Market Overview

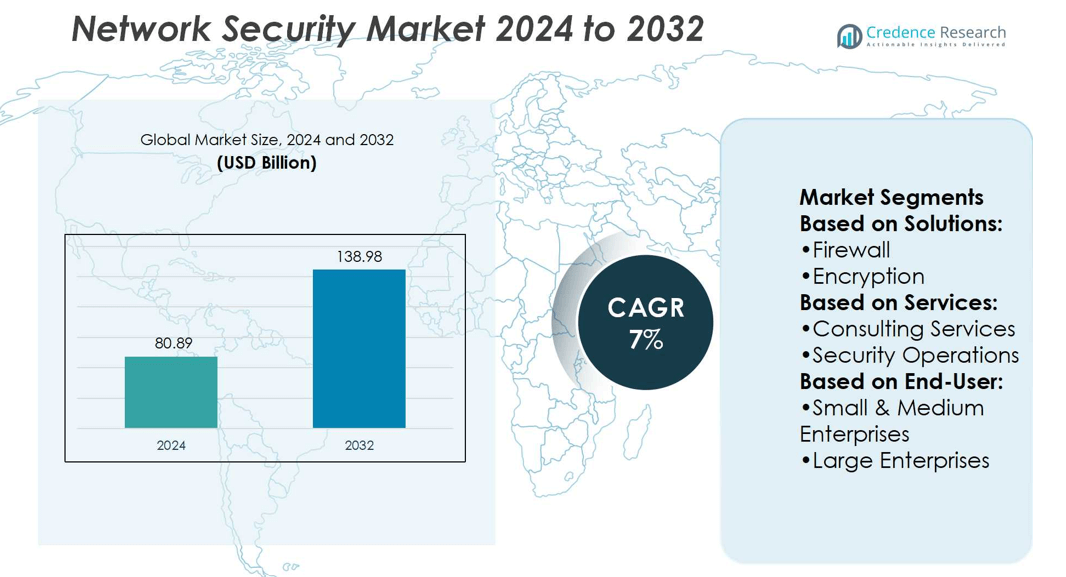

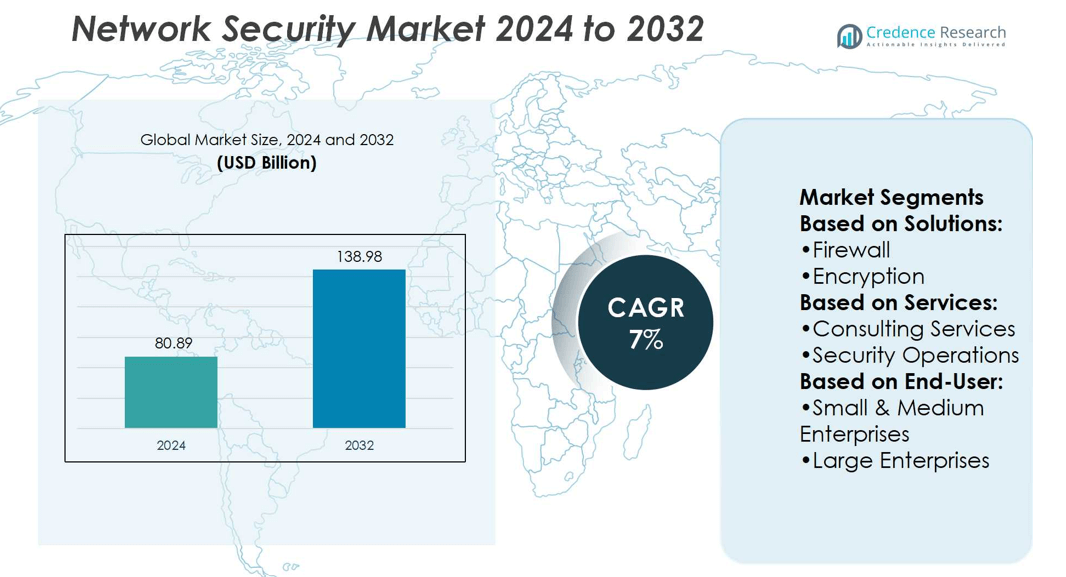

Network Security Market size was valued at USD 80.89 billion in 2024 and is anticipated to reach USD 138.98 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Network Security Market Size 2024 |

USD 80.89 billion |

| Network Security Market CAGR |

7% |

| Network Security Market Size 2032 |

USD 138.98 billion |

The Network Security Market grows strongly with rising cyber threats, regulatory compliance, and rapid cloud adoption. Enterprises invest in firewalls, intrusion detection, and identity management to secure expanding digital infrastructures. Remote work and hybrid environments intensify demand for zero-trust frameworks and managed security services. AI and machine learning integration improves threat detection, while automation enhances response efficiency. Cloud-native platforms and secure access solutions gain prominence with increasing reliance on distributed systems. Regulatory mandates reinforce adoption across sectors, while IoT and edge devices expand the scope of protection. Continuous innovation ensures the market evolves to meet complex and evolving security needs.

The Network Security Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with mature adoption, while Asia-Pacific records the fastest growth due to rapid digital transformation. Europe maintains steady demand under strict regulatory frameworks, and emerging regions expand with rising digitization. Competition remains intense with global players focusing on innovation and partnerships. Leading participants strengthen portfolios in cloud-native security, zero-trust models, and AI-driven solutions to capture wider market share.

Market Insights

- The Network Security Market size was valued at USD 80.89 billion in 2024 and is projected to reach USD 138.98 billion by 2032, at a CAGR of 7%.

- Rising cyber threats, strict compliance laws, and rapid cloud adoption drive steady market expansion.

- AI, machine learning, and automation enhance detection accuracy and accelerate incident response across industries.

- Market restraints include high infrastructure complexity and shortage of skilled cybersecurity professionals worldwide.

- North America leads in market share, while Asia-Pacific records the fastest growth due to digital transformation.

- Europe maintains consistent demand supported by GDPR, while Latin America and Middle East & Africa expand gradually.

- Competition stays intense with global players focusing on cloud-native platforms, zero-trust frameworks, and AI-driven security innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Cybersecurity Threats Driving Adoption of Advanced Network Security Solutions

The Network Security Market expands with the increasing frequency and sophistication of cyberattacks. Enterprises face constant risks from ransomware, phishing, and distributed denial-of-service attacks. Rising digital connectivity across industries exposes networks to complex vulnerabilities. Organizations prioritize deploying next-generation firewalls, intrusion detection systems, and endpoint protection tools. Cloud adoption and remote work accelerate the need for secure access controls. It strengthens demand for integrated solutions that can adapt quickly to evolving threats.

- For instance, Aruba’s ESP platform supports management of over 5.2 million devices and handles more than 2 billion network services, all under consistent policy controls across deployment models including virtual private cloud and on-premises, preserving data sovereignty and regulatory alignment.

Regulatory Compliance and Data Protection Requirements Fueling Demand

Governments worldwide enforce strict regulations on data privacy and cybersecurity standards. The Network Security Market benefits from frameworks such as GDPR, HIPAA, and CCPA. These mandates require businesses to maintain robust protection for sensitive information. Industries like healthcare, banking, and telecom face higher pressure to invest in compliance-driven solutions. Network monitoring, encryption technologies, and identity access management gain prominence in meeting legal obligations. It ensures businesses remain compliant while building trust with customers.

- For instance, Ruckus’ SmartCell Insight platform stores up to 3 years of traffic data across 100,000 access points and millions of clients daily, enabling long-term compliance monitoring and analytics.

Growing Cloud Migration and Remote Work Intensifying Security Needs

Cloud services and hybrid work models create complex network environments. The Network Security Market responds with advanced tools for securing cloud workloads and remote endpoints. Traditional perimeter-based defense models struggle against distributed infrastructures. Secure access service edge (SASE) and zero-trust architectures emerge as vital solutions. Enterprises demand scalable, flexible, and cloud-native protection systems to ensure business continuity. It positions security integration as a core enabler of digital transformation.

Rising Investment in Advanced Technologies to Strengthen Network Resilience

Artificial intelligence and machine learning redefine how organizations address cybersecurity challenges. The Network Security Market leverages predictive analytics to detect anomalies in real time. Automated threat response reduces incident resolution times and improves resilience. Integration of blockchain supports tamper-proof data exchange across networks. Cybersecurity spending by governments and enterprises reinforces development of cutting-edge defenses. It drives continuous innovation and strengthens the overall market ecosystem.

Market Trends

Rising Deployment of Zero-Trust Security Models Across Enterprises

The Network Security Market advances with rapid adoption of zero-trust frameworks. Businesses shift from perimeter-based models to continuous verification of every access request. It enhances resilience against insider threats and unauthorized lateral movements within networks. Zero-trust architecture gains traction across government, healthcare, and financial institutions. Enterprises integrate multi-factor authentication, micro-segmentation, and identity-based access control to strengthen systems. Growing hybrid workforces and cloud adoption accelerate the pace of zero-trust deployment.

- For instance, Cisco’s Universal ZTNA blocked and detected all 30 real-world attack attempts in independent testing—12 stolen credential attacks, 8 MFA brute-force attempts, and 10 session hijacks—earning a top SE Labs AAA rating.

Expanding Integration of Artificial Intelligence and Machine Learning in Security Tools

The Network Security Market leverages AI and ML to detect and respond to threats faster. Predictive analytics improves identification of anomalies in network traffic. It reduces dependence on manual monitoring and enhances real-time decision-making. Advanced algorithms help security teams combat polymorphic malware and evolving attack vectors. AI-driven tools also support automated patch management and vulnerability assessments. Industries adopt these technologies to improve efficiency and reduce operational risks.

- For instance, Broadcom’s Symantec Enterprise Cloud leverages its Global Intelligence Network—one of the world’s largest civilian threat intelligence networks. Using advanced AI and machine learning, the platform analyzes 11 trillion elements of telemetry to discover, block, and remediate advanced attacks.

Growing Importance of Cloud-Native Security for Hybrid Environments

The Network Security Market evolves to address complex hybrid and multi-cloud systems. Enterprises invest in cloud-native security to protect workloads and applications. It ensures consistent data protection across public, private, and edge infrastructures. Secure access service edge (SASE) and cloud workload protection platforms gain prominence. Vendors deliver scalable, flexible solutions tailored for distributed IT architectures. The expansion of remote access drives strong demand for adaptive cloud-based defenses.

Increasing Focus on Security Automation and Orchestration Solutions

The Network Security Market emphasizes automation to improve response speed and accuracy. Security orchestration, automation, and response platforms streamline incident detection and containment. It minimizes human error while managing large volumes of alerts. Automated playbooks and workflows enhance operational efficiency in security operations centers. Enterprises adopt these systems to address skilled workforce shortages in cybersecurity. Growing adoption of orchestration reflects a long-term trend toward more intelligent and proactive defense mechanisms.

Market Challenges Analysis

High Complexity of Managing Advanced Security Infrastructure Across Enterprises

The Network Security Market faces significant hurdles in handling complex and layered defense systems. Enterprises deploy multiple tools for firewalls, intrusion detection, endpoint security, and cloud protection. It creates integration challenges that increase administrative overhead and slow response times. Small and mid-sized businesses struggle with limited budgets and lack of skilled resources to manage such environments. Frequent software updates and evolving threat intelligence demand continuous adaptation. The absence of interoperability across vendor platforms further complicates security operations for organizations.

Shortage of Skilled Cybersecurity Professionals Hindering Effective Implementation

The Network Security Market struggles with a global shortage of trained cybersecurity specialists. Enterprises compete for limited talent while facing rising threats across industries. It leads to delays in deploying advanced solutions and weakens incident response capabilities. Training existing staff remains costly and time-consuming for many organizations. The gap in expertise limits adoption of AI-driven and zero-trust architectures. Rising demand for specialized skills in cloud, endpoint, and identity security highlights the ongoing workforce challenge.

Market Opportunities

Rising Demand for Cloud Security and Zero-Trust Architectures Creating New Growth Paths

The Network Security Market benefits from expanding adoption of cloud platforms and hybrid environments. Enterprises require advanced solutions to safeguard distributed applications and remote access points. It opens opportunities for vendors delivering cloud-native firewalls, secure access service edge (SASE), and zero-trust frameworks. Growing digital transformation across industries drives investments in scalable, flexible, and automated systems. The focus on secure migration of mission-critical workloads strengthens demand for innovative offerings. Service providers with end-to-end integration capabilities stand to gain a competitive advantage.

Growing Investments in Artificial Intelligence and Automation for Security Enhancement

The Network Security Market finds opportunities in AI-driven monitoring, threat prediction, and automated response. Enterprises adopt advanced analytics to identify anomalies faster and reduce false alerts. It creates room for vendors offering security orchestration and automated incident management platforms. Governments and corporations fund large projects focused on predictive defense technologies. Cloud providers integrate AI features into their security tools to improve resilience. The rising preference for automation to address workforce shortages ensures strong long-term market potential.

Market Segmentation Analysis:

By Solutions

The Network Security Market demonstrates strong demand across multiple solution categories. Firewalls remain a cornerstone, offering critical protection against unauthorized access and data breaches. Encryption gains prominence with rising concerns over data privacy and regulatory compliance. Intrusion Detection Systems support organizations in identifying unusual activities and preventing potential breaches in real time. Identity and Access Management secures critical assets by ensuring only authorized users can access sensitive data. Unified Threat Management solutions integrate multiple capabilities into a single platform, offering cost-effective and comprehensive protection for enterprises of varying sizes. It highlights the trend of organizations adopting both specialized and consolidated solutions to strengthen network defenses.

- For instance, Juniper’s next-generation SRX Series firewall achieved a 99.7% exploit block rate with zero false positives in independent testing, ensuring highly accurate protection at network edges.

By Services

The Network Security Market expands significantly through specialized service offerings. Consulting Services play a vital role in helping organizations design strategies aligned with regulatory and operational needs. Security Operations provide continuous monitoring and incident handling to protect critical infrastructure. Managed Security Services gain traction among enterprises looking to outsource security functions due to limited internal expertise. It supports cost savings, while offering advanced monitoring tools and access to global threat intelligence. Growing reliance on professional service providers underlines the importance of services in enhancing overall resilience against cyber threats.

- For instance, Huawei’s UB-Mesh is designed to achieve very high per-chip bandwidth. A key technical feature cited by Huawei is the capability to scale from 100 Gbps to 10 Tbps (1.25 TB/s) per device, which is necessary for next-generation AI clusters.

By End User

The Network Security Market caters to a diverse range of enterprise needs across different sizes. Small and Medium Enterprises adopt scalable and affordable solutions to safeguard digital assets while managing tight budgets. Firewalls, endpoint protection, and managed services are often prioritized in this segment. Large Enterprises invest in complex, multi-layered solutions that integrate AI, machine learning, and zero-trust frameworks. These organizations require advanced identity management and real-time monitoring systems to protect expansive networks. It reflects a dual demand pattern where SMEs focus on cost-efficient security while large corporations emphasize comprehensive and proactive defense. This segmentation ensures the market continues to address unique needs across industries and organizational scales.

Segments:

Based on Solutions:

Based on Services:

- Consulting Services

- Security Operations

Based on End-User:

- Small & Medium Enterprises

- Large Enterprises

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the Network Security Market with the largest global share, ranging between 36% and 53% in recent estimates. The United States drives most of this demand, supported by Canada’s steady growth. Strong regulatory frameworks such as HIPAA, PCI DSS, and state-level data privacy laws create consistent pressure on enterprises to invest in advanced defenses. Companies in finance, healthcare, and government spend heavily on intrusion detection, encryption, and identity management. Cloud adoption in the U.S. further fuels demand for zero-trust security and managed services. It makes North America the most mature and technologically advanced hub for network security innovation. The region continues to lead in integrating AI and automation into cybersecurity platforms, reinforcing its global leadership.

Europe

Europe contributes close to 25% of the Network Security Market, placing it behind North America but ahead of other regions. The region benefits from stringent laws such as the General Data Protection Regulation (GDPR), which mandate stronger data protection across industries. Key markets include Germany, the United Kingdom, and France, where enterprises invest in unified threat management and identity solutions. Financial institutions, manufacturing companies, and telecom operators remain the top adopters of advanced security. It sees growing use of encryption and managed services as firms adapt to evolving cyber threats. Vendors find opportunities in tailoring products to strict compliance standards. Europe’s share demonstrates how regulation-driven demand sustains growth even in a slower-expanding digital economy.

Asia-Pacific

Asia-Pacific secures around 22% of the Network Security Market and stands out as the fastest-growing region. Countries such as China, India, Japan, and South Korea drive momentum through rapid digital transformation. Expanding e-commerce, cloud adoption, and mobile-first services expose enterprises to higher risks, creating demand for firewalls, intrusion systems, and endpoint protection. Governments launch national cybersecurity programs, strengthening regulatory frameworks across the region. It boosts adoption of zero-trust models and AI-based monitoring solutions. Rising cyberattacks on financial and manufacturing sectors accelerate spending on both consulting and managed services. Asia-Pacific’s dynamic growth positions it as the future leader in cybersecurity expansion.

Latin America

Latin America represents about 7% of the Network Security Market, with Brazil and Mexico being key contributors. Growing cloud adoption and rising internet penetration drive demand for managed security services. Enterprises in banking, telecom, and energy invest in encryption and identity solutions to safeguard critical systems. Governments also push for stronger cybersecurity regulations, opening opportunities for vendors. It remains an emerging market with limited budgets compared to advanced regions, yet demand for affordable solutions continues to grow. The presence of multinational firms accelerates adoption of global security practices. Latin America’s market demonstrates steady growth potential in the coming years.

Middle East & Africa

The Middle East & Africa account for roughly 6% of the Network Security Market. Countries such as Saudi Arabia, the UAE, and South Africa lead adoption, supported by strong government initiatives. The energy, oil and gas, and banking sectors remain top users of intrusion detection and encryption tools. Rising investment in smart city projects in the Gulf states accelerates demand for cloud-native security solutions. It reflects a shift toward integrating identity management and unified threat systems into critical infrastructure. Africa sees gradual adoption, with South Africa driving most spending. While smaller in share, this region provides significant long-term opportunities due to rising digitization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sophos Ltd

- Aruba Networks

- Fortinet Inc

- Motorola Solutions

- Ruckus

- Cisco Systems Inc

- Aerohive

- Dell Technologies

- Broadcom Inc

- Jupiter Networks Inc

Competitive Analysis

The Network Security Market features include Sophos Ltd, Aruba Networks, Fortinet Inc, Motorola Solutions, Ruckus, Cisco Systems Inc, Aerohive, Dell Technologies, Broadcom Inc, and Jupiter Networks Inc. The Network Security Market remains highly competitive, shaped by continuous innovation and rising enterprise demand for advanced protection. Companies focus on expanding product portfolios that include firewalls, intrusion detection, cloud-native platforms, and identity management solutions. Strategic mergers, acquisitions, and technology partnerships play a central role in gaining market share. Vendors emphasize integration of artificial intelligence, automation, and zero-trust frameworks to address complex security needs. Service offerings such as managed security and consulting also create differentiation in a crowded landscape. Strong investment in R&D ensures consistent development of next-generation solutions, reinforcing competition and driving the overall market forward.

Recent Developments

- In May 2025, Huawei Technologies Co., Ltd. unveiled the Xinghe Intelligent High-Quality Wi-Fi 7 Campus Network Solution, offering advanced performance and security features for enterprise wireless connectivity.

- In July 2024, SonicWall launched Cloud Secure Edge (CSE), an innovative suite of Zero-Trust Network Access (ZTNA) offerings developed specifically for Managed Service Providers (MSPs). It is a cost-effective and flexible solution which provides remote access and internet access to organizations to connect with their employees and third-party users securely from any device and location.

- In July 2024, Fortinet, Inc. introduced a hardware-as-a-service offering that keep the latest firewall technology updated. The FortiGate-as-a-Service (FGaaS) enables customers to choose the hardware they want and FortiGate next-gen firewalls. The company will manage and configure the device for the customer’s service.

- In April 2024, HPE Aruba Networking launched its first range of Wi-Fi 7-capable access points, introducing the 730 Series Campus APs. While built on the latest Wi-Fi 7 standard, the products are positioned to stand out in the wireless market not solely for speed, but for their integrated network security and location-based services.

Report Coverage

The research report offers an in-depth analysis based on Solutions, Services, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Network Security Market will expand with growing adoption of zero-trust architectures.

- AI and machine learning will strengthen real-time threat detection and automated response.

- Cloud-native security platforms will dominate with rising multi-cloud and hybrid deployments.

- Demand for managed security services will grow due to global workforce shortages.

- IoT and edge device expansion will create new requirements for endpoint protection.

- Regulatory pressure will drive greater investment in compliance-focused security solutions.

- Small and medium enterprises will increasingly adopt scalable and affordable protection tools.

- Integration of blockchain will enhance data integrity and secure transaction environments.

- Remote and hybrid work models will keep secure access and identity management in focus.

- Continuous innovation in orchestration and automation will define long-term competitive advantage.