Market Overview

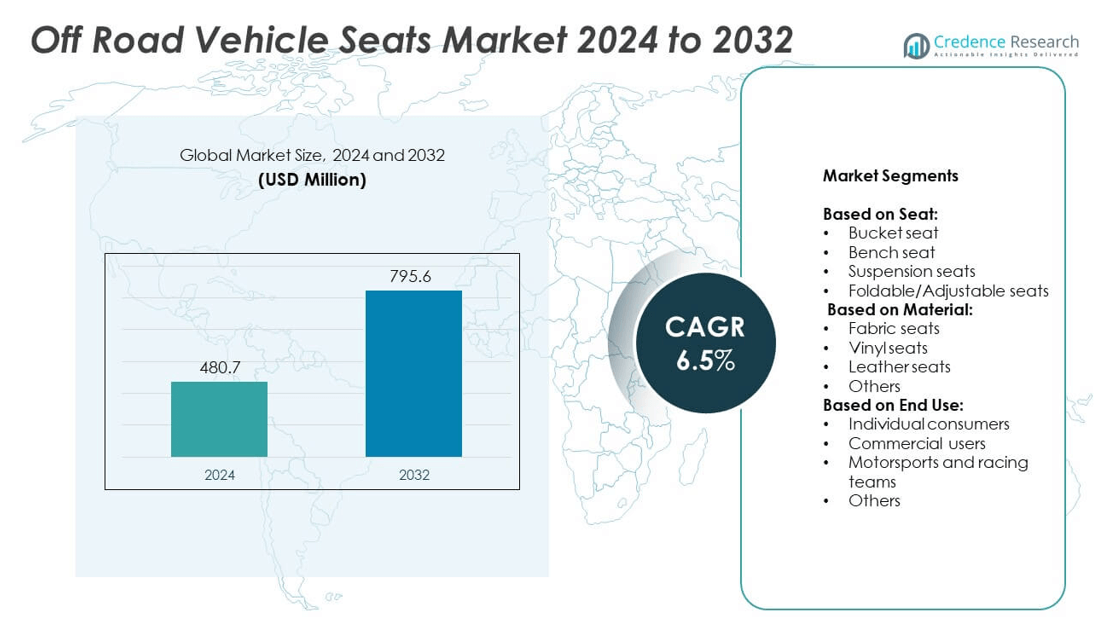

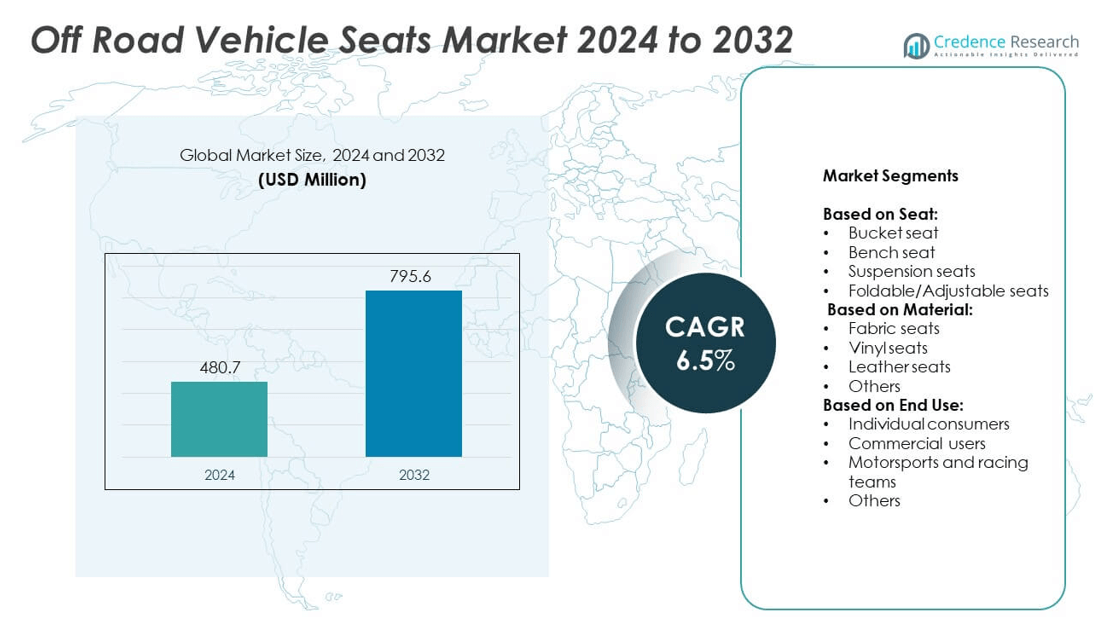

Off Road Vehicle Seats Market size was valued at USD 480.7 million in 2024 and is anticipated to reach USD 795.6 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off Road Vehicle Seats Market Size 2024 |

USD 480.7 million |

| Off Road Vehicle Seats Market, CAGR |

6.5% |

| Off Road Vehicle Seats Market Size 2032 |

USD 795.6 million |

The Off Road Vehicle Seats market grows with rising demand for recreational and utility vehicles across varied terrains. Key drivers include increasing focus on rider comfort, safety regulations, and the need for durable, ergonomic seating in commercial and motorsport segments. Seat innovations such as modular designs, lightweight materials, and smart features enhance product appeal. Trends point toward premium upgrades, sustainability, and integration with electric vehicle platforms.

North America leads the Off Road Vehicle Seats market due to high off-road vehicle usage in recreation, agriculture, and motorsports. Europe follows with strong demand from forestry and utility sectors, while Asia-Pacific shows fast growth driven by industrial expansion and rising vehicle production. Latin America and the Middle East & Africa experience steady demand from agriculture, mining, and tourism applications. Regional buyers focus on durability, comfort, and ease of maintenance. Key players operating across these markets include PRP Seats, Recaro Automotive, Sparco, and Simpson Race Products, each offering a wide range of products tailored to performance, commercial, and recreational needs.

Market Insights

- The Off Road Vehicle Seats market was valued at USD 480.7 million in 2024 and is projected to reach USD 795.6 million by 2032, growing at a CAGR of 6.5%.

- Increased demand for recreational and utility off-road vehicles continues to drive seating innovation and volume sales.

- Smart seating systems with adjustable features, heating elements, and lightweight designs are gaining popularity.

- Manufacturers face challenges from raw material cost fluctuations and high expectations for durability in harsh environments.

- Leading companies such as PRP Seats, Recaro Automotive, Sparco, and Simpson Race Products invest in performance-driven and ergonomic seat solutions.

- North America leads the market due to high recreational vehicle usage, followed by Europe and Asia-Pacific with strong commercial and industrial demand.

- Environmental concerns encourage the use of sustainable materials like recycled fabrics and bio-based foams in new seat designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growth in Recreational and Utility Off-Road Vehicle Demand Boosts Seat Market Expansion

The rising popularity of recreational activities such as off-road racing, trail riding, and adventure touring continues to fuel demand for off-road vehicles. These activities require vehicles with enhanced safety and comfort features, pushing manufacturers to invest in specialized seating systems. Utility applications in agriculture, forestry, and construction also drive demand, with operators seeking ergonomic and durable seating options for extended work hours. The growing use of ATVs and UTVs in both personal and commercial segments strengthens the seating component supply chain. Seat upgrades offer improved cushioning, suspension, and adaptability, which are critical for driver performance and safety. The Off Road Vehicle Seats market benefits directly from the wider use of off-road vehicles across diverse terrain and applications.

- For instance, Sparco advanced its off-road seating with the Evo QRT-X seat, which features a QRT (Quick Resin Technology) fiberglass composite shell resulting in a weight reduction of up to 30% compared to traditional manufacturing methods. The seat has a fully waterproof fabric cover designed specifically for rugged, wet, and off-road environments. The weight of the standard size Evo QRT-X seat is approximately 16.09 lbs (7.3 kg). It meets FIA 8855-1999 homologation for use in competition

Focus on Comfort and Ergonomics in Long-Duration Use Cases Fuels Seat Innovation

Manufacturers prioritize rider comfort in harsh and vibration-heavy environments, especially for users involved in long-duration operations. This demand for comfort leads to advancements in shock absorption materials, lumbar support systems, and breathable fabrics. Technological integration, such as heating elements and adjustable components, enhances seating value for high-end models. Comfort-driven designs reduce fatigue and injury risk, increasing productivity and reducing downtime. Consumer expectations push seat producers to create more ergonomic designs tailored to diverse user demographics. It creates new growth avenues in both premium and mid-range off-road vehicle segments.

- For instance, PRP Seats unveiled the Contour Suspension Seat in 2024, with availability continuing into 2025. This seat features a three-layer, gel-infused FlexFoam cushion and a removable seat cushion designed to drain sand, mud, and water. The standard fixed-back Contour seat for cars and trucks weighs approximately 20 pounds. Its ergonomic design includes an extended seat depth to position the hips lower than the knees and improve posture during long rides, but PRP Seats does not provide specific numerical measurements for the changes in posture or foam thickness

Strict Safety Regulations and Industry Standards Drive Seat Design Improvements

Governments enforce strict safety regulations for off-road vehicles, especially in North America and Europe. These include rollover protection, seatbelt integration, and crash-resistant structures. Seats now require advanced anchoring systems, high-strength materials, and certified testing to meet compliance standards. The focus on occupant protection drives OEMs to collaborate closely with seat manufacturers. Commercial vehicle segments such as mining and forestry must meet high safety thresholds due to operational risk. It encourages continual innovation in material selection, design, and testing methods.

Rising Customization and Aftermarket Demand Expands Replacement Seat Sales

Off-road vehicle owners increasingly seek personalized experiences, prompting demand for custom and aftermarket seat options. Consumers replace standard seats with upgraded versions featuring better design, durability, and support. The trend also supports niche segments like motorsports, where performance seating is critical. A growing second-hand vehicle market supports retrofit opportunities, widening aftermarket potential. Seat manufacturers offer modular systems to fit varied models and brands, reducing inventory challenges. The Off Road Vehicle Seats market gains traction from this shift toward value-added and user-centric upgrades.

Market Trends

Integration of Smart Features and Technology Elevates Seat Functionality

The trend toward smart seating continues to gain momentum across off-road vehicle categories. Manufacturers introduce features such as heating, ventilation, electronic adjustment, and position memory in high-end models. These innovations improve user comfort while supporting the growing premiumization of recreational and utility vehicles. Smart sensors embedded in seats offer posture correction and fatigue alerts, aligning with health-focused design trends. OEMs also explore integration with in-vehicle displays and apps to personalize seating settings. The Off Road Vehicle Seats market evolves with rising user demand for intelligent and responsive features.

- For instance, Gentherm Incorporated pioneered thermoelectric seat climate control systems. Its “Climate Control Seat,” initially adopted on the 2000 Lincoln Navigator, delivers both heating and cooling via Peltier-effect modules and now appears in over 50 modern vehicle models.

Lightweight and Sustainable Materials Gain Prominence in Seat Design

Weight reduction remains a top priority in off-road vehicle design to improve efficiency and maneuverability. Seat makers shift toward lightweight frames using aluminum alloys, advanced polymers, and composite structures. Sustainable materials such as recycled fabrics and bio-based foams enter mainstream use, supported by growing environmental awareness. These changes lower fuel consumption and help meet emissions goals without compromising performance. Consumers show rising interest in eco-conscious products, pushing manufacturers to adopt green production methods. It supports regulatory compliance and enhances brand image in competitive markets.

- For instance, Tecnocraft Composites designs ultra-light dry carbon-fiber seats tailored for motorsport environments. The T2 model weighs approximately 6.5 lbs (3.0 kg), while the T3 variant comes in at only 6.0 lbs (2.7 kg), highlighting major weight reductions compared to traditional designs.

Modular and Adjustable Seating Systems Support Versatility Across Applications

Multi-purpose off-road vehicles require seating that can adapt to different terrain, user needs, and cargo layouts. Manufacturers invest in foldable, removable, and adjustable seat designs to boost space flexibility. These modular systems enhance the value of UTVs and ATVs used for both personal and professional tasks. Commercial sectors demand configurations that allow easy transition between crew and cargo transport. The modular trend also supports faster maintenance and easier upgrades. It reinforces the importance of customization and adaptability in seat engineering.

Rising Demand for Luxury Seating in High-End Off-Road Vehicles

Luxury features are no longer limited to passenger cars, with off-road vehicles now incorporating premium seating options. High-grade leather, memory foam, stitched branding, and contrast designs enhance aesthetic appeal. Buyers in the motorsport and adventure travel segments expect refined interiors with superior support. Premium segments focus on detail, offering enhanced comfort without compromising ruggedness. Companies launch limited-edition variants to showcase bespoke craftsmanship and exclusivity. The Off Road Vehicle Seats market benefits from this trend by capturing value in the top-tier customer segment.

Market Challenges Analysis

High Cost Pressures and Price Sensitivity Limit Adoption of Advanced Seat Systems

Off-road vehicle users in cost-sensitive markets often prioritize affordability over premium features. Advanced seating systems with electronic adjustments, premium materials, or ergonomic designs increase overall vehicle costs. OEMs face challenges in balancing seat quality with competitive pricing across mass-market segments. Supply chain volatility, especially in specialty foam, fabric, and lightweight metals, further adds to manufacturing costs. Small and mid-size manufacturers struggle to scale operations while maintaining margins. The Off Road Vehicle Seats market must address this cost challenge to expand in entry-level and mid-range segments.

Durability Expectations in Harsh Environments Challenge Product Development Cycles

Off-road environments expose seats to extreme dust, moisture, vibrations, and temperature shifts. Users expect seats to perform reliably under these demanding conditions without frequent repair or replacement. Designing such durable seats requires advanced testing, better materials, and longer development timelines. It increases lead time and capital investment, limiting agility in responding to rapid design changes or new use cases. Commercial users such as mining and forestry fleets often demand customized solutions, making scalability difficult. It forces manufacturers to balance innovation with product robustness and lifecycle performance.

Market Opportunities

Rising Electrification and New Vehicle Platforms Open New Product Avenues

The shift toward electric off-road vehicles creates demand for redesigned interior layouts and lightweight components. Electrification allows more flexible chassis configurations, giving manufacturers greater design freedom for seat placement and structure. Seating systems optimized for battery packaging, thermal management, and weight distribution hold strong growth potential. Companies that offer seats with integrated electronics and reduced weight can align better with electric powertrain requirements. Startups entering the EV segment seek component partners who deliver innovative, compact, and cost-efficient seating. The Off Road Vehicle Seats market gains new business channels from these evolving vehicle platforms.

Growing Recreational Tourism and Rental Fleets Offer Volume-Based Growth

Adventure tourism, nature excursions, and off-road rentals are growing in developed and emerging markets. Tour operators and rental companies require vehicles with durable, easily serviceable, and comfortable seating to cater to diverse customers. High seat turnover and wear rates in these fleets create a steady aftermarket and replacement demand. Seat makers can partner with fleet managers to offer modular systems and quick-replacement options. Branded tourism operators also seek premium features that enhance rider experience and safety. It enables seat manufacturers to scale volumes through repeat orders and long-term contracts.

Market Segmentation Analysis:

By Seat:

Bucket seats dominate the Off Road Vehicle Seats market due to their superior support and fit for rugged terrains. These seats are widely used in ATVs, UTVs, and performance-focused off-road vehicles. Suspension seats hold strong demand in commercial and utility applications where ride comfort and shock absorption are critical. Bench seats find application in utility terrain vehicles designed for multiple passengers and ease of access. Foldable and adjustable seats gain traction due to their flexibility and space-saving benefits, especially in multi-use and cargo-based models. It shows strong adoption in fleet and recreational vehicles alike, driven by storage needs and customization options.

- For instance, the Corbeau LG1 reclining bucket seat weighs 26 lb for the standard version and 28 lb for the wide version. The standard seat fits waist sizes up to 38″, while the wide version fits up to 42″. Both versions include a 3.5″ base height for optimal driver support.

By Material:

Vinyl seats lead the market due to their durability, water resistance, and ease of cleaning. These features make vinyl ideal for harsh environments and high-usage vehicles. Fabric seats follow closely, favored for their breathability and comfort in moderate conditions. Leather seats cater to the premium segment, offering superior aesthetics and long-term wear resistance, though they remain less common in commercial use. The “others” category includes specialty materials like mesh, synthetics, and multi-layer composites developed for advanced comfort and lightweight performance. The Off Road Vehicle Seats market adapts its material mix based on end-user expectations and vehicle type.

- For instance, the Grammer MSG 20 is a compact, mechanical suspension seat designed for small off-road vehicles, such as forklifts, small tractors, diggers, and skid steers. It significantly reduces operator fatigue and improves comfort by using a mechanical suspension system with 60mm of vertical travel to absorb vibrations and jolts.

By End-User:

Individual consumers represent a major segment, driven by demand for recreational, utility, and farm vehicles. These buyers value comfort, aesthetics, and seat adjustability. Commercial users rely on durable and ergonomic seating for long working hours in sectors such as agriculture, construction, and mining. Motorsports and racing teams prefer high-performance seating with reinforced support and lightweight construction for competitive applications. The “others” segment includes tourism, government, and rental fleet use cases where modularity and cost control are essential. It highlights a varied customer base with distinct product requirements across usage environments.

Segments:

Based on Seat:

- Bucket seat

- Bench seat

- Suspension seats

- Foldable/Adjustable seats

Based on Material:

- Fabric seats

- Vinyl seats

- Leather seats

- Others

Based on End Use:

- Individual consumers

- Commercial users

- Motorsports and racing teams

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Off Road Vehicle Seats market, accounting for 38.2% in 2024. The region benefits from a strong culture of off-road recreation, high disposable income, and advanced vehicle infrastructure. The United States leads due to a well-established market for ATVs, UTVs, and snowmobiles, especially in states like California, Texas, and Utah. Seat upgrades and customizations are popular among individual owners and motorsport teams. Commercial sectors such as agriculture, forestry, and oil exploration also demand durable and ergonomic seating. The presence of major OEMs and aftermarket players supports innovation and fast product rollout. Demand for lightweight, premium, and smart seating features contributes to sustained market expansion.

Europe

Europe represents 24.7% of the global Off Road Vehicle Seats market, supported by rising demand in recreational and utility sectors. Countries like Germany, France, and the UK see steady growth in utility terrain vehicles for agricultural and forestry operations. Motorsports remain a major driver in Western Europe, where racing and competitive off-road events fuel demand for bucket and suspension seats. Regulatory compliance with safety and sustainability norms encourages use of advanced materials in seating systems. OEMs invest in R&D to meet EU environmental regulations and weight-reduction goals. Interest in electric off-road vehicles also boosts demand for newly designed seating structures. The region balances performance, design, and environmental priorities in seat selection.

Asia-Pacific

Asia-Pacific holds a market share of 20.6%, with growth driven by expanding off-road vehicle production and rural mobility needs. China, India, and Japan lead the regional demand, especially in the utility and agriculture sectors. Rapid industrialization and increasing farm mechanization in Southeast Asia fuel vehicle adoption, creating volume demand for low-cost yet durable seats. OEMs in the region focus on cost optimization and modular design, addressing local usage patterns and road conditions. Rising awareness of safety and comfort gradually drives replacement demand. The region presents strong future potential, with emerging middle-class consumers showing interest in recreational off-road activities.

Latin America

Latin America captures 9.1% of the global Off Road Vehicle Seats market. Brazil, Mexico, and Argentina drive the majority of sales, supported by agriculture, mining, and oil industries. Seat manufacturers cater to rough terrain vehicles used in plantations, quarries, and mountainous regions. The aftermarket segment sees steady activity due to aging vehicle fleets and lack of standardization. Import restrictions and economic fluctuations impact premium seat adoption. Still, utility-driven demand ensures consistent business opportunities for rugged and simple seating systems.

Middle East & Africa

The Middle East & Africa account for 7.4% of market share, driven by specialized use cases across desert, mining, and safari applications. Countries like South Africa and the UAE see demand for off-road seats in tourism and resource extraction vehicles. Harsh climate conditions require seats with high UV resistance and thermal stability. Fleet owners prioritize serviceable and long-lasting seating over advanced features. Imports dominate the market, with limited local production capacity. Despite challenges, infrastructure projects and growing recreational interest support gradual growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corbeau USA

- UTV Mountain Accessories

- PRP Seats

- Bestop

- MOMO Automotive

- TV Parts Holding NV

- Simpson Race Products

- MasterCraft Safety

- Sparco

- Recaro Automotive

- Beard Seats

Competitive Analysis

The Off Road Vehicle Seats market features strong competition among key players including Corbeau USA, UTV Mountain Accessories, PRP Seats, Bestop, MOMO Automotive, TV Parts Holding NV, Simpson Race Products, MasterCraft Safety, Sparco, Recaro Automotive, and Beard Seats. These companies compete on technology, material innovation, comfort, and product durability across both OEM and aftermarket segments. Market leaders focus on developing lightweight, modular seat systems that enhance vehicle performance and meet user expectations for safety and ergonomics. Manufacturers invest in materials such as memory foam, high-strength composites, and weather-resistant fabrics to suit rugged off-road conditions. Product customization, seat adjustability, and aesthetic appeal also influence buyer preferences, particularly in motorsports and recreational vehicles. Companies strengthen their market position through partnerships with vehicle manufacturers, motorsport teams, and specialty distributors. Growth in electric off-road vehicles and rising consumer interest in premium upgrades offer further competitive advantage to innovation-driven brands. Players continuously adapt to regional regulations and customer usage trends to retain market share and expand product lines.

Recent Developments

- In January 2025, PRP seats introduced the all‑new contour suspension seat. the design lets drivers sit deeper—keeping hips lower than knees—for better comfort, support, and posture during aggressive off-road driving

- In August 2024, Ford has revealed a hardcore off-road-focused version of the Everest SUV in Australia. The vehicle is known as the Everest Tremor, this SUV gets a range of upgrades to make it even more capable than the standard version that was once sold in India under the Endeavour moniker.

- In May 2023, Toyota introduced sophisticated suspension technology to the front seats of Tacoma, a mid-size pickup truck. When buyers select the TRD Pro off-road version of the Tacoma, with its jacked-up suspension

Report Coverage

The research report offers an in-depth analysis based on Seat, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for recreational and utility off-road vehicles.

- Lightweight seat designs will gain traction to improve vehicle efficiency and performance.

- Electrification of off-road vehicles will create new design and integration opportunities for seating systems.

- Seat manufacturers will adopt smart features like heating, sensors, and electronic adjustment.

- Customization and modular seating options will become standard in both OEM and aftermarket segments.

- Sustainable materials such as recycled fabrics and bio-based foams will see increased usage.

- Asia-Pacific will emerge as a major growth region due to expanding agriculture and industrial demand.

- High-end segments will drive demand for leather, memory foam, and premium ergonomic features.

- Partnerships between OEMs and seat makers will focus on safety, durability, and compliance.

- The aftermarket for replacement and upgraded off-road vehicle seats will grow with vehicle aging.