth and suburban development further raised demand for reliable low-voltage supply. The region’s strong construction pipeline and rising power consumption made it the fastest-growing market for new deployments.

Latin America

Latin America captured roughly 3% share of the market in 2024, shaped by grid upgrades in Brazil, Mexico, and Argentina. Utilities expanded distribution networks to support residential growth in peri-urban areas. Rural electrification efforts in several countries increased deployment of single-phase units. Economic constraints slowed replacement cycles, but demand for stable voltage regulation kept installations steady. Rising integration of renewable energy sources in local grids also encouraged selective upgrades of distribution transformers to support fluctuating generation patterns.

Middle East and Africa

Middle East and Africa held about 2% share of the market in 2024, with growth driven by electrification programs in Africa and infrastructure expansion in Gulf countries. Utilities focused on extending supply to remote communities, raising demand for pole-mounted units due to ease of installation. Regional governments invested in distribution upgrades for new residential and commercial projects. Hot climate conditions increased preference for oil-immersed transformers that handle higher thermal loads. Slow economic development in parts of Africa limited large-scale upgrades, but rural grid expansion maintained steady demand.

Market Segmentations:

By Cooling

By Phase

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pole Mounted Transformer Market features key players such as Jiangshan Scotech, SGB Smit, GE, Eaton, Shihlin Electric, ABB, Siemens Energy, Schneider Electric, Hitachi Energy, and Ermco. Competition grows as manufacturers focus on improving efficiency, reliability, and outdoor durability to meet rising grid expansion needs. Companies invest in advanced insulation, low-loss cores, and enhanced cooling systems to support heavy load conditions. Many suppliers also integrate smart monitoring features to help utilities track voltage changes and predict failures. Regional players strengthen their presence by offering cost-effective units tailored to local grid standards. Global firms expand through partnerships with utilities and EPC contractors to secure long-term supply contracts. Sustainability goals push manufacturers to reduce environmental risks by upgrading oil containment systems and promoting safer materials. Growing electrification across developing regions continues to intensify competition, encouraging firms to scale production and enhance technical capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jiangshan Scotech

- SGB Smit

- GE

- Eaton

- Shihlin Electric

- ABB

- Siemens Energy

- Schneider Electric

- Hitachi Energy

- Ermco

Recent Developments

- In 2025, SGB-SMIT signed an agreement to acquire Southwest Electric Co., adding North-American manufacturing and service capability for custom distribution and specialty transformers, including designs suited for pole-mounted and overhead line use.

- In 2024, ABB Electrification Service launched its TRAFCOM digital monitoring solution for power and distribution transformers with Oktogrid, adding advanced online condition monitoring for fleets that include pole-mounted units.

- In 2023, Eaton announced a major expansion of its Nacogdoches, Texas transformer plant, increasing output of single-phase pole-mounted and pad-mounted distribution transformers to help utilities address equipment shortages across North America.

Report Coverage

The research report offers an in-depth analysis based on Cooling, Phase, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as utilities expand rural and semi-urban electrification networks.

- Grid modernization programs will increase replacement of aging distribution transformers.

- Adoption of smart monitoring features will grow across developed and emerging regions.

- Renewable energy integration will push utilities to upgrade voltage regulation capacity.

- Oil-immersed designs will remain preferred due to stronger cooling and overload support.

- Dry-type transformers will gain traction in safety-sensitive zones and urban installations.

- Rising electricity use in residential and commercial sectors will sustain new deployments.

- Efficiency regulations will encourage adoption of low-loss transformer materials.

- Manufacturers will expand supply chains to meet demand from fast-growing Asian markets.

- Digital tools will support predictive maintenance and reduce long-term operational costs.