| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherland Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 217.72 Million |

| Netherland Autonomous Off-Road Vehicles And Machinery Market, CAGR |

11.44% |

| Netherland Autonomous Off-Road Vehicles And Machinery Market Size 2032 |

USD 577.25 Million |

Market Overview:

Netherland Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 217.72 million in 2023 and is anticipated to reach USD 577.25 million by 2032, at a CAGR of 11.44% during the forecast period (2023-2032).

Several key factors are propelling the growth of autonomous off-road vehicles and machinery in the Netherlands. Technological advancements in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of autonomous systems, enabling them to operate efficiently in complex and rugged terrains. Industries such as agriculture and construction are increasingly adopting these technologies to improve operational efficiency, reduce labor costs, and enhance safety. Additionally, the Netherlands’ commitment to sustainability and environmental stewardship is driving the demand for autonomous solutions that minimize environmental impact and optimize resource utilization. The increasing demand for data-driven decision-making and predictive maintenance further boosts the adoption of autonomous vehicles, ensuring better long-term operational performance. Moreover, the strong emphasis on improving productivity in labor-intensive sectors like agriculture and mining in the Netherlands is encouraging the integration of automation for better outcomes.

The Netherlands stands out as a leader in the adoption of autonomous vehicle technologies within Europe. According to KPMG’s Autonomous Vehicles Readiness Index, the country ranks highly due to its excellent road infrastructure, supportive government policies, and a high level of public acceptance of autonomous technologies. This conducive environment has facilitated the deployment of autonomous off-road vehicles in various sectors, including agriculture and construction. The Dutch government’s proactive approach in fostering innovation and its strategic investments in smart infrastructure further bolster the growth prospects of autonomous off-road vehicles and machinery in the region. Additionally, the Netherlands’ positioning within the European Union, with its strong trade relationships and connectivity to major markets, provides an advantageous platform for the international expansion of autonomous vehicle technologies, strengthening the country’s competitive edge in this sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Netherlands’ autonomous off-road vehicles and machinery market is valued at USD 217.72 million in 2023 and is projected to grow to USD 577.25 million by 2032, with a CAGR of 11.44%.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological advancements in AI, machine learning, and sensor technologies are significantly enhancing the performance of autonomous systems, enabling them to operate in challenging terrains.

- The Dutch government’s support for sustainability and environmental initiatives is accelerating the adoption of autonomous off-road vehicles, particularly in agriculture and construction sectors.

- Increasing demand for automation in labor-intensive sectors such as agriculture and mining is driving the growth of autonomous vehicles in the Netherlands.

- The country’s strong infrastructure and pro-innovation government policies are providing a favorable environment for the development and deployment of autonomous vehicles.

- Despite high initial investment costs, long-term operational savings, including reduced labor costs and improved efficiency, are expected to boost adoption over time.

- Regulatory uncertainties and technology limitations, such as challenges with extreme weather conditions, remain significant barriers to the widespread adoption of autonomous off-road machinery.

Market Drivers:

Technological Advancements

The growth of autonomous off-road vehicles and machinery in the Netherlands is primarily driven by significant technological advancements. Innovations in artificial intelligence (AI), machine learning, and sensor technologies have dramatically improved the capabilities of autonomous systems. These systems are now capable of performing complex tasks in difficult and hazardous terrains, which were previously not feasible for traditional vehicles. Autonomous vehicles equipped with advanced sensors such as LiDAR, GPS, and cameras enable real-time data processing, navigation, and decision-making. As technology continues to evolve, the efficiency, precision, and reliability of these vehicles in agriculture, construction, and mining sectors are expected to rise significantly, facilitating their increased adoption.

Labor Efficiency and Cost Reduction

Another key driver is the need to optimize labor efficiency and reduce operational costs. Autonomous off-road vehicles significantly enhance productivity by minimizing human intervention and reducing dependency on manual labor, which is often a challenge in remote or hazardous locations. For instance, at the National Fieldlab for Precision Farming, autonomous tractors have demonstrated the ability to operate around the clock without breaks, directly reducing the need for human operators and minimizing fuel consumption due to optimized pacing. In sectors like agriculture and mining, these vehicles can operate continuously without fatigue, improving operational uptime and resource allocation. The high cost of human labor, coupled with labor shortages in industries such as agriculture and construction, further accelerates the demand for automation. By automating routine tasks, companies in the Netherlands are able to lower labor costs while increasing overall operational efficiency, making autonomous vehicles a valuable investment.

Sustainability and Environmental Concerns

Sustainability is a driving force behind the adoption of autonomous off-road vehicles in the Netherlands. The country’s strong focus on environmental sustainability aligns well with the growing trend of using autonomous technologies to reduce the environmental impact of traditional machinery. For instance, Dutch manufacturing company EMOSS Mobile Systems specializes in electrifying both on-road and off-road vehicles, contributing to the reduction of CO2 emissions from end-use sectors. Autonomous vehicles are designed to optimize fuel consumption, minimize emissions, and reduce resource waste, thereby contributing to more sustainable operations. Additionally, the ability to efficiently manage land use in agriculture and minimize soil degradation is becoming increasingly important. The Dutch government’s support for green technologies, including renewable energy sources and clean technologies, further strengthens the appeal of autonomous vehicles as an eco-friendly solution in sectors like agriculture, mining, and forestry.

Government Policies and Infrastructure Development

Government policies and investments in infrastructure are crucial factors driving the growth of autonomous off-road vehicles in the Netherlands. The Dutch government has long been at the forefront of fostering innovation and technological advancements, and its policies are increasingly supportive of autonomous technologies. With a strong regulatory framework, the government ensures the safe and efficient integration of autonomous vehicles into the national economy. Moreover, the Netherlands boasts excellent infrastructure, including digital roads and smart technologies, that enables the seamless operation of autonomous systems. The government’s investment in developing smart cities and autonomous vehicle-friendly policies is creating an ideal environment for the widespread adoption of autonomous off-road vehicles across various industries, further stimulating market growth.

Market Trends:

Increased Integration with IoT and Data Analytics

A prominent trend in the Netherlands’ autonomous off-road vehicle market is the increased integration of Internet of Things (IoT) technology and data analytics. For example, New Holland Agriculture, a brand under CNH Industrial, equips its autonomous T8 series tractors with IoT-enabled systems that allow farmers to manage their fleets efficiently by tracking combine harvesters’ coverage in real-time, analyzing tractor and combine performance, monitoring fuel status and run time, and providing real-time location data for all machines. The advent of IoT devices in autonomous machinery allows for continuous monitoring and data collection, enabling fleet managers to track performance, detect maintenance issues, and optimize operations in real-time. By leveraging the vast amounts of data generated by autonomous vehicles, companies can analyze patterns, predict equipment failures, and enhance the decision-making process. This integration of IoT and data analytics is transforming how off-road vehicles are operated, leading to improved efficiency, reduced downtime, and better long-term asset management.

Adoption of Electric Autonomous Vehicles

The shift towards electric-powered autonomous vehicles is another key trend gaining momentum in the Netherlands. As the country places a strong emphasis on sustainability and reducing carbon footprints, there is a rising demand for electric off-road vehicles in industries like agriculture and construction. Electric autonomous vehicles offer lower operational costs due to their energy efficiency and reduced maintenance requirements compared to traditional diesel-powered machinery. Furthermore, the Dutch government’s support for clean energy initiatives and electric vehicles is accelerating the adoption of electric autonomous off-road machinery, positioning these vehicles as a sustainable solution in various sectors. The growing shift towards electric technology is expected to be a dominant trend in the coming years, aligning with the global push for green technologies.

Advancement in Autonomous Vehicle Safety Features

Another trend in the Dutch market for autonomous off-road vehicles is the continuous development of advanced safety features. As autonomous vehicles are deployed in industries with inherent safety risks, such as construction and mining, there is a growing emphasis on incorporating safety measures like obstacle detection, automated emergency braking, and real-time hazard recognition. These safety advancements are designed to protect workers, reduce accidents, and ensure compliance with regulatory standards. Manufacturers are investing in cutting-edge technologies to enhance the safety of autonomous off-road vehicles, making them not only more efficient but also safer to operate in challenging environments. As safety becomes a top priority, this trend is expected to accelerate the adoption of autonomous systems in sectors that require high safety standards.

Collaboration with Startups and Technology Providers

Collaboration between established machinery manufacturers and technology startups is also emerging as a key trend in the Netherlands’ autonomous off-road vehicle market. For instance, T-Hive, a multinational company, has established its AV control systems development in the Netherlands, leveraging the country’s innovation mindset and strengths in artificial intelligence (AI) and transportation. Traditional machinery manufacturers are partnering with tech companies specializing in artificial intelligence, robotics, and sensor technologies to enhance their autonomous vehicles. These collaborations allow for faster innovation and the development of more advanced systems, including enhanced AI algorithms for navigation and sensor technologies for improved precision. Such partnerships are accelerating the rollout of autonomous vehicles across industries, helping companies stay competitive in a rapidly evolving market. As these collaborations continue to grow, they will play a pivotal role in shaping the future of autonomous off-road vehicles in the Netherlands.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary restraints for the widespread adoption of autonomous off-road vehicles and machinery in the Netherlands is the high initial investment required for these technologies. Although autonomous systems offer long-term operational savings through efficiency and reduced labor costs, the upfront capital expenditure can be a significant barrier for smaller businesses or those in sectors with tighter profit margins, such as agriculture and construction. The cost of advanced sensors, AI software, and electric or hybrid powertrains can be prohibitively expensive, especially for companies that need to purchase multiple units. Despite the potential for savings in the long run, the high cost of implementation remains a challenge for broader market penetration.

Regulatory and Legal Hurdles

The regulatory landscape for autonomous vehicles is still evolving, and this creates a level of uncertainty for the adoption of autonomous off-road vehicles in the Netherlands. While the Dutch government is supportive of innovation, there is still a lack of comprehensive regulations governing the use of autonomous machinery in off-road applications. Issues related to liability, insurance, and safety standards are still being debated. Additionally, as these vehicles operate in environments like construction sites or farmland, the legal framework surrounding worker safety, environmental impact, and public infrastructure may pose challenges. Uncertainty in these areas can delay the widespread adoption of autonomous off-road machinery.

Technology Limitations

Despite significant advancements in autonomous vehicle technology, some technical limitations still hinder full-scale adoption. For example, while AI and sensor systems are becoming more sophisticated, they are not yet perfect in detecting complex terrain or unpredictable environmental conditions. Autonomous systems may struggle in extreme weather conditions, such as heavy rain or snow, or in highly variable terrains that require human intervention for safe navigation. These limitations could restrict the deployment of autonomous vehicles in certain industries or regions, especially in the Netherlands, where weather conditions can be unpredictable.

Public Perception and Workforce Resistance

Another challenge is public perception and resistance from the workforce. While the adoption of autonomous machinery can improve efficiency, there is a fear of job displacement among workers, particularly in sectors such as agriculture and construction. Workers and unions may resist the introduction of autonomous vehicles due to concerns about job loss, which could lead to public opposition and slow the pace of adoption. For instance, according to the Netherlands Organisation for Applied Scientific Research (TNO), the integration of AI increases cognitive demands on workers, who must now supervise and interact with complex systems, leading to concerns about job security and workplace stress. Additionally, societal acceptance of autonomous technology is still developing, and skepticism around safety and reliability could also act as a restraint.

Market Opportunities:

The Netherlands presents a significant market opportunity for autonomous off-road vehicles and machinery, driven by its strong technological infrastructure and commitment to sustainability. As industries such as agriculture, mining, and construction increasingly focus on improving efficiency, reducing labor costs, and enhancing safety, autonomous systems are becoming a viable solution. The Dutch government’s focus on clean technologies and its incentives for sustainable practices further enhance the attractiveness of autonomous off-road vehicles. These vehicles offer the potential to reduce carbon footprints and optimize resource usage, aligning with the country’s environmental goals. The integration of autonomous machinery can also help meet the growing demand for precision agriculture, where autonomous systems can efficiently manage tasks such as planting, harvesting, and monitoring crops.

Additionally, the rise in technological advancements presents an opportunity for Dutch manufacturers and startups to lead innovation in the global autonomous off-road vehicle market. The Netherlands’ strategic position in Europe, coupled with its advanced infrastructure and robust digital connectivity, provides a favorable environment for the development and deployment of autonomous systems. Collaborative efforts between traditional machinery manufacturers and technology providers can accelerate the advancement of these technologies, opening up new avenues for market expansion. As these innovations continue to improve, autonomous off-road vehicles can become increasingly cost-effective, unlocking new opportunities for a broader range of industries. The market is poised for growth as businesses in the Netherlands look to enhance their operational efficiency, sustainability, and competitiveness on a global scale.

Market Segmentation Analysis:

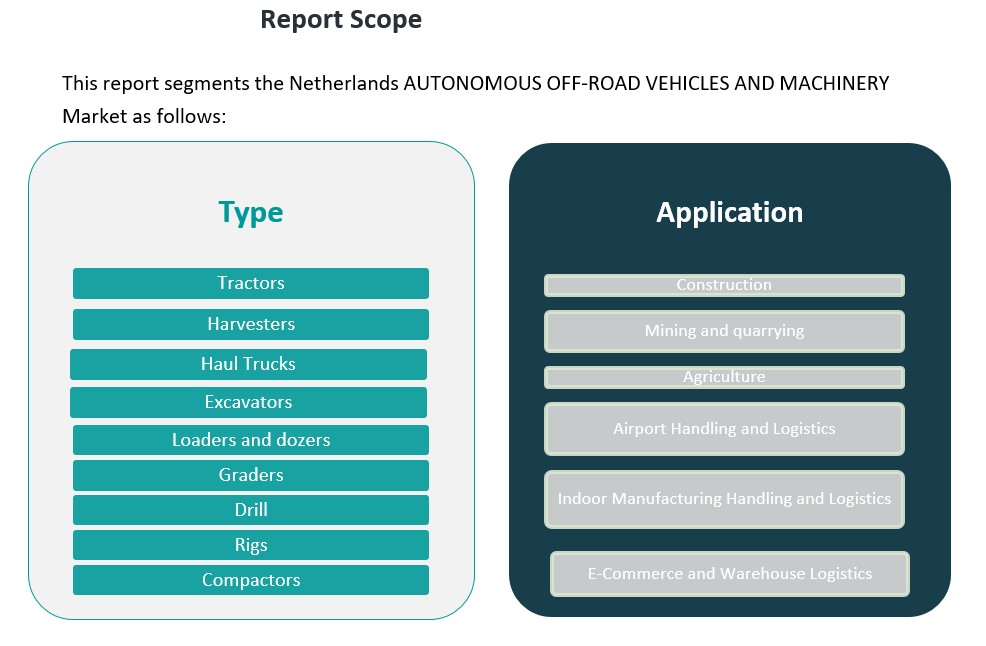

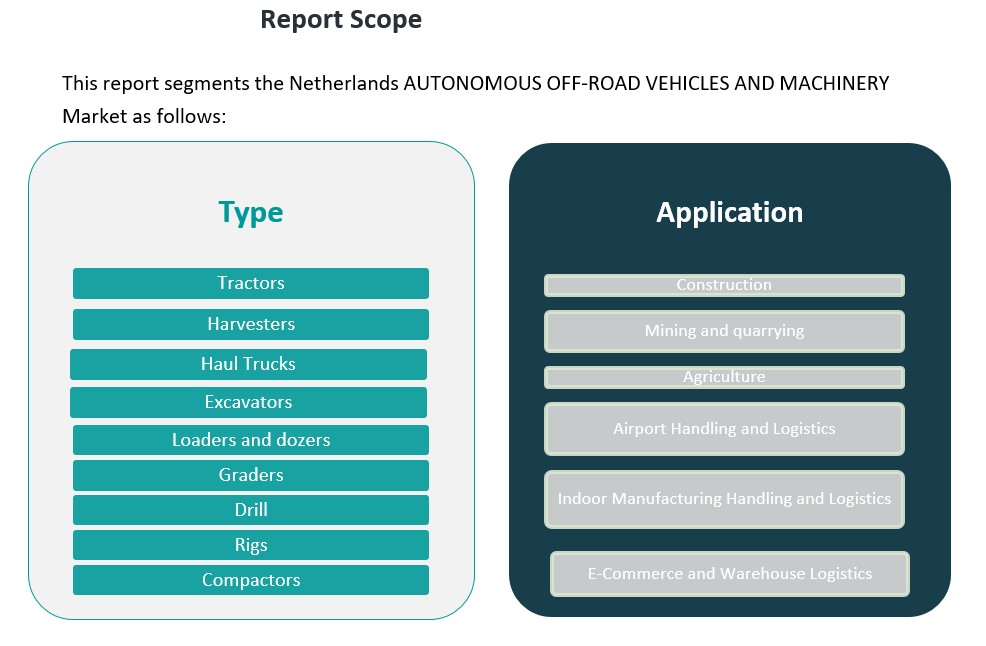

The autonomous off-road vehicle market in the Netherlands is segmented by type and application, with each segment exhibiting distinct growth drivers.

By Type Segment

The market is dominated by several key types of autonomous machinery, including tractors, harvesters, haul trucks, excavators, loaders and dozers, graders, drills, rigs, and compactors. Among these, tractors and harvesters are crucial in the agricultural sector, where automation is used to improve productivity and reduce labor costs. Haul trucks and excavators are prominent in construction and mining, where their ability to operate autonomously in rugged terrains is highly valuable. Loaders and dozers play a significant role in both agriculture and construction, aiding in soil movement and grading, while compactors are essential in road construction. The demand for each of these machines is directly linked to the ongoing digital transformation and push for operational efficiency within these industries.

By Application Segment

In terms of application, the market is primarily driven by sectors such as construction, mining and quarrying, and agriculture. Autonomous machinery in construction is widely used for earthmoving and site preparation, while mining applications focus on improving safety and operational efficiency. The agriculture segment benefits from autonomous vehicles that assist in planting, irrigation, and harvesting, enhancing precision farming techniques. Other emerging application areas include airport handling and logistics, indoor manufacturing handling, and e-commerce and warehouse logistics, where autonomous systems are utilized for material handling and supply chain optimization. Each of these applications reflects the growing need for automation to boost productivity, safety, and sustainability across industries in the Netherlands.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

The Netherlands stands at the forefront of the autonomous off-road vehicle market in Europe, owing to its advanced technological infrastructure, strong economic position, and progressive regulatory environment. The country’s strategic focus on innovation, sustainability, and automation has made it an ideal location for the widespread adoption of autonomous systems across industries such as agriculture, mining, construction, and logistics. The market in the Netherlands is poised to continue its growth trajectory as autonomous off-road vehicles gain prominence in various sectors, driving efficiency, productivity, and safety.

In Europe, the Netherlands holds a significant share of the autonomous off-road vehicle market, estimated at around 15% of the total market share. This is primarily due to the country’s commitment to sustainability and environmental stewardship, which aligns well with the adoption of energy-efficient, autonomous machinery. The Dutch government has supported innovation through policies that encourage the development and deployment of smart technologies, which further boosts the market for autonomous off-road vehicles. The country’s high level of digital connectivity and smart infrastructure provides a solid foundation for the integration of autonomous technologies, making it a leader in autonomous off-road vehicle adoption within the European Union.

In terms of regional market growth, the Netherlands is experiencing rapid adoption of autonomous systems, especially in sectors like agriculture and construction, where these technologies are increasingly used for tasks such as precision farming, earthmoving, and site preparation. The agriculture sector in the Netherlands is expected to maintain a strong growth trajectory, driven by the demand for automation in crop monitoring, harvesting, and irrigation. Construction and mining sectors are also seeing increased investments in autonomous machinery, with an emphasis on safety and operational efficiency.

Regionally, Northern Europe continues to dominate the autonomous off-road vehicle market, with a focus on countries like Germany, Sweden, and the Netherlands. The region holds a combined market share of approximately 40%. The Netherlands plays a critical role within this market, contributing a significant portion to the overall growth of autonomous systems in Northern Europe. Meanwhile, Southern European markets, such as Spain and Italy, are expected to experience steady growth, but they still lag behind Northern Europe in terms of technology adoption and market penetration.

Key Player Analysis:

- Caterpillar Inc

- Komatsu Ltd

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

The competitive landscape for autonomous off-road vehicles and machinery in the Netherlands is characterized by a mix of established players and emerging innovators. Key global manufacturers such as Caterpillar Inc., Komatsu Ltd., and Volvo Group are actively involved in the development and deployment of autonomous systems for construction, mining, and agricultural applications. These companies leverage their technological expertise, extensive product portfolios, and strong market presence to drive the adoption of autonomous machinery in the Netherlands. In addition to these established players, several technology-driven companies and startups specializing in artificial intelligence, robotics, and sensor technologies are contributing to the evolution of autonomous systems. Companies like Sandvik and Kubota Corporation are focusing on innovation in AI-powered autonomous vehicles for specific industries such as mining and agriculture. As the market for autonomous off-road vehicles expands, competition is expected to intensify, with new entrants focusing on cost-effective solutions, safety enhancements, and sustainability-driven innovations.

Recent Developments:

- In March 2023, Honda revealed a new prototype of its Autonomous Work Vehicle (AWV) at CONEXPO-CON/AGG in Las Vegas, specifically targeting rugged off-road applications in the construction industry. The all-electric Honda AWV features advanced autonomous driving capabilities, enhanced payload and pallet capacity, and improved obstacle detection, making it suitable for autonomous operation or delivery solutions in challenging worksite environments.

- In July 2024, Liebherr Group and Fortescue announced a partnership to jointly develop and validate a fully integrated Autonomous Haulage Solution (AHS) for large-scale mining operations. This collaboration involves onsite validation of a fleet of four zero-emission, battery-electric Liebherr T 264 autonomous trucks at Fortescue’s Christmas Creek mine site. The AHS ecosystem includes an integrated Fleet Management System and Machine Guidance Solution, designed to coordinate mixed fleets of autonomous vehicles such as mining trucks, road trains, and light vehicles and to be scalable and OEM-agnostic.

Market Concentration & Characteristics:

The market for autonomous off-road vehicles and machinery in the Netherlands is moderately concentrated, with a mix of global industry leaders and regional innovators. Major players such as Caterpillar Inc., Komatsu Ltd., and Volvo Group dominate the market, leveraging their established brand presence, extensive distribution networks, and significant financial resources to maintain competitive advantages. These companies focus on integrating advanced technologies like AI, machine learning, and sensor systems into their autonomous machinery offerings, catering to sectors such as construction, mining, and agriculture. At the same time, the market is witnessing increased competition from smaller, specialized technology firms and startups that are pushing the boundaries of innovation in autonomous systems. These players often focus on niche applications, such as precision agriculture or specific construction tasks, offering cost-effective and customized solutions. This dynamic competition is fostering continuous innovation, pushing the industry towards greater efficiency, safety, and sustainability in autonomous off-road machinery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market for autonomous off-road vehicles in the Netherlands is expected to grow significantly due to increased demand for automation in agriculture, construction, and mining.

- Advancements in AI and sensor technology will enhance the precision and efficiency of autonomous systems, driving wider adoption.

- Increased government incentives and support for sustainable technologies will accelerate the deployment of autonomous vehicles.

- The demand for electric-powered autonomous vehicles will rise, aligning with the Netherlands’ sustainability goals.

- Industry players will focus on reducing the cost of autonomous machinery, making it more accessible to smaller businesses.

- Autonomous vehicles will play a key role in addressing labor shortages and improving safety in hazardous environments.

- Regulatory frameworks around autonomous off-road vehicles will mature, providing clearer guidelines and enhancing market confidence.

- Integration of IoT and data analytics will lead to more efficient fleet management and predictive maintenance solutions.

- The agriculture sector will see high adoption rates as autonomous machinery improves productivity and reduces operational costs.

- Strong partnerships between traditional manufacturers and tech startups will drive innovation and foster market growth.