Market Overview:

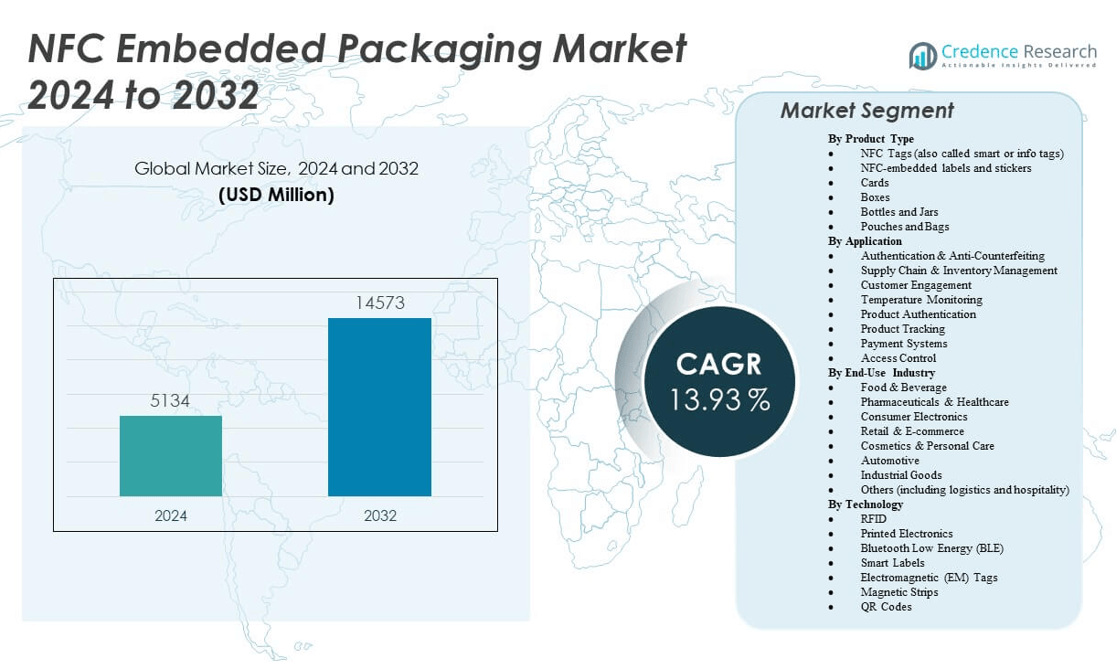

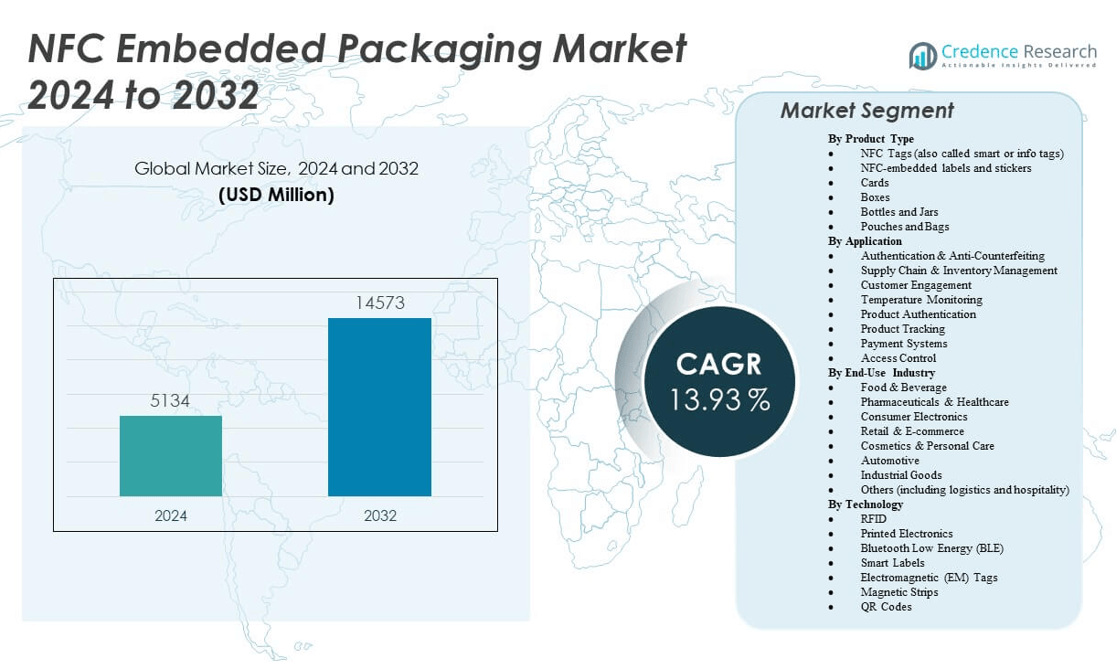

The NFC Embedded Packaging Market is projected to grow from USD 5,134 million in 2024 to an estimated USD 14,573 million by 2032, with a compound annual growth rate (CAGR) of 13.93% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| NFC Embedded Packaging Market Size 2024 |

USD 5,134 million |

| NFC Embedded Packaging Market, CAGR |

13.93% |

| NFC Embedded Packaging Market Size 2032 |

USD 14,573 million |

The market is gaining momentum due to the growing demand for smart packaging solutions across various industries, particularly in food and beverages, pharmaceuticals, and consumer electronics. Companies are integrating Near Field Communication (NFC) technology to enhance product traceability, security, and customer engagement. This advancement enables real-time data sharing, authentication, and anti-counterfeiting measures, driving adoption. Consumer preference for interactive packaging and brand transparency further propels market growth, encouraging innovation in printed electronics and sustainable packaging formats.

Regionally, North America leads the NFC embedded packaging market due to early adoption of digital technologies, strong retail infrastructure, and high consumer awareness. Europe follows, supported by stringent regulations around product authentication and safety. Meanwhile, Asia-Pacific is emerging as a high-growth region, driven by expanding e-commerce, increasing smartphone penetration, and rapid industrialization in countries like China, Japan, and South Korea. The presence of major packaging and electronics manufacturing hubs in these regions contributes to technological integration and market expansion.

Market Insights:

- The NFC Embedded Packaging Market was valued at USD 5,134 million in 2024 and is projected to reach USD 14,573 million by 2032, growing at a CAGR of 13.93%.

- Rising demand for smart, secure packaging in pharmaceuticals, food, and cosmetics is accelerating NFC integration for authentication and traceability.

- Increasing consumer engagement with interactive packaging is encouraging brands to deploy NFC-enabled labels and tags for real-time product information.

- High implementation costs and technological complexities in embedding NFC into various packaging formats limit adoption among small and medium enterprises.

- North America holds the largest market share due to advanced retail infrastructure, strong digital adoption, and investment in anti-counterfeit solutions.

- Europe follows closely, driven by regulatory compliance, sustainability goals, and growing deployment of NFC in high-value consumer goods.

- Asia-Pacific is the fastest-growing region, supported by digital transformation, e-commerce expansion, and manufacturing capabilities in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Need for Enhanced Supply Chain Transparency and Product Authentication

The NFC Embedded Packaging Market is being propelled by the growing need for advanced supply chain transparency and robust product authentication methods. It enables manufacturers and retailers to track and verify the authenticity of products at every stage of the distribution network. This capability significantly reduces the risks associated with counterfeit goods, especially in high-value sectors like pharmaceuticals and luxury items. The integration of NFC tags supports item-level data logging, enhancing traceability and regulatory compliance. It also boosts operational efficiency by automating inventory tracking and reducing human error. End-users benefit from improved safety, while brands gain protection from reputational damage. The market is gaining support from stricter global anti-counterfeiting regulations. Companies are actively investing in NFC packaging to align with compliance and secure brand integrity.

Growing Consumer Demand for Smart and Interactive Packaging Solutions

Increasing consumer expectations for transparency and real-time engagement is a primary growth driver for the NFC Embedded Packaging Market. Brands are embedding NFC tags into packaging to offer digital experiences, such as product tutorials, loyalty programs, and promotions. Consumers can scan NFC-enabled packages using smartphones to access detailed product information and origin. It enhances customer trust and supports informed purchasing decisions. Retailers also use NFC technology to personalize marketing and upsell related products. The enhanced convenience and interactivity improve overall customer experience. Adoption is growing across food, beverage, and personal care industries. Businesses see NFC packaging as a differentiator in competitive retail environments.

- For instance, Meiyume, a cosmetic manufacturer, launched NFC- and QR-enabled smart packaging for beauty products in 2024. Each product contains NTAG210u NFC tags that trigger digital experiences and allow customers to verify product authenticity, receive tutorials, and join loyalty programs by scanning the package.

Adoption of NFC Technology in Healthcare and Pharmaceutical Packaging

]The healthcare sector is integrating NFC technology into packaging to enhance medication safety, improve adherence, and ensure authenticity. NFC-embedded packaging allows patients to access dosage instructions, alerts, and expiry dates via mobile apps. It reduces medication errors and supports remote monitoring. Pharmaceutical companies use NFC to authenticate drug packages and meet stringent serialization mandates. The technology also helps in combating illegal drug distribution. It aligns with digital health initiatives and improves patient engagement. NFC packaging enables efficient recalls and provides real-time data for pharmacovigilance. The NFC Embedded Packaging Market benefits from the industry’s push toward smart, patient-centric solutions.

Advancements in Printed Electronics and Tag Miniaturization

Technological progress in printed electronics and miniaturized NFC tags is expanding the scope of applications across industries. Manufacturers can now embed cost-effective, ultra-thin NFC tags into flexible packaging materials without compromising design or durability. This innovation supports high-speed production and integration into small or curved surfaces. It enables adoption in sectors like cosmetics, fashion, and perishable goods. NFC tags with improved memory and faster communication enhance user experience and data accuracy. It also reduces manufacturing complexity and cost. The NFC Embedded Packaging Market continues to attract investment from tech developers and packaging innovators. Collaborative ecosystems are emerging to accelerate deployment across supply chains.

- For example, DYCONEX (an MST company) has commercialized 6 mm diameter NFC modules using Liquid Crystal Polymer (LCP) substrates and encapsulation. These tags are chemically robust (resisting acids, saltwater, humidity) and remain fully readable using standard NFC readers even when integrated into curved, flexible, or very limited packaging spaces.

Market Trends:

Integration of NFC with Blockchain for End-to-End Traceability

A prominent trend in the NFC Embedded Packaging Market is the convergence of NFC technology with blockchain to create secure, transparent product journeys. By combining these technologies, companies can build immutable records of a product’s lifecycle. Consumers can access this verified data through a simple smartphone tap, boosting confidence in product authenticity. It is gaining traction in food, luxury, and healthcare sectors, where traceability is critical. Brands use it to highlight ethical sourcing and sustainability credentials. This integration helps in combating fraud and strengthens supply chain accountability. It also supports data-driven audits and compliance checks. Technology providers are building platforms that bridge NFC hardware with blockchain systems.

- For instance, STMicroelectronics has developed turnkey solutions using the ST25TV Type 5 NFC Tag ICs, directly pairing low-cost, passive NFC tags with blockchain platforms to enable end-to-end, tamper-evident traceability in global logistics.

Expansion of NFC Packaging in E-commerce and Omnichannel Retailing

The growth of e-commerce and omnichannel strategies is encouraging brands to deploy NFC packaging for consumer engagement and logistics efficiency. In e-commerce, NFC tags offer a means to verify unopened packages and authenticate products before delivery acceptance. They also enhance post-sale engagement through reordering options and personalized offers. Retailers use NFC data to monitor product movement and inventory in real time. It helps in managing returns and addressing customer complaints more effectively. NFC packaging becomes a key tool for seamless digital and physical channel integration. It empowers brands to deliver consistent experiences across platforms. Startups and retailers are investing in NFC-enabled packaging to gain operational agility.

- For example, Identiv Inc.’s 2023 partnership with OTACA Tequila deployed NTAG210u NFC tags on all product lids, allowing real-time digital authentication and consumer access to product provenance before acceptance at delivery.

Growing Emphasis on Sustainable Packaging Enabled by Smart Features

Sustainability goals are influencing the design of NFC-embedded packages, where smart features improve lifecycle management and consumer awareness. Brands are embedding NFC tags to educate customers about recyclability, reuse instructions, and environmental impact. It promotes responsible consumption and waste reduction. Smart recycling bins and retail return schemes are also using NFC-based identification. It helps cities and companies collect and analyze recycling behaviors. The integration of green materials with NFC functions supports both circular economy models and digital engagement. The NFC Embedded Packaging Market reflects this dual push for smart and sustainable packaging innovation. Material suppliers are developing recyclable substrates compatible with printed NFC circuits.

Surge in Demand from Food Safety and Freshness Monitoring Applications

Food manufacturers and distributors are deploying NFC technology to enhance food safety and freshness verification. NFC tags can store and transmit data about temperature excursions, humidity exposure, and shelf life. Consumers can verify if a product has remained within recommended conditions during transport and storage. It increases consumer trust and reduces food waste. Restaurants and grocery chains benefit from better inventory management and fewer spoilage-related losses. NFC tags are increasingly integrated into QR code ecosystems to provide layered data. This trend is particularly relevant for meat, dairy, seafood, and frozen products. The NFC Embedded Packaging Market is expanding into cold chain logistics with real-time data solutions.

Market Challenges Analysis:

High Implementation Costs and Technological Integration Complexity

Despite its benefits, the NFC Embedded Packaging Market faces challenges due to high initial implementation costs and complex technological integration. Embedding NFC tags into packaging involves investment in hardware, software, and redesigning packaging processes. Smaller manufacturers often struggle with the cost burden and resource allocation. Packaging lines may require upgrades to handle embedded electronics efficiently. Compatibility with mobile devices across different platforms must also be ensured. It creates challenges in delivering a uniform customer experience. Tag durability under harsh environmental conditions poses another issue. Limited standardization across industries further hampers scalability and cross-sector adoption.

Data Privacy, Consumer Acceptance, and Regulatory Hurdles

Concerns over consumer data privacy and security present a significant barrier to adoption in the NFC Embedded Packaging Market. Consumers may hesitate to engage with smart packaging due to tracking apprehensions. Companies must ensure transparent communication about data use and protection. Regulatory compliance varies by region, with some markets enforcing stricter data laws. It complicates global deployment strategies. There is also a learning curve in consumer interaction with NFC features. Brands need to invest in educating end-users. Misuse or malfunction of NFC tags may lead to reputational risks and customer dissatisfaction. Ensuring reliability and building trust is critical for long-term success.

Market Opportunities:

Emergence of NFC in Personal Care and Luxury Packaging Applications

Expanding applications in the personal care and luxury goods sectors offer significant opportunities for the NFC Embedded Packaging Market. Brands in these industries use NFC technology to fight counterfeiting and reinforce exclusivity through interactive experiences. Customers can access authenticity certificates, limited-edition details, or exclusive content via a simple tap. It enhances brand storytelling and customer loyalty. These sectors value both aesthetics and innovation, making NFC a fitting enhancement. Companies can also track consumer behavior through engagement analytics. NFC-enabled packaging allows personalized services such as product recommendations or refill alerts. It helps luxury and cosmetic brands differentiate in competitive markets.

Rising Demand for NFC Integration in Smart Retail and IoT Ecosystems

The proliferation of IoT and smart retail ecosystems creates new opportunities for the NFC Embedded Packaging Market. Retailers are integrating NFC packaging with POS systems, loyalty platforms, and real-time analytics engines. It allows seamless inventory tracking, automatic reordering, and personalized promotions. Smart shelves and vending machines with NFC capabilities create connected environments that enhance convenience. NFC tags can act as digital twins for packaged products in IoT networks. This capability supports automation and reduces operational friction. Retailers and brands that invest in NFC packaging gain data-driven insights and a competitive edge. It strengthens their ability to adapt to dynamic consumer expectations.

Market Segmentation Analysis:

By Product Type

The product type segment is led by NFC tags and embedded labels, which offer versatile integration across packaging formats. Cards are common in retail loyalty and access control, while boxes, bottles, and pouches are popular in cosmetics, beverages, and pharmaceuticals for interactive consumer engagement. Each product type serves different functionality and durability requirements, enabling brands to choose based on industry-specific needs.

- For example, Avery Dennison Smartrac supplies FlexSense® NFC inlays used by wine brand Alpine Wines to embed in bottle labels. These tags allow consumers to check authenticity and receive tasting notes by tapping the label. Avery Dennison reports over 100 million units shipped globally for food, wine, and pharma packaging as of 2024.

By Application

Authentication and anti-counterfeiting dominate the application segment due to rising concerns over product integrity in pharmaceuticals, cosmetics, and luxury goods. Customer engagement is expanding as brands seek to connect directly with users through digital content. Supply chain and inventory management applications are helping businesses achieve transparency and operational efficiency. NFC also supports temperature monitoring, product tracking, access control, and contactless payment systems in smart retail and logistics.

- For instance, L’Oréal Paris partnered with Stora Enso to launch NFC-enabled cosmetic packaging. Consumers can tap to access bespoke tutorials and AR experiences. The campaign led to a 22% increase in repeat purchases, as documented by L’Oréal’s digital marketing analytics.

By End-Use Industry

Among end-use industries, food & beverage and pharmaceuticals show the highest adoption due to stringent safety and traceability demands. Consumer electronics and automotive sectors use NFC packaging to protect high-value goods and enhance digital engagement. Retail and e-commerce leverage the technology for smart inventory and secure delivery. Cosmetics and personal care brands use NFC to drive loyalty and offer premium user experiences, while industrial goods and logistics explore the benefits of real-time tracking.

By Technology

RFID and printed electronics are the most established technologies in the market, enabling fast, low-cost deployment of NFC functionalities. Bluetooth Low Energy (BLE) is emerging for applications requiring broader connectivity and active data transmission. Smart labels integrate with QR codes and magnetic strips for enhanced user interactivity. Electromagnetic (EM) tags are suited for secure access systems, supporting high-security environments in logistics, retail, and healthcare.

Segmentation:

By Product Type

- NFC Tags (also called smart or info tags)

- NFC-embedded labels and stickers

- Cards

- Boxes

- Bottles and Jars

- Pouches and Bags

By Application

- Authentication & Anti-Counterfeiting

- Supply Chain & Inventory Management

- Customer Engagement

- Temperature Monitoring

- Product Authentication

- Product Tracking

- Payment Systems

- Access Control

By End-Use Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Consumer Electronics

- Retail & E-commerce

- Cosmetics & Personal Care

- Automotive

- Industrial Goods

- Others (including logistics and hospitality)

By Technology

- RFID

- Printed Electronics

- Bluetooth Low Energy (BLE)

- Smart Labels

- Electromagnetic (EM) Tags

- Magnetic Strips

- QR Codes

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading share in the NFC Embedded Packaging Market, accounting for 34.2% of the global revenue. The region benefits from early adoption of smart packaging technologies, strong digital infrastructure, and high consumer engagement with interactive product formats. The United States drives market growth due to its advanced retail sector and increased investments in anti-counterfeit packaging, particularly in pharmaceuticals and consumer electronics. Key players in packaging and tech industries collaborate to develop scalable NFC solutions. Retailers and brands in North America actively use NFC for personalized marketing and secure supply chains. Regulatory frameworks supporting data privacy and product traceability further stimulate market adoption.

Europe ranks second in the global NFC Embedded Packaging Market, contributing 29.6% of the total market share. The region emphasizes sustainable packaging and traceability in compliance with strict regulatory mandates. Countries such as Germany, France, and the UK are witnessing widespread deployment of NFC tags in food, cosmetics, and luxury goods. Brands leverage NFC to promote circular economy practices and improve consumer awareness on recyclability. Integration of NFC with blockchain in European supply chains is gaining traction. Strong public support for digital transformation enhances the market outlook in this region.

Asia-Pacific is an emerging powerhouse in the NFC Embedded Packaging Market, holding 24.8% of the global share and demonstrating the fastest growth. Rapid urbanization, increasing smartphone penetration, and the expansion of organized retail drive demand for smart packaging in countries like China, Japan, and South Korea. Packaging and semiconductor manufacturing hubs across Asia-Pacific facilitate cost-effective production and technological innovation. E-commerce platforms deploy NFC for secure deliveries and improved consumer trust. Government initiatives supporting digital supply chains and anti-counterfeiting laws further promote adoption. The region is poised to become a central hub for NFC-enabled packaging development and deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Avery Dennison

- CCL Industries

- Impinj

- Identiv Inc.

- Checkpoint Systems

- Smartrac N.V.

- Zebra Technologies Corporation

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Alien Technology, LLC

- HID Global Corporation

- SATO Holdings Corporation

- Brady Corporation

- Ams AG

- Schreiner Group GmbH & Co. KG

Competitive Analysis:

The NFC Embedded Packaging Market features a mix of established technology firms and specialized packaging companies competing on innovation, integration capability, and scalability. Key players such as NXP Semiconductors, STMicroelectronics, Texas Instruments, and Impinj drive advancements in NFC chipsets, while Avery Dennison, Smartrac, and CCL Industries focus on embedding tags into flexible packaging formats. Companies like Identiv and Schreiner Group offer secure, tamper-evident solutions targeting high-risk sectors. Partnerships between semiconductor manufacturers and packaging firms are shaping competitive dynamics. Players invest in miniaturization, energy efficiency, and data security to enhance product performance. The market encourages vertical integration to streamline supply chains and reduce deployment costs. Continuous R&D and patent activity reflect a strong focus on differentiation and application expansion. The NFC Embedded Packaging Market is defined by its fast-paced innovation cycle and strategic collaborations aimed at creating end-to-end smart packaging solutions.

Recent Developments:

- In June 2025, Avery Dennison unveiled an industry-first RFID label recognized by the Association of Plastic Recyclers (APR) for its compatibility with PET recycling streams, supporting a circular economy approach in packaging. This launch highlights Avery Dennison’s commitment to sustainability through its NFC and RFID technology for embedded packaging.

- In March 2025, Identiv Inc. launched its ID-Brain dual-frequency inlays, which combine NFC and RAIN UHF RFID in a single solution. These inlays, leveraging EM Microelectronic’s em|echo-V chip, target logistics, pharma, healthcare, and retail packaging by streamlining traceability, authenticity, and consumer engagement for embedded packaging.

- In January 2025, Zebra Technologies introduced several new AI-enabled products, including an AI-powered data capture software suite. This advancement empowers enhanced workflow context capture via Zebra’s mobile devices, directly supporting the deployment of NFC and RFID in modern, intelligent packaging ecosystems for retail.

- In Aug 2023, CCL Industries announced the acquisition of the intellectual property portfolio of Imprint Energy Inc., expanding CCL’s capabilities in advanced battery and smart label solutions. This move strengthens CCL’s positioning in next-generation NFC-enabled packaging for IoT and security applications.

Market Concentration & Characteristics:

The NFC Embedded Packaging Market demonstrates moderate to high concentration, with a few global players dominating the technology supply side and several mid-sized firms leading in packaging integration. It combines electronics, materials science, and IoT to deliver smart packaging capabilities across retail, healthcare, and logistics. The market is characterized by rapid innovation, complex supply chains, and growing demand for customization. Product development cycles are short, and companies prioritize adaptability to evolving consumer and regulatory demands. It favors firms with cross-domain expertise in semiconductors, printed electronics, and digital platforms. The market maintains a dynamic competitive environment, driven by technological convergence and global smart packaging trends.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry and Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Integration of NFC with AI and IoT platforms will enhance real-time data processing and smart decision-making in packaging.

- Consumer demand for transparency and product authenticity will continue to drive NFC adoption across food, cosmetics, and pharma.

- Expansion of e-commerce logistics will increase the use of NFC-enabled packaging for secure, trackable deliveries.

- Advancements in biodegradable and recyclable NFC tag materials will align smart packaging with sustainability goals.

- Growth in mobile device usage will improve accessibility and consumer interaction with NFC features.

- Retailers will leverage NFC data for hyper-personalized marketing and inventory automation.

- Cross-industry collaborations between semiconductor, packaging, and retail tech firms will accelerate innovation.

- Emerging markets in Asia-Pacific and Latin America will witness rapid adoption due to digital infrastructure development.

- Governments and regulatory bodies will adopt smart packaging mandates in sectors like pharmaceuticals and food safety.

- NFC functionality will evolve to support multipurpose applications such as loyalty programs, digital receipts, and reordering triggers.