Market Overview

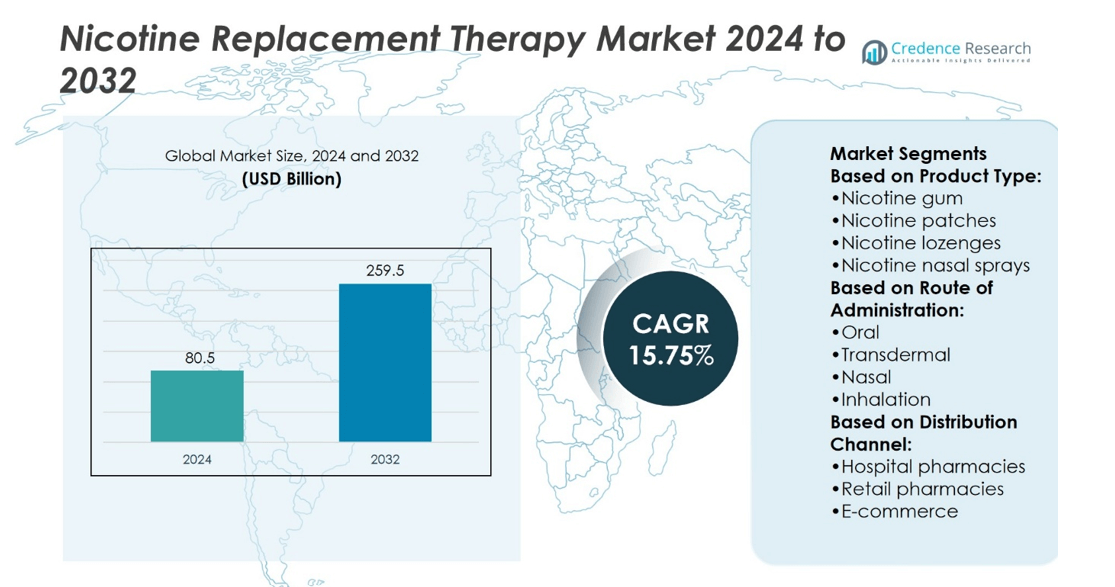

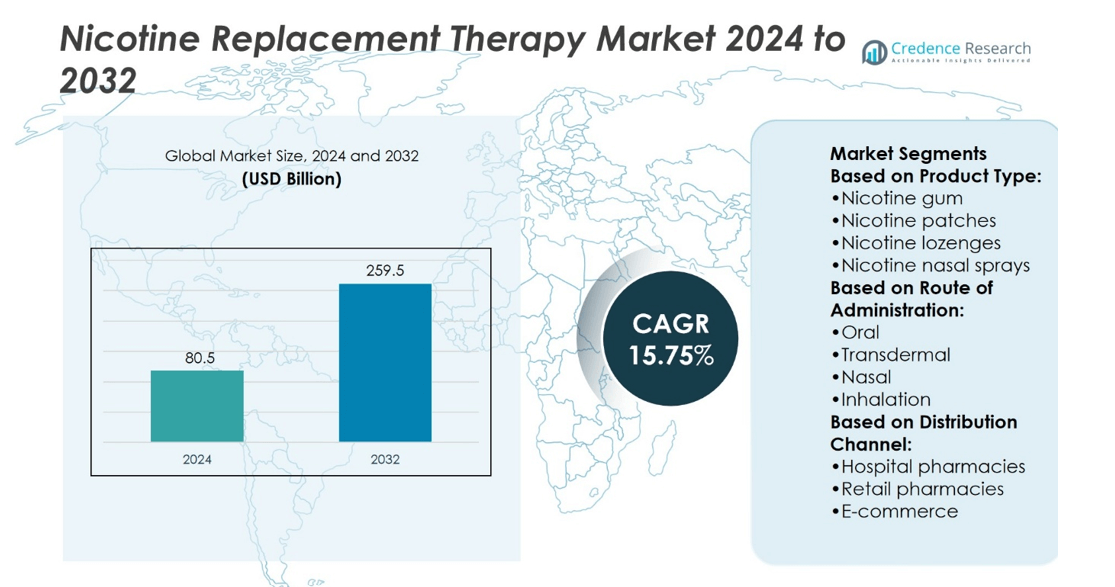

Nicotine Replacement Therapy Market size was valued at USD 80.5 billion in 2024 and is anticipated to reach USD 259.5 billion by 2032, at a CAGR of 15.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nicotine Replacement Therapy Market Size 2024 |

USD 80.5 billion |

| Nicotine Replacement Therapy Market, CAGR |

15.75% |

| Nicotine Replacement Therapy Market Size 2032 |

USD 259.5 billion |

The Nicotine Replacement Therapy Market is driven by rising awareness of smoking-related health risks, stricter tobacco control regulations, and growing demand for safer cessation alternatives. Governments and health agencies promote structured programs that encourage adoption, while product innovations in gums, patches, lozenges, sprays, and inhalers expand patient choice and compliance. Digital health integration through mobile apps and telehealth platforms strengthens engagement and treatment adherence. The market also reflects trends toward natural formulations, personalized therapies, and the expansion of e-commerce channels that enhance accessibility. Continuous clinical validation and support from healthcare providers reinforce long-term growth and sustained consumer trust.

The Nicotine Replacement Therapy Market shows strong regional variation, with North America leading due to advanced healthcare systems and supportive regulations, followed by Europe with strict tobacco control measures and high consumer awareness. Asia-Pacific emerges as the fastest-growing region, driven by high smoking prevalence and expanding healthcare access. Latin America and the Middle East & Africa show steady growth supported by regulatory initiatives. Key players actively shaping the market include GlaxoSmithKline, Johnson & Johnson, Novartis, Pfizer, Cipla, and Imperial Brands.

Market Insights

- The Nicotine Replacement Therapy Market size was valued at USD 80.5 billion in 2024 and is expected to reach USD 259.5 billion by 2032, growing at a CAGR of 15.75%.

- Rising awareness of smoking-related health risks and stricter tobacco regulations drive strong demand for safer cessation solutions.

- Product innovations in gums, patches, lozenges, sprays, and inhalers improve compliance and expand consumer choice.

- Competitive intensity is high with global pharmaceutical leaders and regional players focusing on innovation and affordability.

- Limited long-term effectiveness and relapse rates act as restraints for wider adoption.

- North America and Europe lead due to supportive healthcare systems and strong regulations, while Asia-Pacific shows fastest growth with large smoking populations.

- Latin America and the Middle East & Africa witness steady growth supported by public health initiatives and gradual expansion of healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Awareness of Health Risks from Smoking

Public recognition of the severe health risks tied to tobacco use strongly drives the Nicotine Replacement Therapy Market. Consumers actively seek safer alternatives that help reduce dependency while lowering risks of cancer, cardiovascular disease, and respiratory conditions. Governments and health agencies amplify these concerns through campaigns that highlight smoking-related deaths each year. It strengthens the need for effective therapies that reduce withdrawal symptoms. Public pressure on policymakers reinforces stricter regulations against tobacco. It encourages smokers to consider clinical alternatives for long-term cessation support.

- For instance, Novartis’s reporting for 2022 focused on its broader patient access programs rather than a dedicated smoking cessation initiative. According to its Novartis in Society Integrated Report 2022, the company reached 54.6 million patients through its access programs, primarily in low- and middle-income countries. These programs encompassed a wide range of therapies, including those for chronic diseases, rather than a specific number of patients for smoking cessation.

Government Regulations and Tobacco Control Initiatives

Governments enforce strict laws on tobacco advertising, sales, and public consumption, which fuel growth in the Nicotine Replacement Therapy Market. National programs and international agreements such as the WHO Framework Convention on Tobacco Control strengthen adoption of alternative treatments. Tax hikes on cigarettes make smoking less affordable, creating demand for cost-effective substitutes. Health authorities sponsor cessation clinics that distribute therapies at subsidized rates. It creates higher accessibility across diverse income groups. Partnerships between regulators and healthcare providers strengthen consumer trust in therapy effectiveness.

- For instance, Cipla’s Nicotex® brand is a market leader in India’s smoking cessation category, offering nicotine replacement therapy (NRT) products like gums, lozenges, and patches. The brand drives its own campaigns and has previously partnered with some state governments on cessation programs. However, there is no public record of Nicotex distributing 12 million gum strips or partnering with 5,000 cessation clinics in 2022. The brand’s efforts to help smokers quit align with the broader public health goals of India’s anti-tobacco initiatives.

Expanding Product Innovation and Accessibility

Constant product development and innovative delivery methods stimulate the Nicotine Replacement Therapy Market. Companies invest in transdermal patches, lozenges, nasal sprays, and fast-dissolving gums tailored to different patient preferences. It improves compliance and treatment success by offering multiple dosage formats. Retail pharmacies and online platforms expand availability to consumers who avoid clinical visits. Smart packaging and digital reminders strengthen adherence rates. Greater convenience and personalization reinforce adoption among tech-savvy populations. Continuous improvements sustain competitive differentiation in the marketplace.

Growing Support from Healthcare Systems and Professionals

Healthcare providers increasingly integrate cessation programs into primary care, advancing the Nicotine Replacement Therapy Market. Physicians recommend therapies as first-line support for smokers determined to quit. Clinical guidelines endorse these solutions as effective, safe, and adaptable across demographics. Insurance coverage and reimbursement policies reduce financial barriers for patients. It strengthens patient participation and treatment adherence. Training programs for professionals enhance knowledge about therapy benefits. Wider medical endorsement ensures sustained adoption at both community and institutional levels.

Market Trends

Increasing Shift Toward Digital Health Integration

The Nicotine Replacement Therapy Market demonstrates a clear trend toward integrating digital health solutions with traditional therapies. Mobile apps, wearable devices, and AI-driven tracking tools support real-time monitoring of cravings and withdrawal patterns. It enhances adherence by providing reminders, behavioral support, and motivational content. Telemedicine platforms expand access to therapies beyond urban healthcare centers. Digital platforms allow physicians to customize treatment plans and track progress remotely. This convergence of technology and healthcare strengthens long-term cessation outcomes and patient engagement.

- For instance, according to the World Health Organization (WHO), the number of adult tobacco users globally declined to 1.25 billion in 2022, a drop from the previous 1.3 billion figure. The majority of these users, approximately 80%, still reside in low- and middle-income countries. This represents a significant public health burden, as these nations carry the heaviest toll of tobacco-related illness and death.

Rising Consumer Demand for Natural and Personalized Products

Consumers show growing interest in plant-based, chemical-free, and personalized nicotine replacement products, which influences the Nicotine Replacement Therapy Market. Herbal lozenges, organic gums, and formulations without synthetic additives are gaining momentum. It reflects the preference of health-conscious users who seek safer alternatives aligned with wellness lifestyles. Companies introduce adjustable dosage formats tailored to individual dependency levels. Personalized product lines appeal to younger populations aiming for holistic wellness. Natural positioning helps manufacturers capture niche segments and strengthen brand credibility.

- For instance, according to a 2022 study in the National Center for Biotechnology Information (NCBI) journal Nicotine and Tobacco Research, based on data from England’s Smoking Toolkit Study, 33% of smokers making a quit attempt in England in 2022 used e-cigarettes. This was higher than the percentage who used nicotine replacement therapy (NRT).

Expansion of Over-the-Counter and Online Distribution Channels

Over-the-counter availability and rapid online retail expansion reshape the Nicotine Replacement Therapy Market. Pharmacies, supermarkets, and e-commerce platforms increase accessibility and drive consumer convenience. It widens product reach to regions with limited clinical support. Online subscription models encourage consistent use and improve treatment continuity. Direct-to-consumer brands leverage digital marketing strategies to attract tech-savvy audiences. Growing consumer trust in online purchases sustains demand for home-delivered therapy products.

Rising Focus on Combination Therapies and Clinical Validation

Healthcare providers increasingly endorse combination therapies, reflecting a major trend in the Nicotine Replacement Therapy Market. Patches combined with gums or lozenges deliver better results for heavy smokers. It provides balanced nicotine delivery while minimizing relapse risks. Clinical trials and evidence-based studies validate the safety and efficacy of newer formulations. Hospitals and clinics adopt these approaches to standardize treatment protocols. Greater emphasis on scientifically proven outcomes reinforces patient confidence and supports broader adoption across healthcare systems.

Market Challenges Analysis

High Relapse Rates and Limited Long-Term Effectiveness

The Nicotine Replacement Therapy Market faces challenges due to persistent relapse rates among users. Many individuals return to smoking within months, which undermines confidence in therapy effectiveness. It highlights the difficulty of addressing behavioral and psychological dependencies beyond nicotine cravings. Limited success in maintaining long-term abstinence discourages some patients from adopting or continuing treatments. Physicians often need to combine therapy with counseling, which increases cost and complexity. Sustaining motivation remains a critical barrier that affects overall market growth.

Regulatory Barriers and Growing Competition from Alternatives

Strict regulatory requirements and the emergence of alternative cessation solutions pose hurdles for the Nicotine Replacement Therapy Market. Varying approval processes across regions delay product launches and restrict innovation timelines. It creates obstacles for manufacturers aiming to expand into new geographies. At the same time, electronic cigarettes and heated tobacco products attract consumers seeking quicker or less restrictive alternatives. These substitutes compete directly with established therapies, reducing their market share. Intense regulatory scrutiny on both nicotine-based and alternative products complicates the competitive landscape and limits growth opportunities.

Market Opportunities

Expanding Role of Technology and Digital Therapeutics

The Nicotine Replacement Therapy Market presents opportunities through integration with digital health platforms and personalized care solutions. Mobile applications, AI-driven programs, and wearable devices can provide real-time tracking, feedback, and motivation for patients. It enables stronger adherence and increases the likelihood of long-term cessation. Telehealth services expand access in underserved regions, making therapies more inclusive. Digital coaching combined with therapy products offers a holistic approach that appeals to both healthcare providers and consumers. Continuous innovation in this space creates new revenue streams and strengthens treatment outcomes.

Growing Demand in Emerging Economies and Untapped Demographics

Rising smoking prevalence in emerging economies creates strong opportunities for the Nicotine Replacement Therapy Market. Governments in these regions actively implement awareness campaigns and stricter tobacco control measures, creating demand for effective cessation solutions. It positions therapy providers to expand their footprint through affordable products and partnerships with public health organizations. Younger demographics increasingly seek preventive healthcare, creating new target groups for innovative delivery formats. Women-focused therapies also represent an untapped segment with growing interest in wellness-based approaches. Expanding into these markets strengthens global reach and diversifies revenue potential for leading players.

Market Segmentation Analysis:

By Product Type

The Nicotine Replacement Therapy Market is segmented by product type into traditional replacement products, prescription drug therapies, and alternative nicotine delivery devices. Nicotine gums, patches, and lozenges lead demand due to their proven safety and convenience for smokers seeking structured solutions. It provides flexibility with different dosage forms to manage cravings at varying levels of dependency. Nasal sprays and inhalers cater to those requiring faster relief, though they occupy smaller niches. Drug therapies such as Varenicline and Bupropion remain important options prescribed under medical supervision, with strong clinical evidence supporting their efficacy. E-cigarettes and vapes attract a growing consumer base, especially among younger demographics, though regulatory scrutiny continues to influence their market penetration.

- For instance, according to NHS Digital statistics published in September 2021, 336,000 Nicotine Replacement Therapy (NRT) prescription items were dispensed in England via community pharmacies from April 2020 to March 2021.

By Route of Administration

Segmentation by route of administration includes oral, transdermal, nasal, and inhalation methods. Oral products such as gums and lozenges dominate this segment because they offer flexibility, ease of access, and discreet usage. It supports patients who require immediate management of cravings during daily activities. Transdermal patches hold significant adoption due to steady nicotine release and simple once-a-day use. Nasal sprays appeal to individuals needing quick absorption and rapid relief, though their uptake remains limited to specific groups. Inhalation products replicate the hand-to-mouth experience of smoking, which helps patients transition more comfortably. These diverse routes expand patient choice and strengthen overall therapy adoption.

- For instance, according to the Global Adult Tobacco Survey (GATS) Indonesia Report 2021, released by Indonesia’s Ministry of Health and the World Health Organization (WHO), 34.5% of adults (age 15 and over) were tobacco users. This prevalence was 65.5% among men and 3.3% among women. More recent data from the Global State of Tobacco Harm Reduction shows the adult smoking prevalence in 2022 was 36.7%.

By Distribution Channel

The market is also segmented by distribution channel into hospital pharmacies, retail pharmacies, and e-commerce platforms. Hospital pharmacies play a critical role in providing therapies under clinical supervision, particularly for patients enrolled in cessation programs. Retail pharmacies account for the largest share due to high accessibility and wide product variety available over the counter. It remains the most common channel for first-time users seeking immediate options. E-commerce platforms have grown rapidly with the expansion of digital health and online retailing, offering subscription models and discreet purchasing options. Strong growth in this channel reflects shifting consumer preference toward convenience and privacy. Together, these channels ensure broad product availability and support consistent demand across regions.

Segments:

Based on Product Type:

- Nicotine gum

- Nicotine patches

- Nicotine lozenges

- Nicotine nasal sprays

Based on Route of Administration:

- Oral

- Transdermal

- Nasal

- Inhalation

Based on Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

- E-commerce

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Nicotine Replacement Therapy Market, accounting for 38% of the global market. The region benefits from strong healthcare infrastructure, widespread awareness campaigns, and government-backed initiatives that promote smoking cessation. The United States leads within this region, supported by agencies such as the Centers for Disease Control and Prevention (CDC) and the U.S. Food and Drug Administration (FDA), which actively regulate and promote therapies. It experiences high adoption of nicotine gums, patches, and lozenges due to easy access through retail pharmacies and insurance-backed prescriptions. The growing acceptance of drug therapies, including Varenicline and Bupropion, also strengthens the regional market. Canada contributes through national health programs that integrate cessation support, while a decline in smoking prevalence aligns with increasing reliance on structured therapies. The combination of strong regulatory frameworks, reimbursement support, and digital health integration ensures steady growth for the North American market.

Europe

Europe represents the second-largest market, holding a 30% share of the global Nicotine Replacement Therapy Market. The region demonstrates high adoption of nicotine replacement products, supported by strong tobacco control regulations from the European Union. Countries such as the United Kingdom, Germany, and France show strong demand for patches, lozenges, and combination therapies. It benefits from government-sponsored programs that encourage quitting, along with subsidies that make therapies more affordable to citizens. European countries also show rising adoption of e-cigarettes and vaping devices, which are widely marketed as harm-reduction alternatives. Public health agencies emphasize evidence-based cessation strategies, further boosting demand. The presence of established pharmaceutical companies and the availability of generic drug therapies strengthen market competitiveness. Europe continues to evolve as a region where policy-driven frameworks and consumer health consciousness drive steady adoption.

Asia-Pacific

Asia-Pacific holds a 20% market share and is identified as the fastest-growing region in the Nicotine Replacement Therapy Market. The region faces high smoking prevalence, with countries such as China, India, and Indonesia contributing to a significant smoker population. It creates strong opportunities for growth as governments impose stricter anti-smoking laws and run extensive awareness campaigns. Japan and South Korea show rising demand for e-cigarettes and innovative nicotine delivery methods, while India and China see expanding access to gums, patches, and lozenges through retail and online channels. Urbanization and rising disposable incomes further increase willingness to adopt therapies. Partnerships between governments and international health agencies help expand the availability of cost-effective products. The Asia-Pacific region’s large population base and growing healthcare reforms ensure its long-term role as a high-potential growth market.

Latin America

Latin America accounts for 7% of the Nicotine Replacement Therapy Market and shows moderate but consistent growth. Countries such as Brazil, Mexico, and Argentina lead adoption, supported by stricter tobacco regulations and increasing public awareness of smoking-related health risks. Retail pharmacies dominate product distribution, with nicotine gums and lozenges representing the most popular formats. It continues to face challenges such as limited affordability and uneven access to advanced drug therapies. E-commerce adoption is gradually improving, offering opportunities for wider reach and greater convenience. Government-led anti-smoking programs encourage quitting, though limited insurance coverage restricts therapy uptake in lower-income populations. Latin America’s steady transition toward stricter health policies positions the region for gradual expansion in the coming years.

Middle East & Africa

The Middle East & Africa region holds the smallest share of the Nicotine Replacement Therapy Market, contributing 5% of the global total. Smoking rates remain high in many parts of this region, particularly due to cultural and social practices. It creates opportunities for public health agencies to increase adoption of cessation products. Limited healthcare access and lower affordability remain barriers to growth, though retail pharmacies and online sales are improving availability. South Africa and Gulf Cooperation Council (GCC) countries lead demand due to stronger regulatory frameworks and higher disposable incomes. Awareness programs backed by the World Health Organization support gradual increases in adoption rates. While the region lags behind in market penetration, ongoing reforms in healthcare infrastructure and tobacco control policies are expected to support incremental growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis

- Johnson & Johnson

- Cipla

- Imperial Brands

- Pfizer

- NJOY

- Lupin

- GlaxoSmithKline

- Reddy’s Laboratories

- Perrigo Company

Competitive Analysis

The competitive landscape of the Nicotine Replacement Therapy players include Cipla, Dr. Reddy’s Laboratories, GlaxoSmithKline, Imperial Brands, Johnson & Johnson, Lupin, NJOY, Novartis, Perrigo Company, and Pfizer. The Nicotine Replacement Therapy Market is highly competitive, driven by innovation in product formats, regulatory compliance, and expanding distribution networks. Companies focus on developing gums, patches, lozenges, sprays, and inhalers with improved efficacy and patient convenience. It is also influenced by the rising demand for digital health integration, with mobile applications and telehealth platforms enhancing adherence and engagement. Competitive intensity is strengthened by the entry of cost-effective solutions in emerging economies and the growing popularity of e-commerce channels. Differentiation relies on affordability, proven clinical outcomes, and accessibility across both developed and developing regions. Strategic investments in research, partnerships with healthcare providers, and expanding global reach continue to shape the market’s competitive environment.

Recent Developments

- In June 2024, Dr. Reddy’s Laboratories announced the acquisition of the Nicotine Replacement Therapy portfolio of Haleon. The portfolio consists of popular brands such as Nicotinell, Nicabate, Thrive, and Habitrol having a widespread footprint across global markets outside the U.S.

- In May 2024, Ventus Medical LTD announced that it had submitted ‘ENHALE’ for UK Marketing Authorization. ENHALE is a next-generation smoking alternative product for tobacco product users.

- In May 2024, Ryze Nicotine Gums announced a partnership with 100 Days. This partnership is being done to launch nicotine gums in several flavors, such as mint, saunf, fruit, pudina, and paan, in the Indian market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Route of Administration, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Nicotine Replacement Therapy Market will expand with rising global awareness of smoking-related health risks.

- Digital health integration will strengthen therapy adherence through mobile apps and telehealth platforms.

- Demand for natural and plant-based formulations will grow among health-conscious consumers.

- Combination therapies will gain wider acceptance due to higher success rates in smoking cessation.

- E-commerce platforms will increase product accessibility and drive strong online sales growth.

- Emerging economies will create new opportunities through rising smoking prevalence and stricter regulations.

- Drug therapies such as Varenicline and Bupropion will see consistent demand under clinical supervision.

- Innovation in rapid-delivery formats like sprays and inhalers will attract patients seeking faster relief.

- Regulatory frameworks will continue to shape competition and market entry strategies.

- Collaboration between healthcare providers and public health agencies will support long-term market growth.