Market Overview

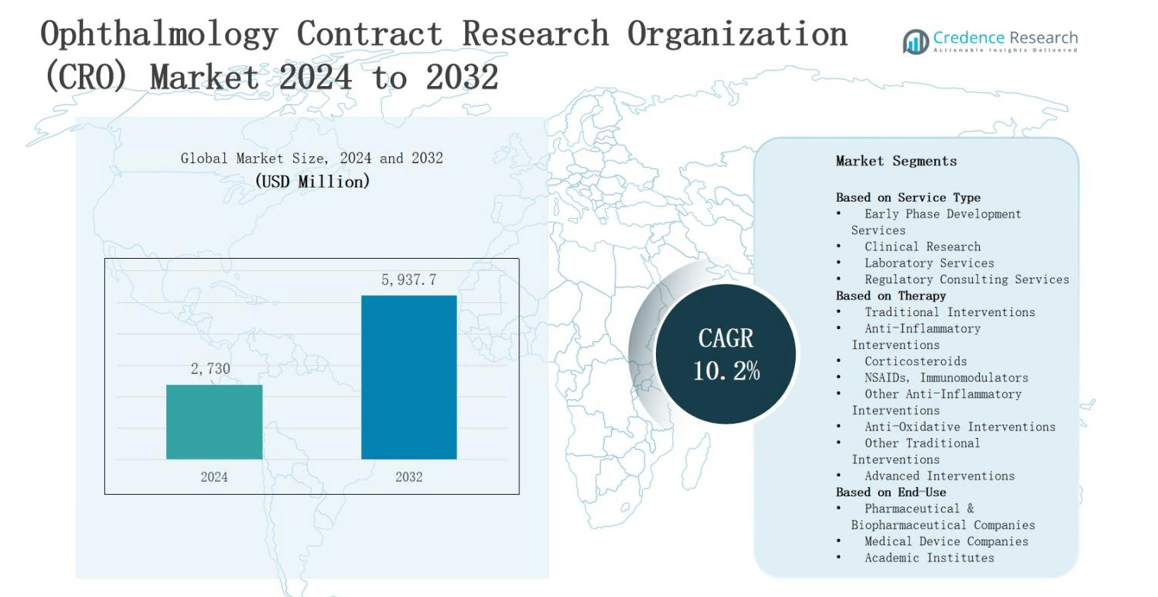

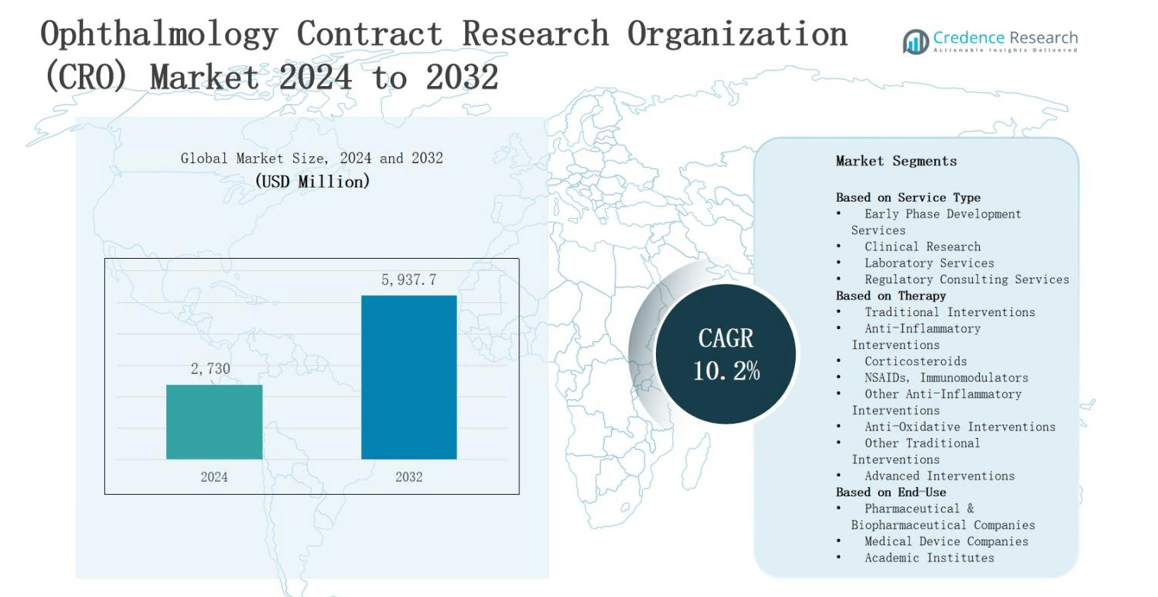

The ophthalmology contract research organization (CRO) market is projected to grow from USD 2,730 million in 2024 to USD 5,937.7 million by 2032, registering a robust CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmology Contract Research Organization (CRO) Market Size 2024 |

USD 2,730 million |

| Ophthalmology Contract Research Organization (CRO) Market, CAGR |

10.2% |

| Ophthalmology Contract Research Organization (CRO) Market Size 2032 |

USD 5,937.7 million |

The ophthalmology contract research organization (CRO) market is driven by the rising prevalence of eye disorders, increasing demand for advanced clinical trials, and the growing pipeline of ophthalmic drugs and devices. Regulatory agencies emphasize strict compliance, prompting pharmaceutical and biotech firms to outsource to specialized CROs for cost efficiency and expertise. Advancements in imaging technologies, personalized medicine, and adaptive trial designs shape key trends, while digital platforms and AI-powered analytics enhance trial efficiency. Strategic collaborations between sponsors and CROs are expanding global reach, supporting faster patient recruitment, improved data management, and accelerated development of innovative ophthalmic treatments.

The ophthalmology contract research organization (CRO) market demonstrates strong regional diversity, with North America leading at 36%, followed by Europe at 28% and Asia-Pacific at 22%. Latin America contributes 8%, while the Middle East & Africa account for 6%, reflecting expanding opportunities across emerging regions. It is driven by advanced infrastructure, growing patient pools, and rising clinical trial activity. Key players include Medpace, Inc., ORA Inc., Charles River Laboratories International, Inc., Syneos Health, WuXi AppTec, ICON plc, Iris Pharma, Trial Runners, The Emmes Company LLC, and Lexitas Pharma Services, Inc.

Market Insights

- The ophthalmology contract research organization (CRO) market will grow from USD 2,730 million in 2024 to USD 5,937.7 million by 2032, at a CAGR of 10.2%.

- Clinical research dominates service type with 42% share, followed by early phase development at 25%, laboratory services at 20%, and regulatory consulting services holding 13%, driven by compliance needs.

- Traditional interventions lead therapy with 48% share, supported by corticosteroids and NSAIDs, while advanced interventions at 20% highlight growing adoption of gene therapies, biologics, and precision ophthalmology treatments.

- Pharmaceutical and biopharmaceutical companies dominate end-use with 58% share, followed by medical device companies at 27% and academic institutes at 15%, reflecting diverse stakeholder reliance on CRO expertise.

- Regionally, North America leads with 36%, Europe holds 28%, Asia-Pacific captures 22%, Latin America accounts for 8%, and Middle East & Africa represent 6%, reflecting global market diversity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Eye Disorders and Growing Research Needs

The ophthalmology contract research organization (CRO) market is primarily driven by the rising incidence of eye disorders such as glaucoma, cataracts, diabetic retinopathy, and macular degeneration. Growing patient populations in both developed and emerging economies are fueling the demand for advanced treatment options. Pharmaceutical and biotechnology companies are expanding their ophthalmic pipelines to address unmet medical needs. It creates strong opportunities for CROs to provide specialized trial design, patient recruitment, and regulatory support.

- For instance, Genentech (Roche) expanded clinical research for its bispecific antibody faricimab (Vabysmo™), which by 2023 had been approved in more than 70 countries, requiring extensive CRO partnerships to manage multi-country ophthalmology trials and regulatory submissions.

Increasing Outsourcing by Pharmaceutical and Biotech Companies

The ophthalmology contract research organization (CRO) market benefits from a growing trend of outsourcing clinical development to reduce costs and enhance efficiency. Companies prefer CROs with deep ophthalmic expertise to accelerate drug discovery and approval timelines. Rising R&D costs and strict compliance requirements encourage reliance on external partners. It enables sponsors to focus on core competencies while CROs handle complex trials. Outsourcing also provides access to global networks, improving patient enrollment and regional trial diversity.

- For instance, Syneos Health has supported the development and commercialization of nearly 50 approved therapies for eye disorders since 2016, running over 100 ophthalmology clinical studies and leveraging relationships with almost 600 global research sites for patient recruitment.

Advancements in Technology and Data-Driven Research

The ophthalmology contract research organization (CRO) market gains momentum through technological advancements, including imaging systems, artificial intelligence, and electronic data capture platforms. These tools enable more accurate diagnostics, efficient trial monitoring, and real-time analytics. It allows sponsors to improve decision-making and accelerate development cycles. Advanced trial methodologies, such as adaptive designs and decentralized models, are increasingly implemented. The integration of technology strengthens CRO capabilities, ensuring better trial outcomes and enhanced compliance with evolving regulatory frameworks.

Globalization of Clinical Trials and Strategic Collaborations

The ophthalmology contract research organization (CRO) market expands further through globalization of clinical research and strategic partnerships. Growing demand for diverse patient populations encourages multinational trial execution. It supports faster recruitment, broader regulatory approvals, and access to emerging markets. Collaborations between CROs and sponsors foster knowledge sharing, improve trial efficiency, and reduce development risks. Expanding operations across regions allows CROs to align with global healthcare needs, driving long-term growth and sustainable market expansion.

Market Trends

Adoption of Decentralized and Virtual Clinical Trial Models

The ophthalmology contract research organization (CRO) market is witnessing a growing shift toward decentralized and virtual clinical trial approaches. Rising patient expectations for convenience and accessibility encourage companies to adopt remote monitoring, telemedicine consultations, and digital recruitment methods. It reduces geographic barriers, shortens timelines, and expands patient participation. CROs integrate digital platforms and wearable technologies to track treatment outcomes more effectively. This trend reflects industry focus on patient-centric trial designs that improve compliance and accelerate ophthalmic drug development.

- For instance, Medpace employs its proprietary TrialPACE® platform to collect and integrate data from wearable devices like rhythm monitors and continuous glucose monitors, allowing thorough remote patient monitoring across various ocular diseases.

Integration of Artificial Intelligence and Advanced Analytics

The ophthalmology contract research organization (CRO) market experiences increasing use of artificial intelligence and advanced data analytics in clinical research. AI-powered diagnostic tools and imaging systems enable more precise disease detection and monitoring. It enhances efficiency in trial design, patient segmentation, and data validation. Advanced analytics supports predictive modeling for trial outcomes, reducing risks and improving resource allocation. CROs leverage these technologies to deliver high-quality results, strengthen sponsor confidence, and improve decision-making in complex ophthalmic studies.

- For instance, IDx Technologies’ FDA-approved IDx-DR system autonomously detects diabetic retinopathy through retinal imaging, improving early disease detection.

Growing Emphasis on Personalized Medicine and Targeted Therapies

The ophthalmology contract research organization (CRO) market is shaped by the rising adoption of personalized medicine and targeted therapies for eye diseases. Pharmaceutical and biotechnology firms are developing treatments tailored to genetic markers and patient-specific characteristics. It requires advanced trial designs and specialized testing capabilities from CROs. Demand for precision-based approaches fuels investment in molecular diagnostics and genomic research. CROs position themselves as strategic partners by offering expertise in niche trial methodologies and biomarker-based clinical development.

Expansion of Strategic Partnerships and Global Trial Networks

The ophthalmology contract research organization (CRO) market evolves through growing partnerships and global collaborations between CROs, sponsors, and research institutions. Companies expand networks to access diverse patient pools, meet regional regulatory demands, and optimize trial execution. It enables greater operational flexibility and cost savings while improving trial diversity. Strategic alliances allow CROs to enhance service portfolios, strengthen geographic reach, and adopt best practices. This trend drives innovation, accelerates market entry, and supports faster approval of ophthalmic therapies worldwide.

Market Challenges Analysis

High Operational Complexity and Regulatory Barriers

The ophthalmology contract research organization (CRO) market faces significant challenges due to the complex nature of ophthalmic clinical trials. Eye-related studies require advanced imaging, precise diagnostic tools, and specialized clinical endpoints, which increase operational difficulty and cost. It demands highly trained personnel, rigorous trial protocols, and strict compliance with evolving global regulations. Meeting diverse regional standards adds further complexity to multinational studies. Regulatory delays, lengthy approval timelines, and documentation burdens hinder trial progress, reducing efficiency and increasing development risks for CROs and sponsors.

Limited Patient Recruitment and Retention Challenges

The ophthalmology contract research organization (CRO) market also struggles with limited patient recruitment and retention across different ophthalmic indications. Rare diseases, variable symptoms, and slow disease progression make patient identification difficult. It affects enrollment timelines and increases trial duration. Geographic limitations and lack of awareness about clinical trials further restrict patient participation. Retaining patients for long-term follow-ups is equally challenging due to frequent visits and intensive monitoring. These constraints impact trial success rates, resource allocation, and overall sponsor satisfaction in a competitive clinical research environment.

Market Opportunities

Rising Demand for Innovative Ophthalmic Therapies and Precision Medicine

The ophthalmology contract research organization (CRO) market holds strong opportunities due to the expanding pipeline of advanced therapies, including gene therapy, stem cell treatment, and biologics for eye disorders. Pharmaceutical and biotechnology companies are investing heavily in precision medicine approaches that target specific genetic and molecular pathways. It drives the need for CROs with specialized expertise in niche trial designs and biomarker validation. Increasing focus on rare and orphan eye diseases also creates new avenues for specialized research. CROs offering tailored solutions can secure long-term partnerships and gain a competitive edge.

Expanding Global Footprint and Strategic Collaborations

The ophthalmology contract research organization (CRO) market benefits from growing opportunities through globalization of clinical trials and rising collaboration between sponsors and research institutions. Emerging markets in Asia-Pacific, Latin America, and the Middle East offer access to large, diverse patient populations and lower operational costs. It strengthens CRO participation in multinational studies, supporting faster recruitment and broader regulatory acceptance. Strategic alliances with academic centers and technology providers enhance innovation, while digital platforms expand data management capabilities. These opportunities position CROs to capture new growth and deliver advanced solutions to evolving ophthalmic research needs.

Market Segmentation Analysis:

By Service Type

In the ophthalmology contract research organization (CRO) market, clinical research dominates the service type segment with a share of nearly 42%. The growing need for large-scale ophthalmic trials, patient recruitment efficiency, and advanced trial designs drives this dominance. Early phase development services hold about 25%, driven by increasing preclinical testing demand. Laboratory services capture nearly 20%, supported by advanced diagnostic imaging and biomarker analysis. Regulatory consulting services account for around 13%, fueled by rising compliance complexity and evolving global standards.

- For example, Iris Pharma has contributed to bringing over 70 ocular drugs and devices to market since 1989, providing extensive early phase pharmacology and safety testing services across glaucoma, dry eye, and ocular inflammation indications.

By Therapy

Traditional interventions lead the therapy segment with nearly 48% share in the ophthalmology contract research organization (CRO) market. Strong reliance on corticosteroids, NSAIDs, and immunomodulators for managing common eye disorders supports this dominance. Anti-inflammatory interventions account for around 22%, while anti-oxidative approaches hold 10%, reflecting interest in novel therapeutic pathways. Advanced interventions capture nearly 20%, driven by gene therapies, stem cell solutions, and biologics. It highlights a shift toward precision-based ophthalmology treatments and personalized medicine strategies.

- For instance, Novartis has explored antioxidant-based strategies in ophthalmology through investigational compounds targeting oxidative stress in retinal conditions.

By End-Use

Pharmaceutical and biopharmaceutical companies represent the largest share, nearly 58%, in the ophthalmology contract research organization (CRO) market. Growing ophthalmic drug pipelines, rising outsourcing activities, and high R&D investments drive this dominance. Medical device companies contribute around 27%, supported by demand for intraocular lenses, diagnostic devices, and surgical equipment. Academic institutes hold nearly 15%, with increased focus on translational research, novel drug discovery, and collaborative trials. It strengthens CRO engagement across diversified end-use stakeholders in ophthalmology.

Segments:

Based on Service Type

- Early Phase Development Services

- Clinical Research

- Laboratory Services

- Regulatory Consulting Services

Based on Therapy

- Traditional Interventions

- Anti-Inflammatory Interventions

- Corticosteroids

- NSAIDs, Immunomodulators

- Other Anti-Inflammatory Interventions

- Anti-Oxidative Interventions

- Other Traditional Interventions

- Advanced Interventions

Based on End-Use

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Academic Institutes

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the leading position in the ophthalmology contract research organization (CRO) market with a share of 36%. Strong presence of global pharmaceutical and biotechnology firms, coupled with advanced healthcare infrastructure, drives regional dominance. It benefits from high investments in ophthalmic R&D, advanced imaging technologies, and specialized trial networks. Regulatory expertise and early adoption of innovative therapies further strengthen the market. CROs in this region collaborate closely with sponsors to deliver faster and more efficient ophthalmic studies.

Europe

Europe accounts for 28% of the ophthalmology contract research organization (CRO) market, supported by strict regulatory frameworks and strong academic research networks. It is driven by the growing incidence of eye-related disorders and the expansion of precision medicine programs. The region emphasizes compliance with international trial standards, making it an attractive hub for multinational studies. Leading CROs leverage technological expertise and long-standing clinical experience to support sponsors. Collaborations between industry and research institutions reinforce Europe’s strong position.

Asia-Pacific

Asia-Pacific represents 22% of the ophthalmology contract research organization (CRO) market, fueled by rising patient populations and increasing demand for affordable clinical research solutions. It benefits from cost-effective operations, diverse patient recruitment pools, and expanding clinical trial infrastructure. Governments in countries like China and India encourage clinical research through supportive policies and investments. CROs leverage these conditions to expand global trial footprints. The region shows significant growth potential, supported by advancements in ophthalmic therapies and medical technologies.

Latin America

Latin America holds 8% of the ophthalmology contract research organization (CRO) market, driven by the rising demand for accessible healthcare and improving clinical research capabilities. It is supported by expanding medical infrastructure, increasing patient awareness, and regional partnerships. Countries such as Brazil and Mexico lead in clinical trial activities, attracting multinational sponsors. Cost efficiency also contributes to growing CRO involvement. The region is gradually strengthening its role in global ophthalmic research through improved regulatory harmonization.

Middle East & Africa

The Middle East & Africa account for 6% of the ophthalmology contract research organization (CRO) market, supported by improving healthcare facilities and rising investments in clinical research. It benefits from growing awareness of eye health and increasing collaboration with international sponsors. Countries in the Gulf region are investing in modern medical infrastructure, which strengthens ophthalmic research capabilities. It faces challenges of limited trial networks but shows promise with ongoing government initiatives. Expansion opportunities remain strong for CROs targeting emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medpace, Inc.

- ORA Inc.

- Charles River Laboratories International, Inc.

- Syneos Health

- WuXi AppTec

- ICON plc

- Iris Pharma

- Trial Runners

- The Emmes Company LLC

- Lexitas Pharma Services, Inc.

Competitive Analysis

The ophthalmology contract research organization (CRO) market is highly competitive, shaped by a mix of global leaders and specialized service providers. Companies focus on expanding ophthalmic expertise, enhancing trial design, and strengthening geographic reach to meet growing demand for innovative therapies. Key players such as Medpace, Inc., ORA Inc., Charles River Laboratories International, Inc., Syneos Health, WuXi AppTec, ICON plc, Iris Pharma, Trial Runners, The Emmes Company LLC, and Lexitas Pharma Services, Inc. compete through service diversification and advanced technology adoption. It emphasizes patient-centric trial models, AI-driven analytics, and regulatory compliance to attract sponsors. Market participants also pursue collaborations, mergers, and partnerships to reinforce capabilities across early phase development, clinical research, and laboratory services. Strong emphasis on data quality, operational efficiency, and global networks helps leading CROs maintain a competitive edge. The competitive environment reflects ongoing consolidation and strategic expansion, with firms seeking to deliver integrated solutions that address the rising complexity of ophthalmic drug and device trials while meeting diverse regional requirements effectively.

Recent Developments

- In January 2024, iuvo BioScience acquired Promedica International, an ophthalmology-focused clinical CRO, expanding its services in front- and back-of-eye research while appointing Shannon Stoddard as President, Clinical Research.

- In July 2025, TFS HealthScience strengthened its global ophthalmology unit by introducing new leadership and an integrated delivery model, enhancing its expertise in specialized ophthalmology clinical trial execution worldwide.

- In September 2024, Lindus Health launched its “All‑in‑One Ophthalmology CRO” solution, offering end‑to‑end ophthalmic trial execution in the US, UK, and Europe.

- In January 2025, Edgewater Capital Partners partnered with CBCC Global Research, boosting its clinical trial expertise across ophthalmology and other therapeutic areas.

Market Concentration & Characteristics

The ophthalmology contract research organization (CRO) market demonstrates a moderately consolidated structure, with a mix of global leaders and specialized niche players shaping competition. Large CROs dominate through extensive service portfolios, advanced technology adoption, and global trial networks, while smaller firms focus on targeted ophthalmic expertise and personalized solutions. It is characterized by high barriers to entry due to strict regulatory requirements, specialized infrastructure needs, and strong demand for clinical accuracy. The market emphasizes data integrity, patient-centric approaches, and integration of AI-driven platforms to enhance trial outcomes. Growing collaborations between pharmaceutical companies, biotech firms, and CROs reinforce partnerships and increase operational efficiency. Regional diversity strengthens competition, with North America and Europe driving leadership while Asia-Pacific, Latin America, and the Middle East & Africa emerge as high-growth zones. The competitive landscape reflects ongoing investment in innovation, regulatory compliance, and global expansion strategies that shape market concentration and long-term sustainability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Therapy, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing demand for advanced ophthalmic drug and device trials.

- Rising adoption of decentralized and virtual trial models will improve patient participation and efficiency.

- Artificial intelligence integration will enhance diagnostics, data analysis, and trial monitoring for ophthalmic studies.

- Precision medicine and genetic research will drive demand for specialized trial designs in ophthalmology.

- Strategic collaborations between CROs and sponsors will strengthen global trial networks and accelerate drug approvals.

- Emerging markets will attract more ophthalmic trials due to cost efficiency and diverse patient populations.

- Advanced imaging technologies will support more accurate endpoints and outcomes in clinical ophthalmology research.

- Increasing outsourcing by pharmaceutical and biotech companies will reinforce CROs’ role in ophthalmology development.

- Academic partnerships will contribute to innovation in rare disease trials and niche ophthalmic therapies.

- Regulatory harmonization across regions will simplify multinational trials and strengthen global CRO operational capabilities.