Market Overview:

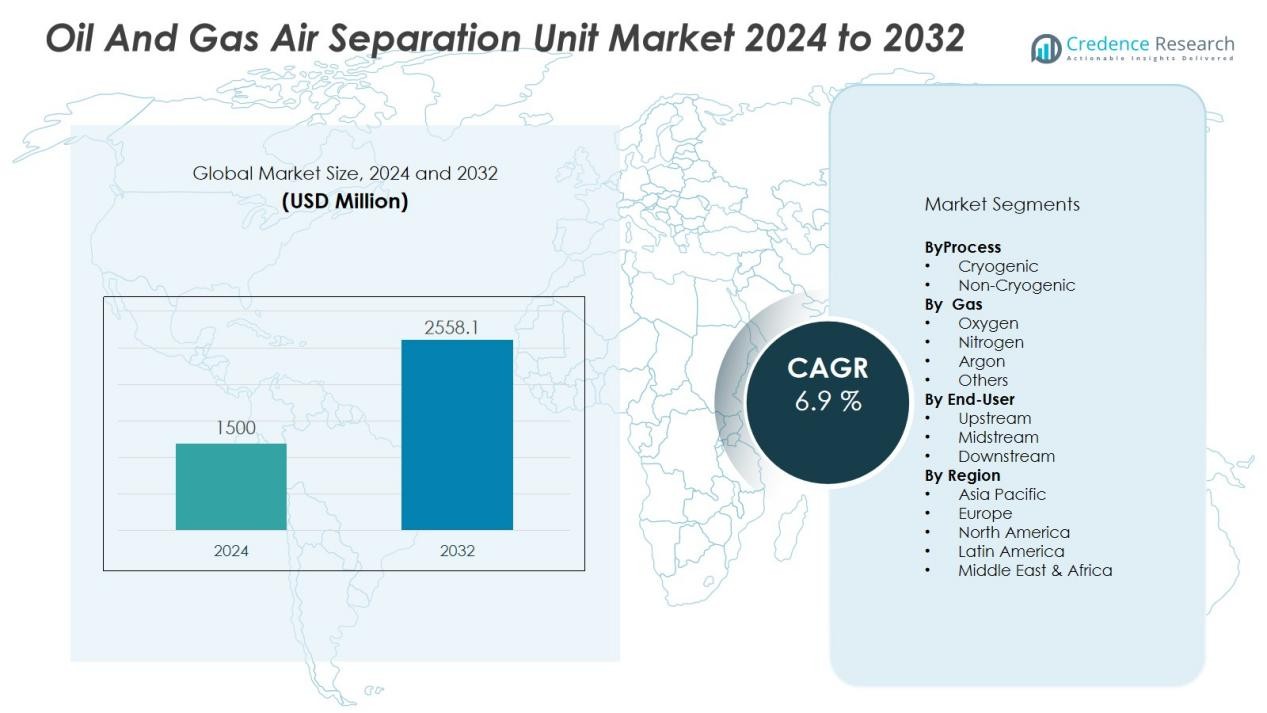

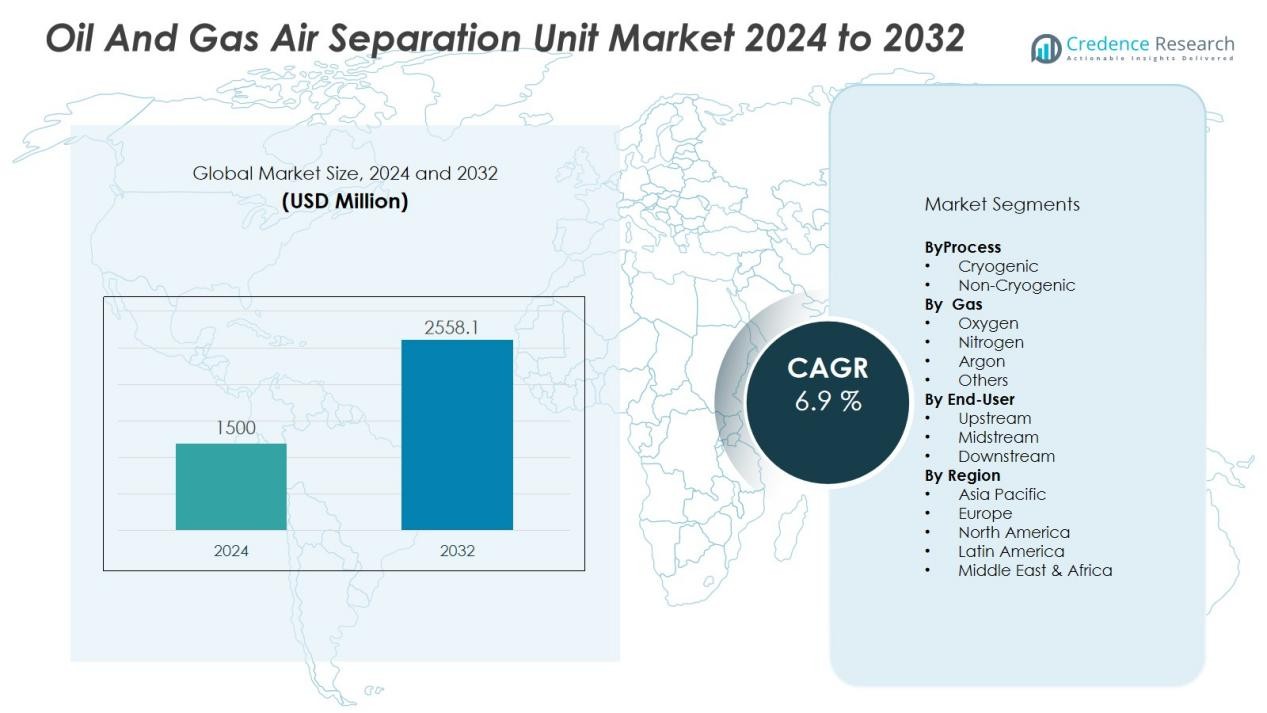

The Oil and Gas Air Separation Unit Market size was valued at USD 1500 million in 2024 and is anticipated to reach USD 2558.1 million by 2032, at a CAGR of 6.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil and Gas Air Separation Unit Market Size 2024 |

USD 1500 Million |

| Oil and Gas Air Separation Unit Market, CAGR |

6.9 % |

| Oil and Gas Air Separation Unit Market Size 2032 |

USD 2558.1 Million |

Key drivers shaping the market include the rising demand for oxygen in enhanced oil recovery (EOR) and nitrogen for inerting, blanketing, and pipeline purging. Advancements in non-cryogenic and modular air separation technologies are lowering costs, enabling deployment in remote oilfields and offshore projects. Growing environmental regulations are further encouraging adoption, as these units enhance process efficiency and reduce greenhouse gas emissions by optimizing combustion and improving energy recovery in refineries and petrochemical facilities.

Regionally, Asia-Pacific leads the oil and gas air separation unit market due to rapid industrialization, refinery expansion, and major petrochemical investments in China and India. North America follows, supported by shale gas exploration and modernized refining capacity. Europe maintains steady demand driven by energy transition policies and high-value petrochemical production. Emerging opportunities are visible in the Middle East & Africa, where large-scale oil and gas projects are fueling adoption of air separation units. Latin America is gradually increasing uptake, supported by infrastructure investments in Brazil and Mexico.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The oil and gas air separation unit market was valued at USD 1500 million in 2024 and will reach USD 2558.1 million by 2032, growing at a CAGR of 6.9%.

- Rising demand for oxygen in enhanced oil recovery and nitrogen in inerting, blanketing, and pipeline purging is driving adoption.

- Expansion of refining and petrochemical projects is increasing the requirement for large-scale oxygen and nitrogen supply.

- Technological advancements in modular and non-cryogenic systems are lowering costs and enabling deployment in remote oilfields.

- High capital costs, operational expenses, and regulatory compliance challenges remain barriers for smaller operators.

- Asia-Pacific led with 38% market share in 2024, followed by North America at 27% and Europe at 21%.

- Emerging opportunities in the Middle East, Africa, and Latin America are supported by large oilfield projects and refinery modernization.

Market Drivers:

Rising Demand for Industrial Gases in Oil and Gas Operations:

The oil and gas air separation unit market benefits from the growing requirement for industrial gases across upstream, midstream, and downstream activities. Oxygen plays a vital role in enhanced oil recovery techniques, while nitrogen is essential for inerting and purging in pipelines and storage facilities. These applications improve operational efficiency, reduce risks, and extend asset life cycles. It is driving significant adoption among exploration and refining companies.

- For instance, Linde’s customized nitrogen complex at Mexico’s Cantarell oil field comprises five air separation units, each delivering 10,000 tonnes per day of high-pressure nitrogen to enhance recovery rates from the offshore reservoir.

Expansion of Refining and Petrochemical Capacity:

Expanding refining and petrochemical projects worldwide is a key driver for the oil and gas air separation unit market. Modern refineries require reliable oxygen and nitrogen supply to support complex processes such as hydrocracking and catalytic reforming. Growing demand for high-value petrochemical products also supports installations across large-scale projects. It strengthens market growth by aligning with the energy and chemical industry’s rising output needs.

- For instance, INOX Air Products built India’s largest greenfield oxygen plant with a capacity to generate 2,150 tonnes per day of industrial gases to support heavy industrial operations and refining processes.

Technological Advancements and Modular System Deployment:

Technological improvements, including energy-efficient designs and modular non-cryogenic systems, are advancing adoption. The oil and gas air separation unit market benefits from solutions that offer lower capital and operating costs while supporting on-site production in remote fields. Modular designs ensure quick installation and scalability, meeting project-specific requirements in both offshore and onshore operations. It enhances project economics and reduces supply chain dependence.

Environmental Regulations and Process Optimization Needs:

Environmental policies are creating pressure to reduce emissions and improve energy efficiency across the oil and gas sector. The oil and gas air separation unit market supports these goals by enabling optimized combustion and improved energy recovery in refining and petrochemical operations. Operators use these systems to comply with tightening emission standards while maintaining production efficiency. It is reinforcing the role of air separation units as an essential tool for sustainable operations.

Market Trends:

Growing Preference for On-Site and Modular Air Separation Units:

The oil and gas air separation unit market is witnessing a clear trend toward on-site and modular systems that provide greater flexibility and cost efficiency. On-site units reduce reliance on external supply chains and ensure consistent availability of oxygen and nitrogen for critical processes. Modular designs are becoming popular in offshore platforms and remote oilfields where rapid deployment and scalability are essential. Companies are investing in compact, energy-efficient units that lower operating costs and allow quick installation. It is reshaping how operators plan their industrial gas supply strategies in challenging environments. This trend supports operational resilience while reducing project delays linked to transportation or supply disruptions.

- For example, Linde’s SPECTRA on-site nitrogen generation plants offer capacities ranging from 7,000 to 70,000 Nm3/h with the highest operational efficiency and lowest environmental footprint, enabling resilient supply chain management in remote or offshore applications.

Integration of Digital Technologies and Energy-Efficient Designs:

The oil and gas air separation unit market is also being influenced by the integration of digital monitoring systems and advanced energy-saving technologies. Digital controls and IoT-enabled solutions allow real-time monitoring, predictive maintenance, and optimization of air separation processes. Energy-efficient designs, such as advanced compressors and optimized heat exchangers, reduce power consumption and align with industry sustainability goals. Companies are adopting automation to enhance reliability and reduce downtime in refining and petrochemical operations. It is improving performance standards while helping operators comply with stricter environmental regulations. This trend is driving innovation and shaping a competitive landscape focused on efficiency and sustainability.

- For instance, Ecolab’s OMNI Air Separation Unit Intelligence utilizes predictive analytics with real-time data to optimize main air compressor performance while minimizing operating costs and downtime in industrial gas production.

Market Challenges Analysis:

High Capital Investment and Operational Costs:

The oil and gas air separation unit market faces challenges from the high upfront investment required for installation and operation. Air separation units demand significant capital for equipment, infrastructure, and integration into existing oil and gas facilities. Ongoing expenses related to energy consumption, maintenance, and skilled labor further increase the total cost of ownership. Smaller operators often struggle to justify such investments when project budgets remain constrained. It limits adoption in regions where financing options and government incentives are less developed. This challenge creates a barrier to entry for new players and slows expansion in price-sensitive markets.

Complex Regulatory Environment and Supply Chain Constraints:

The oil and gas air separation unit market also encounters difficulties linked to regulatory compliance and supply chain risks. Stricter environmental standards require continuous upgrades to designs and technology, creating pressure on manufacturers and operators. Global supply chain disruptions can delay delivery of critical components, impacting project timelines and increasing costs. Skilled workforce shortages in certain regions add further complexity, limiting efficient operation and maintenance of advanced systems. It creates operational uncertainty for companies managing multiple projects across diverse geographies. This challenge highlights the need for robust planning, local sourcing strategies, and regulatory adaptability to ensure long-term market stability.

Market Opportunities:

Expansion of Refining and Petrochemical Infrastructure in Emerging Economies:

The oil and gas air separation unit market has strong opportunities in emerging economies with rising energy and petrochemical demand. Countries in Asia-Pacific, the Middle East, and Africa are investing heavily in new refining and petrochemical complexes. These projects require reliable and large-scale supply of oxygen and nitrogen, creating demand for advanced air separation units. Governments in these regions are supporting industrial growth through favorable policies and infrastructure funding. It opens pathways for global and regional players to expand their footprint by offering tailored solutions. The opportunity is further enhanced by joint ventures and partnerships with local companies to meet project-specific needs.

Integration with Sustainable Energy and Advanced Technologies:

The oil and gas air separation unit market can also capitalize on the shift toward energy efficiency and sustainability. Units designed with advanced compressors, waste heat recovery, and digital monitoring systems align with global decarbonization goals. Companies investing in smart, IoT-enabled air separation technologies gain competitive advantages through improved operational reliability and lower lifecycle costs. Offshore and remote projects present growing opportunities for modular and portable systems that reduce dependence on external supply chains. It positions the market as a critical enabler of efficiency and environmental compliance in oil and gas operations. These opportunities highlight the role of innovation in driving long-term growth.

Market Segmentation Analysis:

By Process:

The oil and gas air separation unit market is segmented into cryogenic and non-cryogenic processes. Cryogenic units dominate due to their ability to produce large volumes of oxygen and nitrogen with high purity, making them essential in large refineries and petrochemical complexes. Non-cryogenic units, including pressure swing adsorption and membrane technologies, are gaining traction for smaller facilities and remote oilfields. It supports cost efficiency and quick installation, aligning with the industry’s need for flexible solutions.

- For instance, Absolut Air’s PSA nitrogen systems generate up to 2 500 Nm³/h of nitrogen at 99.9999% purity on-site, enabling reliable, compact gas generation for remote wellhead and modular plant applications.

By Gas:

The market is classified into oxygen, nitrogen, and others. Oxygen is widely used in enhanced oil recovery, refining, and petrochemical operations to optimize combustion and improve output. Nitrogen holds significant demand for pipeline purging, blanketing, and inerting processes, ensuring safety in oil and gas environments. Other gases, including argon, also serve niche applications in refining and petrochemical operations. It reflects the growing diversity of applications driving adoption across different project scales.

By End-User:

The market caters to upstream, midstream, and downstream segments. Upstream operations rely on nitrogen and oxygen for enhanced oil recovery and drilling support. Midstream activities demand nitrogen for storage and transportation safety. Downstream refineries and petrochemical plants are the largest end-users, driving adoption for efficiency and compliance with emission standards. It highlights the integral role of air separation units in ensuring reliability across the oil and gas value chain.

- For instance, Air Products supplied nitrogen generation units to ExxonMobil’s Permian Basin projects, enabling continuous enhanced oil recovery with an output capacity of 50 million standard cubic feet per day, verified via recent company disclosures.

Segmentations:

By Process:

By Gas:

- Oxygen

- Nitrogen

- Argon

- Others

By End-User:

- Upstream

- Midstream

- Downstream

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 38% market share in 2024, leading the oil and gas air separation unit market. It benefits from large-scale refinery and petrochemical projects in China and India supported by industrial growth. Government investments in infrastructure and energy security further strengthen demand for advanced air separation systems. Rising natural gas processing and petrochemical feedstock production also create opportunities for capacity expansion. Operators are adopting modular and energy-efficient units to reduce costs and ensure consistent supply. It positions the region as the most dynamic hub for long-term growth in the market.

North America:

North America accounted for 27% market share in 2024, supported by shale gas exploration and refining modernization. The United States leads with strong investments in petrochemical plants and LNG projects requiring nitrogen and oxygen. Growing emphasis on process efficiency and compliance with emission standards drives demand for advanced systems. Canada contributes through oil sands projects that require reliable industrial gas supply. Operators are investing in on-site and modular units to ensure supply reliability in remote fields. It highlights the region’s focus on sustainable and efficient operations within the oil and gas sector.

Europe:

Europe secured 21% market share in 2024, driven by energy transition policies and petrochemical production. Strict regulatory frameworks push adoption of efficient and low-emission units across refining and gas processing facilities. The Middle East & Africa represented 9% share, supported by large-scale oilfield projects and downstream investments. Latin America held 5% share, driven by refinery modernization in Brazil and energy reforms in Mexico. Local players are collaborating with global suppliers to accelerate deployment and reduce cost pressures. It shows balanced growth potential across mature and emerging regions, with increasing emphasis on technology integration and sustainable operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Linde PLC

- SIAD Macchine Impianti SpA

- Messer Group GmBH

- Taiyo Nippon Sanso Corporation

- Air Liquide SA

- Shanghai Chinllenge Gases Co. Ltd

- Universal Industrial Plants

- Bhoruka Gases Limited

- Air Products and Chemicals Inc

- Sichuan Air Separation Group

Competitive Analysis:

The oil and gas air separation unit market is highly competitive, driven by innovation, regional expansion, and technology integration. Key players include Linde PLC, SIAD Macchine Impianti SpA, Messer Group GmbH, Taiyo Nippon Sanso Corporation, Air Liquide SA, Shanghai Chinllenge Gases Co. Ltd, and Universal Industrial Plants. These companies focus on offering both cryogenic and non-cryogenic solutions to serve diverse upstream, midstream, and downstream applications. It is marked by continuous investment in modular designs, energy-efficient systems, and digital monitoring technologies to enhance operational reliability. Strategic partnerships, joint ventures, and long-term supply agreements strengthen their market presence across established and emerging economies. Regional companies compete by offering cost-effective solutions and tailoring products to specific project requirements. Global leaders emphasize sustainability and compliance with environmental regulations to maintain a competitive edge and capture demand from large-scale refining and petrochemical projects worldwide.

Recent Developments:

- In June 2025, Linde signed a long-term agreement with Blue Point Number One to supply industrial gases to a large low-carbon ammonia plant in Louisiana. Linde will build and operate a world-scale air separation unit as part of this project expected to start in 2029.

- In May 2024, ESAB Corporation signed an agreement to acquire Linde Industries Private Limited (LIPL) in Bangladesh, a market leader in welding consumables and equipment.

- In May 2024, SIAD Macchine Impianti launched a new 550 bar oil-free high-pressure hydrogen compressor designed for hydrogen mobility and refueling stations.

Report Coverage:

The research report offers an in-depth analysis based on Process, Gas, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The oil and gas air separation unit market will see strong demand from expanding refining and petrochemical capacity.

- Rising adoption of modular and on-site systems will support flexibility and reduce supply chain risks.

- Integration of digital monitoring and IoT will improve efficiency, predictive maintenance, and operational reliability.

- Environmental regulations will drive the need for energy-efficient and low-emission unit designs.

- Emerging economies in Asia-Pacific, the Middle East, and Africa will remain major growth hubs.

- Offshore projects will create demand for compact and portable units designed for harsh environments.

- Strategic partnerships between global suppliers and local companies will accelerate adoption in developing regions.

- Innovations in compressors and waste heat recovery systems will lower energy consumption and operating costs.

- The market will benefit from growing investments in LNG and natural gas processing projects.

- Operators will increasingly prioritize sustainability, positioning air separation units as key enablers of compliance and efficiency.