Market Overview

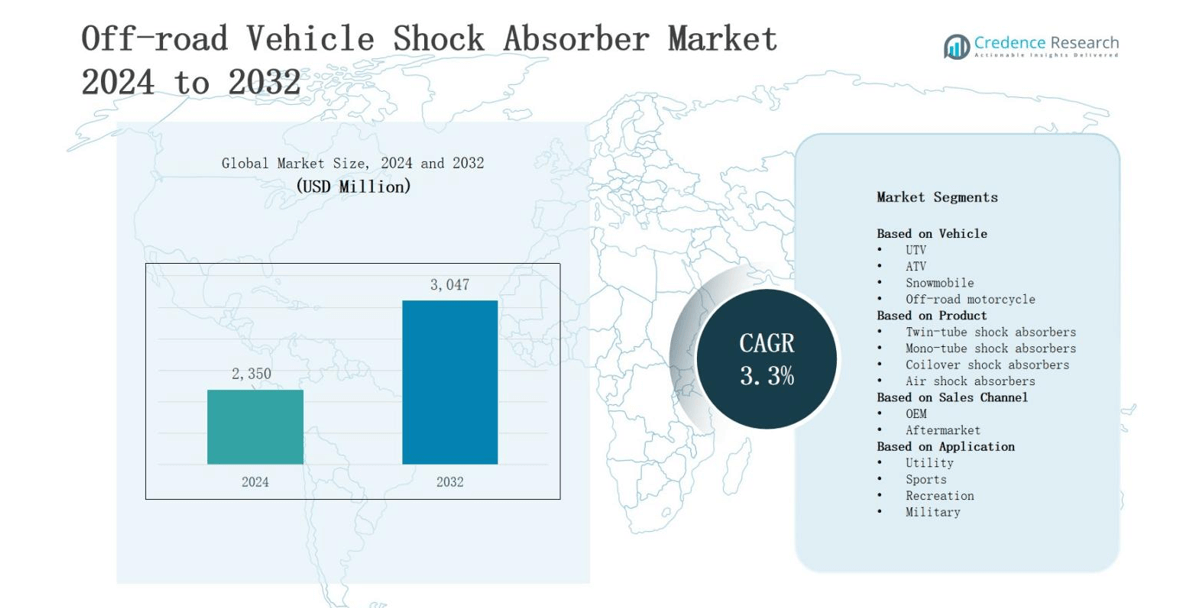

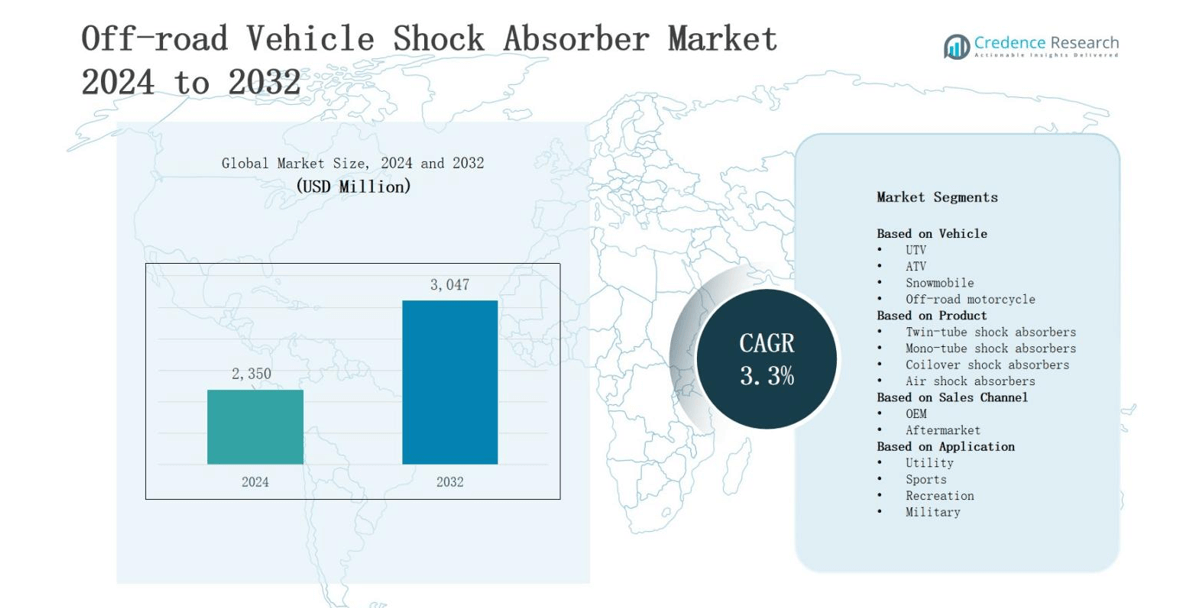

The off-road vehicle shock absorber market is projected to grow from USD 2,350 million in 2024 to USD 3,047 million by 2032, registering a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-Road Vehicle Shock Absorber Market Size 2024 |

USD 2,350 million |

| Off-Road Vehicle Shock Absorber Market, CAGR |

3.3% |

| Off-Road Vehicle Shock Absorber Market Size 2032 |

USD 3,047 million |

The off-road vehicle shock absorber market grows with rising demand for advanced suspension systems that enhance durability, comfort, and performance across rugged terrains. Increasing recreational activities such as off-road racing and adventure tourism drive product adoption. Automakers emphasize shock absorbers that improve vehicle stability, load handling, and passenger safety. Trends highlight integration of lightweight, high-strength materials, along with electronic and adaptive damping technologies for optimized ride quality. Growing consumer preference for customization and premium off-road vehicles further supports innovation. Expanding aftermarket sales and rising investments in R&D by leading manufacturers strengthen the market’s long-term growth outlook.

The off road vehicle shock absorber market shows diverse geographical dynamics, with North America leading at 35% due to strong recreational demand, followed by Asia Pacific at 28% supported by rising motorsports and manufacturing bases. Europe holds 25% with emphasis on premium performance and sustainability, while Latin America accounts for 7% driven by agriculture and outdoor activities. The Middle East & Africa holds 5%, fueled by desert racing and safari tourism. Key players include KYB, Fox Factory, Monroe, Bilstein, Öhlins Racing, ICON Vehicle Dynamics, Rancho, King Shocks, Koni, and Walker Evans Racing.

Market Insights

- The off road vehicle shock absorber market is projected to grow from USD 2,350 million in 2024 to USD 3,047 million by 2032, registering a CAGR of 3.3%.

- ATVs dominate the vehicle segment with 40% share, followed by UTVs at 30%, motorcycles at 20%, and snowmobiles at 10%, driven by recreational demand and motorsports growth.

- Twin-tube shock absorbers lead with 45% share, followed by mono-tube at 25%, coilover at 20%, and air shocks at 10%, supported by rising demand for durability and performance.

- OEM sales channel holds 65% share due to integration in new vehicles, while aftermarket at 35% grows rapidly through customization, replacement demand, and expanding e-commerce distribution networks.

- North America leads with 35% share, followed by Asia Pacific at 28%, Europe at 25%, Latin America at 7%, and Middle East & Africa at 5%, supported by diverse regional drivers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Popularity of Off-Road Adventures and Recreational Activities

The off road vehicle shock absorber market is driven by the increasing participation in off-road sports, adventure tourism, and recreational driving. Consumers seek vehicles that provide enhanced safety and comfort while navigating rocky, sandy, or uneven terrain. Manufacturers develop advanced shock absorbers to improve handling and stability during extreme conditions. Rising demand for all-terrain vehicles and specialized SUVs fuels market growth. It benefits from higher consumer interest in outdoor experiences.

- For instance, KYB offers electronically controlled shock absorbers that adapt damping force real-time to terrain changes, enhancing ride control in off-road SUVs.

Rising Demand for Vehicle Durability and Performance

The off road vehicle shock absorber market benefits from growing consumer expectations for durability, stability, and consistent performance. Shock absorbers designed with high-strength alloys and advanced damping systems address these needs effectively. It supports improved load capacity and reduces vehicle wear on rugged surfaces. Automakers invest in suspension innovation to differentiate their products. Strong emphasis on ride comfort and safety during extreme usage continues to drive consistent market adoption.

- For instance, King Shocks designs custom-tuned performance shocks widely favored in racing and recreational off-roading for their superior ride quality and resilience.

Technological Advancements and Smart Suspension Systems

The off road vehicle shock absorber market experiences strong growth due to rapid technological improvements. Integration of electronic damping, adaptive suspension, and sensor-based control systems is transforming product design. It allows vehicles to adjust shock response dynamically, enhancing driver experience and passenger safety. Lightweight composite materials extend product life while reducing overall vehicle weight. These innovations align with consumer demand for premium off-road models. Strong R&D investments sustain continuous advancements.

Expanding Aftermarket and Customization Preferences

The off road vehicle shock absorber market benefits from the expanding aftermarket segment and rising customization culture. Vehicle owners invest in performance upgrades, premium shock absorbers, and specialized suspension kits to match personal driving styles. It opens new revenue streams for manufacturers and suppliers. Increased accessibility through online sales channels strengthens aftermarket demand globally. Growing interest in vehicle personalization fuels consistent replacement cycles. This dynamic drives sustained opportunities across multiple regional markets.

Market Trends

Integration of Advanced Suspension Technologies in Off-Road Vehicles

The off road vehicle shock absorber market is witnessing a clear shift toward advanced suspension technologies that enhance vehicle control and stability. Manufacturers are adopting adaptive damping systems, electronic sensors, and automated controls to deliver better ride quality on rugged terrains. It ensures precision in handling and reduces driver fatigue during long-distance off-road trips. Automakers highlight these innovations as key differentiators in premium models. Continuous demand for smart suspension systems reinforces steady market adoption.

- For instance, Tenneco’s Monroe® Intelligent Suspension CVSA2/Kinetic® technology, used in off-road-ready electric pickups, features semi-active dampers with electronic valves that adjust damping in real time, enhancing comfort and stability on demanding terrains.

Growing Use of Lightweight and High-Strength Materials

The off road vehicle shock absorber market shows a trend toward materials that reduce weight while improving durability. Manufacturers are investing in aluminum alloys, composites, and advanced polymers to create stronger and lighter shock absorbers. It improves vehicle fuel efficiency and increases load-handling capability under harsh conditions. Reduced component weight also enhances speed and maneuverability. Rising consumer preference for high-performance vehicles ensures steady adoption of lightweight materials across both OEM and aftermarket products.

- For instance, Fox Factory Holding Corp. uses 6061-T6 aluminum alloy bodies in its Factory Series shock absorbers, which provide high strength while significantly cutting weight compared to steel.

Rising Demand for Customization and Aftermarket Solutions

The off road vehicle shock absorber market benefits from increasing consumer interest in customization and aftermarket upgrades. Owners seek specialized shock absorbers that enhance vehicle stability, comfort, and style while driving in extreme terrains. It supports the growth of premium suspension kits tailored for different usage patterns. Expanding e-commerce platforms make such products widely accessible to global customers. Customization trends create new revenue channels for suppliers and maintain consistent demand across recreational and commercial off-road vehicles.

Focus on Sustainability and Eco-Friendly Manufacturing Practices

The off road vehicle shock absorber market aligns with growing sustainability goals in the automotive industry. Manufacturers focus on eco-friendly production methods, recyclable materials, and energy-efficient designs to reduce environmental impact. It addresses regulatory pressure and consumer demand for greener mobility solutions. Companies invest in cleaner technologies without compromising performance. This transition reflects a long-term trend of balancing innovation with responsibility. Sustainable product offerings strengthen brand reputation and improve market competitiveness globally.

Market Challenges Analysis

High Manufacturing Costs and Pricing Pressures

The off road vehicle shock absorber market faces significant challenges due to high production costs and pricing pressures. Advanced designs require premium raw materials such as composites and specialized alloys, which increase overall expenses. It creates difficulties for manufacturers in offering cost-effective products while maintaining quality. Intense competition among global players adds further strain on profit margins. Fluctuating raw material prices also contribute to financial instability. Balancing affordability with durability remains a constant hurdle for industry participants.

Maintenance Complexity and Limited Awareness in Emerging Markets

The off road vehicle shock absorber market encounters obstacles from the complexity of maintenance and limited awareness in emerging economies. Consumers often lack technical knowledge about the role of shock absorbers in vehicle performance and safety. It reduces replacement rates and hinders aftermarket growth. Advanced electronic or adaptive suspension systems demand skilled service, which is not widely available in developing regions. Limited infrastructure for high-quality servicing restricts adoption. These challenges slow broader market penetration and long-term expansion.Market Opportunities

Expanding Demand for Premium and Customized Off-Road Vehicles

The off road vehicle shock absorber market presents strong opportunities through the rising demand for premium and customized vehicles. Consumers increasingly seek specialized suspension systems that enhance comfort, stability, and handling across extreme terrains. It creates scope for manufacturers to introduce advanced designs tailored to different driving styles and conditions. Growing recreational activities and motorsport participation further expand this demand. Customization trends supported by e-commerce platforms strengthen aftermarket growth, opening diverse revenue opportunities across developed and emerging regions.

Adoption of Advanced Technologies and Sustainable Materials

The off road vehicle shock absorber market benefits from opportunities driven by technological adoption and sustainability initiatives. Integration of electronic damping systems, adaptive suspensions, and lightweight materials creates new product possibilities. It helps automakers address consumer demand for safety, efficiency, and eco-friendly performance. Governments encouraging sustainable manufacturing practices increase the relevance of recyclable materials in product design. Strong investments in research and development support innovation in advanced shock absorber solutions. These developments enhance competitiveness and global market reach.

Market Segmentation Analysis:

By Vehicle

In the off road vehicle shock absorber market, ATVs dominate with around 40% share, supported by their extensive use in recreational activities, sports, and agricultural applications. UTVs account for nearly 30%, driven by demand in utility and adventure tourism. Off-road motorcycles hold about 20%, reflecting popularity among enthusiasts and motorsports. Snowmobiles represent close to 10%, limited to seasonal and regional demand. Growing outdoor recreation and improved vehicle performance continue to strengthen segment growth across key regions.

- For instance, Polaris Industries reported strong demand for its Sportsman ATV line, widely used by farmers for towing equipment and off-road transport.

By Product

Twin-tube shock absorbers lead the segment with nearly 45% share, driven by their cost-effectiveness and widespread adoption across ATVs and UTVs. Mono-tube designs account for around 25%, supported by better heat dissipation and high-performance applications. Coilover shock absorbers hold 20%, popular in customization and premium off-road models. Air shock absorbers capture about 10%, appealing to advanced vehicles with adjustable suspension systems. Rising demand for durability and comfort ensures continuous product innovation across all categories.

- For instance, Öhlins’ EC air suspension systems have been adopted in high-performance utility vehicles, offering electronically controlled damping for variable terrain.

By Sales Channel

The OEM channel dominates with about 65% share, supported by automakers integrating advanced suspension systems directly into new vehicles. Consumers prefer factory-installed systems for quality assurance and warranty benefits. The aftermarket segment holds nearly 35%, fueled by rising customization, performance upgrades, and replacement demand. It benefits from strong e-commerce penetration and expanding distribution networks. Growth in off-road racing and adventure activities ensures steady aftermarket adoption, while OEMs maintain leadership through continuous innovation and premium offerings.

Segments:

Based on Vehicle

- UTV

- ATV

- Snowmobile

- Off-road motorcycle

Based on Product

- Twin-tube shock absorbers

- Mono-tube shock absorbers

- Coilover shock absorbers

- Air shock absorbers

Based on Sales Channel

Based on Application

- Utility

- Sports

- Recreation

- Military

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The off road vehicle shock absorber market in North America holds the largest share at 35%, driven by the strong culture of recreational sports, adventure tourism, and professional motorsports. High ownership of ATVs, UTVs, and off-road motorcycles supports demand for advanced suspension systems. It benefits from established OEMs, widespread aftermarket availability, and consumer preference for premium upgrades. The region emphasizes innovation in adaptive suspension and performance-focused designs. Expanding off-road events and trails continue to strengthen market growth across the United States and Canada.

Europe

Europe accounts for 25% of the off road vehicle shock absorber market, supported by strong adoption in adventure tourism and motorsports. The region’s advanced automotive industry ensures continuous innovation in high-performance and lightweight shock absorbers. It gains traction from regulatory focus on safety and sustainability, pushing manufacturers toward eco-friendly production. Aftermarket demand for customization is also strong, particularly in Germany, France, and Nordic countries. Increasing use of snowmobiles and motorcycles boosts product adoption across diverse terrains.

Asia Pacific

Asia Pacific represents 28% of the off road vehicle shock absorber market, driven by growing recreational activities, rising incomes, and expanding motorsports culture. Countries such as China, Japan, and India lead in manufacturing and adoption of affordable off-road vehicles. It gains momentum from strong aftermarket growth fueled by e-commerce platforms and customization trends. Expanding production bases support competitive pricing and global exports. Increasing consumer preference for durable and performance-oriented suspension systems strengthens long-term demand across the region.

Latin America

Latin America contributes 7% to the off road vehicle shock absorber market, supported by rising adoption of ATVs and UTVs in agriculture, forestry, and outdoor recreation. Brazil and Mexico serve as leading markets with growing demand for durable suspension systems. It faces infrastructure limitations, but strong aftermarket demand balances growth. Expanding outdoor activities and off-road sports events provide opportunities for new entrants. Rising focus on vehicle durability under harsh conditions strengthens market acceptance across the region.

Middle East & Africa

The Middle East & Africa holds 5% of the off road vehicle shock absorber market, driven by desert racing, safari tourism, and recreational off-road activities. High demand in countries such as the UAE, Saudi Arabia, and South Africa supports segment expansion. It benefits from a growing culture of customization and performance upgrades. Harsh terrain conditions create consistent need for advanced suspension solutions. Expanding motorsport events and increasing vehicle imports enhance long-term growth opportunities across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KYB Corporation

- Rancho (Tenneco Inc.)

- Walker Evans Racing

- Fox Factory, Inc.

- Monroe (Tenneco Inc.)

- Öhlins Racing AB

- ICON Vehicle Dynamics

- Bilstein (ThyssenKrupp AG)

- King Shocks

- Koni (ITT Corporation)

Competitive Analysis

The off road vehicle shock absorber market is highly competitive, shaped by innovation, brand strength, and aftermarket presence. Key players such as KYB Corporation, Rancho (Tenneco Inc.), Walker Evans Racing, Fox Factory, Inc., Monroe (Tenneco Inc.), Öhlins Racing AB, ICON Vehicle Dynamics, Bilstein (ThyssenKrupp AG), King Shocks, and Koni (ITT Corporation) focus on advanced technologies to enhance durability, comfort, and handling on rugged terrains. It relies on continuous product development, including adaptive suspension and lightweight materials, to meet diverse consumer needs across recreational, motorsport, and utility applications. Companies leverage strategic partnerships with OEMs, expand distribution networks, and strengthen aftermarket offerings to secure larger shares. Premium product lines, performance upgrades, and customization options play a critical role in differentiation, while brand reputation and reliability heavily influence consumer preference. Competition remains intense with global and regional manufacturers balancing cost-efficiency and quality. Growing investments in R&D and expansion into emerging markets reinforce the competitive landscape, enabling established leaders to maintain dominance while creating space for niche players to capture targeted demand.

Recent Developments

- In January 2023, FOX Factory announced a new line of performance shock absorbers specifically designed for electric vehicles, reflecting a focus on advanced technology and the evolving electric off-road vehicle segment.

- In April 2023, ZF Friedrichshafen AG launched TRW shock absorbers with advanced features such as a smoother piston rod surface and faster response valve technology for improved vehicle safety and handling.

- In May 2025, Arizona Desert Shocks (ADS) launched its expanded Mesa 2.5 Series, offering direct-replacement kits for Toyota, Jeep, Ford, Chevy, GMC, and Ram trucks. The kits deliver race-inspired performance, premium materials, and simple installation for everyday drivers.

- In May 2025, ICON Vehicle Dynamics partnered with FlexShopper, enabling FlexShopper’s lease-to-own financing for ICON’s customers. This collaboration makes premium off-road suspension upgrades more accessible

Market Concentration & Characteristics

The off road vehicle shock absorber market is moderately concentrated, with a mix of global leaders and specialized regional players competing across OEM and aftermarket channels. It is characterized by continuous innovation, where manufacturers focus on integrating adaptive damping, lightweight materials, and advanced suspension technologies to meet evolving consumer demand for performance, safety, and durability. Competition is shaped by established brands such as KYB Corporation, Fox Factory, Monroe, Bilstein, Öhlins Racing, ICON Vehicle Dynamics, Rancho, King Shocks, Koni, and Walker Evans Racing, which emphasize premium quality and strong distribution networks. The market also benefits from rising customization trends and aftermarket growth, supported by e-commerce platforms and global supply chains. It reflects a balance between high-volume production in cost-sensitive segments and premium offerings in performance-driven categories. Strong R&D investments, brand reputation, and strategic OEM partnerships define the key competitive characteristics, ensuring steady expansion while maintaining barriers for new entrants.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Product, Sales Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced suspension systems will rise with growing off-road recreational and motorsport activities worldwide.

- Adoption of adaptive and electronic damping technologies will enhance vehicle stability and passenger comfort significantly.

- Lightweight and durable materials will dominate designs, supporting efficiency, load capacity, and overall vehicle performance.

- Aftermarket sales will expand as customization and performance upgrades gain popularity among off-road vehicle enthusiasts.

- OEM partnerships will strengthen, with automakers integrating premium shock absorbers in factory-installed off-road models.

- E-commerce platforms will boost global accessibility, driving replacement demand and aftermarket sales growth across regions.

- Sustainability focus will drive innovation toward recyclable materials and eco-friendly manufacturing practices in shock absorbers.

- Emerging markets will see rising adoption fueled by income growth, motorsport expansion, and vehicle availability.

- R&D investments will intensify, enabling manufacturers to deliver smarter, more adaptive suspension solutions for consumers.

- Brand reputation and product reliability will remain key factors influencing customer preference and market competitiveness.