Market Overview:

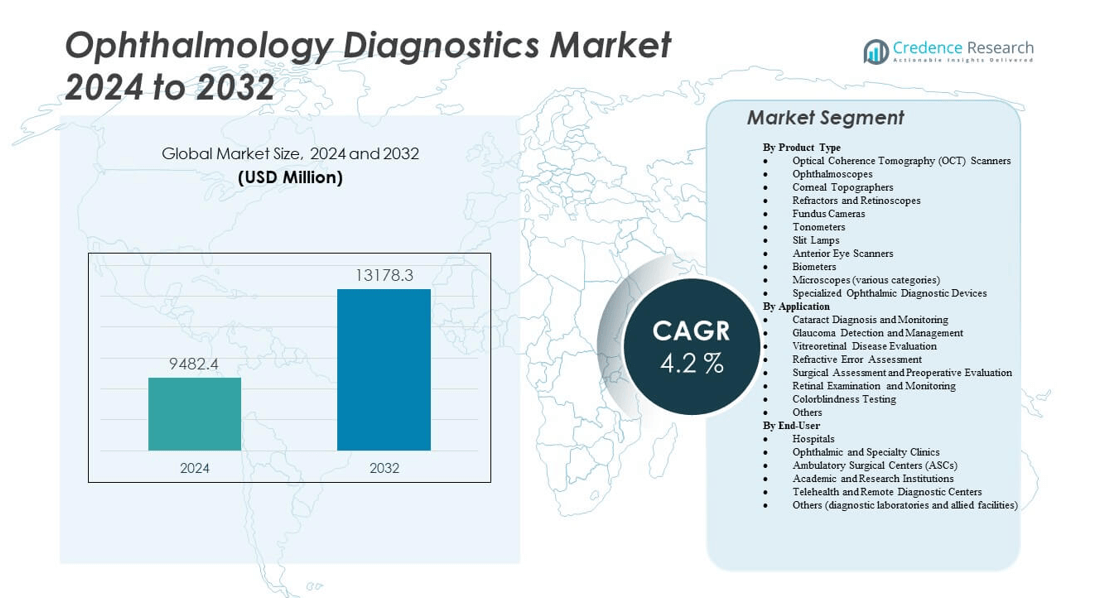

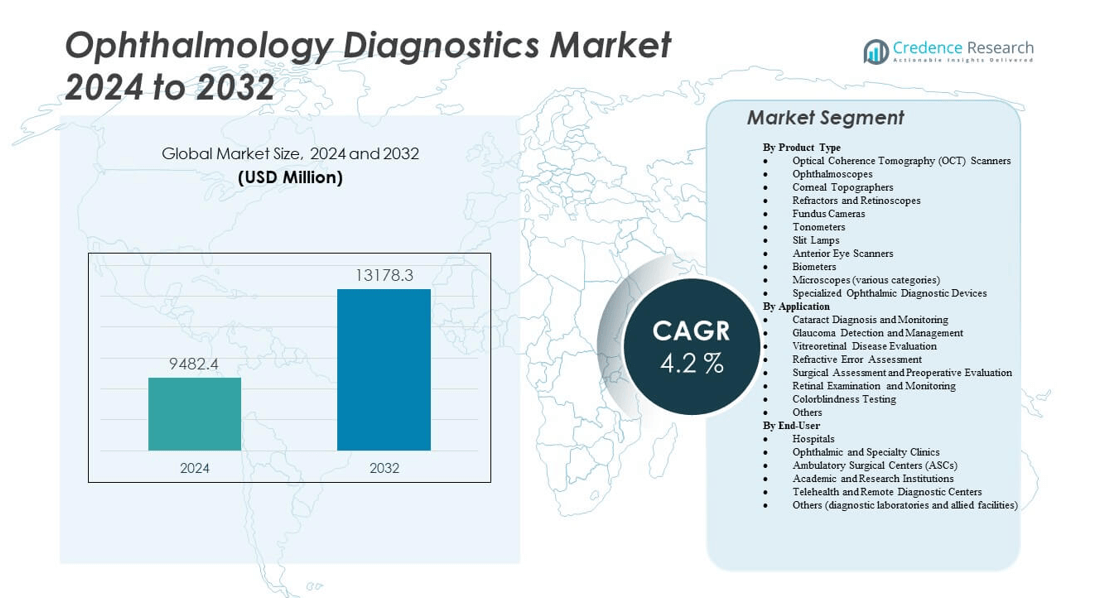

The ophthalmology diagnostics market is projected to grow from USD 9482.4 million in 2024 to an estimated USD 13178.3 million by 2032, with a compound annual growth rate (CAGR) of 4.2 % from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmology Diagnostics Market Size 2024 |

USD 9482.4 million |

| Ophthalmology Diagnostics Market, CAGR |

4.2% |

| Ophthalmology Diagnostics Market Size 2032 |

USD 13178.3 million |

Technological advances accelerate the ophthalmology diagnostics market as innovative imaging modalities and portable devices enhance early disease detection and improve patient outcomes. Rising prevalence of eye disorders like glaucoma and diabetic retinopathy intensifies demand for accurate diagnostics. Healthcare providers invest in modern screening tools to streamline diagnosis and reduce treatment delays. Growing awareness among patients and physicians drives proactive eye care. Additionally, expanding tele-ophthalmology and remote monitoring capabilities empower clinicians to assess patients efficiently. Together, these forces energize the market’s expansion by fostering adoption and enabling broader access.

North America leads the ophthalmology diagnostics market, fueled by advanced healthcare infrastructure, robust research investment, and high adoption of digital imaging technologies. Europe follows closely, benefiting from established reimbursement systems and growing attention to preventive eye care. In Asia Pacific, emerging markets such as India and China are gaining traction due to expanding healthcare access, rising prevalence of ocular diseases, and increasing government focus on eye health programs. Latin America and the Middle East & Africa are gradually expanding, supported by improving medical facilities and increasing awareness of vision-related disorders.

Market Insights:

- The ophthalmology diagnostics market is projected to grow from USD 9482.4 million in 2024 to USD 13178.3 million by 2032, registering a CAGR of 4.2%.

- Rising demand for early detection of glaucoma, cataracts, and retinal diseases drives consistent adoption of advanced diagnostic devices.

- Technological innovation in OCT scanners, fundus cameras, and AI-powered imaging strengthens accuracy and efficiency in clinical practice.

- High cost of advanced diagnostic equipment and limited accessibility in emerging economies restrict broader adoption.

- North America leads with 38% share, supported by strong infrastructure and presence of key manufacturers.

- Europe holds 29% share, supported by structured screening programs and government initiatives for preventive eye care.

- Asia-Pacific accounts for 23% share, with rapid growth fueled by increasing healthcare investments and large patient populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Emphasis on Early Detection and Preventive Eye Care

The growing emphasis on preventive healthcare has reinforced the role of ophthalmology diagnostics in global healthcare systems. Rising awareness among patients about routine eye check-ups strengthens demand for advanced diagnostic solutions. Early detection of glaucoma, diabetic retinopathy, and macular degeneration remains central to preventing irreversible vision loss. Governments and health organizations promote screening programs to reduce the economic and social burden of blindness. Technological adoption in diagnostic imaging supports physicians in identifying diseases at earlier stages. Rising geriatric population further contributes to this demand by driving cases of age-related vision disorders. The ophthalmology diagnostics market benefits significantly from this growing preventive healthcare focus.

- For instance, ZEISS launched its CIRRUS HD-OCT 6000 platform, which enables ultra-high-speed scanning at 100,000 A-scans per second, allowing clinicians to screen large volumes of patients per day with improved repeatability for early glaucoma detection.

Technological Advancement in Imaging and Diagnostic Devices

Rapid advances in imaging technologies such as optical coherence tomography and fundus photography propel market growth. New diagnostic systems now provide high-resolution images, faster analysis, and improved accuracy for complex eye conditions. Integration of artificial intelligence tools enhances predictive capabilities and enables real-time image interpretation. Manufacturers invest heavily in R&D to introduce portable and user-friendly diagnostic solutions. Clinics and hospitals adopt advanced systems to improve workflow and patient outcomes. Digital transformation of healthcare encourages providers to integrate smart diagnostic platforms. The ophthalmology diagnostics market expands as technology becomes more efficient and accessible across different care settings.

- For instance, Topcon Healthcare introduced its Triton Swept-Source OCT, capable of penetrating through media opacities and acquiring a 12 mm x 9 mm wide-field OCT angiography scan in under 3 seconds, significantly enhancing diagnostic throughput and image depth across retinal and choroidal layers.

Expanding Prevalence of Lifestyle-Induced and Chronic Diseases

The rising prevalence of diabetes and hypertension directly increases the incidence of diabetic retinopathy and hypertensive retinopathy. Lifestyle-related disorders continue to influence ophthalmic disease patterns worldwide. Sedentary behavior and poor dietary habits contribute to a higher risk of vision impairment in younger demographics. Healthcare providers prioritize early diagnosis to manage these conditions effectively. Payers and insurers support diagnostic testing to control long-term treatment costs. Hospitals and specialized eye centers enhance diagnostic capacity to meet growing demand. The ophthalmology diagnostics market strengthens its role as a critical component in managing chronic and lifestyle-driven disorders.

Integration of Digital Health Solutions into Ophthalmic Practices

Digital health adoption influences diagnostics by integrating tele-ophthalmology and cloud-based platforms. Physicians remotely monitor patients with access to digital imaging and secure communication tools. Cloud storage facilitates better collaboration among eye specialists across regions. Remote consultations increase access to diagnostics for patients in underserved areas. This digital shift also accelerates patient data management and streamlines clinical workflows. Hospitals and private practices embrace digital transformation to improve service quality. The ophthalmology diagnostics market grows as it adapts to digital health integration, improving efficiency and expanding its reach across varied geographies.

Market Trends:

Rising Adoption of Artificial Intelligence in Ophthalmic Imaging

Artificial intelligence transforms diagnostic capabilities by automating image recognition and disease detection. AI-powered algorithms now assist ophthalmologists in identifying subtle abnormalities that might escape human observation. Predictive analytics improves disease management and supports long-term patient monitoring. Integration with diagnostic platforms reduces time spent on manual interpretation. AI-driven applications gain regulatory approvals across major healthcare markets. Hospitals invest in AI-based systems to enhance accuracy and efficiency. The ophthalmology diagnostics market advances as AI adoption becomes central to precision medicine strategies.

- For instance, Google DeepMind’s AI model for retinal scans achieved detection of over 50 eye diseases with a diagnostic accuracy comparable to expert ophthalmologists, processing scans in under 30 seconds.

Development of Non-Invasive and Patient-Centric Diagnostic Tools

Manufacturers design diagnostic systems that prioritize patient comfort and reduce procedural complexity. Non-invasive devices such as handheld fundus cameras improve accessibility and minimize discomfort during testing. Portable diagnostic equipment supports screening in rural and remote locations. The trend toward patient-friendly technology expands reach to pediatric and elderly groups. Innovations focus on shortening examination time while maintaining diagnostic accuracy. Such tools increase patient compliance with regular eye check-ups. The ophthalmology diagnostics market reflects this trend as it prioritizes solutions that balance accuracy with user comfort.

- For example, the Volk iNview is a handheld retinal camera designed to work with Apple devices, enabling clinicians to capture wide-field digital retinal images. It provides a field of view of approximately 50 degrees, which supports effective documentation and screening of retinal health. Its portability makes it practical for point-of-care imaging and broader accessibility in community or outreach settings.

Increasing Role of Big Data and Analytics in Ophthalmology Research

Healthcare providers harness big data to uncover patterns in disease progression and treatment response. Diagnostic systems now integrate with analytics platforms to deliver population-level insights. Researchers apply advanced data analysis to strengthen clinical trials and regulatory submissions. Real-world data supports predictive modeling of eye disease burdens. Cloud platforms enhance collaboration by enabling shared data access across global networks. Data-driven insights improve resource allocation in healthcare systems. The ophthalmology diagnostics market aligns with this trend as analytics strengthens evidence-based decision-making.

Emergence of Wearable and Connected Ophthalmic Devices

Wearable technology enters ophthalmology diagnostics through smart contact lenses and connected monitoring tools. These devices collect continuous ocular health data and support early detection of abnormalities. Integration with mobile apps enables patients to track eye health independently. Connectivity features allow real-time sharing of diagnostic information with physicians. Such innovations complement traditional diagnostic procedures by adding continuous monitoring capabilities. Wearable devices gain popularity among tech-savvy consumers focused on preventive care. The ophthalmology diagnostics market evolves with this trend, merging traditional practices with connected healthcare solutions.

Market Challenges Analysis:

High Cost of Advanced Diagnostic Equipment and Limited Accessibility

The cost of advanced ophthalmology diagnostic systems poses a major barrier for small clinics and healthcare providers in emerging economies. High acquisition and maintenance expenses limit widespread adoption of cutting-edge technologies. Patients in rural areas often lack access to modern equipment, leading to delays in diagnosis and treatment. Reimbursement policies in certain regions fail to cover advanced diagnostic tests adequately. Limited budgets in public hospitals further restrict adoption of innovative systems. Manufacturers face the challenge of balancing innovation with affordability. The ophthalmology diagnostics market must address these disparities to achieve broader penetration.

Shortage of Skilled Professionals and Regulatory Constraints

Effective use of advanced diagnostic equipment requires specialized training and skilled professionals. A shortage of trained ophthalmologists and technicians limits diagnostic efficiency, particularly in developing nations. Regulatory approvals for new diagnostic devices remain time-consuming and complex. Compliance with international safety and performance standards creates additional delays for product launches. These regulatory challenges slow the pace of innovation and market expansion. Healthcare providers struggle to maintain consistent quality in diagnostics due to skill gaps. The ophthalmology diagnostics market faces these workforce and compliance challenges while striving for global growth.

Market Opportunities:

Expansion of Tele-Ophthalmology and Remote Screening Programs

The growth of telehealth creates strong opportunities for expanding ophthalmology diagnostics in underserved regions. Remote screening initiatives allow patients in rural areas to access timely diagnostics without traveling to urban centers. Mobile diagnostic units equipped with portable devices further extend outreach. Governments and NGOs increasingly invest in digital health programs to combat preventable blindness. Cloud-based storage and secure platforms support collaboration between primary physicians and eye specialists. The ophthalmology diagnostics market captures this opportunity by leveraging remote connectivity to broaden accessibility and reduce disease burden.

Rising Demand for Personalized and Precision-Based Ophthalmic Care

Growing emphasis on personalized medicine generates demand for diagnostic solutions tailored to individual patient needs. Genomic testing and biomarker-based diagnostics strengthen disease stratification and treatment planning. Hospitals adopt precision-based diagnostic systems to deliver targeted therapies. Customized diagnostic protocols improve patient outcomes by aligning care with unique risk profiles. Manufacturers introduce diagnostic platforms compatible with precision treatment approaches. Payers and insurers increasingly support such targeted strategies to improve cost-effectiveness. The ophthalmology diagnostics market benefits from this opportunity as it integrates with precision medicine to deliver tailored eye care solutions.

Market Segmentation Analysis:

By product type, the ophthalmology diagnostics market includes a wide range of instruments designed to enhance precision and efficiency in clinical practice. Optical Coherence Tomography (OCT) scanners dominate advanced imaging, while ophthalmoscopes, fundus cameras, and slit lamps remain essential for routine examinations. Corneal topographers, refractors, and retinoscopes support vision assessment, and anterior eye scanners strengthen early disease detection. Biometers and ophthalmic microscopes hold critical roles in surgical planning. Specialized ophthalmic diagnostic devices such as keratometers, lensometers, angiography systems, and ophthalmic ultrasound extend diagnostic accuracy and enable detailed evaluations.

- For example, the AngioVue OCTA system (Optovue) is a dye-less imaging platform that visualizes retinal and choroidal vasculature using SSADA technology. Multi-center studies involving 426 eyes have validated its strong diagnostic utility for detecting ocular vascular diseases.

By application, the market spans cataract diagnosis and monitoring, glaucoma detection and management, and vitreoretinal disease evaluation. Refractive error assessment and surgical preoperative evaluation sustain steady demand with growing surgical volumes. Retinal examination and monitoring are vital for chronic disease management, while colorblindness testing and other applications such as age-related macular degeneration and diabetic retinopathy reflect expanding needs across diverse patient groups. It demonstrates versatility by addressing acute, chronic, and hereditary conditions.

- For instance, the AI‑GS glaucoma screening network from Tohoku University achieved a sensitivity of 93.52% at 95% specificity using a test dataset of 8,000 fundus images, delivering performance comparable to that of expert ophthalmologists.

By end-user, hospitals hold a significant share due to advanced infrastructure and comprehensive diagnostic capabilities. Ophthalmic and specialty clinics offer targeted services with increasing adoption of modern devices. Ambulatory surgical centers expand access to outpatient diagnostics and procedures. Academic and research institutions strengthen innovation through diagnostic technology development. Telehealth and remote diagnostic centers create new avenues for accessibility, while diagnostic laboratories and allied facilities extend the reach of specialized testing. The ophthalmology diagnostics market benefits from diverse end-user participation that supports continuous growth.

Segmentation:

By Product Type

- Optical Coherence Tomography (OCT) Scanners

- Ophthalmoscopes

- Corneal Topographers

- Refractors and Retinoscopes

- Fundus Cameras

- Tonometers

- Slit Lamps

- Anterior Eye Scanners

- Biometers

- Microscopes (various categories)

- Specialized Ophthalmic Diagnostic Devices

By Application

- Cataract Diagnosis and Monitoring

- Glaucoma Detection and Management

- Vitreoretinal Disease Evaluation

- Refractive Error Assessment

- Surgical Assessment and Preoperative Evaluation

- Retinal Examination and Monitoring

- Colorblindness Testing

- Others (including age-related macular degeneration, diabetic retinopathy, and related disorders)

By End-User

- Hospitals

- Ophthalmic and Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Academic and Research Institutions

- Telehealth and Remote Diagnostic Centers

- Others (diagnostic laboratories and allied facilities)

By region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading position in the ophthalmology diagnostics market, accounting for 38% of the global share. The region benefits from advanced healthcare infrastructure, strong adoption of innovative imaging systems, and high awareness of preventive eye care. U.S. healthcare providers invest heavily in OCT scanners, fundus cameras, and slit lamps to support early detection of glaucoma, cataracts, and retinal diseases. Favorable reimbursement policies and strong presence of leading manufacturers accelerate adoption. The growing prevalence of diabetes also fuels demand for retinal evaluation tools. It continues to strengthen its dominance with rising integration of AI and digital health platforms in diagnostic practices.

Europe represents the second-largest market, capturing 29% of the share. The region’s growth is supported by strong regulatory frameworks, widespread access to eye care, and active government programs to prevent vision loss. Germany, France, and the U.K. remain central hubs for adoption of advanced diagnostic technologies. Hospitals and specialty clinics across Europe prioritize early diagnosis, particularly for cataracts and age-related macular degeneration. Increasing investments in research and innovation contribute to new product development and clinical applications. It maintains steady expansion by combining innovation with a strong tradition of preventive healthcare and structured screening programs.

Asia-Pacific emerges as the fastest-growing region, holding 23% of the market share. Expanding healthcare infrastructure in China, India, and Southeast Asia strengthens access to modern diagnostic technologies. Rising incidence of diabetes and myopia accelerates demand for early and accurate detection tools. Japan and Australia lead in adoption, while China and India are rapidly advancing due to government-led eye health programs. Growing medical tourism and rising investments in ophthalmic clinics also contribute to regional momentum. It displays significant long-term potential as manufacturers focus on expanding affordable diagnostic solutions in emerging economies. Latin America accounts for 6%, while the Middle East & Africa represent 4%, supported by gradual improvements in healthcare systems and rising awareness of preventive eye care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alcon

- Carl Zeiss Meditec

- Topcon

- NIDEK

- Canon

- Haag-Streit

- Ziemer Ophthalmic Systems

- Reichert Technologies

- Marco Ophthalmic

Competitive Analysis:

The ophthalmology diagnostics market is highly competitive, with global and regional players investing in advanced imaging and diagnostic solutions. Leading companies such as Carl Zeiss Meditec, Topcon, NIDEK, Canon, Haag-Streit, and Alcon focus on expanding product portfolios through innovation in OCT scanners, fundus cameras, and slit lamps. Strategic collaborations, product launches, and regulatory approvals strengthen their positions. Smaller players like Marco Ophthalmic and Reichert Technologies contribute by offering specialized diagnostic instruments. Competition intensifies with digital integration, AI-based platforms, and portable diagnostic devices. It continues to evolve with companies seeking to balance innovation, affordability, and accessibility to address diverse healthcare needs worldwide.

Recent Developments:

- In August 2025, ZEISS Medical Technology announced CE mark approval for the CIRRUS PathFinder AI tool, which uses deep learning algorithms to identify abnormal macular OCT B-scans and improve OCTA image quality and segmentation for enhanced diagnostics.

- In July 2025, Optomed USA introduced the Optomed Lumo handheld fundus camera, which enables retinal imaging in primary care and remote settings by offering wireless DICOM integration and an intuitive dual-use design.

- In July 2025, Topcon Healthcare completed the acquisition of Intelligent Retinal Imaging Systems (IRIS), expanding its Healthcare from the Eye cloud platform with AI-driven retinal screening technology designed to facilitate early identification of ocular and systemic disease in primary care settings.

- In July 2025, Alcon announced the acquisition of LumiThera, a firm specializing in photobiomodulation devices for dry age-related macular degeneration (AMD), augmenting Alcon’s non-invasive treatment portfolio.

Market Concentration & Characteristics:

The ophthalmology diagnostics market demonstrates a moderate to high level of concentration, dominated by a few established multinational players with strong brand recognition and extensive distribution networks. Innovation in imaging technologies and AI integration defines competitive differentiation. It is characterized by continuous R&D investment, increasing adoption of digital health platforms, and expanding demand in emerging economies. High entry barriers exist due to regulatory requirements, capital intensity, and the need for specialized expertise. The market remains dynamic, with established players consolidating their positions while niche manufacturers address specific diagnostic needs.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Advancements in AI-powered imaging and predictive analytics will enhance diagnostic precision and support personalized treatment planning.

- Expansion of portable and handheld diagnostic devices will improve accessibility in rural and underserved regions.

- Growing integration of tele-ophthalmology platforms will expand remote screening and consultation services worldwide.

- Rising focus on early detection of chronic eye diseases will increase demand for advanced diagnostic technologies in preventive care.

- Continuous innovation in non-invasive imaging systems will improve patient comfort and encourage routine screening compliance.

- Strategic collaborations between device manufacturers and healthcare providers will accelerate the adoption of digital diagnostic ecosystems.

- Increasing use of big data and cloud-based platforms will strengthen collaboration among clinicians and research institutions.

- Market players will emphasize affordability and cost-effective solutions to cater to emerging economies with rising demand.

- Regulatory approvals and supportive government programs will create opportunities for the rapid deployment of new technologies.

- Growing awareness of ocular health and lifestyle-related vision disorders will drive steady long-term demand for diagnostic solutions.