Market Overview:

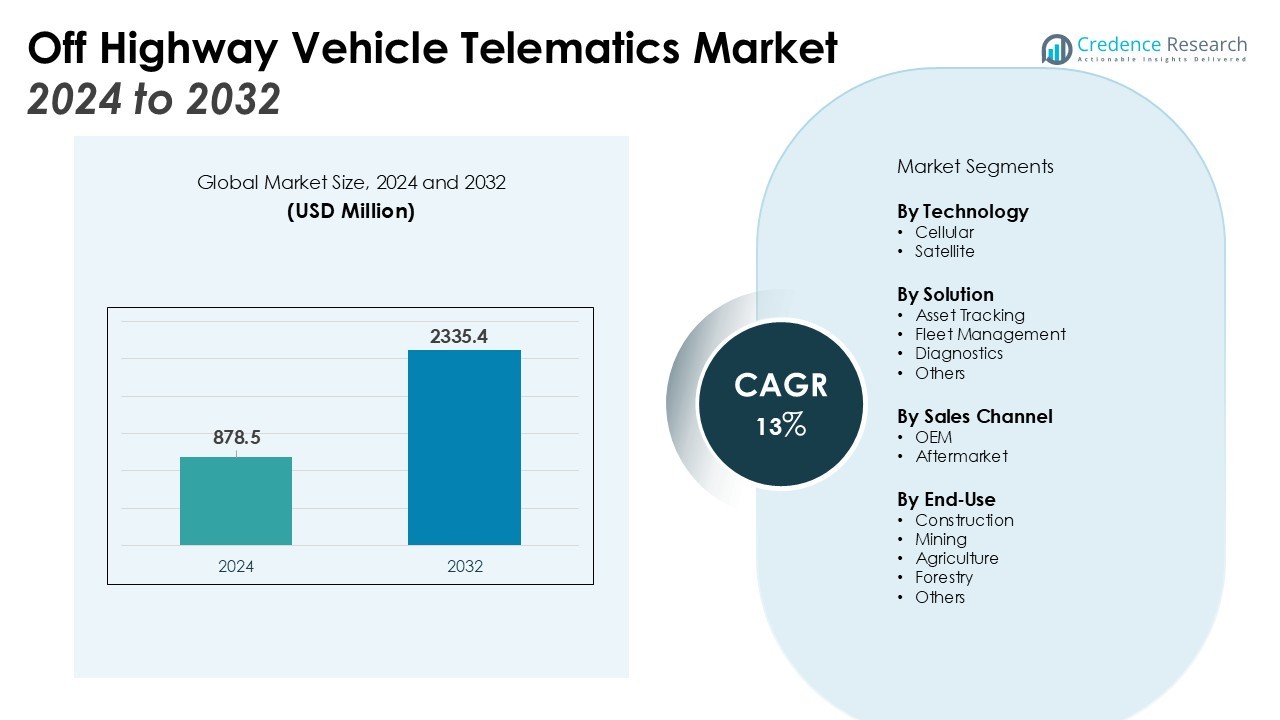

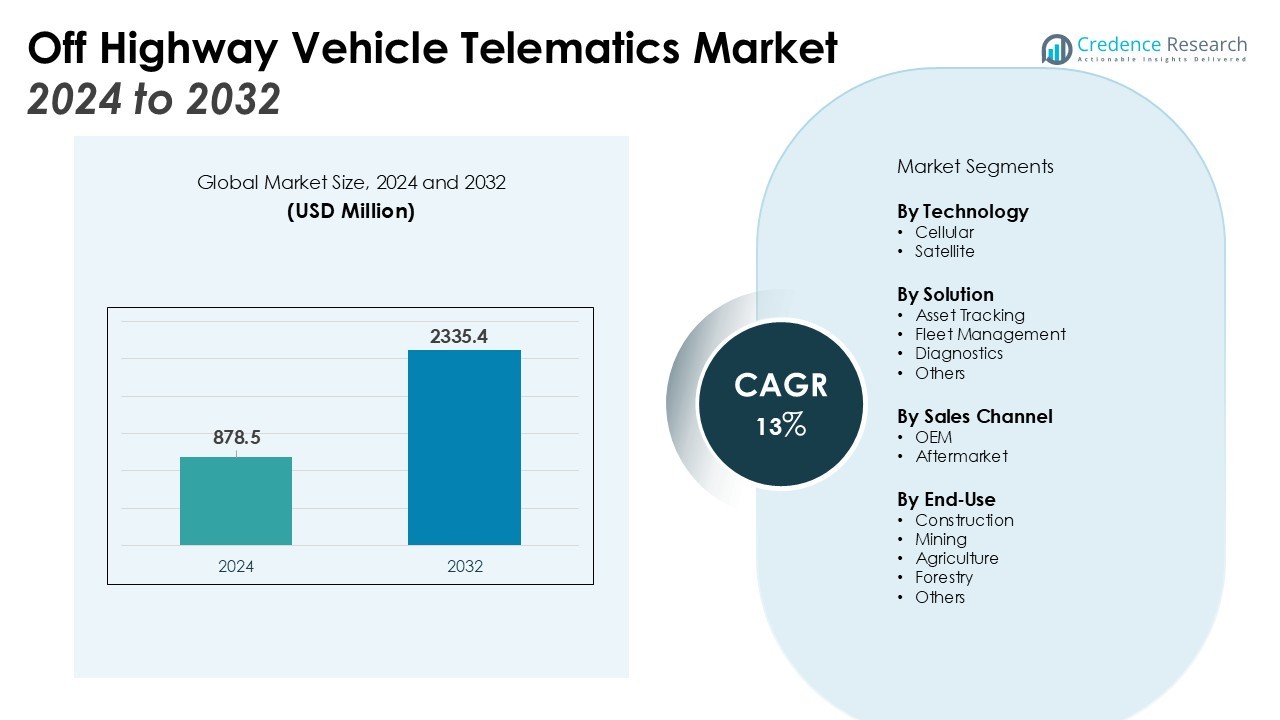

The Off Highway Vehicle Telematics Market size was valued at USD 878.5 million in 2024 and is anticipated to reach USD 2335.4 million by 2032, at a CAGR of 13% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off Highway Vehicle Telematics Market Size 2024 |

USD 878.5 Million |

| Off Highway Vehicle Telematics Market, CAGR |

13% |

| Off Highway Vehicle Telematics Market Size 2032 |

USD 2335.4 Million |

Growth is strongly influenced by the demand for higher operational efficiency, real-time diagnostics, and reduced downtime in heavy equipment. The adoption of predictive maintenance tools is helping operators extend machine life and reduce unplanned failures. Expanding fleet visibility and remote monitoring capabilities are improving decision-making and driving higher returns on asset utilization. At the same time, original equipment manufacturers are embedding telematics systems at the factory stage, making the technology more cost-effective and widely accessible. Rising integration of AI and IoT within telematics platforms is further enhancing analytics and automation capabilities.

Asia Pacific is emerging as the fastest-growing region, fueled by large-scale infrastructure development and the adoption of mechanized farming solutions. North America maintains a strong position with advanced digital adoption, regulatory frameworks, and an established dealer network that supports widespread implementation. Europe also demonstrates solid momentum as regulatory pressure on safety and emissions encourages greater telematics use, while the U.S. benefits from infrastructure expansion and the need to optimize operating costs. Growing collaborations between technology providers and equipment manufacturers are strengthening market penetration across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Off Highway Vehicle Telematics Market is projected to grow at a 13% CAGR, reaching strong multi-billion valuations by 2032.

- Rising demand for higher efficiency, real-time diagnostics, and reduced downtime is fueling adoption across construction, mining, and agriculture.

- Predictive maintenance capabilities are helping operators extend machine life, lower repair costs, and reduce unplanned failures.

- Integration of AI, IoT, and advanced connectivity is enhancing data analytics, automation, and remote fleet monitoring.

- High costs, data management complexity, and cybersecurity concerns remain major barriers, particularly for smaller operators.

- Asia Pacific leads with the largest share due to infrastructure growth and mechanized agriculture, while North America remains strong through regulations and advanced networks.

- Europe demonstrates consistent growth, driven by strict emission standards, safety regulations, and expanding OEM-technology collaborations.

Market Drivers:

Rising Demand for Operational Efficiency and Cost Reduction

The Off Highway Vehicle Telematics Market is driven by the need to maximize operational efficiency and lower costs. Companies in construction, mining, and agriculture focus on minimizing downtime and ensuring equipment reliability. Telematics solutions provide real-time diagnostics that enable faster decision-making. It helps reduce unplanned maintenance and ensures better use of assets across fleets. This efficiency focus strengthens adoption across industries managing high-value machinery.

- For instance, Caterpillar’s Product Link telematics system enables real-time access to engine operating hours and key diagnostics, helping operators reduce unexpected downtime by monitoring conditions continuously through VisionLink software, used across more than 1 million connected machines globally.

Growing Adoption of Predictive Maintenance Solutions

Predictive maintenance has become a key factor fueling demand in the Off Highway Vehicle Telematics Market. Advanced telematics systems allow operators to detect faults early, extend machine life, and improve safety. It reduces unexpected breakdowns and supports better planning for servicing schedules. Companies benefit from lower repair costs and improved machine availability. This driver plays a critical role in expanding the market footprint.

Integration of AI, IoT, and Advanced Connectivity

The Off Highway Vehicle Telematics Market benefits from the rapid integration of AI, IoT, and advanced connectivity. These technologies enhance data collection, enable accurate analytics, and improve automation in equipment management. It supports remote monitoring and real-time tracking of fleet operations. Enhanced connectivity ensures seamless information flow across operators and owners. This development is strengthening telematics adoption across diverse applications.

- For instance, Bosch Rexroth’s BODAS Connect system, based on over 20 years of Linux-based connectivity unit development with Owasys hardware, provides rugged IoT telematics solutions customizable for off-highway vehicles operating reliably in harsh environments.

Regulatory Support and OEM Factory Integration

Government regulations on safety, emissions, and operational transparency are creating strong opportunities in the Off Highway Vehicle Telematics Market. OEMs increasingly embed telematics systems at the factory stage, reducing integration costs and encouraging widespread use. It allows customers to access ready-to-use solutions with advanced features. Regulatory standards further push companies to adopt systems that improve compliance. These combined factors continue to accelerate market expansion.

Market Trends:

Advancement of Connected Technologies and Data-Driven Insights

The Off Highway Vehicle Telematics Market is witnessing strong progress through connected technologies that enhance equipment management and decision-making. Telematics platforms now combine GPS tracking, real-time diagnostics, and cloud-based analytics to deliver actionable insights. It enables fleet managers to monitor fuel consumption, machine health, and operator behavior with higher accuracy. The integration of AI and IoT supports predictive capabilities that improve productivity and reduce downtime. Strong demand for data-driven decision-making is pushing companies to invest in advanced telematics systems. This trend is also creating opportunities for partnerships between technology providers and equipment manufacturers to develop tailored solutions.

- For instance, Geotab’s GO9 RUGGED telematics device, designed for harsh environments, provides IP67-rated protection and real-time location tracking for heavy equipment, supporting fleet visibility in diverse conditions.

Shift Toward Integrated Ecosystems and Sustainability Goals

The Off Highway Vehicle Telematics Market is evolving into an ecosystem that connects multiple stakeholders, including OEMs, service providers, and operators. It supports seamless communication across fleets and improves transparency in operations. Integration with digital platforms is enhancing asset tracking, regulatory compliance, and remote support. A growing focus on sustainability is driving the adoption of telematics to reduce emissions and improve resource utilization. Companies are using these systems to meet environmental standards while optimizing operational efficiency. This shift highlights the broader role of telematics in building sustainable and connected industrial operations.

- For instance, Komatsu’s My Komatsu digital hub aggregates data from multiple equipment brands using ISO API 15143-3 standards, providing maintenance alerts and performance insights that help operators reduce downtime and better manage fuel consumption.

Market Challenges Analysis:

High Implementation Costs and Data Management Complexity

The Off Highway Vehicle Telematics Market faces barriers due to high upfront costs and integration challenges. Many small and mid-sized operators hesitate to invest because installation and subscription fees increase total ownership expenses. It also demands skilled technicians and advanced IT infrastructure to manage operations effectively. Data management adds complexity, as handling large volumes of telematics information requires secure storage and processing systems. Concerns over data ownership between OEMs, fleet managers, and service providers further limit adoption. These factors slow penetration among price-sensitive end users and regions with limited digital infrastructure.

Cybersecurity Risks and Connectivity Limitations

The Off Highway Vehicle Telematics Market also faces challenges linked to cybersecurity and network reliability. Growing reliance on connected platforms exposes fleets to risks of unauthorized access and data breaches. It raises concerns over equipment safety, operational disruption, and financial losses. Limited connectivity in remote mining, forestry, and construction sites restricts real-time monitoring and reduces system effectiveness. Variations in global standards for data security and compliance complicate large-scale deployments. These issues highlight the need for robust cybersecurity measures and improved connectivity to unlock the full potential of telematics solutions.

Market Opportunities:

Expansion of Smart Infrastructure and Digital Transformation

The Off Highway Vehicle Telematics Market holds significant opportunities through the expansion of smart infrastructure and digital adoption across industries. Governments and private sectors are investing in modern construction, mining, and agriculture projects that demand advanced fleet management. It enables operators to adopt connected solutions that improve efficiency, safety, and cost control. Digital transformation is creating demand for predictive analytics and automation, strengthening the role of telematics in equipment ecosystems. Emerging applications in precision farming and resource optimization further expand the scope of deployment. These developments provide strong potential for growth across both developed and developing regions.

OEM Partnerships and Sustainability-Driven Adoption

The Off Highway Vehicle Telematics Market is positioned to benefit from closer collaboration between OEMs and technology providers. Factory-installed telematics systems reduce integration costs and accelerate adoption among end users. It ensures customers have access to ready-to-use platforms that enhance compliance and operational performance. Growing emphasis on sustainability also creates opportunities, as telematics supports emission reduction and better fuel efficiency. Companies are increasingly aligning telematics with environmental goals to meet regulations and corporate responsibility targets. These factors highlight the potential for strong long-term expansion in global markets.

Market Segmentation Analysis:

By Technology

The Off Highway Vehicle Telematics Market by technology is segmented into cellular and satellite-based systems. Cellular technology dominates due to widespread mobile network availability and cost-effective integration. It supports real-time data transfer, remote monitoring, and advanced analytics across construction and agriculture fleets. Satellite-based systems remain important in mining, forestry, and other remote applications where terrestrial connectivity is limited. The growing use of hybrid models combining both technologies is enhancing system reliability.

By Solution

The market by solution is divided into asset tracking, fleet management, diagnostics, and others. Fleet management leads the segment due to its ability to optimize fuel use, operator performance, and equipment scheduling. It improves productivity and enables compliance with safety and environmental regulations. Diagnostics solutions are gaining traction as operators adopt predictive maintenance to reduce downtime. Asset tracking supports theft prevention and utilization monitoring across high-value machines. Each solution continues to expand with integration of IoT and AI.

- For instance, Fleetio was named AutoTech Breakthrough Fleet Management Technology Company of the Year in 2024, known for enabling extended asset lifespan by optimizing tire and warranty management through enhanced sensor data integration.

By Sales Channel

By sales channel, the Off Highway Vehicle Telematics Market is segmented into OEM and aftermarket. OEMs dominate due to factory-fitted systems that reduce integration costs and provide standardized features. It ensures faster adoption among end users seeking ready-to-use solutions. Aftermarket remains significant, particularly for older fleets that require upgrades or customized features. Growing collaborations between OEMs and technology providers are expected to strengthen both channels and expand overall adoption.

- For instance, Caterpillar has connected more than 1.5 million off-highway vehicles globally through its factory-installed telematics systems, underscoring its leadership in OEM telematics adoption.

Segmentations:

By Technology

By Solution

- Asset Tracking

- Fleet Management

- Diagnostics

- Others

By Sales Channel

By End-Use

- Construction

- Mining

- Agriculture

- Forestry

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

Asia Pacific Emerging as a Growth Leader

Asia Pacific held the largest share of the Off Highway Vehicle Telematics Market, accounting for 39% of global demand. It is set to expand further due to strong adoption in infrastructure and agriculture sectors. Governments in the region are investing heavily in smart city projects, road development, and mechanized farming. It is driving adoption of telematics solutions that enhance fleet utilization, reduce fuel costs, and improve safety. Local and global OEMs are increasingly providing factory-integrated solutions to meet regional demand. These developments position Asia Pacific as a primary driver of future market growth.

North America Maintaining a Leading Share

North America captured 32% of the Off Highway Vehicle Telematics Market, supported by early adoption of connected technologies. It remains a strong contributor due to regulatory requirements and high implementation across construction and mining fleets. The region benefits from a mature dealer network and advanced IT infrastructure that enable seamless system integration. It emphasizes compliance, operational efficiency, and safety, aligning with telematics value propositions. Investments in infrastructure modernization and labor efficiency further drive adoption. Strong OEM presence with advanced telematics solutions continues to consolidate North America’s position.

Europe Strengthening Adoption Through Regulation and Innovation

Europe accounted for 23% of the Off Highway Vehicle Telematics Market, reflecting steady adoption through regulation and innovation. It continues to advance integration of telematics through strict rules on emissions, safety, and operational standards. Governments in the region encourage adoption to reduce fuel consumption and optimize maintenance schedules. It also benefits from digital transformation initiatives that promote automation and predictive analytics. OEMs are expanding collaborations with technology providers to deliver integrated systems that suit regional demands. These conditions support sustained growth opportunities for telematics across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Off Highway Vehicle Telematics Market is highly competitive with strong participation from global OEMs, technology providers, and specialized telematics companies. Leading players focus on integrating advanced features such as predictive analytics, AI-driven diagnostics, and IoT-enabled connectivity to strengthen their market position. It is characterized by continuous innovation, where companies invest in research and development to improve real-time monitoring, fleet optimization, and compliance management. Strategic collaborations between OEMs and telematics providers are expanding factory-installed solutions, reducing integration costs for end users. Regional players also compete by offering customized platforms tailored to local infrastructure and regulatory needs. Competitive strategies include mergers, acquisitions, and partnerships aimed at expanding geographic presence and enhancing service portfolios. This dynamic landscape is pushing companies to focus on differentiation through technology, reliability, and customer support to capture long-term growth opportunities in the sector.

Recent Developments:

- In September 2025, Volvo Construction Equipment completed the divestment of its stake in Shandong Lingong Construction Machinery (SDLG) to a Lingong Group fund for SEK 8 billion, to refocus its China presence strategically.

- In April 2025, Hitachi Construction Machinery continues expanding its zero-emission product line, showcased its LANDCROS One excavator concept at bauma 2025 with modular cab design and autonomous operation capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Solution, Sales Channel, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Off Highway Vehicle Telematics Market will expand with wider adoption in construction, mining, and agriculture fleets.

- It will benefit from growing integration of AI and IoT, enhancing predictive analytics and automation.

- Demand for real-time monitoring and remote diagnostics will strengthen adoption across developed and emerging regions.

- OEMs will continue embedding factory-installed telematics systems, reducing integration costs and improving accessibility.

- It will see increasing demand for predictive maintenance solutions that extend equipment life and reduce downtime.

- Sustainability goals will drive adoption as companies use telematics to cut fuel consumption and emissions.

- Partnerships between OEMs and technology providers will accelerate innovation and global deployment.

- It will face continued pressure to address cybersecurity risks and secure data management systems.

- Regions with limited digital infrastructure will create opportunities for hybrid solutions combining cellular and satellite systems.

- Expanding infrastructure projects and mechanized farming in Asia Pacific will position the region as a global growth leader.