Market Overview

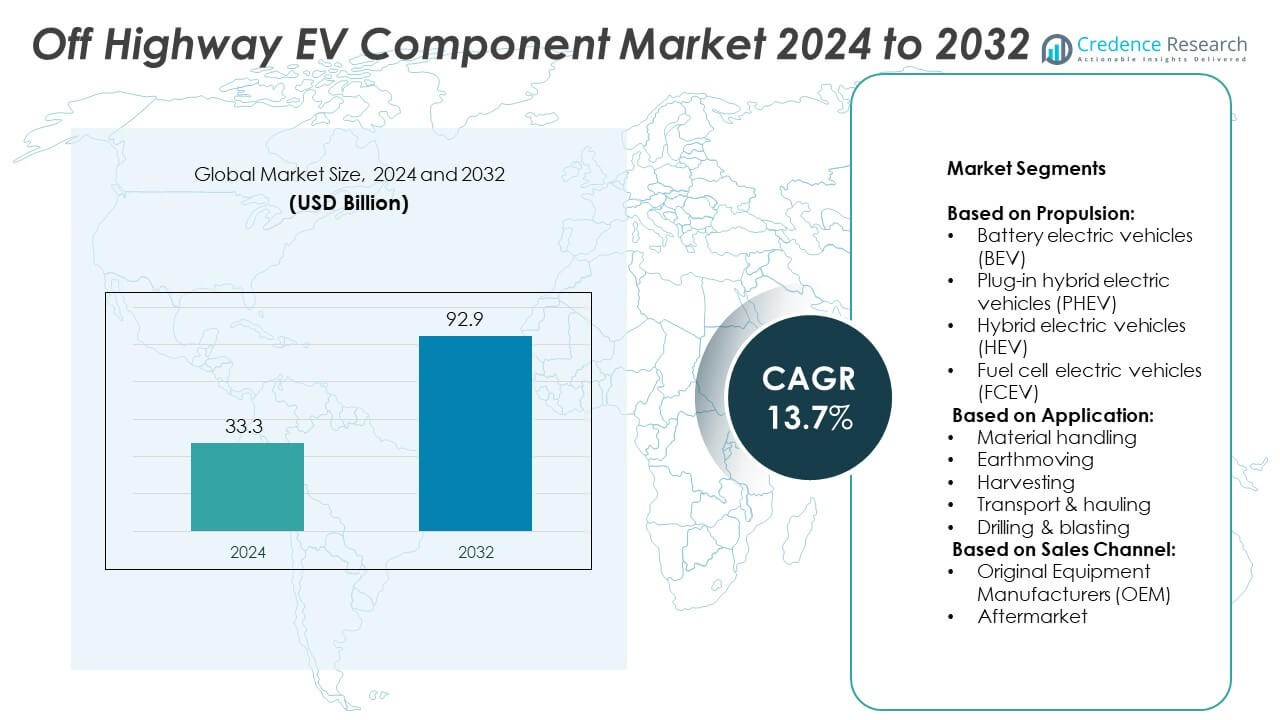

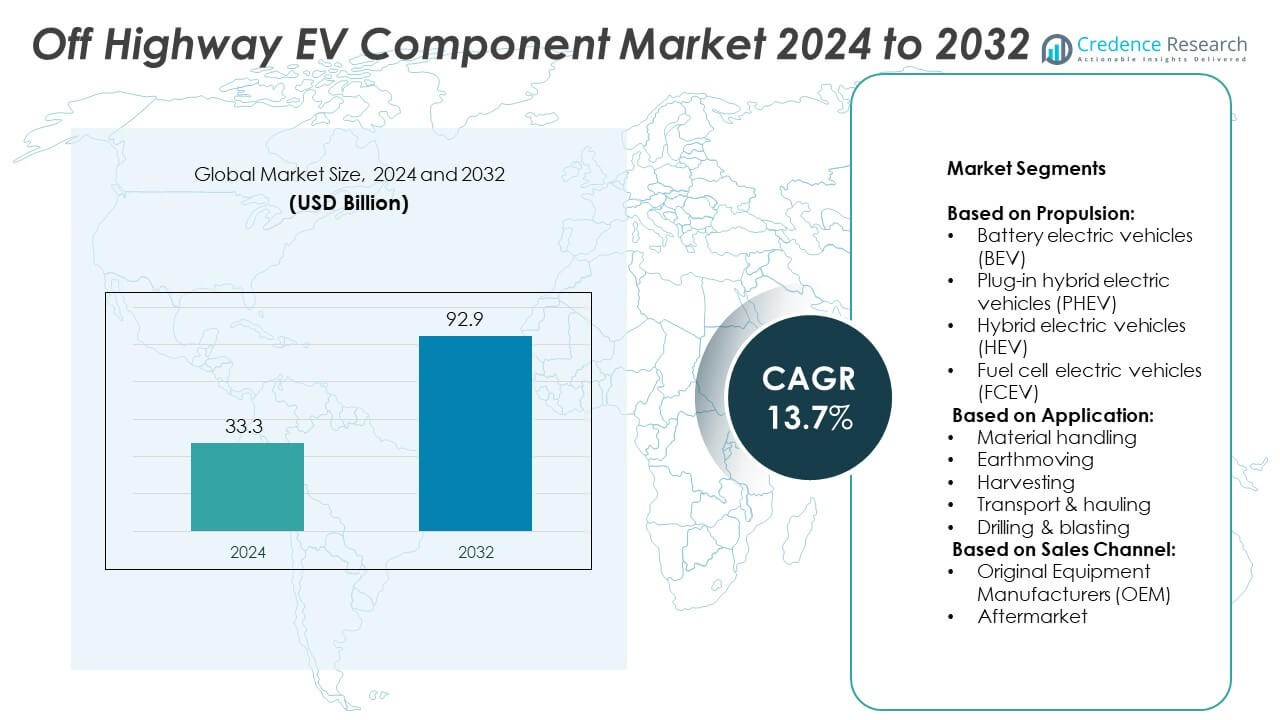

Off Highway EV Component Market size was valued at USD 33.3 billion in 2024 and is anticipated to reach USD 92.9 billion by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off Highway EV Component Market Size 2024 |

USD 33.3 Billion |

| Off Highway EV Component Market, CAGR |

13.7% |

| Off Highway EV Component Market Size 2032 |

USD 92.9 Billion |

The Off Highway EV Component market grows rapidly due to rising electrification across construction, agriculture, and mining sectors. Increasing demand for energy-efficient solutions, government emission regulations, and sustainability goals drive adoption. Advancements in battery technologies, smart powertrain systems, and IoT integration enhance performance and operational efficiency. Growing investments in charging infrastructure and innovative EV components further accelerate market expansion. Collaboration between OEMs and technology providers supports development of advanced solutions, positioning the market for significant long-term growth.

The Off Highway EV Component market shows strong growth across Asia Pacific, North America, and Europe, driven by rising electrification and technological innovation. Asia Pacific leads adoption with rapid industrialization and infrastructure development, while North America focuses on advanced battery technologies and smart systems. Europe emphasizes sustainability and stringent emission regulations, boosting electric equipment demand. Key players such as Caterpillar, Komatsu, Volvo AB, and Deere & Company invest heavily in research, partnerships, and innovative solutions to enhance market competitiveness globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Off Highway EV Component market was valued at USD 33.3 billion in 2024 and is projected to reach USD 92.9 billion by 2032, growing at a CAGR of 13.7% during the forecast period.

- Rising demand for electrification in construction, mining, and agriculture drives market expansion, supported by government regulations and sustainability initiatives.

- Advancements in battery technologies, IoT integration, and smart powertrain systems create strong growth opportunities and enhance operational efficiency in off-highway vehicles.

- The market is highly competitive, with key players like Caterpillar, Komatsu, Volvo AB, and Deere & Company investing in innovation, partnerships, and advanced EV components to strengthen their global presence.

- High initial costs, limited charging infrastructure, and technical challenges in heavy-duty vehicle electrification act as restraints, slowing adoption in some regions.

- Asia Pacific leads the market due to rapid industrialization, infrastructure growth, and manufacturing strength, while North America and Europe focus on sustainability, technological innovation, and regulatory compliance.

- Emerging economies in Latin America and the Middle East & Africa offer significant growth potential, driven by fleet modernization, supportive policies, and increasing adoption of energy-efficient off-highway machinery.

Market Drivers

Rising Adoption of Electrification in Off-Highway Vehicles

The Off Highway EV Component market experiences strong growth driven by rapid electrification trends. Construction, agriculture, and mining industries increasingly shift toward electric powertrains to reduce emissions. Governments promote clean energy adoption through stricter regulations and incentive programs. Manufacturers integrate advanced battery systems, motors, and controllers for improved performance and efficiency. Growing environmental awareness encourages fleet owners to replace diesel-powered equipment with electric alternatives. This transition accelerates demand for high-performance EV components supporting sustainable operations.

- For instance, Sandvik has deployed a fleet of over 600 electric off‑highway units, including loaders, trucks, and drill rigs.

Advancements in Battery Technologies Enhancing Vehicle Performance

Lithium-ion and solid-state battery developments improve energy density and charging efficiency, fueling market expansion. The Off Highway EV Component market benefits from extended operational hours and lower maintenance requirements due to advanced battery designs. Manufacturers focus on producing compact, lightweight batteries with higher power output. Fast-charging technologies reduce downtime, supporting continuous equipment usage in demanding environments. Integration of battery management systems ensures greater safety and reliability. These advancements strengthen adoption across heavy-duty applications, increasing demand for premium components.

- For instance, a major mining application, such as the electrification of a 100-tonne haul truck, Xerotech supplied six modular battery packs, each rated at 290 kWh, which are connected together. These packs contain many thousands of individual cells to achieve the required energy capacity, but the final count depends on the specific battery configuration

Government Regulations and Incentives Driving Market Expansion

Stringent emission norms and sustainability goals drive industries to adopt electric-powered machinery. The Off Highway EV Component market sees rising investments due to policy-driven transitions from diesel to electric solutions. Governments introduce tax benefits, subsidies, and funding for research on EV technologies. Infrastructure development, including charging stations for off-highway vehicles, boosts overall adoption. Regulatory mandates encourage OEMs to innovate and deliver efficient, eco-friendly components. This support fosters wider electrification across multiple off-highway applications globally.

Integration of Smart Technologies for Operational Efficiency

IoT-enabled systems and advanced telematics optimize electric vehicle operations and maintenance schedules. The Off Highway EV Component market benefits from predictive analytics improving battery performance and overall machine uptime. Real-time data tracking enhances energy management, reducing operational costs for fleet operators. Manufacturers integrate intelligent power distribution units and control systems to maximize efficiency. AI-driven software assists in monitoring equipment health and extending component life cycles. These innovations accelerate the adoption of electric systems across the off-highway equipment landscape.

Market Trends

Growing Shift Toward Electrification Across Off-Highway Applications

The Off Highway EV Component market shows a strong transition from diesel-powered equipment to electric alternatives. Industries like construction, agriculture, and mining increasingly prefer electric machines for better efficiency and lower emissions. Manufacturers introduce advanced electric drivetrains to improve performance and meet sustainability targets. Rising fuel costs encourage operators to adopt electric solutions for long-term savings. Increased awareness of carbon reduction drives global demand for eco-friendly components. This shift creates growth opportunities for innovative suppliers supporting electric transformation.

- For instance, public listings show 325 models of electric and zero-emission construction and mining equipment included in a regulatory clean equipment list

Advancements in Powertrain and Energy Storage Technologies

Innovations in battery energy density, charging speed, and motor efficiency influence market dynamics significantly. The Off Highway EV Component market gains momentum with improved lithium-ion and solid-state battery technologies. Compact, high-capacity batteries enable extended machine operation with minimal downtime. Manufacturers develop efficient powertrain systems integrating smart controllers and regenerative braking technologies. High-voltage architectures enhance energy utilization while reducing overall weight and maintenance costs. These advancements strengthen adoption across heavy-duty sectors seeking reliable electric solutions.

- For instance, the electrification of material handling is a significant trend, driven by regulations and market demand. A July 2024 fact sheet from the California Air Resources Board (CARB) indicates that the number of certified zero-emission forklifts on their “Advanced Clean Off-Road Equipment” (ACE) list was 394 at that time.

Rising Integration of IoT and Telematics in EV Systems

Connected technologies enable real-time monitoring and improved operational efficiency in off-highway machinery. The Off Highway EV Component market benefits from IoT-enabled systems tracking battery health and performance. Telematics solutions provide predictive maintenance insights, reducing unexpected failures. Integration of AI-based analytics optimizes energy consumption and improves equipment uptime. Fleet managers leverage data-driven insights to enhance productivity and cost control. These intelligent technologies accelerate the adoption of smart, efficient EV components globally.

Increasing Investments and Collaborations Among Industry Players

Global manufacturers focus on strategic partnerships to advance electric vehicle technologies and infrastructure. The Off Highway EV Component market experiences rapid investment growth from OEMs and technology providers. Companies collaborate to develop innovative motors, batteries, and charging solutions tailored for heavy-duty applications. Expanding research efforts aim to achieve higher energy efficiency and lower production costs. Joint ventures between component makers and equipment manufacturers strengthen market competitiveness. This trend drives large-scale electrification across the off-highway equipment sector worldwide.

Market Challenges Analysis

High Initial Costs and Limited Charging Infrastructure

The Off Highway EV Component market faces significant challenges due to high upfront investment requirements. Electric powertrains, advanced batteries, and control systems increase equipment costs for manufacturers and end-users. Many operators in construction, agriculture, and mining hesitate to transition because of uncertain return on investment. Limited availability of fast-charging infrastructure in remote locations further slows adoption. It requires substantial funding to develop reliable charging networks that support heavy-duty operations. These cost-related barriers restrict large-scale deployment across multiple off-highway applications.

Technical Limitations and Supply Chain Constraints

Performance optimization of batteries and motors for demanding off-highway environments remains complex. The Off Highway EV Component market struggles with balancing energy efficiency, durability, and operational range. Extreme weather, high loads, and rough terrains challenge system reliability. Global supply chain disruptions create shortages of critical components such as semiconductors and lithium. It impacts production timelines and delays equipment delivery across key sectors. Manufacturers invest heavily in research to overcome technical limitations and ensure stable supply availability.

Market Opportunities

Expanding Demand for Sustainable and Energy-Efficient Equipment

The Off Highway EV Component market presents strong opportunities due to rising global focus on sustainability. Governments implement stricter emission regulations, driving industries to adopt electric-powered machinery. Operators seek energy-efficient solutions to reduce operational costs and meet environmental targets. Manufacturers develop advanced battery systems, motors, and control technologies to enhance performance and productivity. It creates growth potential for suppliers offering innovative and eco-friendly components. Increasing investments in green technologies support widespread adoption across construction, agriculture, and mining sectors.

Growing Infrastructure Development and Technological Innovation

Rapid advancements in charging infrastructure and smart energy solutions create significant market prospects. The Off Highway EV Component market benefits from ongoing investments in fast-charging systems and high-capacity batteries. Integration of IoT-enabled monitoring and AI-driven analytics enhances operational efficiency and machine performance. Manufacturers explore opportunities in developing modular, scalable EV components tailored for diverse applications. It drives collaboration between OEMs, technology providers, and energy companies to accelerate adoption. Expanding electrification projects in emerging economies further strengthen future market growth potential.

Market Segmentation Analysis:

By Propulsion:

The Off Highway EV Component market is segmented into battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), hybrid electric vehicles (HEV), and fuel cell electric vehicles (FCEV). BEVs lead the segment due to their zero-emission capabilities and lower operating costs. Manufacturers focus on developing high-capacity batteries to support longer operating hours in demanding conditions. PHEVs gain traction in sectors requiring flexibility between electric and fuel-based systems. HEVs remain popular in regions with limited charging infrastructure, offering better fuel efficiency and reduced emissions. FCEVs show growing potential, particularly in applications requiring extended range and high-power output, supported by ongoing hydrogen infrastructure developments.

- For instance, Komatsu has deployed more than 875 autonomous haul haul trucks that have collectively transported over 10 billion metric tonnes of material using electric-drive technology.

By Application:

The market is categorized into material handling, earthmoving, harvesting, transport and hauling, and drilling and blasting. Material handling equipment, including forklifts and loaders, holds a significant share due to rising warehouse automation and industrial electrification. The earthmoving segment shows rapid growth, driven by construction and mining projects requiring high-performance components. Harvesting equipment adoption rises with precision farming techniques and increasing demand for sustainable agricultural practices. Transport and hauling applications benefit from the shift toward electrification in logistics and mining sectors. Drilling and blasting equipment gradually adopts electric systems to reduce emissions and improve operational efficiency in extreme environments.

- For instance, Volvo Construction Equipment’s L120 Electric wheel loader features a 22‑ton operating weight, a 6‑ton lifting capacity, and a 282-kWh battery delivering up to nine hours of runtime per charge.

By Sales Channel:

The market is divided into original equipment manufacturers (OEM) and aftermarket. OEMs dominate the segment due to rising production of electric-powered equipment and strong collaborations with technology providers. Manufacturers invest in integrating advanced EV components into new machinery to meet regulatory and efficiency demands. The aftermarket segment gains momentum with the growing need for replacement batteries, motors, and control systems. It supports long-term operational performance and enhances the life cycle of off-highway vehicles. Both channels contribute significantly to expanding the overall market presence and driving continuous innovation.

Segments:

Based on Propulsion:

- Battery electric vehicles (BEV)

- Plug-in hybrid electric vehicles (PHEV)

- Hybrid electric vehicles (HEV)

- Fuel cell electric vehicles (FCEV)

Based on Application:

- Material handling

- Earthmoving

- Harvesting

- Transport & hauling

- Drilling & blasting

Based on Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The region holds a commanding 30% share of the global Off Highway EV Component market. Its strong position stems from government incentives, sustainable policies, and rapidly expanding infrastructure. The United States and Canada lead growth, driven by electrification in construction, mining, and agriculture sectors. It benefits from substantial investment in charging networks and research collaborations between OEMs and technology firms. Growing adoption of BEVs and hybrid platforms fuels demand for high-performance components. Manufacturers focus on rugged, efficient batteries and electric drivetrains tailored to heavy-duty operations. The region’s advanced regulatory frameworks and financial support enhance its competitive edge.

Europe

Europe delivers approximately 25% of the global Off Highway EV Component market share. The region’s share stems from stringent emission standards, government subsidy schemes, and strong sustainability mandates. Key markets such as Germany, UK, and France push heavy machinery electrification in construction and agriculture. It shows rising demand for sophisticated EV components featuring smart control systems and high-density batteries. Collaboration between OEMs and energy firms accelerates charging infrastructure rollout. Component makers tailor solutions to meet tougher safety and performance regulations. Europe’s green industrial strategy underpins long-term market stability and innovation.

Asia Pacific

Asia Pacific commands the largest share at 35% of the Off Highway EV Component market, led by China and India. Urbanization, infrastructure expansion, and industrial electrification drive robust growth. It taps into deep supply chains, local manufacturing strength, and government backing for electric machinery. Component makers in the region ramp up production of cost-efficient batteries, motors, and power electronics. Manufacturers leverage IoT integration and modular designs to meet diverse application needs. Rapid adoption across mining and agriculture sectors strengthens demand. The region’s scale and manufacturing advantages position it as a global leader in off‑highway EV components.

Latin America

Latin America accounts for roughly 5% of the global Off Highway EV Component market. Adoption lags due to limited infrastructure and higher equipment costs. It shows early signs of growth in infrastructure projects and mining operations. Governments begin exploring EV incentives and subsidies for heavy machinery. Component suppliers target opportunities in fleet modernization and energy-efficient equipment deployment. Modular, lower-cost solutions make inroads in agriculture and construction sectors. The region holds long-term potential as policy shifts and funding improve market viability.

Middle East & Africa

This region contributes about 5% of the global Off Highway EV Component market share. Growth remains modest due to infrastructure gaps, regulatory challenges, and capital limitations. It reveals niche demand in mining and specialized material handling operations. Governments gradually promote cleaner technologies in key industries. Component providers explore opportunities in fleet electrification and renewable energy integration. Durability and compatibility with harsh environments guide component design. Expansion depends on policy support, infrastructure investment, and regional collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr

- Tata Elxsi

- Volvo AB

- Sona Comstar

- Komatsu

- Kubota

- Caterpillar

- Hitachi Construction Machinery

- Tata AutoComp

- Deere & Company

Competitive Analysis

The Off Highway EV Component market is highly competitive, with leading players including Caterpillar, Deere & Company, Hitachi Construction Machinery, Komatsu, Kubota, Liebherr, Sona Comstar, Tata AutoComp, Tata Elxsi, and Volvo AB. These companies focus on technological innovation, strategic partnerships, and expanding product portfolios to strengthen their market positions. They invest heavily in developing advanced batteries, electric drivetrains, and control systems to meet growing demand for sustainable and high-performance solutions. Strong research and development initiatives enable them to improve efficiency, durability, and energy optimization in off-highway machinery. Manufacturers emphasize collaboration with OEMs and technology providers to enhance integration of EV components across applications such as construction, agriculture, and mining. Market leaders also expand their global footprints by leveraging production capabilities, local partnerships, and aftersales networks. Increasing competition drives continuous improvements in product quality, cost-effectiveness, and operational reliability, ensuring sustained growth in a rapidly evolving industry landscape.

Recent Developments

- In 2025, Caterpillar also showcased investments in autonomy, connectivity, alternative fuels, and electrification at CES.

- In 2025, Deere unveiled its autonomy kit for large tractors and expanded capabilities for its 9RX autonomous tillage tractor.

- In February 2025, global private equity firm Carlyle acquired controlling stakes in India’s Roop Automotives and Highway Industries, merging them to form a diversified global auto parts platform. The new platform, backed by Carlyle Asia Partners, manufactures forged and precision-machined components, steering assemblies, and powertrain parts for electric, hybrid, and internal combustion engine (ICE) vehicles.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric drivetrains will rise in construction, agriculture, and mining.

- Manufacturers will optimize battery systems for extended run-time and durability.

- Integration of smart controls and IoT will increase component efficiency.

- Growth in charging infrastructure will support remote, heavy-duty equipment.

- OEMs will form partnerships with tech firms to innovate EV components.

- Governments will expand subsidies and policies to boost sector electrification.

- Suppliers will develop modular components for scalability across applications.

- Fuel cell and hydrogen hybrid systems will gain momentum for high-load tasks.

- Aftermarket services will expand to support maintenance of EV systems.

- Adoption in emerging markets will grow as infrastructure and funding improve.