Market Overview

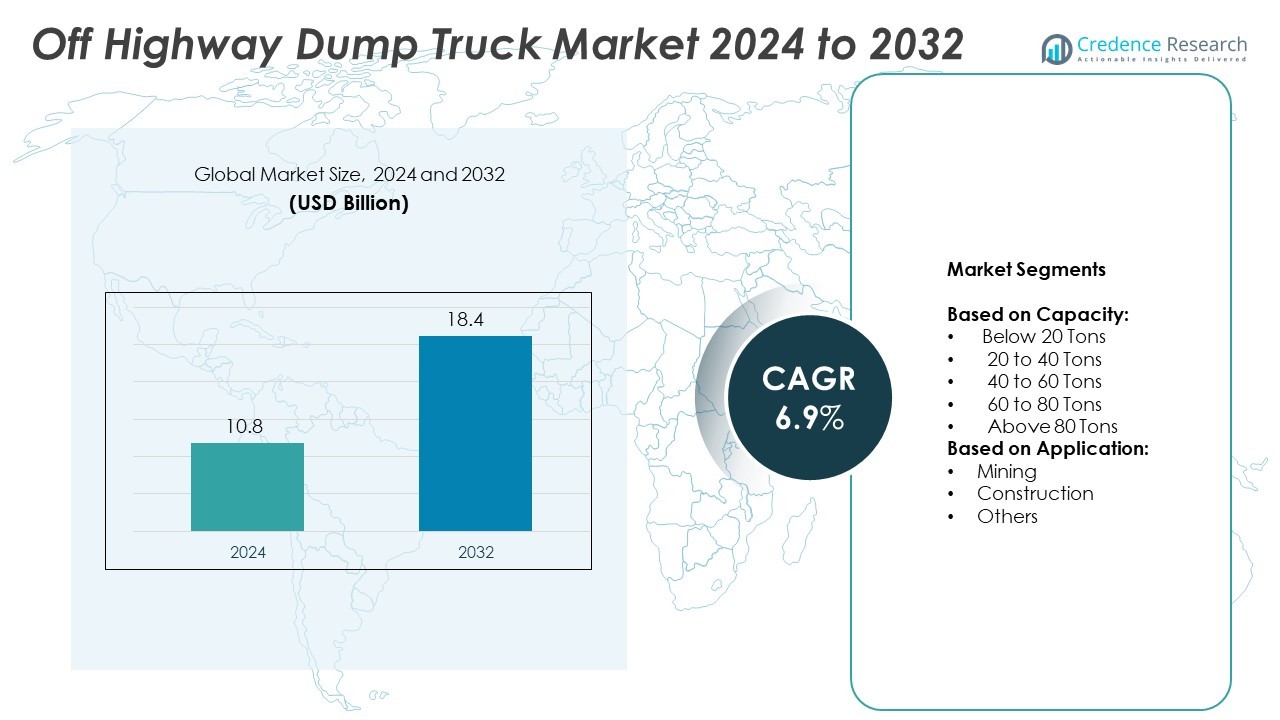

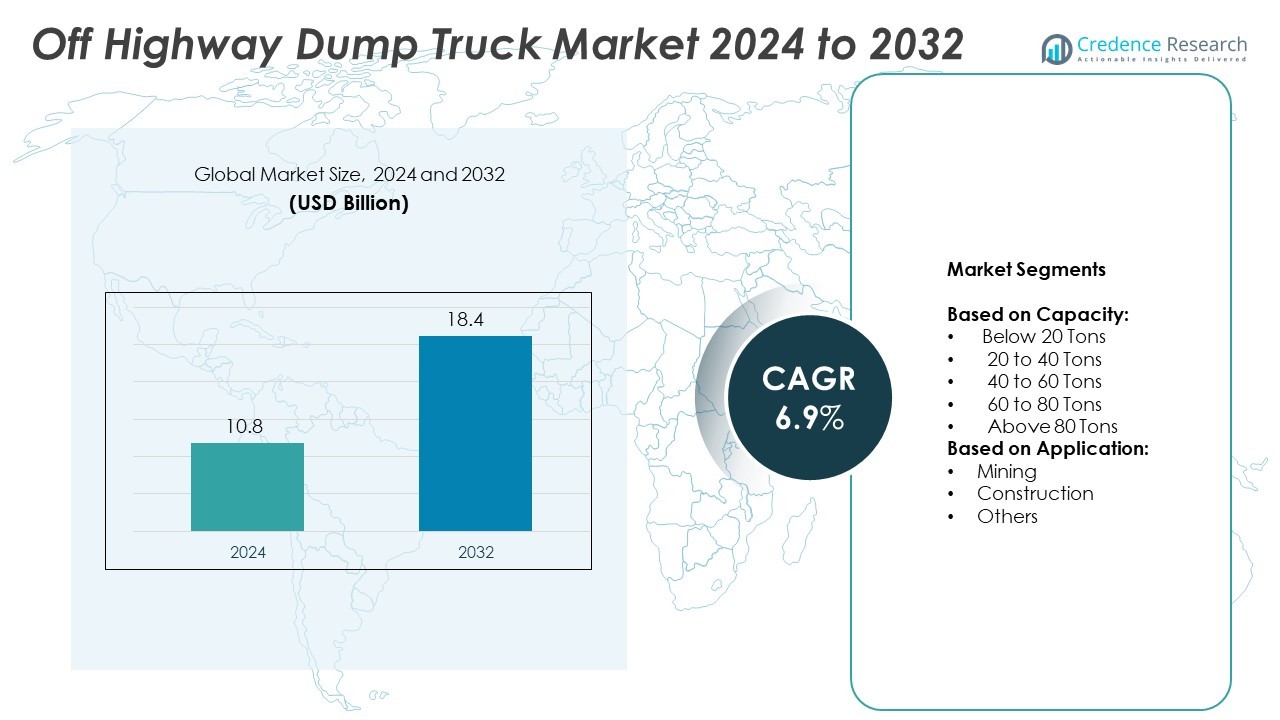

Off Highway Dump Truck market size was valued at USD 10.8 billion in 2024 and is anticipated to reach USD 18.4 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off Highway Dump Truck Market Size 2024 |

USD 10.8 Billion |

| Off Highway Dump Truck Market, CAGR |

6.9% |

| Off Highway Dump Truck Market Size 2032 |

USD 18.4 Billion |

The Off Highway Dump Truck market is driven by rising mining activities, large-scale infrastructure projects, and demand for high-capacity hauling solutions. Manufacturers focus on fuel efficiency, safety, and automation to meet operational needs. Trends include adoption of hybrid engines, autonomous systems, and telematics for real-time monitoring. Regulatory pressure for lower emissions also influences product design. Companies invest in durable, low-maintenance trucks to support extended use in harsh terrains. These developments shape product innovation and fleet modernization across key industries.

Asia-Pacific leads the Off Highway Dump Truck market due to strong mining operations and infrastructure growth in China, India, and Australia. North America follows with steady demand from construction and energy sectors, while Europe focuses on sustainable and fuel-efficient equipment. Latin America and the Middle East & Africa show growing interest driven by mining expansion and infrastructure investment. Key players operating across these regions include Caterpillar, Komatsu, Volvo, and Hitachi Construction Machinery, offering a wide range of models and advanced technology solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Off Highway Dump Truck market was valued at USD 10.8 billion in 2024 and is projected to reach USD 18.4 billion by 2032, growing at a CAGR of 6.9%.

- Growth is driven by increased mining activity and large infrastructure development projects worldwide.

- Key trends include adoption of autonomous dump trucks, hybrid powertrains, and advanced telematics for real-time tracking.

- Leading players such as Caterpillar, Komatsu, Volvo, and Hitachi Construction Machinery compete on technology, durability, and after-sales support.

- High capital costs, maintenance expenses, and strict environmental regulations limit adoption, especially among smaller contractors.

- Asia-Pacific leads the market due to strong demand in China, India, and Australia, with North America and Europe showing steady growth.

- Manufacturers invest in digital fleet management, fuel-efficient engines, and durable designs to meet diverse industry needs.

Market Drivers

Rising Demand from Expanding Mining Activities Across Key Global Regions

The Off Highway Dump Truck market benefits from strong growth in global mining operations. Countries including China, India, and Australia continue to increase mineral and coal extraction. Demand for large-capacity and high-performance dump trucks rises to support heavy load hauling. Mining firms invest in fleets that improve productivity and reduce downtime. The need for trucks with advanced suspension and drivetrain systems grows to handle tough terrains. It creates steady procurement cycles and encourages technological upgrades in the industry. The Off Highway Dump Truck market aligns with growing extraction targets and safety norms.

- For instance, the Komatsu HD1500-8 mechanical drive truck offers a rated payload capacity of 142 metric tonnes (156.5 US tons). It is available with two different heaped body volumes, including 78 m³ (102 yd³). The truck is equipped with a high-rigidity frame that features a V-shape body design and a hydropneumatic suspension system, which allows it to handle rugged mine site conditions

Infrastructure Development Projects Fuel Equipment Procurement Across Developing Economies

Large-scale construction projects in emerging markets stimulate demand for high-capacity transport vehicles. Governments in Southeast Asia, Latin America, and Africa invest heavily in roads, bridges, and dams. It supports high-volume orders of dump trucks for earthmoving and material handling. Urbanization increases pressure on infrastructure networks, prompting quick expansion efforts. Contractors seek machines with high load efficiency, fuel savings, and operator comfort. Modern dump trucks match these requirements and strengthen construction timelines. The Off Highway Dump Truck market gains momentum through recurring equipment demand from project-based work.

- For instance, Liebherr’s T 264 rigid-frame dump truck offers a payload capacity of 240 tonnes, an empty vehicle weight of 176 tonnes, and a gross power output of 2,013 kW. It pairs a Cummins QSK 60 or Liebherr D9812 engine with a highly efficient Litronic Plus AC drive system.

Adoption of Advanced Technologies to Improve Operational Efficiency and Safety

Technology integration in dump trucks drives performance, fuel savings, and safety enhancements. Telematics systems offer real-time data on load, location, and engine conditions. It allows operators and managers to reduce idle times, plan maintenance, and avoid breakdowns. Automation features including collision alerts and GPS-based control boost safety in hazardous areas. Demand for trucks with smart diagnostics and remote monitoring increases among large fleet operators. The Off Highway Dump Truck market reflects this push toward digitalized, data-driven fleet management. Truck makers offer models equipped to meet modern safety and efficiency standards.

Shift Toward Sustainable Equipment and Fuel-Efficient Engines

Environmental regulations increase pressure to lower emissions in heavy-duty equipment. Manufacturers focus on fuel-efficient diesel engines and hybrid powertrains to reduce operating costs and pollution. It encourages adoption of dump trucks with cleaner engines and reduced carbon footprints. Governments promote energy-efficient equipment through incentives and emissions mandates. Fleet operators adopt greener trucks to meet ESG goals and reduce fuel expenses. This trend reshapes product development strategies and procurement decisions. The Off Highway Dump Truck market shows rising interest in sustainable solutions that meet evolving compliance needs.

Market Trends

Growing Preference for Autonomous and Semi-Autonomous Dump Trucks in Mining Fleets

Mining companies increasingly adopt autonomous dump trucks to reduce labor costs and increase safety. Operators use GPS, sensors, and AI systems to control vehicle movement with minimal human input. It improves route efficiency and reduces downtime from human errors. Leading OEMs develop autonomous solutions designed for high-volume mining environments. Trials in regions like Australia and Chile show improved productivity and safety outcomes. Remote operation capabilities support usage in hazardous or isolated zones. The Off Highway Dump Truck market sees steady investment in autonomous technologies across large mining sites.

- For instance, Komatsu’s HD325-8 rigid dump truck delivers a payload of 36.5 metric tonnes, powered by a 518 HP engine, and features an ergonomic operator cab with heated and ventilated seating that enhances operator comfort and productivity

Increased Focus on Electrification and Hybrid Powertrain Integration

Electrification trends reshape product development in heavy-duty off-highway equipment. Manufacturers design hybrid models that cut fuel use and meet emission norms. Electric drivetrains lower noise levels, reduce operating costs, and simplify maintenance. It helps mining and construction companies meet sustainability goals without performance loss. Growth in renewable energy infrastructure supports charging solutions in remote sites. Companies prioritize trucks that offer both environmental and cost-saving benefits. The Off Highway Dump Truck market aligns with these shifts in energy and emission regulations.

- For instance, Volvo CE unveiled the A40 Electric articulated dump truck with a 39-ton payload, powered by a 350 kW electric motor and supported by a 350 kWh battery. It delivers 4–4.5 hours of runtime and can fast-charge from 20 % to 80 % in about one hour using a 350 kW DC charger

Advancement in Tire Technology and Vehicle Durability Solutions

Harsh off-road environments require durable dump truck components that can withstand heavy use. Companies adopt high-performance tires with improved tread and puncture resistance. Suspension systems evolve to reduce vibration and protect payloads across uneven terrain. It minimizes maintenance downtime and extends vehicle life. Manufacturers use lightweight yet high-strength materials to reduce weight while increasing durability. Customers value dump trucks that operate longer with fewer service interruptions. The Off Highway Dump Truck market responds to these needs with rugged, low-maintenance models.

Integration of Fleet Management Systems for Productivity Optimization

Fleet operators rely on digital systems to manage dump truck performance and route efficiency. Telematics platforms provide data on fuel use, load cycles, and maintenance schedules. It helps reduce unplanned downtime and improve fuel economy across large fleets. Companies analyze real-time information to optimize shift planning and machine allocation. Software integration supports preventive maintenance strategies and remote diagnostics. Data-driven decision-making enhances cost control in both mining and construction. The Off Highway Dump Truck market evolves to support connected and intelligent fleet operations.

Market Challenges Analysis

High Capital and Maintenance Costs Limit Adoption Among Small to Mid-Size Operators

Off-highway dump trucks involve significant upfront investments, which restrict adoption by smaller contractors. Procurement, transport, and customization drive up total ownership cost. Routine maintenance, tire replacement, and part wear increase operational expenses over time. It creates financial pressure for companies operating on tight budgets. The need for skilled operators and specialized maintenance crews adds to ongoing costs. Many regional players lease or delay upgrades due to budget limitations. The Off Highway Dump Truck market sees uneven adoption, with large firms driving most purchases.

Regulatory Pressures and Environmental Norms Slow Equipment Deployment

Strict emission standards in key markets require upgrades in engine and exhaust systems. Compliance demands raise production and operational costs for manufacturers and end users. It reduces deployment speed, especially in regions lacking clear subsidy or incentive frameworks. Developing countries often face delays due to slow policy rollouts and infrastructure gaps. Fuel quality standards and restrictions on older diesel engines also affect fleet operations. Companies must invest in cleaner alternatives while managing cost-effectiveness. The Off Highway Dump Truck market faces delays in fleet renewal due to tightening environmental rules.

Market Opportunities

Expansion of Mining Projects in Africa and South America Drives New Equipment Demand

Africa and South America continue to open new mining zones with large resource deposits. Governments support mining activity through foreign investments and regulatory reforms. It fuels demand for high-capacity off-highway dump trucks that can operate in remote and rugged areas. Companies seek vehicles with improved reliability and low fuel consumption to meet long-haul needs. Rising exploration for lithium, copper, and iron ore adds steady equipment requirements. Manufacturers and rental firms gain access to emerging markets through partnerships and service networks. The Off Highway Dump Truck market benefits from this geographic diversification of mining activity.

Smart Infrastructure Development and Smart City Projects Encourage Product Uptake

Public and private investments in smart infrastructure increase demand for efficient earthmoving equipment. Mega projects such as highways, tunnels, and ports require reliable dump trucks to handle bulk materials. Governments allocate large budgets for urban expansion and rural connectivity. It creates recurring orders for trucks with higher payloads, better maneuverability, and digital control features. Cities implementing smart grids and renewable energy hubs need material transport in tight timelines. Trucks with telematics and automation improve planning and site efficiency. The Off Highway Dump Truck market aligns with evolving construction models and digital project management needs.

Market Segmentation Analysis:

By Capacity:

Dump trucks with a capacity of 20 to 40 tons hold a significant share due to balanced payload and cost. These models offer efficiency for both construction and small-scale mining operations. Their lower ownership and fuel costs make them attractive for regional contractors. The 40 to 60 tons segment also shows strong demand from mid-sized mining and infrastructure projects. Trucks above 80 tons dominate heavy mining applications where bulk material needs continuous movement. It includes deployment in coal, iron ore, and copper mining zones. The Off Highway Dump Truck market sees rising preference for higher-capacity models in large-scale operations to reduce cycle times.

- For instance, Hitachi Construction Machinery’s EH4000AC-5 rigid-frame dump truck offers a nominal payload of 242 tonnes and a gross machine operating weight of 427 tonnes. This was an industry-leading payload in the 400-tonne class at the time of its announcement in September 2024. The EH4000AC-5 also achieves a top speed of 65 km/h, representing a significant enhancement in both capacity and productivity compared to its predecessor.

By Application:

Mining is the leading application segment, accounting for the majority of the global demand. Dump trucks support material handling in open-pit and underground mining sites, where payload capacity and engine strength are critical. Mining companies seek models with improved durability, reduced maintenance, and longer service intervals. The construction segment also plays a strong role, especially in urban infrastructure and rural road projects. Construction companies prefer compact models with better maneuverability for varied site conditions. The “Others” segment includes agriculture, quarrying, and landfill use cases with intermittent but rising demand. The Off Highway Dump Truck market addresses these varied needs by offering application-specific configurations and attachments.

- For instance, Komatsu’s 930E-5 electric-drive haul truck handles a payload of 290 metric tons, with an operating weight of 521,631 kg, optimized for equipment-intensive open-pit mining

Segments:

Based on Capacity:

- Below 20 Tons

- 20 to 40 Tons

- 40 to 60 Tons

- 60 to 80 Tons

- Above 80 Tons

Based on Application:

- Mining

- Construction

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 21.3% of the global Off Highway Dump Truck market share. The region sees strong demand from advanced mining operations across the U.S. and Canada. Large-scale infrastructure upgrades, including highway and energy projects, further boost sales. Contractors seek reliable, high-load dump trucks to improve site productivity and reduce labor reliance. Manufacturers in the region offer advanced telematics and operator-assist systems. Demand for semi-autonomous models rises in mining zones with strict safety standards. The Off Highway Dump Truck market in North America continues to benefit from fleet renewals and replacement cycles.

Europe

Europe holds 18.7% of the Off Highway Dump Truck market, supported by ongoing infrastructure investments and regulatory mandates. Countries like Germany, France, and the U.K. focus on sustainable construction and mining practices. Operators in the region prioritize fuel-efficient and low-emission dump trucks. Hybrid models gain traction in environmentally sensitive zones. Cold climate and rough terrains in parts of Northern and Eastern Europe drive demand for durable, weather-resistant equipment. Mining operations in Scandinavia and Eastern Europe contribute steadily to regional sales. It drives continuous investment in modern, low-maintenance vehicle fleets.

Asia-Pacific

Asia-Pacific leads the global market with a dominant 34.6% share, driven by large-scale mining and infrastructure activity. China and India remain key contributors due to high resource extraction and urbanization needs. Massive projects in road construction, dam building, and industrial expansion require large fleets of dump trucks. OEMs in the region offer localized, cost-effective models tailored to terrain and regulatory conditions. Australia supports demand through its strong mining export industry, especially in iron ore and coal. It fuels constant equipment upgrades and high-capacity fleet operations. The Off Highway Dump Truck market in Asia-Pacific sees continued expansion with support from public and private investments.

Latin America

Latin America holds 12.4% of the market, largely driven by the mining sector in countries like Brazil, Chile, and Peru. Copper, lithium, and gold mining create strong demand for dump trucks with high-load capabilities. Many sites operate in remote regions, prompting need for fuel-efficient and rugged models. Public infrastructure projects in major cities increase construction-based truck procurement. Regional governments promote development through public-private partnerships. Import reliance remains high, but fleet modernization efforts support market activity. It positions Latin America as a steadily growing region for equipment suppliers.

Middle East & Africa

The Middle East & Africa contribute 13.0% of the Off Highway Dump Truck market share. Resource extraction remains a key driver, with mining and quarrying gaining momentum. South Africa, Nigeria, and the UAE show increased interest in upgrading material transport fleets. Infrastructure growth, especially in the GCC region, also fuels demand. Harsh climate and terrain require heavy-duty models with thermal and dust-resistant features. OEMs expand service networks to support product performance and maintenance. It helps meet rising demand across new and developing projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Doosan

- BZK

- Komatsu

- Liebherr

- Freightliner

- Hitachi Construction Machinery

- John Deere

- Shougang Heavy Truck

- Hydrema

- Bell

- Volvo

- Caterpillar

- XCMG

- NHL

- Belaz

Competitive Analysis

The Off Highway Dump Truck market includes key players such as Caterpillar, Komatsu, Volvo, Hitachi Construction Machinery, Liebherr, John Deere, Doosan, Bell, Belaz, Hydrema, XCMG, Shougang Heavy Truck, BZK, NHL, and Freightliner. These companies compete through technological innovation, broad product portfolios, and strong distribution networks. Market leaders invest heavily in R&D to develop fuel-efficient engines, autonomous systems, and electric drivetrains. They focus on performance, durability, and total cost of ownership to meet the evolving needs of mining and construction sectors.Product customization and after-sales support play major roles in customer retention. Players with strong global service infrastructure gain a competitive edge, especially in remote and high-demand environments. Pricing strategies vary across regions, depending on local regulations, import duties, and fleet size requirements. Companies also prioritize partnerships with local dealers and financing firms to strengthen market reach. Brand reputation, safety features, and machine reliability influence buying decisions in high-volume sectors. The competitive landscape remains dynamic, with continuous upgrades in load capacity, automation, and predictive maintenance tools. Players that align product design with sustainability and digital control trends are likely to maintain leadership. Global presence, innovation, and operational support continue to shape competition in the Off Highway Dump Truck market.

Recent Developments

- In April 2025,Volvo Construction Equipment (Volvo CE) revealed its world‑first battery‑electric articulated haulers (A30 Electric and A40 Electric), announcing availability for European customers from 2026

- In February 2025, Komatsu began testing what it claims is the world’s first large hydrogen‑combustion dump truck (HD785, 92‑ton payload) in concept trials

- In July 2023, Komatsu launched the Operator Guidance Monitor (OGM), a digital solution for rigid dump trucks on mine and quarry sites to boost safety and reduce costs.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of autonomous dump trucks in large-scale mining operations.

- Demand for hybrid and electric dump trucks will rise to meet emission regulations.

- Asia-Pacific will continue leading global demand due to strong infrastructure growth.

- Telematics and real-time monitoring systems will become standard across new models.

- OEMs will expand aftermarket services and parts support in emerging markets.

- Fleet operators will focus on fuel-efficient trucks to cut long-term operational costs.

- Government-funded infrastructure projects will boost short-term equipment demand.

- Compact dump trucks will gain traction in urban construction projects.

- Manufacturers will invest in lightweight and durable materials for extended truck life.

- Remote and digital maintenance tools will improve uptime and reduce service costs.