Market Overview:

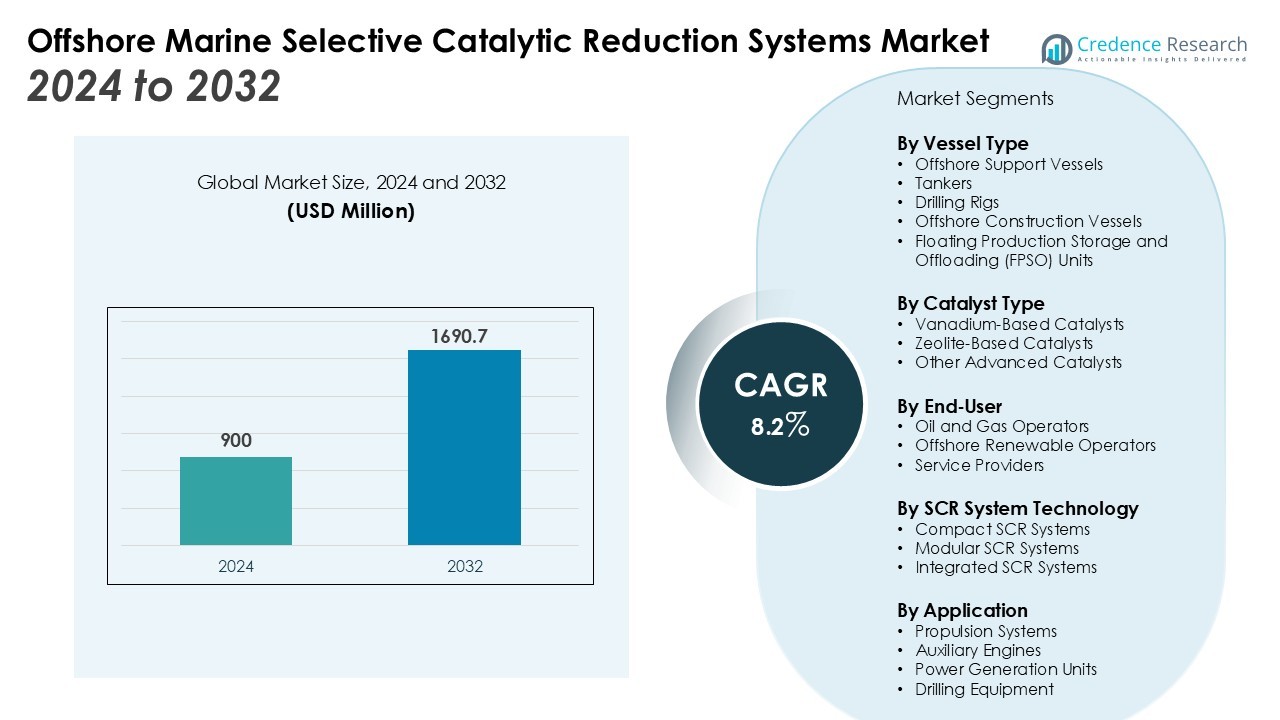

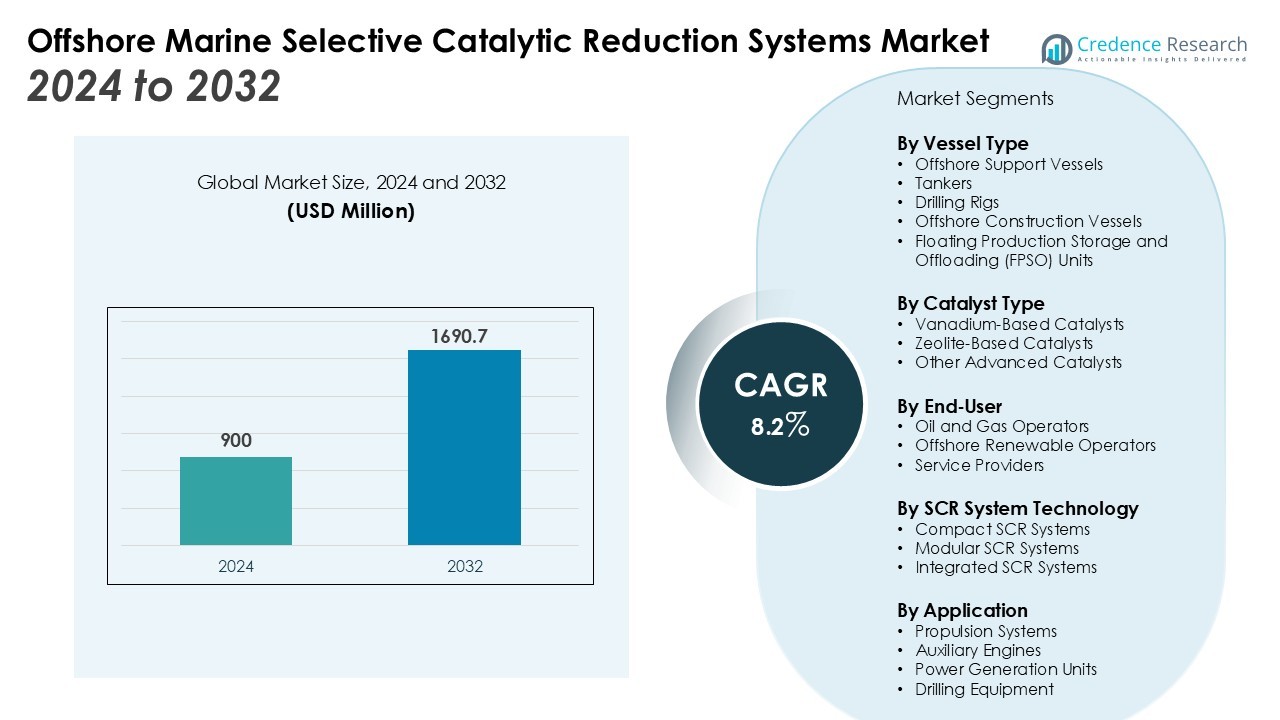

The Offshore Marine Selective Catalytic Reduction Systems Market size was valued at USD 900 million in 2024 and is anticipated to reach USD 1690.7 million by 2032, at a CAGR of 8.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Marine Selective Catalytic Reduction Systems Market Size 2024 |

USD 900 Million |

| Offshore Marine Selective Catalytic Reduction Systems Market, CAGR |

8.2% |

| Offshore Marine Selective Catalytic Reduction Systems Market Size 2032 |

USD 1690.7 Million |

Key drivers include the rising demand for cleaner marine operations, growing fleet modernization, and investments in energy-efficient offshore vessels. Offshore service providers are increasingly prioritizing SCR systems to reduce nitrogen oxide emissions and improve fuel efficiency. In addition, advancements in catalyst technology and modular SCR designs are lowering operational costs, making these systems more accessible for a wide range of vessel types, including offshore support vessels, tankers, and drilling rigs.

Regionally, Europe holds a significant share due to early adoption of IMO-compliant technologies and strong regulatory enforcement in emission control areas (ECAs). North America follows closely, supported by strict EPA standards and offshore exploration activity. The Asia-Pacific region is expected to record the fastest growth, driven by rising shipbuilding activities in China, South Korea, and Japan, alongside expanding offshore energy projects. The Middle East is also emerging as a key market, supported by offshore oil and gas development and investments in cleaner marine technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Offshore Marine Selective Catalytic Reduction Systems Market was valued at USD 900 million in 2024 and is projected to reach USD 1690.7 million by 2032, registering a CAGR of 8.2%.

- Stringent IMO Tier III regulations and enforcement in emission control areas are driving strong adoption across global offshore fleets.

- Rising demand for cleaner offshore operations is positioning SCR systems as essential for balancing performance with sustainability goals.

- Fleet modernization programs and investments in energy-efficient offshore vessels are accelerating system integration and market expansion.

- High installation costs and technical complexity remain key challenges, limiting adoption among small and mid-sized operators.

- Europe led the market with 38% share in 2024, followed by North America at 27% and Asia-Pacific at 24%.

- Rapid shipbuilding activity in Asia-Pacific and growing offshore oil, gas, and renewable projects are expected to create the fastest growth opportunities in the forecast period.

Market Drivers:

Stringent International Maritime Regulations Driving Compliance Requirements

The Offshore Marine Selective Catalytic Reduction Systems Market is expanding as international regulations enforce strict emission limits. The International Maritime Organization (IMO) Tier III standards mandate significant reductions in nitrogen oxide emissions from vessels operating in emission control areas. Shipowners and operators are compelled to adopt SCR systems to avoid penalties and maintain compliance. Regulatory pressure has created steady demand for reliable and cost-efficient solutions that align with long-term sustainability targets.

- For instance, Kanadevia had received orders for 86 marine vessel SCR systems for dual-stroke diesel engines as of February 2021, marking a significant technological deployment of SCR solutions compliant with IMO Tier III regulations.

Rising Demand for Cleaner Offshore Operations Supporting Technology Adoption

The growing emphasis on reducing the environmental footprint of offshore activities is boosting the Offshore Marine Selective Catalytic Reduction Systems Market. Offshore operators recognize the need for technologies that minimize emissions without compromising vessel performance. SCR systems deliver clear benefits by improving air quality and aligning operations with global sustainability goals. This alignment between environmental responsibility and operational efficiency is making SCR integration a preferred choice for offshore fleets.

- For instance, YANMAR Marine International has developed an SCR system for its 6LY400-440 engine series, achieving a 90 reduction in nitrogen oxide emissions to meet IMO Tier III standards.

Fleet Modernization and Energy-Efficient Vessel Investments Boosting Growth

The Offshore Marine Selective Catalytic Reduction Systems Market benefits from fleet modernization initiatives and investments in advanced offshore vessels. Shipowners are replacing outdated assets with vessels equipped with modern emission control systems. These investments are driven by the dual goals of meeting regulatory demands and improving energy efficiency. By integrating SCR systems, operators enhance vessel value, reduce fuel consumption, and improve overall competitiveness.

Technological Advancements Enhancing System Efficiency and Lowering Costs

Continuous innovation is transforming the Offshore Marine Selective Catalytic Reduction Systems Market with more efficient and cost-effective solutions. New catalyst designs, modular configurations, and compact system architectures make SCR deployment simpler and more affordable. It ensures operational flexibility while reducing downtime and maintenance needs. Advancements are making SCR technology scalable, enabling wider adoption across offshore support vessels, tankers, and drilling rigs.

Market Trends:

Growing Integration of Digital Monitoring and Smart Control Solutions

The Offshore Marine Selective Catalytic Reduction Systems Market is experiencing strong momentum from the integration of digital monitoring and smart control solutions. Vessel operators are adopting real-time emission tracking tools to ensure compliance with regulatory frameworks. It enables predictive maintenance, lowers operational risks, and improves system efficiency during offshore operations. Digital platforms also enhance data transparency, supporting sustainability reporting demanded by regulators and investors. Growing reliance on automation is reducing manual intervention and optimizing the performance of SCR systems. This trend reflects a broader industry movement toward digitalized vessel management and long-term environmental accountability.

- For instance, MAN Energy Solutions’ PrimeServ Assist uses AI-powered real-time monitoring to optimize equipment performance and availability 24/7, ensuring increased operational uptime and proactive maintenance for SCR systems.

Expansion of Retrofit Installations and Modular System Demand

The Offshore Marine Selective Catalytic Reduction Systems Market is seeing a rise in retrofit installations, driven by older fleets requiring compliance upgrades. Shipowners are selecting modular SCR systems that allow flexible installation across various vessel types, including offshore support vessels and drilling rigs. It minimizes downtime and reduces overall costs while extending the operational lifespan of existing assets. Modular systems also provide scalability, making them suitable for both large and small offshore fleets. Increasing focus on cost control in the offshore sector is accelerating the adoption of these adaptable solutions. This trend demonstrates a shift toward practical and cost-sensitive emission reduction strategies in global offshore markets.

- For instance, MAN PrimeServ retrofitted the Ambience cruise ship with SCR systems on two MAN 8L58/64 engines, enabling operation with ammonia slip levels measured at 10 parts per million (ppm), successfully meeting strict Tier III emission regulations for sensitive areas.

Market Challenges Analysis:

High Installation and Operational Costs Restricting Wider Adoption

The Offshore Marine Selective Catalytic Reduction Systems Market faces barriers due to high installation and operational costs. Integrating SCR systems requires significant capital investment, which many small and mid-sized operators find challenging. It also demands specialized infrastructure and technical expertise, raising the overall expense of deployment. Fuel compatibility and the need for quality urea-based reductants add further financial pressure. These factors limit adoption rates, particularly in regions with less stringent enforcement. Cost sensitivity within offshore operations remains a major hurdle to market expansion.

Technical Complexity and Maintenance Requirements Creating Operational Constraints

The Offshore Marine Selective Catalytic Reduction Systems Market is constrained by the technical complexity of SCR systems. It requires precise calibration, regular catalyst replacement, and continuous monitoring to maintain performance. In offshore conditions, system reliability often suffers due to exposure to high humidity, vibration, and corrosive elements. Skilled labor shortages intensify the challenge, as not all operators have trained personnel for proper system upkeep. Downtime caused by maintenance can disrupt offshore operations and increase overall costs. These operational challenges make adoption less attractive for operators prioritizing simplicity and reliability.Top of Form

Market Opportunities:

Rising Offshore Energy Investments Creating Strong Demand Potential

The Offshore Marine Selective Catalytic Reduction Systems Market is positioned to benefit from expanding offshore oil, gas, and renewable energy projects. Governments and private investors are channeling funds into offshore exploration, subsea development, and wind farm construction. It drives the need for emission-compliant support vessels, drilling rigs, and transport fleets. The push for cleaner energy supply chains reinforces the role of SCR systems in meeting global sustainability goals. Offshore operators view SCR adoption as a way to strengthen regulatory compliance and maintain operational licenses. This growing alignment between environmental responsibility and offshore expansion provides attractive long-term opportunities.

Advancements in Compact and Modular SCR Technologies Expanding Market Reach

The Offshore Marine Selective Catalytic Reduction Systems Market is gaining opportunities from advances in compact and modular SCR technologies. It allows easier retrofitting on existing fleets and flexible integration into new vessels. Compact designs reduce space requirements, addressing challenges faced by offshore support and utility vessels. Modular systems lower installation time and costs, encouraging wider adoption across diverse vessel categories. Operators are increasingly considering these systems to balance compliance with operational efficiency. These technological improvements create significant prospects for manufacturers and solution providers targeting offshore markets worldwide.

Market Segmentation Analysis:

By Vessel Type

The Offshore Marine Selective Catalytic Reduction Systems Market is segmented into offshore support vessels, tankers, and drilling rigs. Offshore support vessels account for a significant share due to frequent operations in emission control areas. Tankers and drilling rigs also contribute strongly as operators integrate SCR systems to comply with IMO Tier III standards. It highlights the broad adoption of emission control technology across multiple offshore vessel categories.

By Catalyst Type

The market includes vanadium-based, zeolite-based, and other advanced catalyst formulations. Vanadium-based catalysts dominate due to their proven effectiveness in reducing nitrogen oxide emissions under offshore operating conditions. Zeolite-based catalysts are gaining wider acceptance, offering durability and cost advantages. It demonstrates ongoing innovation in catalyst design aimed at enhancing performance and extending system lifecycles.

- For instance, Yanmar’s vanadium-based SCR system for the 6LY400 marine engine completed 9,000 hours of combined land-based and onboard testing, confirming its operational stability and NOx reduction efficiency.

By End-User

The market is divided into oil and gas operators, offshore renewable operators, and service providers. Oil and gas operators lead the segment due to extensive offshore exploration and production activities. Offshore renewable operators are increasing SCR adoption to meet sustainability goals and comply with regulatory mandates. It underscores the growing importance of SCR systems in supporting cleaner offshore operations across different end-user groups.

- For instance, BP’s Thunder Horse oil field in the Gulf of Mexico has a peak production capacity of 250,000 barrels of oil per day.

Segmentations:

By Vessel Type

- Offshore Support Vessels

- Tankers

- Drilling Rigs

- Offshore Construction Vessels

- Floating Production Storage and Offloading (FPSO) Units

By Catalyst Type

- Vanadium-Based Catalysts

- Zeolite-Based Catalysts

- Other Advanced Catalysts

By End-User

- Oil and Gas Operators

- Offshore Renewable Operators

- Service Providers

By SCR System Technology

- Compact SCR Systems

- Modular SCR Systems

- Integrated SCR Systems

By Application

- Propulsion Systems

- Auxiliary Engines

- Power Generation Units

- Drilling Equipment

By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Latin America

Regional Analysis:

Europe Maintaining Leadership Through Strict Environmental Regulations

Europe accounted for 38% of the Offshore Marine Selective Catalytic Reduction Systems Market in 2024. The region’s dominance is driven by stringent environmental policies and enforcement of emission control areas in the Baltic and North Seas. It ensures compliance with IMO Tier III standards and strengthens the sustainability of offshore fleets. European shipbuilders integrate SCR systems into new vessel designs, sustaining steady demand. Government-backed initiatives and funding programs further enhance adoption levels across offshore operations.

North America Advancing with Regulatory Support and Offshore Exploration Activity

North America held 27% of the Offshore Marine Selective Catalytic Reduction Systems Market in 2024. Strong U.S. Environmental Protection Agency (EPA) standards and offshore exploration in the Gulf of Mexico are driving adoption. It pushes operators to retrofit existing fleets with SCR systems to maintain compliance and extend operational lifespans. Offshore wind developments are also accelerating system deployment in the region. Regional manufacturers and service providers collaborate actively to create efficient and cost-effective solutions.

Asia-Pacific Emerging as the Fastest-Growing Market with Expanding Shipbuilding Industry

Asia-Pacific represented 24% of the Offshore Marine Selective Catalytic Reduction Systems Market in 2024. The region’s growth is driven by strong shipbuilding activity in China, South Korea, and Japan. It benefits from rising offshore oil and gas exploration along with expanding renewable energy projects. Governments are enforcing stricter emission norms, pushing adoption across offshore fleets. Continuous investment in modern vessels positions Asia-Pacific as a leading growth hub for the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Agriemach Ltd.

- Caterpillar

- Ceco Environmental

- DCL International LLC

- DEC Marine AB

- Ecourea

- Ecospray Technologies S.r.l.

- Environmental Energy Services Corporation

- HHI Engine & Machinery

- Hitachi Zosen Corporation

- H+H Engineering & Service GmbH

- Hug Engineering

- Industrial & Marine Silencers Ltd.

- Johnson Matthey

- Kwang Sung

Competitive Analysis:

The Offshore Marine Selective Catalytic Reduction Systems Market is characterized by the presence of established global players and specialized solution providers. Leading companies focus on developing advanced catalyst technologies, modular system architectures, and compact designs to enhance efficiency and lower operational costs. It is driving competition through innovation, strategic partnerships, and integration with digital monitoring solutions. Key participants are also investing in retrofitting solutions to capture demand from existing offshore fleets. Regional players compete by offering cost-effective and customized systems tailored to specific vessel requirements. Market leaders are strengthening their global footprint through collaborations with shipbuilders, offshore service providers, and regulatory bodies. The competitive landscape emphasizes compliance-driven innovation, cost optimization, and technological differentiation, positioning SCR systems as a critical component of sustainable offshore operations.

Recent Developments:

- In August 2025, Caterpillar signed a long-term strategic agreement with Hunt Energy Company to provide power solutions for data centers.

- In March 2025, DCL International Inc. unveiled a new catalyst for hydrogen peroxide decomposition, aimed at clean propulsion technologies.

Report Coverage:

The research report offers an in-depth analysis based on Vessel Type, Catalyst Type, End-User, SCR System Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Offshore Marine Selective Catalytic Reduction Systems Market will witness strong adoption due to stricter IMO Tier III regulations.

- It will benefit from increasing offshore exploration and production projects requiring emission-compliant vessels.

- Growing investments in offshore renewable energy, particularly wind farms, will expand system demand.

- Shipbuilders will integrate SCR systems into new vessel designs, strengthening long-term adoption trends.

- Retrofitting opportunities for older fleets will create steady revenue streams for solution providers.

- Advances in compact and modular SCR systems will enhance operational flexibility and lower installation barriers.

- It will see rising demand for digital monitoring and automation, improving compliance and efficiency.

- Regional growth in Asia-Pacific will accelerate due to strong shipbuilding activity and stricter emission norms.

- Collaboration between global manufacturers and regional service providers will expand system accessibility.

- Rising environmental sustainability goals will continue to position SCR technology as a critical component of offshore operations.