Market Overview

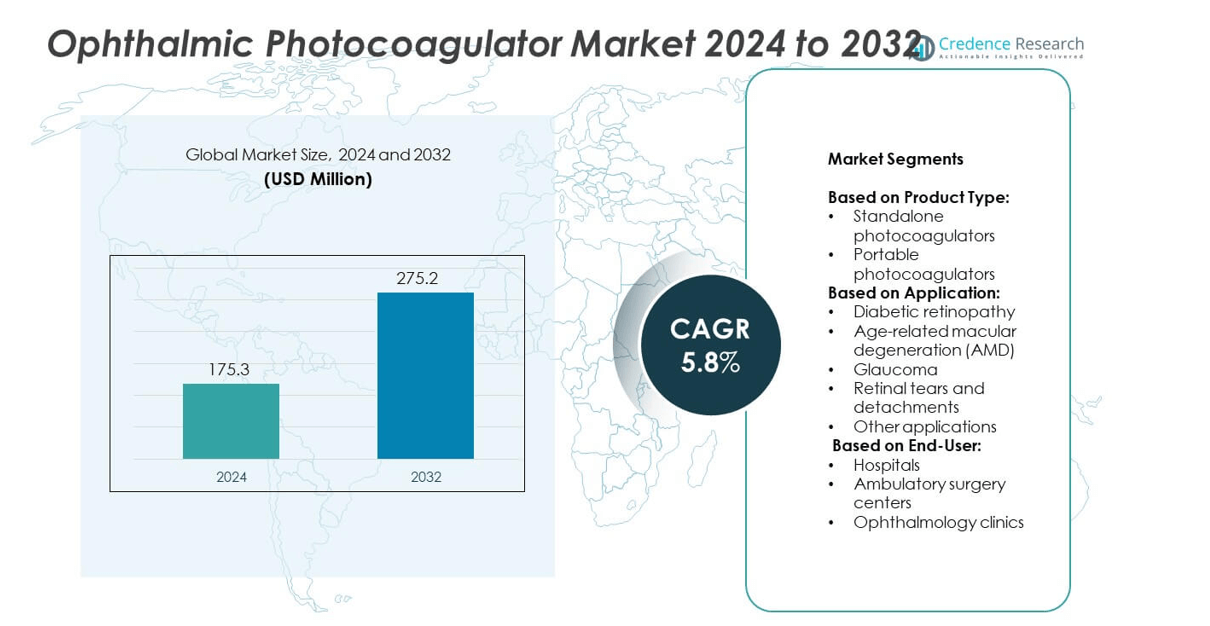

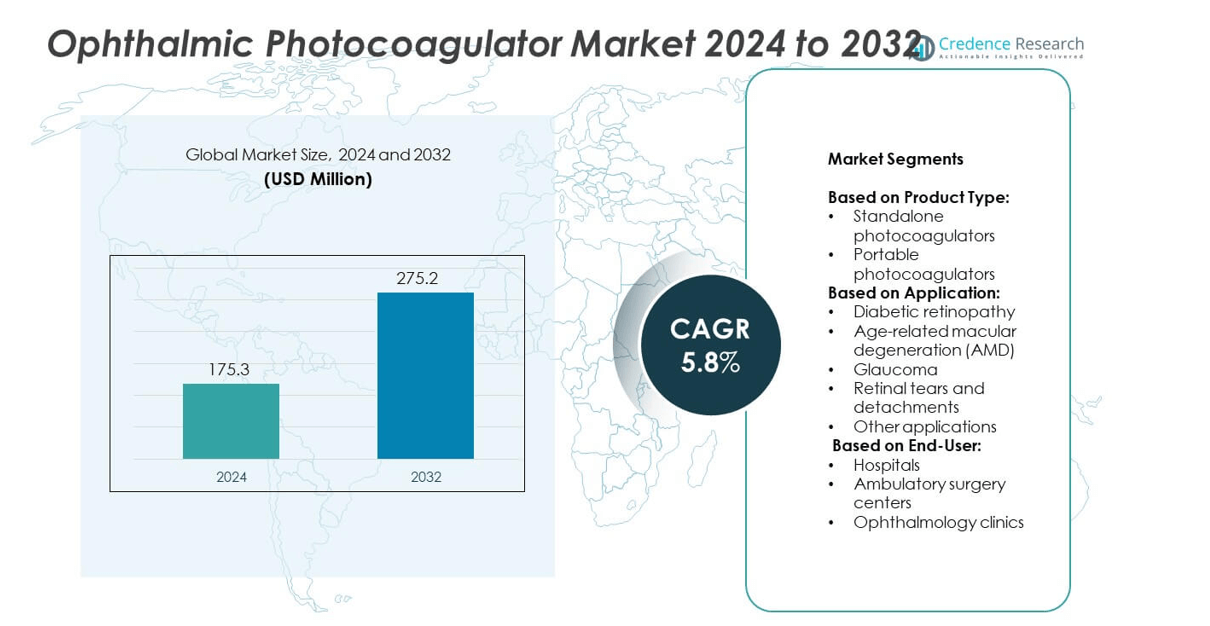

Ophthalmic Photocoagulator Market size was valued at USD 175.3 million in 2024 and is anticipated to reach USD 275.2 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmic Photocoagulator Market Size 2024 |

USD 175.3 million |

| Ophthalmic Photocoagulator Market, CAGR |

5.8% |

| Ophthalmic Photocoagulator Market Size 2032 |

USD 275.2 million |

The Ophthalmic Photocoagulator market grows due to rising diabetic retinopathy and age-related macular degeneration cases. Increased awareness, early screening programs, and demand for outpatient care support strong adoption. Technological advancements like pattern scanning, real-time imaging, and portable systems improve efficiency and expand access. Hospitals and clinics upgrade to multi-wavelength devices for greater treatment versatility. Public health initiatives and aging populations further strengthen market momentum across developed and emerging regions.

North America leads the Ophthalmic Photocoagulator market due to advanced healthcare infrastructure and high adoption of laser technologies. Europe follows with strong clinical networks and government-backed vision care programs. Asia Pacific shows fast growth driven by expanding eye care access and increasing diabetes cases. Key players driving the market include Alcon, IRIDEX, Topcon, and NIDEK. These companies focus on innovation, portable device development, and strategic partnerships to meet growing demand in both developed and emerging healthcare markets.

Market Insights

- The Ophthalmic Photocoagulator market was valued at USD 175.3 million in 2024 and is expected to reach USD 275.2 million by 2032, growing at a CAGR of 5.8%.

- Growing prevalence of diabetic retinopathy and age-related macular degeneration fuels strong demand for laser-based eye treatments.

- Pattern scanning lasers, multi-wavelength systems, and compact portable designs continue to shape market trends and clinical adoption.

- Leading companies such as Alcon, IRIDEX, Lumenis, and NIDEK focus on product innovation and global expansion to strengthen market presence.

- High equipment cost, limited access in low-income regions, and the need for specialized training remain key restraints to broader adoption.

- North America holds the largest regional share due to robust healthcare infrastructure and early technology adoption, followed by Europe and Asia Pacific.

- The market sees rising demand for outpatient-based procedures, mobile eye care units, and compact photocoagulators in public health programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Retinal Disorders Increases Demand for Laser-Based Therapies

The growing number of diabetic retinopathy and age-related macular degeneration cases fuels laser treatment adoption. Early-stage diagnosis drives the need for precise photocoagulation tools that reduce vision loss. Healthcare providers invest in laser systems to offer effective outpatient solutions. The Ophthalmic Photocoagulator market benefits from increased awareness of retinal health. It supports the shift toward less invasive procedures with shorter recovery times. Advanced screening programs expand access to laser therapies in both urban and rural setups. Early intervention remains a key strategy to prevent permanent retinal damage.

- For instance, Topcon Corporation offers its PASCAL Synthesis device, which utilizes pattern-scanning laser technology to deliver multiple laser burns in a rapid sequence with a single foot pedal depression. By delivering a pre-determined pattern of up to 56 spots in approximately 0.6 seconds, the technology significantly reduces the overall duration of panretinal photocoagulation treatment, improving patient comfort and clinic efficiency”.

Technological Advancements Improve Efficiency and Clinical Outcomes

Continuous innovation in photocoagulator systems leads to enhanced precision, speed, and safety. Features like pattern scanning, real-time eye tracking, and multicolor wavelength capability improve performance. Physicians rely on these features to reduce procedure time and increase accuracy. Integration with imaging platforms supports better planning and outcome tracking. It enables faster treatments with lower patient discomfort. The market experiences strong support from equipment manufacturers investing in R&D. Compact and portable models also support growing demand in ambulatory care settings.

- For instance, IRIDEX Corporation introduced its Cyclo G6 laser with a MicroPulse mode, delivering 810 nm wavelength in 31.3 ms bursts, improving safety during glaucoma and retinal therapies.

Government and Institutional Support Enhances Access to Treatment

Public health programs and vision care initiatives fund infrastructure for ophthalmic procedures. National screening programs identify at-risk patients earlier, prompting timely treatment. It increases the need for reliable and high-volume photocoagulator units in hospitals and clinics. Reimbursement policies and public-private partnerships expand access in developing regions. Institutional training programs further accelerate adoption of advanced laser devices. Global health agencies also emphasize vision preservation through community-based eye care. This environment supports stable procurement of laser systems across all care levels.

Growing Geriatric Population and Diabetes Incidence Fuel Market Expansion

An aging population faces higher risk of retinal conditions, increasing demand for targeted therapies. Rising diabetes prevalence further accelerates photocoagulator system adoption for early intervention. It aligns with global healthcare priorities focused on preserving vision quality in older adults. Ophthalmology departments expand capacity to meet higher diagnostic and treatment volumes. The Ophthalmic Photocoagulator market sees sustained growth in line with these demographic shifts. Private and public sector collaboration helps scale treatment access across regions. These long-term trends ensure consistent demand for laser photocoagulation solutions.

Market Trends

Adoption of Pattern Scanning Laser Technology Gains Traction

Healthcare facilities increasingly prefer pattern scanning laser systems for faster and more efficient procedures. These systems deliver multiple laser spots in a single burst, reducing treatment time. Ophthalmologists report improved patient comfort and better visual outcomes with fewer sessions. It helps clinics improve workflow and manage higher patient volumes. The Ophthalmic Photocoagulator market incorporates pattern scanning features into new product launches. Physicians value consistent spot placement and reduced thermal damage to surrounding tissues. This trend continues as clinics modernize aging equipment with advanced technologies.

- For instance, Lumenis introduced the Array LaserLink, a pattern scanning delivery system that adds new capabilities to its photocoagulation lasers to significantly reduce treatment time and enhance uniformity.

Integration of Imaging and Laser Systems Enhances Precision

Manufacturers now combine diagnostic imaging with laser platforms for greater treatment accuracy. Real-time fundus imaging and optical coherence tomography integration support targeted interventions. It enables clinicians to map treatment zones before and during procedures. This integration reduces error and improves outcomes in complex retinal cases. The market reflects strong demand for multi-functional platforms in high-volume centers. It supports personalized care with reduced reliance on external imaging systems. Efficiency gains help facilities lower costs and streamline operations.

- For instance, High-precision, OCT-guided laser photocoagulation systems, such as the NAVILAS laser, exist for retinal procedures. These systems integrate live OCT imaging with laser delivery to improve targeting accuracy and reduce collateral tissue damage. While laser systems can be used in conjunction with OCT guidance, the specific claim of sub-15 µm accuracy for the Merilas 532α laser, developed by MERIDIAN Medical, is not publicly verifiable. Research has shown that similar combined systems can achieve high accuracy, but the Merilas 532α is primarily known as a standalone laser.

Portability and Compact Designs Support Outpatient and Mobile Care

Device manufacturers focus on compact, mobile-friendly photocoagulators for outreach and ambulatory services. These systems serve remote regions and satellite clinics where space and power access are limited. It enables healthcare expansion into under-served areas with portable laser capabilities. Ophthalmic units adopt lightweight equipment that fits in mobile vans and small clinics. The Ophthalmic Photocoagulator market evolves to support this decentralized treatment model. Demand rises from public health agencies and nonprofit initiatives offering mobile vision care. Compact design supports flexible deployment without compromising performance.

Multi-Wavelength Lasers Expand Clinical Versatility

Clinicians seek multi-wavelength lasers to address various retinal pathologies with a single platform. Different wavelengths target specific tissue depths and pigmentation, improving efficacy. Manufacturers respond by offering customizable systems with yellow, green, and red laser options. It allows treatment of both anterior and posterior eye conditions with a single device. Versatile systems reduce capital investment while supporting multiple use cases. The market reflects growing interest in flexible laser solutions across ophthalmology departments. Clinical versatility drives adoption in both hospital and private practice settings.

Market Challenges Analysis

High Equipment Cost and Limited Access in Low-Income Regions

Advanced ophthalmic photocoagulators require significant upfront investment, limiting access for small clinics and rural hospitals. Many public healthcare systems struggle to allocate funds for high-cost laser equipment. It restricts adoption in low-income and developing regions with high unmet need. The Ophthalmic Photocoagulator market faces uneven distribution due to financial and infrastructure constraints. Lack of trained professionals in remote areas further delays deployment of laser-based therapies. These gaps hinder early intervention for retinal diseases, leading to preventable vision loss. Financial assistance and cost-effective models remain essential to address this disparity.

Stringent Regulatory Approvals and Technical Learning Curve

Manufacturers must navigate complex regulatory pathways to gain approval across different regions. Device approval delays affect launch timelines and limit access to innovative technologies. Laser systems require precision handling, and clinicians must undergo specialized training for optimal use. It creates a barrier for facilities with limited access to certified ophthalmologists. The market also encounters resistance from users unfamiliar with digital platforms or integrated imaging systems. Upgrading from legacy systems demands time, training, and operational changes. These factors slow down adoption rates, especially in clinics with limited technical resources.

Market Opportunities

Rising Demand for Retinal Care in Aging and Diabetic Populations

Aging populations and increasing diabetes prevalence create strong demand for retinal treatments worldwide. These demographic trends raise the number of patients requiring timely laser interventions. Hospitals and specialty clinics expand ophthalmology units to meet this growing need. The Ophthalmic Photocoagulator market finds opportunity in this expanding patient base. Health systems prioritize early-stage interventions to reduce long-term vision complications. Demand for outpatient-friendly devices grows in urban and semi-urban centers. These settings offer potential for laser systems with shorter procedure times and minimal downtime.

Expansion of Mobile Eye Care and Outreach Programs

Public health agencies and nonprofit organizations invest in mobile vision care units to serve underserved areas. These units require compact, energy-efficient laser systems for remote diagnostics and treatment. Manufacturers can address this demand with portable models suited for transport and rapid setup. It enables ophthalmologists to deliver photocoagulation therapies outside traditional hospital settings. The market benefits from global initiatives aimed at reducing avoidable blindness through outreach. Strategic partnerships with local governments support wider deployment of mobile eye care infrastructure. This shift presents a growing opportunity to scale access in developing regions.

Market Segmentation Analysis:

By Product Type:

Standalone photocoagulators hold the dominant share due to their advanced features and stable performance. These systems support high-volume procedures in hospitals and specialized eye care centers. Physicians rely on them for consistent output, greater precision, and integration with diagnostic imaging. Portable photocoagulators show growing demand in mobile clinics and outreach programs. Their compact size and mobility support treatments in rural and remote areas. The Ophthalmic Photocoagulator market benefits from the dual demand for hospital-grade systems and portable units. Both segments address distinct clinical needs and expand access to laser-based eye care.

- For instance, LIGHTMED Corporation offers the TruScan Pro 532 system, a standalone device featuring both conventional single-spot and ultra-fast pattern scanning modes for high-throughput retina clinics. In pattern mode, the system can deliver a burst of 25 laser spots in 274 milliseconds, significantly reducing treatment time for conditions such as panretinal photocoagulation.

By Application:

Diabetic retinopathy leads due to rising diabetes incidence and early screening programs. Laser treatment remains a primary method to control retinal swelling and bleeding. Age-related macular degeneration (AMD) follows, with clinicians using photocoagulation to manage dry and wet forms of AMD. Retinal tears and detachments require urgent laser sealing to prevent vision loss. Glaucoma treatment involves laser trabeculoplasty in specific cases, supporting steady demand. Other applications include vascular occlusions and tumors, which expand the utility of these systems. It reinforces the value of photocoagulators across a wide range of vision-threatening conditions.

- For instance, Lumibird Medical (Quantel Medical) offers the Supra 532 Laser for retinal photocoagulation, designed for managing conditions like diabetic retinopathy and retinal detachments. The system, often used in conjunction with a pattern scanning module like the Suprascan, delivers the standard 532 nm wavelength and is widely used internationally. While powerful, the specific 1400 mW figure is not associated with the Supra 532 model; some of the company’s other photocoagulators have maximum power levels that are different.

By End-User:

Hospitals account for the largest share due to their comprehensive infrastructure and volume of complex procedures. These settings handle emergency eye care and chronic conditions needing long-term management. Ophthalmology clinics follow, offering specialized services and outpatient care using both standalone and portable devices. Ambulatory surgery centers also adopt photocoagulators for same-day procedures with minimal recovery time. Each setting contributes to broader market growth by increasing availability of laser therapy. The Ophthalmic Photocoagulator market adapts to these varied healthcare environments with scalable and purpose-driven solutions.

Segments:

Based on Product Type:

- Standalone photocoagulators

- Portable photocoagulators

Based on Application:

- Diabetic retinopathy

- Age-related macular degeneration (AMD)

- Glaucoma

- Retinal tears and detachments

- Other applications

Based on End-User:

- Hospitals

- Ambulatory surgery centers

- Ophthalmology clinics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Ophthalmic Photocoagulator market at 34.6%. Strong healthcare infrastructure and high awareness of retinal diseases drive early adoption of laser systems. The United States leads the region with advanced diagnostic capabilities, widespread insurance coverage, and specialized ophthalmology networks. Large hospital chains and academic centers regularly invest in next-generation standalone systems. The region shows consistent demand from diabetic and elderly populations, particularly for diabetic retinopathy and AMD treatment. Government programs such as Medicare and private health plans support access to photocoagulation therapy. Canada also contributes through public health screening and increased use of mobile eye care units in rural provinces.

Europe

Europe accounts for 28.1% of the global Ophthalmic Photocoagulator market. Countries like Germany, France, and the United Kingdom dominate regional demand due to robust clinical networks and rising geriatric populations. Ophthalmology practices across Europe widely adopt multicolor laser systems for AMD and glaucoma management. Public health systems support early diagnosis through national screening programs for diabetes-related complications. Portable photocoagulators find use in outreach services in Eastern Europe and smaller EU nations. The market benefits from favorable reimbursement policies and regulatory alignment across member countries. It enables steady procurement of devices in both private and public hospital settings.

Asia Pacific

Asia Pacific holds a significant market share of 22.7%, driven by large patient pools and rapid healthcare investments. China, Japan, and India lead adoption with expanding vision care infrastructure and growing awareness of retinal health. Rising diabetes prevalence boosts demand for laser-based diabetic retinopathy treatment across urban and semi-urban clinics. It creates need for both compact and high-performance photocoagulators. Mobile eye care programs in Southeast Asia use portable units to reach under-served populations. The region attracts manufacturers due to volume potential and government initiatives for blindness prevention. Academic collaborations and public-private partnerships further drive market penetration.

Latin America

Latin America contributes 8.3% to the Ophthalmic Photocoagulator market. Brazil and Mexico represent key countries with expanding private healthcare and urban eye clinics. Increasing diabetic populations and government-run vision care programs support photocoagulation adoption. Hospitals and clinics in these markets show interest in cost-effective, multipurpose systems. Rural health programs promote portable device usage in community screening efforts. Challenges in reimbursement and budget allocation slow down large-scale procurement. Still, international health initiatives help bridge access gaps in lower-income segments.

Middle East and Africa

The Middle East and Africa account for 6.3% of the global market. GCC countries such as Saudi Arabia and the UAE invest in advanced ophthalmic devices through public and private hospitals. Specialized eye care centers in South Africa and Kenya integrate photocoagulation into diabetic eye care protocols. Budget limitations restrict broader adoption across low-resource countries. Nonprofit organizations play a major role by deploying portable laser systems in mobile clinics. Regional market growth depends on expanding training programs and public investment in diagnostic infrastructure. Demand remains steady but underpenetrated due to access and affordability constraints

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Appasamy Associates

- Lumenis

- MERIDIAN

- R.C. Laser

- IRIDEX

- Topcon

- Bausch + Lomb

- Phoenix-Micron

- Alcon

- NIDEK

- Lumibird Medical

- LIGHTMED

- Coherent

Competitive Analysis

The Ophthalmic Photocoagulator market features strong competition among key players such as Alcon, IRIDEX, Topcon, NIDEK, Lumenis, LIGHTMED, Bausch + Lomb, A.R.C. Laser, Coherent, Appasamy Associates, MERIDIAN, Phoenix-Micron, and Lumibird Medical. These companies actively invest in product development, aiming to offer advanced systems with multi-wavelength capabilities, shorter treatment times, and enhanced targeting accuracy. Leading firms focus on integrating real-time imaging and pattern scanning technologies to improve clinical outcomes and procedure efficiency. Strategic collaborations with hospitals and research institutions help manufacturers test and refine next-generation photocoagulators. Major players maintain a strong presence in North America and Europe through established distribution networks and ongoing service support. In emerging markets, competition increases as local manufacturers provide cost-effective devices to match demand in budget-sensitive environments. Companies differentiate their offerings through user-friendly interfaces, compact designs, and mobile compatibility. Some firms expand their market share by supplying portable models tailored for outreach and mobile eye care units. Continuous innovation, regulatory compliance, and clinical validation remain key competitive factors. Companies that align their products with healthcare provider needs and global vision care initiatives will strengthen their positions in this growing market.

Recent Developments

- In April 2025, Alcon introduced the Unity VCS/CS platforms, featuring multiple first-to-market surgical innovations, showcased at ASCRS 2025

- In 2025, Lumenis and IRIDEX both continue innovation to serve growing demand, highlighted in broader U.S. market growth context reported in May 2025

- In May 2023, Norlase, a Denmark based ophthalmic laser manufacturer announced that it has received both FDA 510(k) clearance and CE Mark approval for its ECHO Green Pattern Laser photocoagulator. This development will improve its product portfolio and aid in better sales prospect for the company.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher demand due to rising cases of diabetic retinopathy and age-related eye diseases.

- Manufacturers will focus on developing more portable and lightweight photocoagulators for outreach settings.

- Multi-wavelength systems will gain traction for treating various retinal conditions with greater precision.

- Integration of real-time imaging and laser systems will enhance procedural accuracy and clinical outcomes.

- Eye care centers will adopt AI-based planning tools to support laser treatment decision-making.

- Public health initiatives will boost access to photocoagulation therapy in rural and low-income regions.

- The number of trained ophthalmologists using laser systems will grow through structured clinical training.

- Hospitals and clinics will replace aging devices with compact, high-efficiency photocoagulation units.

- Demand for minimally invasive and outpatient-based laser procedures will increase across urban centers.

- Global partnerships will support deployment of mobile laser solutions in vision care programs.