Market Overview:

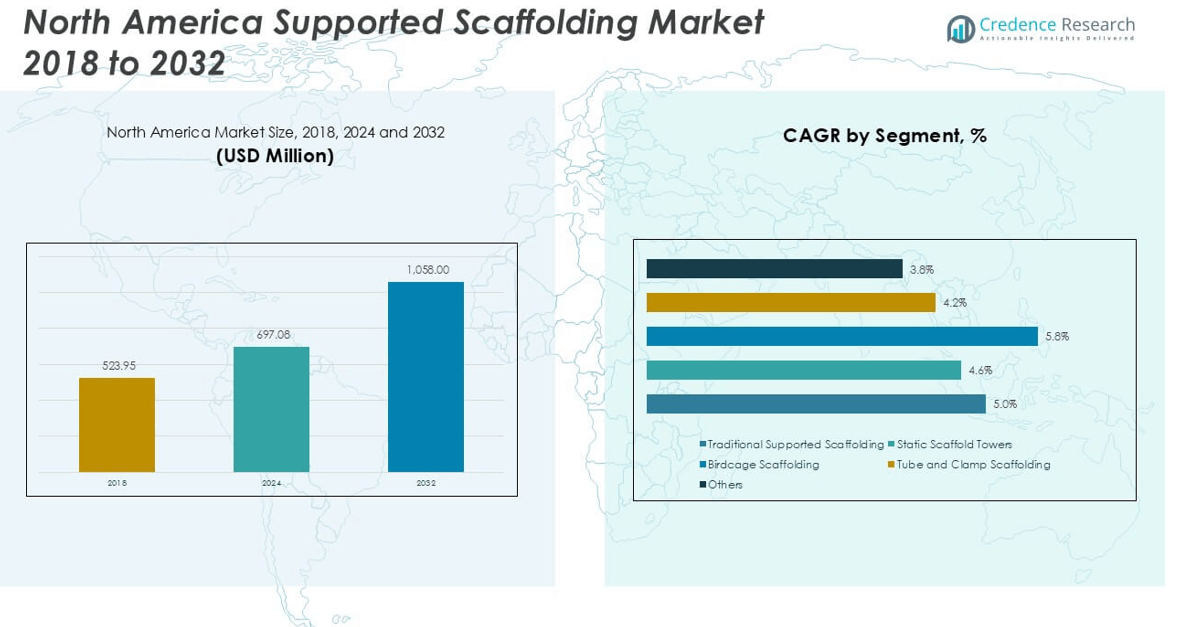

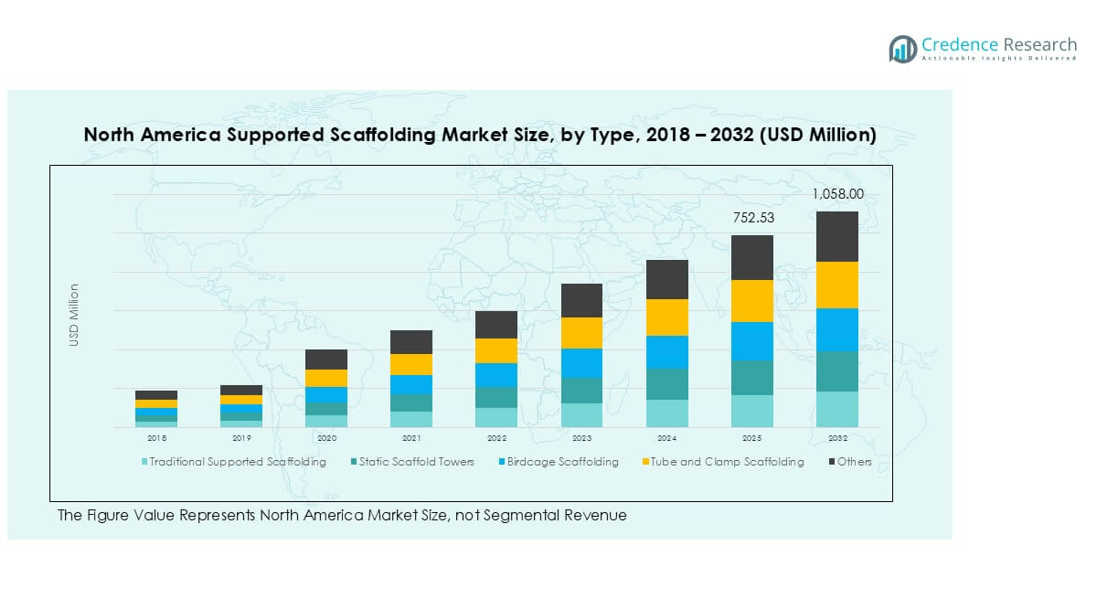

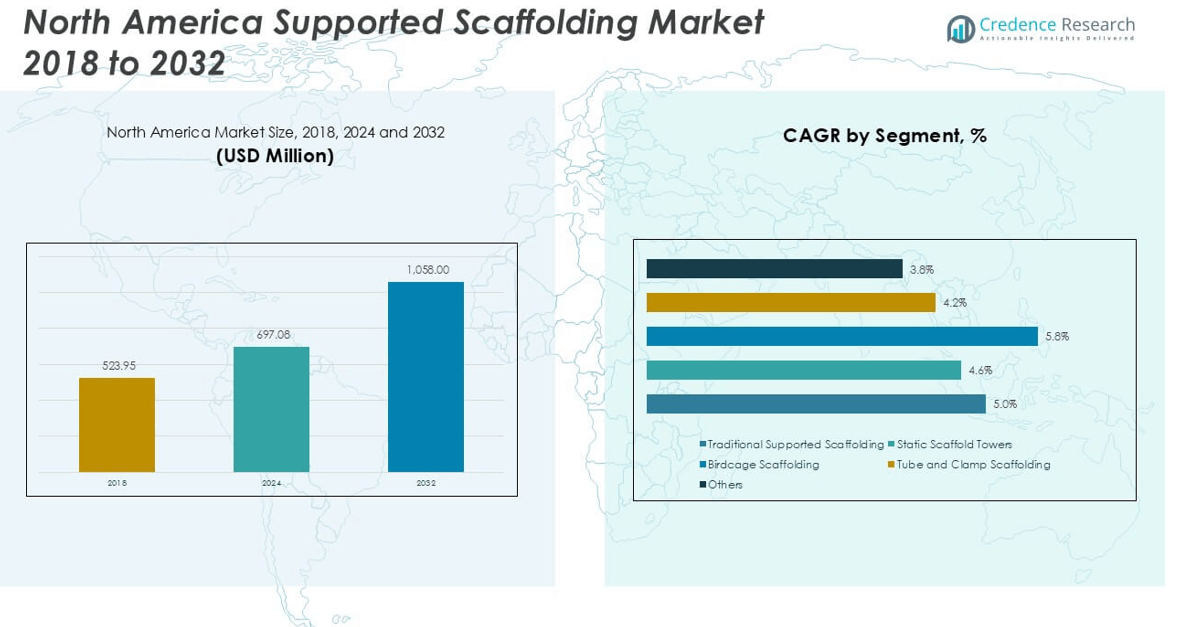

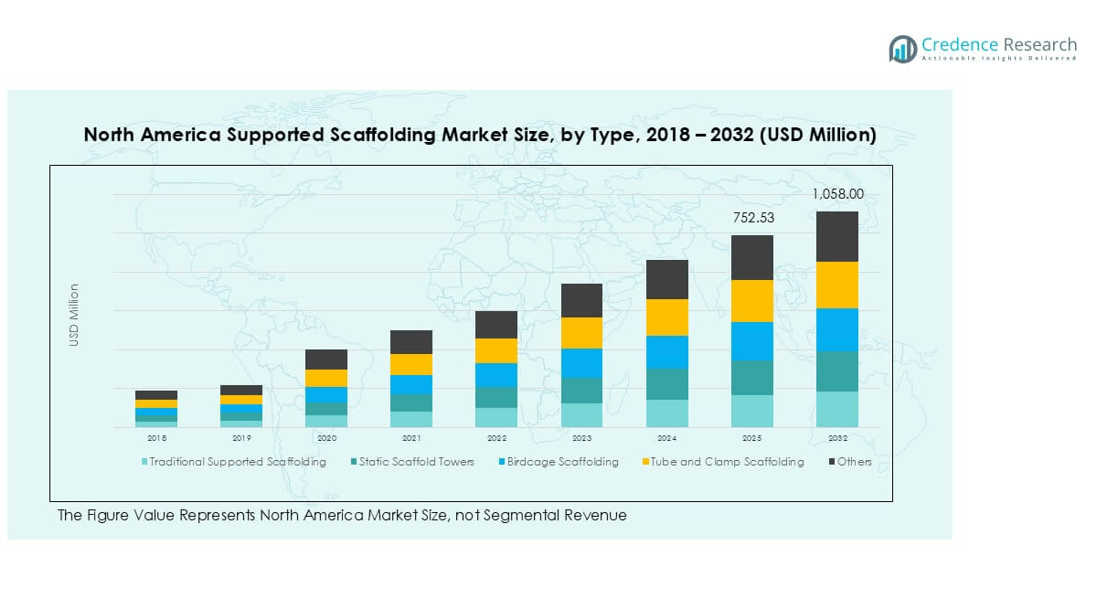

North America Supported Scaffolding market size was valued at USD 523.95 million in 2018, increased to USD 697.08 million in 2024, and is anticipated to reach USD 1,058.00 million by 2032, at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Supported Scaffolding Market Size 2024 |

USD 697.08 million |

| North America Supported Scaffolding Market, CAGR |

5.0% |

| North America Supported Scaffolding Market Size 2032 |

USD 1,058.00 million |

The North America supported scaffolding market is led by prominent players such as BSL Scaffolding Ltd., Brand Industrial Services, Inc., Waco Kwikform Ltd., Rapid Scaffolding (Engineering) Co. Ltd., and American Scaffolding, Inc. These companies dominate the competitive landscape through comprehensive product portfolios, rental services, and strong regional presence. Their focus on safety compliance, modular systems, and tailored solutions gives them a competitive edge. Among regions, the United States holds the dominant position with a market share of approximately 70%, driven by large-scale construction, infrastructure modernization, and stringent safety regulations. Canada and Mexico follow, supported by ongoing urban development and industrial expansion.

Market Insights

- The North America supported scaffolding market was valued at USD 697.08 million in 2024 and is expected to reach USD 1,058.00 million by 2032, growing at a CAGR of 5.0% during the forecast period.

- Market growth is primarily driven by the rise in construction and infrastructure projects, increasing renovation activities, and stricter safety regulations across the U.S. and Canada.

- A key trend is the growing adoption of modular and lightweight scaffolding systems, particularly aluminum-based structures, for improved flexibility and ease of installation.

- The competitive landscape includes major players such as BSL Scaffolding Ltd., Brand Industrial Services, Inc., and Waco Kwikform Ltd., who focus on innovation, rental services, and regional expansion.

- Regionally, the United States dominates with a 70% share, followed by Canada (20%) and Mexico (10%). Among types, Traditional Supported Scaffolding holds the largest segment share due to its cost-efficiency and wide applicability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

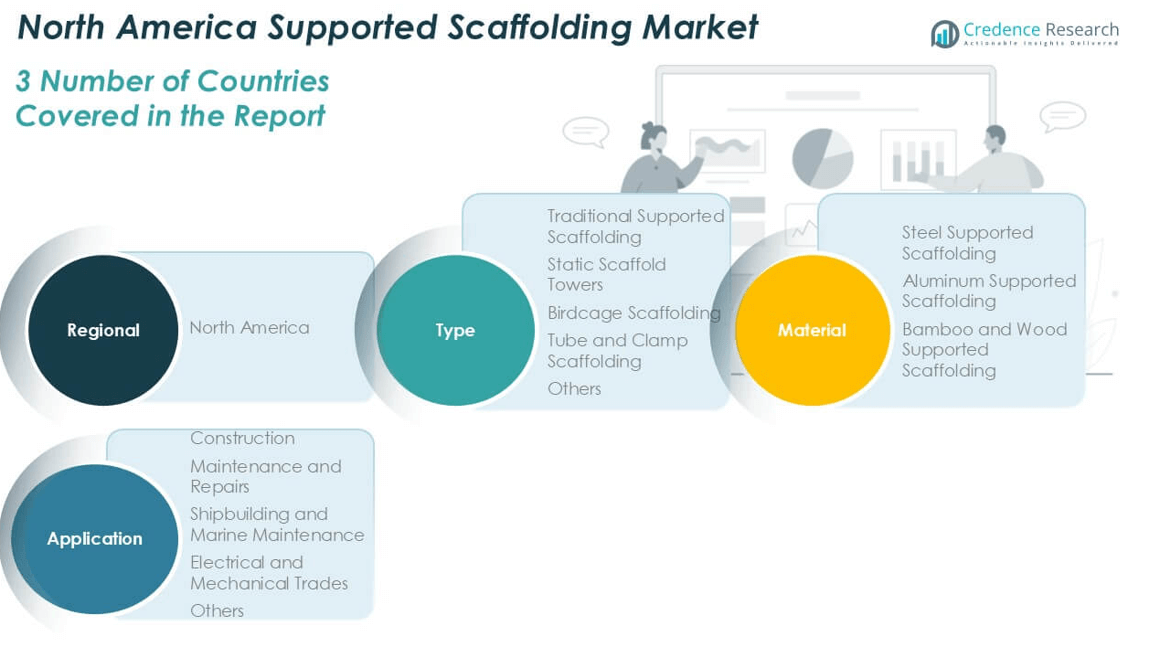

By Type

In the North America Supported Scaffolding market, Traditional Supported Scaffolding held the dominant share in 2024, accounting for over 35% of the market. Its widespread use across commercial and residential construction projects is driven by its cost-effectiveness, simplicity of design, and compatibility with various building heights. Static Scaffold Towers and Birdcage Scaffolding are gaining traction, especially in indoor environments and for ceiling-related work, due to their stability and adaptability. Tube and Clamp Scaffolding, while more complex, remains in demand for custom and irregular structures. The “Others” category includes niche types serving specialized applications.

- For instance, Layher North America introduced its Allround® Scaffolding system, which enables up to 80% reduction in assembly time compared to conventional tube-and-clamp setups, enhancing efficiency on irregular structures.

By Material

Steel Supported Scaffolding emerged as the leading material segment in 2024, commanding approximately 50% of the market share. Its superior strength, durability, and load-bearing capacity make it the preferred choice for large-scale and high-rise construction projects. Aluminum Supported Scaffolding is growing steadily due to its lightweight nature and ease of transport, which benefits projects requiring frequent relocation or indoor setups. Meanwhile, Bamboo and Wood Supported Scaffolding hold a minor share, primarily used in temporary or low-budget applications, although their popularity remains limited due to safety and regulatory concerns.

- For instance, Safway Group reported using over 4,500 tons of steel scaffolding in the Hudson Yards project in New York, demonstrating steel’s role in supporting complex vertical construction.

By Application

Construction remains the dominant application segment in 2024, contributing to over 60% of the total market. The ongoing infrastructure development, residential expansion, and commercial building projects across the U.S. and Canada continue to drive demand for supported scaffolding systems. The Maintenance and Repairs segment follows, supported by increasing renovation and retrofitting activities across aging structures. Shipbuilding and Marine Maintenance and Electrical and Mechanical Trades represent niche yet essential applications, where custom scaffolding setups are crucial for safety and access. The “Others” category includes uses in industrial inspections and event staging, contributing modestly to overall market demand.

Market Overview

Surge in Construction and Infrastructure Projects

The North America supported scaffolding market is experiencing robust growth due to a significant increase in construction and infrastructure development. Rapid urbanization, expansion of commercial real estate, and public infrastructure upgrades are driving consistent demand for safe and reliable scaffolding solutions. Government investments in transport, housing, and energy sectors across the U.S. and Canada are particularly fueling this expansion. Additionally, the growth in residential renovation and remodeling projects is contributing to the steady need for supported scaffolding across both short-term and long-term applications.

- For instance, BrandSafway deployed over 1.2 million cubic meters of scaffolding during the Los Angeles Metro expansion, highlighting its critical role in infrastructure development.

Stringent Workplace Safety Regulations

Strict occupational safety regulations set by OSHA and other regulatory bodies in North America are accelerating the adoption of supported scaffolding systems. These frameworks mandate safe working environments for laborers at elevated heights, increasing the reliance on structured, load-bearing scaffolding solutions. As enforcement intensifies and penalties for non-compliance rise, construction firms are investing in safer and more standardized scaffolding technologies. This compliance-driven demand is pushing both contractors and project owners to prioritize quality scaffolding systems over makeshift or informal alternatives, thereby boosting market growth.

- For instance, Waco International achieved a recordable incident rate (RIR) of 0.13 across its scaffolding operations in North America, showcasing the impact of safety-focused designs and compliance adherence.

Advancements in Scaffolding Design and Materials

Innovations in scaffolding materials and modular design systems are improving efficiency and flexibility on construction sites. The increasing availability of lightweight materials like aluminum, combined with quick-locking systems and pre-engineered components, is reducing assembly time and enhancing site productivity. These advancements are particularly appealing to contractors aiming to reduce labor costs and project timelines. Moreover, technological integration such as scaffold management software and sensor-based safety enhancements is transforming traditional scaffolding into smarter, more efficient infrastructure support solutions, fostering wider market acceptance.

Key Trends & Opportunities

Growing Preference for Modular and Mobile Scaffolding

The market is witnessing a shift toward modular and mobile supported scaffolding systems, especially in urban projects with tight timelines and spatial constraints. These systems offer flexibility, ease of assembly, and adaptability to various architectural forms, making them ideal for both new construction and renovation activities. The demand for mobile scaffolding is also increasing in industrial maintenance applications where frequent repositioning is required. This trend presents an opportunity for manufacturers to innovate and offer lightweight, customizable solutions that align with evolving job site requirements.

- For instance, BilJax Inc. launched the Rolling Tower 6’ scaffolding system that requires under 10 minutes for full deployment and repositioning, significantly enhancing operational efficiency in constrained environments.

Rising Adoption of Eco-Friendly and Recyclable Materials

As sustainability becomes a critical focus across industries, the supported scaffolding market is exploring the use of recyclable and low-impact materials. Aluminum scaffolding, in particular, is gaining popularity for being corrosion-resistant, reusable, and environmentally friendly. Contractors and project developers are increasingly choosing materials that align with green building certifications and environmental regulations. This shift not only supports circular economy goals but also opens up new business avenues for suppliers offering eco-certified scaffolding systems that contribute to long-term cost savings and brand value.

- For instance, PERI Group reports that 95% of its aluminum scaffolding components are recyclable and have been deployed in over 15 LEED-certified projects across North America

Key Challenges

High Initial Investment and Maintenance Costs

One of the major challenges in the North America supported scaffolding market is the high upfront cost associated with quality scaffolding systems. Steel and aluminum structures require significant capital expenditure, and ongoing maintenance, storage, and transportation costs can be burdensome for smaller contractors. While rental services alleviate some of this pressure, the long-term costs still pose a financial barrier, particularly for small and mid-sized enterprises operating on tight budgets and short project cycles.

Labor Shortages and Skill Gaps

The market is grappling with a shortage of skilled labor proficient in safe scaffolding assembly and dismantling practices. This shortage not only delays project timelines but also increases safety risks at construction sites. The aging workforce in the construction sector, coupled with insufficient training programs for younger workers, exacerbates the issue. Companies must invest in workforce development and training to mitigate these operational inefficiencies and uphold compliance with safety standards.

Risk of Accidents and Liability Concerns

Despite safety regulations, supported scaffolding remains a source of construction site accidents due to improper installation, overloading, or poor maintenance. These incidents can result in serious injuries, project delays, and legal liabilities for construction firms. The risk of accidents discourages some contractors from fully adopting scaffolding systems or prompts them to seek less efficient alternatives. Manufacturers and service providers must address these concerns through design improvements, safety features, and user training to build trust and ensure safe operations.

Regional Analysis

United States

The United States holds the largest share in the North America supported scaffolding market, accounting for approximately 70% of the regional revenue in 2024. This dominance is driven by large-scale infrastructure development, high-rise commercial and residential construction, and a strong emphasis on workplace safety regulations. Major urban centers such as New York, Los Angeles, and Chicago are witnessing consistent demand for scaffolding in new construction and maintenance projects. Additionally, the government’s push for smart cities and urban renewal programs has further fueled market expansion. The U.S. also benefits from established manufacturers and a mature rental scaffolding services network.

Canada

Canada represents around 20% of the North America supported scaffolding market, with growth primarily supported by ongoing infrastructure modernization, increased residential housing development, and investments in public sector projects. Cities like Toronto, Vancouver, and Calgary are experiencing a rise in mixed-use construction, boosting the demand for safe and adaptable scaffolding systems. Additionally, stringent provincial safety codes and the focus on environmentally friendly materials are influencing product selection. The expansion of industrial facilities, especially in the oil and gas sector, also contributes to scaffolding demand for maintenance and mechanical installations, strengthening the market’s long-term outlook in Canada.

Mexico

Mexico accounts for approximately 10% of the regional market share in 2024 and is emerging as a fast-growing segment within North America. The country is witnessing rising demand for supported scaffolding systems, driven by growth in industrial parks, transport infrastructure, and urban housing developments. Government initiatives to modernize public infrastructure and attract foreign investment in manufacturing are further boosting construction activity. However, the market faces challenges related to inconsistent enforcement of safety standards and reliance on traditional, labor-intensive methods. Despite this, increasing awareness about scaffold safety and the entry of international players are expected to improve product quality and adoption.

Market Segmentations:

By Type

- Traditional Supported Scaffolding

- Static Scaffold Towers

- Birdcage Scaffolding

- Tube and Clamp Scaffolding

- Others

By Material

- Steel Supported Scaffolding

- Aluminum Supported Scaffolding

- Bamboo and Wood Supported Scaffolding

By Application

- Construction

- Maintenance and Repairs

- Shipbuilding and Marine Maintenance

- Electrical and Mechanical Trades

- Others

By Geography

Competitive Landscape

The North America supported scaffolding market is moderately fragmented, with a mix of established international players and regional service providers competing for market share. Key companies such as BSL Scaffolding Ltd., Brand Industrial Services, Inc., and Waco Kwikform Ltd. lead the market by offering a broad range of scaffolding solutions and rental services tailored to diverse construction needs. These players invest heavily in product innovation, safety enhancements, and strategic partnerships to strengthen their competitive positioning. Regional players like American Scaffolding, Inc. and Associated Scaffolding Co., Inc. cater to niche markets with localized service support and flexible rental terms. The competitive environment is further shaped by advancements in modular scaffolding systems and eco-friendly materials, compelling companies to focus on sustainability and regulatory compliance. Mergers, acquisitions, and geographic expansion remain common strategies, while customer demand for safety, efficiency, and cost-effectiveness continues to drive innovation and differentiation among vendors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BSL Scaffolding Ltd.

- Brand Industrial Services, Inc.

- Waco Kwikform Ltd.

- Seaway Scaffold & Equipment Co

- American Scaffolding, Inc.

- Rapid Scaffolding (Engineering) Co. Ltd.

- Universal Building Supply Inc.

- Associated Scaffolding Co., Inc.

- QuickAlly Access Solutions

- Penn Tool Co.

Recent Developments

- In July 2022,StepUp Scaffold UK, a Glasgow-based subsidiary of the StepUp Scaffold Group in Memphis (US), which offers scaffolding and access equipment in the UK market, has finalized the acquisition of MP House ApS, which is located just outside Copenhagen. MP House is a market leader in the supply of tools, equipment, and accessories to Danish scaffolding operators.

- In July 2022,Doka, a provider of formwork, solutions, and services to the construction industry, has reinforced its existing partnership with renowned American scaffolding manufacturer AT-PAC by acquiring a significant investment in the US-based company. Doka and AT-PAC developed an initial relationship in 2020 to provide comprehensive building site solutions, and the partnership has been increasing ever since.

Market Concentration & Characteristics

The North America Supported Scaffolding Market exhibits moderate market concentration, with several established players occupying significant market share while regional companies compete in niche segments. It is characterized by a strong reliance on rental services, driven by high initial costs and the need for project-specific scaffolding solutions. The market shows clear segmentation by material, with steel scaffolding dominating due to its durability and load-bearing strength. Demand remains high across construction, maintenance, and industrial sectors, where safety compliance is a key priority. Manufacturers focus on modular systems and lightweight materials to meet project demands and reduce labor costs. The market structure supports both large multinational providers and local suppliers, fostering competition based on customization, service efficiency, and pricing. The presence of strict safety regulations and frequent infrastructure development projects, particularly in the United States, continues to shape product standards and service models. It supports steady growth through technological upgrades and compliance-driven procurement.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by continued infrastructure development across urban and industrial sectors.

- Demand for modular and easy-to-assemble scaffolding systems will increase due to the need for time-efficient construction processes.

- Rental services will become more prominent as companies seek cost-effective and flexible scaffolding solutions.

- Safety regulations will continue to influence product innovation and standardization across the market.

- Lightweight materials like aluminum will gain wider adoption for their ease of transport and installation.

- The United States will remain the dominant regional market due to large-scale construction and regulatory compliance.

- Canada’s market is expected to grow steadily with rising investments in public and residential infrastructure.

- Mexico will see accelerated growth supported by industrial expansion and foreign investments.

- Digital tools and scaffold design software will enhance operational planning and reduce project risks.

- Strategic collaborations and acquisitions will shape competitive positioning and market consolidation.