Market Overview

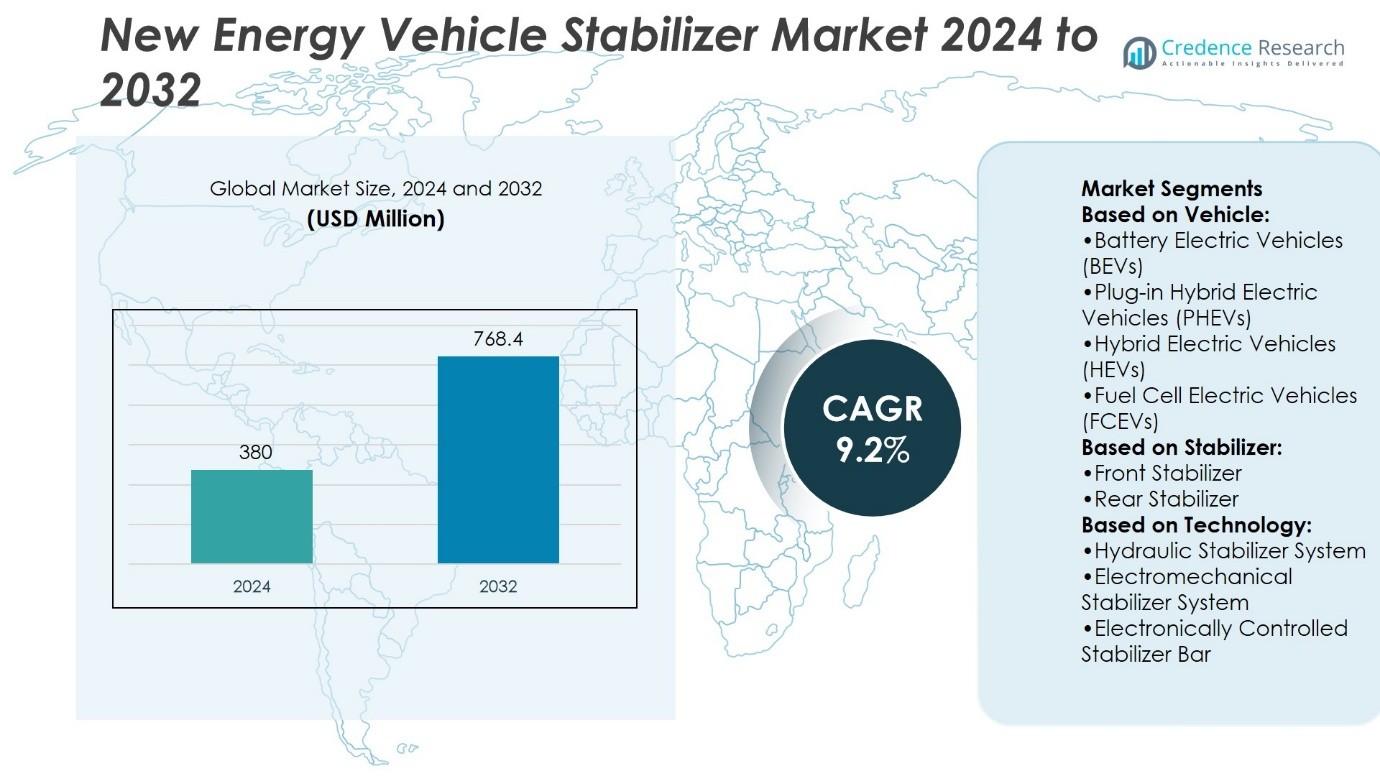

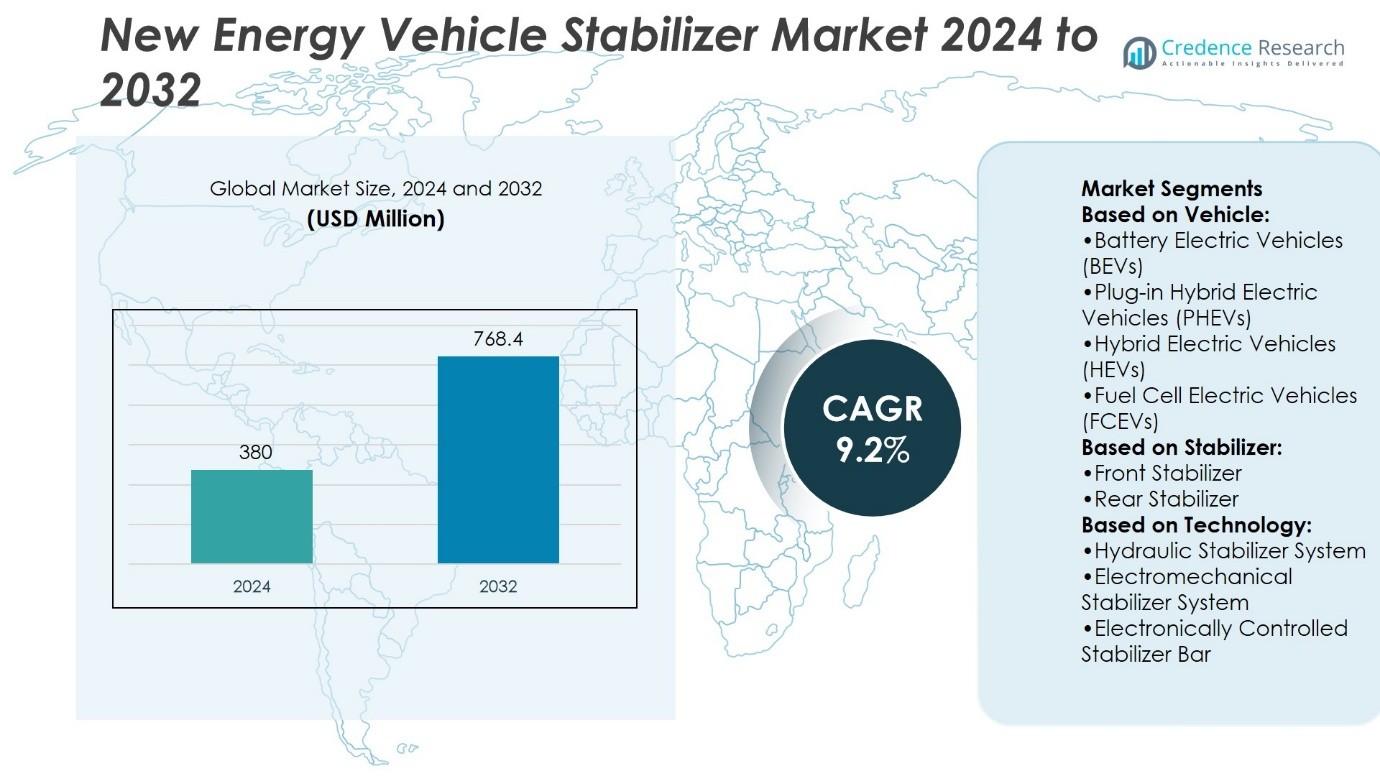

New Energy Vehicle Stabilizer Market size was valued at USD 380 million in 2024 and is anticipated to reach USD 768.4 million by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| New Energy Vehicle Stabilizer Market Size 2024 |

USD 380 Million |

| New Energy Vehicle Stabilizer Market, CAGR |

9.2% |

| New Energy Vehicle Stabilizer Market Size 2032 |

USD 768.4 Million |

The New Energy Vehicle Stabilizer Market grows with rising adoption of electric and hybrid vehicles, driven by stricter emission regulations and consumer demand for safer, more efficient mobility. Lightweight stabilizers enhance energy efficiency and extend driving range, while advanced systems improve vehicle balance and comfort. Trends highlight the shift toward electronically controlled and adaptive stabilizers, supporting integration with driver assistance and autonomous technologies. Expanding production of electric SUVs and performance models accelerates demand for high-performance solutions. The market also moves toward modular and scalable designs, enabling cost efficiency and faster deployment across diverse EV platforms.

The New Energy Vehicle Stabilizer Market shows strong geographical presence, with Asia-Pacific leading due to large-scale EV production, followed by Europe driven by strict emission norms, and North America supported by advanced automotive infrastructure. Latin America and Middle East & Africa display gradual but rising adoption with growing electrification efforts. Key players such as ZF, Thyssenkrupp, Mubea, NHK International, Kongsberg Automotive, Sogefi Group, Daewon, Dongfeng, Hendrickson, and SwayTec focus on innovation, lightweight materials, and electronic stabilizer technologies to strengthen global competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The New Energy Vehicle Stabilizer Market was valued at USD 380 million in 2024 and is expected to reach USD 768.4 million by 2032, growing at a CAGR of 9.2%.

- The market grows with rising adoption of electric and hybrid vehicles supported by stricter emission rules.

- Lightweight stabilizers improve energy efficiency and help extend driving range in modern EVs.

- Electronically controlled and adaptive stabilizers gain traction with integration into driver assistance technologies.

- Competition is strong as companies focus on innovation, modular designs, and global expansion strategies.

- High production costs and supply chain challenges act as restraints for mass adoption.

- Asia-Pacific leads the market, Europe follows with strict norms, North America shows steady growth, while Latin America and Middle East & Africa display gradual but rising demand.

Market Drivers

Rising Adoption of Electric Mobility Solutions

The New Energy Vehicle Stabilizer Market expands with rapid adoption of electric and hybrid vehicles. Governments worldwide enforce strict emission targets, leading manufacturers to integrate stabilizers that improve vehicle balance and handling. It enhances passenger safety while ensuring better stability at higher speeds. The demand for reliable stabilization systems grows as urban mobility shifts to cleaner transportation. Consumers also expect advanced safety standards from electric cars, driving wider adoption of stabilizers. It remains a key component in delivering smooth driving performance for electric vehicles.

- For instance, Mubea developed a transversal blade spring that replaces multi‑link axles, removing 20 kg of weight and freeing battery installation space in BEVs It enhances passenger safety while ensuring better stability at higher speeds.

Increasing Focus on Passenger Safety Standards

The New Energy Vehicle Stabilizer Market gains momentum due to rising safety regulations. Authorities push automakers to comply with stricter crash prevention measures. Stabilizers play a direct role in reducing rollover risks and enhancing steering control. It supports greater driver confidence, particularly for high-performance and heavy battery vehicles. Demand intensifies with increasing production of SUVs and crossovers in the electric category. The industry aligns with global safety norms, ensuring stabilizer integration becomes standard practice.

- For instance, the Dongfeng Aeolus Haohan PHEV utilizes a 4-speed series-parallel hybrid system, which the company claims is a world-first. It delivers a combined output of 265 kW and 615 Nm of torque. The manufacturer claims a combined range of up to 1,300 km. The vehicle features various safety and driver assistance systems, including front collision warnings, adaptive cruise control, and lane-keeping assist. The suspension is also described as providing a smooth ride and good stability.

Advancements in Vehicle Suspension Technologies

The New Energy Vehicle Stabilizer Market benefits from innovation in suspension and chassis systems. Manufacturers develop lightweight stabilizers that reduce energy loss and improve battery efficiency. It provides both stability and efficiency, crucial for electric mobility. New designs enhance durability, adapting to higher torque levels in modern EVs. Automakers invest in advanced materials, including composites and high-strength alloys. It improves performance under variable road conditions, strengthening consumer trust in EV reliability.

Growing Investments in Electric Vehicle Infrastructure

The New Energy Vehicle Stabilizer Market strengthens with expanding EV charging networks and supportive ecosystems. Strong infrastructure boosts EV adoption, increasing demand for stabilizer systems. It ensures vehicles maintain consistent handling during longer commutes and diverse terrains. Rising investments from automakers and governments create favorable conditions for technology integration. Stabilizers become essential in premium EVs, where comfort and control remain priority features. It supports global expansion of EV adoption, fueling consistent growth for stabilizer solutions.

Market Trends

Integration of Lightweight Materials for Efficiency

The New Energy Vehicle Stabilizer Market shows a clear trend toward advanced lightweight materials. Automakers adopt aluminium alloys and composites to reduce overall vehicle weight. It improves energy efficiency while supporting longer driving ranges. Stabilizers made from durable, light components also extend battery performance. Manufacturers design these systems to withstand higher torque and stress from electric drivetrains. It reflects the push for eco-friendly components that balance safety and efficiency in electric mobility.

- For instance, ZF’s sMOTION active chassis damper system entered serial production in late 2024, offering continuously variable damping that can actively adjust to a wide range of driving situations to enhance stability and ride comfort.

Expansion of Smart and Adaptive Stabilizers

The New Energy Vehicle Stabilizer Market embraces smart stabilizer technologies with electronic control systems. Automakers integrate adaptive features that adjust stiffness based on road conditions. It enhances driving comfort while improving real-time safety responses. These stabilizers support integration with advanced driver assistance systems, creating a seamless safety ecosystem. Growth in semi-autonomous and connected vehicles further accelerates adoption of adaptive stabilizers. It highlights the shift from mechanical solutions to digitally controlled technologies in the EV sector.

- For instance, Hendrickson’s STEERTEK NXT steer axle introduced in mid-2025 offers 25 pounds of additional weight savings in school buses compared to its prior axle generation.

Rising Demand for Performance-Oriented Stabilization

The New Energy Vehicle Stabilizer Market experiences growth in demand for high-performance stabilization systems. Sports EVs and premium models require advanced stabilizers to handle strong acceleration and cornering. It ensures improved handling, stability, and passenger comfort. Manufacturers focus on designs that reduce body roll and enhance control at higher speeds. The growing appeal of performance-driven electric cars strengthens this trend globally. It highlights the importance of stabilization as a core factor in the EV driving experience.

Focus on Modular and Scalable Designs

The New Energy Vehicle Stabilizer Market sees a strong move toward modular and scalable stabilizer designs. Automakers prefer systems that can be adapted across multiple EV platforms. It reduces production costs and accelerates time-to-market for new models. Modular stabilizers support both compact electric cars and large utility vehicles. Manufacturers enhance flexibility while maintaining consistent safety standards across product lines. It reflects the industry’s focus on cost efficiency and faster innovation cycles.

Market Challenges Analysis

High Production Costs and Material Constraints

The New Energy Vehicle Stabilizer Market faces a significant challenge from rising production costs and limited access to advanced materials. Automakers rely on lightweight alloys and composites to enhance efficiency, but these materials increase manufacturing expenses. It restricts mass adoption, especially for mid-range and entry-level EVs. Supply chain disruptions further intensify cost pressures, delaying stabilizer availability for large-scale production. High investment requirements in R&D and specialized tooling add to the burden for manufacturers. It creates barriers for smaller companies aiming to compete in the stabilizer segment.

Technical Integration and Durability Concerns

The New Energy Vehicle Stabilizer Market also struggles with integration challenges across diverse EV platforms. Stabilizers must adapt to different battery layouts, suspension systems, and weight distributions, which complicates standardization. It raises engineering complexity and testing requirements, extending development timelines. Durability remains another concern, as stabilizers must withstand higher torque and unique stress levels from electric drivetrains. Failures in long-term reliability could affect customer trust and regulatory compliance. It compels automakers to balance innovation with proven performance, ensuring stabilizers meet strict safety and endurance standards.

Market Opportunities

Growing Demand from Expanding Electric Vehicle Adoption

The New Energy Vehicle Stabilizer Market presents strong opportunities driven by rapid EV adoption worldwide. Governments enforce stricter emission regulations, and consumers seek sustainable mobility options, creating a surge in demand. It strengthens the requirement for advanced stabilizers that enhance safety, comfort, and performance. Expanding production of electric SUVs and premium models further boosts the need for high-performance stabilizers. Automakers look for solutions that align with global safety standards and consumer expectations. It positions stabilizer manufacturers to capitalize on growing volumes across multiple EV segments.

Advancements in Smart and Modular Technologies

The New Energy Vehicle Stabilizer Market benefits from opportunities in smart and modular stabilizer systems. Automakers adopt electronically controlled stabilizers that integrate with ADAS and autonomous driving platforms. It enables vehicles to adapt stability in real time, enhancing both safety and driving experience. Modular designs allow cost-efficient deployment across compact cars, sedans, and utility EVs. Manufacturers gain the advantage of scalability while meeting diverse market needs. It opens avenues for innovation and collaboration, helping companies strengthen competitiveness in the evolving EV landscape.

Market Segmentation Analysis:

By Vehicle

The New Energy Vehicle Stabilizer Market demonstrates strong growth across all vehicle categories. Battery Electric Vehicles (BEVs) lead adoption due to rising demand for zero-emission transport and advanced safety features. It creates opportunities for stabilizer manufacturers to develop lightweight, energy-efficient systems. Plug-in Hybrid Electric Vehicles (PHEVs) show steady demand, supported by consumers seeking extended driving range with lower emissions. Hybrid Electric Vehicles (HEVs) continue to hold relevance in regions with limited charging infrastructure, driving moderate adoption of stabilizers. Fuel Cell Electric Vehicles (FCEVs) emerge as a niche segment, where stabilizers ensure safety in larger, high-performance platforms. It highlights the market’s broad application potential across evolving powertrain technologies.

- For instance, Kongsberg Automotive developed a rear axle stabilizer that uses high‑strength forged link arms and advanced tube forming. This design achieves a weight reduction of over 30% compared to traditional solid‑rod stabilizers—while lodging the stabilizer directly beneath the axle to improve roll behavior and free up space.

By Stabilizer

The market divides into front and rear stabilizers, both serving distinct performance functions. Front stabilizers hold a dominant share due to their critical role in maintaining vehicle stability during cornering and braking. It enhances steering control and minimizes rollover risks, making it essential in all EV categories. Rear stabilizers witness growing demand, particularly in premium EVs and SUVs where load balancing and passenger comfort remain priorities. Automakers invest in dual-stabilizer systems to optimize performance across diverse driving conditions. It reflects a trend toward comprehensive stability solutions rather than single-component integration.

- For instance, Thyssenkrupp’s VarioShape® tubular stabilizer bar achieves a weight reduction of up to 50 % compared to conventional solid stabilizers while maintaining mechanical strength. It enhances passenger safety while ensuring better stability at higher speeds.

By Technology

The technology segment shows rapid evolution, moving from mechanical to electronic solutions. Hydraulic stabilizer systems remain widely used for cost-effective applications but face limitations in energy efficiency. It paves the way for electromechanical stabilizer systems that deliver precision control with reduced energy loss. Electronically controlled stabilizer bars gain traction due to their compatibility with ADAS and autonomous systems, ensuring real-time adaptability. Traditional mechanical systems maintain relevance in low-cost EVs but are gradually replaced by advanced alternatives. It signals a clear shift toward intelligent and energy-efficient stabilization technologies aligned with modern EV requirements.

Segments:

Based on Vehicle:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Based on Stabilizer:

- Front Stabilizer

- Rear Stabilizer

Based on Technology:

- Hydraulic Stabilizer System

- Electromechanical Stabilizer System

- Electronically Controlled Stabilizer Bar

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds about 22% of the market, supported mainly by the U.S. and Canada. The region benefits from strong automotive infrastructure, growing consumer awareness of EVs, and steady government support for clean transportation. It sees high demand for stabilizers in electric SUVs, pickup trucks, and performance cars, where safety and control are essential. Automakers invest in electromechanical stabilizers and adaptive technologies to improve comfort and meet consumer expectations. The region is also a hub for innovation, with companies working on modular stabilizers that can fit multiple EV platforms. Demand continues to rise as more states promote zero-emission policies and expand charging infrastructure. North America remains a steady market where both innovation and regulation shape future opportunities.

Europe

Europe accounts for about 25% of the global stabilizer market, driven by strict emission rules and strong adoption of electric cars. Countries like Germany, France, and the UK lead growth with established automotive industries and strong government incentives for clean mobility. It benefits from innovation in electronically controlled stabilizers that meet the demand for luxury electric models and performance vehicles. European carmakers focus heavily on integrating stabilizers with driver-assistance systems, ensuring safer and smoother rides. The region also invests in advanced materials and modular designs, making stabilizers lighter while keeping them durable. Consumer demand for premium features and safety standards keeps the market steady and reliable. Europe remains a key hub for technological advancements and sets benchmarks for global safety and efficiency standards.

Asia-Pacific

Asia-Pacific holds the largest share of the New Energy Vehicle Stabilizer Market, at nearly 45%. China dominates this region with its massive electric vehicle production and government-backed policies that encourage cleaner transportation. It benefits from strong investments in technology, where stabilizers are being designed to handle the heavy weight and higher torque of battery-powered cars. Japan and South Korea contribute with advanced research, especially in lightweight materials and electronic stabilizers that improve energy efficiency. India is emerging as a strong player, driven by its urban electrification programs and growing EV sales supported by infrastructure expansion. Automakers in the region focus on offering both affordable and premium stabilizers to meet the diverse needs of consumers. Asia-Pacific continues to grow quickly because of rising local demand, strong exports, and ongoing innovation in the electric vehicle sector.

Latin America

Latin America accounts for nearly 4% of the global stabilizer market, showing slower but steady growth. Brazil leads the region with early adoption of EVs and a growing interest in cleaner mobility. Mexico, Chile, and Argentina also add to the market through gradual electrification and urban sustainability projects. It remains a developing market where demand focuses on affordable and durable stabilizers suitable for diverse road and weather conditions. Consumers prioritize cost-effective solutions, while automakers explore modular systems to meet regional requirements. The market is still small compared to Asia, Europe, or North America, but opportunities are rising as governments expand EV programs. Over the next decade, Latin America is expected to move from niche adoption to broader mainstream demand.

Middle East & Africa

Middle East & Africa together hold about 4% of the market, with growth led by Gulf countries and South Africa. The Middle East benefits from government initiatives to diversify economies and adopt clean energy, creating space for EV development. It supports stabilizer demand for vehicles that must operate in hot climates and across long highway networks. Africa shows gradual progress, with South Africa leading adoption due to its stronger automotive base. It is still an early-stage market where affordability and durability matter more than advanced features. Manufacturers focus on simple but effective stabilizer systems to match local driving conditions and budgets. Over time, as infrastructure expands and EV awareness grows, the region will show stronger adoption of advanced stabilizers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SwayTec

- Mubea

- Dongfeng

- ZF

- Hendrickson

- NHK International

- Kongsberg Automotive

- Thyssenkrupp

- Daewon

- Sogefi Group

Competitive Analysis

The New Energy Vehicle Stabilizer Market players include Daewon, Dongfeng, Sogefi Group, Kongsberg Automotive, Mubea, NHK International, Hendrickson, SwayTec, Thyssenkrupp, and ZF. The New Energy Vehicle Stabilizer Market is marked by strong competition, driven by continuous innovation and rising demand for advanced mobility solutions. Companies prioritize the development of lightweight, durable, and electronically controlled stabilizers that meet the performance requirements of modern electric vehicles. The focus remains on improving vehicle safety, reducing body roll, and enhancing overall driving comfort, especially in SUVs and premium models. Manufacturers invest heavily in research and development to introduce smart systems compatible with driver assistance technologies. Cost efficiency and scalability also play an important role, as stabilizers must adapt across multiple EV platforms. Expanding production capacity and securing long-term partnerships with automakers are key strategies shaping the competitive landscape. The market continues to evolve as firms balance affordability with advanced engineering, ensuring stabilizers meet the growing global demand for efficient and safe electric vehicles.

Recent Developments

- In April of 2025, GM has issued a new safety recall for certain units of the 2023-2025 Cadillac Lyriq that have loose front stabilizer bar bracket bolts that were inaccurately torqued in assembly. The error was due to an issue in the production software logic utilized for bolt fastening.

- In January 2025 at CES in Las Vegas, American Axle & Manufacturing (AAM) introduced their SmartBar which is a disconnecting stabilizer bar designed for use on off-road vehicles. The SmartBar system uses an electronically controlled module to disengage the stabilizer bar, enabling maximum wheel articulation over tough terrain to improve traction and ride comfort.

- In September of 2024, Stumpp Schuele & Somappa Springs (SSS), which is part of the MG Brothers Group announced a joint venture with Chuhatsu of Japan to form SSS Chuhatsu Precision Springs Pvt. Ltd. The joint venture is the first domestic manufacturer of powerbackdoor springs in India.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Stabilizer, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global adoption of electric and hybrid vehicles.

- Stabilizers will increasingly use lightweight materials to improve efficiency and driving range.

- Electronically controlled stabilizer systems will gain wider adoption in premium and mid-range EVs.

- Demand for modular stabilizers will grow to support multiple EV platforms and reduce costs.

- Integration with advanced driver assistance systems will strengthen stabilizer relevance in safety design.

- High-performance electric SUVs and sports models will drive innovation in advanced stabilizer technologies.

- Emerging markets will show stronger demand as EV infrastructure and adoption rates increase.

- Partnerships between automakers and stabilizer suppliers will accelerate product development and standardization.

- Research will focus on improving durability and adapting stabilizers to unique EV stress loads.

- The market will remain competitive, shaped by continuous innovation and regional expansion strategies.