Market Overview:

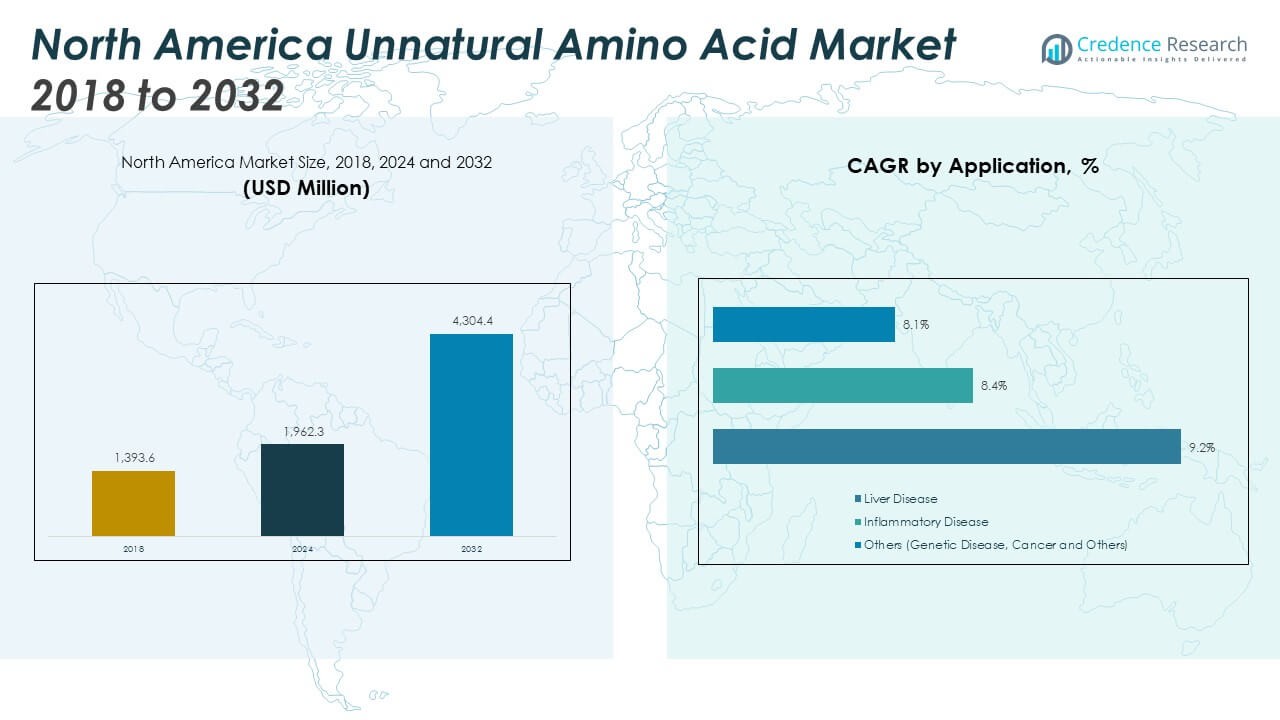

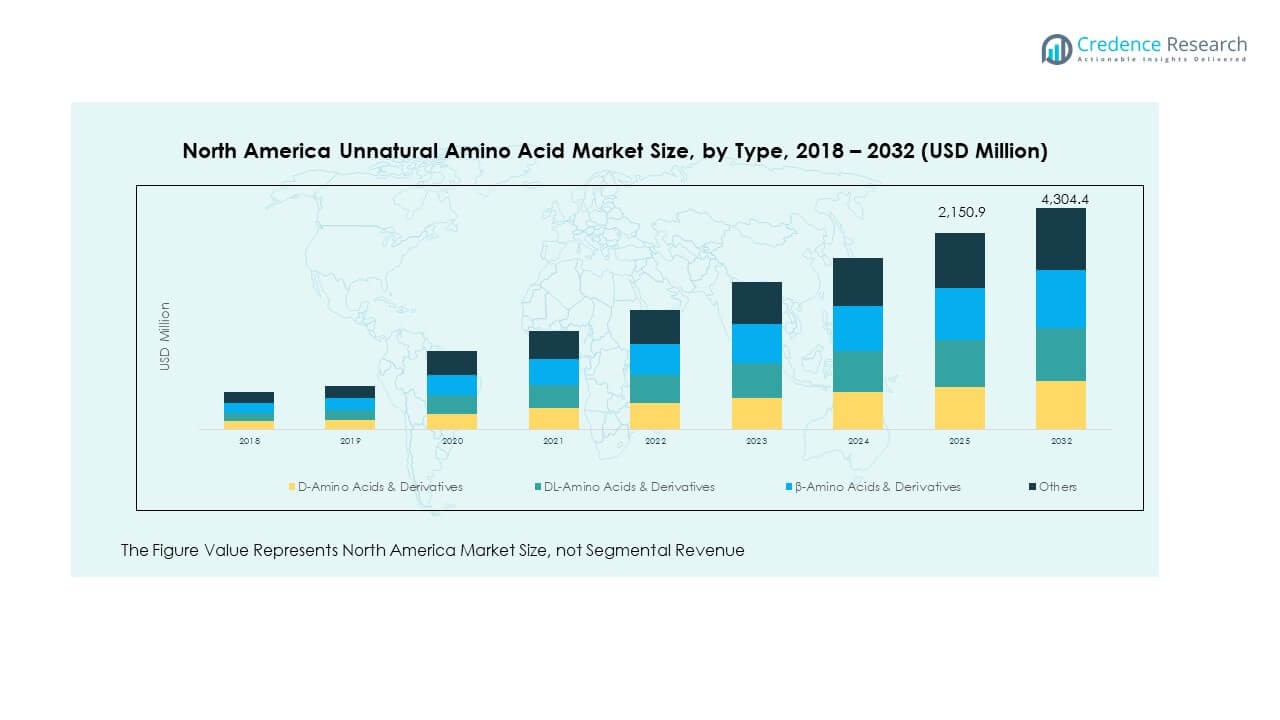

The North America Unnatural Amino Acid Market size was valued at USD 1,393.6 million in 2018 to USD 1,962.3 million in 2024 and is anticipated to reach USD 4,304.4 million by 2032, at a CAGR of 10.40% during the forecast period.

Market growth in North America is driven by advancements in protein engineering, synthetic biology, and biopharmaceutical research. Rising demand for site-specific protein modification and enhanced biologics is fueling adoption. Biotech and pharmaceutical companies are investing heavily in research to develop innovative therapeutics, particularly in oncology and rare diseases. The growing emphasis on precision medicine, coupled with technological progress in genetic code expansion, strengthens the application scope. Increasing collaboration between academic institutions and industry players also supports market expansion by accelerating the translation of laboratory innovations into commercial solutions.

Geographically, the United States leads the North America Unnatural Amino Acid Market due to its strong biotechnology ecosystem, well-established pharmaceutical industry, and advanced R&D infrastructure. Canada is emerging as a promising market, supported by government-backed research initiatives and rising biotech startups. Mexico is gradually gaining traction with growing pharmaceutical manufacturing activities and expanding healthcare infrastructure. Collectively, these countries contribute to the market’s robust growth, with the U.S. dominating due to its innovation-driven ecosystem, while Canada and Mexico present significant opportunities through emerging applications and supportive policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Unnatural Amino Acid Market grew from USD 1,393.6 million in 2018 to USD 1,962.3 million in 2024 and is projected to reach USD 4,304.4 million by 2032, expanding at a CAGR of 10.40%.

- The United States holds 72% share, driven by its strong pharmaceutical industry, advanced research infrastructure, and high investment in biopharmaceutical innovation.

- Canada accounts for 18% share, benefiting from supportive government policies, biotech startups, and strong academic-industry collaborations, positioning it as the fastest-growing subregion.

- D-amino acids and derivatives accounted for 38% of the market in 2024, reflecting their widespread use in therapeutic protein engineering and enzyme modification.

- DL-amino acids and derivatives held 28% share in 2024, supported by their versatile role in drug development and biochemical research applications.

Market Drivers

Rising importance of protein engineering and expanding applications in therapeutic development

Protein engineering has become a critical growth driver for the North America Unnatural Amino Acid Market. Pharmaceutical and biotech companies are deploying these amino acids to design stable and efficient therapeutic proteins. The ability to control protein activity and structure is encouraging greater investments. Researchers rely on these materials to achieve targeted modifications in biologics. It supports enhanced drug efficacy and reduced side effects across multiple treatment areas. Oncology, metabolic disorders, and rare disease therapies benefit most from engineered proteins. Strong collaborations between academic labs and industry partners accelerate adoption. The steady integration of synthetic tools strengthens long-term demand for unnatural amino acids.

Expanding demand for site-specific protein labeling and diagnostic innovations

The need for site-specific labeling of proteins fuels growth within diagnostic and therapeutic research. Precision modifications enable more reliable biomarker detection and imaging applications. It provides researchers with consistent performance in studying cellular mechanisms. Clinical diagnostics firms are leveraging these benefits to develop advanced tools. Pharmaceutical players are also adopting labeling approaches for drug mechanism validation. The North America Unnatural Amino Acid Market gains from the intersection of healthcare and biotechnology. Site-specific incorporation ensures predictable protein interactions. Expanding clinical studies reinforce the importance of these tools for innovation.

- For instance, HaloTag® technology has been successfully combined with near-infrared dye systems in research to enable multiplexed protein labeling with higher precision and reduced background noise, supporting improved reliability in protein analysis workflows relevant to therapeutic development.

Growing investment in precision medicine and advanced biopharmaceutical pipelines

The surge in precision medicine initiatives drives continuous adoption of unnatural amino acids. Personalized therapies depend on engineered proteins for specific patient needs. Biopharmaceutical pipelines include a growing share of antibody-drug conjugates and engineered enzymes. It allows companies to meet rising expectations for targeted treatment outcomes. Precision tools ensure that therapies show higher safety and effectiveness. Large pharma players invest heavily in R&D to secure leadership positions. Government agencies and private investors provide funding to support these efforts. The market benefits from the increasing shift toward patient-tailored solutions.

- For instance, NINGBO INNO PHARMCHEM CO., LTD. is a supplier of unnatural amino acid derivatives, including Boc-protected compounds, which are widely used as intermediates in solid-phase peptide synthesis and early-stage drug development workflows across North America. These materials support the growing demand for stable and high-performance building blocks in therapeutic research.

Strong academic research ecosystem and collaborations with industrial partners

Universities and research institutes across North America create steady demand through laboratory innovation. Academic groups often pioneer new incorporation techniques and platforms. Their findings contribute directly to commercial applications in healthcare and biotech. It encourages industry partners to form joint ventures with universities. Collaborative agreements provide faster routes to translate early discoveries into products. Research grants and public funding further strengthen this ecosystem. The North America Unnatural Amino Acid Market relies on this structure for long-term growth. It ensures knowledge transfer between scientific discovery and commercial application.

Market Trends

Rising adoption of genetic code expansion techniques across biotechnology research

Genetic code expansion tools are transforming protein modification capabilities across the region. Researchers deploy these systems to incorporate unnatural amino acids with higher precision. It improves functional studies of proteins and accelerates biomedical discoveries. Biotechnology startups are adopting expansion technologies to scale research. Large firms are commercializing novel incorporation kits for broader usage. The North America Unnatural Amino Acid Market benefits from this commercialization wave. Genetic tools enable higher efficiency in producing modified proteins. This trend reinforces the market’s role in advanced research applications.

- For instance, published research has demonstrated the site-specific incorporation of p-azido-L-phenylalanine (pAzF) into proteins in mammalian cells using amber codon suppression techniques, achieving reliable efficiency levels suitable for bioconjugation and protein labeling applications.

Growing influence of synthetic biology startups and innovation-driven incubators

A surge of synthetic biology companies is shaping the market landscape. These firms focus on building scalable platforms for unnatural amino acid applications. It drives fresh investment from venture capital and government programs. Innovation hubs across Boston, San Francisco, and Toronto encourage ecosystem growth. Startups provide cost-effective solutions for research and industrial partners. The North America Unnatural Amino Acid Market reflects this entrepreneurial momentum. Incubators and accelerators promote commercialization pathways for early discoveries. This trend strengthens the pipeline of future applications across industries.

Integration of unnatural amino acids in industrial enzymes and biocatalysis applications

Industrial applications are expanding beyond healthcare, with enzymes showing improved stability. Unnatural amino acids enhance catalytic performance in harsh processing conditions. It supports industries such as pharmaceuticals, agriculture, and sustainable chemicals. Biocatalysts with improved half-life enable more efficient production processes. Companies view this as a strategic step toward sustainable manufacturing. The North America Unnatural Amino Acid Market increasingly aligns with industrial biotechnology. Enzyme engineering creates competitive advantages through cost savings and durability. Broader industrial adoption expands revenue streams for the market.

- For instance, Codexis has developed engineered enzymes with improved stability and catalytic performance using advanced protein engineering methods, enabling more efficient biotransformation processes in pharmaceutical and industrial applications. Research across the field also shows that incorporating non-canonical amino acids into enzymes can enhance their resistance to harsh conditions, supporting broader use in sustainable manufacturing.

Increased focus on antibody-drug conjugates and targeted oncology therapies

Pharmaceutical companies are focusing on oncology therapies that rely on engineered proteins. Antibody-drug conjugates gain precision through site-specific incorporation methods. It enhances drug safety by reducing off-target effects. This aligns with the healthcare industry’s shift toward targeted therapies. Drug developers partner with technology firms to access novel incorporation tools. The North America Unnatural Amino Acid Market grows with each clinical milestone achieved. Regulatory acceptance of these therapies encourages broader investment. Oncology remains a core application driving future demand.

Market Challenges Analysis

High production costs and complexity in large-scale applications across industries

One of the biggest hurdles for the North America Unnatural Amino Acid Market is cost. Large-scale production requires advanced infrastructure and precise technology. It increases the financial burden on small and medium enterprises. Scaling up remains complex due to integration challenges in bioreactors. Strict process validation adds delays to commercialization timelines. High costs limit accessibility for academic labs with restricted budgets. Pharmaceutical companies balance these expenses with expected therapeutic benefits. The challenge slows broader adoption despite strong research interest.

Regulatory uncertainty and limited standardization across research and clinical use

Regulatory bodies have yet to establish clear standards for all unnatural amino acid applications. It creates uncertainty for firms pursuing clinical development. Different regions within North America interpret guidelines in varying ways. Lack of standardization impacts technology transfer from labs to industry. Delays in approvals discourage investors from funding risky projects. The North America Unnatural Amino Acid Market must navigate this unclear environment. Companies devote resources to compliance rather than innovation. Regulatory inconsistency remains a critical barrier to faster growth.

Market Opportunities

Expansion into sustainable industrial biotechnology and enzyme engineering applications

Opportunities extend beyond pharmaceuticals into industrial biotechnology sectors. Unnatural amino acids enhance enzymes used in sustainable manufacturing processes. It improves stability and reduces waste in chemical and agricultural production. Firms in North America target these applications for new revenue streams. Partnerships between biotech firms and industrial manufacturers increase development speed. The North America Unnatural Amino Acid Market gains competitive strength by entering industrial domains. Demand for eco-friendly solutions supports future market penetration. Industrial biotechnology offers long-term prospects for diversified growth.

Growing collaborations in personalized medicine and academic research ecosystems

Personalized medicine represents a strong opportunity for innovative therapies. Engineered proteins with site-specific modifications strengthen targeted treatment strategies. It aligns with precision initiatives promoted by healthcare leaders in the region. Academic institutions remain central to this advancement through ongoing research. Collaborations between research groups and pharmaceutical firms create faster commercialization. The North America Unnatural Amino Acid Market benefits from this collaborative momentum. It accelerates the introduction of novel therapeutics into clinical settings. These opportunities reinforce the market’s position in next-generation healthcare.

Market Segmentation Analysis:

By type, D-amino acids and derivatives account for a significant share in the North America Unnatural Amino Acid Market due to their widespread application in therapeutic protein modification and enzyme engineering. DL-amino acids and derivatives are steadily expanding their role across pharmaceutical and biochemical research, offering flexibility in synthesis and drug development. β-amino acids and derivatives attract attention for their unique structural stability, supporting advanced applications in oncology and metabolic research. The “others” category, including specialty derivatives, caters to niche research and experimental drug pipelines, reinforcing the market’s depth.

- For instance, D-PMI-α, a D-amino acid-based peptide inhibitor developed using mirror-image phage display, has been shown to disrupt MDM2/MDMX–p53 interactions with high affinity, demonstrating strong stability compared to L-peptide analogs and measurable anti-tumor activity in preclinical cancer models.

By application, liver disease treatments dominate due to the increasing focus on metabolic disorder management and improved therapeutic efficiency. Inflammatory disease applications continue to rise, supported by growing research into immune modulation and chronic illness management. The “others” segment, including genetic disease and cancer, reflects an expanding horizon where engineered amino acids support innovative therapies and targeted interventions. It ensures broad utility across critical therapeutic areas, driving continuous adoption.

By end-use, pharmaceutical companies remain the largest consumers, integrating unnatural amino acids into advanced drug pipelines and precision medicine strategies. Strong investment in R&D and biologics strengthens their share of demand. The “others” category, encompassing biotechnological companies, research laboratories, and academic institutes, plays a pivotal role in early-stage innovation and validation studies. It provides a foundation for translating laboratory findings into commercialized applications, ensuring a balanced ecosystem across industry and academia within the North America Unnatural Amino Acid Market.

- For example, Ambrx developed a site-specific protein conjugation platform using the unnatural amino acid p-acetylphenylalanine, enabling precise PEGylation of therapeutic proteins and improving their pharmacokinetic stability compared to conventional approaches, supporting clinical development of long-acting biologics.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

The United States holds the dominant position in the North America Unnatural Amino Acid Market, capturing nearly 72% share. Strong pharmaceutical and biotechnology ecosystems, supported by advanced research infrastructure, underpin its leadership. Leading universities, research institutions, and global pharma companies create a robust environment for innovation. Government funding and venture capital investments encourage continuous product development in biopharmaceuticals. The U.S. market benefits from high adoption of protein engineering and precision medicine initiatives. It continues to set the benchmark for research and commercialization across the region.

Canada accounts for around 18% of the North America Unnatural Amino Acid Market, reflecting a growing emphasis on healthcare innovation and biotechnology. The country’s supportive policies for life sciences research and government-backed initiatives strengthen demand. Canadian universities and startups are advancing in synthetic biology and protein modification applications. Pharmaceutical collaborations and cross-border research agreements with U.S. firms further accelerate market penetration. It creates a dynamic ecosystem where smaller players actively contribute to growth. Canada is becoming a significant hub for early-stage research and clinical trials.

Mexico holds nearly 10% share of the North America Unnatural Amino Acid Market, with growth driven by expanding pharmaceutical manufacturing and rising healthcare infrastructure. The country is gradually integrating advanced protein engineering tools into its research and industrial processes. Multinational companies establish partnerships with Mexican facilities to expand regional manufacturing capacity. Government reforms to encourage healthcare innovation also support uptake. It reflects growing interest from academic and biotechnological institutes in building research capabilities. Mexico shows potential as an emerging market with opportunities for long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bayer AG

- BASF SE

- AnaSpec Inc.

- AstraZeneca

- Pfizer

- Enzo Life Sciences, Inc.

- Nippon Rika

- Senn Chemicals

Competitive Analysis:

The North America Unnatural Amino Acid Market is highly competitive, shaped by global pharmaceutical companies, specialty chemical producers, and niche biotechnology firms. Large players such as Bayer AG, BASF SE, AstraZeneca, and Pfizer dominate through extensive R&D pipelines, strong financial resources, and established market presence. It allows them to drive innovation in therapeutic protein engineering, antibody-drug conjugates, and enzyme stability. Companies like AnaSpec Inc., Enzo Life Sciences, Nippon Rika, and Senn Chemicals strengthen the ecosystem with specialized portfolios, research reagents, and custom synthesis services. Their expertise supports both commercial and academic applications, providing competitive diversity. Strategic initiatives define the competitive environment, with mergers, acquisitions, and collaborations central to expansion. Companies prioritize partnerships with research institutes and startups to access disruptive technologies and accelerate clinical adoption. It creates opportunities to strengthen supply chains and expand product offerings across therapeutic and industrial applications. New product launches targeting oncology, metabolic disorders, and diagnostic innovations ensure steady competition among leading firms. Regional expansion into Canada and Mexico further broadens the operational footprint. Competitive intensity remains high, driven by continuous technological advancement, demand for precision medicine, and a strong research culture that sustains growth across the North America Unnatural Amino Acid Market.

Recent Developments:

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In June 2025, BASF SE reinforced its footprint in North America’s biopharmaceutical sector by inaugurating a new Good Manufacturing Practice (GMP) Solution Center in Wyandotte, Michigan. The facility, launched on June 17, 2025, is dedicated to advancing pharmaceutical ingredient quality, collaborative product development, and production innovation, thereby strengthening BASF’s ability to serve the growing demand for high-quality excipients and bioprocessing ingredients in the unnatural amino acid market.

- In January 2025, Pfizer expanded its partnership with PostEra, a startup specializing in AI-driven medicinal chemistry, to accelerate the design of novel small molecules and antibody-drug conjugates. This $350 million collaboration focuses on optimizing payloads for advanced medicines, which often utilize unnatural amino acid derivatives, thus fostering innovation in North American drug design.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing integration of engineered amino acids in oncology therapies will remain a key driver.

- Expansion of antibody-drug conjugates with higher safety profiles will shape pharmaceutical pipelines.

- Rising adoption of genetic code expansion technologies will enhance research and clinical applications.

- Growing collaborations between academia and industry will accelerate commercialization of new products.

- Expansion into enzyme engineering will support industrial biotechnology and sustainable manufacturing practices.

- Increased investment in precision medicine will strengthen applications across liver and inflammatory diseases.

- Advances in biocatalysis will open new opportunities in chemical and agricultural production.

- Regulatory clarity and harmonization are expected to improve clinical adoption and product approvals.

- Expansion of biotech startups in Canada and Mexico will create regional growth opportunities.

- Continuous innovation from established pharma companies will maintain competitive intensity and market leadership.

FAQs

Q1. What is the current market size for North America Unnatural Amino Acid Market, and what is its projected size in 2032?

The North America Unnatural Amino Acid Market was valued at USD 1,962.3 million in 2024 and is projected to reach USD 4,304.4 million by 2032.

Q2. At what Compound Annual Growth Rate is the North America Unnatural Amino Acid Market projected to grow between 2024 and 2032?

The North America Unnatural Amino Acid Market is projected to expand at a CAGR of 10.40% during the forecast period.

Q3. Which North America Unnatural Amino Acid Market segment held the largest share in 2024?

By type, D-amino acids and derivatives held the largest share in the North America Unnatural Amino Acid Market in 2024.

Q4. What are the primary factors fueling the growth of the North America Unnatural Amino Acid Market?

Growth is fueled by rising protein engineering, expanding precision medicine, strong R&D investments, and increased therapeutic applications in the North America Unnatural Amino Acid Market.

Q5. Who are the leading companies in the North America Unnatural Amino Acid Market?

Key players include Bayer AG, BASF SE, Pfizer, AstraZeneca, AnaSpec Inc., Enzo Life Sciences, Nippon Rika, and Senn Chemicals in the North America Unnatural Amino Acid Market.

Q6. Which region commanded the largest share of the North America Unnatural Amino Acid Market in 2024?

The United States commanded the largest share of the North America Unnatural Amino Acid Market in 2024, supported by strong research infrastructure and advanced pharma ecosystems.

Table of Content

CHAPTER NO. 1 : GENESIS OF THE MARKET

1.1 Market Prelude – Introduction & Scope

1.2 The Big Picture – Objectives & Vision

1.3 Strategic Edge – Unique Value Proposition

1.4 Stakeholder Compass – Key Beneficiaries

CHAPTER NO. 2 : EXECUTIVE LENS

2.1 Pulse of the Industry – Market Snapshot

2.2 Growth Arc – Revenue Projections (USD Million)

2.3. Premium Insights – Based on Primary Interviews

CHAPTER NO. 3 : NORTH AMERICA UNNATURAL AMINO ACID MARKET FORCES & INDUSTRY PULSE

3.1 Foundations of Change – Market Overview

3.2 Catalysts of Expansion – Key Market Drivers

3.2.1 Momentum Boosters – Growth Triggers

3.2.2 Innovation Fuel – Disruptive Technologies

3.3 Headwinds & Crosswinds – Market Restraints

3.3.1 Regulatory Tides – Compliance Challenges

3.3.2 Economic Frictions – Inflationary Pressures

3.4 Untapped Horizons – Growth Potential & Opportunities

3.5 Strategic Navigation – Industry Frameworks

3.5.1 Market Equilibrium – Porter’s Five Forces

3.5.2 Ecosystem Dynamics – Value Chain Analysis

3.5.3 Macro Forces – PESTEL Breakdown

3.6 Price Trend Analysis

3.6.1 Regional Price Trend

3.6.2 Price Trend by product

CHAPTER NO. 4 : KEY INVESTMENT EPICENTER

4.1 Regional Goldmines – High-Growth Geographies

4.2 Product Frontiers – Lucrative Product Categories

4.3 Application Sweet Spots – Emerging Demand Segments

CHAPTER NO. 5: REVENUE TRAJECTORY & WEALTH MAPPING

5.1 Momentum Metrics – Forecast & Growth Curves

5.2 Regional Revenue Footprint – Market Share Insights

5.3 Segmental Wealth Flow – Type & Application Revenue

CHAPTER NO. 6 : TRADE & COMMERCE ANALYSIS

6.1. Import Analysis by Region

6.1.1. North America Unnatural Amino Acid Market Import Revenue By Region

6.2. Export Analysis by Region

6.2.1. North America Unnatural Amino Acid Market Export Revenue By Region

CHAPTER NO. 7 : COMPETITION ANALYSIS

7.1. Company Market Share Analysis

7.1.1. North America Unnatural Amino Acid Market: Company Market Share

7.2. North America Unnatural Amino Acid Market Company Revenue Market Share

7.3. Strategic Developments

7.3.1. Acquisitions & Mergers

7.3.2. New Product Launch

7.3.3. Regional Expansion

7.4. Competitive Dashboard

7.5. Company Assessment Metrics, 2024

CHAPTER NO. 8 : NORTH AMERICA UNNATURAL AMINO ACID MARKET – BY TYPE SEGMENT ANALYSIS

8.1. North America Unnatural Amino Acid Market Overview by Type Segment

8.1.1. North America Unnatural Amino Acid Market Revenue Share By Type

8.2. D-Amino Acids & Derivatives

8.3. DL-Amino Acids & Derivatives

8.4. β-Amino Acids & Derivatives

8.5. Others

CHAPTER NO. 9 : NORTH AMERICA UNNATURAL AMINO ACID MARKET – BY APPLICATION SEGMENT ANALYSIS

9.1. North America Unnatural Amino Acid Market Overview by Application Segment

9.1.1. North America Unnatural Amino Acid Market Revenue Share By Application

9.2. Liver Disease

9.3. Inflammatory Disease

9.4. Others (Genetic Disease, Cancer and Others)

CHAPTER NO. 10 : NORTH AMERICA UNNATURAL AMINO ACID MARKET – BY END-USE SEGMENT ANALYSIS

10.1. North America Unnatural Amino Acid Market Overview by End-use Segment

10.1.1. North America Unnatural Amino Acid Market Revenue Share By End-use

10.2. Pharmaceutical

10.3. Others (Biotechnological Companies, Research Laboratories and Academic Institutes)

CHAPTER NO. 11 : NORTH AMERICA UNNATURAL AMINO ACID MARKET – COUNTRY ANALYSIS

11.1. North America Unnatural Amino Acid Market Overview by Country Segment

11.1.1. North America Unnatural Amino Acid Market Revenue Share By Region

11.2. North America

11.2.1. North America Unnatural Amino Acid Market Revenue By Country

11.2.2. Type

11.2.3. North America Unnatural Amino Acid Market Revenue By Type

11.2.4. Application

11.2.5. North America Unnatural Amino Acid Market Revenue By Application

11.2.6. End-use

11.2.7. North America Unnatural Amino Acid Market Revenue By End-use

11.3. U.S.

11.4. Canada

11.5. Mexico

CHAPTER NO. 12 : COMPANY PROFILES

12.1. Bayer AG

12.1.1. Company Overview

12.1.2. Product Portfolio

12.1.3. Financial Overview

12.1.4. Recent Developments

12.1.5. Growth Strategy

12.1.6. SWOT Analysis

12.2. BASF SE

12.3. AnaSpec Inc.

12.4. AstraZeneca

12.5. Pfizer

12.6. Enzo-Life-Sciences, Inc

12.7. Nippon Rika

12.8. Senn Chemicals