Market Overview

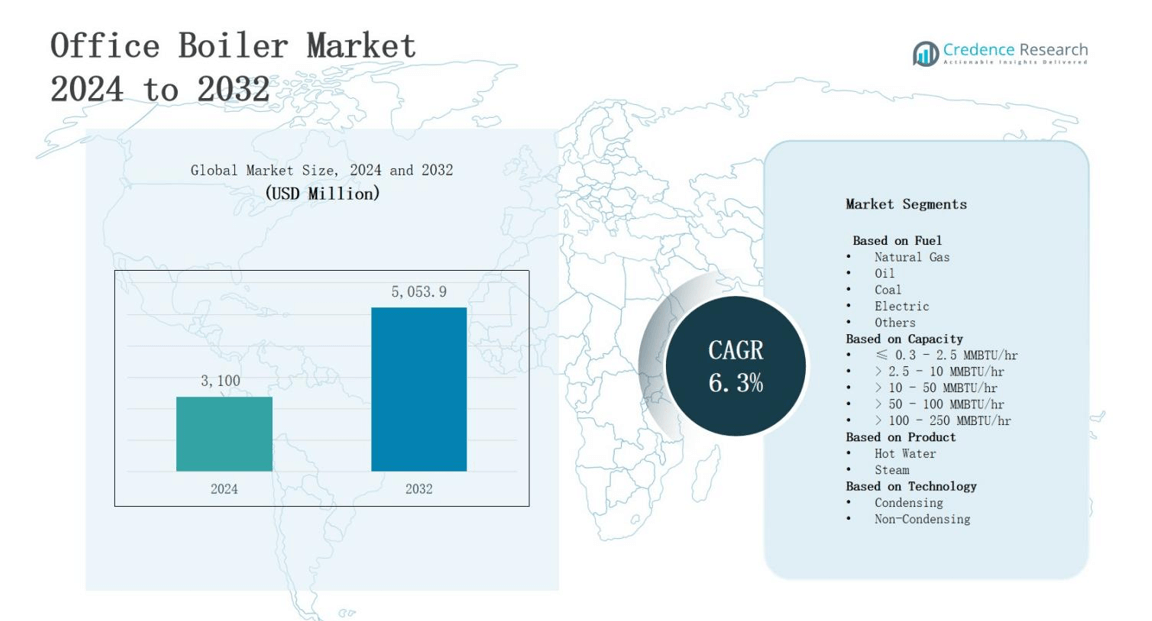

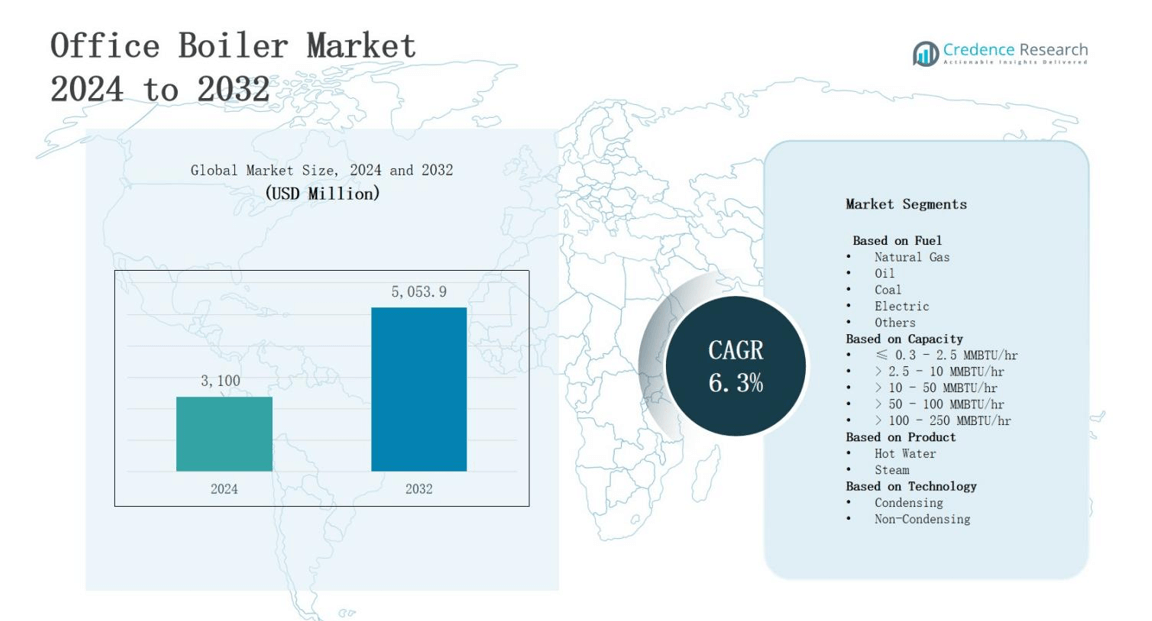

The office boiler market is projected to grow from USD 3,100 million in 2024 to USD 5,053.9 million by 2032, registering a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Office Boiler Market Size 2024 |

USD 3,100 million |

| Office Boiler Market, CAGR |

6.3% |

| Office Boiler Market Size 2032 |

USD 5,053.9 million |

The office boiler market is driven by rising demand for energy-efficient heating systems, stricter environmental regulations, and growing corporate focus on sustainable infrastructure. Companies are investing in advanced boiler technologies to reduce operational costs and carbon emissions. Increasing refurbishment of office spaces and replacement of outdated systems further fuels adoption. Trends highlight the integration of smart controls, IoT-enabled monitoring, and hybrid heating solutions that combine renewable sources with conventional systems. Manufacturers are also emphasizing compact designs and modular solutions to cater to modern office layouts, while regional demand shifts toward eco-friendly solutions enhance long-term market growth opportunities.

The office boiler market demonstrates diverse regional dynamics, with North America leading at 32% driven by retrofits and efficiency regulations, followed by Europe at 27% supported by stringent carbon reduction policies. Asia-Pacific holds 24% share fueled by rapid urbanization and smart office demand, while Latin America captures 9% through modernization projects in Brazil and Mexico. Middle East & Africa account for 8% with rising adoption in urban hubs. Key players include Cleaver-Brooks, FERROLI, Fulton, Vaillant Group, VIESSMANN, Weil-McLain, Precision Boilers, and Miura America.

Market Insights

- The office boiler market will grow from USD 3,100 million in 2024 to USD 5,053.9 million by 2032, registering a 6.3% CAGR, driven by efficiency demand and sustainability initiatives.

- Natural gas boilers dominate with 48% share in 2024, supported by cost advantages and lower emissions, while electric boilers gain traction at 15% due to zero on-site emissions in green buildings.

- By capacity, ≤0.3–2.5 MMBTU/hr leads with 35% share, serving small to mid-sized offices, followed by 2.5–10 MMBTU/hr at 28%, catering to medium-scale office complexes needing higher loads.

- Hot water boilers dominate with 62% share, driven by reliability and flexible heating performance, while steam boilers at 38% serve high-capacity office buildings and centralized heating requirements.

- Regionally, North America leads with 32%, Europe follows at 27%, Asia-Pacific holds 24%, Latin America captures 9%, and Middle East & Africa represent 8%, reflecting diverse growth dynamics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy-Efficient Heating Systems

The office boiler market benefits from rising emphasis on energy efficiency across commercial spaces. Businesses aim to cut energy consumption while maintaining reliable heating performance, pushing demand for advanced condensing boilers. These systems help reduce utility costs and meet sustainability goals. Governments introduce stricter efficiency standards that encourage companies to adopt innovative heating technologies. It drives replacement of outdated units with modern systems designed for reduced energy waste and long-term operational reliability.

- For instance, Bosch Thermotechnology installed its Uni 8000F stainless-steel condensing boiler at commercial sites in the UK, which supports carbon reduction goals by lowering NOx emissions to below 40 mg/kWh.

Growing Focus on Environmental Regulations and Sustainability

Stricter environmental regulations accelerate adoption of low-emission office boilers. Companies seek eco-friendly heating solutions to comply with carbon reduction targets and green building standards. Manufacturers respond by developing boilers with improved combustion technology and lower greenhouse gas output. It strengthens the appeal of hybrid and renewable-compatible boilers in commercial sectors. Demand aligns with corporate sustainability initiatives, supporting cleaner energy use in office infrastructure and shaping long-term purchasing decisions in the office boiler market.

- For instance, Cleaver-Brooks has launched a sustainability initiative tailored to help companies achieve their carbon targets, offering boilers with low NOx technology and support for renewable fuels that lower emissions.

Expansion of Office Infrastructure and Refurbishment Projects

The growth of office refurbishment projects creates strong demand for advanced boilers. Companies modernize heating systems during retrofitting to meet efficiency and safety requirements. It improves comfort levels while lowering operating costs, making efficient boilers an attractive investment. Growing office construction in urban centers also drives new installations. The need for reliable heating solutions aligns with corporate goals to enhance employee productivity. Adoption of modern boilers ensures compliance and operational resilience.

Technological Advancements and Smart Integration

Rapid technological advancements strengthen the appeal of smart-enabled office boilers. Integration of IoT and automation allows real-time monitoring, predictive maintenance, and optimized performance. It provides facilities managers with greater control over energy usage and system reliability. The trend supports reduced downtime and enhanced sustainability. Demand rises for modular and compact designs suited for modern office layouts. The office boiler market grows with evolving technologies that improve efficiency, connectivity, and long-term value delivery.

Market Trends

Adoption of Smart and Connected Boiler Systems

The office boiler market is witnessing strong adoption of smart and connected systems. Facility managers prefer IoT-enabled boilers that provide real-time performance data, predictive maintenance, and automated control. These features help reduce downtime and optimize energy usage. It enhances efficiency by detecting faults early and preventing costly breakdowns. Growing digital integration supports remote monitoring, aligning with workplace automation trends. Demand for intelligent systems reflects a broader shift toward technology-driven facility management in commercial spaces.

- For instance, Miura’s Smart Control device allows users to remotely monitor their steam boilers via a web portal and receive instant alerts about any issues, helping to prevent downtime and costly repairs.

Rising Popularity of Eco-Friendly and Hybrid Boilers

Sustainability drives a clear trend toward eco-friendly and hybrid boiler solutions. Companies focus on lowering emissions and improving environmental performance. Hybrid systems that combine conventional boilers with renewable energy inputs gain popularity. It supports compliance with green building certifications and stricter regulations. Manufacturers develop boilers designed for cleaner combustion and improved fuel efficiency. The office boiler market benefits from these advancements, aligning with rising corporate commitments toward achieving carbon neutrality and energy sustainability targets.

- For instance, Bosch Industriekessel provides hybrid boilers that use surplus green electricity from onsite solar panels, supplemented by natural gas boilers for backup, enabling significant CO₂ reductions in industrial applications like PepsiCo’s facility in Poland.

Shift Toward Modular and Compact Boiler Designs

Architectural changes in modern office layouts push demand for modular and compact boiler solutions. Space constraints in urban office buildings require equipment that is flexible, scalable, and easy to install. It allows companies to optimize heating infrastructure without sacrificing performance. Modular systems also enable phased capacity expansion, offering cost benefits. Manufacturers are investing in innovative designs that balance efficiency with compactness. This trend strengthens the appeal of adaptable heating solutions in competitive commercial environments.

Growing Integration of Renewable Energy with Boiler Systems

The integration of renewable energy into heating systems is reshaping market demand. Companies increasingly install boilers compatible with solar thermal or biomass inputs. It supports long-term energy savings and reduces reliance on fossil fuels. Manufacturers highlight renewable-ready solutions to meet sustainability targets and regulations. The office boiler market aligns with broader decarbonization efforts in commercial sectors. Rising investment in renewable-compatible systems reflects a clear trend of blending traditional heating with clean energy advancements.

Market Challenges Analysis

High Installation and Maintenance Costs Limiting Wider Adoption

The office boiler market faces a challenge from the high costs associated with installation and long-term maintenance. Modern energy-efficient boilers require advanced technology and skilled labor for setup, increasing upfront expenses for businesses. It creates hesitation among small and medium enterprises that operate on limited budgets. Regular servicing and replacement of components further add to overall costs. Uncertainty in fuel prices also affects the return on investment, making decision-making more complex for buyers.

Regulatory Compliance and Shift Toward Alternative Heating Solutions

Stringent regulatory requirements create compliance challenges for office boiler installations. Companies must adapt to evolving standards on emissions and efficiency, which increases design and operational complexity. It often requires manufacturers to invest heavily in R&D to keep products aligned with environmental mandates. At the same time, the growing popularity of alternative heating solutions such as heat pumps and district energy systems intensifies competition. The office boiler market must adapt to retain relevance against emerging sustainable technologies.

Market Opportunities

Rising Demand for Sustainable and Energy-Efficient Solutions

The office boiler market presents strong opportunities with the growing demand for sustainable and energy-efficient heating systems. Companies seek advanced boilers that align with carbon reduction targets and reduce operational expenses. It opens pathways for manufacturers to introduce condensing boilers, hybrid systems, and renewable-compatible models. Government incentives for green building adoption create further growth potential. Rising corporate focus on ESG compliance supports this transition. Expanding availability of eco-friendly technologies strengthens market prospects across developed and emerging economies.

Advancements in Smart Technology and Modular Designs

Technological innovation offers a clear growth avenue for the office boiler market. Integration of IoT and automation enables predictive maintenance, real-time monitoring, and improved energy management. It allows businesses to lower downtime and improve heating efficiency. Demand is also growing for modular and compact designs that suit modern office layouts. These solutions provide scalability and cost flexibility, encouraging adoption. The combination of smart control features and adaptable designs creates long-term opportunities for industry players.

Market Segmentation Analysis:

By Fuel

The office boiler market by fuel is dominated by natural gas boilers, holding nearly 48% share in 2024. Their popularity stems from high efficiency, lower emissions, and cost advantages compared to oil and coal alternatives. Oil-fired boilers account for around 22%, supported by regions with limited gas infrastructure. Electric boilers represent about 15%, favored for zero on-site emissions and easy integration in green buildings. Coal maintains a small 8% share, declining due to environmental restrictions, while other fuels, including biomass, cover the remaining 7%, driven by sustainability initiatives.

- For instance, Cleaver-Brooks offers electric resistance boilers producing up to 200 psig steam without combustion, aligning with all-electric building policies in cities like New York.

By Capacity

In capacity segmentation, the ≤0.3–2.5 MMBTU/hr range leads with about 35% share, reflecting strong demand in small to mid-sized offices where compact and efficient systems are essential. The 2.5–10 MMBTU/hr segment holds nearly 28%, serving medium-sized office complexes requiring higher load handling. Larger units of 10–50 MMBTU/hr represent 18%, preferred in multi-building campuses and high-rise offices. The 50–100 MMBTU/hr category secures 11%, while 100–250 MMBTU/hr accounts for 8%, used in specialized large-scale office facilities. Efficiency requirements and operational scale drive segmentation trends.

- For instance, Miura’s LX Series boilers, which scale up to 9.5 MMBTU/hr, are installed in corporate campuses due to their modular, quick-start design.

By Product

By product type, hot water boilers dominate with nearly 62% share in the office boiler market, supported by their reliability in providing central heating across office environments. Their efficiency and suitability for variable heating loads make them the most installed option. Steam boilers account for about 38%, mainly adopted in larger buildings requiring high-capacity heating or integration with centralized systems. It highlights a steady demand balance, where hot water solutions remain the standard for comfort-driven applications, while steam boilers cater to high-demand, large-scale office operations.

Segments:

Based on Fuel

- Natural Gas

- Oil

- Coal

- Electric

- Others

Based on Capacity

- ≤ 0.3 – 2.5 MMBTU/hr

- > 2.5 – 10 MMBTU/hr

- > 10 – 50 MMBTU/hr

- > 50 – 100 MMBTU/hr

- > 100 – 250 MMBTU/hr

Based on Product

Based on Technology

- Condensing

- Non-Condensing

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the office boiler market with 32% in 2024. Strong demand comes from the U.S. and Canada, where modern office complexes require reliable and energy-efficient heating systems. Strict regulatory policies on emissions push adoption of natural gas and electric boilers. It is further supported by corporate sustainability programs that prioritize green building certifications. Replacement of aging infrastructure also drives installations, with technology-focused retrofits increasing market opportunities.

Europe

Europe accounts for 27% of the global office boiler market, led by countries such as Germany, the U.K., and France. The region emphasizes energy efficiency and carbon reduction, encouraging the use of condensing and hybrid boilers. It benefits from strong regulatory enforcement under EU climate goals. High refurbishment activities in older office buildings continue to drive replacement demand. It is further shaped by rising interest in compact and modular solutions that fit into urban office layouts.

Asia-Pacific

Asia-Pacific secures 24% share in the office boiler market, with China, Japan, and India contributing significantly. Rapid urbanization and growth of corporate office spaces drive installations across the region. Rising energy demand pushes adoption of advanced heating solutions with higher efficiency. It is also influenced by government incentives for cleaner energy adoption. Expanding investment in smart office infrastructure increases interest in IoT-enabled boiler systems, supporting steady growth in this diverse regional market.

Latin America

Latin America represents 9% of the office boiler market in 2024. Brazil and Mexico lead adoption due to expanding commercial real estate and modernization of office facilities. Demand is fueled by the need for cost-effective heating systems in large office complexes. It is influenced by growing investment in energy-efficient technologies. Replacement of outdated oil and coal systems provides further opportunities. The region continues to transition toward natural gas and electric boilers to align with environmental goals.

Middle East & Africa

The Middle East & Africa region holds 8% share of the office boiler market. Countries like the UAE, Saudi Arabia, and South Africa drive demand through office infrastructure development and urban expansion. Although heating needs are lower compared to colder regions, demand grows for modern and efficient systems in commercial hubs. It benefits from the adoption of natural gas boilers supported by infrastructure development. It also shows potential for renewable-compatible solutions aligned with sustainability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Precision Boilers

- FERROLI

- Fulton

- Vaillant Group

- Hurst Boiler & Welding

- VIESSMANN

- PARKER BOILER

- Cleaver-Brooks

- Weil-McLain

- Energy Kinetics

- FONDITAL

- Miura America

Competitive Analysis

The office boiler market is characterized by strong competition among global and regional manufacturers focusing on efficiency, sustainability, and advanced technology integration. Key players such as Cleaver-Brooks, Precision Boilers, FERROLI, Fulton, Vaillant Group, Hurst Boiler & Welding, VIESSMANN, PARKER BOILER, Weil-McLain, Energy Kinetics, FONDITAL, and Miura America actively compete by offering product portfolios tailored to diverse office heating needs. It reflects a market where demand for natural gas, electric, and hybrid boilers continues to expand, driven by stricter emission regulations and the rising importance of green building certifications. Companies emphasize innovation in IoT-enabled monitoring, predictive maintenance, and modular system designs to strengthen operational reliability and meet the expectations of modern office infrastructure. Partnerships with real estate developers and service providers further enhance market penetration. Price competitiveness, product durability, and compliance with environmental standards remain central to competitive positioning. Continuous investment in R&D ensures players maintain differentiation in a market shaped by energy efficiency requirements and evolving corporate sustainability goals.

Recent Developments

- In February 2025, Cleaver-Brooks introduced new CBEX-3W Power Plus Plan models integrated with Prometha®, an IoT-enabled monitoring platform designed to provide real-time boiler performance insights and improve operational reliability.

- In May 2024, Lochinvar unveiled the LECTRUS™ Light Commercial Electric Boiler, offering efficient electric heating designed for commercial spaces.

- In April 2025, Utica Boilers inaugurated its new training center, equipped with high-efficiency wall-hung boilers and live-fire demo units to train contractors in cutting-edge boiler technologies.

Market Concentration & Characteristics

The office boiler market displays moderate to high concentration, with a mix of global leaders and regional manufacturers competing on efficiency, innovation, and compliance with environmental standards. Established companies such as Cleaver-Brooks, VIESSMANN, Vaillant Group, and Fulton dominate through strong product portfolios and extensive distribution networks, while emerging players focus on niche applications and cost-effective solutions. It is shaped by stringent regulatory frameworks that prioritize energy efficiency, low emissions, and sustainability in heating systems. Market characteristics emphasize steady replacement demand driven by aging infrastructure, growing refurbishment projects, and rising corporate focus on green building certifications. Technological advancements, including IoT-enabled monitoring, predictive maintenance, and modular designs, enhance product differentiation and expand adoption in modern office environments. Competitive intensity remains high, with players investing in R&D, partnerships, and customized solutions to meet diverse regional requirements and capture long-term growth opportunities in a market shaped by evolving efficiency standards and sustainability goals.

Report Coverage

The research report offers an in-depth analysis based on Fuel, Capacity, Product, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient boilers will grow as offices prioritize cost savings and sustainability goals.

- Natural gas boilers will maintain dominance, while electric boilers gain traction in green-certified office spaces.

- Hybrid and renewable-compatible boilers will see stronger adoption to meet stricter emission reduction targets.

- Smart IoT-enabled boilers will expand, offering predictive maintenance and real-time performance monitoring for office facilities.

- Modular and compact designs will increase adoption in urban offices with limited installation space availability.

- Replacement demand will rise as outdated systems are phased out to meet new regulatory standards.

- Asia-Pacific will witness strong growth driven by rapid urbanization and rising corporate office infrastructure investments.

- North America and Europe will focus on retrofitting projects supported by stricter environmental policy frameworks.

- Key manufacturers will invest heavily in R&D to develop advanced, efficient, and connected boiler technologies.

- Partnerships with construction firms and energy service providers will boost installation rates and regional market penetration.