Market Overview

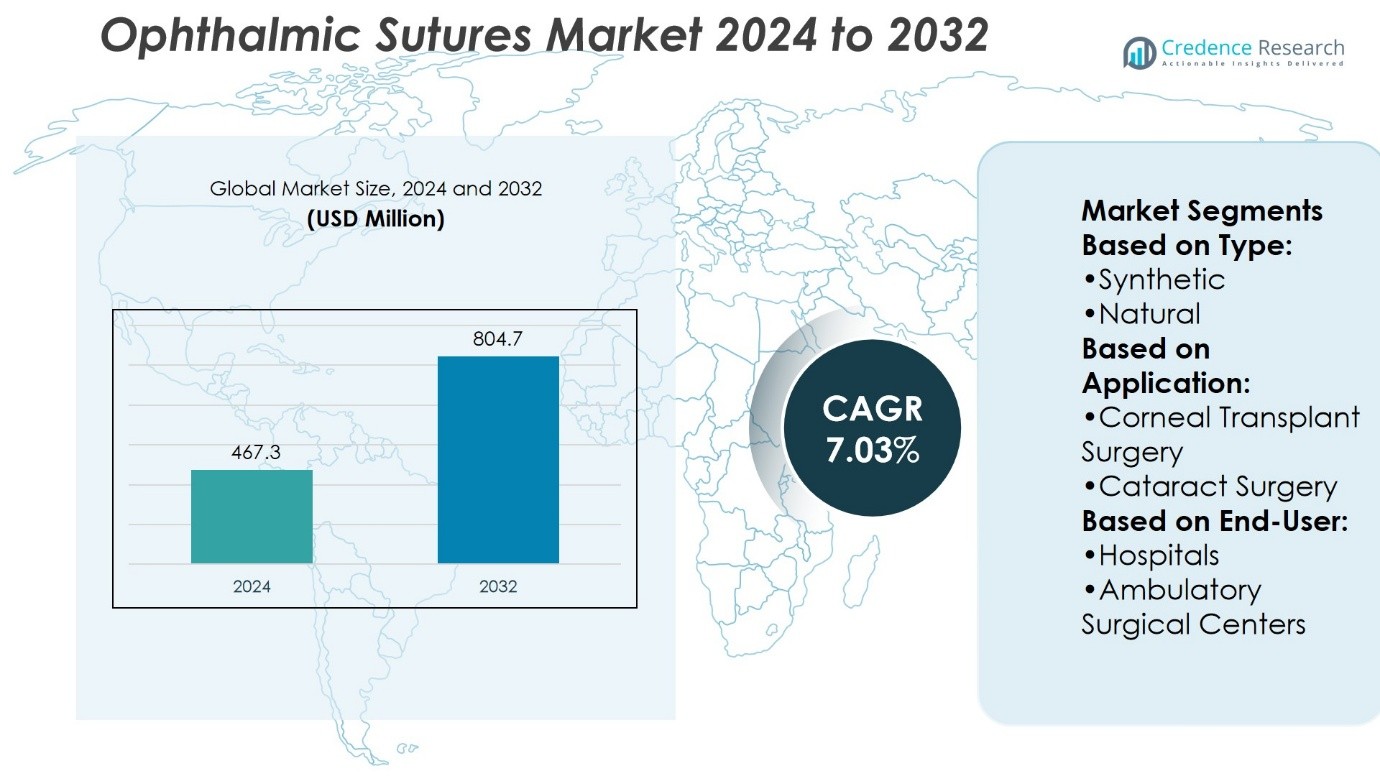

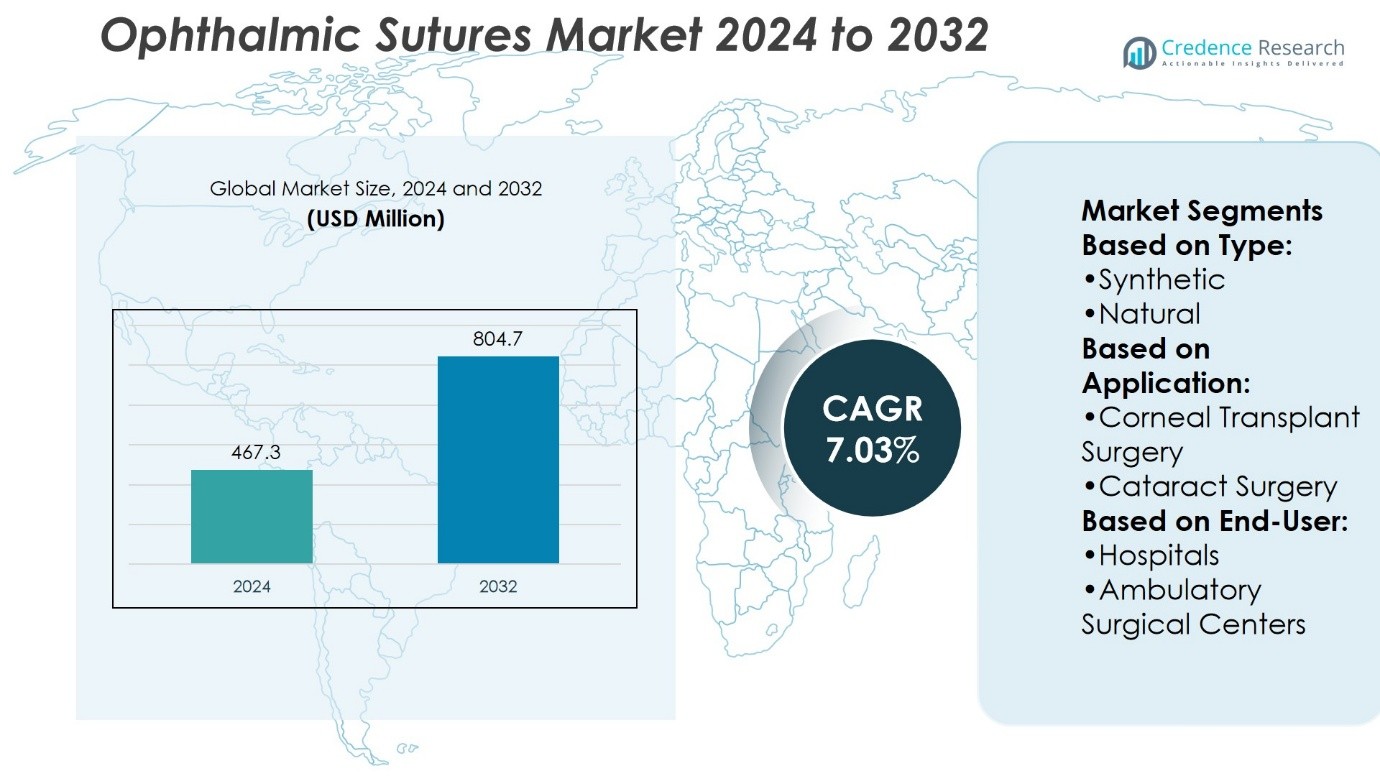

Ophthalmic Sutures Market size was valued at USD 467.3 million in 2024 and is anticipated to reach USD 804.7 million by 2032, at a CAGR of 7.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmic Sutures Market Size 2024 |

USD 467.3 Million |

| Ophthalmic Sutures Market, CAGR |

7.03% |

| Ophthalmic Sutures Market Size 2032 |

USD 804.7 Million |

The Ophthalmic Sutures Market grows due to rising prevalence of cataract, corneal, and other ocular surgeries. It benefits from increasing adoption of minimally invasive procedures and bioresorbable sutures that reduce recovery time and post-operative complications. Surgeons prefer ultra-fine synthetic sutures for precision and improved patient outcomes. Technological advancements enhance suture strength, handling, and antimicrobial properties, driving adoption across hospitals and ambulatory surgical centers. Growing healthcare infrastructure in emerging regions and an aging population in developed markets support steady demand. Training programs and awareness of advanced ophthalmic procedures further encourage consistent market expansion.

North America and Europe dominate the Ophthalmic Sutures Market due to advanced healthcare infrastructure and high adoption of ophthalmic surgeries. Asia-Pacific shows rapid growth driven by expanding eye care facilities and rising surgical procedures. Key players focus on regional distribution and product innovation to strengthen their presence. Companies invest in surgeon training, partnerships, and localized manufacturing to meet diverse clinical needs. Emerging markets in Latin America and the Middle East offer growth opportunities with increasing awareness and healthcare investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ophthalmic Sutures Market size was valued at USD 467.3 million in 2024 and is projected to reach USD 804.7 million by 2032, growing at a CAGR of 7.03%.

- Rising prevalence of cataract, corneal, and other ocular surgeries drives consistent demand.

- Surgeons increasingly adopt minimally invasive procedures and bioresorbable sutures for faster recovery and reduced complications.

- Technological improvements enhance suture strength, handling, knot security, and antimicrobial properties, supporting adoption across hospitals and surgical centers.

- The market faces challenges from high costs of advanced sutures and limited accessibility in underdeveloped regions.

- Key players focus on innovation, surgeon training, and regional distribution to maintain competitiveness and expand market presence.

- North America and Europe dominate due to advanced healthcare infrastructure, while Asia-Pacific shows rapid growth. Latin America and the Middle East present emerging opportunities with rising awareness and healthcare investments.

Market Drivers

Rising Prevalence of Eye Disorders and Surgical Procedures

The Ophthalmic Sutures Market is driven by the increasing prevalence of eye disorders, including cataracts, glaucoma, and corneal injuries. It supports the growing number of ophthalmic surgeries worldwide. Surgeons prefer advanced sutures that ensure precision and reduce post-operative complications. The demand for microsurgical procedures encourages adoption of high-quality, fine-gauge sutures. Hospitals and specialized eye clinics invest in modern suture technologies to enhance surgical outcomes. Patient safety standards also influence selection, emphasizing sutures with consistent tensile strength and biocompatibility.

- For instance, Alcon’s UNITY Vitreoretinal Cataract System (VCS) features a vitrectomy probe capable of 30,000 cuts per minute and uses a phacoemulsification modality that halves nucleus removal time while reducing energy delivery by about 40%, according to Alcon R&D and user manuals.

Technological Advancements in Suture Materials and Designs

Innovations in suture materials fuel market growth. The Ophthalmic Sutures Market benefits from bioresorbable sutures that degrade safely over time, reducing the need for removal procedures. It also includes synthetic and coated sutures that minimize tissue reactions and improve knot security. Manufacturers introduce sutures with enhanced flexibility and superior handling characteristics. Developments in antimicrobial-coated sutures help reduce the risk of post-surgical infections. Continuous research ensures improved performance and wider adoption among ophthalmic surgeons.

- For instance, FCI Ophthalmics offers a 9‑0 polypropylene suture featuring double‑armed curved needles, available in 30 cm length, designed for secure knot holding in capsular tension ring fixation (such as Cionni CTR applications).

Expansion of Ophthalmic Healthcare Infrastructure

The growing number of specialized eye care centers drives suture demand. The Ophthalmic Sutures Market supports hospitals and clinics in urban and emerging regions. It ensures availability of high-quality sutures for routine and complex surgeries. Investment in surgical training programs improves surgeon proficiency with advanced suture techniques. The expansion of ophthalmic facilities enhances surgical throughput and patient access. Rising awareness of eye care benefits adoption of superior suturing solutions.

Government Initiatives and Health Awareness Programs

Public health initiatives promote timely treatment of eye conditions. The Ophthalmic Sutures Market benefits from programs that increase access to cataract and corneal surgeries. It supports efforts to reduce preventable blindness in developing countries. Government policies encourage hospitals to adopt safe and reliable suture products. Eye health awareness campaigns drive patients to seek surgical interventions earlier. These initiatives strengthen demand for advanced ophthalmic sutures in both public and private sectors.

Market Trends

Shift Toward Bioresorbable and Synthetic Sutures

The Ophthalmic Sutures Market shows a strong trend toward bioresorbable and synthetic materials. It offers surgeons sutures that safely dissolve over time, eliminating the need for removal. Synthetic sutures provide uniform strength, flexibility, and reduced tissue reaction. Surgeons increasingly prefer coated sutures for enhanced knot security and smooth passage through delicate ocular tissues. These innovations improve post-operative recovery and reduce complications. Patient outcomes and procedural efficiency influence the growing adoption of advanced suture designs.

- For instance, Corza Medical recently expanded its Onatec Ophthalmic Suture Portfolio to nearly 130 products designed specifically for ophthalmic and oculoplastic surgery, each paired with highly tempered stainless-steel needles engineered for exceptional.

Increasing Adoption of Minimally Invasive Ophthalmic Procedures

Minimally invasive surgeries drive demand for finer and more precise sutures. The Ophthalmic Sutures Market supports microsurgical procedures, including cataract, corneal, and glaucoma surgeries. It ensures sutures with ultra-fine gauges and high tensile strength for accurate wound closure. Surgeons adopt sutures that allow better maneuverability in confined spaces. The trend enhances patient comfort and reduces healing time. High-precision sutures contribute to improved surgical success and lower post-operative complications.

- For instance, Geuder’s NanoEdge® single-use trephines feature blade progression of 0.0625 mm per quarter-turn and 0.25 mm per full rotation for highly precise corneal cuts in keratoplasty.

Rising Focus on Infection Control and Sterile Techniques

Infection prevention is a key driver for advanced sutures. The Ophthalmic Sutures Market benefits from antimicrobial-coated sutures that lower the risk of post-surgical infections. It ensures consistent sterility standards in hospitals and eye care centers. Surgeons increasingly demand sutures with verified biocompatibility and minimal tissue irritation. Hospitals implement protocols that rely on high-quality sutures for safe procedures. Improved infection control strengthens trust in ophthalmic surgical products.

Expansion of Ophthalmic Healthcare Services Globally

The growth of specialized eye care facilities fuels the Ophthalmic Sutures Market. It supports hospitals and clinics expanding surgical capacities in both urban and emerging regions. Increasing awareness of vision care encourages patients to seek timely surgical intervention. Surgeons adopt advanced sutures to maintain high-quality outcomes. Investment in ophthalmic infrastructure enables wider access to modern suture technologies. This trend drives steady demand across developed and developing countries.

Market Challenges Analysis

High Cost of Advanced Ophthalmic Sutures Limiting Adoption

The Ophthalmic Sutures Market faces challenges from the high cost of bioresorbable and coated synthetic sutures. It limits accessibility for smaller clinics and hospitals in developing regions. Surgeons in low-resource settings often rely on traditional sutures due to budget constraints. The cost difference between advanced and conventional sutures affects procurement decisions. Hospitals must balance quality, patient outcomes, and operational expenses. Limited insurance coverage for premium sutures further restricts adoption. This challenge slows market penetration in price-sensitive regions despite clinical benefits.

Technical Complexity and Training Requirements for Surgeons

Complex handling requirements of ultra-fine and high-precision sutures present another challenge. The Ophthalmic Sutures Market is influenced by the need for specialized surgical training. Surgeons require skill and experience to manipulate delicate sutures in microsurgeries. Improper handling can lead to complications, wound dehiscence, or suture breakage. Training programs demand time and investment from healthcare institutions. Limited exposure in emerging markets delays adoption of advanced sutures. Ensuring adequate proficiency remains a critical barrier to widespread implementation.

Market Opportunities

Expansion in Emerging Markets and Untapped Regions

The Ophthalmic Sutures Market offers opportunities in emerging economies with growing healthcare infrastructure. It supports expanding eye care services in regions with rising prevalence of cataracts and corneal diseases. Hospitals and specialized clinics increasingly invest in advanced suture technologies to improve surgical outcomes. Government initiatives and vision care programs encourage wider access to ophthalmic procedures. Rising disposable income and awareness of eye health boost demand for high-quality sutures. Companies can introduce cost-effective solutions to capture untapped regional markets. Expanding distribution networks enhances availability in remote and underserved areas.

Innovation in Suture Materials and Smart Surgical Solutions

Technological innovation drives significant market potential. The Ophthalmic Sutures Market benefits from development of antimicrobial, bioresorbable, and coated synthetic sutures. It supports surgeons in performing safer and faster microsurgeries with improved patient recovery. Integration of smart surgical tools and suture delivery systems increases procedural efficiency. Research on biodegradable polymers and novel coatings enhances durability and tissue compatibility. Continuous investment in R&D creates opportunities for differentiated product offerings. Surgeons and hospitals increasingly prefer sutures with superior handling, strength, and safety features, driving adoption across diverse clinical applications.

Market Segmentation Analysis:

By Type

The Ophthalmic Sutures Market is segmented into synthetic and natural sutures. Synthetic sutures, including polyglycolic acid and polyglactin, dominate due to predictable tensile strength and minimal tissue reaction. It supports microsurgeries by providing consistent performance and high knot security. Natural sutures, such as silk and catgut, remain in use for specific corneal and conjunctival procedures due to flexibility and handling characteristics. Surgeons select sutures based on patient tissue compatibility, healing requirements, and procedure complexity. Ongoing innovations in synthetic coatings, including antimicrobial and bioresorbable layers, enhance safety and reduce post-operative infections.

- For instance, B. Braun’s Novosyn® absorbable sutures retain 40–50 units of tensile strength at 21 days post-implantation, with complete mass absorption achieved between 56 and 70 days.

By Application

The market is divided into corneal transplant surgery and cataract surgery applications. Ophthalmic sutures support delicate wound closure in corneal transplants, ensuring graft stability and minimal scarring. It enables precise tissue approximation in cataract surgeries, reducing post-surgical complications and improving recovery. Surgeons increasingly adopt fine-gauge, high-tensile sutures for both procedures. Advanced suture designs improve handling during microsurgeries and maintain tissue integrity. Rising prevalence of cataracts and corneal disorders drives consistent demand across these applications.

- For instance, Assut Medical offers AssuCryl MonoSlow absorbable sutures that retain 80 units of tensile strength at 14 days and 50 units at 28 days, with complete absorption between 180 and 210 days.

By End-User

Hospitals and ambulatory surgical centers (ASCs) form the primary end-users of ophthalmic sutures. Hospitals maintain large inventories to support high-volume ophthalmic surgeries and complex procedures. It ensures immediate availability of various suture types for routine and specialized interventions. ASCs adopt advanced sutures to optimize surgical outcomes in outpatient settings. Investment in surgeon training and surgical infrastructure strengthens adoption in both settings. Rising focus on outpatient ophthalmic care and minimally invasive procedures fuels demand in ASCs. End-users prioritize sutures with superior biocompatibility, knot security, and ease of handling to enhance patient safety and operational efficiency.

Segments:

Based on Type:

Based on Application:

- Corneal Transplant Surgery

- Cataract Surgery

Based on End-User:

- Hospitals

- Ambulatory Surgical Centers

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of the Ophthalmic Sutures Market, accounting for 35% of the global demand. The region benefits from advanced healthcare infrastructure and high adoption of minimally invasive ophthalmic surgeries. It supports a growing number of cataract, corneal, and glaucoma procedures requiring high-precision sutures. Surgeons prefer bioresorbable and coated synthetic sutures due to improved handling and reduced post-operative complications. The presence of leading suture manufacturers ensures availability of innovative products with superior tensile strength and antimicrobial properties. Strong healthcare reimbursement policies further encourage the use of premium suture solutions. Research and development activities in the U.S. and Canada drive continuous improvements in suture materials and designs.

Europe

Europe contributes approximately 25% of the global Ophthalmic Sutures Market. It demonstrates consistent demand driven by an aging population and rising prevalence of eye disorders. The market benefits from well-established ophthalmic healthcare facilities and high awareness of surgical eye care. Surgeons adopt advanced sutures, including ultra-fine synthetic types, for corneal and cataract surgeries. Regulatory standards emphasize quality, sterility, and biocompatibility, supporting the use of premium sutures. Countries such as Germany, France, and the U.K. lead in introducing technologically advanced sutures with antimicrobial coatings and bioresorbable materials. Training programs for ophthalmic surgeons enhance adoption and ensure proper utilization of sophisticated sutures.

Asia-Pacific

Asia-Pacific accounts for 28% of the Ophthalmic Sutures Market, driven by increasing healthcare expenditure and expanding eye care infrastructure. High prevalence of cataracts, corneal injuries, and other ocular disorders fuels demand for advanced sutures. Surgeons in China, India, and Japan prefer synthetic and bioresorbable sutures for precise tissue approximation and improved patient outcomes. It supports both hospital and ambulatory surgical centers with reliable, high-quality suture products. Government initiatives promoting vision care and investments in hospital upgrades enhance market penetration. Rising awareness of eye health and growing middle-class populations drive steady adoption of premium suture technologies.

Latin America

Latin America represents around 7% of the global Ophthalmic Sutures Market. Demand is fueled by increasing ophthalmic procedures in urban hospitals and specialized eye clinics. Surgeons adopt synthetic and coated sutures to reduce post-operative complications and improve recovery. Investments in healthcare infrastructure in countries such as Brazil and Mexico support wider distribution of advanced suture products. It benefits from partnerships between local distributors and global manufacturers to ensure availability of innovative sutures. Awareness campaigns promoting cataract and corneal surgeries encourage timely surgical interventions.

Middle East & Africa

The Middle East & Africa contributes approximately 5% of the global market. Demand is primarily driven by rising prevalence of eye disorders and increasing investments in hospital modernization. Surgeons prefer high-quality synthetic sutures for corneal and cataract surgeries to ensure patient safety. It benefits from government initiatives aimed at improving healthcare access and eye care programs. Adoption remains limited compared to developed regions due to infrastructure challenges, but growing private healthcare facilities enhance market potential. Regional distributors increasingly introduce bioresorbable and antimicrobial sutures to meet evolving clinical needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DemeTECH Corporation

- Ethicon (J&J)

- Alcon

- FCI Ophthalmics

- Corzamedical

- Geuder

- B Braun Melsungen AG

- Accutome

- Aurolab

- Asssut Medical

Competitive Analysis

The Ophthalmic Sutures Market players include Alcon, Asssut Medical, Aurolab, Accutome, B Braun Melsungen AG, Corzamedical, DemeTECH Corporation, Ethicon (J&J), FCI Ophthalmics, and Geuder. The Ophthalmic Sutures Market is highly competitive, driven by continuous innovation in materials and product design. Companies focus on enhancing suture strength, biocompatibility, and antimicrobial properties to meet evolving surgical requirements. Advanced synthetic and bioresorbable sutures provide precise tissue approximation, faster healing, and reduced post-operative complications. Manufacturers emphasize coated and antimicrobial sutures to improve surgical safety and lower infection risks. Investments in research and development enable the introduction of next-generation sutures with superior handling, knot security, and reduced tissue trauma. Regional adaptation and surgeon training programs further strengthen market positioning. Continuous innovation, combined with expanding distribution networks and improving procedural efficiency, remains critical for maintaining a competitive edge in the growing Ophthalmic Sutures Market.

Recent Developments

- In July 2025, Assut Medical maintains product safety and clinical performance certifications across its absorbable and non-absorbable ophthalmic sutures, with continuous post-market clinical follow-up studies validating their effectiveness and reliability.

- In October 2024, Corza Medical (Corzamedical) launched a new line of Onatec ophthalmic microsurgical sutures unveiled at the American Academy of Ophthalmology (AAO) conference in Chicago, introducing advanced suture materials designed for enhanced precision and patient recovery in eye surgeries.

- In September 2023, BVI announced its acquisition of Medical Mix, which offers ophthalmic surgical devices in Portugal and Spain. This acquisition has enhanced BVI’s presence in the European markets.

- In April 2023, Bausch + Lomb launched the StableVisc cohesive ophthalmic viscosurgical device (OVD) and the TotalVisc Viscoelastic System in the US. The company stated that StableVisc helps maintain space in the eye’s anterior chamber, allowing doctors to remove and replace the clouded natural lens.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ophthalmic sutures will grow due to increasing cataract and corneal surgeries.

- Adoption of bioresorbable and coated sutures will rise to reduce post-operative complications.

- Surgeons will prefer ultra-fine synthetic sutures for precision in microsurgeries.

- Outpatient surgical centers will increasingly adopt advanced sutures for faster recovery.

- Technological innovations will improve suture handling, knot security, and tissue compatibility.

- Aging populations in developed regions will drive consistent demand for ophthalmic procedures.

- Investments in training programs will enhance surgeon proficiency and suture utilization.

- Expansion of healthcare infrastructure in emerging markets will increase regional adoption.

- Development of antimicrobial sutures will reduce infection risks and improve patient outcomes.

- Continuous R&D will focus on lightweight, high-strength sutures for complex ophthalmic surgeries.