Market Overview

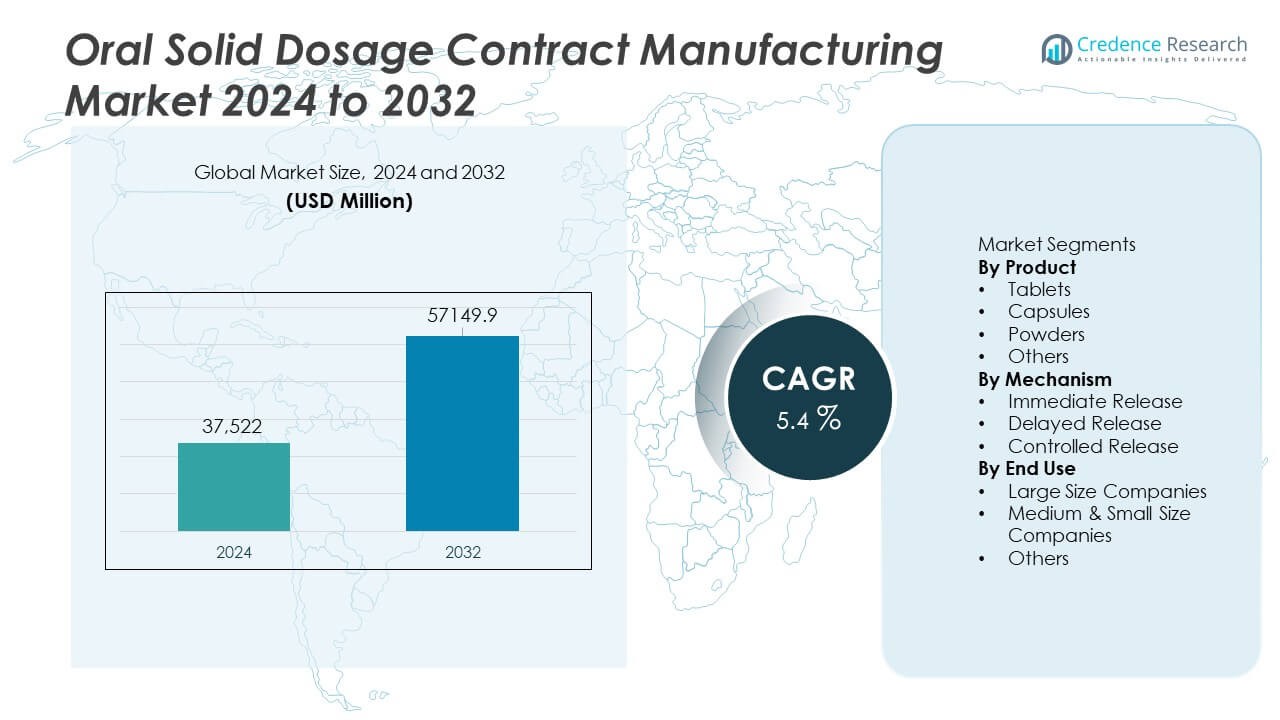

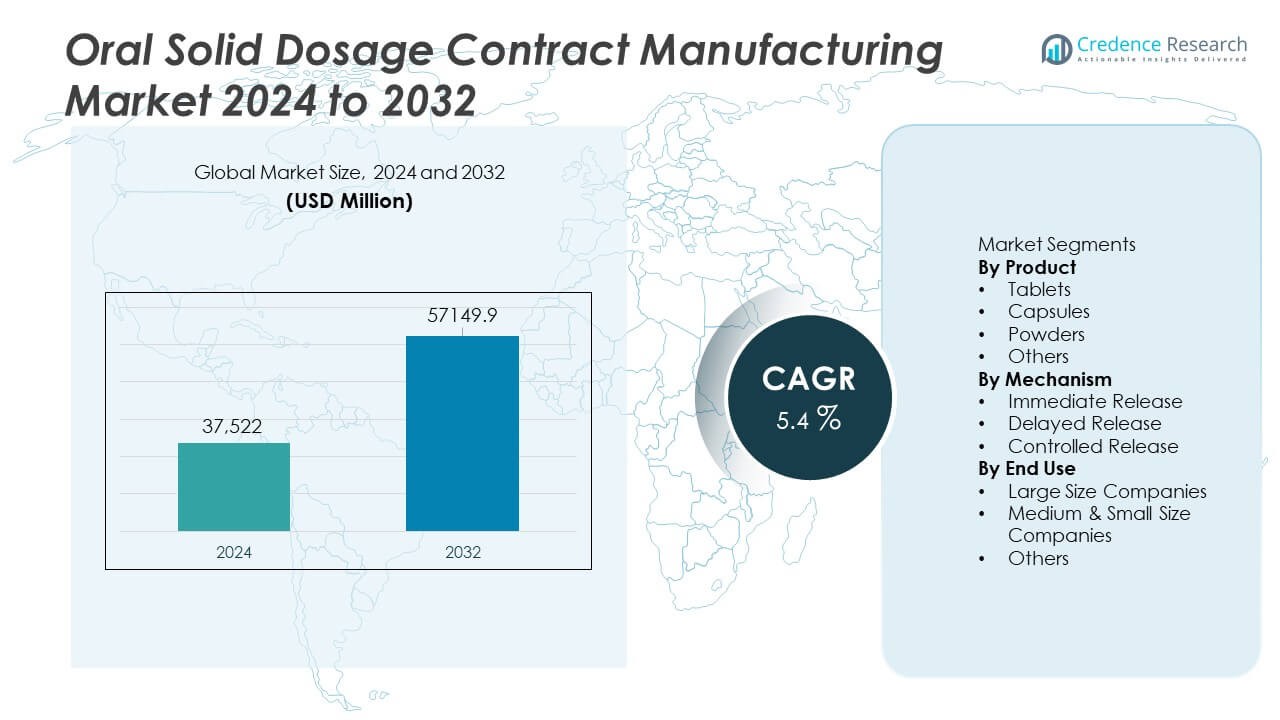

The Oral Solid Dosage Contract Manufacturing Market was valued at USD 37,522 million in 2024 and is projected to reach USD 57,149.9 million by 2032, expanding at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oral Solid Dosage Contract Manufacturing Market Size 2024 |

USD 37,522 Million |

| Oral Solid Dosage Contract Manufacturing Market, CAGR |

5.4% |

| Oral Solid Dosage Contract Manufacturing Market Size 2032 |

USD 57,149.9 Million |

The Oral Solid Dosage Contract Manufacturing market is driven by leading players such as Jubilant Pharmova Limited, Lonza, Siegfried Holding AG, Piramal Pharma Solutions, Patheon Pharma Services, Recipharm AB, Corden Pharma International, Boehringer Ingelheim International GmbH, Catalent Inc., and Aenova Group, each offering large-scale production capacity, advanced formulation services, and strong regulatory expertise. These companies focus on high-potency handling, controlled-release technologies, and cost-efficient manufacturing models to support global pharmaceutical outsourcing. Asia Pacific leads the market with 30% share, supported by cost advantages and expanding GMP-certified facilities. North America follows with 34% share, driven by strong generic drug demand and mature outsourcing networks, while Europe holds 28% share, reflecting its advanced manufacturing infrastructure and regulatory excellence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Oral Solid Dosage Contract Manufacturing market reached USD 37,522 million in 2024 and will grow at a CAGR of 5.4% through 2032.

- Outsourcing rises as pharma companies seek cost-efficient production, with tablets dominating the product segment at 62% share due to high scalability and flexibility.

- Advanced formulation technologies, high-potency handling, and controlled-release capabilities shape key trends as CMOs invest in automation and continuous manufacturing.

- Competitive intensity grows as major players expand global footprints, strengthen regulatory compliance, and form partnerships to support complex OSD development and large-volume production.

- Asia Pacific leads with 30% share, North America follows with 34%, and Europe holds 28%, driven by strong generic drug demand, expanding manufacturing capacity, and rising adoption of outsourcing across both large and small pharmaceutical companies.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Tablets dominate the product segment with 62% share, driven by their high stability, ease of manufacturing, and cost-effectiveness. Pharmaceutical companies continue to outsource tablet production due to rising demand for generic drugs, large-volume batch requirements, and improved formulation technologies such as film coating and taste-masking. Capsules gain momentum as they support complex formulations, including combination drugs and modified-release profiles. Powders and other oral formats serve niche therapeutic needs. Tablets maintain their leadership as contract manufacturers invest in high-capacity production lines, advanced compression systems, and flexible scalability to support global drug development pipelines.

- For instance, Catalent expanded its Winchester site with new rotary presses that raise output to 1.2 billion tablets per year. The upgrade includes a 300-liter high-shear granulator that supports complex blends.

By Mechanism

Immediate-release formulations lead this segment with 58% share, supported by their widespread use in chronic and acute therapies and faster regulatory approvals. These products offer rapid onset of action, making them preferred for pain management, cardiovascular drugs, and antibiotics. Delayed-release products grow as demand rises for acid-resistant coatings and targeted gastrointestinal delivery. Controlled-release formulations expand steadily due to increased development of long-acting therapies that enhance patient adherence. Immediate-release dominance continues as contract manufacturers optimize granulation, coating, and dissolution technologies to support high-volume, fast-turnaround production for global markets.

- For instance, Recipharm has fluid-bed processors that handle a range of granulation volumes for immediate-release drugs. The company also utilizes dissolution testing units capable of running automated samples each cycle.

By End Use

Large-size companies hold the leading 49% share, driven by extensive outsourcing strategies aimed at reducing manufacturing costs, improving supply chain resilience, and expanding production capacity for high-demand therapies. These companies rely on CMOs for technology-intensive operations such as high-shear granulation, high-potency handling, and advanced coating processes. Medium and small pharmaceutical firms grow rapidly as they outsource to access specialized expertise and avoid capital-intensive facility investments. Other end users contribute steady demand through niche formulations and regional supply needs. Large companies maintain dominance as they increasingly adopt flexible outsourcing models to accelerate product development and global distribution.

Key Growth Drivers

Rising Demand for Generic and Affordable Medications

Growing global demand for cost-effective generic drugs drives strong reliance on oral solid dosage contract manufacturing. As major patents expire and healthcare systems prioritize affordability, pharmaceutical companies increasingly outsource production to reduce operational costs and expand capacity. Contract manufacturers offer high-volume capabilities, advanced formulation expertise, and regulatory-compliant facilities that support rapid scale-up. This shift enables drug developers to focus on R&D and commercialization while leveraging CMO efficiencies. The rising burden of chronic diseases and expanding access to essential medicines further accelerates outsourcing growth.

- For instance, Piramal Pharma Solutions expanded its Pithampur site to support annual output of oral solid units and added a fluid-bed processor for large-scale granulation.

Increasing Outsourcing by Large Pharmaceutical Companies

Large pharmaceutical companies expand outsourcing to improve flexibility, reduce manufacturing burdens, and strengthen supply-chain resilience. Oral solid dosage forms such as tablets and capsules require high-capacity equipment, stringent quality control, and specialized handling, which CMOs provide at lower capital cost. Outsourcing enables faster global distribution and better alignment with fluctuating market demand. As innovation pipelines widen, companies rely on CMOs for formulation development, scale-up, and compliance management. This trend accelerates as firms adopt lean manufacturing models and prioritize efficiency in competitive therapeutic markets.

- For instance, Lonza expanded its Bend facility with new capabilities for clinical bottling and labeling, solid form services, and advanced particle engineering technologies like spray-drying and hot-melt extrusion for oral solid and inhaled applications.

Advancements in Formulation and Manufacturing Technologies

Technological progress supports the development of complex OSD formulations, including controlled-release, taste-masked, and high-potency products. CMOs invest in automated systems, continuous manufacturing, and advanced granulation and coating technologies to improve product consistency and reduce production time. These advancements attract pharmaceutical companies seeking reliable partners capable of producing high-quality, innovative oral dosage forms. Improved process analytics and quality-by-design approaches enhance regulatory compliance and reduce batch variability. As demand grows for specialized formulations, technology-driven CMOs gain significant competitive advantage.

Key Trends & Opportunities

Growth of High-Potency and Modified-Release Formulations

Demand increases for high-potency APIs and modified-release oral dosage forms that improve treatment outcomes and patient adherence. CMOs expand containment capabilities, precision dosing technologies, and coating expertise to support complex formulations. These capabilities create strong opportunities in oncology, hormonal therapies, and chronic disease management. Pharmaceutical companies increasingly partner with CMOs that provide specialized facilities and regulatory expertise. As the market shifts toward differentiated products, modified-release and high-potency solutions become a major growth avenue.

- For instance, Thermo Fisher Scientific (PPD) expanded its high-potency capability with contained isolators and added a large high-shear granulator for potent solid dose blends.

Expansion of Global Supply Networks and Regional Manufacturing Hubs

Pharmaceutical firms diversify production networks to reduce supply disruptions and meet regional regulatory requirements. Emerging markets in Asia and Eastern Europe become attractive hubs due to lower costs, skilled labor, and improving GMP-compliant infrastructure. CMOs expand global footprints to support local production, faster delivery, and compliance with country-specific standards. This trend opens opportunities for cross-border partnerships and capacity expansion. As global demand rises, regional manufacturing hubs strengthen resilience and enhance competitiveness.

- For instance, Recipharm expanded its India site with extensive tablet and capsule lines capable of producing significant volumes of solid dosage forms annually for global and regional programs.

Key Challenges

Strict Regulatory Compliance and Quality Requirements

The OSD contract manufacturing sector faces stringent regulatory expectations from agencies such as the FDA and EMA. CMOs must maintain rigorous quality systems, data integrity, and documentation practices to meet audit standards. Continuous regulatory updates increase compliance complexity, especially for companies operating across multiple regions. Failure to meet standards can delay product launches or result in penalties. Maintaining consistent quality while scaling production remains a significant operational challenge for many manufacturers.

High Capital Investment and Competitive Pricing Pressure

OSD manufacturing requires substantial investment in advanced equipment, containment systems, skilled labor, and facility upgrades. These costs create barriers for smaller CMOs and increase competition among established players. Pricing pressure intensifies as pharmaceutical companies seek cost-efficient outsourcing partners while demanding high quality and rapid turnaround. Maintaining profitability becomes challenging as firms balance operational expenses with competitive bids. CMOs must innovate, automate, and optimize processes to remain sustainable in a cost-sensitive market.

Regional Analysis

North America

North America holds 34% share of the Oral Solid Dosage Contract Manufacturing market, supported by strong outsourcing trends among large pharmaceutical companies and rising production of generics. The region benefits from advanced GMP-compliant facilities, strong regulatory oversight, and high investment in formulation development. Demand grows as companies shift to cost-efficient manufacturing models and expand biologics-to-OSD conversion strategies. Chronic disease prevalence and large-scale drug consumption further boost production needs. Collaborations between CMOs and branded drug manufacturers enhance innovation, while expansions in high-potency and modified-release capabilities strengthen the region’s leadership.

Europe

Europe accounts for 28% share, driven by strong pharmaceutical manufacturing infrastructure and high adoption of contract services among companies seeking regulatory excellence and technological expertise. The region’s focus on high-quality standards encourages outsourcing of tablets, capsules, and complex modified-release formulations. Increased demand for generics and rising emphasis on sustainability support market expansion. Western Europe leads with advanced capacity for high-potency OSD production, while Eastern Europe grows as a cost-competitive outsourcing hub. Ongoing modernization of facilities and strong R&D pipelines reinforce Europe’s position in the global OSD contract manufacturing landscape.

Asia Pacific

Asia Pacific holds 30% share, emerging as the fastest-growing region due to cost advantages, expanding GMP-certified facilities, and increased investment from global pharmaceutical companies. India and China lead in large-scale generic manufacturing and high-volume OSD production. Rising healthcare demand, supportive government policies, and growing clinical trial activity drive regional growth. CMOs in the region strengthen capabilities in controlled-release technologies, high-potency handling, and continuous manufacturing. The combination of competitive pricing and expanding technical expertise positions Asia Pacific as a key global outsourcing destination.

Latin America

Latin America accounts for 5% share, supported by growing pharmaceutical production in Brazil and Mexico and increasing demand for cost-effective outsourcing solutions. Regional CMOs expand capabilities in tablet and capsule manufacturing to serve both domestic and export markets. Market growth benefits from rising consumption of generics and strengthened regulatory harmonization across countries. However, economic fluctuations and variable regulatory environments limit rapid expansion. Despite challenges, investments in facility upgrades and partnerships with multinational drug companies drive steady growth in OSD contract manufacturing.

Middle East & Africa

Middle East & Africa hold 3% share, driven by expanding pharmaceutical manufacturing capacity in Gulf countries and rising demand for affordable oral solid dosage forms. Governments invest in local production to reduce import dependency, creating opportunities for regional CMOs. Growth remains moderate due to limited advanced manufacturing infrastructure in several African nations, but investments in technology and training continue to improve capabilities. Increasing demand for chronic disease medications and essential generics supports long-term growth prospects.

Market Segmentations:

By Product

- Tablets

- Capsules

- Powders

- Others

By Mechanism

- Immediate Release

- Delayed Release

- Controlled Release

By End Use

- Large Size Companies

- Medium & Small Size Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Oral Solid Dosage Contract Manufacturing market is shaped by key players such as Jubilant Pharmova Limited, Lonza, Siegfried Holding AG, Piramal Pharma Solutions, Patheon Pharma Services, Recipharm AB, Corden Pharma International, Boehringer Ingelheim International GmbH, Catalent Inc., and Aenova Group. These companies focus on large-scale production capacity, advanced formulation technologies, and strong regulatory compliance to support global pharmaceutical outsourcing needs. Competitive strategies emphasize expansion of high-potency API handling, controlled-release capabilities, and continuous manufacturing platforms. Many players invest in automation, quality-by-design processes, and digital monitoring systems to enhance efficiency and reduce production variability. Strategic partnerships with pharmaceutical companies strengthen development pipelines and accelerate commercialization. As demand rises for generics, specialty formulations, and flexible manufacturing models, leading CMOs intensify efforts to offer scalable, cost-effective solutions. Firms with diversified service portfolios and global manufacturing footprints continue to maintain a strong competitive advantage.

Key Player Analysis

- Jubilant Pharmova Limited

- Lonza

- Siegfried Holding AG

- Piramal Pharma Solutions

- Patheon Pharma Services

- Recipharm AB

- Corden Pharma International

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Aenova Group

Recent Developments

- In October 2024, Catalent, Inc. agreed to sell its oral solids development and small-scale manufacturing facility in Somerset, New Jersey to Ardena.

- In July 2023, Aenova formed a partnership with Galvita to support formulation, development and production of oral dosage products.

- In January 2023, Catalent partnered with Ethicann to develop Ethicann’s clinical drug pipeline using Catalent’s ODT (orally disintegrating tablet) technology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Mechanism, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for OSD outsourcing will rise as pharmaceutical companies focus on cost efficiency and scalability.

- Tablets and capsules will remain dominant due to high stability, ease of production, and strong patient preference.

- High-potency API handling capabilities will expand as oncology and specialty drugs grow.

- Continuous manufacturing technologies will gain wider adoption for faster and more consistent production.

- Modified-release and complex formulations will increase as companies seek differentiation and improved patient adherence.

- Digitalization and automation will enhance quality control and reduce batch variability.

- Regional manufacturing hubs will strengthen supply-chain resilience and support localized production.

- Partnerships between CMOs and pharma companies will increase to accelerate development timelines.

- Regulatory expectations will push manufacturers to elevate GMP compliance and data integrity.

- Expansion of generic drug portfolios worldwide will continue to drive long-term outsourcing growth.

Market Segmentation Analysis:

Market Segmentation Analysis: