CHAPTER NO. 1 : INTRODUCTION 19

1.1.1. Report Description 19

Purpose of the Report 19

USP & Key Offerings 19

1.1.2. Key Benefits for Stakeholders 19

1.1.3. Target Audience 20

1.1.4. Report Scope 20

CHAPTER NO. 2 : EXECUTIVE SUMMARY 21

2.1. Human Insulin Market Snapshot 21

2.1.1. Netherlands Human Insulin Market, 2018 – 2032 (USD Million) 22

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 23

3.1. Russia-Ukraine and Israel-Palestine War Impacts 23

CHAPTER NO. 4 : HUMAN INSULIN MARKET – INDUSTRY ANALYSIS 24

4.1. Introduction 24

4.2. Market Drivers 25

4.2.1. Driving Factor 1 Analysis 25

4.2.2. Driving Factor 2 Analysis 26

4.3. Market Restraints 27

4.3.1. Restraining Factor Analysis 27

4.4. Market Opportunities 28

4.4.1. Market Opportunity Analysis 28

4.5. Porter’s Five Forces Analysis 29

4.6. Value Chain Analysis 30

4.7. Buying Criteria 31

CHAPTER NO. 5 : IMPORT EXPORT ANALYSIS 32

5.1. Import Analysis by Netherlands 32

5.1.1. Netherlands Human Insulin Market Import Volume/Revenue, By Netherlands, 2018 – 2023 32

5.2. Export Analysis by Netherlands 33

5.2.1. Netherlands Human Insulin Market Export Volume/Revenue, By Netherlands, 2018 – 2023 33

CHAPTER NO. 6 : DEMAND SUPPLY ANALYSIS 34

6.1. Demand Analysis by Netherlands 34

6.1.1. Netherlands Human Insulin Market Demand Volume/Revenue, By Netherlands, 2018 – 2023 34

6.2. Supply Analysis by Netherlands 35

6.2.1. Netherlands Human Insulin Market Supply Volume/Revenue, By Netherlands, 2018 – 2023 35

CHAPTER NO. 7 : PRODUCTION ANALYSIS 36

7.1. Production Analysis by Netherlands 36

7.1.1. Netherlands Human Insulin Market Production Volume/Revenue, By Netherlands, 2018 – 2023 36

CHAPTER NO. 8 : PRICE ANALYSIS 37

8.1. Price Analysis by Type 37

8.1.1. Netherlands Human Insulin Market Price, By Type, 2018 – 2023 37

8.1.2. Netherlands Type Market Price, By Type, 2018 – 2023 37

CHAPTER NO. 9 : RAW MATERIALS ANALYSIS 38

9.1. Key Raw Materials and Suppliers 38

9.2. Key Raw Materials Price Trend 38

CHAPTER NO. 10 : MANUFACTURING COST ANALYSIS 39

10.1. Manufacturing Cost Analysis 39

10.2. Manufacturing Process 39

CHAPTER NO. 11 : ANALYSIS COMPETITIVE LANDSCAPE 40

11.1. Company Market Share Analysis – 2023 40

11.1.1. Netherlands Human Insulin Market: Company Market Share, by Volume, 2023 40

11.1.2. Netherlands Human Insulin Market: Company Market Share, by Revenue, 2023 41

11.1.3. Netherlands Human Insulin Market: Top 6 Company Market Share, by Revenue, 2023 41

11.1.4. Netherlands Human Insulin Market: Top 3 Company Market Share, by Revenue, 2023 42

11.2. Netherlands Human Insulin Market Company Volume Market Share, 2023 43

11.3. Netherlands Human Insulin Market Company Revenue Market Share, 2023 44

11.4. Company Assessment Metrics, 2023 45

11.4.1. Stars 45

11.4.2. Emerging Leaders 45

11.4.3. Pervasive Players 45

11.4.4. Participants 45

11.5. Start-ups /SMEs Assessment Metrics, 2023 45

11.5.1. Progressive Companies 45

11.5.2. Responsive Companies 45

11.5.3. Dynamic Companies 45

11.5.4. Starting Blocks 45

11.6. Strategic Developments 46

11.6.1. Acquisitions & Mergers 46

New Product Launch 46

Netherlands Expansion 46

11.7. Key Players Product Matrix 47

CHAPTER NO. 12 : PESTEL & ADJACENT MARKET ANALYSIS 48

12.1. PESTEL 48

12.1.1. Political Factors 48

12.1.2. Economic Factors 48

12.1.3. Social Factors 48

12.1.4. Technological Factors 48

12.1.5. Environmental Factors 48

12.1.6. Legal Factors 48

12.2. Adjacent Market Analysis 48

CHAPTER NO. 13 : HUMAN INSULIN MARKET – BY TYPE SEGMENT ANALYSIS 49

13.1. Human Insulin Market Overview, by Type Segment 49

13.1.1. Human Insulin Market Revenue Share, By Type, 2023 & 2032 50

13.1.2. Human Insulin Market Attractiveness Analysis, By Type 51

13.1.3. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 51

13.1.4. Human Insulin Market Revenue, By Type, 2018, 2023, 2027 & 2032 52

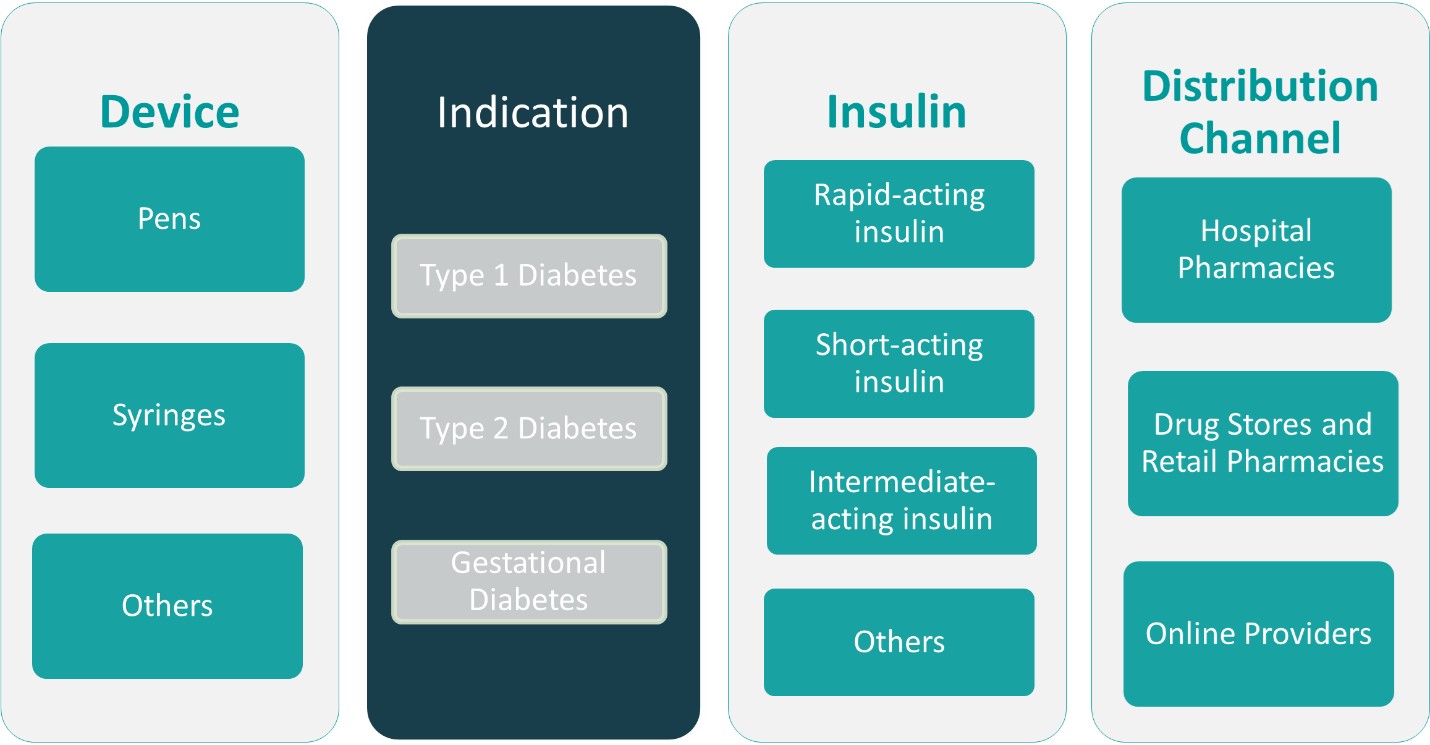

13.2. Pens 53

13.3. Syringes 54

13.4. Others 55

13.5. Type 4 56

13.6. Type 5 57

CHAPTER NO. 14 : HUMAN INSULIN MARKET – BY APPLICATION SEGMENT ANALYSIS 58

14.1. Human Insulin Market Overview, by Application Segment 58

14.1.1. Human Insulin Market Revenue Share, By Application, 2023 & 2032 59

14.1.2. Human Insulin Market Attractiveness Analysis, By Application 60

14.1.3. Incremental Revenue Growth Opportunity, by Application, 2024 – 2032 60

14.1.4. Human Insulin Market Revenue, By Application, 2018, 2023, 2027 & 2032 61

14.2. Type 1 Diabetes 62

14.3. Type 2 Diabetes 63

14.4. Gestational Diabetes 64

14.5. Application 4 65

14.6. Application 5 66

CHAPTER NO. 15 : HUMAN INSULIN MARKET – BY END-USER SEGMENT ANALYSIS 67

15.1. Human Insulin Market Overview, by End-user Segment 67

15.1.1. Human Insulin Market Revenue Share, By End-user, 2023 & 2032 68

15.1.2. Human Insulin Market Attractiveness Analysis, By End-user 69

15.1.3. Incremental Revenue Growth Opportunity, by End-user, 2024 – 2032 69

15.1.4. Human Insulin Market Revenue, By End-user, 2018, 2023, 2027 & 2032 70

15.2. Rapid-acting insulin 71

15.3. Short-acting insulin 72

15.4. Intermediate-acting insulin 73

15.5. Others 74

15.6. End-user 5 75

CHAPTER NO. 16 : HUMAN INSULIN MARKET – BY TECHNOLOGY SEGMENT ANALYSIS 76

16.1. Human Insulin Market Overview, by Technology Segment 76

16.1.1. Human Insulin Market Revenue Share, By Technology, 2023 & 2032 77

16.1.2. Human Insulin Market Attractiveness Analysis, By Technology 78

16.1.3. Incremental Revenue Growth Opportunity, by Technology, 2024 – 2032 78

16.1.4. Human Insulin Market Revenue, By Technology, 2018, 2023, 2027 & 2032 79

16.2. Technology 1 80

16.3. Technology 2 81

16.4. Technology 3 82

CHAPTER NO. 17 : – BY DISTRIBUTION CHANNEL SEGMENT ANALYSIS 83

17.1. Human Insulin Market Overview, by Distribution Channel Segment 83

17.1.1. Human Insulin Market Revenue Share, By Distribution Channel, 2023 & 2032 84

17.1.2. Human Insulin Market Attractiveness Analysis, By Distribution Channel 85

17.1.3. Incremental Revenue Growth Opportunity, by Distribution Channel, 2024 – 2032 85

17.1.4. Human Insulin Market Revenue, By Distribution Channel, 2018, 2023, 2027 & 2032 86

17.2. Hospital Pharmacies 87

17.3. Drug Stores and Retail Pharmacies 88

17.4. Online Providers 89

17.5. Distribution Channel 4 90

17.6. Distribution Channel 5 91

CHAPTER NO. 18 : HUMAN INSULIN MARKET – NETHERLANDS ANALYSIS 92

18.1. Type 92

18.1.1. Netherlands Human Insulin Market Revenue, By Type, 2018 – 2023 (USD Million) 92

18.2. Netherlands Human Insulin Market Revenue, By Type, 2024 – 2032 (USD Million) 92

18.3. Application 93

18.3.1. Netherlands Human Insulin Market Revenue, By Application, 2018 – 2023 (USD Million) 93

18.3.2. Netherlands Human Insulin Market Revenue, By Application, 2024 – 2032 (USD Million) 93

18.4. End-user 94

18.4.1. Netherlands Human Insulin Market Revenue, By End-user, 2018 – 2023 (USD Million) 94

18.4.2. Netherlands Human Insulin Market Revenue, By End-user, 2024 – 2032 (USD Million) 94

18.5. Technology 95

18.5.1. Netherlands Human Insulin Market Revenue, By Technology, 2018 – 2023 (USD Million) 95

18.5.2. Netherlands Human Insulin Market Revenue, By Technology, 2024 – 2032 (USD Million) 95

18.6. Distribution Channel 96

18.6.1. Netherlands Human Insulin Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 96

18.6.2. Netherlands Human Insulin Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 96

CHAPTER NO. 19 : COMPANY PROFILES 97

19.1. Novo Nordisk A/S 97

19.1.1. Company Overview 97

19.1.2. Product Portfolio 97

19.1.3. Swot Analysis 97

19.1.4. Business Strategy 98

19.1.5. Financial Overview 98

19.1.6. MannKind Corporation 99

19.1.7. Pfizer 99

19.1.8. Wockhardt 99

19.1.9. Biocon 99

19.1.10. Lupin 99

19.1.11. Tonghua Dongbao Pharmaceutical Co 99

19.1.12. Eli Lilly and Company 99

19.1.13. Ypsomed 99

19.1.14. Company 10 99

19.1.15. Company 11 99

19.1.16. Company 12 99

19.1.17. Company 13 99

19.1.18. Company 14 99

CHAPTER NO. 20 : RESEARCH METHODOLOGY 100

20.1. Research Methodology 100

20.1.1. Phase I – Secondary Research 101

20.1.2. Phase II – Data Modeling 101

Company Share Analysis Model 102

Revenue Based Modeling 102

20.1.3. Phase III – Primary Research 103

20.1.4. Research Limitations 104

Assumptions 104

List of Figures

FIG NO. 1. Netherlands Human Insulin Market Revenue, 2018 – 2032 (USD Million) 22

FIG NO. 2. Porter’s Five Forces Analysis for Netherlands Human Insulin Market 29

FIG NO. 3. Value Chain Analysis for Netherlands Human Insulin Market 30

FIG NO. 4. Netherlands Human Insulin Market Import Volume/Revenue, By Netherlands, 2018 – 2023 32

FIG NO. 5. Netherlands Human Insulin Market Export Volume/Revenue, By Netherlands, 2018 – 2023 33

FIG NO. 6. Netherlands Human Insulin Market Demand Volume/Revenue, By Netherlands, 2018 – 2023 34

FIG NO. 7. Netherlands Human Insulin Market Supply Volume/Revenue, By Netherlands, 2018 – 2023 35

FIG NO. 8. Netherlands Human Insulin Market Production Volume/Revenue, By Netherlands, 2018 – 2023 36

FIG NO. 9. Netherlands Human Insulin Market Price, By Type, 2018 – 2023 37

FIG NO. 10. Raw Materials Price Trend Analysis, 2018 – 2023 38

FIG NO. 11. Manufacturing Cost Analysis 39

FIG NO. 12. Manufacturing Process 39

FIG NO. 13. Company Share Analysis, 2023 40

FIG NO. 14. Company Share Analysis, 2023 41

FIG NO. 15. Company Share Analysis, 2023 41

FIG NO. 16. Company Share Analysis, 2023 42

FIG NO. 17. Human Insulin Market – Company Volume Market Share, 2023 43

FIG NO. 18. Human Insulin Market – Company Revenue Market Share, 2023 44

FIG NO. 19. Human Insulin Market Revenue Share, By Type, 2023 & 2032 50

FIG NO. 20. Market Attractiveness Analysis, By Type 51

FIG NO. 21. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 51

FIG NO. 22. Human Insulin Market Revenue, By Type, 2018, 2023, 2027 & 2032 52

FIG NO. 23. Netherlands Human Insulin Market for Pens, Revenue (USD Million) 2018 – 2032 53

FIG NO. 24. Netherlands Human Insulin Market for Syringes, Revenue (USD Million) 2018 – 2032 54

FIG NO. 25. Netherlands Human Insulin Market for Others, Revenue (USD Million) 2018 – 2032 55

FIG NO. 26. Netherlands Human Insulin Market for Type 4, Revenue (USD Million) 2018 – 2032 56

FIG NO. 27. Netherlands Human Insulin Market for Type 5, Revenue (USD Million) 2018 – 2032 57

FIG NO. 28. Human Insulin Market Revenue Share, By Application, 2023 & 2032 59

FIG NO. 29. Market Attractiveness Analysis, By Application 60

FIG NO. 30. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 60

FIG NO. 31. Human Insulin Market Revenue, By Application, 2018, 2023, 2027 & 2032 61

FIG NO. 32. Netherlands Human Insulin Market for Type 1 Diabetes, Revenue (USD Million) 2018 – 2032 62

FIG NO. 33. Netherlands Human Insulin Market for Type 2 Diabetes, Revenue (USD Million) 2018 – 2032 63

FIG NO. 34. Netherlands Human Insulin Market for Gestational Diabetes, Revenue (USD Million) 2018 – 2032 64

FIG NO. 35. Netherlands Human Insulin Market for Application 4, Revenue (USD Million) 2018 – 2032 65

FIG NO. 36. Netherlands Human Insulin Market for Application 5, Revenue (USD Million) 2018 – 2032 66

FIG NO. 37. Human Insulin Market Revenue Share, By End-user, 2023 & 2032 68

FIG NO. 38. Market Attractiveness Analysis, By End-user 69

FIG NO. 39. Incremental Revenue Growth Opportunity by End-user, 2024 – 2032 69

FIG NO. 40. Human Insulin Market Revenue, By End-user, 2018, 2023, 2027 & 2032 70

FIG NO. 41. Netherlands Human Insulin Market for Rapid-acting insulin, Revenue (USD Million) 2018 – 2032 71

FIG NO. 42. Netherlands Human Insulin Market for Short-acting insulin, Revenue (USD Million) 2018 – 2032 72

FIG NO. 43. Netherlands Human Insulin Market for Intermediate-acting insulin, Revenue (USD Million) 2018 – 2032 73

FIG NO. 44. Netherlands Human Insulin Market for Others, Revenue (USD Million) 2018 – 2032 74

FIG NO. 45. Netherlands Human Insulin Market for End-user 5, Revenue (USD Million) 2018 – 2032 75

FIG NO. 46. Human Insulin Market Revenue Share, By Technology, 2023 & 2032 77

FIG NO. 47. Market Attractiveness Analysis, By Technology 78

FIG NO. 48. Incremental Revenue Growth Opportunity by Technology, 2024 – 2032 78

FIG NO. 49. Human Insulin Market Revenue, By Technology, 2018, 2023, 2027 & 2032 79

FIG NO. 50. Netherlands Human Insulin Market for Technology 1, Revenue (USD Million) 2018 – 2032 80

FIG NO. 51. Netherlands Human Insulin Market for Technology 2, Revenue (USD Million) 2018 – 2032 81

FIG NO. 52. Netherlands Human Insulin Market for Technology 3, Revenue (USD Million) 2018 – 2032 82

FIG NO. 53. Human Insulin Market Revenue Share, By Distribution Channel, 2023 & 2032 84

FIG NO. 54. Market Attractiveness Analysis, By Distribution Channel 85

FIG NO. 55. Incremental Revenue Growth Opportunity by Distribution Channel, 2024 – 2032 85

FIG NO. 56. Human Insulin Market Revenue, By Distribution Channel, 2018, 2023, 2027 & 2032 86

FIG NO. 57. Netherlands Human Insulin Market for Hospital Pharmacies, Revenue (USD Million) 2018 – 2032 87

FIG NO. 58. Netherlands Human Insulin Market for Drug Stores and Retail Pharmacies, Revenue (USD Million) 2018 – 2032 88

FIG NO. 59. Netherlands Human Insulin Market for Online Providers, Revenue (USD Million) 2018 – 2032 89

FIG NO. 60. Netherlands Human Insulin Market for Distribution Channel 4, Revenue (USD Million) 2018 – 2032 90

FIG NO. 61. Netherlands Human Insulin Market for Distribution Channel 5, Revenue (USD Million) 2018 – 2032 91

FIG NO. 62. Research Methodology – Detailed View 100

FIG NO. 63. Research Methodology 101

List of Tables

TABLE NO. 1. : Netherlands Human Insulin Market: Snapshot 18

TABLE NO. 2. : Drivers for the Human Insulin Market: Impact Analysis 22

TABLE NO. 3. : Restraints for the Human Insulin Market: Impact Analysis 24

TABLE NO. 4. : Netherlands Human Insulin Market Revenue, By Type, 2018 – 2023 34

TABLE NO. 5. : Key Raw Materials & Suppliers 35

TABLE NO. 6. : Netherlands Human Insulin Market Revenue, By Type, 2018 – 2023 (USD Million) 89

TABLE NO. 7. : Netherlands Human Insulin Market Revenue, By Type, 2024 – 2032 (USD Million) 89

TABLE NO. 8. : Netherlands Human Insulin Market Revenue, By Application, 2018 – 2023 (USD Million) 90

TABLE NO. 9. : Netherlands Human Insulin Market Revenue, By Application, 2024 – 2032 (USD Million) 90

TABLE NO. 10. : Netherlands Human Insulin Market Revenue, By End-user, 2018 – 2023 (USD Million) 91

TABLE NO. 11. : Netherlands Human Insulin Market Revenue, By End-user, 2024 – 2032 (USD Million) 91

TABLE NO. 12. : Netherlands Human Insulin Market Revenue, By Technology, 2018 – 2023 (USD Million) 92

TABLE NO. 13. : Netherlands Human Insulin Market Revenue, By Technology, 2024 – 2032 (USD Million) 92

TABLE NO. 14. : Netherlands Human Insulin Market Revenue, By Distribution Channel, 2018 – 2023 (USD Million) 93

TABLE NO. 15. : Netherlands Human Insulin Market Revenue, By Distribution Channel, 2024 – 2032 (USD Million) 93