Market Overview

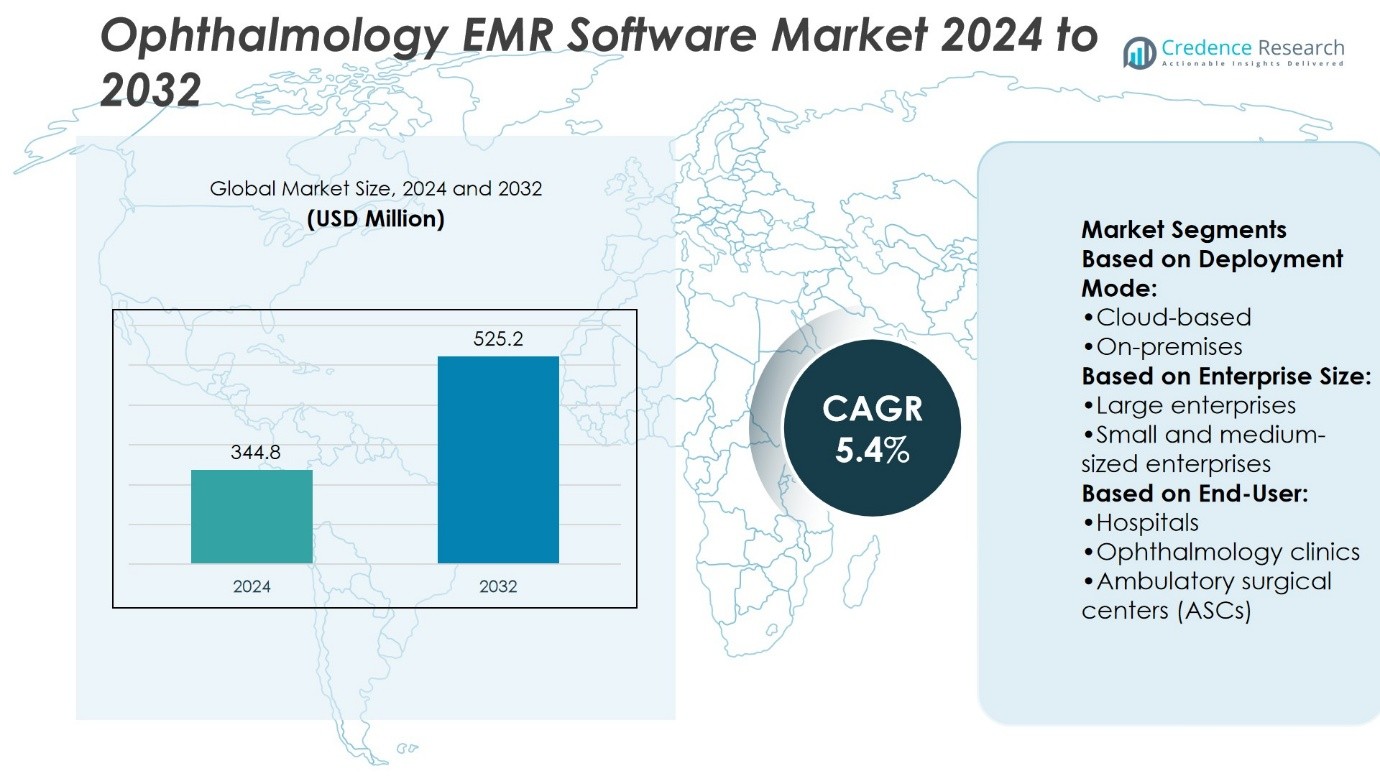

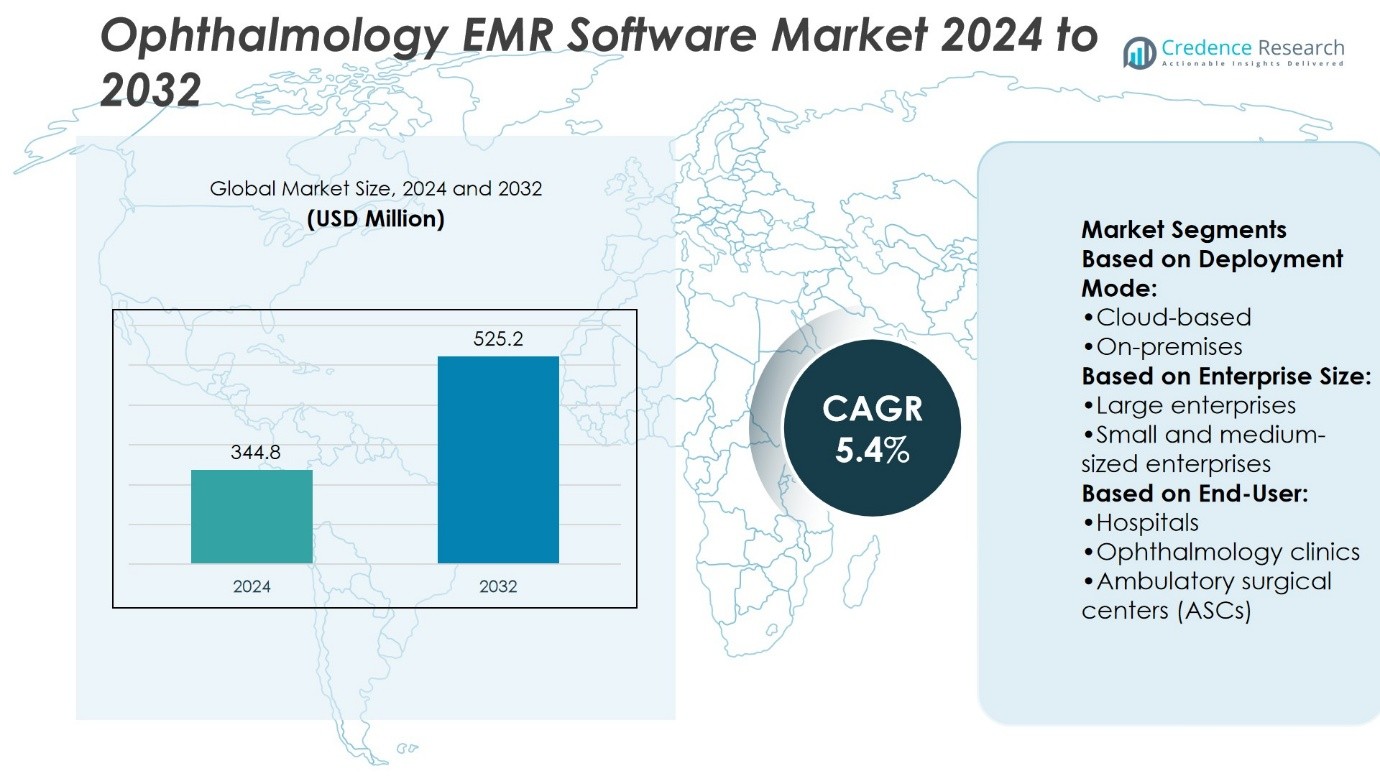

Ophthalmology EMR Software Market size was valued at USD 344.8 million in 2024 and is anticipated to reach USD 525.2 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmology EMR Software Market Size 2024 |

USD 344.8 Million |

| Ophthalmology EMR Software Market, CAGR |

5.4% |

| Ophthalmology EMR Software Market Size 2032 |

USD 525.2 Million |

The Ophthalmology EMR Software Market grows due to increasing demand for digitized patient records, rising prevalence of eye disorders, and government initiatives supporting healthcare IT adoption. Providers seek solutions that streamline workflows, integrate diagnostic imaging, and ensure regulatory compliance, driving steady market expansion. Cloud-based platforms gain traction for cost efficiency and scalability, while AI-powered analytics enhance clinical decision-making. Interoperability with hospital systems and patient engagement features further boost adoption. The market also trends toward mobile accessibility and tele-ophthalmology integration, enabling practices to deliver efficient care in both urban and remote settings, ensuring broader reach and improved patient outcomes.

The Ophthalmology EMR Software Market shows strong regional diversity, with North America holding the largest share due to advanced healthcare infrastructure and high adoption of digital records. Europe follows with supportive regulations and growing demand for efficient ophthalmic care, while Asia-Pacific emerges as the fastest-growing region, supported by expanding healthcare facilities and rising patient volume. Key players such as Advanced Data Systems, Kareo, Inc., Modernizing Medicine, athenahealth, and RevolutionEHR drive innovation and maintain competitiveness through advanced features, integration, and scalability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ophthalmology EMR Software Market was valued at USD 344.8 million in 2024 and is expected to reach USD 525.2 million by 2032, growing at a CAGR of 5.4%.

- Rising prevalence of eye disorders and demand for digitized patient records drive market adoption.

- Government support for healthcare IT and focus on regulatory compliance strengthen market growth.

- Cloud-based solutions and AI-powered analytics improve efficiency, scalability, and clinical decision-making.

- Key players like Advanced Data Systems, Kareo, Inc., Modernizing Medicine, athenahealth, and Revolution EHR enhance competitiveness through innovation and integration.

- Challenges include high implementation costs, interoperability issues, and resistance from smaller practices limiting adoption.

- North America leads the market, Europe shows steady growth with supportive regulations, while Asia-Pacific is the fastest-growing region with expanding healthcare infrastructure and rising patient volume.

Market Drivers

Rising Demand for Digital Health Records in Ophthalmology

The Ophthalmology EMR Software Market grows with the need for efficient digital documentation. Clinics and hospitals seek solutions that reduce errors and streamline patient data management. It allows ophthalmologists to track patient history, imaging results, and prescriptions in a unified system. Integration with diagnostic equipment supports quicker decision-making and improves accuracy. Government incentives for digital record adoption encourage faster implementation across healthcare facilities. The shift from paper-based records drives demand for scalable EMR platforms tailored to eye care.

- For instance, Revolution EHR’s RevClear module reduces each claim transaction by 8.5 minutes, a feature listed among the benefits of the claims processing service.

Increasing Prevalence of Eye Disorders Driving Adoption

The growing cases of glaucoma, cataracts, and diabetic retinopathy push the Ophthalmology EMR Software Market forward. Ophthalmologists require structured platforms to manage rising patient volumes with precision. It ensures timely access to past medical data and imaging scans for better treatment outcomes. Automated alerts for follow-up care strengthen adherence to long-term treatment plans. Rising demand for specialized EMR modules designed for ophthalmic practices strengthens vendor opportunities. Patient-centric features such as electronic prescriptions and mobile access enhance convenience and continuity of care.

- For instance, Waystar’s Claim Manager maintains a 98.5% first-pass clean claim rate, powered by more than 2.5 million built-in claim edits updated in real time. This level of automation reduces resubmission delays and supports faster reimbursement across 5,000 payer connections.

Integration with Diagnostic Devices and Imaging Systems

The Ophthalmology EMR Software Market benefits from seamless connectivity with advanced ophthalmic diagnostic tools. Integration with OCT, fundus cameras, and visual field analyzers enables faster clinical workflows. It reduces manual data entry, saving time and improving reliability in reporting. Real-time synchronization helps specialists access images directly from the EMR platform. Automated comparison of imaging results supports disease progression tracking. These technological advancements strengthen clinical efficiency while improving overall patient safety.

Growing Regulatory Push for Interoperability and Compliance

The Ophthalmology EMR Software Market expands under stricter healthcare regulations and compliance standards. Interoperability mandates require systems to exchange data across multiple providers and platforms. It ensures secure communication of patient records between ophthalmologists, primary care providers, and insurers. Compliance with HIPAA and GDPR reinforces trust and safeguards sensitive data. Vendors focus on certification and regulatory approvals to strengthen product adoption. This regulatory environment accelerates the shift toward advanced EMR solutions tailored to ophthalmology.

Market Trends

Growing Shift Toward Cloud-Based EMR Platforms

The Ophthalmology EMR Software Market observes rising adoption of cloud-based deployment models. Cloud platforms offer lower upfront costs and flexible scalability for clinics of varying sizes. It provides remote access for physicians to review records and imaging results securely. Automatic updates reduce the burden of IT maintenance for healthcare facilities. Vendors enhance data encryption and security protocols to build confidence in cloud adoption. The trend supports small and mid-sized practices in digitizing records without heavy infrastructure investment.

- For instance, NextGen Ambient Assist, introduced nearly two years ago, now handles 1.5 million patient encounters annually. It saves providers up to two hours per day in documentation by transcribing encounters in real time and generating summaries via AI.

Increasing Use of Artificial Intelligence and Analytics

The Ophthalmology EMR Software Market incorporates AI-driven tools for decision support and predictive analysis. Intelligent modules analyze imaging data to detect early signs of glaucoma or diabetic retinopathy. It improves accuracy in diagnosis and reduces manual errors in report interpretation. Predictive analytics help physicians identify patients at higher risk of disease progression. Vendors integrate AI features into EMR platforms to offer clinical insights beyond standard documentation. This trend elevates EMR systems into active diagnostic and management tools.

- For instance, Veradigm’s interoperability network, previously powered under the Allscripts umbrella, spans a rich ecosystem of healthcare connections. The Veradigm Network now enables integrated data access across those 2,700 hospitals and 13,000 extended-care sites, fostering care continuity and seamless system integration.

Rising Patient Engagement Through Mobile and Portal Access

The Ophthalmology EMR Software Market embraces patient-facing technologies such as portals and mobile apps. Patients gain direct access to prescriptions, imaging results, and follow-up schedules through secure platforms. It improves engagement and strengthens adherence to treatment plans in chronic eye conditions. Physicians use messaging features to improve communication and reduce clinic visits. Mobile-friendly systems expand access to younger and tech-savvy patient groups. This trend reshapes EMR software into a collaborative platform for both doctors and patients.

Growing Focus on Interoperability and Standardization

The Ophthalmology EMR Software Market advances with strong demand for interoperable systems. Clinics and hospitals require platforms that exchange data across different healthcare providers. It ensures seamless integration with national health record systems and insurance databases. Vendors develop EMR solutions compliant with HL7 and FHIR standards to improve compatibility. Standardization reduces duplication of data entry and strengthens continuity of care. This trend positions interoperability as a key driver of competitive differentiation among EMR providers.

Market Challenges Analysis

High Implementation Costs and Workflow Disruptions

The Ophthalmology EMR Software Market faces challenges from high implementation and integration costs. Small and mid-sized practices struggle to allocate budgets for advanced systems. It often requires hardware upgrades, staff training, and ongoing technical support. Complex workflows in ophthalmology demand customization, which increases deployment expenses. Transitioning from paper to digital records may slow productivity during the adjustment phase. These barriers limit adoption among practices with limited financial and operational resources.

Data Security Concerns and Interoperability Gaps

The Ophthalmology EMR Software Market also encounters challenges linked to data security and interoperability. It handles sensitive patient information that must comply with strict privacy regulations. Any breach risks financial penalties and loss of patient trust. Interoperability gaps between systems restrict smooth data exchange across healthcare providers. Many platforms lack seamless integration with national health databases and diagnostic equipment. This hinders collaboration and reduces efficiency in multi-specialty or networked care environments. Vendors must address these issues to strengthen user confidence and accelerate adoption.

Market Opportunities

Expansion Through AI-Driven Diagnostic Support

The Ophthalmology EMR Software Market holds strong opportunities in AI-enabled clinical decision support. It can integrate predictive models to detect early-stage glaucoma, macular degeneration, or diabetic retinopathy. Automated pattern recognition in imaging data improves diagnostic accuracy and speeds up treatment planning. Hospitals and clinics benefit from reduced manual workload and improved patient throughput. Vendors offering AI-powered modules gain a competitive edge in specialized ophthalmology practices. The combination of EMR with intelligent diagnostics opens new revenue streams for technology providers.

Growth Potential in Emerging Markets and Cloud Adoption

The Ophthalmology EMR Software Market finds opportunities in expanding healthcare systems in emerging regions. Governments invest heavily in digital infrastructure to support growing patient populations. It creates demand for cost-effective cloud-based EMR platforms with scalable features. Remote accessibility enables smaller clinics to adopt advanced digital records without large capital expenses. Partnerships with regional healthcare providers further accelerate adoption. The rising preference for mobile-enabled platforms positions vendors to capture untapped opportunities in Asia-Pacific, Latin America, and the Middle East.

Market Segmentation Analysis:

By Deployment Mode

The Ophthalmology EMR Software Market divides into cloud-based and on-premises platforms. Cloud-based solutions gain traction due to lower upfront costs and easier scalability. It provides secure remote access, supporting physicians who require flexibility across multiple facilities. Automatic updates and reduced IT maintenance make cloud platforms attractive for mid-sized practices. On-premises systems retain relevance in large hospitals that prioritize data control and internal security. These setups require higher capital investment but offer customization aligned with complex workflows. The choice between deployment modes reflects varying financial capacities and regulatory considerations across healthcare providers.

- For instance, WRS Health indicate an overall satisfaction rating of 4.5 out of 5 stars based on reviews on platforms like Capterra. It is valued by some users for its user-friendliness, customization, and integrated billing, though some reviews note drawbacks such as customer support responsiveness and template limitations.

By Enterprise Size

The Ophthalmology EMR Software Market also segments by enterprise size into large enterprises and small and medium-sized enterprises. Large enterprises adopt advanced EMR platforms with integrated analytics, interoperability features, and high-volume data handling. It helps them manage complex ophthalmology departments within multi-specialty hospitals. Small and medium-sized enterprises focus on affordable, cloud-based solutions with essential functionality. Vendors design modular offerings that allow gradual expansion as practice needs evolve. Limited budgets and IT resources push smaller clinics toward subscription-based models. This segmentation highlights how affordability and operational requirements guide technology adoption across enterprise categories.

- For instance, ChartLogic markets a proprietary command-and-control voice dictation method that it claims can allow clinicians to complete a full patient note in 90 seconds or less.

By End-user

The Ophthalmology EMR Software Market further classifies into hospitals, ophthalmology clinics, and ambulatory surgical centers (ASCs). Hospitals implement comprehensive EMR systems that integrate ophthalmology modules with broader healthcare records. It ensures continuity of care across specialties and supports large-scale diagnostic imaging integration. Ophthalmology clinics demand specialized systems tailored to eye care workflows, diagnostic equipment, and patient engagement tools. These clinics prefer EMR solutions that enhance efficiency in high-volume outpatient settings. Ambulatory surgical centers adopt EMR platforms to streamline surgical scheduling, documentation, and postoperative tracking. Their need for cost-effective, compliant systems drives demand for lightweight but reliable EMR offerings.

Segments:

Based on Deployment Mode:

Based on Enterprise Size:

- Large enterprises

- Small and medium-sized enterprises

Based on End-User:

- Hospitals

- Ophthalmology clinics

- Ambulatory surgical centers (ASCs)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America dominates the Ophthalmology EMR Software Market with nearly 35% share. The United States accounts for the largest portion, supported by extensive adoption of electronic medical records across hospitals, clinics, and specialty practices. Federal initiatives like the HITECH Act and interoperability rules accelerate integration of ophthalmology EMR solutions into wider healthcare networks. High prevalence of eye disorders such as glaucoma and cataracts strengthens demand for advanced documentation and workflow automation. Canada also shows steady adoption, where government-backed EMR incentive programs support ophthalmologists in private and public practice. Vendors in this region compete by offering advanced interoperability features, compliance with HIPAA, ONC, and FDA standards, and seamless integration with diagnostic imaging devices. Cloud-based platforms with AI-powered analytics gain traction, reflecting the shift toward patient-centered care and precision ophthalmology.

Europe

Europe represents about 25% of the global Ophthalmology EMR Software Market. The region benefits from strong regulatory frameworks, with GDPR compliance driving demand for secure and privacy-focused EMR solutions. Germany, the UK, France, and the Nordic countries are key adopters, each supported by national digital health strategies. Hospitals and ophthalmology clinics prefer software that integrates with existing electronic health record platforms used across national health systems. Government-led eHealth initiatives, such as the NHS digital transformation in the UK and France’s digital health reimbursement schemes, create favorable conditions for EMR expansion. The Nordic countries stand out with high EMR penetration, fueled by strong IT infrastructure and emphasis on patient data integration across primary and specialty care. Vendors succeed here by offering multilingual support, cross-border data exchange, and modular deployment models that suit both large hospitals and independent practices.

Asia-Pacific

The Asia-Pacific region contributes approximately 20% of the Ophthalmology EMR Software Market and shows the fastest growth potential. Rising incidence of eye disorders such as diabetic retinopathy and myopia among aging populations in China, India, and Japan drives ophthalmology-focused digital solutions. Governments in countries like India and Australia actively promote healthcare digitization through national programs such as Ayushman Bharat Digital Mission and My Health Record. Japan and South Korea lead in technology integration, favoring advanced EMR systems that combine ophthalmology imaging with AI-based diagnostics. In emerging markets like India and Indonesia, affordability plays a major role, with cloud-based, subscription-driven EMR software becoming more attractive due to lower upfront costs. Vendors expand aggressively in this region by offering localized language interfaces, tele-ophthalmology integration, and scalable systems designed to fit small clinics and ambulatory surgical centers as well as large hospitals.

Latin America

Latin America holds nearly 10% of the Ophthalmology EMR Software Market. Brazil and Mexico represent the largest demand, while Argentina and Chile follow with growing adoption. The region experiences rising healthcare digitization, although uneven IT infrastructure and economic challenges slow EMR penetration compared to developed markets. Ophthalmologists in private clinics are increasingly investing in EMR systems to streamline patient records and support efficient diagnostic processes. Governments in Brazil and Mexico introduce eHealth programs, though implementation remains fragmented across public and private healthcare systems. Vendors compete by offering affordable, cloud-based solutions that require minimal on-site infrastructure and support Spanish and Portuguese interfaces. Training and after-sales service remain crucial factors influencing adoption, as many ophthalmologists require support in transitioning from paper-based systems to digital workflows.

Middle East and Africa

The Middle East and Africa together account for around 10% of the Ophthalmology EMR Software Market. Gulf countries such as the UAE and Saudi Arabia drive market expansion under national digital health transformation policies like Vision 2030. Adoption is strongest among private hospitals and ophthalmology chains that prioritize patient-centric care and integration with advanced diagnostic devices. South Africa and Nigeria lead demand in Africa, though adoption remains concentrated in urban centers due to infrastructure challenges and limited digital literacy in rural healthcare. Vendors succeed in the region by offering mobile-compatible EMR platforms, multilingual capabilities, and flexible pricing tailored to smaller healthcare providers. International players increasingly collaborate with local governments and private healthcare groups to deliver pilot programs that strengthen EMR awareness and improve adoption rates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Compulink Advantage

- RevolutionEHR

- Waystar

- EverHealth Solutions Inc.

- athenahealth

- Kareo, Inc.

- ChartLogic

- Advanced Data Systems

- AdvancedMD, Inc.

- Modernizing Medicine

Competitive Analysis

The Ophthalmology EMR Software Market players including Advanced Data Systems, AdvancedMD, Inc., athenahealth, ChartLogic, Compulink Advantage, EverHealth Solutions Inc., Kareo, Inc., Modernizing Medicine, RevolutionEHR, and Waystar. The Ophthalmology EMR Software Market is highly competitive, driven by innovation, specialization, and strategic expansion. Vendors differentiate through ophthalmology-focused features such as image integration, diagnostic templates, and streamlined workflow management. Cloud-based deployment, interoperability, and AI-powered analytics are central to product development, enabling practices to enhance efficiency and patient outcomes. Companies emphasize affordability and scalability to cater to both small practices and large hospitals. Regional expansion and regulatory compliance also shape competitive positioning, with firms tailoring solutions to meet varied healthcare systems and privacy standards. Continuous investment in telemedicine integration, mobile accessibility, and data security further strengthens market rivalry and ensures sustained growth opportunities.

Recent Developments

- In July 2025, Revolution EHR refined its cloud-based platform that combines clinical tools, patient communication and customizable reporting dashboards, helping practices optimize patient management and billing cycles.

- In 2024, Medical Information Technology, Inc., one of the leading Electronic Health Records (EHR) systems providers, integrated ambient listening technology into its Expanse EHR solution. The solution is expected to leverage the vendors to support data consumption through the Expanse Now mobile app and web-based physician solutions.

- In March 2024, Veradigm LLC acquired ScienceIO, a leading AI platform and foundation model provider for healthcare facilities. The acquisition is aimed at enhancing healthcare data, patient privacy, and data integrity.

- In March 2023, Coryell Health launched OracleCerner (EHR) to promote efficiencies across the healthcare system. The adoption of the system is aimed at streamlining the accessibility for healthcare providers and improving overall patient care.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Enterprise Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of digital healthcare solutions in ophthalmology.

- Cloud-based deployment will gain preference due to cost efficiency and remote accessibility.

- AI integration will support advanced diagnostics and improve clinical decision-making.

- Tele-ophthalmology compatibility will strengthen software value in remote and underserved areas.

- Interoperability with broader hospital and clinic systems will remain a key priority.

- Mobile-friendly platforms will see higher demand among small and mid-sized practices.

- Data security and compliance with evolving healthcare regulations will drive software upgrades.

- Customizable workflows and specialty-focused templates will enhance user adoption across clinics.

- Growing need for patient engagement tools will boost portal and mobile app integration.

- Strategic partnerships and regional expansions will shape competitive positioning worldwide.