| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Facilities Management Market Size 2024 |

USD 388.53 million |

| North America Facilities Management Market, CAGR |

6.03% |

| North America Facilities Management Market Size 2032 |

USD 641.86 million |

Market Overview:

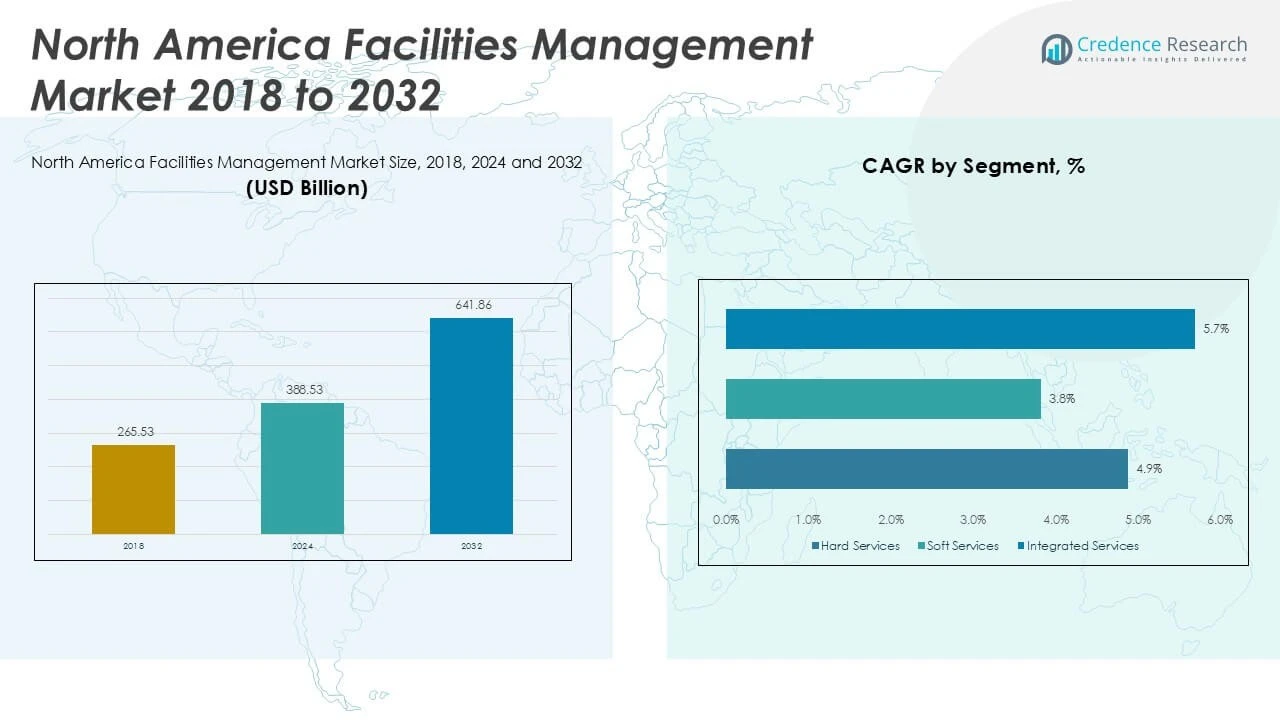

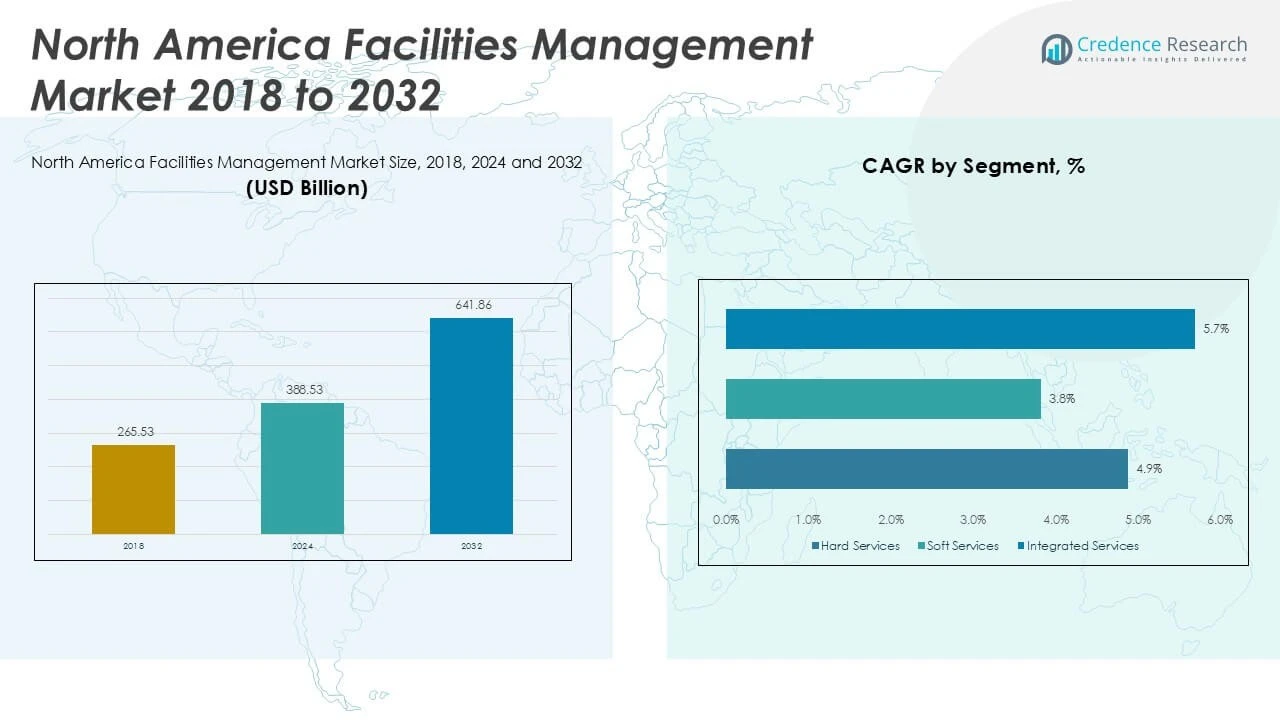

The North America Facilities Management Market size was valued at USD 265.53 million in 2018 to USD 388.53 million in 2024 and is anticipated to reach USD 641.86 million by 2032, at a CAGR of 6.03% during the forecast period.

Several factors are propelling the FM market in North America. The integration of Internet of Things (IoT) and artificial intelligence (AI) in building management systems enhances operational efficiency and predictive maintenance capabilities. Additionally, the growing focus on sustainability and energy efficiency is driving organizations to adopt green building practices and energy-saving measures. The U.S. Department of Energy reports that energy-efficient buildings can achieve significant cost savings, with potential reductions in energy use ranging from 20% to 30%. Moreover, the increasing trend of outsourcing non-core activities allows companies to concentrate on their primary business functions while ensuring professional management of their facilities. The rise of smart workplaces and hybrid work models is also driving demand for agile FM solutions tailored to evolving workplace dynamics. Furthermore, regulatory compliance requirements related to health, safety, and environmental standards are compelling businesses to enhance their FM strategies.

Within North America, the United States dominates the FM market, accounting for approximately 87% of the total market share in 2024. This dominance is attributed to the country’s extensive commercial real estate sector and the rapid adoption of advanced facility management solutions. Canada, while smaller in market size, is experiencing significant growth, particularly in the public/infrastructure segment, driven by government investments in infrastructure development and modernization projects. The Canadian government’s commitment to sustainable building practices and energy efficiency further bolsters the demand for FM services. Mexico, though a smaller player in the region, is witnessing gradual growth in the FM sector, supported by increasing industrial activities and urbanization. Urban development programs and private sector participation in Mexico are creating new avenues for outsourced facility management services. Additionally, the growing demand for quality service delivery and compliance with international FM standards is fostering competitiveness and innovation across the region.

Market Insights:

- The North America Facilities Management Market size grew from USD 265.53 million in 2018 to USD 388.53 million in 2024 and is projected to reach USD 641.86 million by 2032, registering a CAGR of 6.03%.

- The integration of IoT and AI in building management systems is enabling predictive maintenance and enhancing energy efficiency across commercial and institutional facilities.

- Organizations are increasingly outsourcing non-core services such as cleaning, HVAC, and security to streamline operations and reduce costs.

- Sustainability initiatives, including energy optimization and green certifications, are driving demand for eco-friendly and compliant facility management solutions.

- The rise of hybrid work models is reshaping service demands, with increased focus on flexible layouts, indoor air quality, and touchless technologies.

- Labor shortages and rising operational costs are straining service delivery, prompting firms to adopt automation and workforce training strategies.

- The U.S. holds around 87% market share in North America, while Canada and Mexico are gaining momentum through public investments and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Adoption of Smart Building Technologies Enhances Operational Efficiency

The North America Facilities Management Market is undergoing transformation through the integration of smart building technologies. Internet of Things (IoT), Artificial Intelligence (AI), and Building Management Systems (BMS) are reshaping how facilities are monitored and maintained. These tools enable real-time tracking of energy consumption, equipment status, and occupancy, allowing for faster, data-driven decisions. Facility managers are shifting toward predictive maintenance models to avoid costly downtimes and extend asset lifecycles. Organizations are also deploying automation to streamline repetitive tasks, improve security, and reduce energy usage. This shift toward technology-driven operations is reducing human error and increasing cost-efficiency across commercial and institutional facilities.

- For example, AI-powered predictive maintenance is already being used to reduce downtime and extend asset lifecycles, particularly in critical systems such as elevators and HVAC.

Outsourcing Non-Core Operations Supports Business Agility and Cost Control

Outsourcing facilities management functions is becoming a strategic approach across sectors including healthcare, education, manufacturing, and corporate offices. Organizations in the North America Facilities Management Market are partnering with specialized service providers to manage tasks such as cleaning, HVAC maintenance, security, and catering. This approach enables internal teams to focus on core business objectives while ensuring professional upkeep of physical assets. It improves flexibility in resource allocation and reduces long-term operational costs. Outsourcing contracts often include performance-based metrics, ensuring accountability and consistent service quality. The growing demand for integrated facilities services under single contracts reflects the shift toward simplified and efficient vendor management.

Sustainability Goals and Environmental Regulations Drive Green Facility Initiatives

Corporate sustainability goals and environmental regulations are compelling organizations to revise facility operations. The market is seeing increased implementation of eco-friendly practices such as waste reduction, energy optimization, and sustainable procurement. Governments in the U.S. and Canada are promoting energy-efficient buildings through tax incentives and green building certifications like LEED. The North America Facilities Management Market benefits from these policy shifts, which encourage retrofitting and sustainable infrastructure development. Facility managers are investing in renewable energy sources, smart lighting, and water conservation systems to meet compliance standards. These initiatives support long-term operational savings and strengthen brand image in environmentally conscious markets.

- For instance, companies like Brookfield have invested in on-site solar and storage solutions, providing corporate clients with access to renewable energy at the point of consumption, which reduces costs and supports decarbonization goals.

Workplace Evolution and Hybrid Work Models Influence Service Requirements

The rise of hybrid work environments is redefining workplace expectations and facility management needs. Organizations are reducing office footprints while prioritizing flexible, safe, and technology-enabled spaces. Facility managers in the North America Facilities Management Market are adapting by reconfiguring layouts, managing occupancy levels, and integrating touchless systems. Demand for cleaning, air quality monitoring, and health-safety compliance has increased in post-pandemic workplace strategies. It is also prompting investment in workplace analytics to optimize usage and ensure employee well-being. These evolving needs are pushing service providers to offer customizable and scalable solutions tailored to dynamic business environments.

Market Trends:

Growing Demand for Integrated Facilities Management Services Across Sectors

Businesses across North America are moving toward integrated facilities management (IFM) models to simplify operations and reduce vendor complexity. The North America Facilities Management Market is seeing a shift from single-service contracts to bundled and fully integrated service offerings. IFM enables centralized oversight, standardized service delivery, and better cost control. Companies are consolidating contracts for services such as maintenance, cleaning, security, and waste management under one provider. This trend supports operational transparency and performance monitoring through unified service-level agreements. It is also increasing demand for service providers with broad capabilities and scalable solutions.

- For instance, CBRE’s facilities management net revenue increased by 16.7% year-over-year in Q4 2024, reflecting strong demand across enterprise and local businesses, particularly in the technology, industrial, data center, and healthcare sectors.

Rising Importance of Sustainability and Green Building Practices

Sustainability remains a top priority in building operations, driving adoption of environmentally responsible practices. The North America Facilities Management Market is experiencing increased implementation of energy-efficient systems, sustainable materials, and green certification standards. Facility managers are working to meet corporate ESG targets and comply with government regulations. Buildings are being retrofitted with energy management systems, LED lighting, and smart HVAC technologies to reduce carbon emissions and utility costs. Demand for LEED-certified and ENERGY STAR-rated buildings continues to rise in both public and private sectors. It is encouraging long-term investments in sustainable infrastructure and building performance optimization.

- For example, Johnson Controls stated that clients using its OpenBlue platform achieved up significant reductions in energy consumption after retrofitting buildings with smart HVAC, LED lighting, and energy management systems

Technology Adoption Accelerates Data-Driven Decision-Making

Digital transformation is a defining trend across the North America Facilities Management Market. Facility managers are leveraging IoT, AI, and data analytics to optimize space utilization, asset maintenance, and energy consumption. These technologies provide real-time insights and predictive capabilities that support proactive decision-making. Mobile applications and cloud-based platforms are improving workforce coordination, task scheduling, and service reporting. Digital twins and smart sensors are gaining traction in complex facilities for simulation and monitoring. This shift is creating a demand for tech-savvy service providers who can deliver value through digital platforms and data integration.

Increased Focus on Health, Safety, and Workplace Experience

The pandemic has permanently reshaped how organizations manage their built environments, placing greater focus on hygiene, air quality, and employee well-being. The North America Facilities Management Market is responding with services tailored to evolving workplace expectations. Cleaning protocols, indoor air purification systems, and contactless access controls have become standard features. Companies are prioritizing flexible workspaces that adapt to fluctuating occupancy levels and hybrid work arrangements. Workplace experience platforms are emerging to manage space reservations, feedback, and service requests in real time. It is driving facility managers to adopt a people-first approach that balances safety, comfort, and productivity.

Market Challenges Analysis:

Labor Shortages and Rising Operational Costs Disrupt Service Efficiency

The North America Facilities Management Market faces persistent challenges from labor shortages and increasing operational costs. Recruiting and retaining skilled workers for roles such as maintenance technicians, janitorial staff, and HVAC specialists remains difficult. High employee turnover disrupts service continuity and strains contract fulfillment. Rising wages and inflationary pressures further increase the cost of service delivery, putting pressure on profit margins for service providers. It becomes difficult for smaller vendors to remain competitive without compromising on quality or coverage. Companies must invest in workforce training and automation to offset labor constraints and meet service level expectations.

- For instance, according to the U.S. Bureau of Labor Statistics (BLS), the building and grounds cleaning and maintenance occupations are projected to have approximately 786,800 job openings annually from 2023 to 2033.These openings result from employment growth and the need to replace workers who leave the occupations permanently.

Compliance Complexities and Fragmented Regulatory Landscape Increase Operational Risk

Navigating regulatory requirements across states and provinces presents a significant challenge for stakeholders in the North America Facilities Management Market. Different jurisdictions enforce varying standards related to building codes, health and safety, labor laws, and environmental compliance. It creates administrative burdens and increases the risk of non-compliance, especially for providers managing multi-site operations. Frequent changes in legislation and inspection requirements add to the complexity of maintaining adherence. Companies must allocate resources toward compliance monitoring, legal counsel, and certifications to operate efficiently. This fragmented landscape slows expansion and limits standardization of facility management practices across the region.

Market Opportunities:

The North America Facilities Management Market stands to benefit from smart city development and infrastructure upgrades across urban centers. Government-led investments in public transportation, utilities, and civic infrastructure are creating new demand for advanced facility services. Facility managers have the opportunity to provide energy-efficient, tech-enabled solutions for complex assets such as airports, transit hubs, and government buildings. It opens pathways for partnerships with municipal bodies and infrastructure developers. Integrated solutions that combine maintenance, security, and sustainability will gain traction in public sector contracts. This trend supports long-term service agreements and revenue stability.

Specialized sectors such as healthcare and education present high-value opportunities for tailored facilities management services. The North America Facilities Management Market can grow through targeted offerings that address sector-specific needs, such as infection control in hospitals and energy optimization in schools. It allows service providers to differentiate through compliance readiness, risk management, and operational efficiency. Clients in these sectors seek partners with deep expertise and scalable service models. Opportunities exist in both public and private institutions, particularly those investing in modernization and expansion. Strategic focus on these verticals can deliver consistent growth and client retention.

Market Segmentation Analysis:

The North America Facilities Management Market demonstrates a diversified structure across key segments, each reflecting unique demand patterns and service priorities.

By service type, hard services such as HVAC, plumbing, and electrical maintenance lead in revenue due to their critical nature, while soft services like cleaning, catering, and security remain essential for day-to-day operations. Integrated services are gaining traction as organizations seek bundled solutions for streamlined management and cost efficiency.

By facility size, large facilities account for the highest market share owing to their complex infrastructure and need for comprehensive service coverage. Medium facilities follow closely, driven by commercial and institutional expansion, while small facilities are gradually adopting outsourced management solutions to improve efficiency.

By end user industry, the commercial sector dominates the North America Facilities Management Market due to its extensive reliance on outsourced services for corporate offices, retail spaces, and business parks. The healthcare and education segments are growing rapidly, supported by stringent hygiene standards and evolving regulatory frameworks. Government and industrial sectors also contribute significantly, emphasizing infrastructure modernization and safety compliance.

By service delivery model into in-house and outsourced management. It continues to favor outsourced facility management due to the rising demand for expertise, scalability, and strategic focus on core operations.

Segmentation:

By Service Type

- Hard Services

- Soft Services

- Integrated Services

By Facility Size

- Small Facilities

- Medium Facilities

- Large Facilities

By End User Industry

- Commercial

- Residential

- Industrial

- Healthcare

- Education

- Government

By Service Delivery Model

- In-house Facility Management

- Outsourced Facility Management

By Region (North America)

- United States

- Canada

- Mexico

Regional Analysis:

The United States dominates the North America Facilities Management Market with a market share of nearly 87% in 2024. Its leadership position stems from a robust commercial real estate sector, widespread adoption of integrated services, and a strong presence of global FM providers. The U.S. continues to invest in smart building technologies, green infrastructure, and public-private partnerships, which strengthen demand for facility management services. Enterprises across healthcare, education, and government sectors actively outsource non-core operations to improve service quality and compliance. Large urban centers further drive demand for scalable, tech-enabled FM solutions tailored to complex infrastructure needs. The country’s evolving workplace trends, including hybrid models and ESG mandates, accelerate market innovation and vendor consolidation.

Canada accounts for approximately 9% of the North America Facilities Management Market and shows consistent growth in both private and public sectors. Its market is shaped by government investment in infrastructure modernization and sustainability-driven retrofitting projects. Facility managers in Canada are prioritizing energy efficiency, regulatory compliance, and long-term cost reduction across healthcare institutions, universities, and municipal buildings. The rise in LEED-certified projects and green building initiatives also supports growth in integrated and soft service segments. Demand is strong in mid-sized commercial spaces, where bundled services offer operational benefits. Service providers that offer bilingual capabilities and region-specific compliance expertise gain a competitive edge in the Canadian market.

Mexico holds the remaining 4% share of the North America Facilities Management Market and represents an emerging opportunity space. Rapid urbanization, growth in manufacturing zones, and expansion of corporate real estate drive incremental demand for facility services. The industrial sector, including maquiladoras and logistics hubs, relies on FM providers for security, maintenance, and energy optimization. Mexico is witnessing gradual adoption of international service standards and digital platforms, particularly among multinational clients. Infrastructure development and foreign investment in smart cities create favorable conditions for long-term market development. It remains price-sensitive, but the need for professional and scalable services is growing across both public and private domains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CBRE Group, Inc.

- Jones Lang LaSalle (JLL)

- Cushman & Wakefield

- Sodexo

- Aramark Corporation

- EMCOR Group, Inc.

- ISS A/S

- Mitie Group plc

- Atalian North America Services

- Serco Group plc

- Vinci Facilities

- OCS Group Limited

- Brookfield North America Integrated Solutions (BGIS)

Competitive Analysis:

The North America Facilities Management Market features a competitive landscape dominated by global and regional players offering a broad spectrum of services. Leading companies such as CBRE Group, Jones Lang LaSalle (JLL), Cushman & Wakefield, Sodexo, and Aramark focus on integrated service models and technology-driven solutions to strengthen their market position. It reflects a trend where clients demand bundled offerings, digital platforms, and scalable operations across sectors. Firms invest in automation, predictive maintenance, and energy management tools to deliver measurable value and improve client retention. Mid-sized players compete by offering specialized services, flexibility, and localized expertise. Strategic partnerships, mergers, and acquisitions continue to shape the market, with emphasis on expanding service portfolios and geographic presence. The North America Facilities Management Market rewards providers that demonstrate operational excellence, compliance capability, and innovation aligned with evolving client needs.

Recent Developments:

- In February 2023, Planon Corporation and Gilbane Building Company formed a strategic collaboration to serve the North American real estate and facility management sector. This partnership leverages Gilbane’s expertise in integrated construction and facility management with Planon’s technology for smart building and workplace management solutions. The collaboration aims to deliver end-to-end lifecycle maintenance plans, space allocations, asset registers, and other operational management tools to organizations before new facilities are opened, enhancing the efficiency and intelligence of facility operations.

- In January 2023, ISS A/S extended and expanded its partnership with a global technology company in North America. This renewed three-year deal, running until the end of 2025 and supported by ISS Guckenheimer, represents an estimated annual revenue of above 1% of the ISS Group’s total revenue. The partnership focuses on supporting the client’s workplace culture by delivering comprehensive services including cafés, coffee bars, micro-kitchens, catering, and project management, thereby strengthening ISS’s position in the North American facility management market.

- In January 2025, CBRE Group announced a definitive agreement to acquire Industrious National Management Company, a leading provider of flexible workplace solutions. This acquisition will lead to the creation of a new business segment called Building Operations & Experience (BOE), which will unify building operations, workplace experience, and property management. The move positions CBRE to deliver scalable, future-ready solutions for offices, data centers, warehouses, and other facilities, with the transaction expected to close by the end of January 2025.

Market Concentration & Characteristics:

The North America Facilities Management Market exhibits moderate to high market concentration, with a few large players holding significant market share across key service segments. It is characterized by the dominance of multinational firms offering end-to-end solutions, supported by strong financial resources and advanced digital capabilities. The market shows a clear preference for integrated service models and long-term contracts, particularly in commercial and institutional sectors. High client expectations around cost efficiency, compliance, and sustainability influence vendor selection. Regional and mid-sized players compete by offering niche expertise, local responsiveness, and customized solutions. It continues to evolve through consolidation, technological integration, and expanding demand for energy-efficient and tech-enabled facilities management services.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Facility Size, End User Industry and Service Delivery Model. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Smart building adoption will increase demand for AI-driven facility management platforms.

- Sustainability goals will drive investment in energy-efficient and green-certified services.

- Outsourcing will expand across public and private sectors, favoring integrated service providers.

- Workplace flexibility will require adaptive FM solutions tailored to hybrid office models.

- IoT and sensor-based monitoring will support predictive maintenance and real-time asset tracking.

- Government infrastructure spending will open new opportunities in public sector facility contracts.

- Healthcare and education sectors will demand specialized FM services with strict compliance.

- Mid-sized service providers will gain traction through localized expertise and agile delivery models.

- Digital transformation will drive market competition through analytics, automation, and cloud platforms.

- Cross-border partnerships and acquisitions will continue to shape the regional competitive landscape.